Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from rare timing setups and market breadth to the economy, earnings, and US/foreign market exposures. Enjoy!

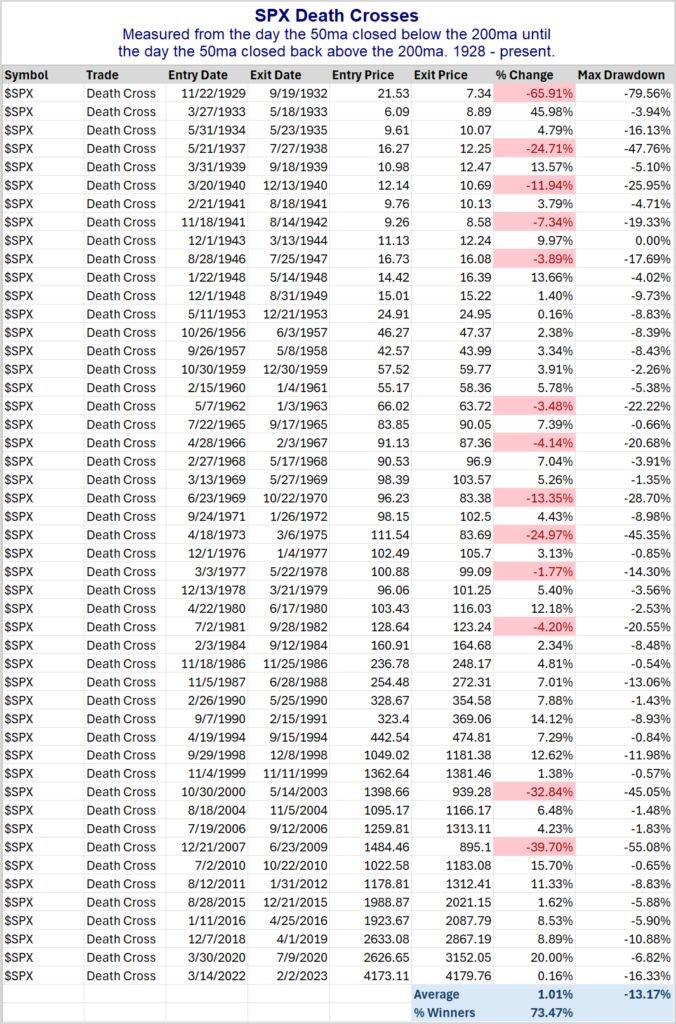

Brian: We started the week with talk of (negative) death crosses

Source: Quantifiable Edges as of 04.18.2025

