Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from historic market movement to inflation and of course, tariffs. Enjoy!

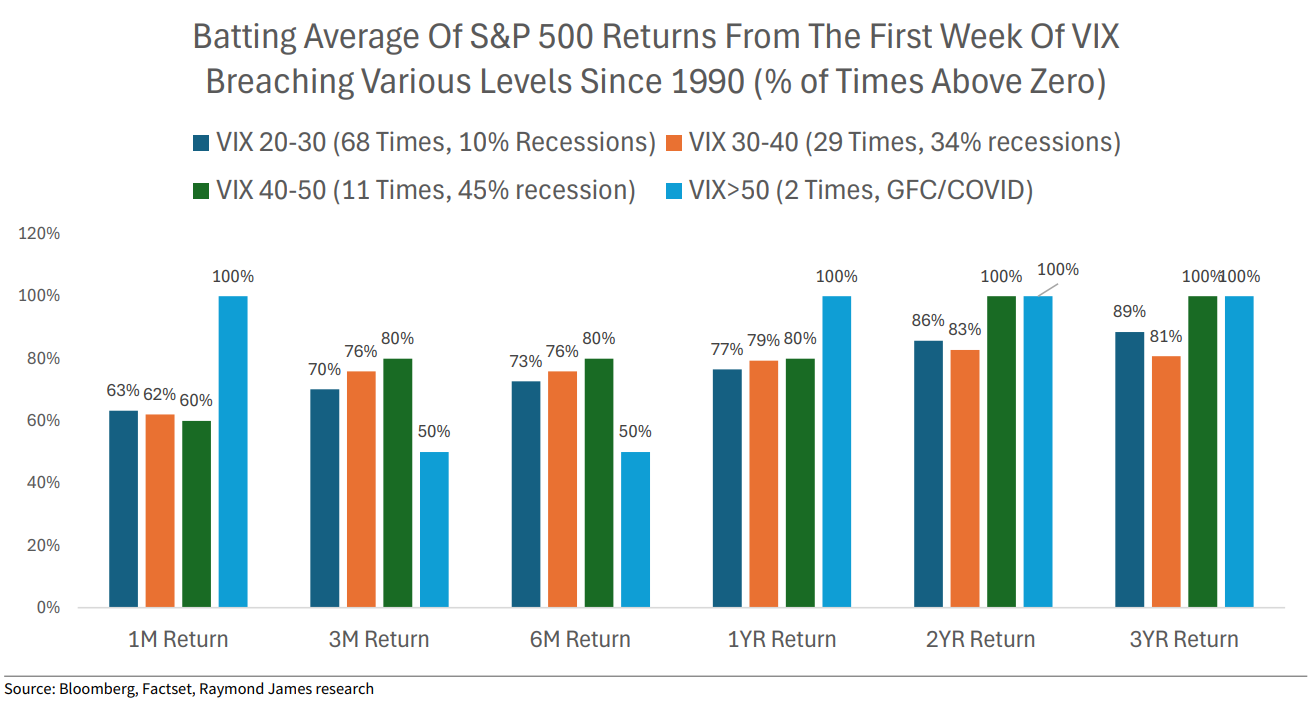

Brad: High VIX has coincided with near-term weakness, but the benefit of improving chances for long-term upside once cleared

