Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

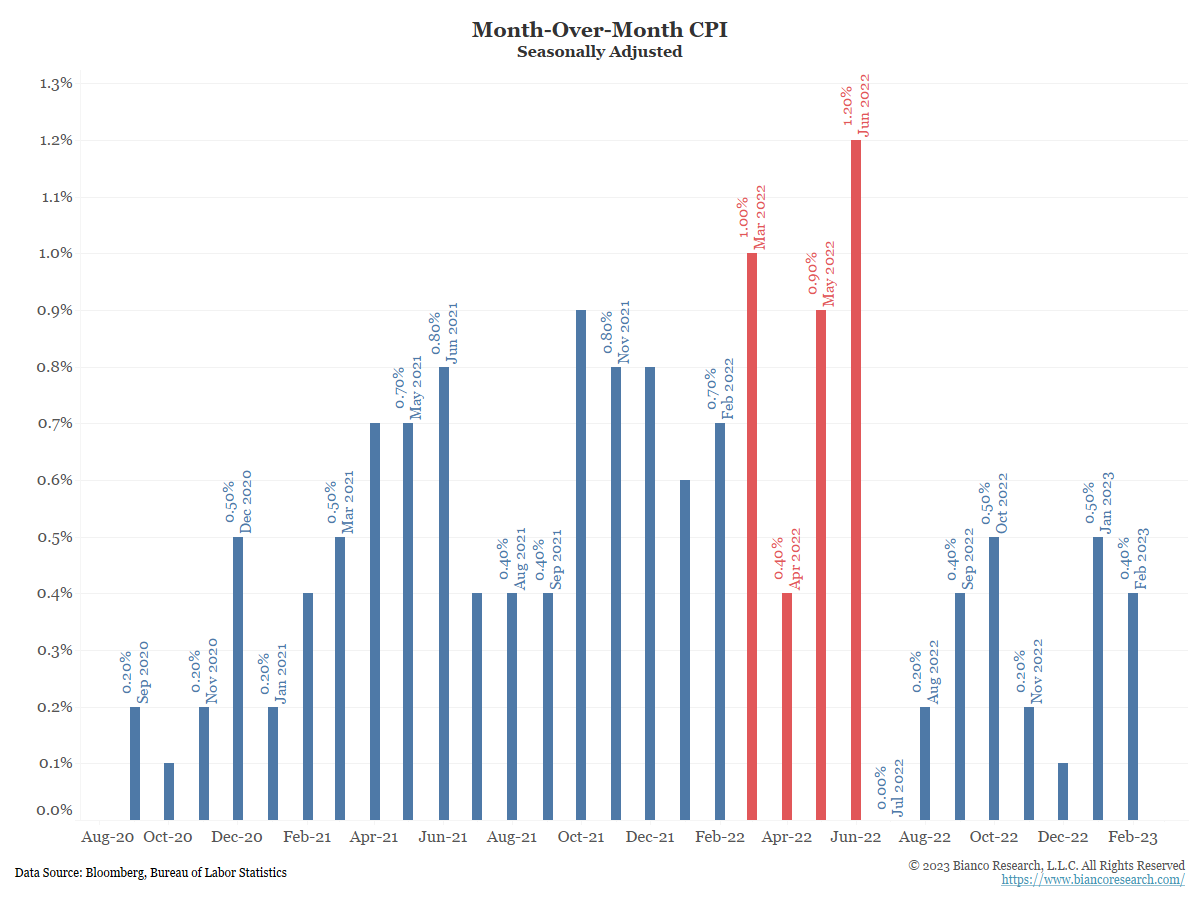

John Luke: Inflation comps get tougher in the next few months vs. the heart of the 2022 Ukraine spike