Source: Quantifiable Edges as of 04.18.2025

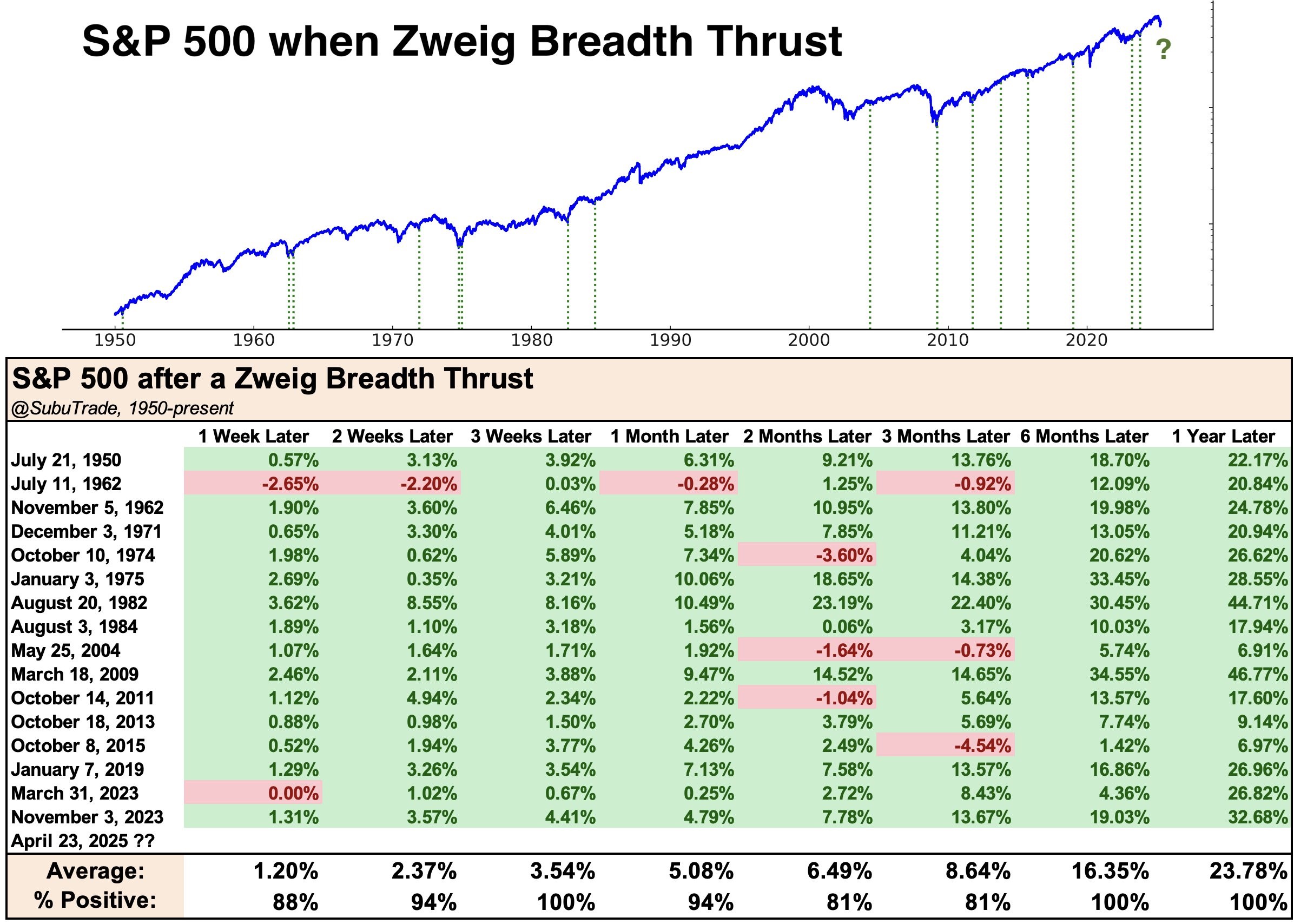

Jake: and finished with (positive) breadth thrusts

Data as of 04.24.2025

Data as of 04.24.2025

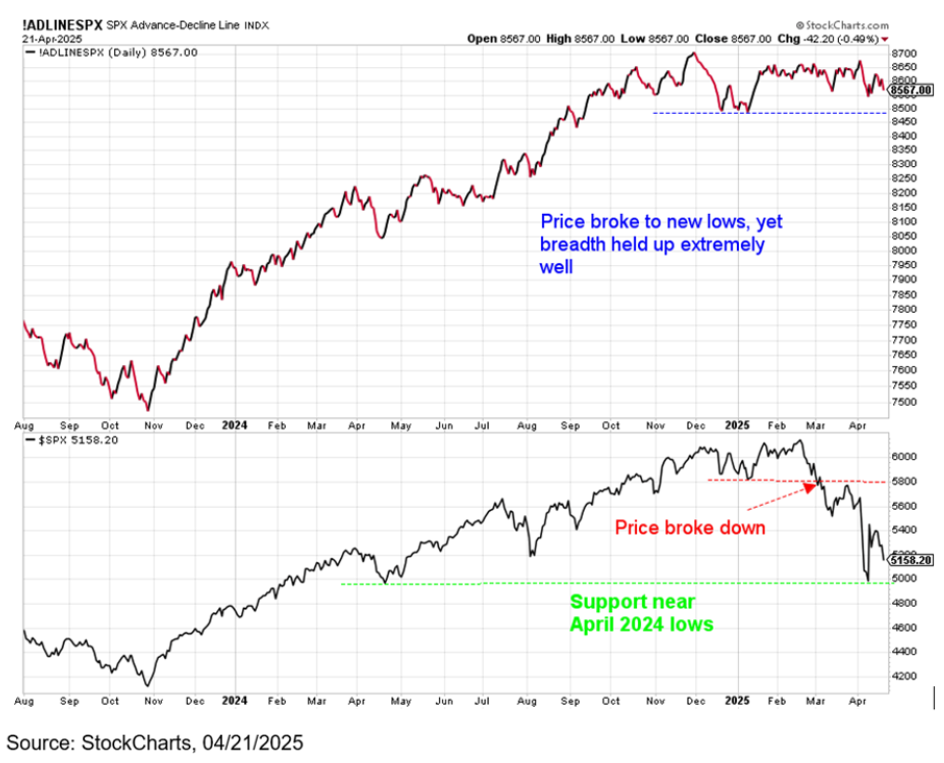

Beckham: Through the correction, the broader market of stocks had held up better than the concentrated leaders at the top

