Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

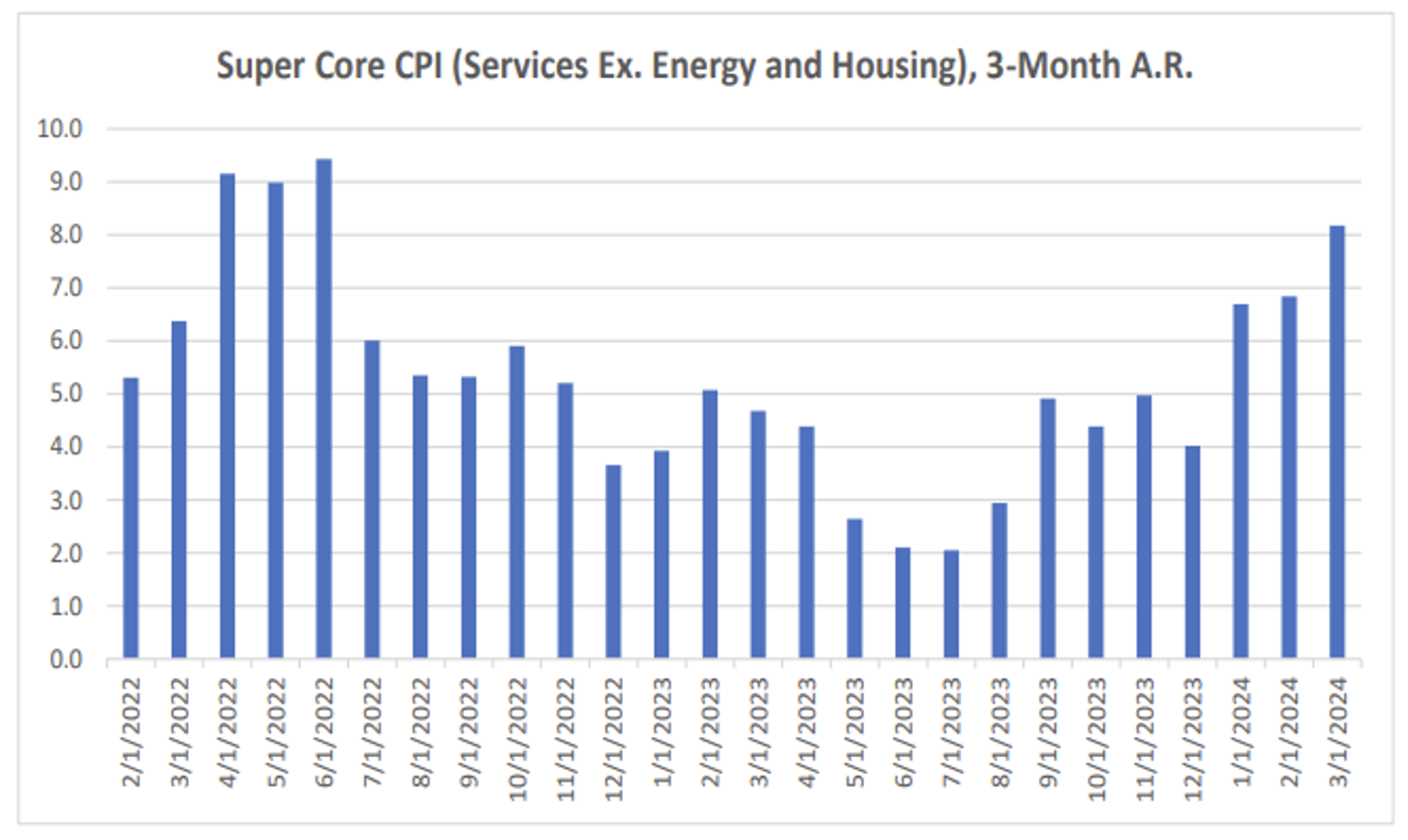

John Luke: This week was mostly about inflation, with CPI Supercore running hot

Source: MKM as of 04.10.2024

Source: MKM as of 04.10.2024

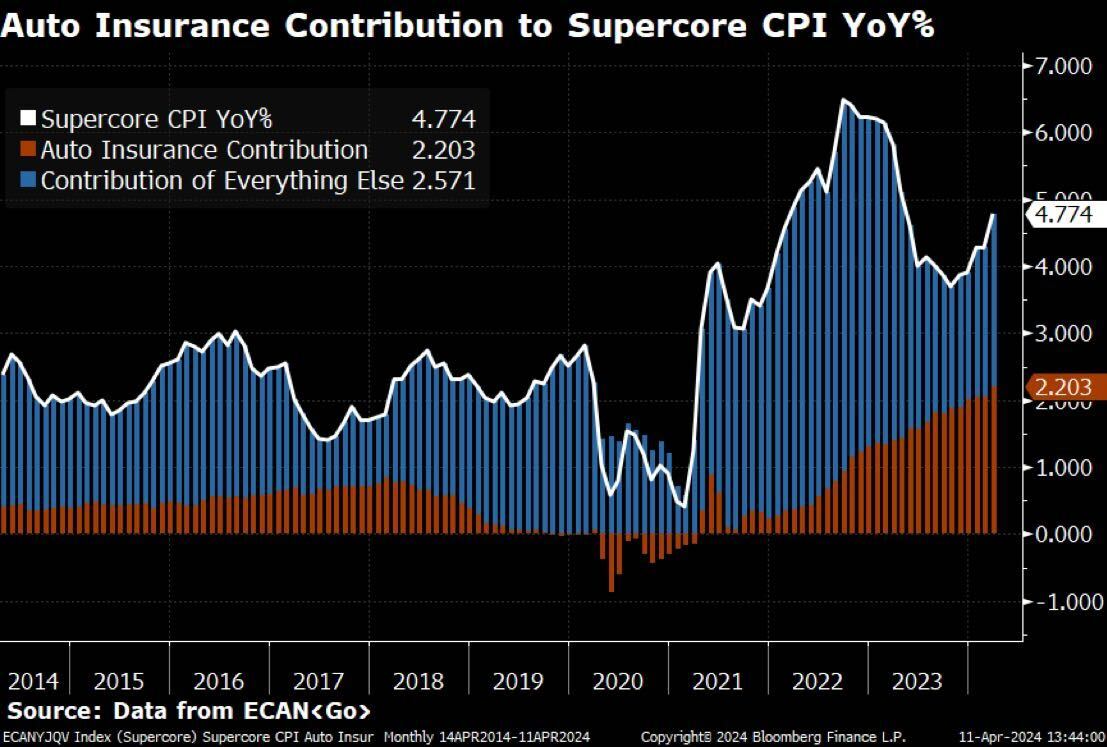