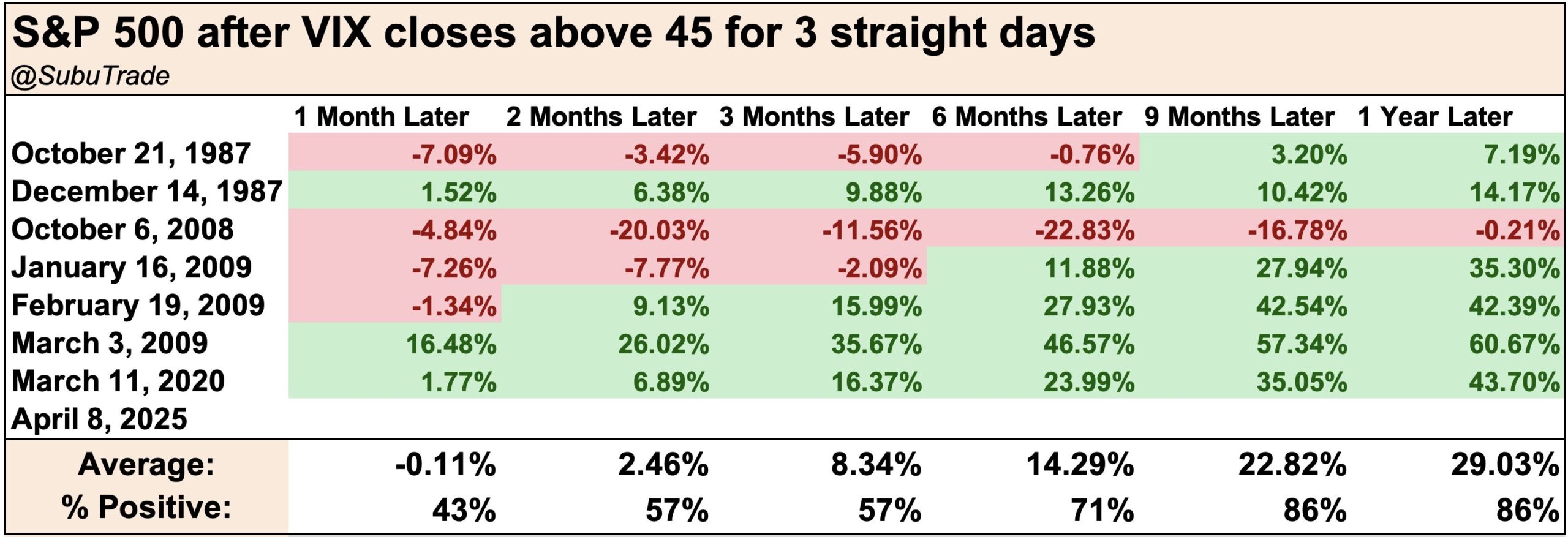

Brett: and a run of consecutive high VIX closes has occurred only in the wildest of markets, with chop continuing but room for upside

Source: @subutrade as of 04.08.2025

Source: @subutrade as of 04.08.2025

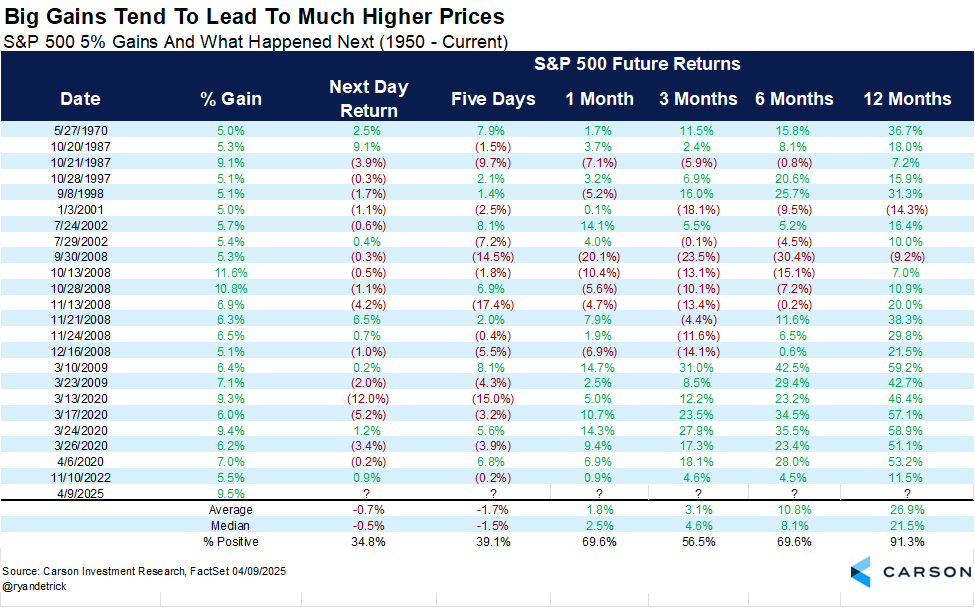

Beckham: While markets are digesting Wednesday’s huge move higher, history has shown those moves to be a potential precursor to continued strength

