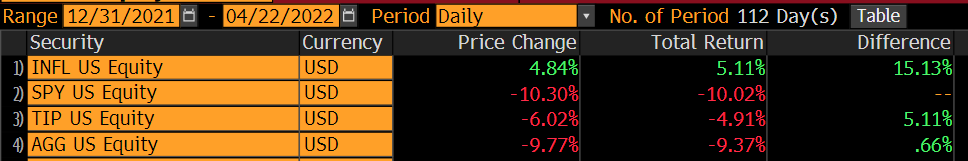

Welp, the call on bonds being a significant drag on portfolios continues to play out. At the end of the quarter, even in a S&P down market, the Barclays Aggregate has underperformed the S&P 500. So much for those safe and sound, set it and forget it bond portfolios.

Even for the last 15 months, bonds have been a significant drag on portfolios.

Since Yields Have Risen, Is It Time to Buy Bonds?!

It is very unclear if the risk-reward is in one’s favor to own bonds here. We’ve not had a situation like this since the 1970s. Using history, coupled with the fact that “inflation is transitory”, as a guide leads us to conclude that we would NOT be putting new money to work in any long duration, fixed assets. The bottom line is: where is the better risk-reward? We don’t know how the inflation path plays out, but to own long duration in a rising inflationary environment with negative real yields is simply not a bet we’d like to take. Additionally, if yields move higher and inflation also continues to ramp Fixed Income likely won’t provide the risk parity hedge it has historically. The magic seltzer that bonds have provided to portfolios over the last 40 years where bonds hedge against stock market volatility while providing reasonable returns seems unrealistic moving forward.

Inflation Continues to Surprise to the Upside

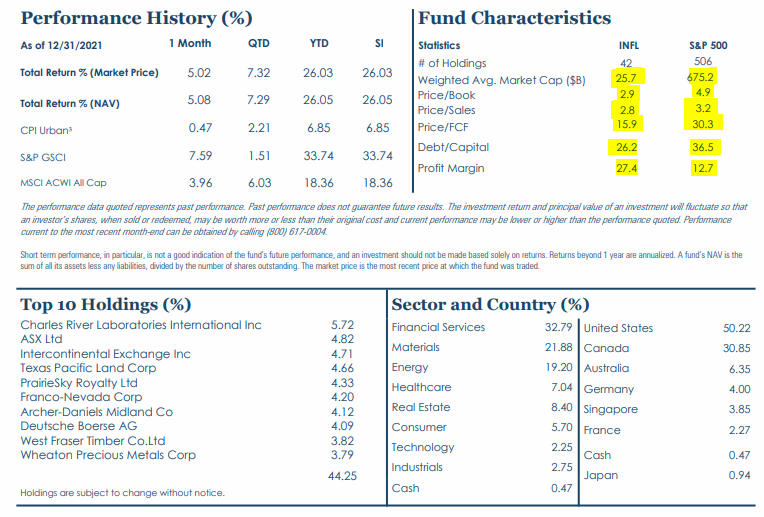

If you remember, we added Horizon Kinetics Inflationary Benefits ETF (“INFL”) to our asset allocation back in June/July of 2021 on the back of rising inflation for the foreseeable future. Boy did that play out – after consecutive “generationally” high inflation reports, we are looking at an inflation back drop we haven’t seen for decades.

We believe INFL’s strategy of investing in profitable businesses that can benefit from inflationary forces while also exhibiting the quality characteristics we seek (i.e., scalable and resilient business models) adds a desirable exposure to our portfolios and compliments our strategy of avoiding traditional bonds). Given the potential for inflationary pressures to persist into the future, we don’t plan to make any changes to this holding at the moment.

The graphic below shows current INFL positioning vs the S&P 500 from a valuation/ characteristic perspective.