Image via @ryandetrick

Image via @ryandetrick

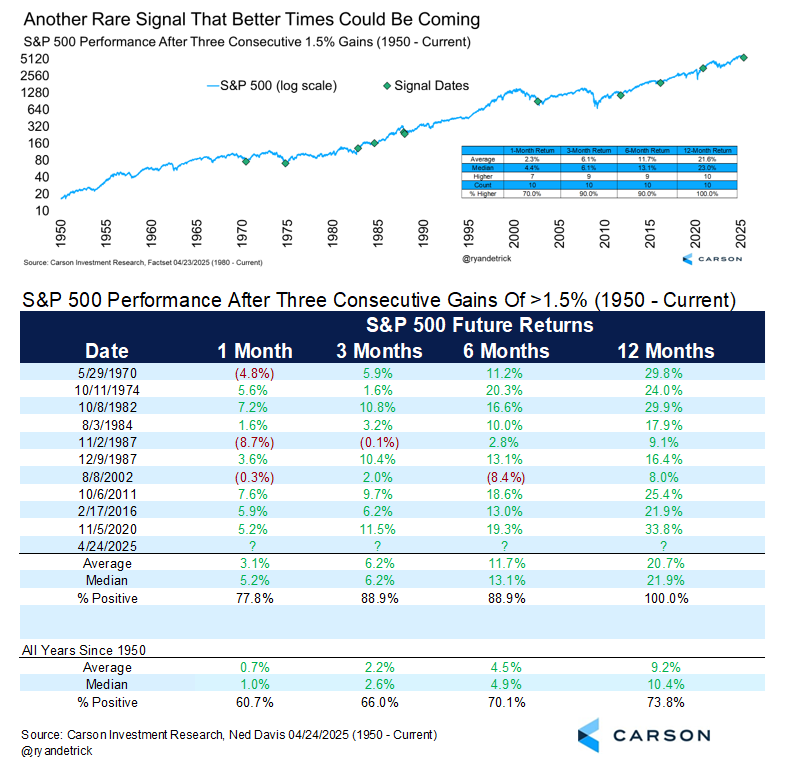

Brett: and then were treated to an amazing display of strength across the index

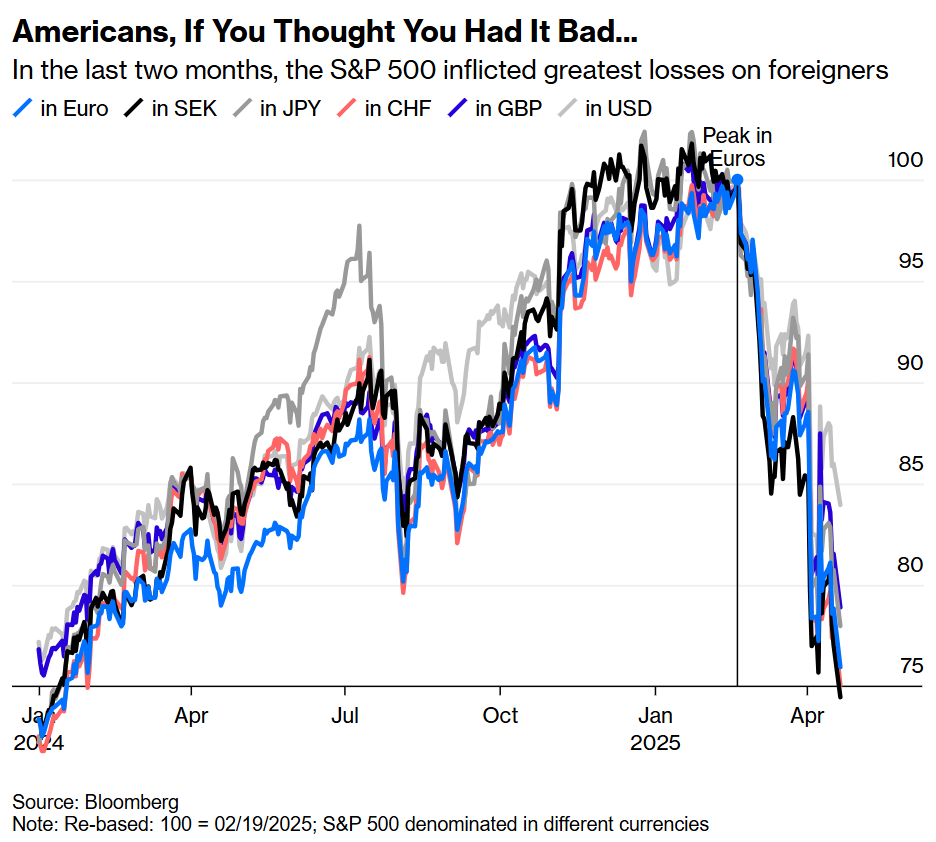

Ten: With the US dollar selloff, the drawdown in equities was even harsher for foreign holders of US stocks

Data as of 04.22.2025

Data as of 04.22.2025

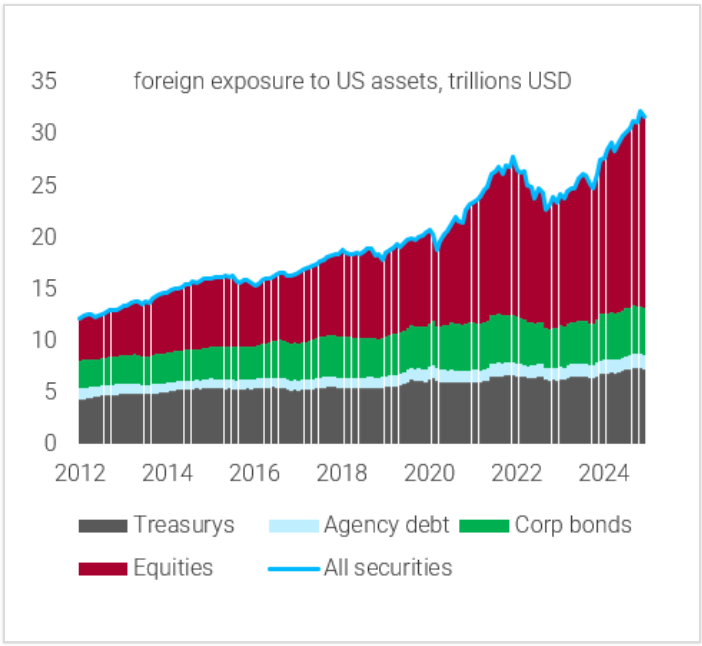

Joseph: which comes after a period of increasing ownership of US stocks in those countries