Source: Bianco as of 04.12.2023

Source: Bianco as of 04.12.2023

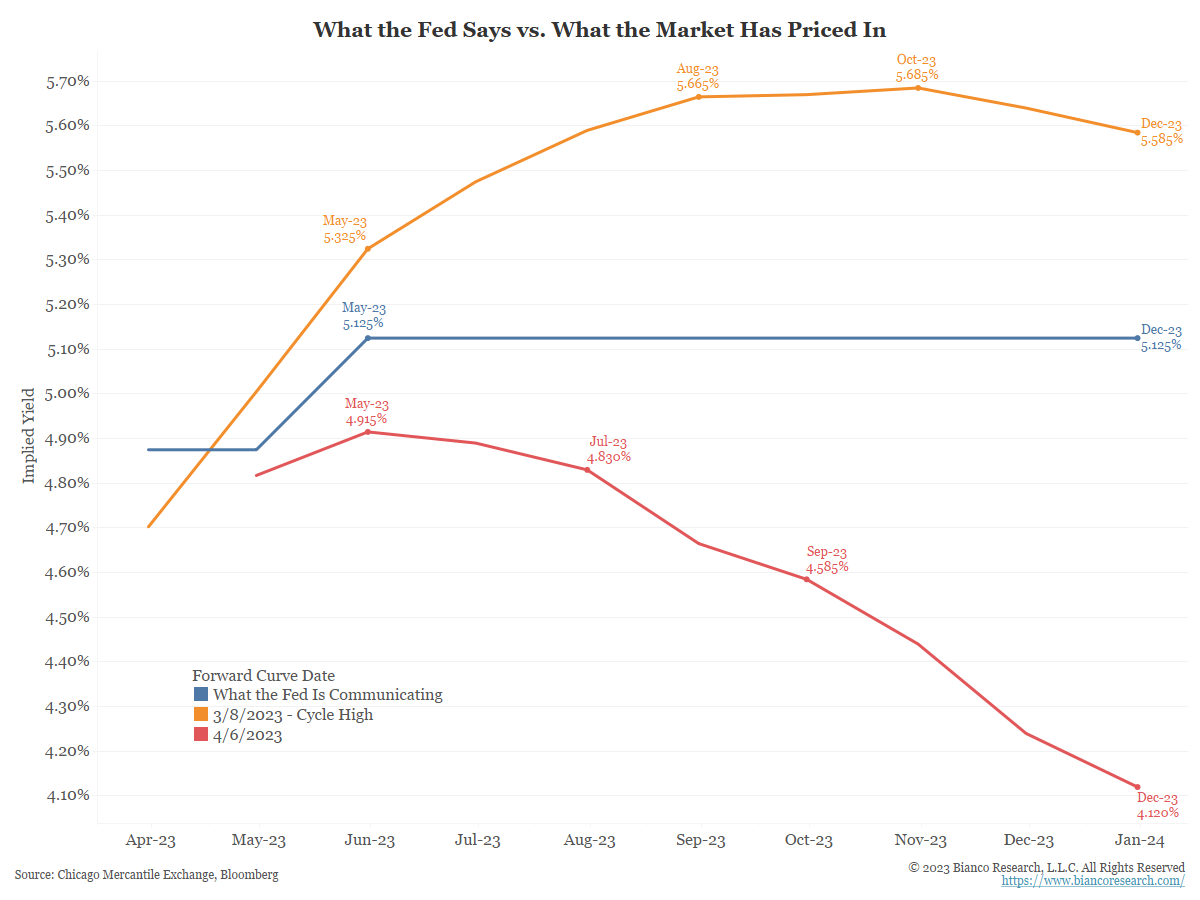

John Luke: which seems to be adding to market confusion about the Fed’s plans for rates

