Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

John Luke: The lagging broader market has finally picked itself up in recent weeks

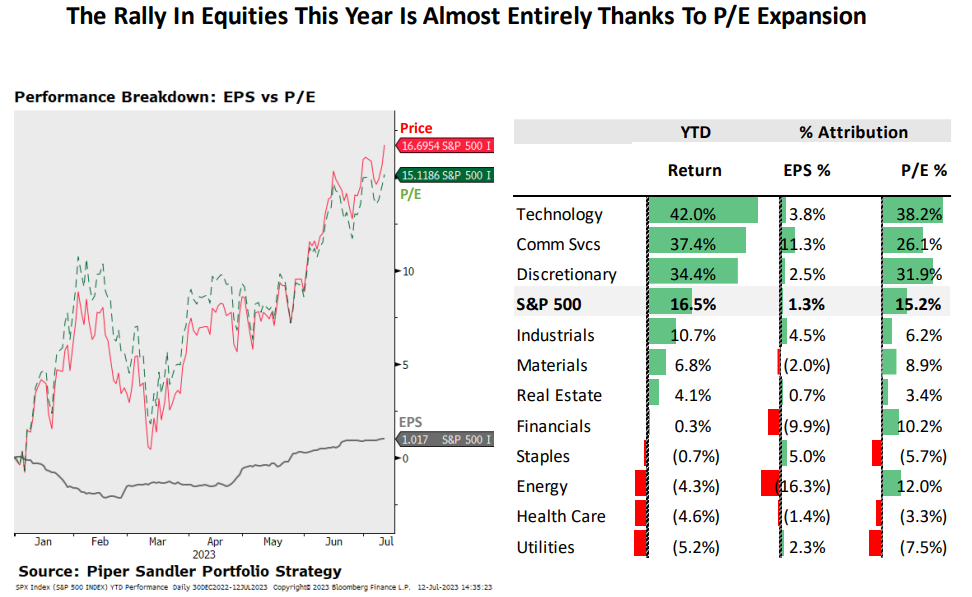

Beckham: though most of this year’s equity gains have been from P/E multiples expanding, not earnings growth