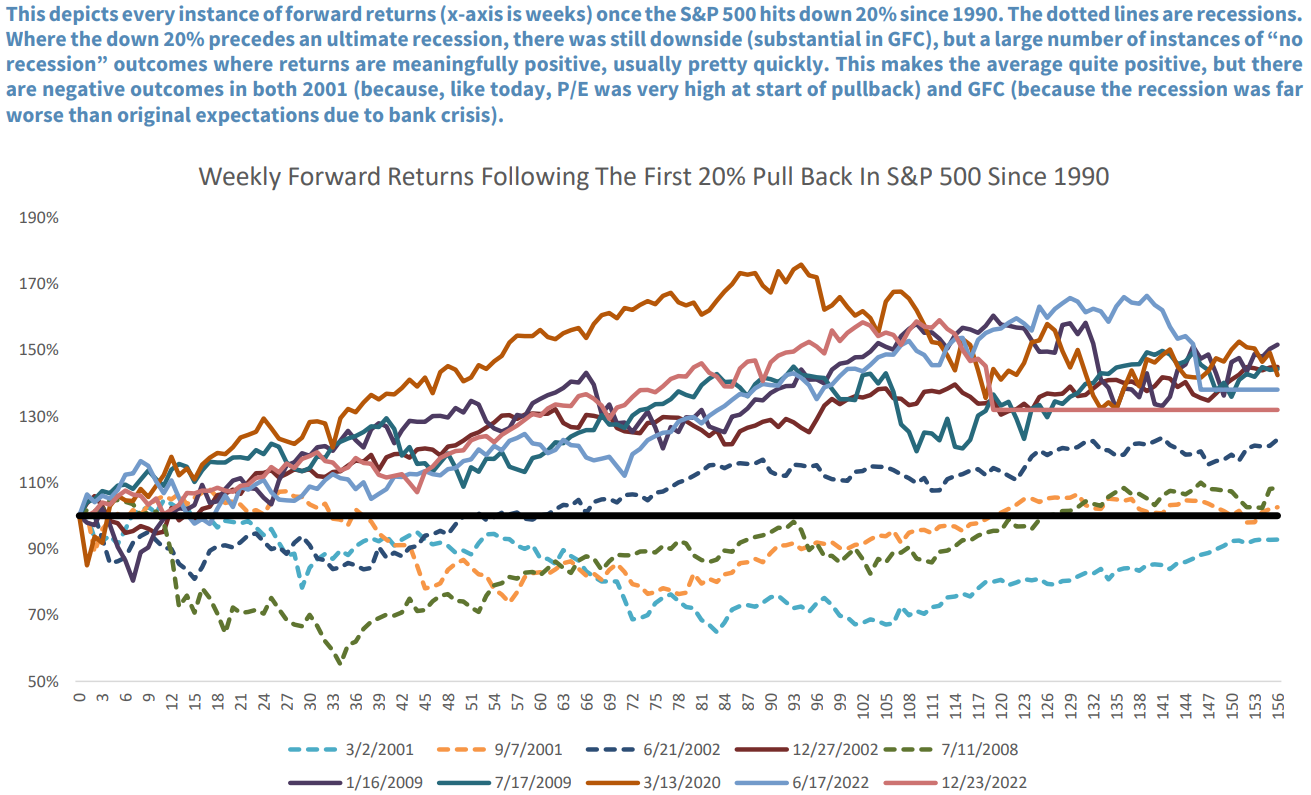

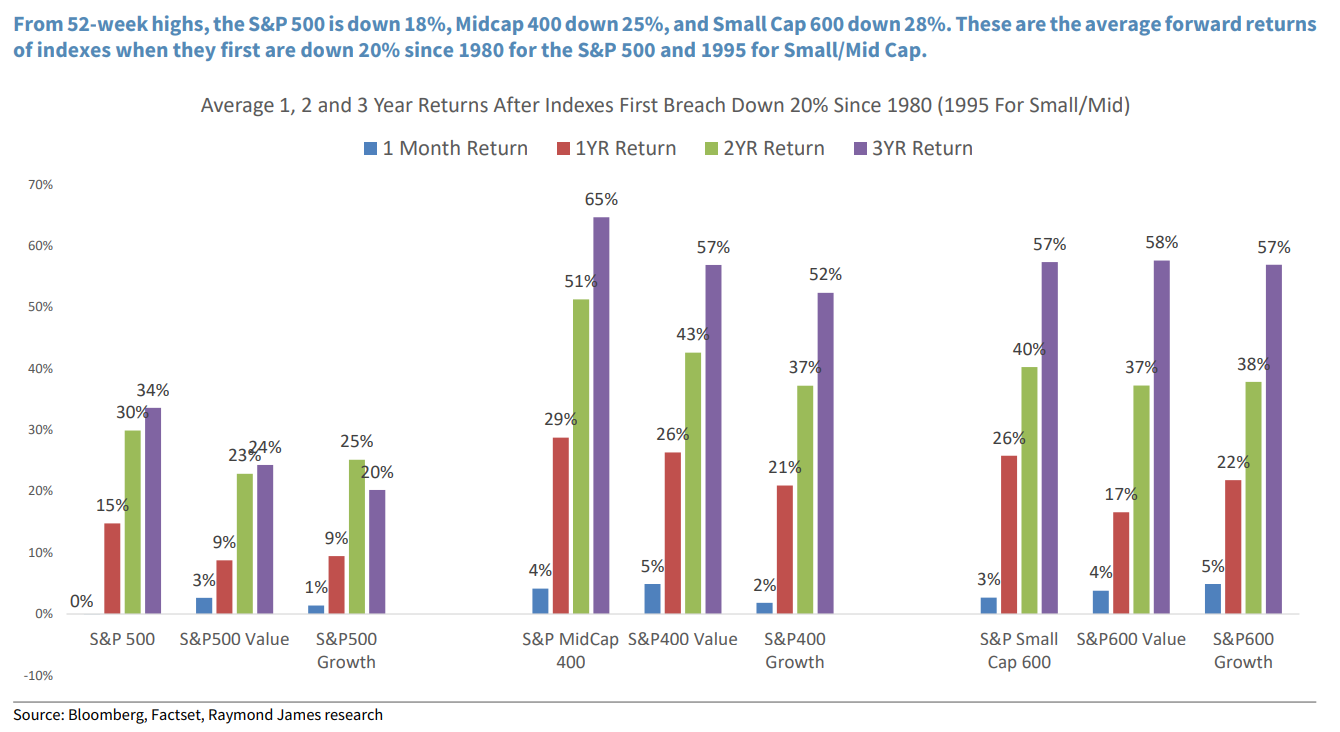

Brad: Historically, a 20% drawdown in the S&P 500 has been a generally good time to put money to work

Source: Raymond James as of 04.07.2025

Source: Raymond James as of 04.07.2025