Source: Bianco as of 04.06.2023

Source: Bianco as of 04.06.2023

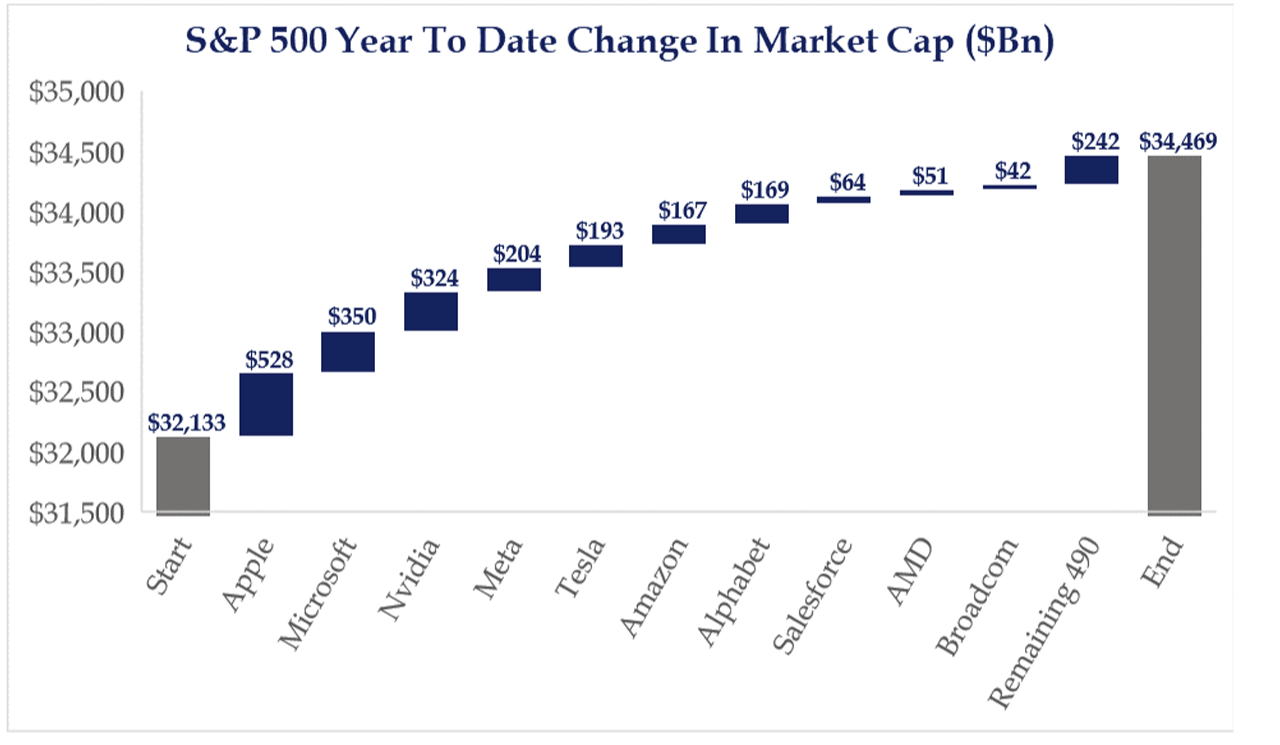

Dave: Year-to-date market cap gains have been bunched into the largest tech names