Source: TS Lombard as of 04.17.2025

Source: TS Lombard as of 04.17.2025

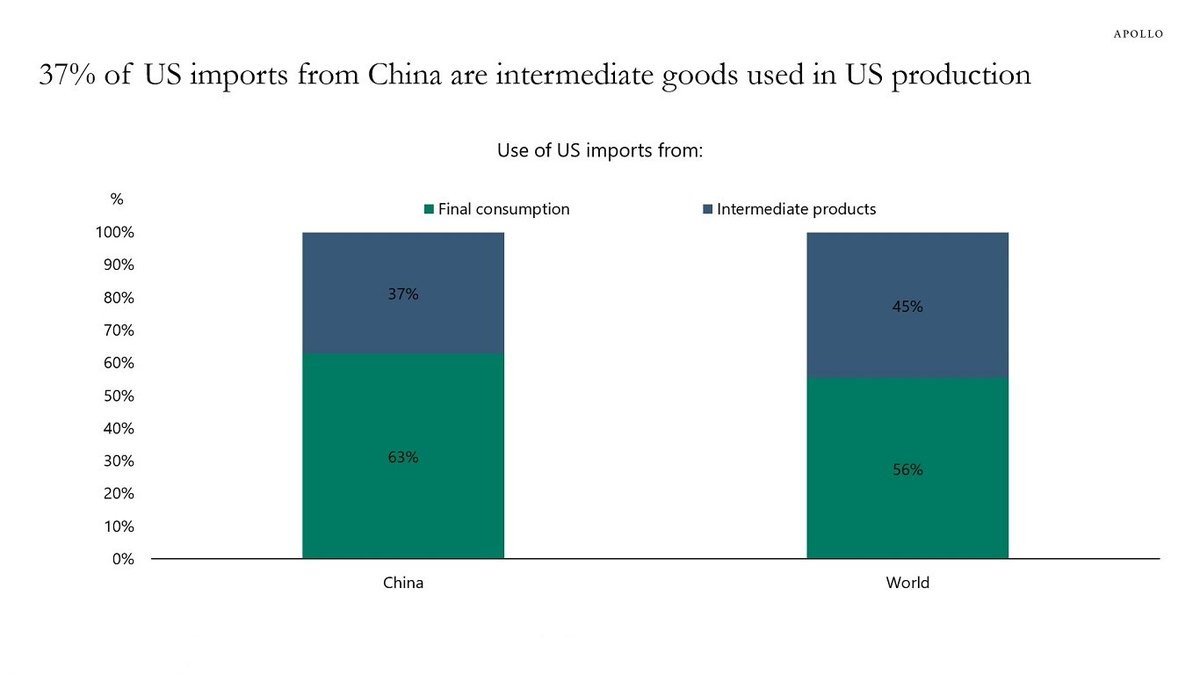

Beckham: It’s not just access to cheap consumer items that spooked markets

Source: Apollo as of 04.19.2025

Source: Apollo as of 04.19.2025

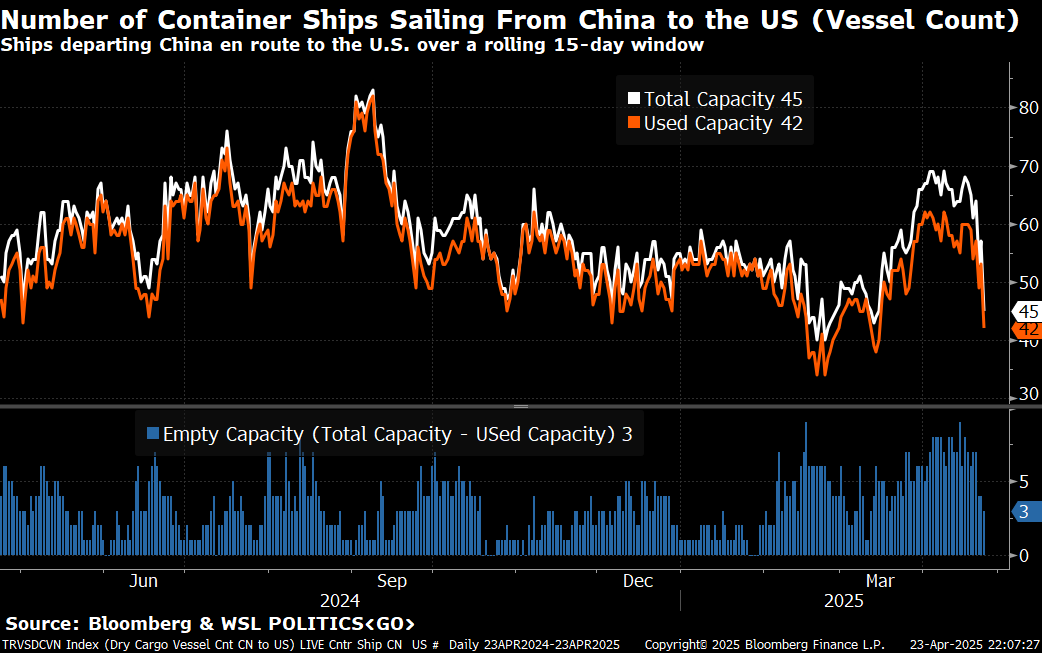

Brian: and we’ll soon be better able to evaluate the economic impact as shipping activity falls

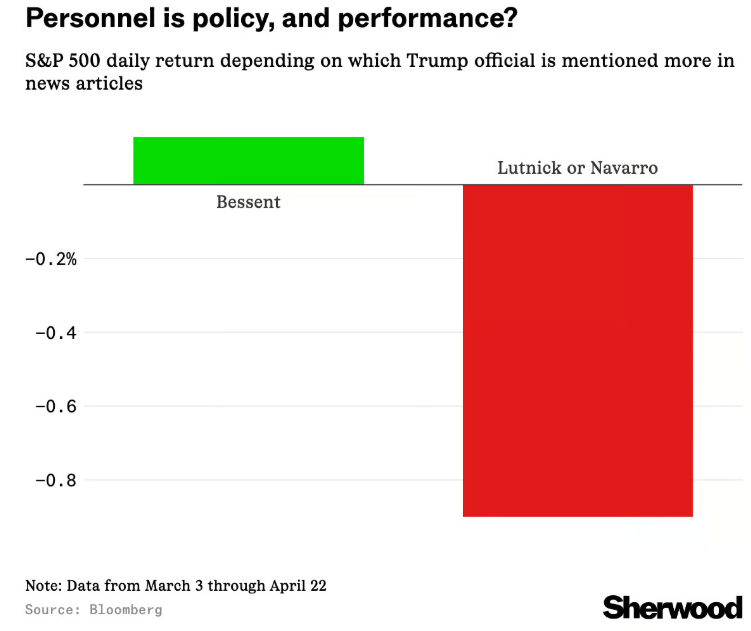

Joseph: either way, investors seem to feel most comfortable with Treasury Secretary Bessent as the economic voice

