Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

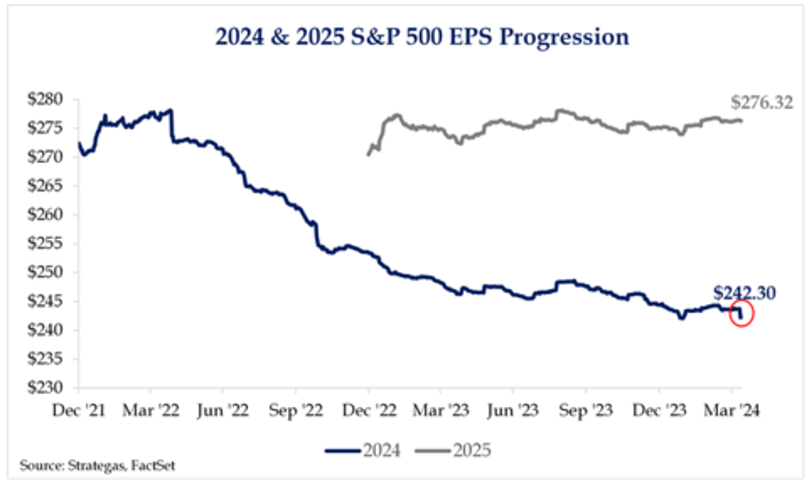

Brad: Earnings among US stocks have continued to decline in recent months, though projections for next year remain robust.

Source: Strategas as of 03.31.2024

Source: Strategas as of 03.31.2024

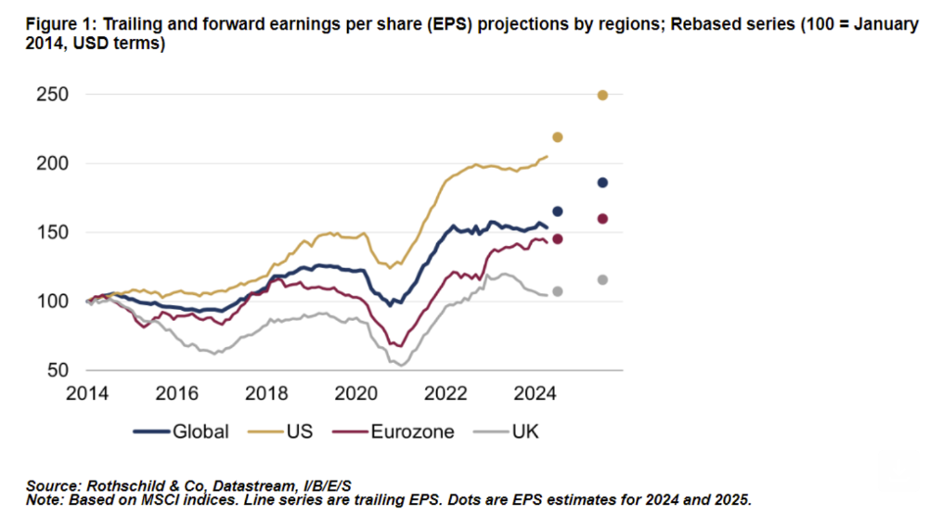

Derek: Either way, US Stocks have proven to be superior to what an investor could have captured outside of the United States.

Source: Rothchild & Co as of 01.31.2024

Source: Rothchild & Co as of 01.31.2024

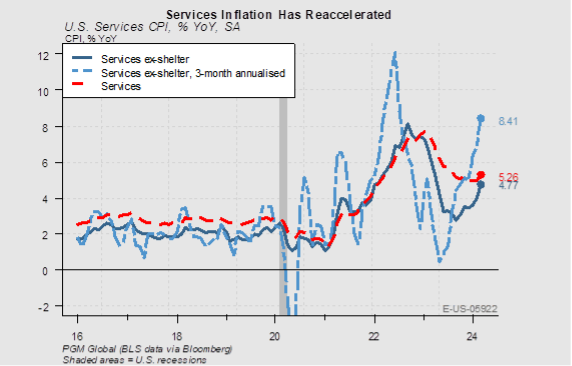

John Luke: Disinflation appears to have been a transitory base-effect improvement, while underlying inflationary pressures look to be entrenched and broadening.