Source: Strategas as of 04.04.2023

Source: Strategas as of 04.04.2023

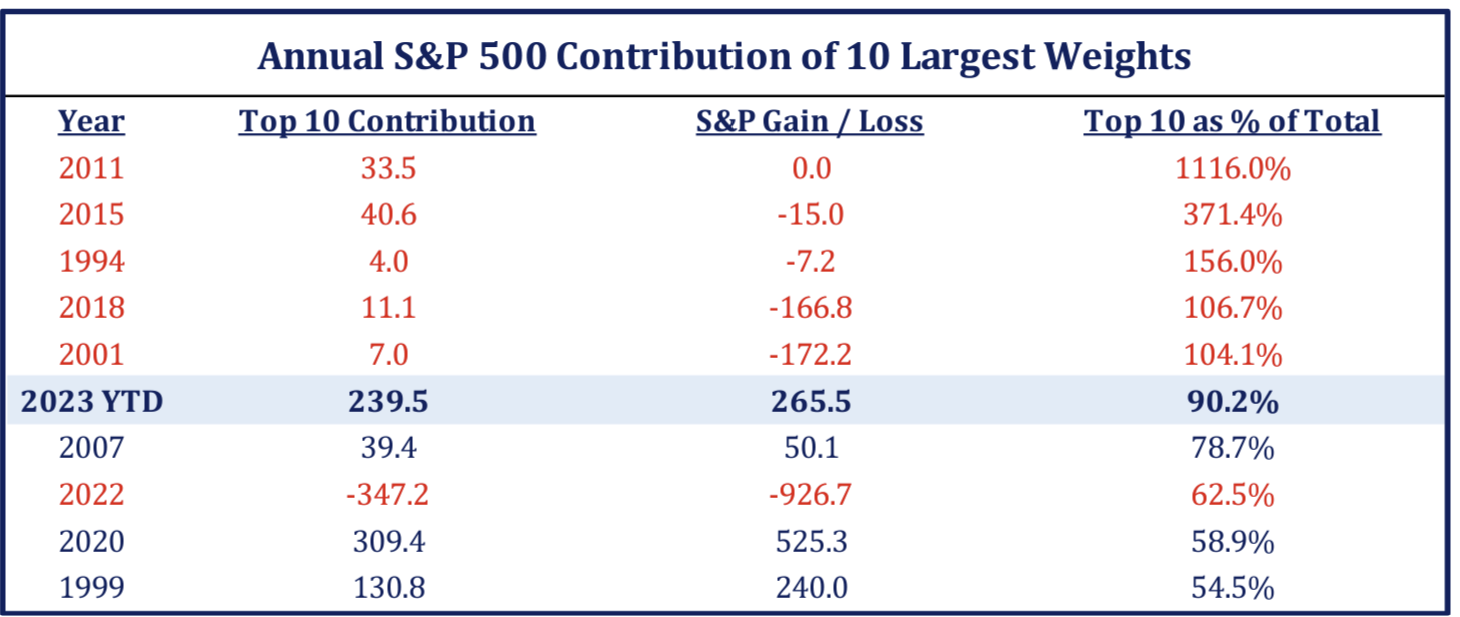

Dave: a pattern that is more typical of down years not up

Source: Strategas as of 04.11.2023

Source: Strategas as of 04.11.2023

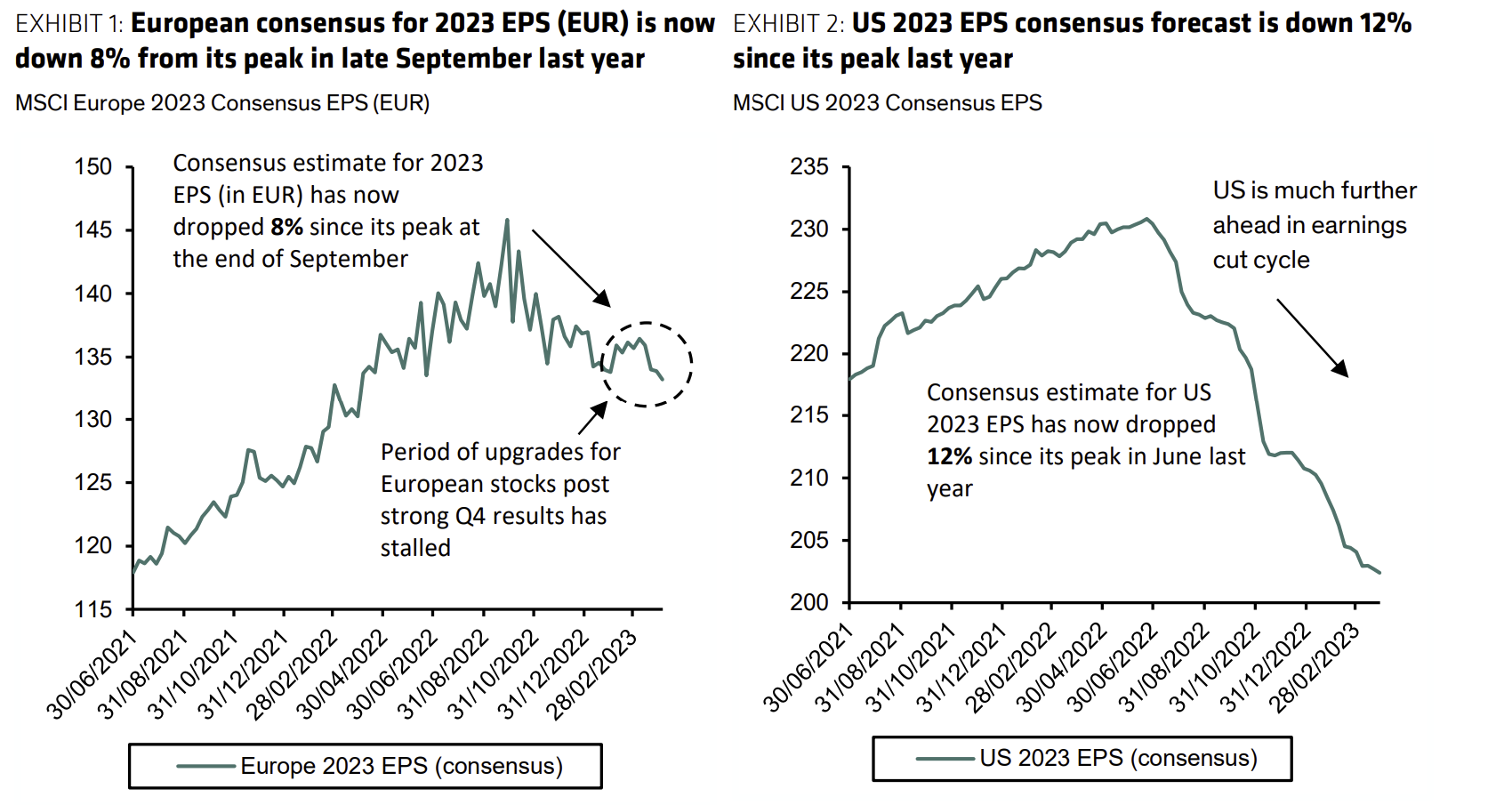

Dave: US earnings have actually seen a larger cut than European ones, pretty rare in recent downturns

Source: Bernstein as of 04.12.2023

Source: Bernstein as of 04.12.2023

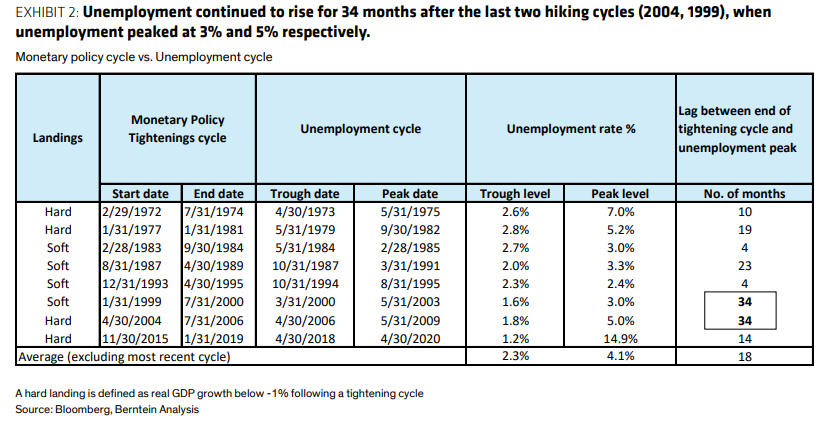

