Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

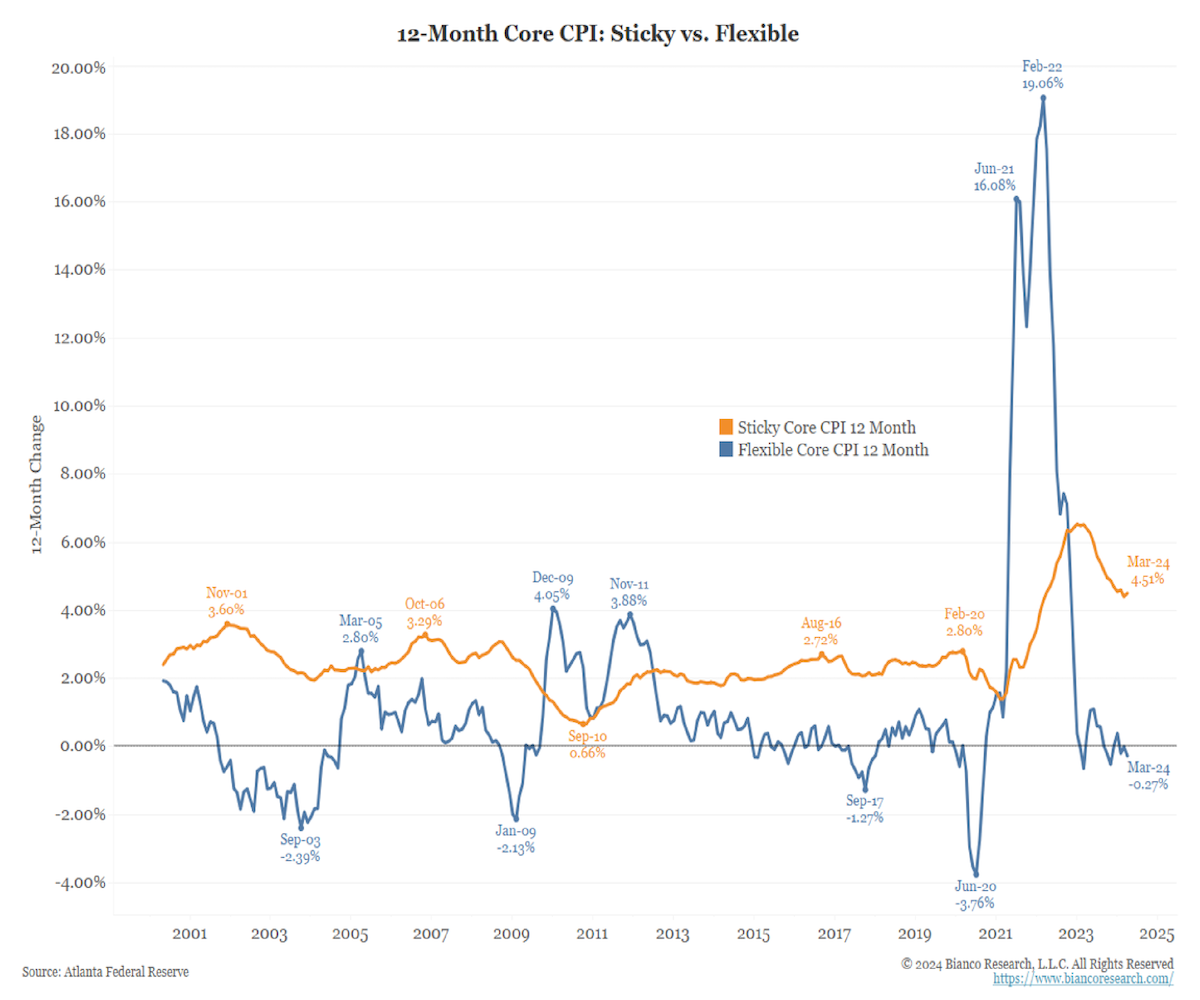

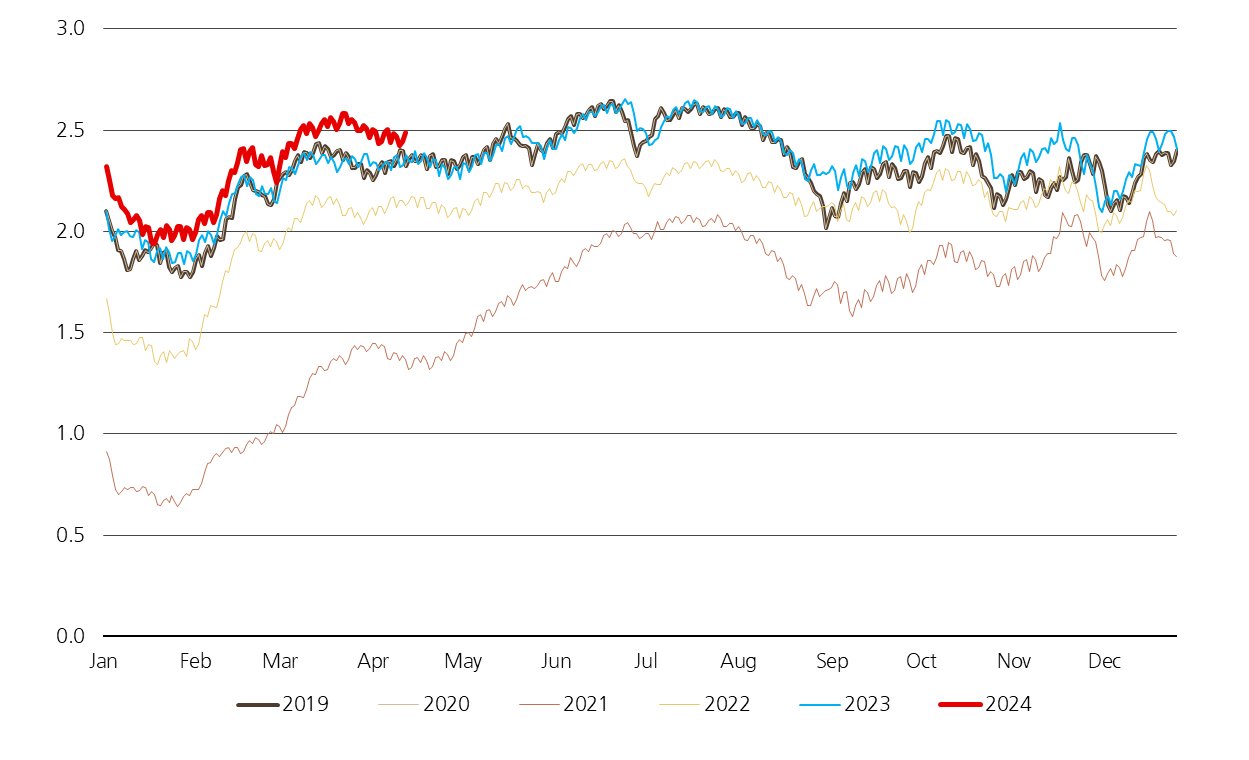

John Luke: Like savers vs. borrowers, there is a huge split right now between services and goods inflation