Data as of 07.12.2023

Data as of 07.12.2023

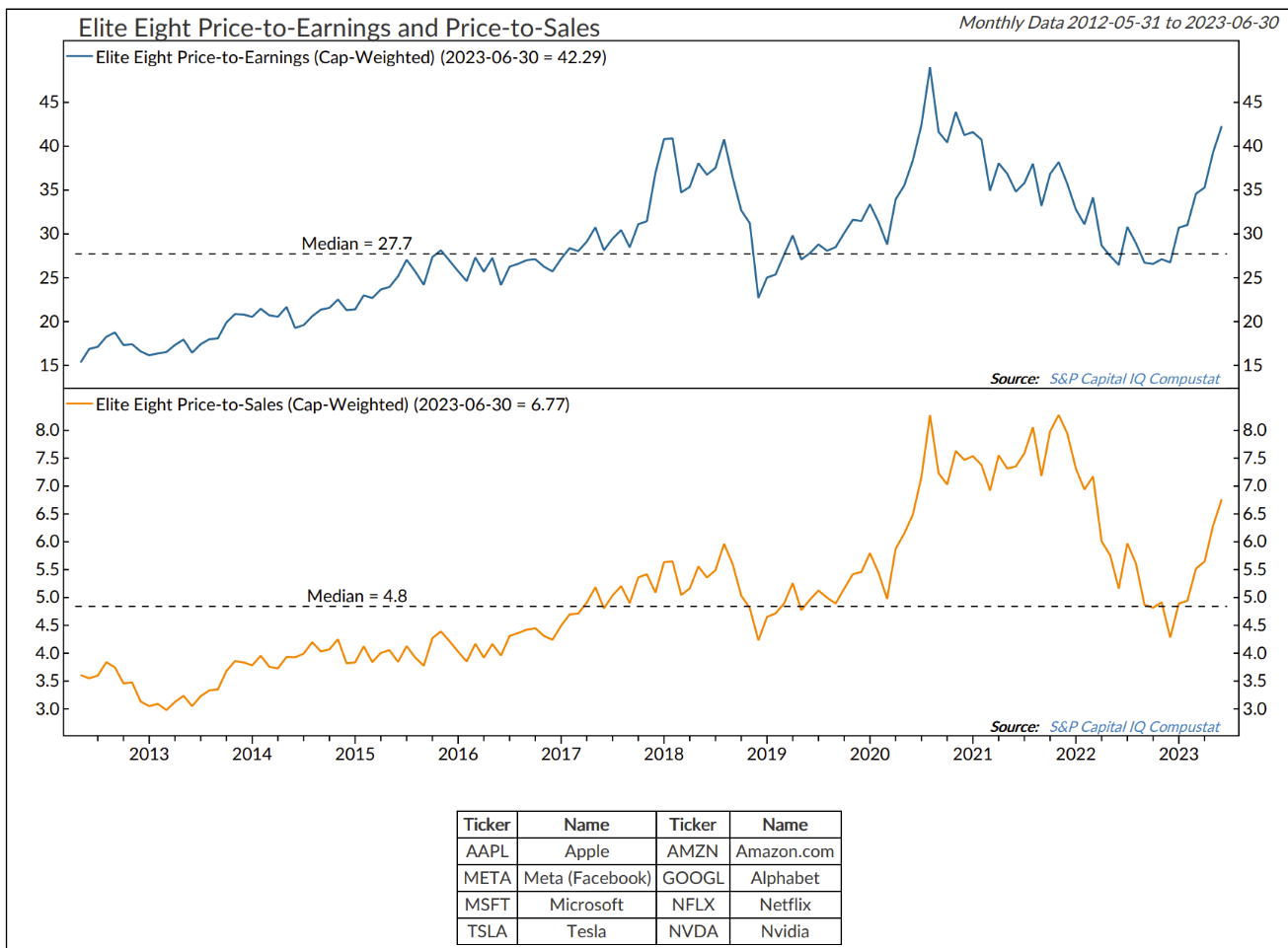

Joseph: The popular megacap techs, in particular, have seen an amazing rise in valuations