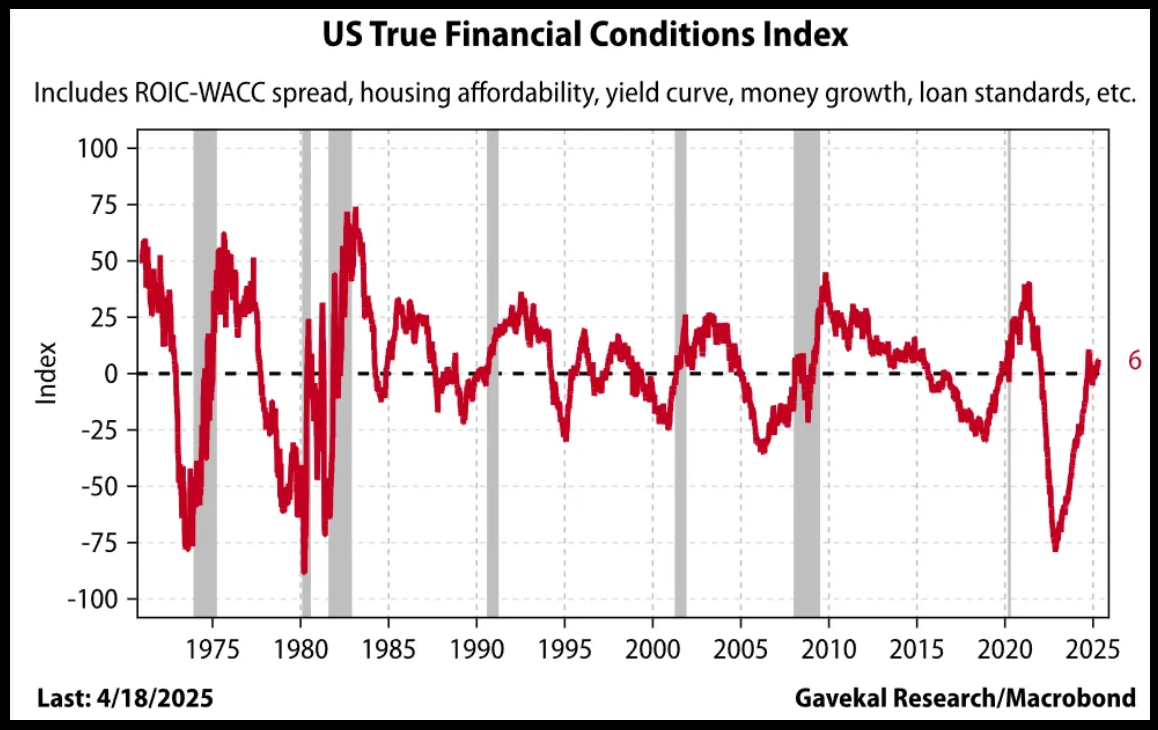

Arch: By this composite measure of conditions, access to money is close to the midpoint of the historical range

