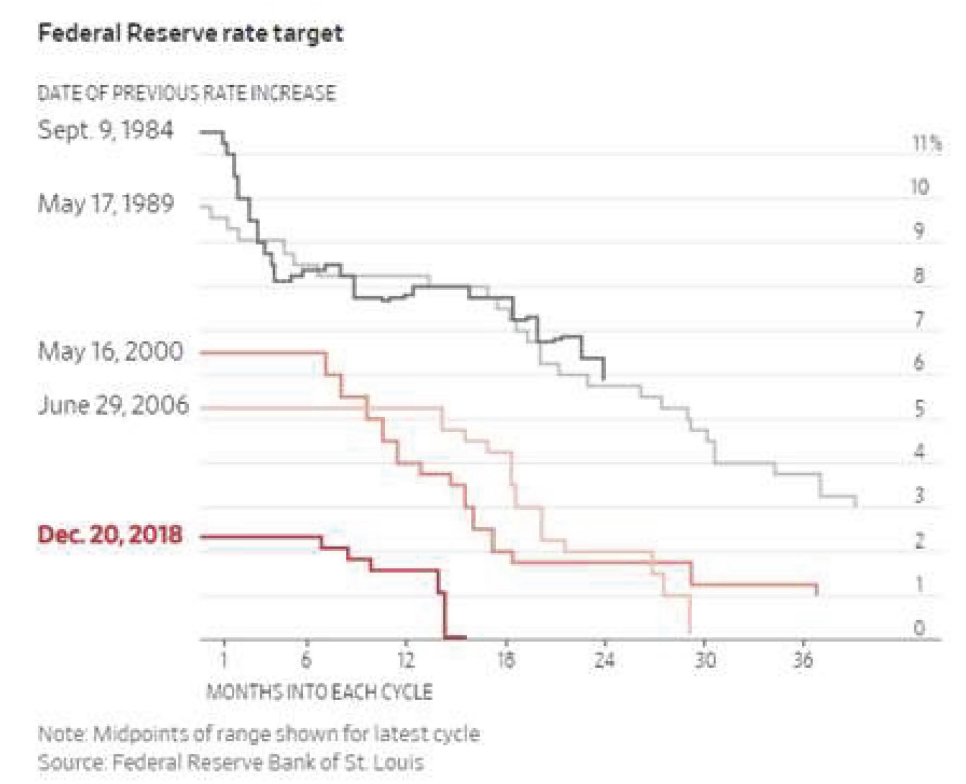

Source: Federal Reserve Bank of St. Louis, as of 04.30.2020

Source: Federal Reserve Bank of St. Louis, as of 04.30.2020

As many market participants predicted, the Fed would have limited effectiveness in using their monetary policy tool (setting short end interest rates) in the event of an economic downturn. We came into a crisis (COVID pandemic) at the lowest Fed Funds Rate ever. Essentially this forced the hand of the Fed to implement supplemental actions in addition to utilizing their 2008 playbook.

We could spend years studying (debating) the Fed’s place in our economy as well as the intricacies of each measure taken during the COVID pandemic. There are some great sources available (shoot us a message if you’d like more resources, also see the end of the post). For time purposes we will summarize the Fed’s response to the crisis and our opinions on most significant. Each facility and Fed action is very detailed on the specific amount of funds, dates available, eligibility criteria, etc. Again, if you have questions feel free to reach out.