John Luke: and that’s before the unemployment spikes that often come following rate hike cycles

Source: Bernstein as of 04.03.2023

Source: Bernstein as of 04.03.2023

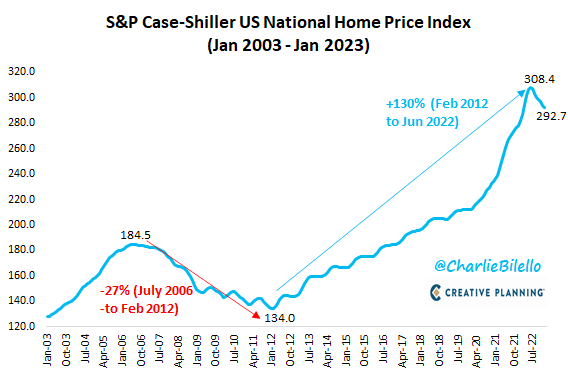

John Luke: Housing prices may be stagnant but they’ve had one heckuva rise in the past decade

Source: Creative Planning as of 04.07.2023

Source: Creative Planning as of 04.07.2023

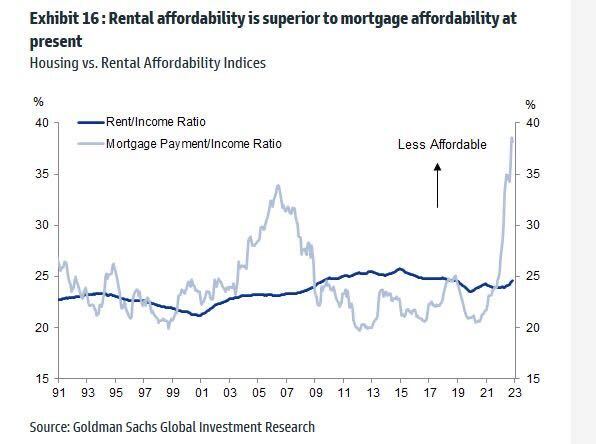

John Luke: which, when combined with higher rates, leads to math that is significantly in favor of renting over buying