Brian: with auto insurance becoming a larger and more painful component

Source: Bloomberg as of 04.11.2024

Source: Bloomberg as of 04.11.2024

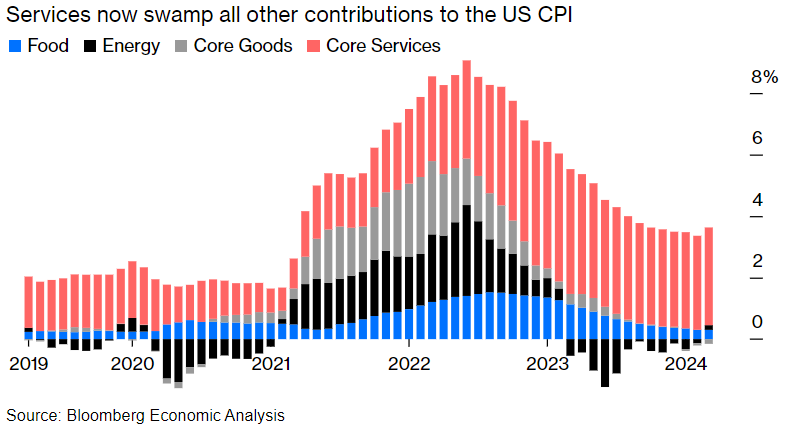

Joseph: and services as a whole staying stubbornly high after receding from peak year-over-year rates