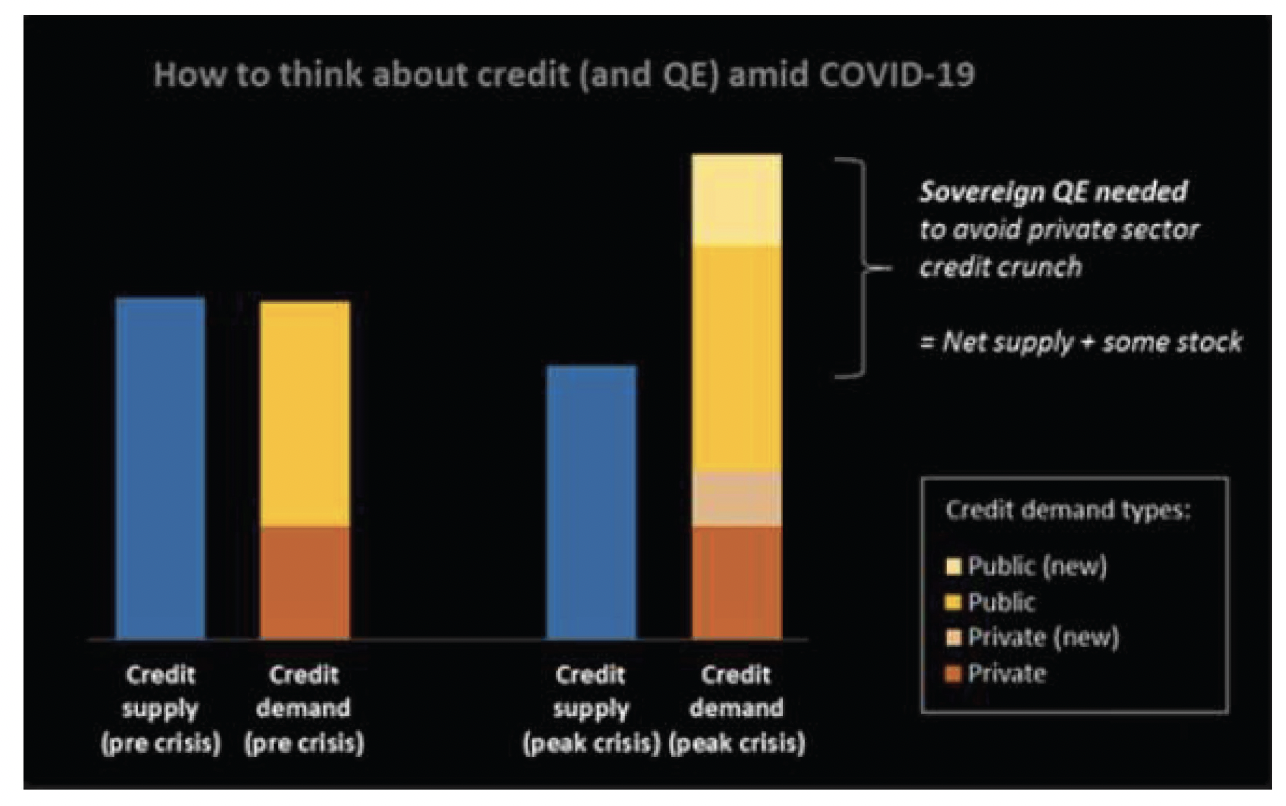

The Federal Reserve “Fed” is responsible for setting monetary policy and being a lender of last resort. During times of crisis, private lenders pull their capital from markets (or hike rates substantially to compensate for higher credit risks). This lack of funding and liquidity can be detrimental to the global economy. Private market lending works most of the time but during times of crisis liquidity dries up and forces the Fed to steps in and “oil the engine” by injecting cash into the market (giving loans to borrowers when no one else will).

Source: Goldman Sachs, as of 04.30.2020

Source: Goldman Sachs, as of 04.30.2020

Quick side note on SPVs The Fed can’t legally take many of the policy actions (at least directly) so they commit funds to a Special Purpose Vehicle “SPV” on a recourse basis and leverage the funds based on their specific mandate. #1 the Fed can’t take losses #2 the Fed can’t print money. The Department of the Treasury uses the Exchange Stabilization Fund to make the initial equity investment in the SPV in connection with each facility. The Fed then uses the funds from the Treasury in order to lend as they are in a better position to act quickly. Keep this in mind when we mention SPVs.