Brad: with broad strength across stocks of all sizes and styles

Data as of 04.07.2025

Data as of 04.07.2025

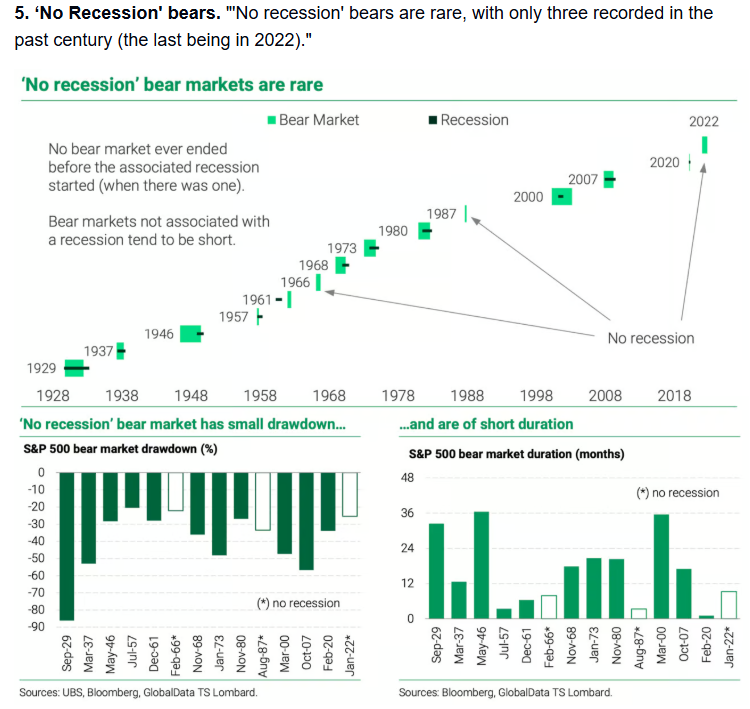

Joseph: Pundits and strategists seem split on recession vs. no recession, but in general, a 20% drop in the S&P 500 has indicated material economic weakness