Source: Ned Davis Research as of 06.30.2023

Source: Ned Davis Research as of 06.30.2023

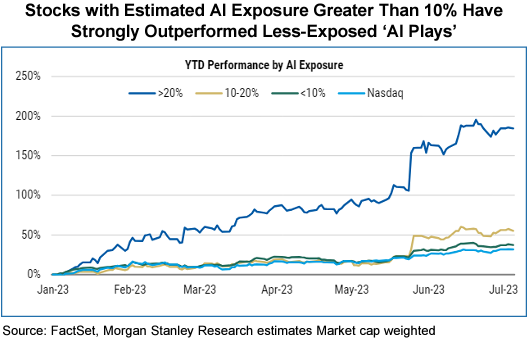

Dave: with a mere mention of Artificial Intelligence giving an additional bump

Data as of 07.10.2023

Data as of 07.10.2023

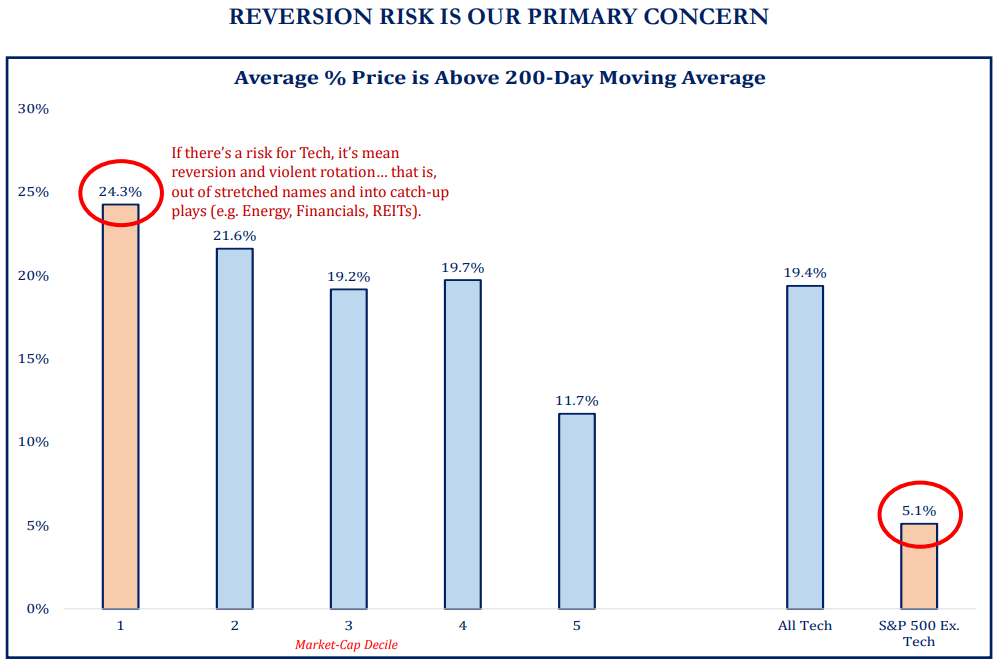

Beckham: perhaps setting up a reversion trade?

Source: Strategas as of 07.10.2023

Source: Strategas as of 07.10.2023

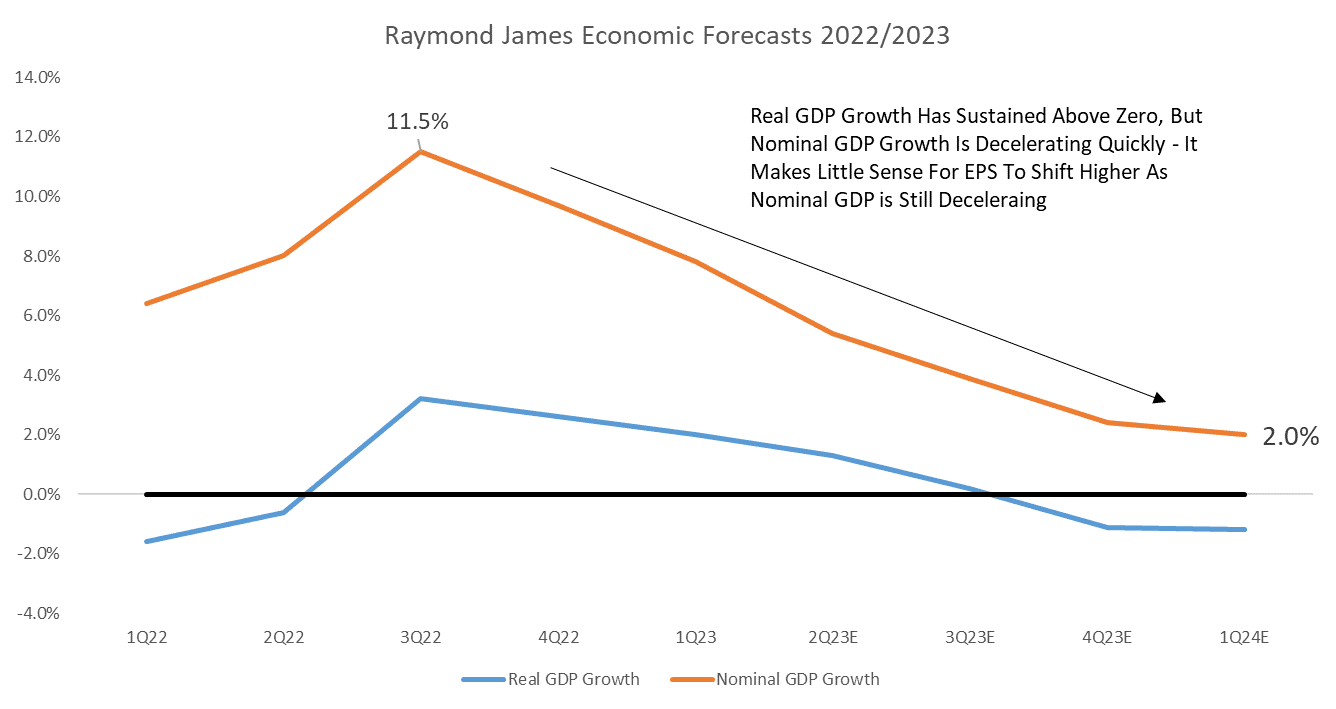

Dave: It will be hard to get actual earnings growth with Nominal GDP fading from recent growth rates