Data as of 04.21.2024

Data as of 04.21.2024

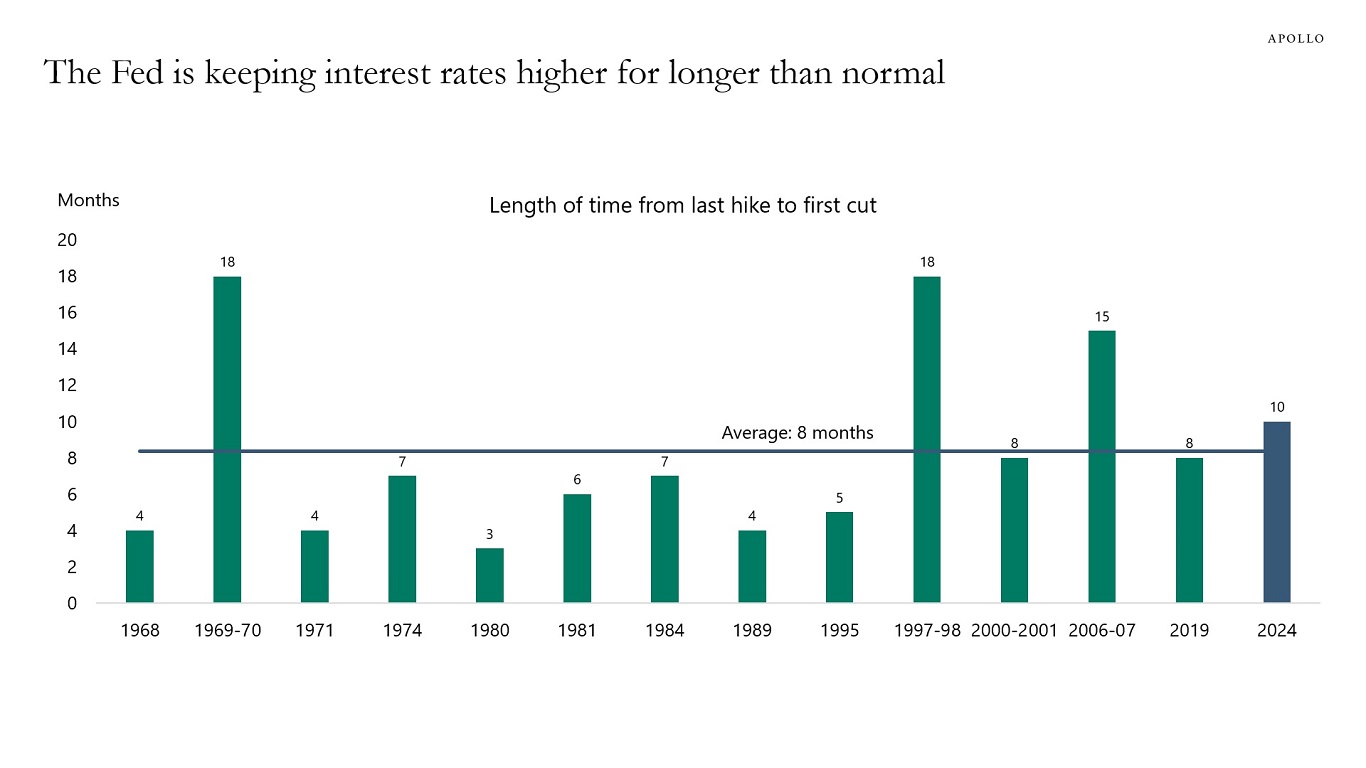

Beckham: and the stickiness of services inflation is what’s keeping the FOMC in this long “pause” mode

Source: Apollo as of 04.19.2024

Source: Apollo as of 04.19.2024

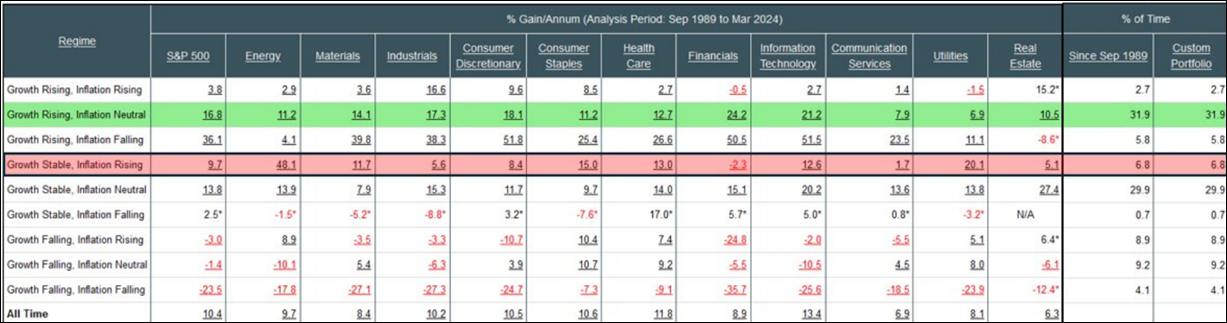

John Luke: historically speaking, stocks can continue to perform in an inflationary environment as long as the economy holds up