Data as of 04.08.2025

Data as of 04.08.2025

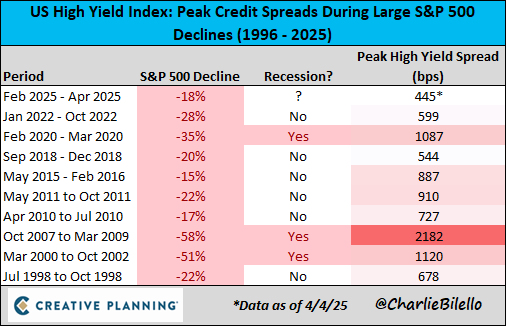

Brad: but if high-yield spreads are an indicator of economic strength or weakness, the evidence for a recession is not there yet

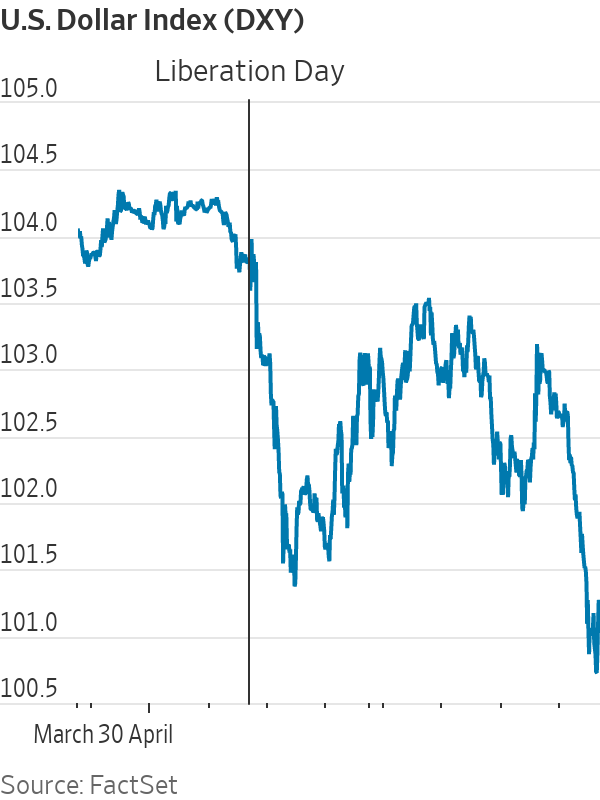

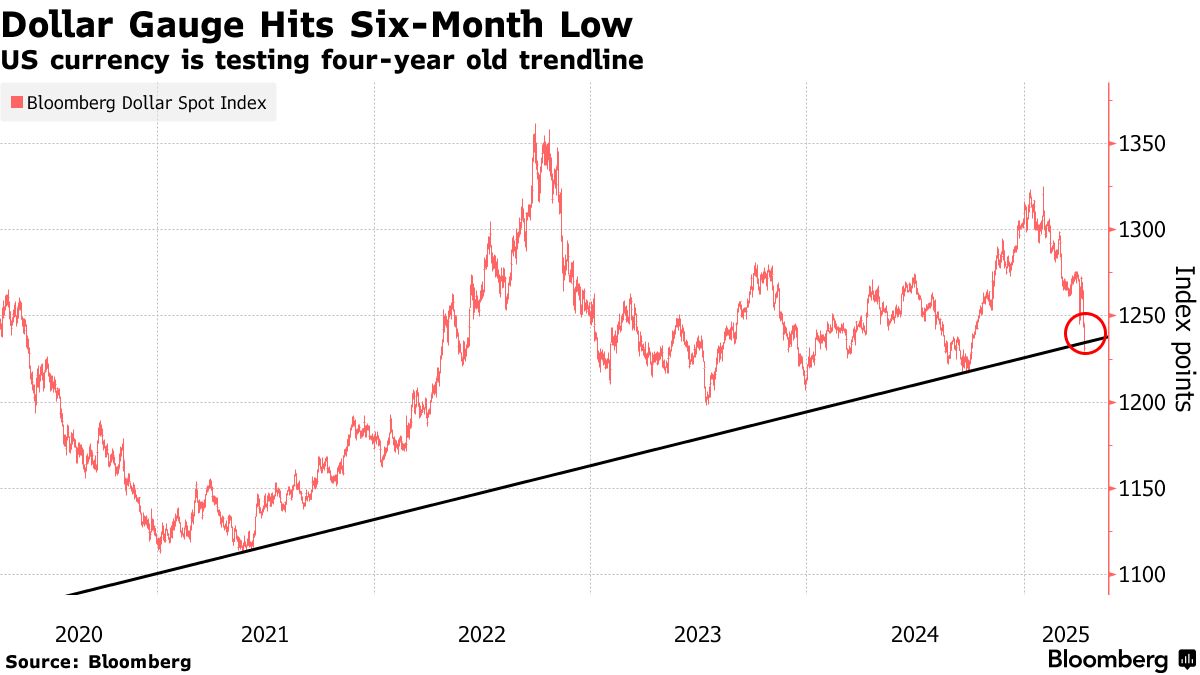

Brian: One of the more notable moves in the past week has been a complete loss of strength in the US dollar

Chart via WSJ as of 04.09.2025

Chart via WSJ as of 04.09.2025

Jake: and while the general trend of US Dollar leadership remains in place, it’s in a more tenuous spot than in recent years