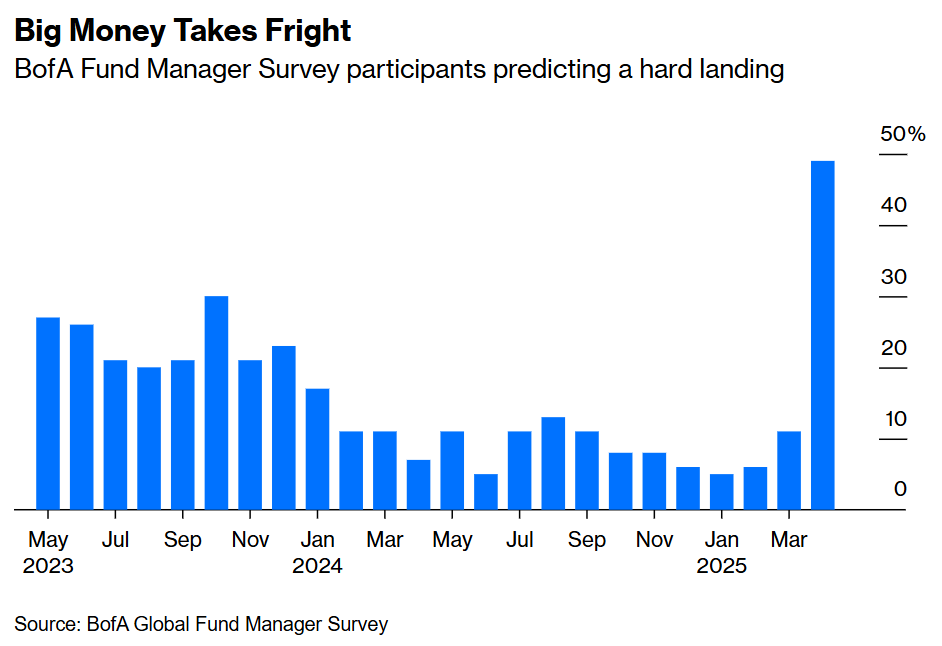

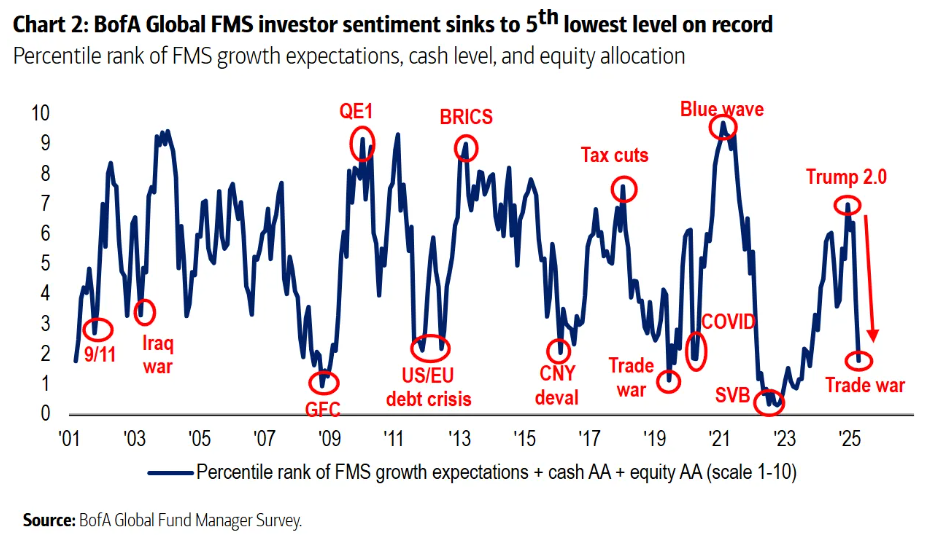

Brad: but fund managers responding to surveys are bracing for an increased chance of recession

Data as of 04.17.2025

Data as of 04.17.2025

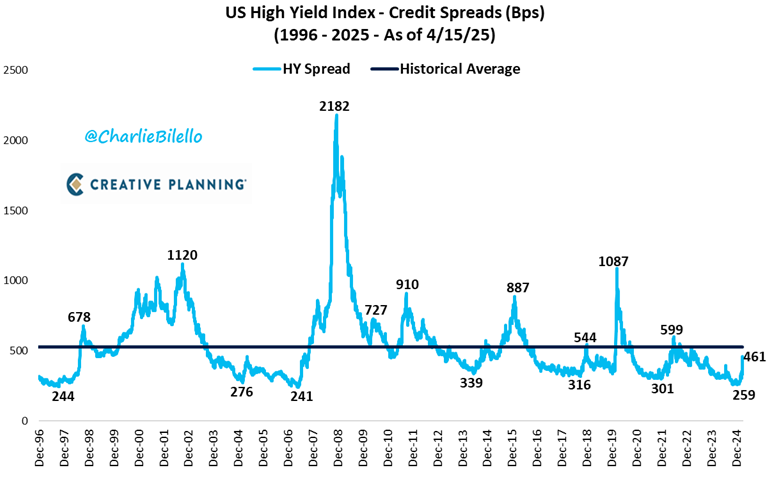

Brad: yet credit spreads remain tame relative to past periods of economic weakness

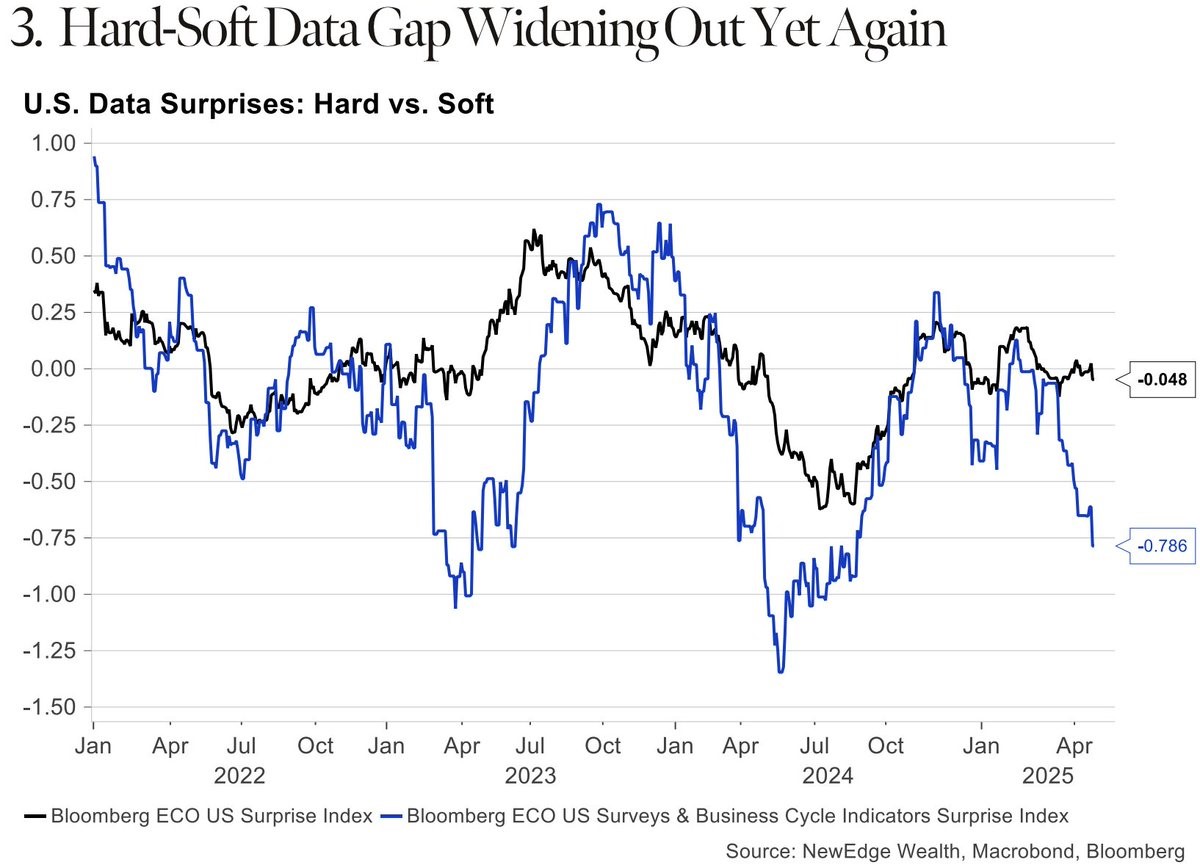

Dave: Much of the economic debate remains split between hard (actual) and soft (survey) data