Source: Ned Davis Research as of 04.12.2024

Source: Ned Davis Research as of 04.12.2024

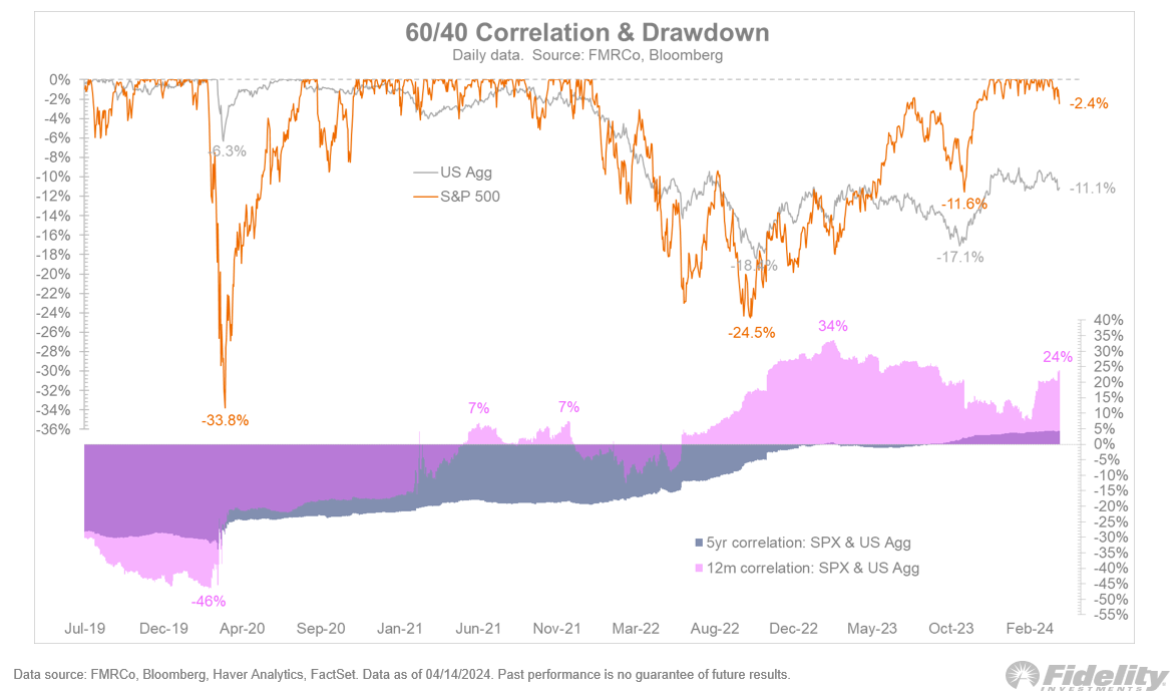

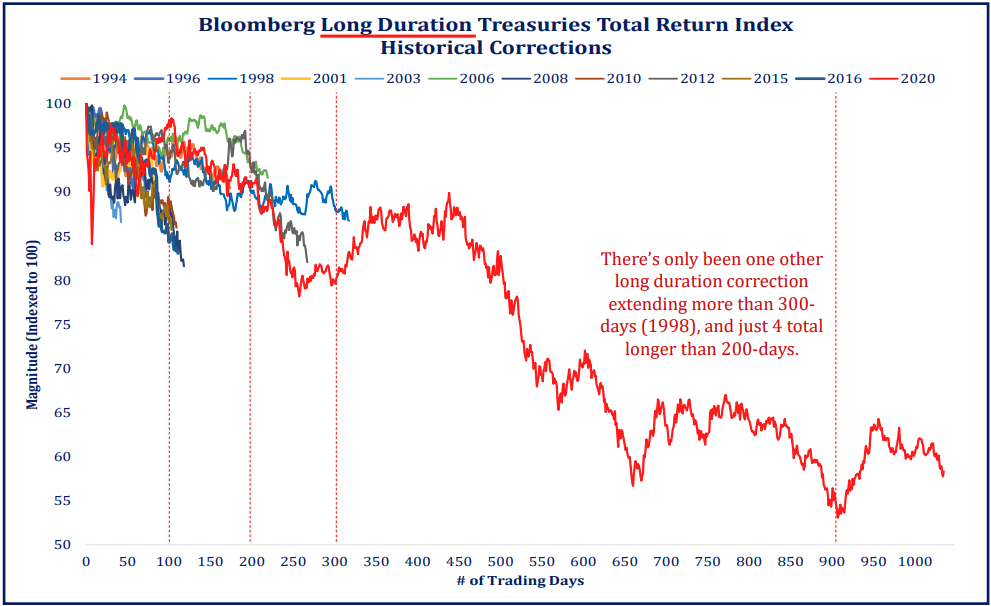

Brett: On the other end of the spectrum, bonds have been unable to sustain a bounce in this higher-inflation regime

Source: Fidelity as of 04.14.2024

Source: Fidelity as of 04.14.2024

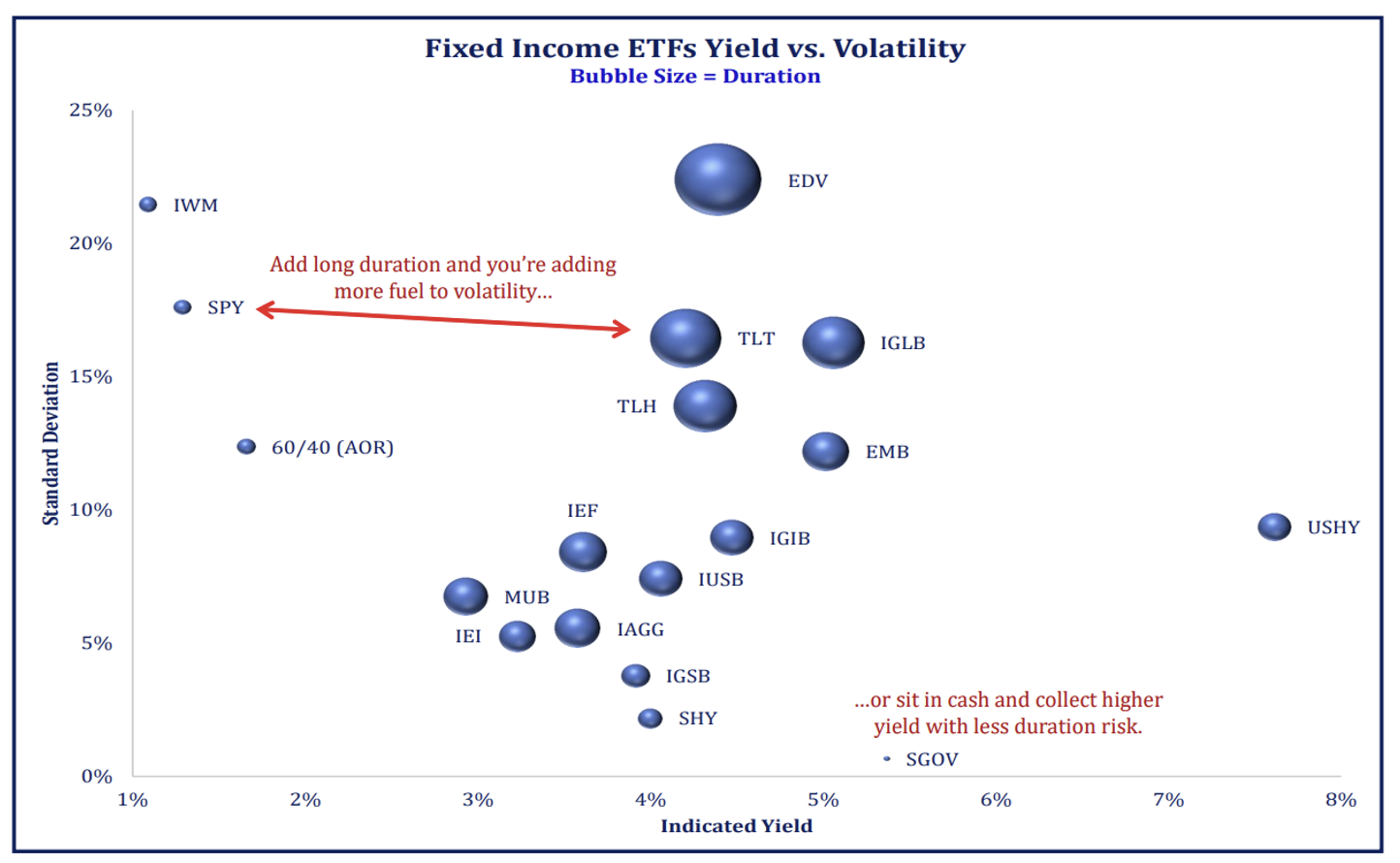

Dave: with some fixed-income ETFs producing nearly the same volatility as supposedly “riskier” stocks