Data as of 04.10.2024

Data as of 04.10.2024

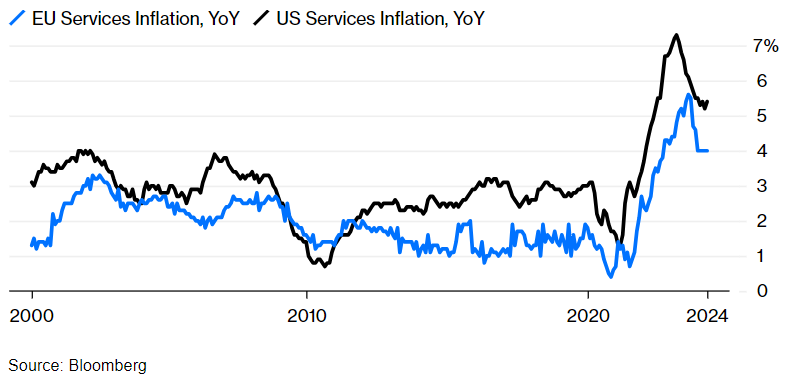

Brett: the story is the same in Europe

Data as of 04.10.2024

Data as of 04.10.2024

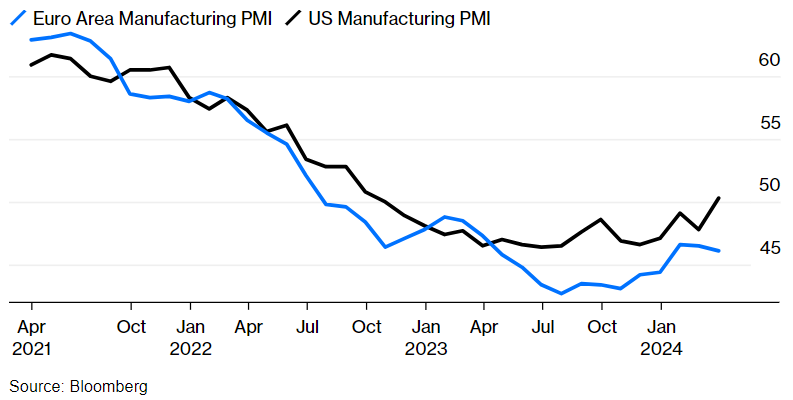

Beckham: Manufacturing is becoming a differentiator for the U.S. vs. the European Union