Source: PGM Global as of 03.31.2024

Source: PGM Global as of 03.31.2024

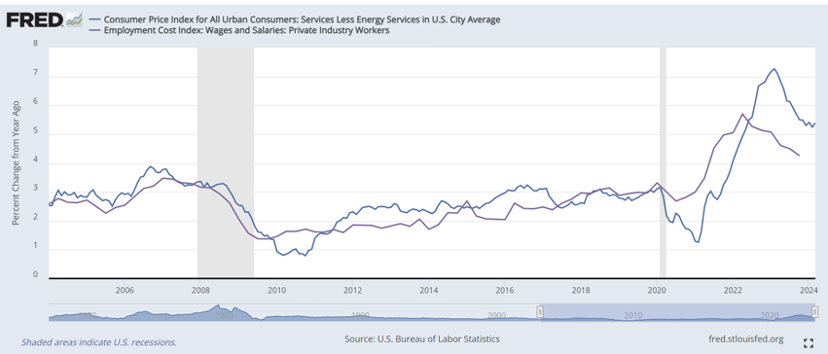

Brian: The good news is that service inflation is mostly wages, so wage growth may continue to outpace broader inflation.

Source: Federal Reserve as of 03.31.2024

Source: Federal Reserve as of 03.31.2024

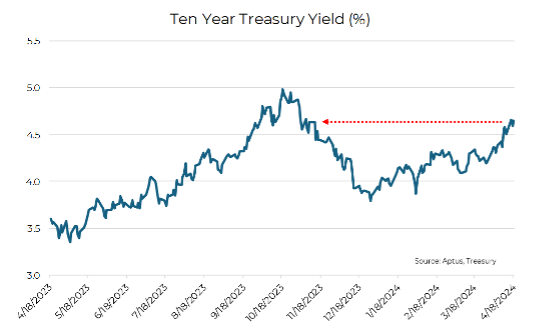

Beckham: the 10-year yield had retraced the entire November to March interest rate rally that was driven by the view that we’d see up to 7 rates cuts.

Source: Aptus, Treasury as of 04.18.2024

Source: Aptus, Treasury as of 04.18.2024

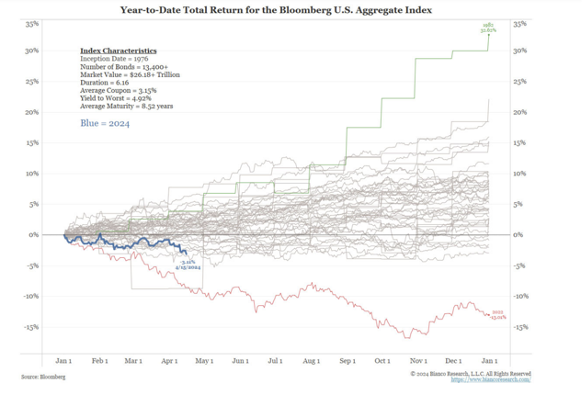

Dave: This has been the cause of US bonds having one of their worst starts to the year they’ve ever seen.

Source: Bianco as of 04.15.2024

Source: Bianco as of 04.15.2024

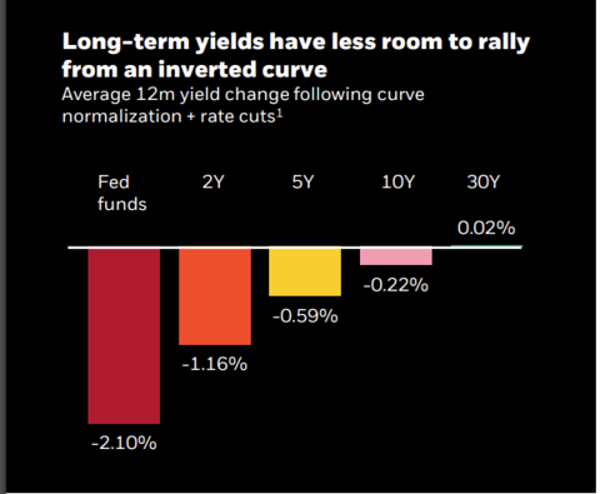

John Luke: One issue is bonds have little room to run even if there is normalization in the yield curve.