Source: Raymond James as of 07.10.2023

Source: Raymond James as of 07.10.2023

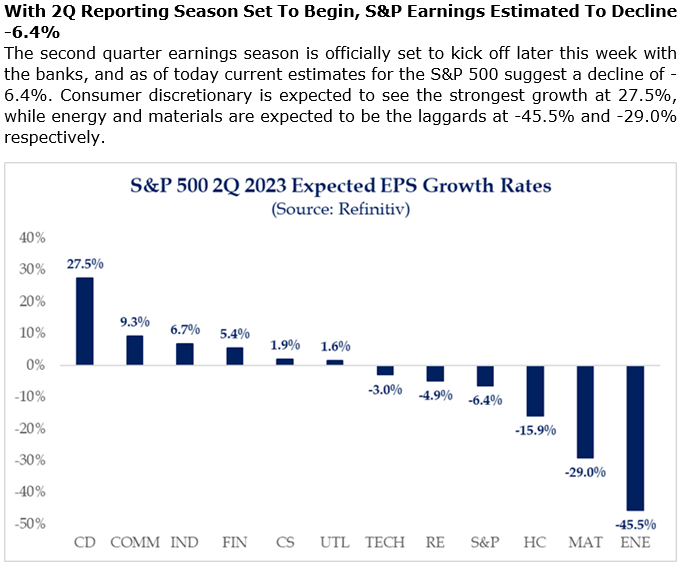

Brad: though there is a wide dispersion of expectations from Consumer Discretionary down to Energy, and in between