Data as of March 2024

Data as of March 2024

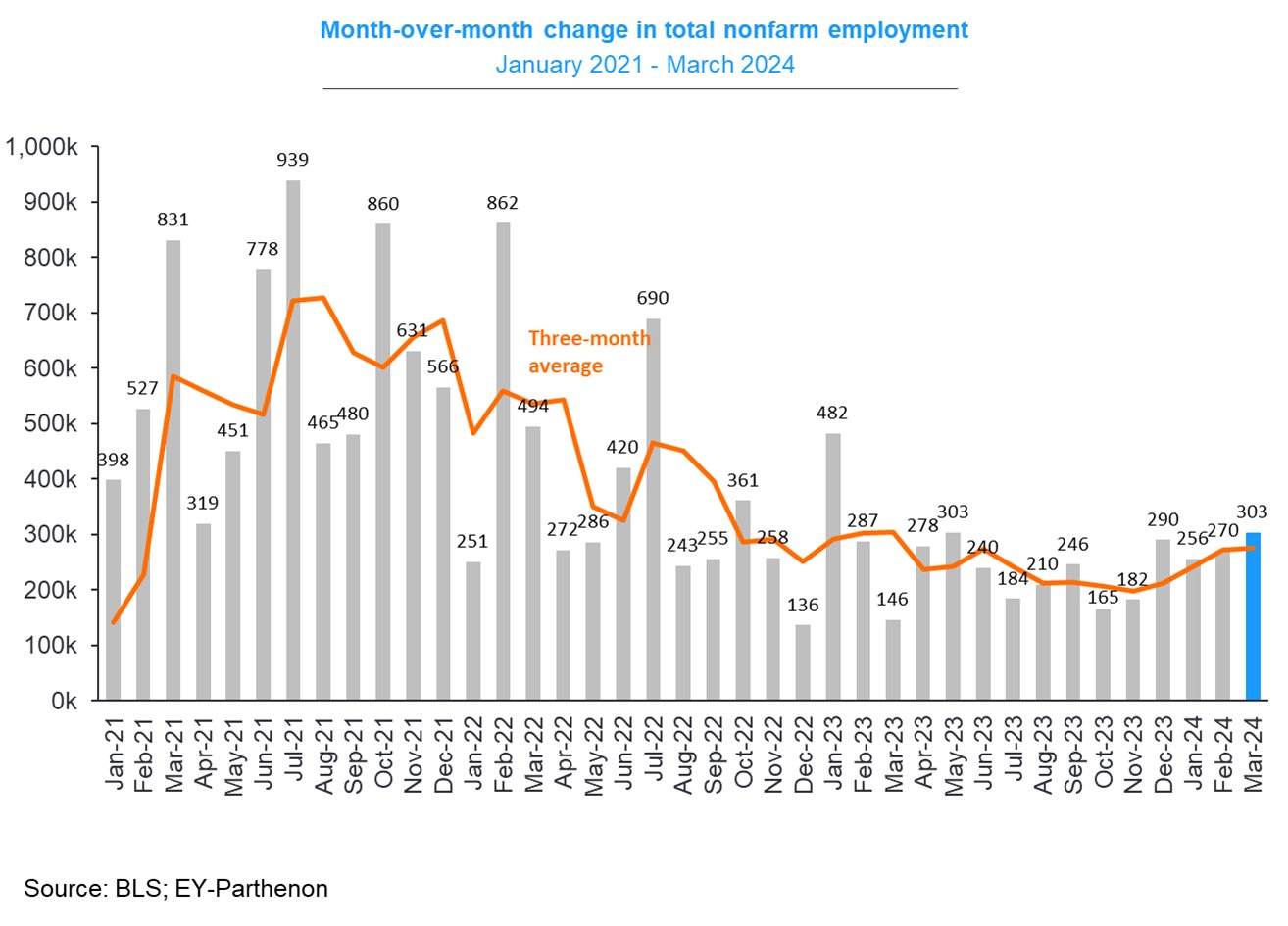

Dave: which is showing up in a stable, positive jobs picture in the U.S.

Data as of 04.05.2024

Data as of 04.05.2024

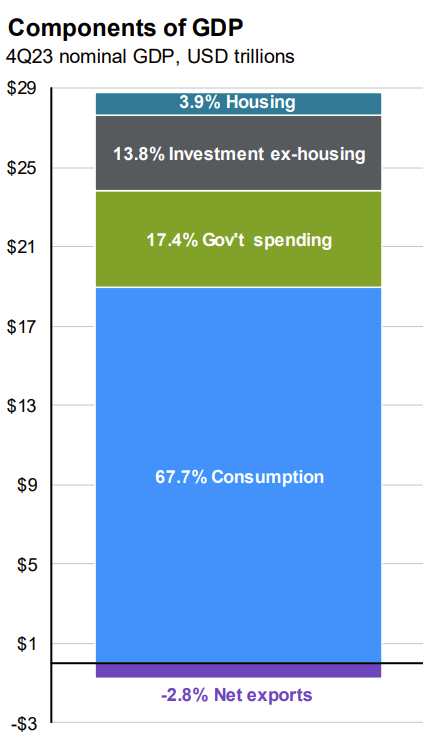

Joseph: and as long as people have jobs, they’re going to spend money and keep the economy growing

Source: JP Morgan as of March 2024

Source: JP Morgan as of March 2024

Brad: The timing of FOMC rate cuts continues to get pushed out, as we remain in a “pause”

