Fear of Missing Out

This market is a FOMO generating machine. From our vantage point, there is more delusion around returns and disregard for risk than we ever thought possible.

Why be content with 15% when you can go buy some random crypto coin that was created out of thin air, backed by nothing, and can be manipulated by celebrity tweets that’s flying higher by the minute? (we are very interested in blockchain…just an example of the thinking we are seeing)

This market seems to have shifted focus towards return and return only. A few quick reminders:

- You cannot have return without risk…the higher the one, the higher the potential for the other.

- Compounding is a powerful force. It does not take astronomical returns to sufficiently grow your wealth to meet your financial objectives – singles and doubles will do the trick, no need to swing for the fences with each bat.

- Drawdowns are a tax on your ability to compound capital! Big losses create friction mathematically and behaviorally, capital should be positioned to minimize large drawdowns

Owning vs Renting

I own my truck. If there’s an issue with it, I like to understand the issue, and have it fixed.

I also rent cars regularly. If there is an issue with a rental, I have it replaced. I don’t care what’s wrong with it, I just want one that works.

Owning something comes with a totally different mindset than renting.

When it comes to the portfolios and investments we manage, we are owners. We aren’t looking for the next shiny strategy to rent while it’s working and then to jump ship when it’s not.

We want to build portfolios with conviction that can adapt, adjust, and adhere to the reminders above. Yes, we build for return first, but that return cannot absorb risk that derails our ability to compound.

Our firm-wide belief is that solid returns with minimal drawdown will compound capital at a greater pace than seeking to rent the shiniest strategies while they are shining.

An owner’s mentality is protection against the detrimental urges of performance chasing. A renter’s mentality does the opposite.

Renting = Performance Chasing

In investing, renting is synonymous with performance chasing…almost a sure way to create friction on the path of where you are now and where you want to be. The urge to performance chase is in all of us – certain environments (like this one!) make it more difficult to suppress!

What better way to illustrate this point than through a real world and recent example – Ark Innovation Fund! Outside of crypto, this has been the market’s shiniest object of late and a magnet for performance chasing.

The following is not a knock on ARKK or an opinion on the strategy, it’s simply too textbook an example of performance chasing to pass on the chance to illustrate our point.

Investor’s Return vs. an Investment’s Return

An investor’s return while exposed to a strategy is more important than an investment’s return. Keep that in mind as you continue.

The ARKK ETF is up over 500% since its inception in 2016 – absolutely trouncing the S&P 500. This ETF has over $22bil. It’s easy to think that all shareholders have experienced that return. Well, that’s not the case. In fact, it’s not even close.