Fed Actions

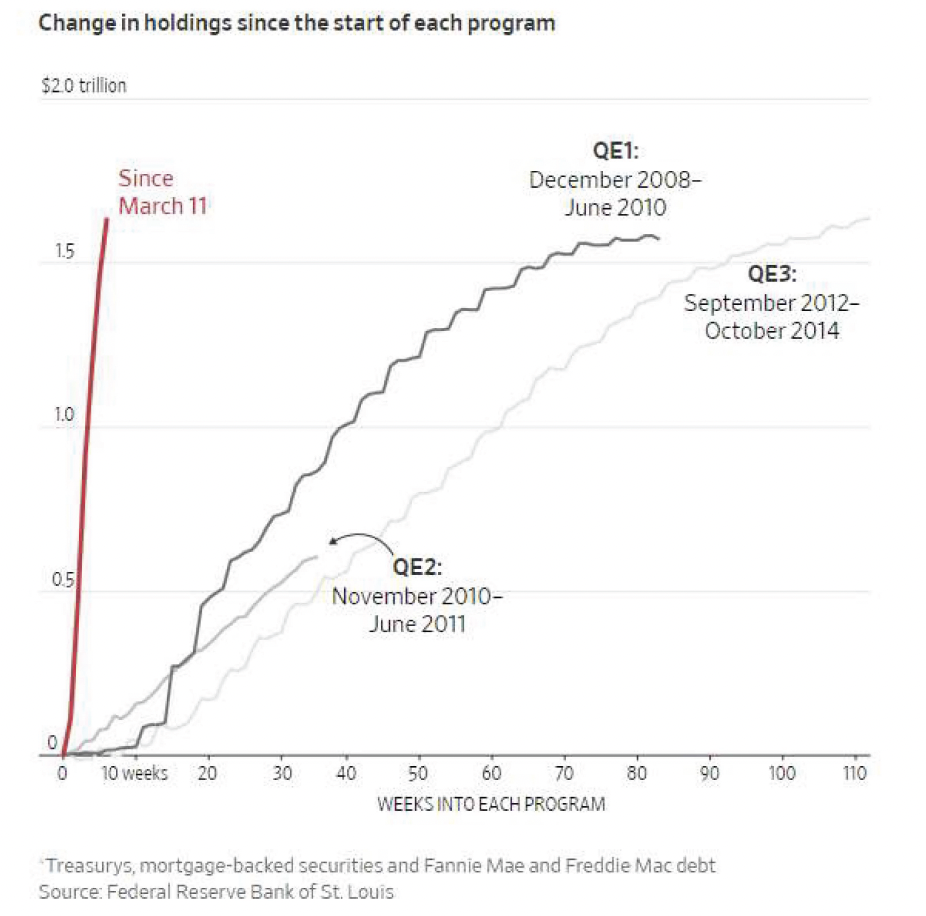

March 15th: the Fed stated they would purchase $500M Treasuries and $200M government-backed mortgages to increase liquidity into the banking system.

Post March 15th Update: This was later increased essentially giving the Fed the ability to purchase an infinite number of Treasuries and MBS. For reference, between March 16 and April 16, the Fed bought Treasury and mortgage securities at a pace of nearly $79 billion a day. By comparison, it bought about $85 billion a month between 2012 and 2014.

Source: Federal Reserve Bank of St. Louis, as of 04.30.2020

Source: Federal Reserve Bank of St. Louis, as of 04.30.2020

March 17th: The return of the Commercial Paper Funding Facility (CPFF). This facility was used back in the 2008 crisis and officially states we are in a crisis (invoking 13(3) emergency) and officially initiate SPVs. Essentially this facility allows corporations to access liquidity via the commercial paper market where the Fed serves as a lender. Many companies use this short-term borrowing mechanism to meet near term liabilities. This fund was necessary to sure up near-term corporate solvency.

The next action was the Primary Dealer Credit Facility. This action offers liquidity to Primary dealers which have a special position in the market to provide bids on all U.S. Treasury issuance which ensure the Treasury auctions succeed. The facility increased the collateral types the Primary Dealers could pledge with the Fed, easing liquidity concerns.

March 18th: Money Market Mutual Fund Liquidity Facility (MMLF): Basically, the Fed will take money market funds as collateral for loans to financial institutions in order to handle liquidity needs (money market funds are a pivotal part of household liquidity). The interesting part here is that the loans are non- recourse, meaning all the Fed has rights to is the collateral in the event of impairment or default. This means banking participants are not exposed to credit or market risk from the subsequent purchase of money market assets that are in turn pledge at the Fed. The facility also allowed the municipal debt 1 year and in as collateral.

Post March 18th Update: The Fed further extended the municipal maturity eligibility to inside three years.

March 23rd: Term Asset- Backed Securities Loan Facility (TALF). This is another facility geared at helping ease liquidity for corporations. Here is list is of the types of eligible collateral: auto loans/ leases; student loans; credit card receivable; equipment loans; floorplan loans; SBA guaranteed loans to name a few. Again, these loans are non- resource.

Arguably the most important of the facilities is the Primary and Secondary Credit Facilities. This was a new measure taken by the Fed allowing them to purchase corporate bonds. The main desire of these facilities was to lower credit spreads over the risk-free rate (since they can’t take rates any government rates lower).

Primary Market Corporate Credit Facility (PMCCF): Serves as a funding backstop for corporate debt issued by eligible issuers. This facility will allow the SPV to purchase qualifying bonds directly from eligible issuers and provide loans to eligible issuers. Additionally, there are limits on how much of the outstanding debt the SPV can purchase based on credit ratings.

Secondary Market Corporate Credit Facility (SMCCF): By way of SPVs this facility will purchase in the secondary market corporate debt issued by eligible issuers. The SPV can purchase corporate bonds in the secondary market as well as eligible corporate bonds in the form of ETFs. This does include ETFs with exposure to U.S. high-yield corporate bonds.

Highlights of Criterion for Inclusion in the Corporate Credit Facilities: Source:https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323b.htm

- The issuer was rated at least BBB-/Baa3 as of March 22, 2020, by a major nationally recognized statistical rating organization (“NRSRO”). If rated by multiple major NRSROs, the issuer must be rated at least BBB-/Baa3 by two or more NRSROs as of March 22, 2020.

- This was Updated: to include Issuers that were rated at least BBB-/Baa3 as of March 22, 2020, but subsequently downgraded, must be rated at least BB-/Ba3 at the time the Facility makes a purchase.