Source: Bloomberg as of 03.31.2024

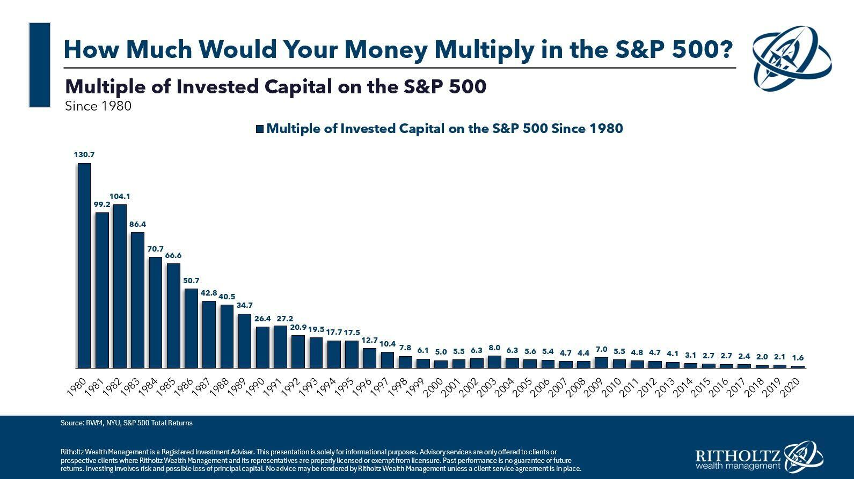

Brian: meanwhile, US equities have clearly ebbed and flowed in their returns over the years, but sticking with an allocation has compounded returns 100-fold the past ~40 years

Source: Ritholtz Wealth Management as of 03.31.2024

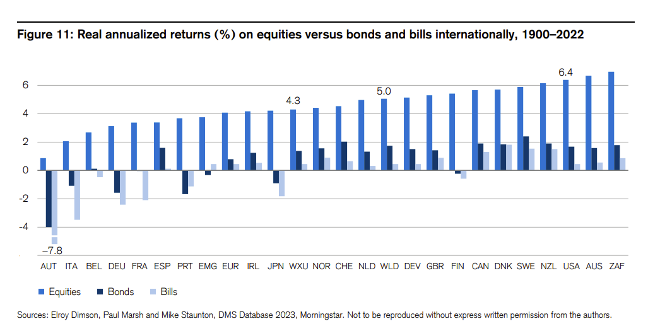

John Luke: Equities have been the place to be globally for the long-term as well.

Source: Credit Suisse as of 12.31.2022

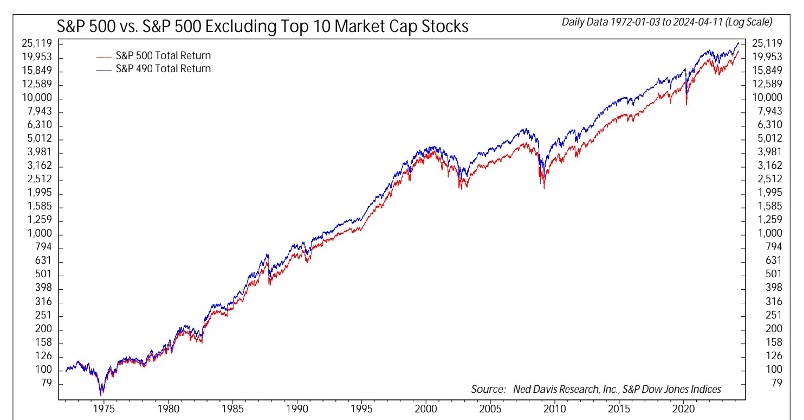

Brian: Sticking with equities, simply excluding the largest 10 stocks in the S&P 500 would have led to outperformance over the past 50+ years.