Data as of 04.10.2024

Data as of 04.10.2024

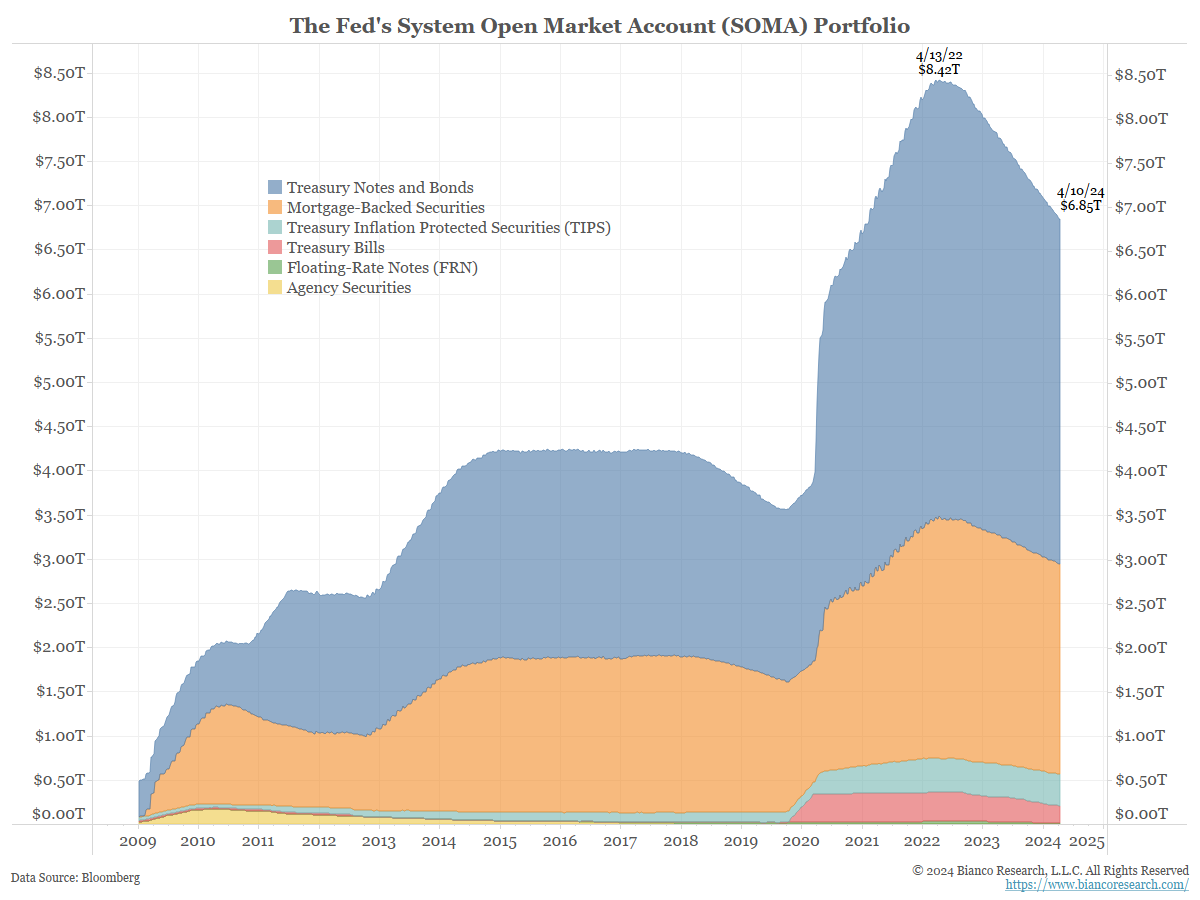

John Luke: with a slow, quiet bleed in quantitative tightening continuing

Data as of 04.10.2024

Data as of 04.10.2024

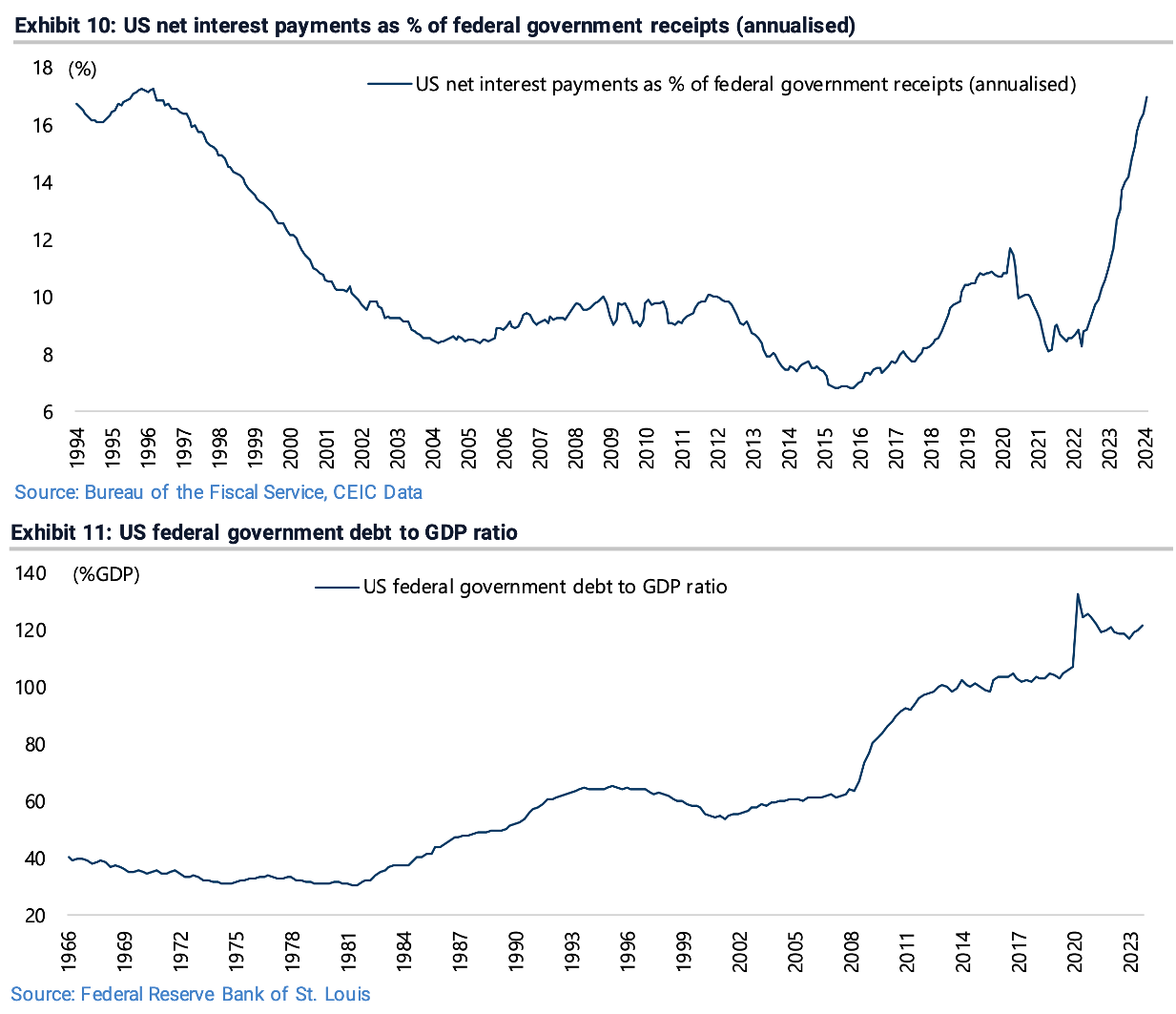

JD: and the U.S. government debt burden just piles up

Source: Jefferies as of March 2024

Source: Jefferies as of March 2024