Source: Strategas as of 07.10.2023

Source: Strategas as of 07.10.2023

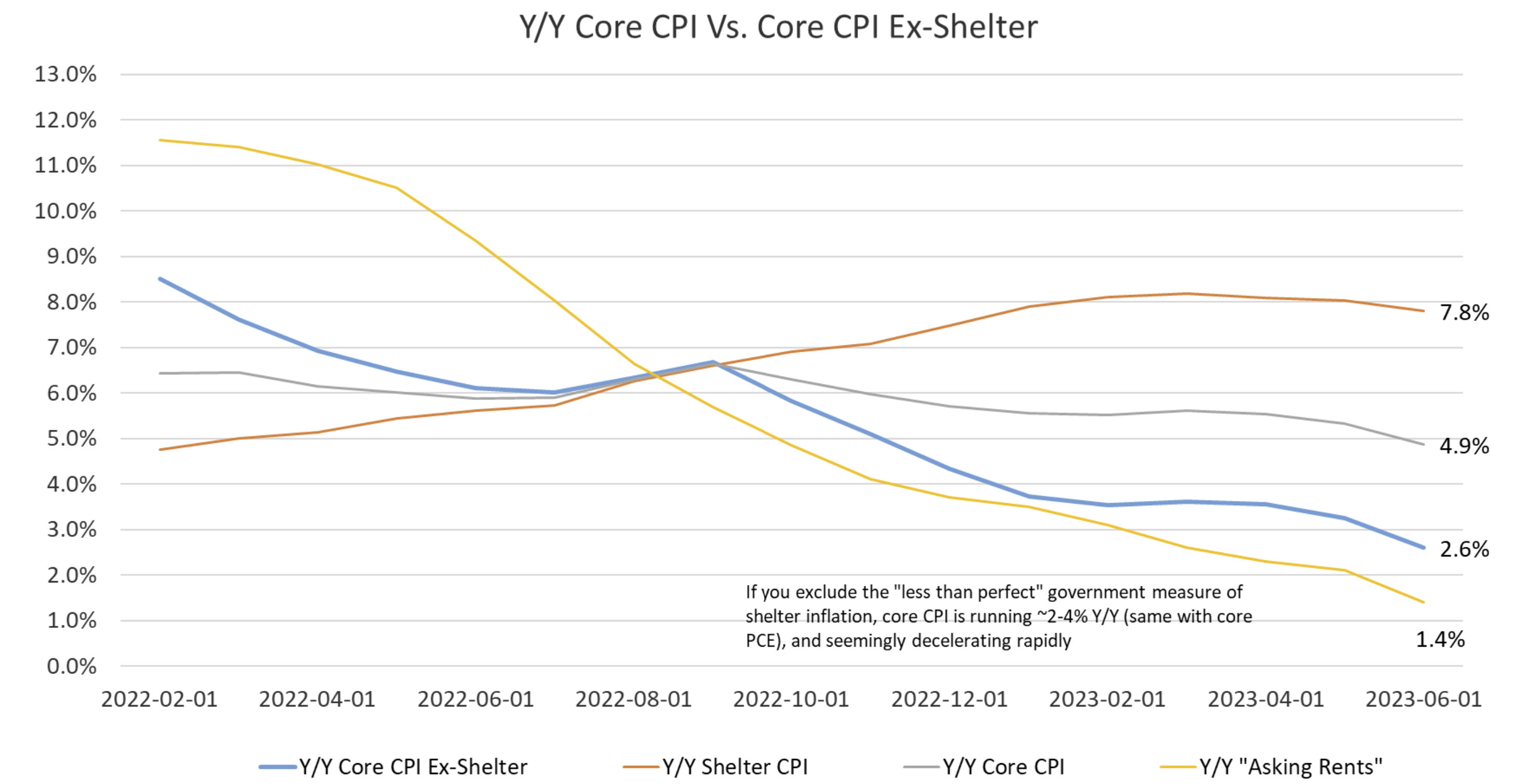

Dave: Core CPI ex-shelter is now approaching the Fed’s stated target

Source: Raymond James as of 07.11.2023

Source: Raymond James as of 07.11.2023

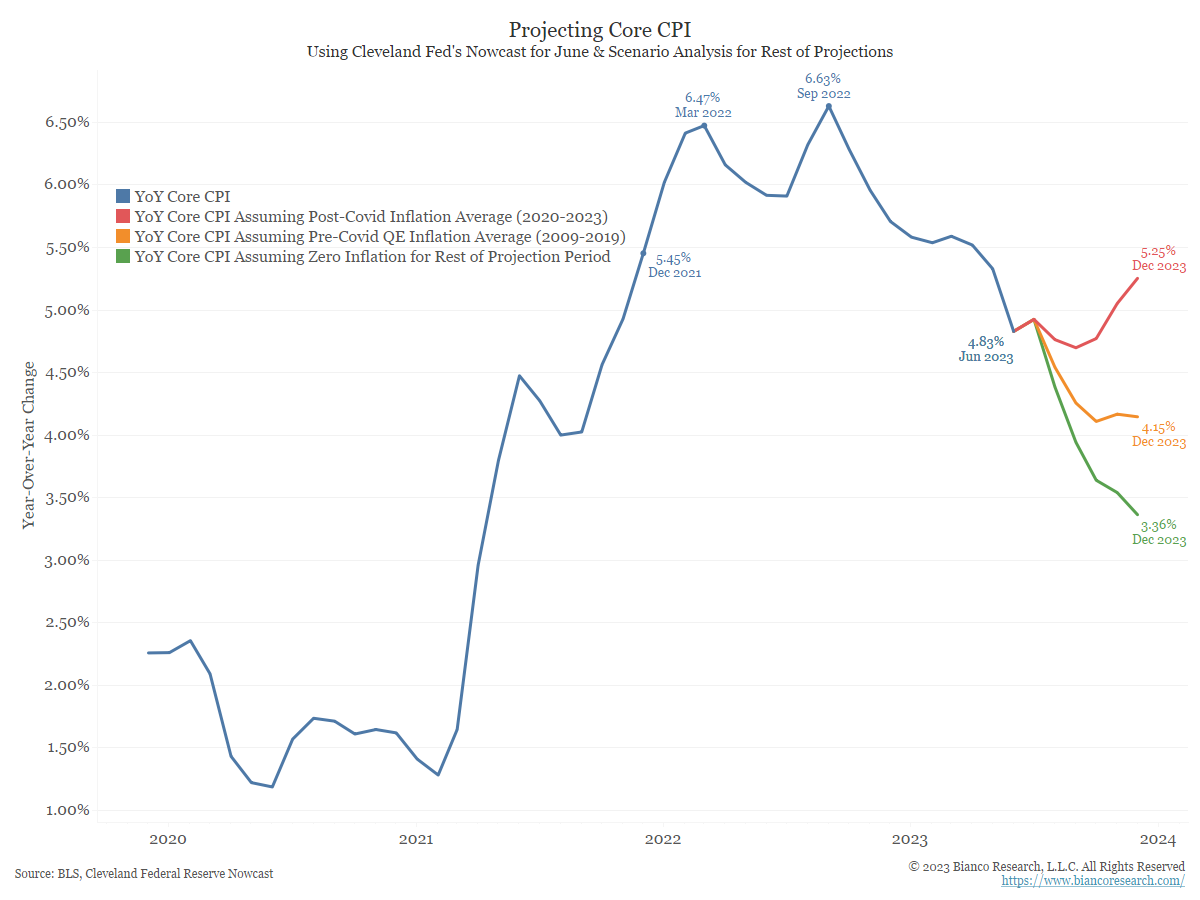

John Luke: but looking to the rest of the year, the timeline of comps suggests that 2% would be a tough destination to reach

Data as of 07.12.2023

Data as of 07.12.2023

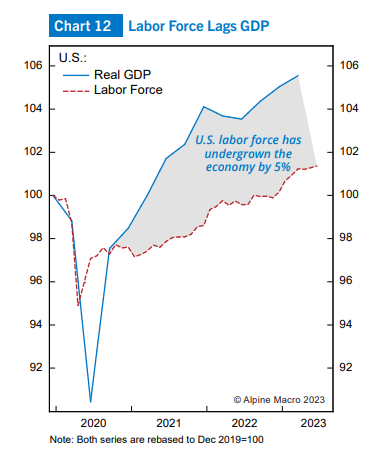

John Luke: particularly with the possibly structural labor force shortage that has emerged in recent years