Source: Strategas as of 04.22.2024

Source: Strategas as of 04.22.2024

Joseph: and the bond bear market extending into easily the worst environment since the inception of the aggregate bond index

Source: Strategas as of 04.22.2024

Source: Strategas as of 04.22.2024

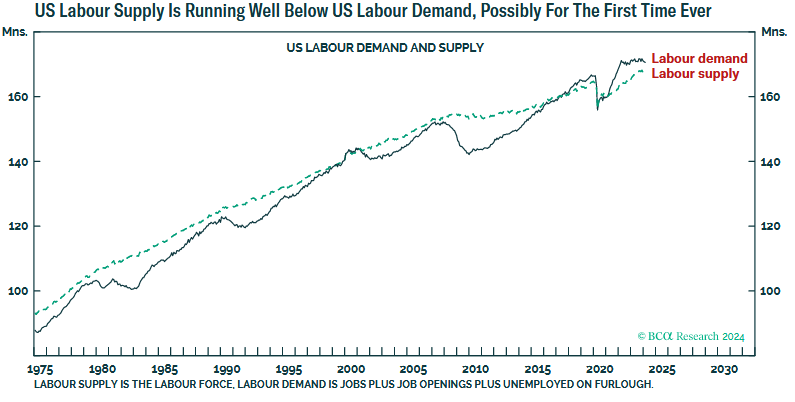

John Luke: One key driver of sticky inflation is tight labor supply

Source: BCA Research as of March 2024

Source: BCA Research as of March 2024

Brad: and as anyone who flies can confirm, airport activity is back to its highs after the COVID-induced slump

Source: @staunovo as of March 2024

Source: @staunovo as of March 2024

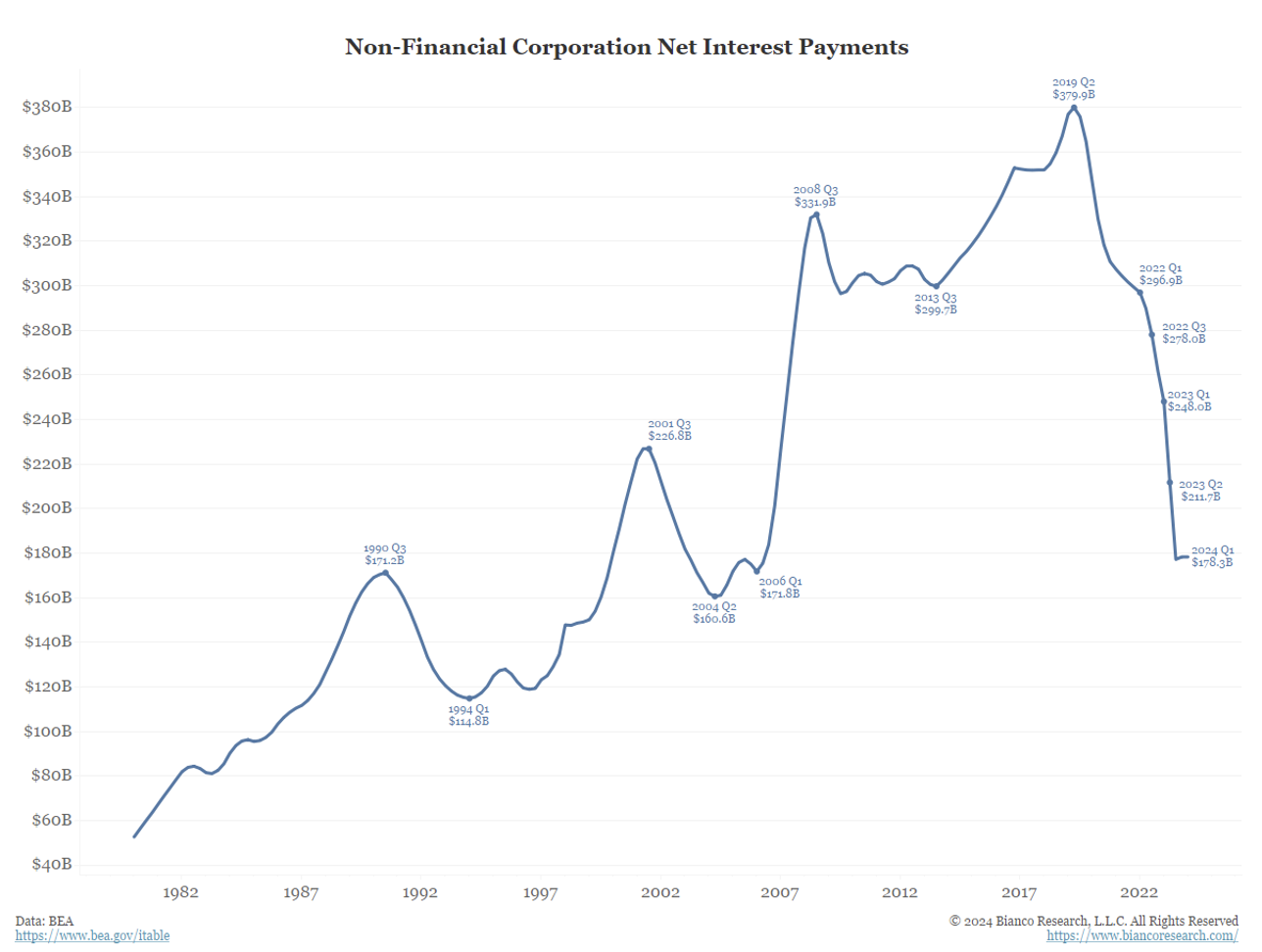

John Luke: The split between savers and borrowers is quite pronounced in major US corporations, leading to REDUCED interest expense despite higher rates