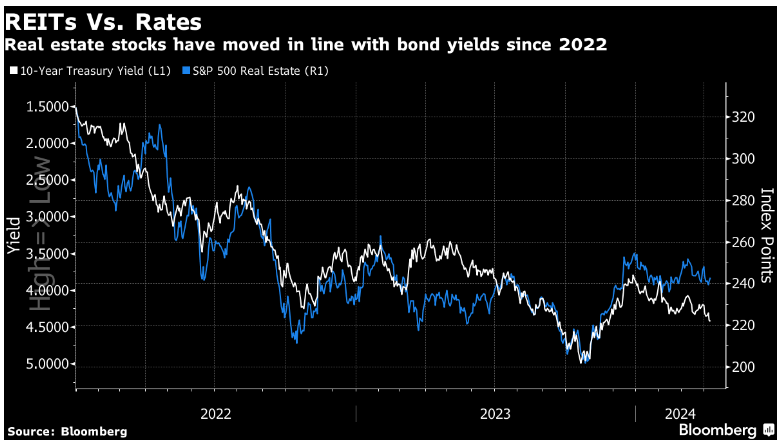

Beckham: The area of the market that’s been most tied to the movements in rates has been Real Estate Investment Trusts (REITs)

Data as of 04.09.2024

Data as of 04.09.2024

Beckham: with the same pattern happening in European REITs

Data as of 04.09.2024

Data as of 04.09.2024

Joseph: and what is now 25+ years of no price appreciation in U.S. office REIT stocks

