“By continuing the process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily, and, while the process impoverishes many, it actually enriches some.”

– John Maynard Keynes

$1,000,000

I’m going to loan you $1,000,000 today. In 10 years, the money will be free and clear. It’s yours to give away to the person or charity of choice.

The catch here is that all you have to do is maintain the purchasing power of the $1,000,000.

Seems simple, right? So, what would you do?

The point of this note is the devastating impact of inflation. It’s more sinister than you may realize.

We’ll do our best to avoid expressing our opinion of economic and monetary policy and won’t bring up our views of a central bank’s ability to debase our currency on demand. Furthermore, we’ll try not to share our opinion on the merits of the government’s measurement of inflation.

With that disclaimer, let’s get back to the question of what would you do with the money.

Put it Under the Mattress

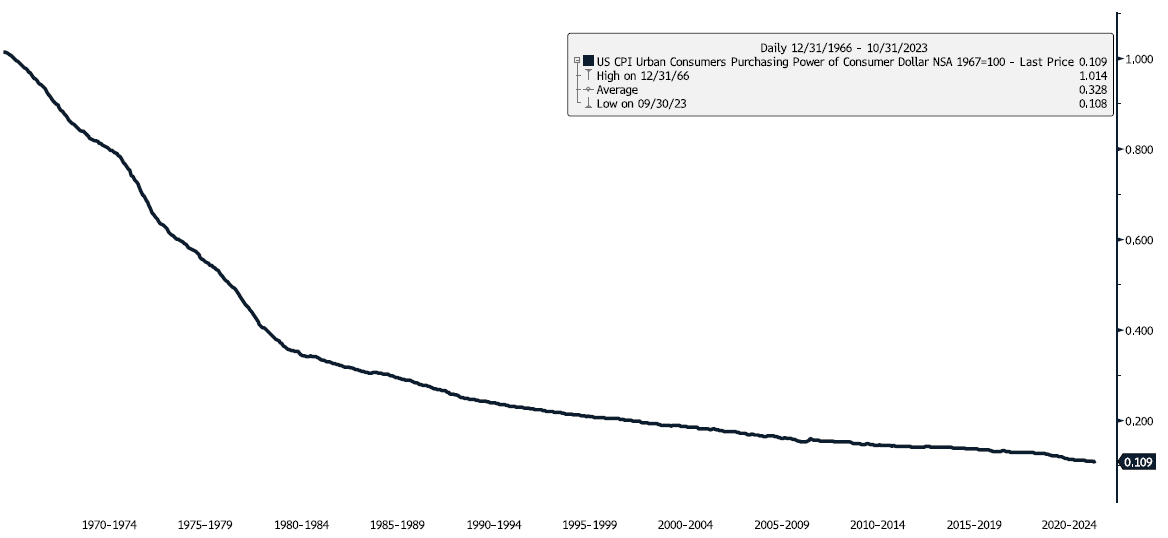

Let’s look at a few charts of the US CPI Urban Consumers Purchasing Power of Consumer Dollar Index. Yes, that’s a mouthful. This data is from Bloomberg.

Inflation is a topic very few could define, with its measurement constantly evolving. Most people discuss inflation in terms of how fast it’s rising. We’ve heard 2% is the target and we seem to accept that at large.

Has anybody ever wondered why we want 2% inflation, or why we want any at all? Is there a reason our central bank targets a constant erosion of our purchasing power? Maybe we can explore those answers at some point.

For now, I think a better perspective to explain this is the value of a dollar over time.

The base year of the above-mentioned index is 1967, and the initial value of $1 is… welp, $1. This index shows the purchasing power of the consumer’s dollar, measuring the change in the quantity of goods and services the dollar will buy at different dates. In other words, as prices increase, the purchasing power of the consumer’s dollar declines.

Up first is 12/31/1967 through 10/31/2023, nearly 56 years.

Source: Bloomberg as of 10.31.2023

Source: Bloomberg as of 10.31.2023

Over this period, if you were to take that $1,000,000 and put it under your mattress, it would have turned into roughly $100,000.

A 90% reduction in your purchasing power. Even if you secured this money in the safest vault on the planet, your purchasing power evaporated. You safely lost 90%. This is the erosion of purchasing power in the reserve currency of the world – the US Dollar. If you had your wealth in any of the other 160 fiat currencies, you’d have fared even worse.