Data as of March 2024

Data as of March 2024

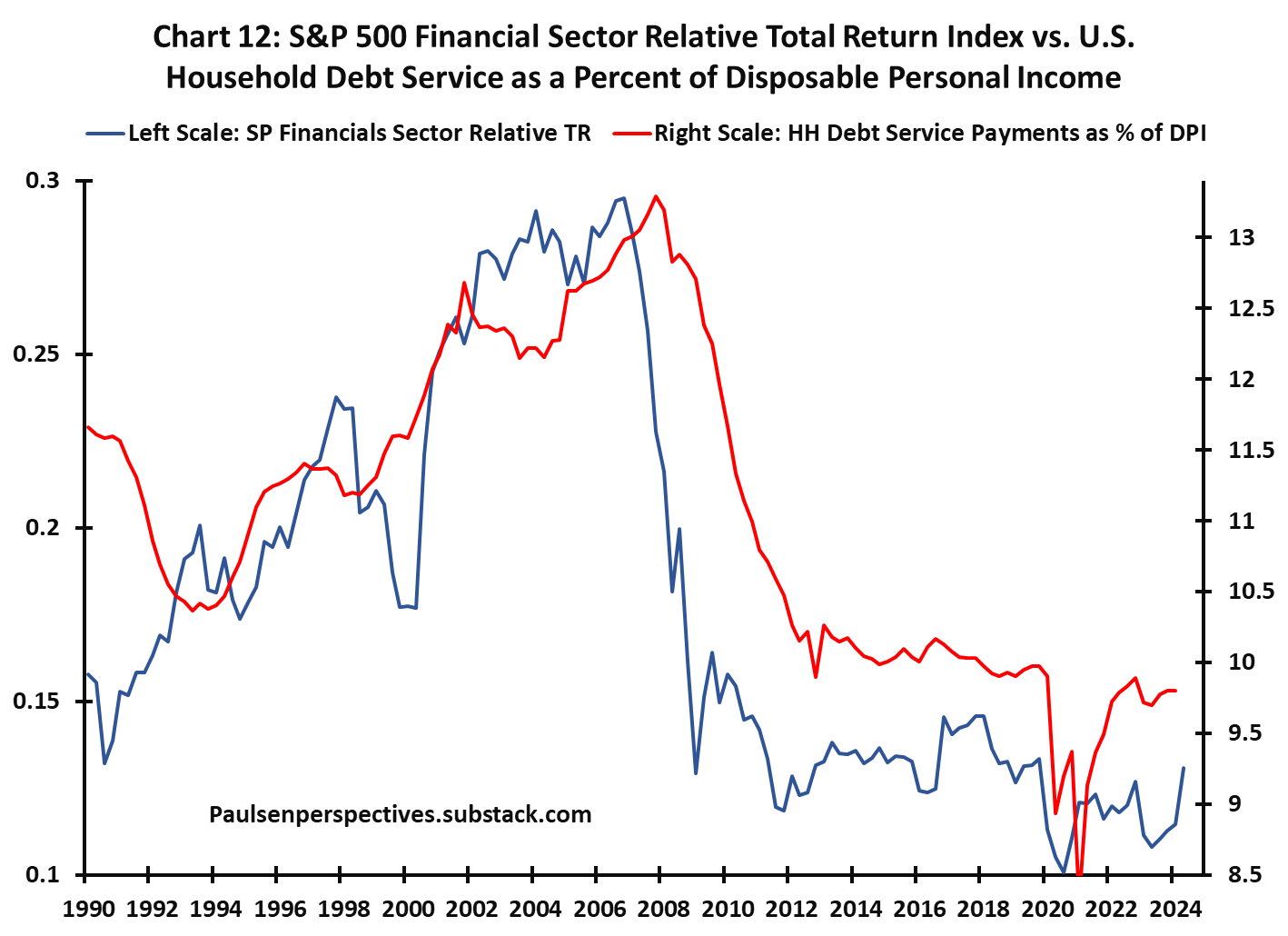

Beckham: with similar activity on the personal side, it’s been a long time since banks have seen the interest margins they’d like

Data as of March 2024

Data as of March 2024

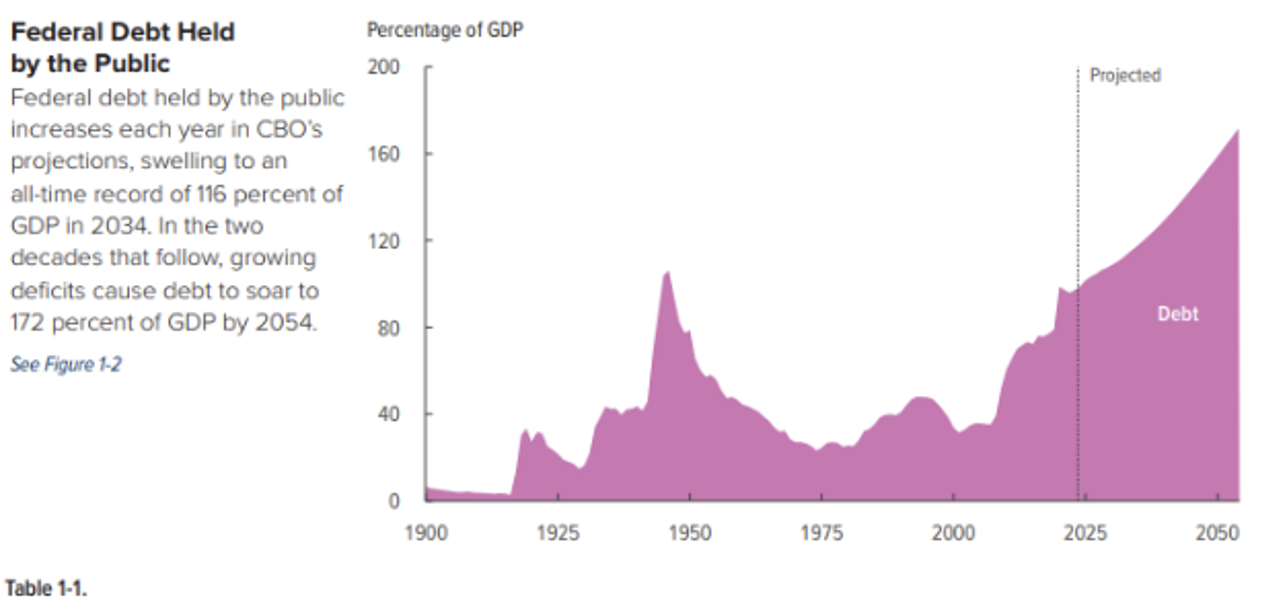

John Luke: but on the other end of things, the government can’t issue debt fast enough and the public is poised to be the big buyers

