Investment Objective

We work with the lifeblood of financial services. With advisors serving the families that have worked hard to accumulate assets and need those assets to work for them. Most investment objectives are based on life goals, not benchmarks.

We think hard-earned assets should be positioned to compound (grow) at a rate that maintains lifestyle if not improves it. That is the general objective that encapsulates most of what we see.

Said from a different angle, we think savings should NOT be positioned in a way that puts lifestyle at risk. The risks we face are:

- Longevity Risk – returns that are too low.

- Volatility Risk – returns that are too wild (the focus of today’s note)

As we are halfway through the year, it is time to revisit the importance of risk #2 above with some background on the current market backdrop.

The Basics => Time and Return

Investors seem to underestimate both a) their time horizon and b) the return required to compound (grow) their wealth at a rate that sustains their current lifestyle…if not improve It. This should be welcomed news!

For example: the 60-year-old that wants to retire in 2 years and thinks that is her horizon. In addition, earning investment returns of 7% a year does not sound exciting. We think those notions around both time and return would be wrong. The time horizon is closer to 25 years (towards end of life), and regarding the idea of 7% being a low return…let us just illustrate what happens when you pair what a boring return with TIME.

The table illustrates the growth of both $100k and $1mil over different time periods as it compounds at 7% with no additional savings:

| Starting | +5 years | +15 years | +25 years | +35 years |

| $100,000 | $140,255 | $275,903 | $542,743 | $1,067,658 |

| $1,000,000 | $1,402,552 | $2,759,031 | $5,427,433 | $10,676,581 |

We show two starting values to emphasize that the focus of investors should not be on the x’s and o’s of markets, or trying to find the next Amazon, but rather, saving the money to maximize the utilization of the greatest asset they have…TIME.

The Backdrop for Finding Returns

We do believe returns will be more difficult to find moving forward. Why? Because valuations matter and they are currently elevated…which could lead to lower returns moving forward in stocks (not negative, just lower).

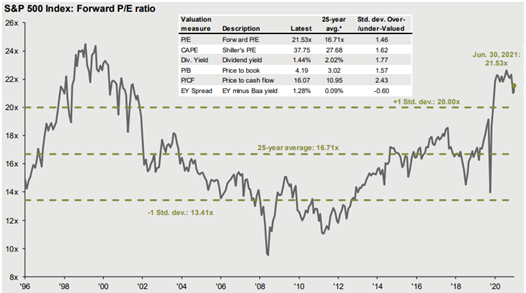

Here is a look from JP Morgan at the valuations of the S&P 500 at the close of Q2 going back to 1996:

Source: JP Morgan

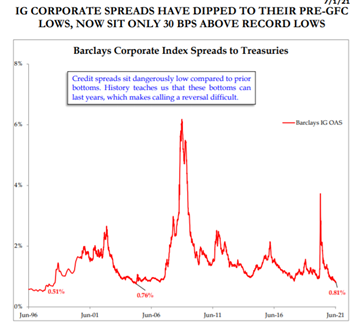

And bonds are even more expensive than stocks! If an investor wants to loan the government money for 10 years for 1.35% interest…good luck with that. On the other hand, if you want to loan money to investment grade companies, check out the current spreads (spreads are measured by the difference in the yield on corporate bonds relative to treasuries…it is the compensation for taking on that credit risk and its near all-time lows):

Source: Strategas as of 7/1/21

The Returns that Matter

We are not concerned with returns you cannot eat…and don’t think you should be either.

Consider a portfolio that is down 50% year one and then up 100% year two. The average return over this simple two-year example = (-50 + 100) / 2…or 25%. That looks great on paper, but the portfolio has gone nowhere. Average returns, or arithmetic returns for the mathematically inclined, are paper returns only!

Compound returns, or geometric returns, are what matters. In this example, your compound return is 0%!

Considering the content above, we made two balancing points:

- Returns could be lower moving forward due to elevated valuations.

- With time, low returns are more powerful than they may look at first glance.

With this valuation backdrop we must be confident that what we own has return potential. Therefore, we place such an emphasis on our yield + growth framework for portfolio positioning.

Most importantly, we think the return stream of those returns is critical. We are laser focused on building an environment for our portfolios to sufficiently compound capital…returns we can eat. What could get in the way? Volatility and negative compounding!

Avoiding the Friction of Volatility

All of that to get to the point of the note…AVOID LARGE LOSSES!

We brand our portfolio construction process as the drawdown patrol. We incorporate long volatility exposure in a way that is disguised on the way up and clear on the way down. Our long volatility exposure (more detail in next months note!) allows us to alter allocations away from bonds and towards stocks to improve return potential while limiting exposure to large losses.

Behaviorally, avoiding losses makes sense. We’ll limit the behavioral insight to this commonsense reality – most would agree that conversations about a portfolio in a 10% drawdown are generally more productive than those when a portfolio is in a 35% drawdown!

Mathematically, avoiding large losses makes sense. Looking back at the example above, the difference in the 25% average return and 0% compound return has to do with volatility. When you compound at a negative rate (which is bound to happen at some point), it is crucial to keep that rate as low as possible. Losses create friction towards the objective of compounding capital. The larger the loss, the greater the friction. The simple example above illustrates that a 50% drawdown requires a 100% gain to just get back to breakeven. Avoid large holes if you want a portfolio that can dig its way out.

Conclusion

Ben Graham said it best:

‘The essence of investment management is the management of risks, not the management of returns.’

In this market, we could argue the importance of defending against large losses has never been greater. If you want to find return you have to own assets that can deliver. Those assets, especially now, tend to be the risker options within the relative opportunity set.

We think investors are being forced into riskier and riskier portfolios. You’d better have a splash (or two) of long volatility exposure with that added risk!

Our portfolios are built for this.

We want to sufficiently compound capital. That doesn’t require exorbitant returns but does require a focus on minimized exposure to large drawdowns.

As always, thank you for the trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2107-3.