Source: Ned Davis Research as of 4.11.2024

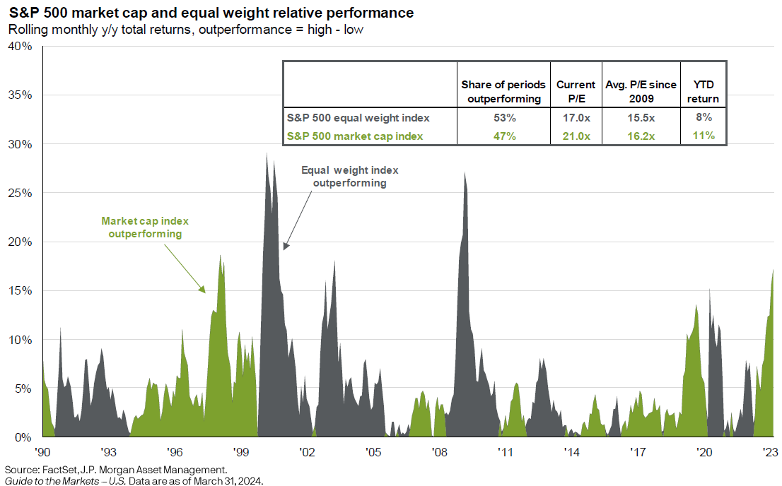

Brad: A similar effect has been seen in the outperformance of equal weight vs market weight over time, though the time frames of relative performance have varied.

Source: JP Morgan as of 3.31.2024

Source: JP Morgan as of 3.31.2024

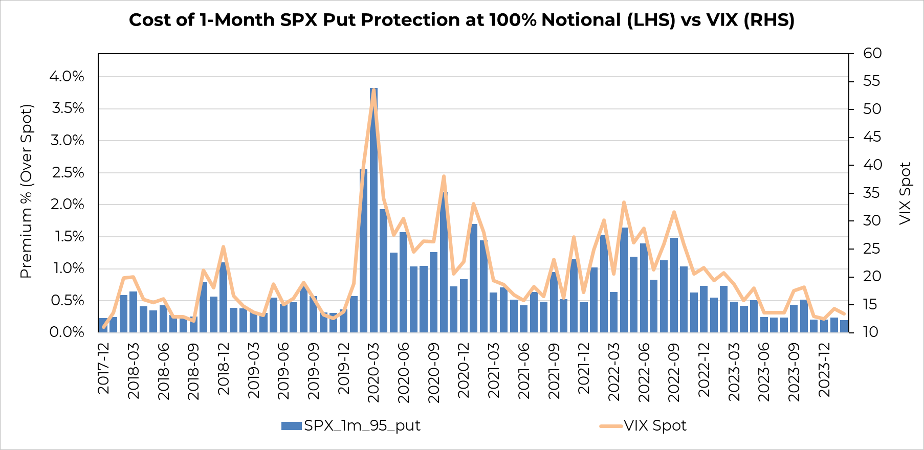

John Luke: Fortunately for investors looking to be overweight equities and hedge through options rather than bonds, the cost of protecting a portfolio from falling (in this case more than 5%) was very cheap at the end of the quarter.

Source: Aptus as of 3.31.2024

Source: Aptus as of 3.31.2024

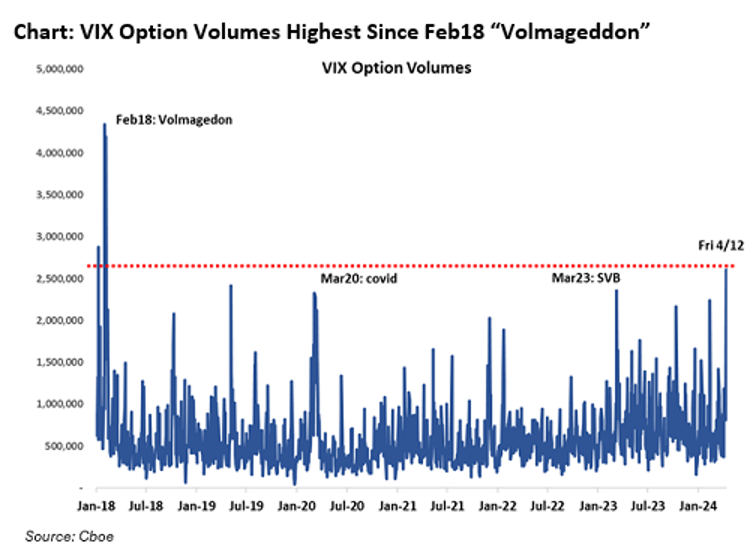

Mark: Investors have seemingly taken notice in recent weeks.

Source: CBOE as of 4.12.2024

Source: CBOE as of 4.12.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-26.