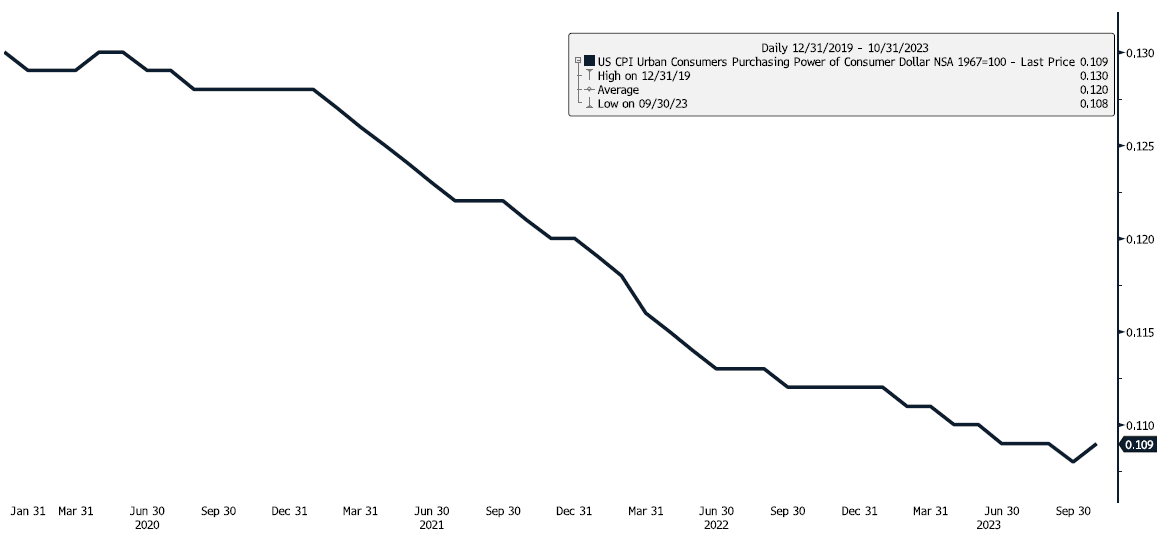

Consider this next period: 12/31/2019 – 10/31/2023.

Source: Bloomberg as of 10.31.2023

Source: Bloomberg as of 10.31.2023

Over just the last ~3 years, we’ve seen purchasing power decline by nearly 30%.

Per Lyn Alden’s book Broken Money, when the Fed was created in 1913, there was $19.31 billion in broad money (a measure of the supply of dollars in the system). At the end of 2022, there was $21.4 Trillion…yes, with a ‘T’. That’s an increase of 1,118x, or an average growth of 6.6% compounded for 109 years. In case you were wondering, the population of the US in 1913 was 97 million and 333 million in 2022. We went from having $199 per person in the system to having $64,800 per person.

The point is simply that when we own units of something with flexible supply, we must constantly be on guard against dilution. We don’t live in a world where we can stash our wealth in dollars under the mattress and maintain its value. For several reasons, we are forced to absorb risk as we search for better alternatives.

Who Wins and Who Loses?

Think about a mortgage taken out early in the periods mentioned above.

The winner is the borrower. You receive a lump sum of dollars today to purchase an asset, a house. As inflation takes its toll, your asset should increase in dollar value while your fixed payments are being made with dollars that are constantly losing purchasing power.

In a way, big borrowers in this environment are shorting all the cash savers out there.

Historically, our government has been a beneficiary of inflation as large levels of debt have been inflated away. It’s much easier and less transparent to fund certain initiatives through non-transparent confiscation of purchasing power than it is with explicit taxation.

If borrowers win, who’s left holding the bag? Those who have saved in dollars.

Thinking about the Future

Will inflation drop like we are being told? Maybe, but what if it doesn’t?

We see more and more people wanting to lock in fixed guarantees that appear, on the surface, much more attractive than they were just a few short months ago. There are more and more people speaking about how attractive bonds are becoming. The issue of inflation and its impact seems to be a topic of last year and less about years to come.

We speak daily about our beliefs that the bonds in the rearview may not be the bonds in the windshield, and how that may impact the default allocation of the present.

We are currently running fiscal deficits which have been monetized, and most likely will continue to be, by the Fed. Raising rates seems to create the potential for a counterproductive cycle that we are beginning to feel. Higher rates on already higher sovereign debt result in even larger deficits thanks to higher interest expenses. This seems to point to even more money creation, with the potential for inflationary pressures.

So back to our initial question, what do you do with the $1,000,000?

Portfolio Impact

You must take on risk, specifically, equity risk. More stocks & less bonds; that’s been our theme and it’s hard to see that changing.

There’s no doom or gloom in this note, just the recognition that the money printer is on standby, and we should be preparing our portfolios accordingly.

Within each portfolio and the risk constraints within, we are leaning into more and more of a barbell portfolio. More growth in the allocation, and better brakes.

Convexity is key. Its presence allows us to confidently absorb more stock exposure without worrying about the potential exposure to volatility tax.

As investors and stewards of wealth, we need to consider opportunity costs in each decision we make. We’d rather absorb short-term volatility from greater exposure to growth assets than watch our purchasing power “safely” erode.

I’m thankful for your trust and I hope this note triggers questions. Please do not hesitate to reach out.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies, and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-9.