Source: Horizon Kinetics INFL Factsheet

Source: Horizon Kinetics INFL Factsheet

International / Emerging Markets

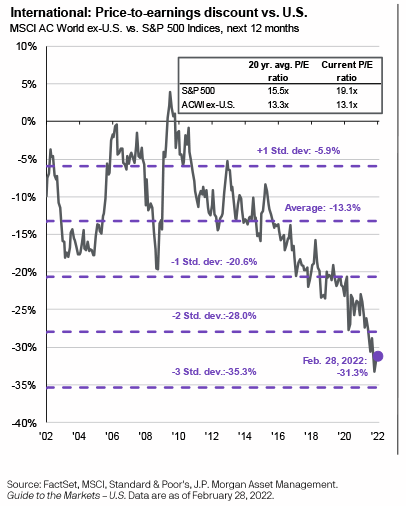

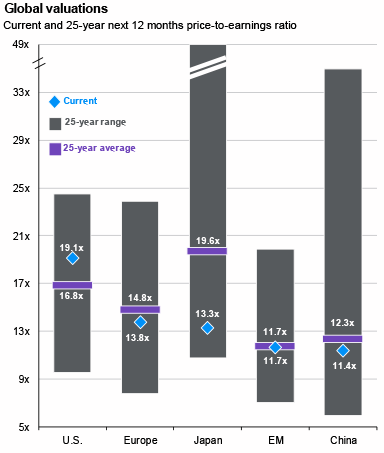

We continue to think equity markets outside the U.S. can provide value to our allocations given the diversification benefits and the cheaper relative valuations. Despite that, we remain underweight to our benchmarks given the current situation in eastern Europe and potential for broader contagion. We are monitoring this closely and as landscapes change, we must be quick to adapt. As new revelations occur with the Russia-Ukraine War and the implications for the global economy, we will be ready to capitalize on opportunities to add value to your asset allocation models.

What Does this Mean for your Portfolios?

While we remain extremely dynamic when it comes to positioning at the ETF level, we still know that the most important decisions when it comes to long term success come at the asset allocation level (hopefully by now we’ve communicated our conviction in owning less bonds). We know that diversification is the first level of defense against market volatility. In saying that, we will be making some slight tweaks across the portfolios, specifically in the higher risk tolerance allocations to decrease hedged exposure (mostly via DRSK) while increasing our US domestic equity market exposure.

Rationale

The S&P 500 valuation has recently come back to more reasonable levels in a historical context. The S&P 500 is comprised amazing companies with strong growth potential and deserves its premium valuation over non-U.S. exposures. Its constituents are arguably the best 500 companies in the world. Over the long run we want exposure to the market with the best stocks in the world and enjoy opportunities to buy them at a discount (meaning higher future returns, higher yield, lower risks, etc.). In addition to pure S&P 500 exposure, we continue to like the equal value S&P 500 (RSP) which gives us an increased exposure to the lower valued, more cyclical components of the market, specifically Industrials, Materials, Real Estate, Financials & Energy.

While DRSK will continue to be a flagship position in our portfolios, we are slightly decreasing DRSK and adding to ACIO, which continues to provide hedged exposure to risk but increases potential for return. DRSK is a fixed income fund in its structure. When it comes to the fixed income universe, we don’t believe you can find a better fund than DRSK. For our more aggressive allocations, we love the profile of blending DRSK and ACIO to complement each other given the two unique structures.

As for ACIO, we feel the current equity backdrop of high volatility and sector rotations couldn’t be more attractive given the strategy and structure of the fund. Given the dynamic capability of selling call options on individual stock positions (versus Index), we can give each long position ample upside each month (often in the 10-15% range). As an added benefit, our ability to “hedge our hedge” gives us the dry powder to take advantage of market moves and volatility to continually cycle hedge profits back into cheapened equities. The structure and capability of being active and dynamic in this market is one we feel will continue to be beneficial to portfolios.

Disclosures

Past performance is not indicative of future results. This information is for illustrative purposes only. Investing involves risk including the potential loss of principal. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Aptus Capital Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Forward looking statements cannot be guaranteed. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Information was obtained from third party sources which we believe to be reliable but are not guaranteed as to their accuracy or completeness.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500 Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2204-31.