Source: CBO as of March 2024

Source: CBO as of March 2024

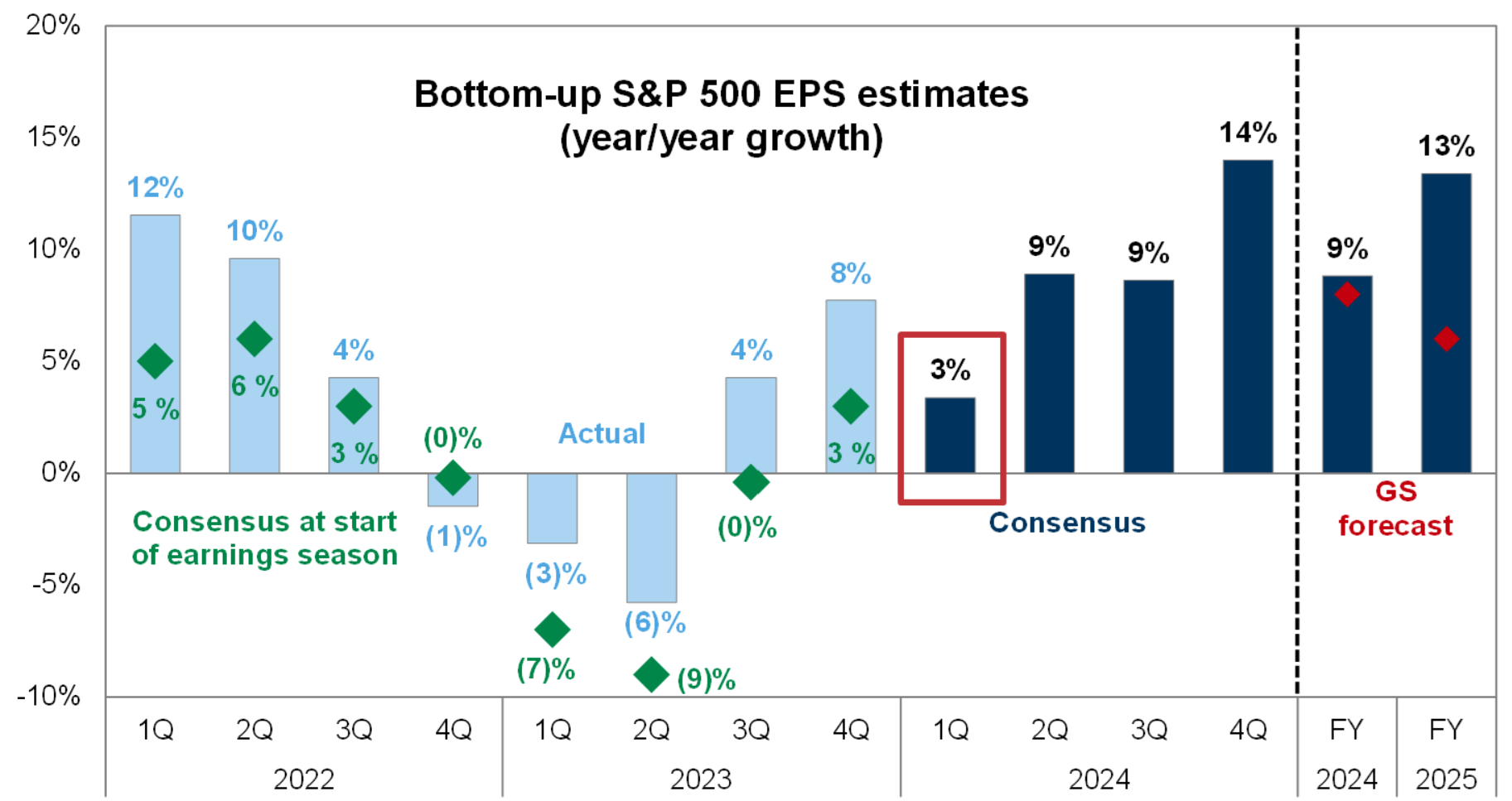

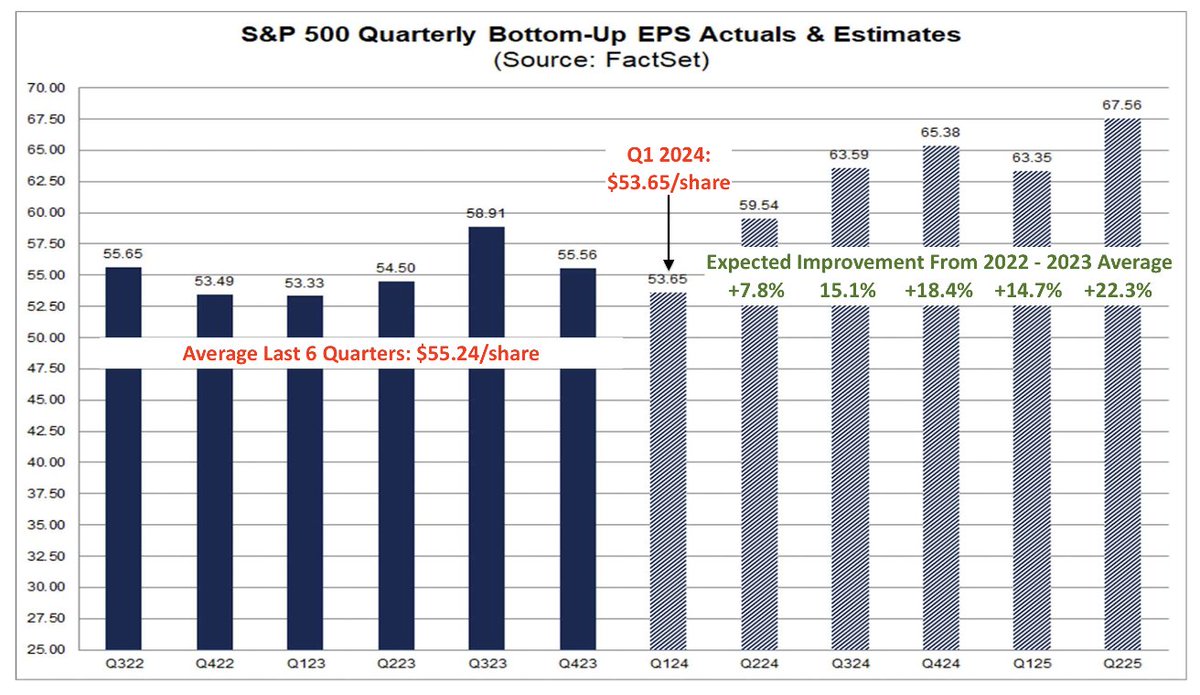

Dave: Q1 earnings are underway, with modest gains expected

Source: Goldman Sachs as of 04.19.2024

Source: Goldman Sachs as of 04.19.2024

Brad: with larger growth expected as we get into Q2

Source: DataTrek as of 04.22.2024

Source: DataTrek as of 04.22.2024

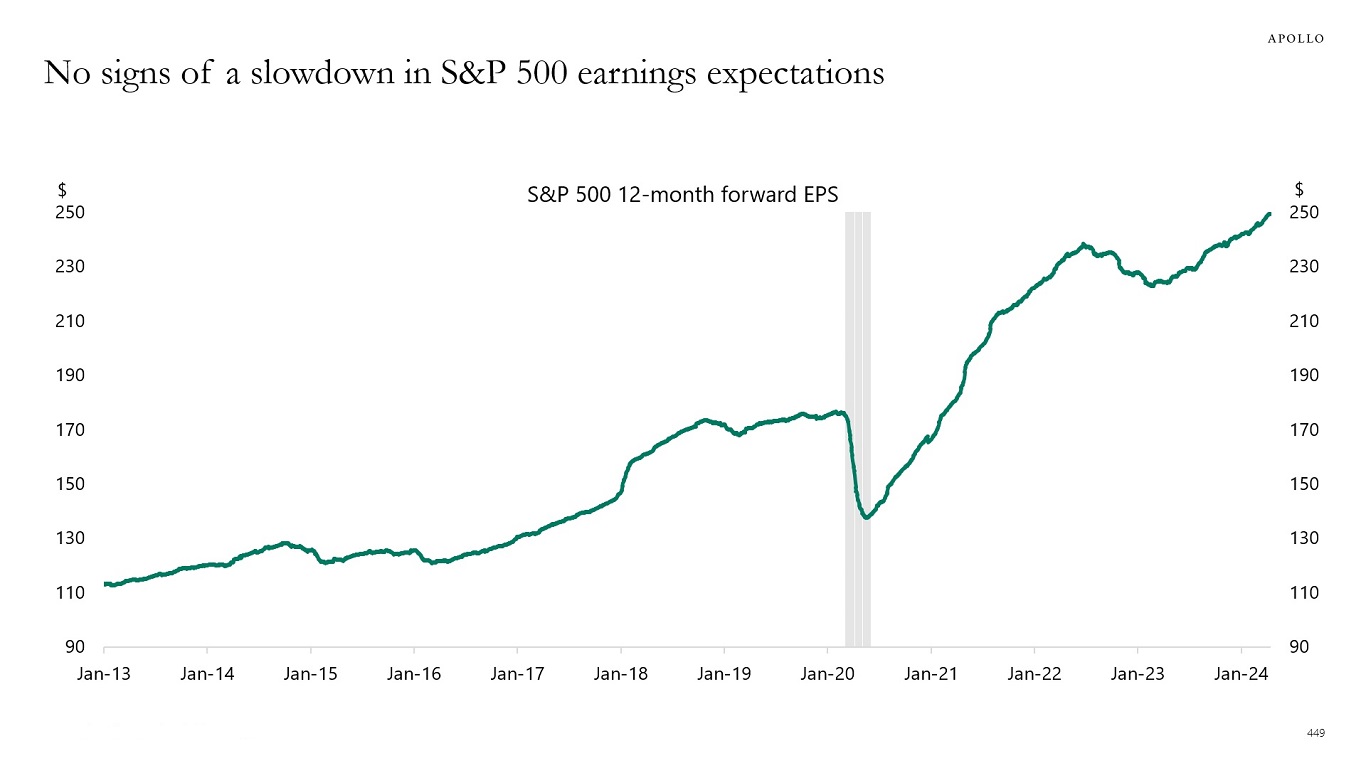