Data as of 04.17.2025

Data as of 04.17.2025

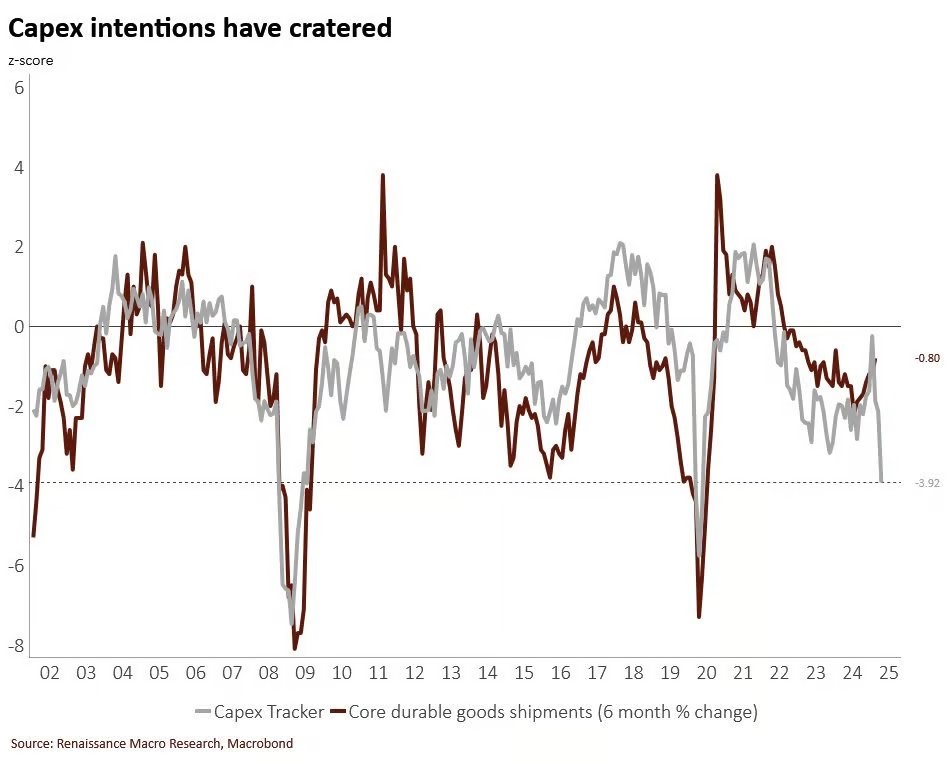

Arch: and companies themselves aren’t sure how best to navigate (current) risk and (future) opportunity

Data as of 04.17.2025

Data as of 04.17.2025

Brad: When it comes to stocks, fund managers have gotten themselves pretty bearish

Data as of 04.17.2025

Data as of 04.17.2025

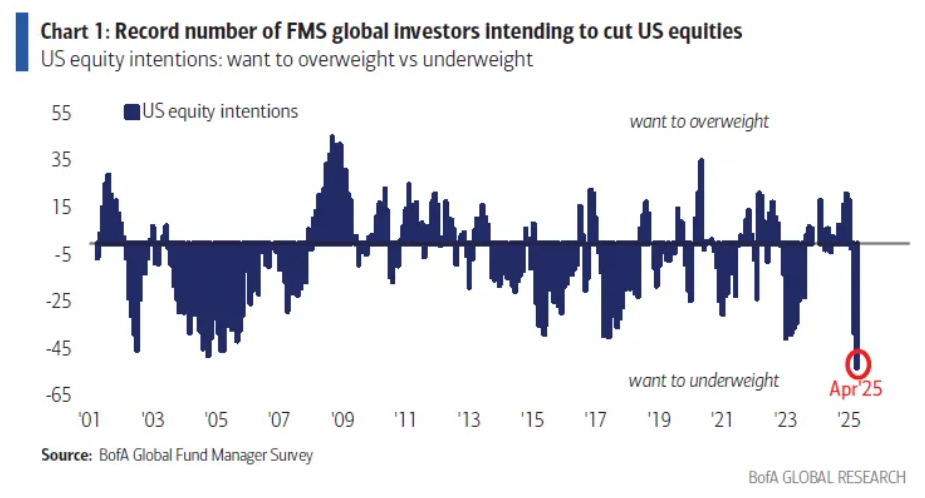

Joseph: and when it comes to buying plans, US stocks have become a target for reduction

Data as of 04.17.2025

Data as of 04.17.2025

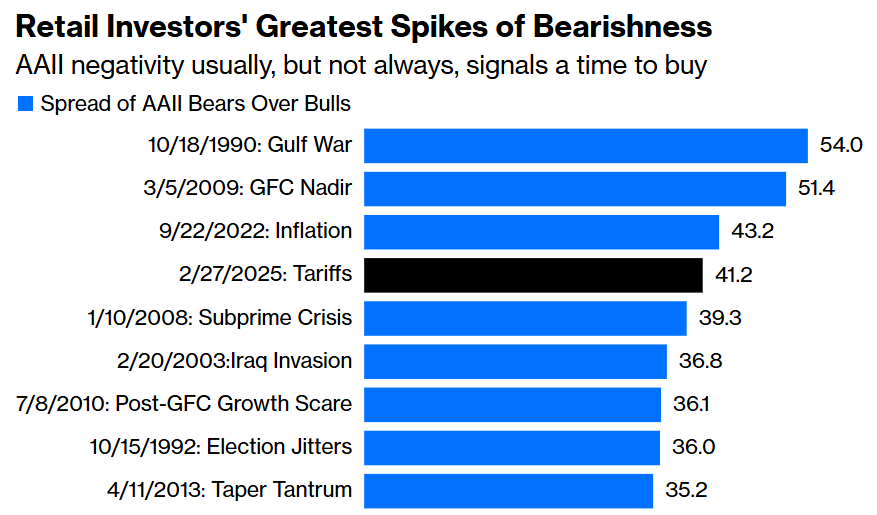

Brian: For better or worse, this puts “professional” investors in the same camp as the often-mocked amateurs