Data as of 04.10.2024

Data as of 04.10.2024

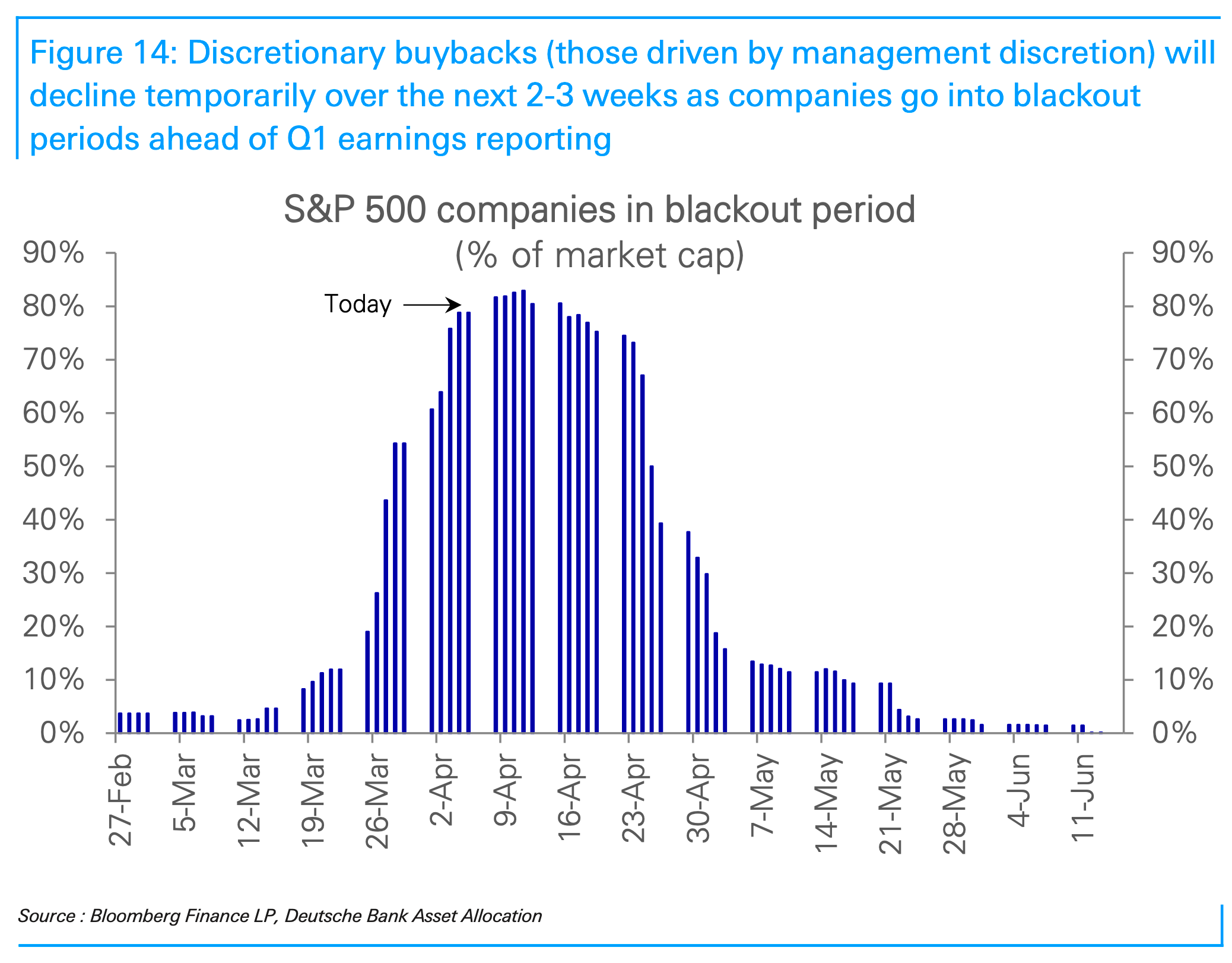

Brett: We’ve entered a blackout window preventing a high % of U.S. companies from buying back stock during earnings season