Data as of 04.09.2025

Data as of 04.09.2025

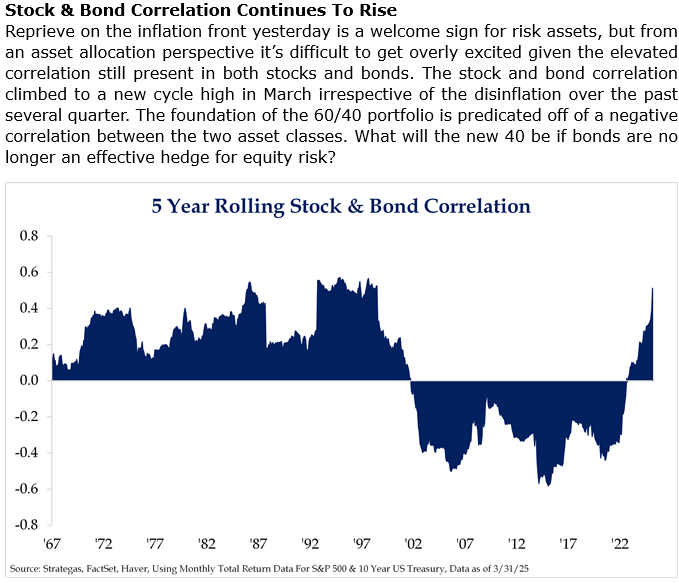

John Luke: Bonds are providing very little support to equity investors hoping to diversify away from extreme outcomes

Dave: with bonds especially unhelpful after the tariff announcement

Chart via WSJ as of 04.09.2025

Chart via WSJ as of 04.09.2025

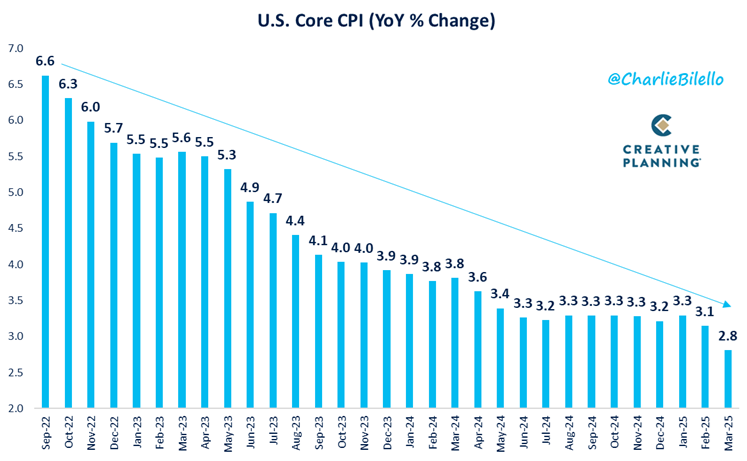

Dave: Government inflation headlines show a steady reduction in year-over-over price increases