Source: Bloomberg as of 04.17.2025

Source: Bloomberg as of 04.17.2025

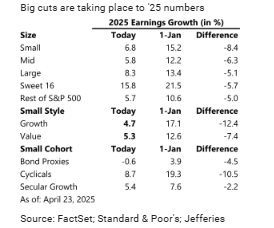

Dave: It’s a hard quarter to evaluate, but ultimately earnings will be the driver of future stock prices, with 2026 becoming more relevant

Data as of 04.23.2025

Data as of 04.23.2025

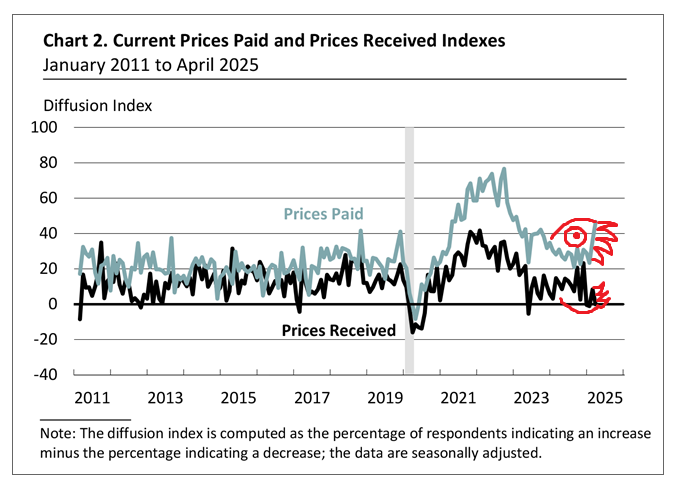

John Luke: a big challenge will be threading the needle on costs vs. pricing, at least in the short-term

Source: Bloomberg as of 04.21.2025

Source: Bloomberg as of 04.21.2025

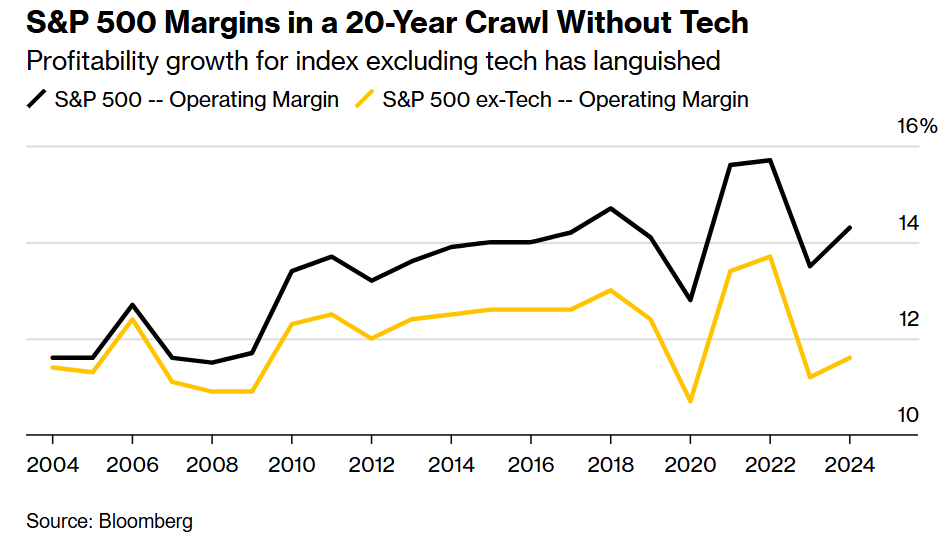

JD: and in general, non-tech companies have faced too much competition to create a whole lot of cushion

Data as of March 2025

Data as of March 2025

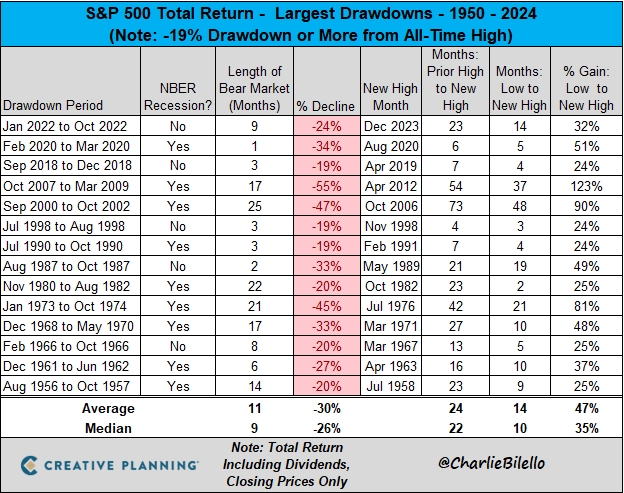

John Luke: For context, a history of significant US equity drawdowns and the paths to recapturing all-time highs

Data as of 04.17.2025

Data as of 04.17.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-28.