Brian: and on a long-term basis, the continuation of a healthy long-term trend

Source: Apollo as of 04.22.2024

Source: Apollo as of 04.22.2024

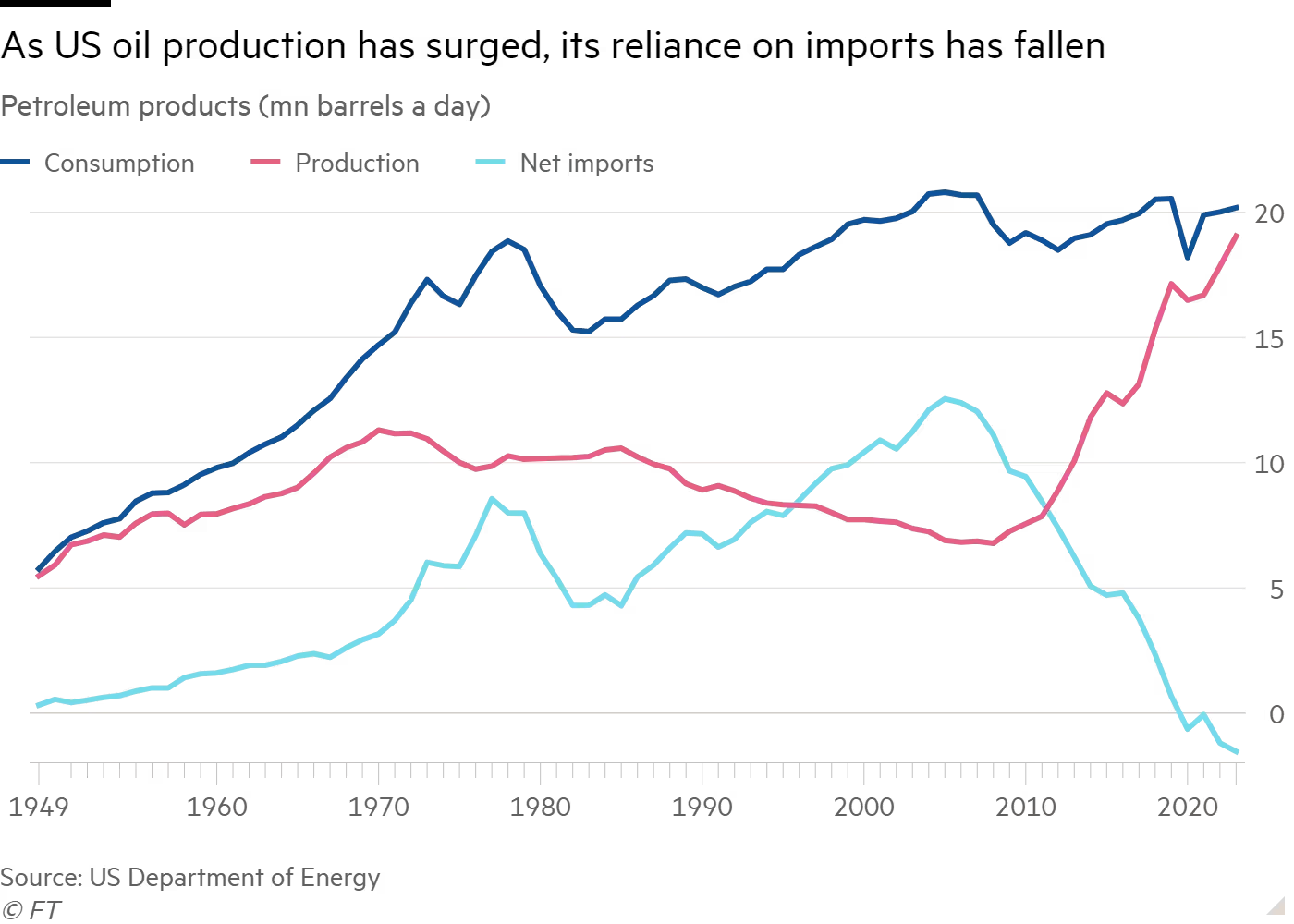

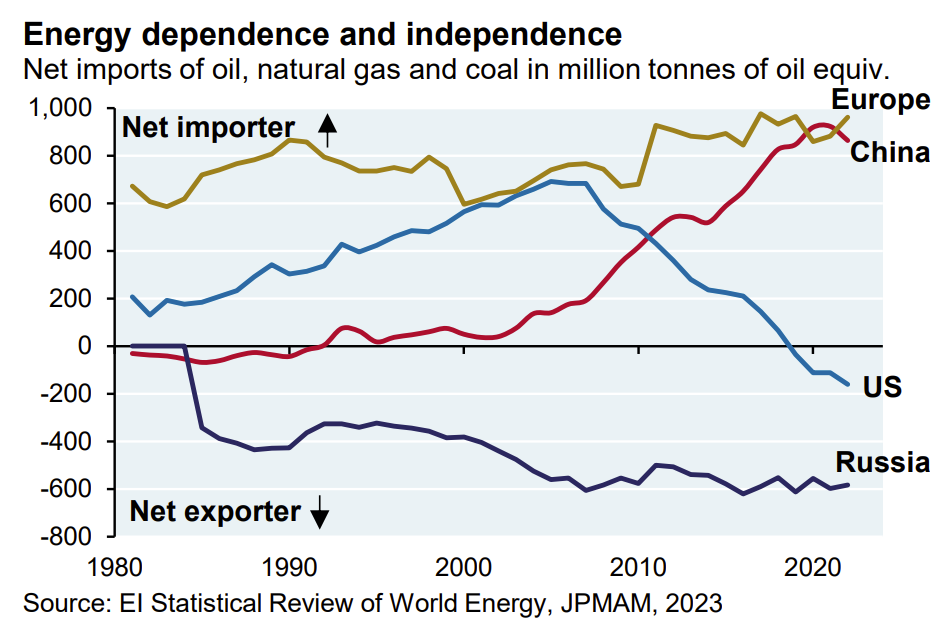

John Luke: Despite talk of converting our economy to “clean” energy, US oil production has never been higher

Data as of March 2024

Data as of March 2024

Joseph: making us less and less dependent on foreign countries for our energy supply