Data as of 04.10.2025

Data as of 04.10.2025

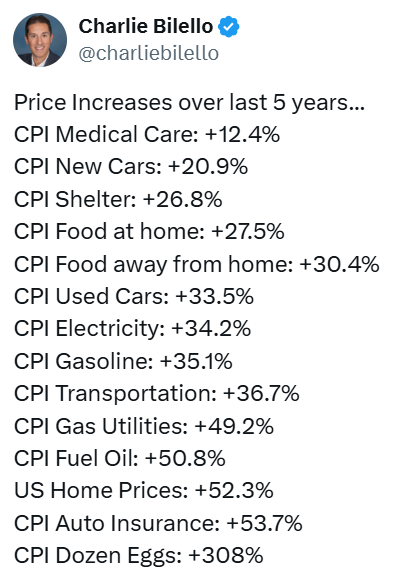

JD: but when you look at the cumulative rise in the cost of the items we consume, you can see why protecting purchasing power is critical

Data as of 04.10.2025

Data as of 04.10.2025

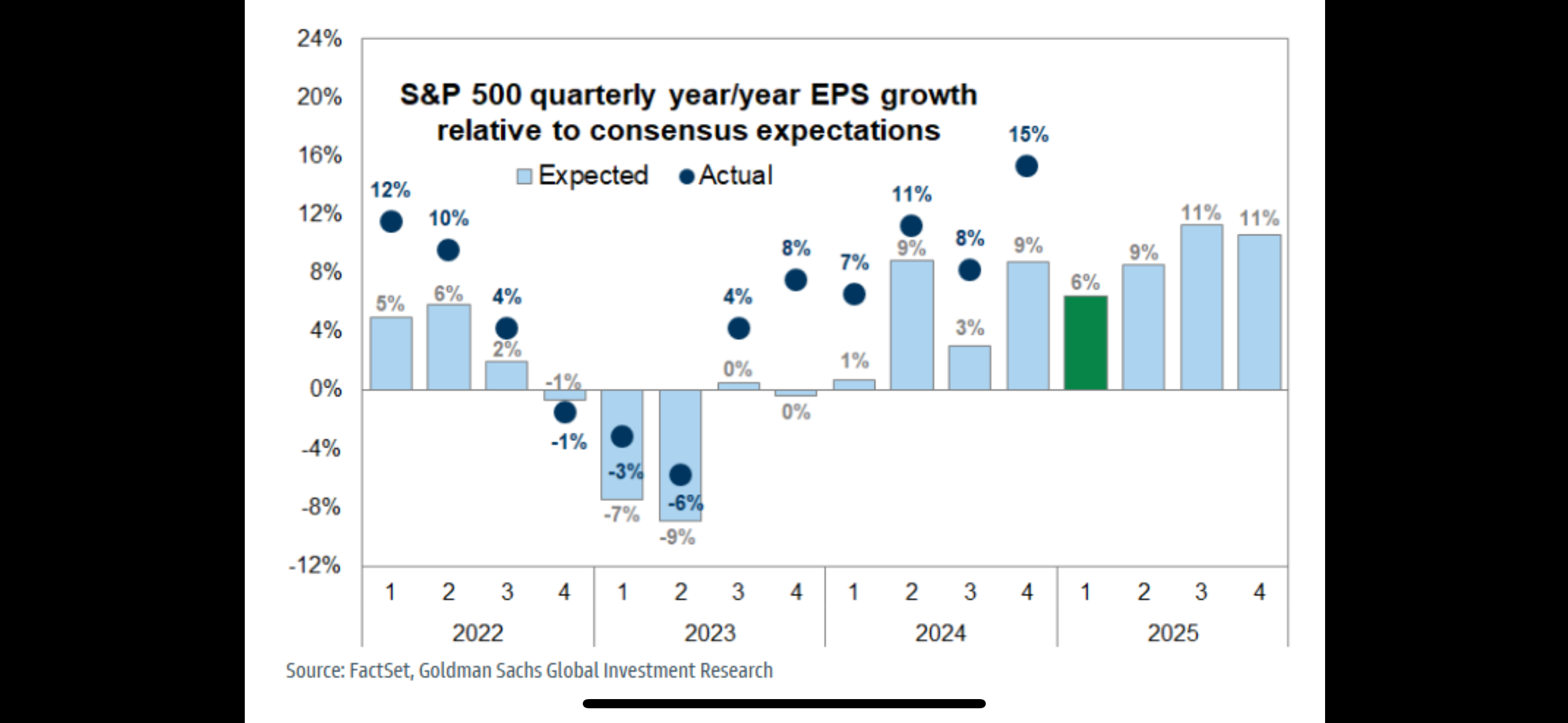

Dave: Earnings season is here, with anxiety hopefully setting the table for the typical batch of positive surprises