Data as of 04.05.2024

Data as of 04.05.2024

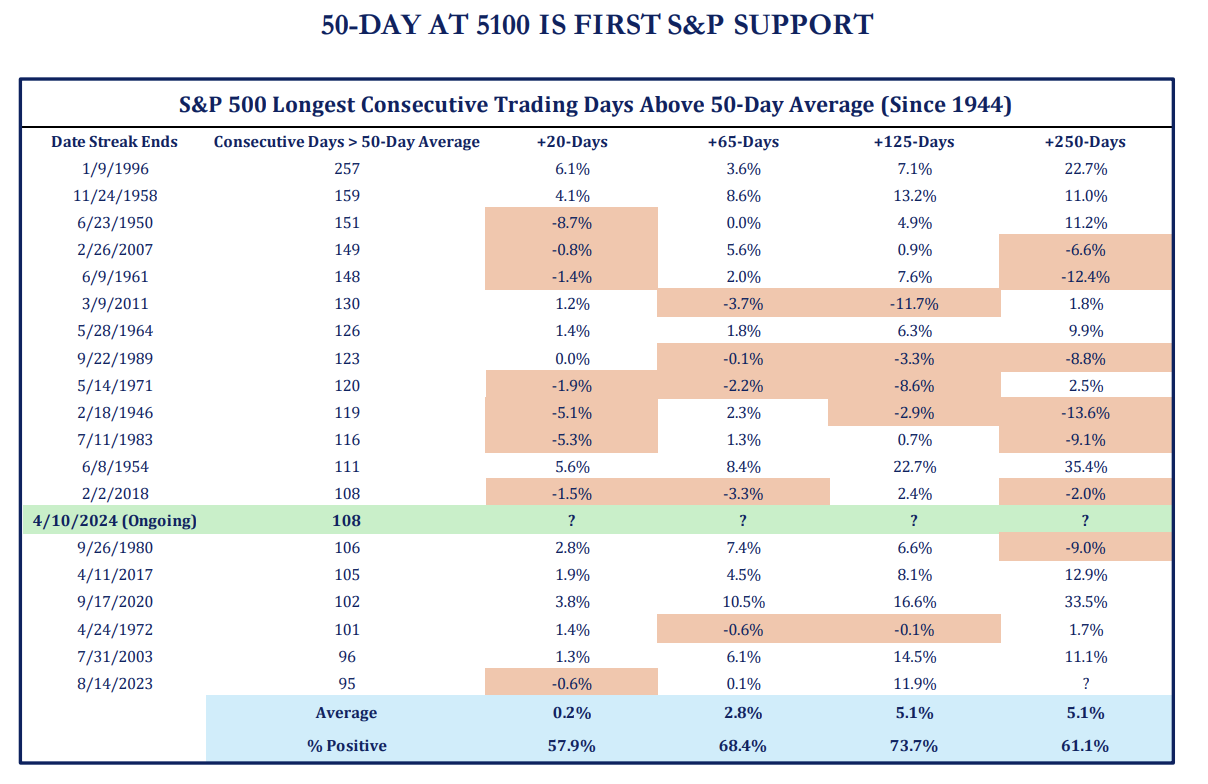

John Luke: at a time when U.S. stocks are getting a bit wobbly after a steady 5-month uptrend

Source: Strategas as of 04.10.2024

Source: Strategas as of 04.10.2024

Dave: Hopefully, after a long period in which the S&P 500 has dominated earnings

Source: Meketa as of January 2024

Source: Meketa as of January 2024

Dave: we may be closer to a broadening of growth rates across more industries and geographies

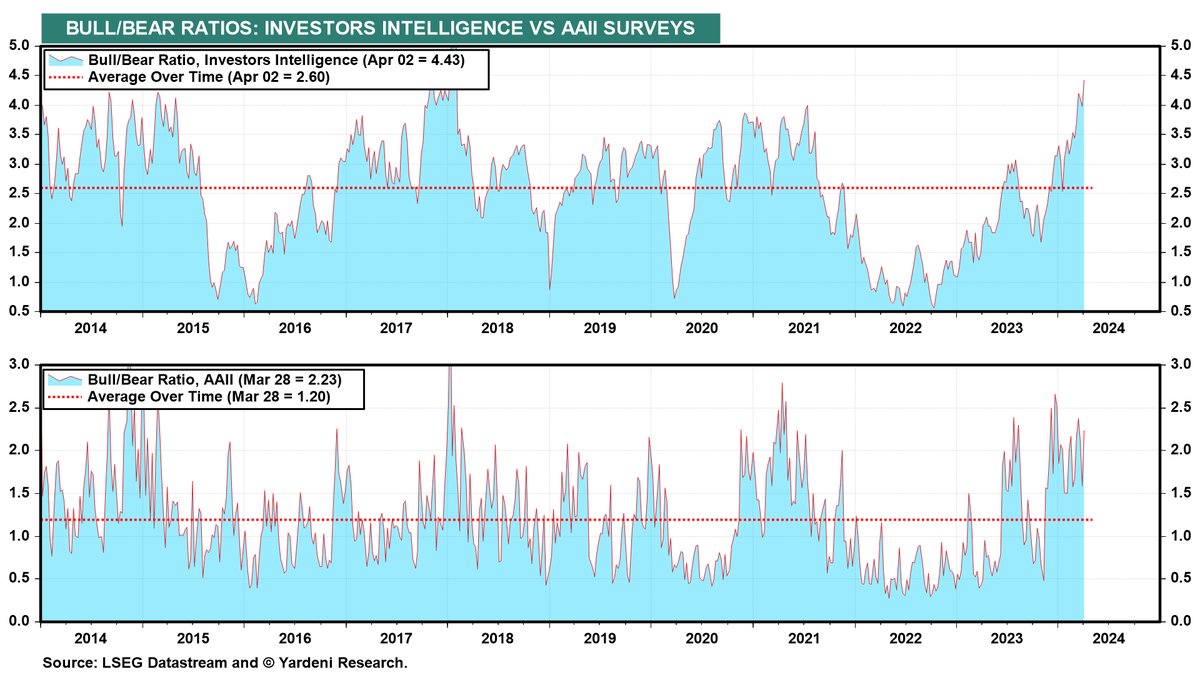

John Luke: While sentiment after the rally may have become a bit too giddy

Data as of 04.05.2024

Data as of 04.05.2024

Brian: we seem to have the general support of a shrunken supply of stocks to soak up investor cash

Data as of 04.08.2024

Data as of 04.08.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-23.