Recent reports set the baseball world abuzz with news of Shohei Ohtani, the dynamic two-way two-time MVP of the American League, signing a staggering $700 million, 10-year contract with the Los Angeles Dodgers. However, as the contract details surfaced, its intricate structure unveiled a significant impact on its actual financial worth.

The contract, rather than the purported lump sum, involves a payment structure of $2 million annually for the first decade, followed by colossal $68 million per year payments for the subsequent ten years. This staggered payment plan considerably alters the initial eye-catching $700 million figure.

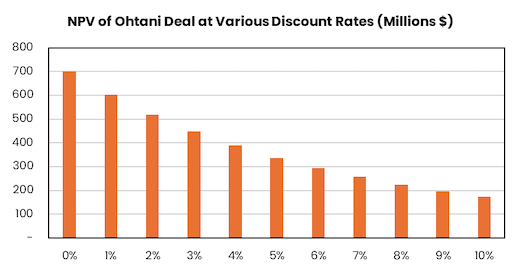

Enter the concept of present value—a financial mechanism used to determine the current worth of future cash flows. Using an 8% discount rate, reminiscent of the historic Bobby Bonilla New York Mets contract deferral (a chilling thought for this lifelong New York Mets fan), the present value of Ohtani’s contract plunges to a “mere” $224 million over its duration.

Source: Aptus as of 12.12.2023

Source: Aptus as of 12.12.2023

This revelation delves beyond the complexities of athlete contracts to underscore the intrinsic value of a dollar today versus its worth in the future. Not only does $1 in the future depreciate due to inflation, but $1 invested today can yield returns higher than inflation, compounding the value of $1 over time for its holder. This contract’s financial intricacies not only redefine the perceived value but also illuminate the potential implications of deferral (including potential tax considerations should Ohtani choose to relocate from California’s high-tax jurisdiction).

In conclusion, while the initial $700 million figure captivated the baseball world, a closer inspection reveals a contrasting reality. Ohtani’s contract with the Dodgers stands as a groundbreaking deal, showcasing the need to comprehend the underlying financial mechanisms shaping such agreements and cash flows. It urges us to look beyond the headlines and recognize the intricate interplay between finance, investment, and sports contracts.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-15.