- Maturity of four years or less for PMCCF inclusion

- Maturity of five years or less for SMCCF inclusion

Main Street Lending Program (MSLNF)

The above facilities are mostly geared towards financial institutions and large publicily traded corporations. This part of the blog will touch on is the MainStreet program. This program gives U.S. Banks access to capital to originate loans for private businesses. This facility is designed to get mid- sized private businesses access to capital at favorable rates with minimal risk to the banks. The eligible lenders will be required to retain 5% of the loan with the remaining 95% sold to the Main Street facility. Companies in turn agree to some terms such as reasonable effort to maintain payroll/ workers, follow certain compensation and capital allocation restrictions, maintain EBITDA leverage conditions and cannot use the proceeds to pay down other loan balances. Also, borrowers can’t double dip between this facility and others if they are eligible to multiple. Overall, we believe the goal of this facility is to keep employees from sizable private business on the payroll while keeping these companies floated until the economy works through the crisis.

Update: The Fed has expanded the MSLNF offering a few different set of loan options as well as increased the business size eligible.

Paycheck Protection Program Liqudity Facility (PPPLF)

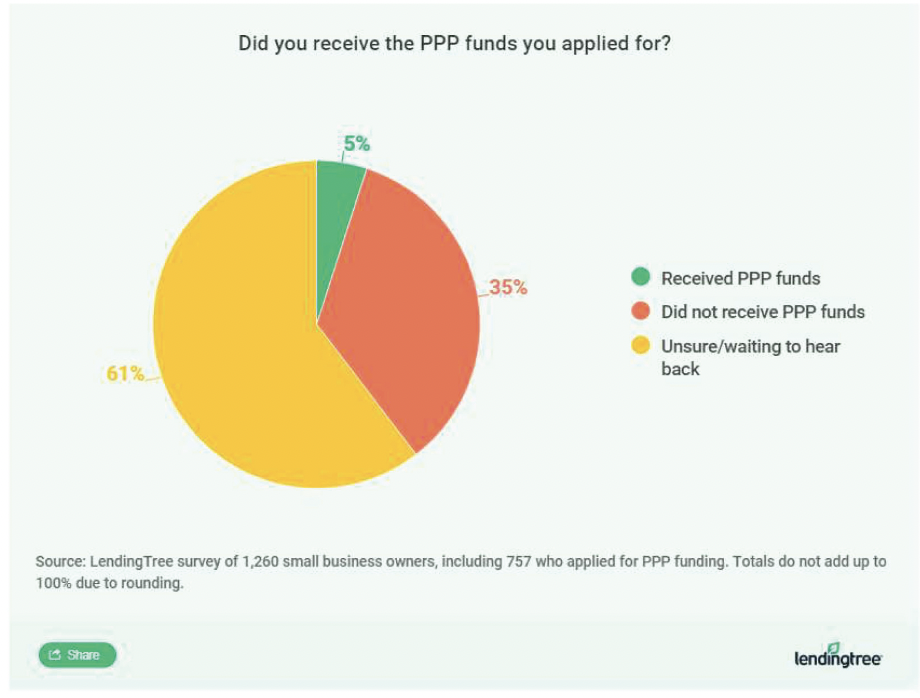

The Paycheck Protection Program (PPP) is being implemented by the Small Business Administation and was one of the core provisions of the CARES act passes March 27th. The facility grants a pathway to funds for eligible lenders to make loans to small businesses to help covers costs like payroll, rent and utilities. We consider two parts of the PPP program to stand out. First, the loans are potentially forgivable if the proceeds are used to pay eligible expenses. The second is to whom the funds are available. The SBA website cites that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant.” We are curious on how strict the SBA will be on potential abusers and how much leeway they will have to expand the size of the facility (already been increased once).

A recent survey done by LendingTree found that only 5% of business owners have received a PPP loan.

Source: Lending Tree as of 04.31.2020

Source: Lending Tree as of 04.31.2020

To summarize: This post covers several actions the Fed has taken thus far to help support the markets and provide liquidity to financial institutions, corporations, private businesses and municipalities facing difficult times. All of these facilites are designed to keep different segments of the economy afloat until things normalize. In our opinion, it was impossible to prepare for the ramifications of businesses being shut down due to the length of shutdown/ stay at home orders. We believe programs were necessary to keep the economy afloat but also acknowledge the Fed has opened new doors with the policies. Specifically, the buying of corporate bonds (especially below investment grade rated) has and will likely continue to create major support in the credit markets. It will be interesting to see how this plays out and the potential moral hazard created as well as potential consequences of owning impaired assets. The Fed Put appears to be alive and well… for now at least.

Sources:

https://www.lendingtree.com/business/just-5-percent-small-businesses-received-ppp-money/

https://www.federalreserve.gov/newsevents/pressreleases/monetary20200409a.htm

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

https://nathantankus.substack.com/

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-20-110