Data as of 04.04.2025

Data as of 04.04.2025

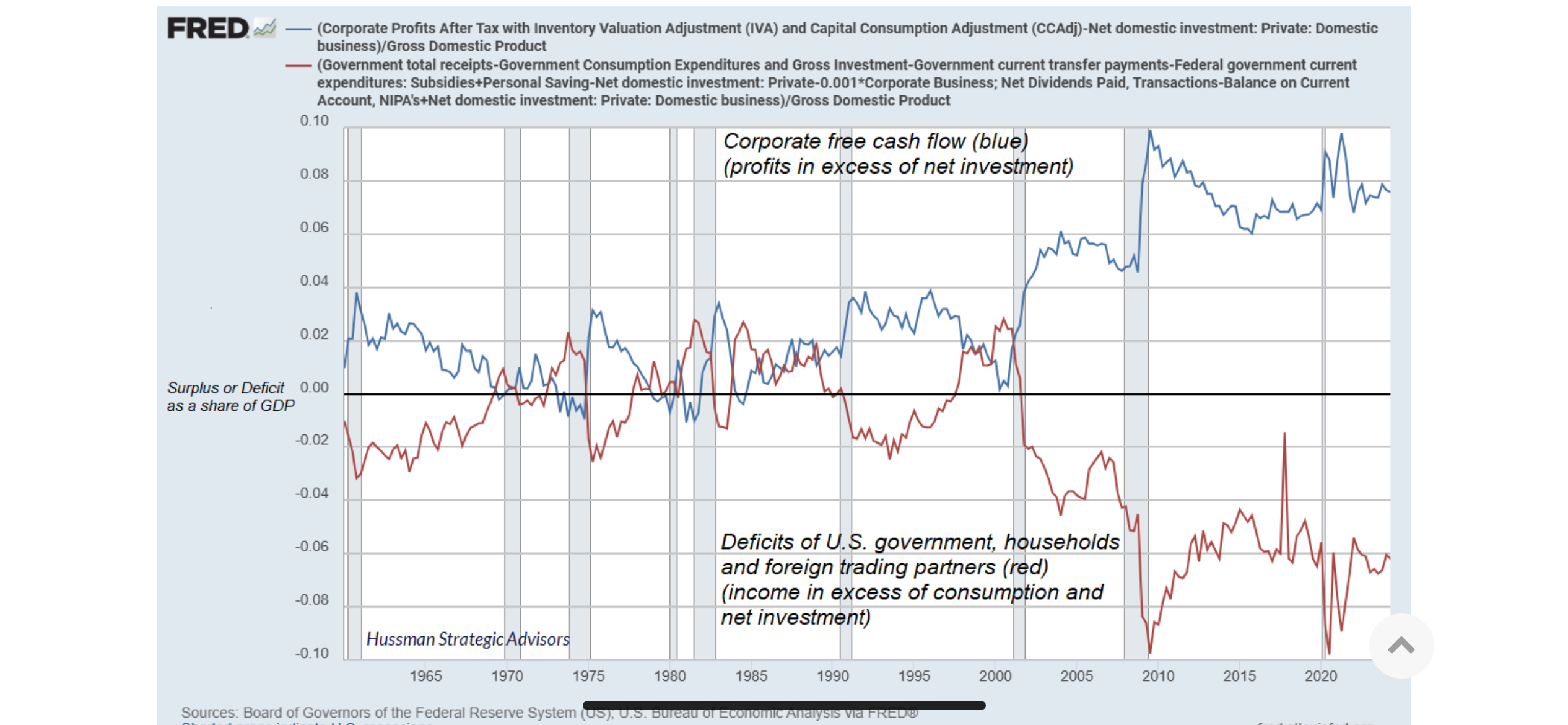

John Luke: The greater question for earnings is, how much will the attempt at deficit reduction impact the amazing rise in corporate profit margins?

Source: Hussman Strategic Advisors as of 04.05.2025

Source: Hussman Strategic Advisors as of 04.05.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-17.