Data as of 04.07.2023

Data as of 04.07.2023

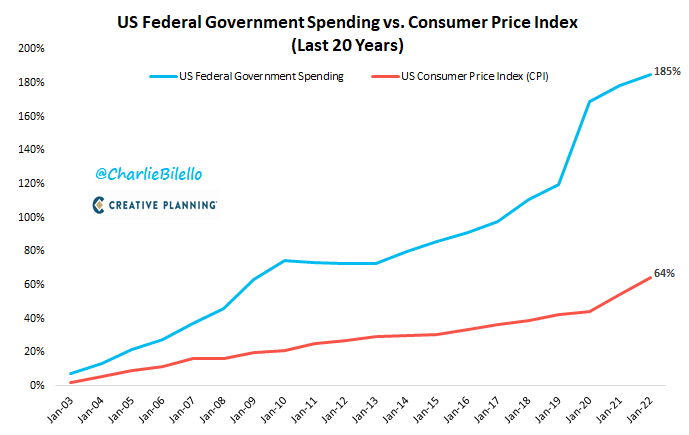

John Luke: CPI might be elevated but it’s nothing compared to the growth in U.S. government spending

Source: Creative Planning as of 04.07.2023

Source: Creative Planning as of 04.07.2023

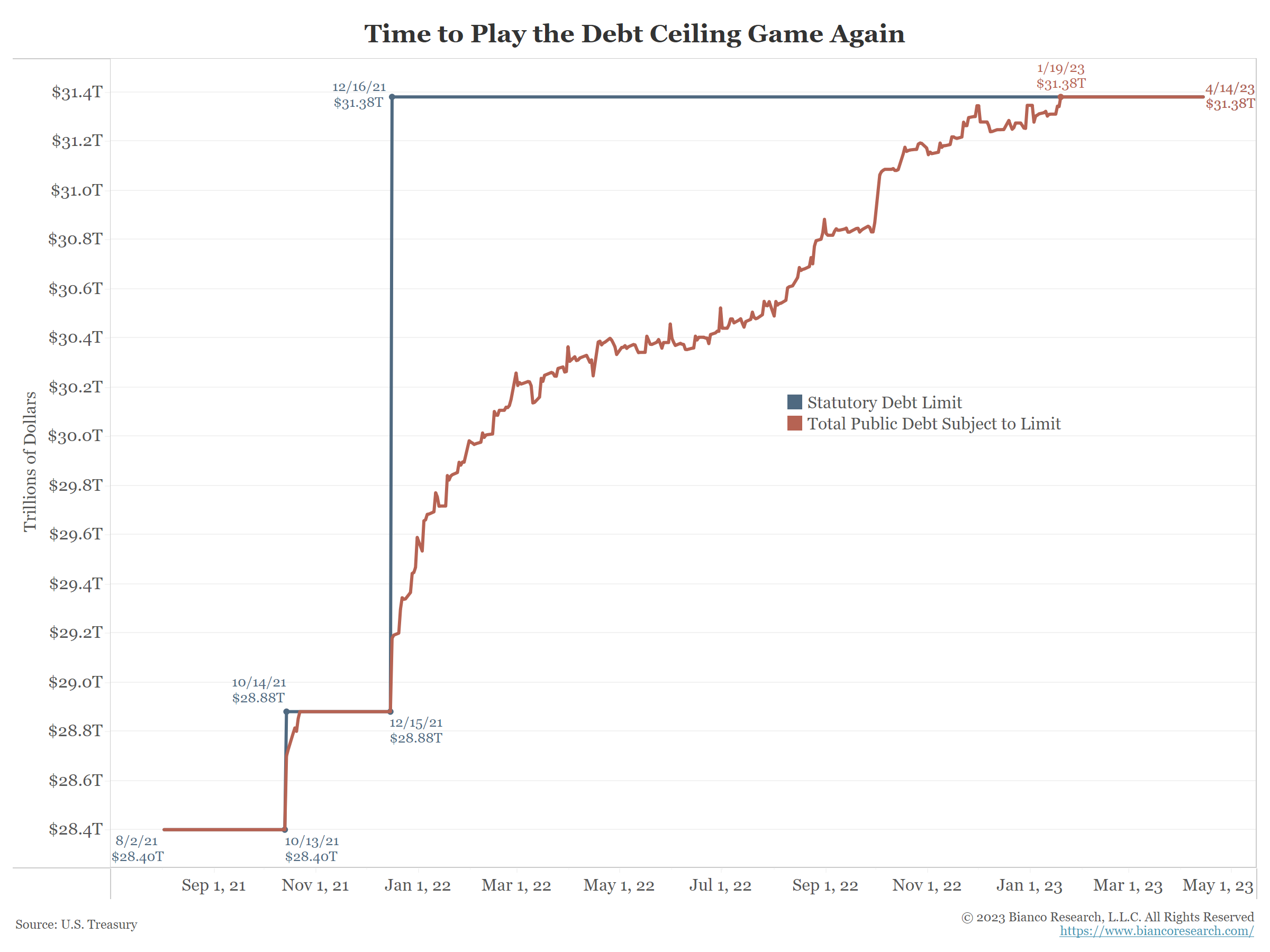

John Luke: which puts us on track for another fun debt ceiling showdown