Source: Alpine as of 07.10.2023

Source: Alpine as of 07.10.2023

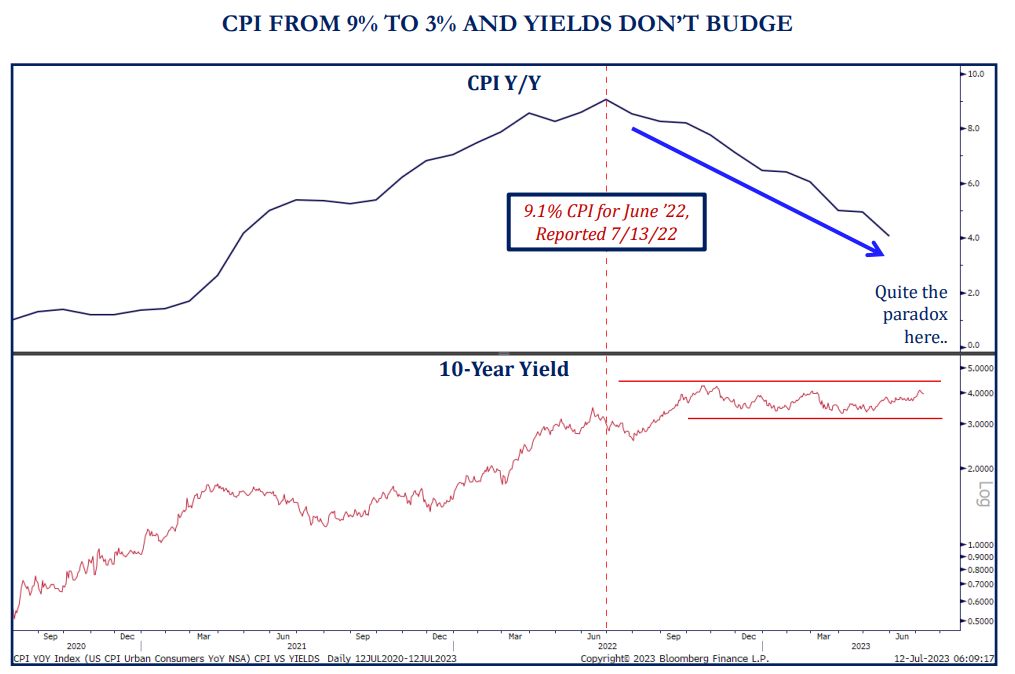

John Luke: The closely watched 10-yr Treasury yield hasn’t been very responsive to the recent fall in headline inflation

Source: Strategas as of 07.12.2023

Source: Strategas as of 07.12.2023

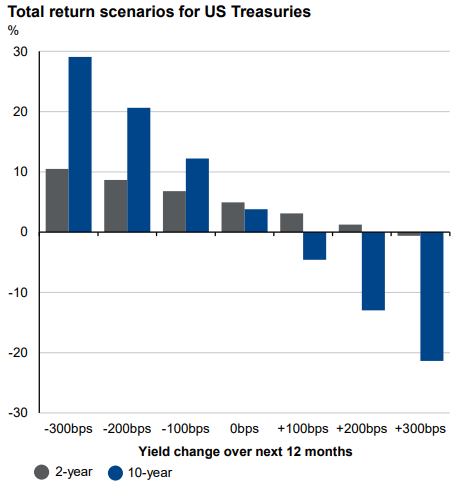

John Luke: but if it finally moves out of this range, here’s a guide to the impact on fixed income price moves

Source: JP Morgan as of 07.11.2023

Source: JP Morgan as of 07.11.2023

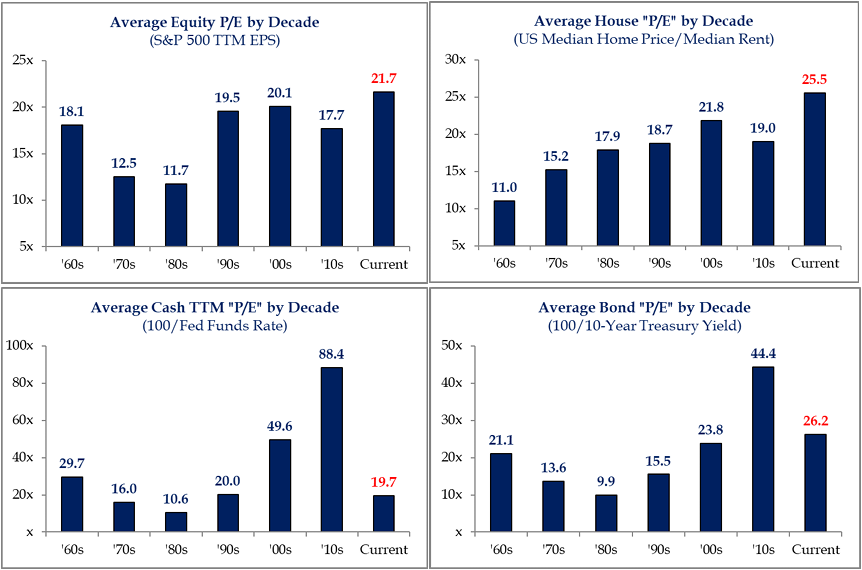

Brad: Fun with math, one way to begin an relative comparison of the valuations of competing asset classes

Source: Strategas as of 07.10.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-21.