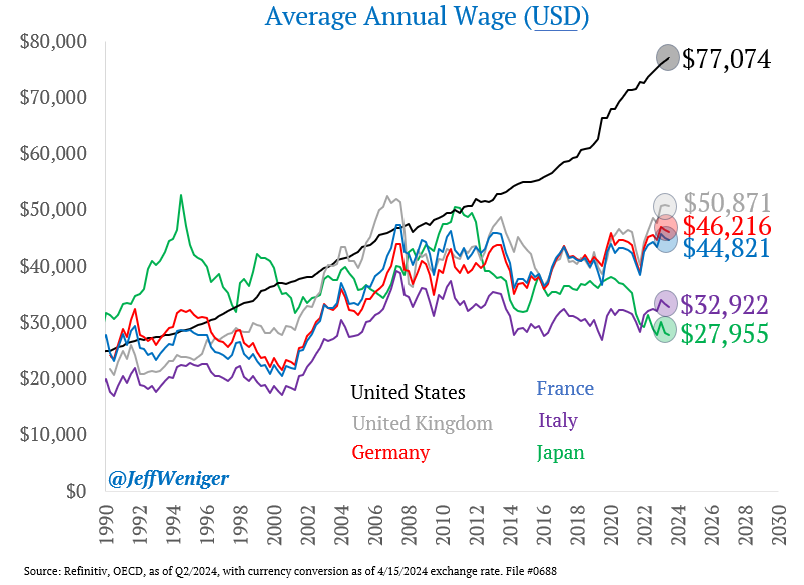

John Luke: Another interesting trend that requires looking globally, wage growth and higher-end labor has been mostly a US experience in recent years

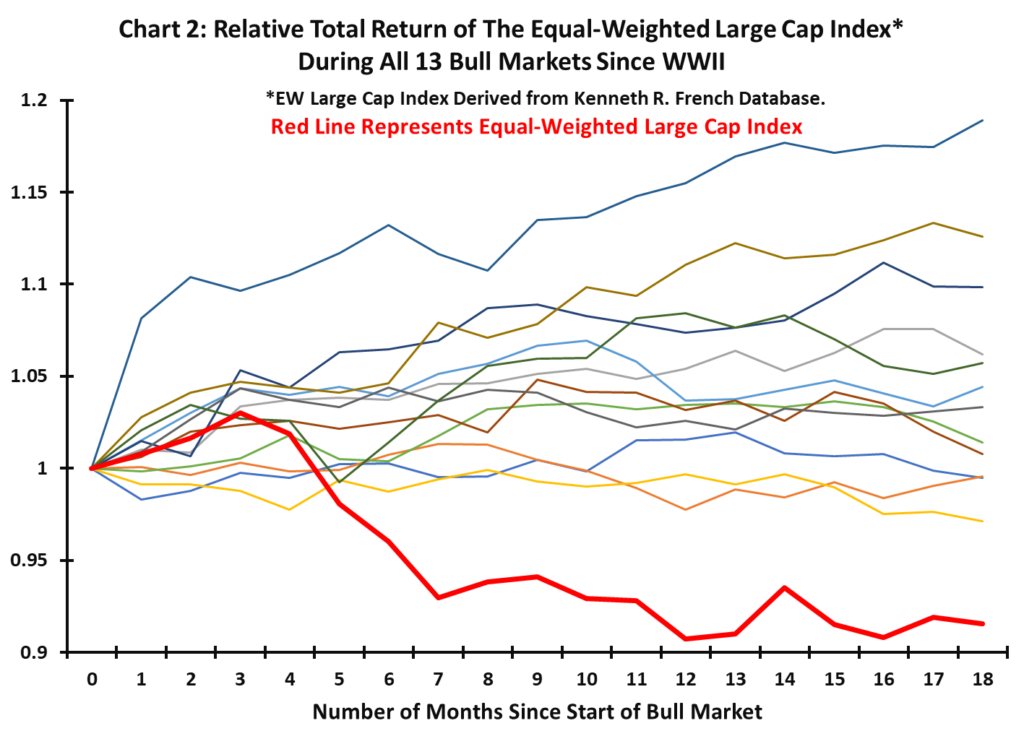

Brian: We hear a lot about the Mag 7 but this has truly been a historic divergence between cap-weighted US Large Caps and their equal-weighted equivalent

Source: Paulsen Perspectives as of 04.19.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-31.