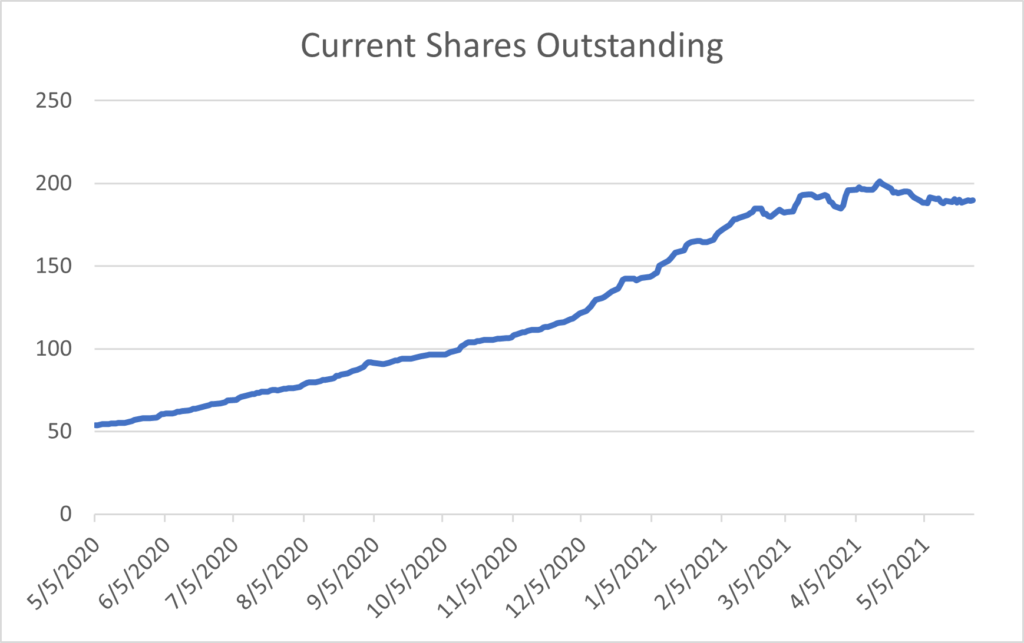

Below is a chart showing the shares outstanding in this ETF. Currently, there are about 190 million shares outstanding.

Shares outstanding measures assets are in the fund. As more demand comes in for an ETF, more shares are created.

Source: Bloomberg

We are only showing this chart back to 2020, when thematic fever really kicked in.

What should jump out at you is ramp of shares outstanding recently. There were just 91 million shares outstanding on 9/1/2020…now there is 190 million! 53% of the shareholders in this fund have been shareholders only since September of last year. The renters saw the returns and could not miss out!

As I am typing on 5/27/2021, let us consider the information above.

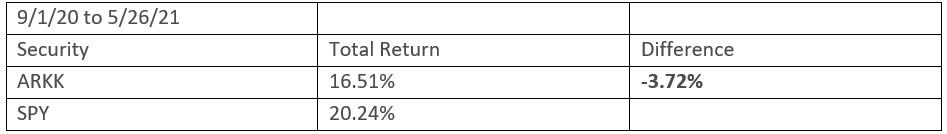

Remember, the recent flood of money came because the fund had outperformed the market…look what the recent shareholders have to show for it:

Source: Bloomberg

Over half of the shareholders have trailed the S&P. Reason – performance chasing.

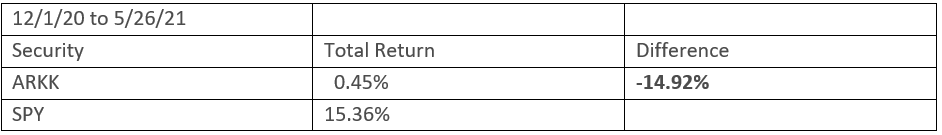

Source: Bloomberg

Approximately 38% of shareholders have made almost nothing and trailed the market by 14.92% since the 12/1/2020. How can this happen in a fund that’s dominated the market? Performance chasing.

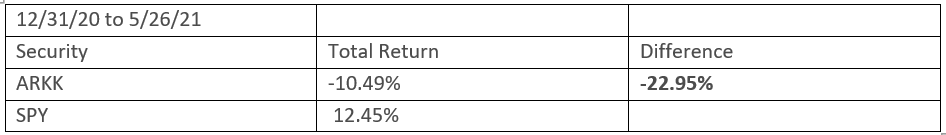

Source: Bloomberg

Approximately 25% of the shareholder base has owned the fund since 12/31/20. They are trailing the market by 22.95% and are down over 10% on the year!

In a fund that’s been a screaming success, over half of the shareholders have performed poorly compared to the S&P and over a quarter of them have lost money! As we see it, the only explanation is performance chasing.

Again – an investor’s return while exposed to an investment is more important than an investment’s return. It’s not the investment’s fault when there is a gap…it’s the investor’s fault!

Be an Owner

We think performance chasing/renting strategies is a bad recipe for accomplishing long-term financial objectives.

It’s much more productive to know what you own and why you own it. In addition, a lower return that’s associated with a drawdown we can handle is preferred over a higher return that can spew volatility.

This month’s note is simply a reminder that we are owners in our approach. While we believe the path of least resistance for equity markets continues to be higher, we’ve positioned portfolios for volatility. The VIX is back in the mid-teens btw 😬…

We are overweight stocks, own very little traditional bonds, and maintain exposure that can rise when volatility does. We think this mix gives us the potential to rise with equities, not have to deal with the longevity risk in bonds and protect if things get wacky.

We want to sufficiently compound capital. That doesn’t require exorbitant returns and we won’t ignore risk while seeking them.

As always, thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2106-2.