Source: Bianco as of 04.10.2023

Source: Bianco as of 04.10.2023

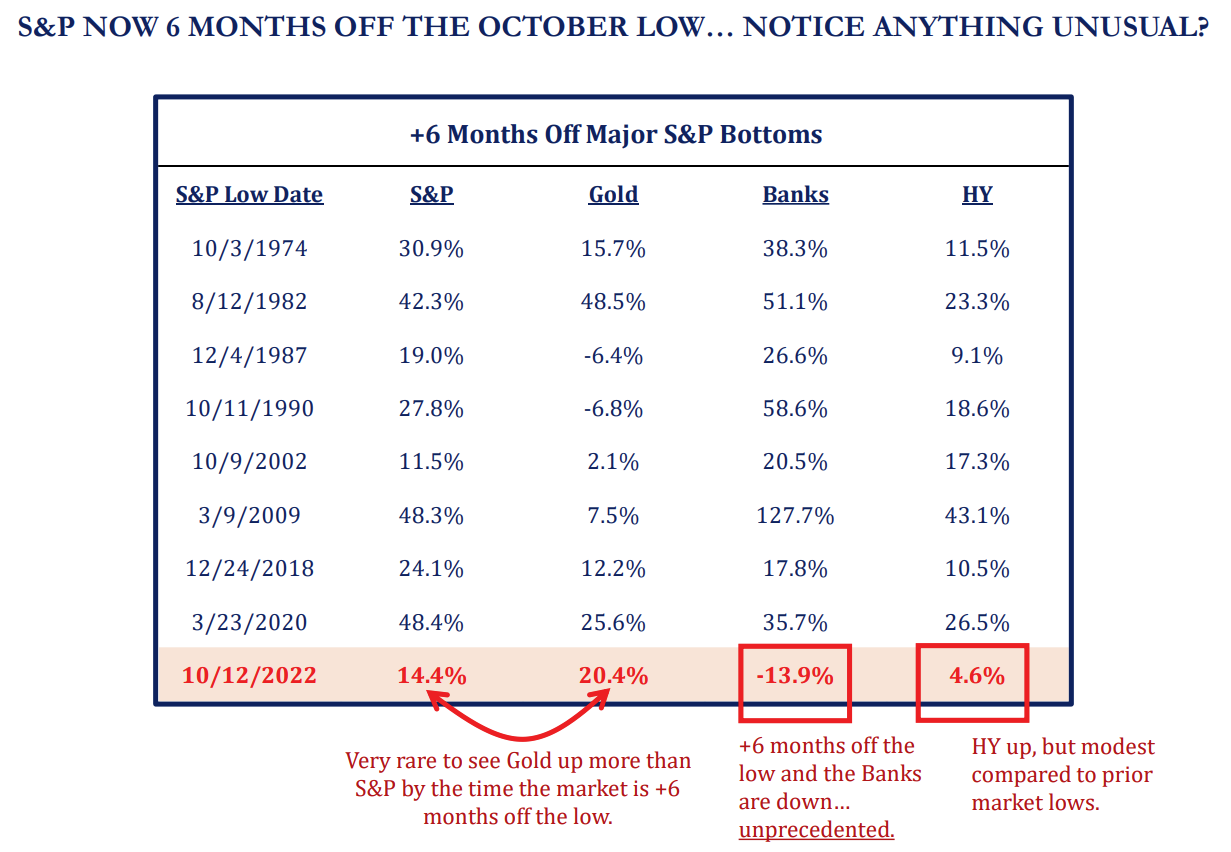

John Luke: If October was the low for stocks, the conditions are quite different than previous lows

Source: Strategas as of 04.12.2023

Source: Strategas as of 04.12.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-20.