Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

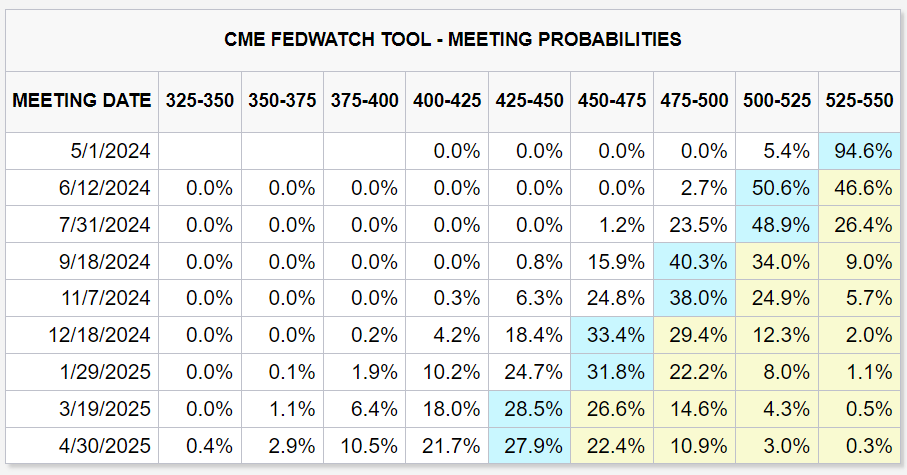

Beckham: After this week’s data and Fedspeak, it’s now a toss-up for markets whether the first rate cut comes in early June or late July

Source: CME as of 04.05.2024

Source: CME as of 04.05.2024

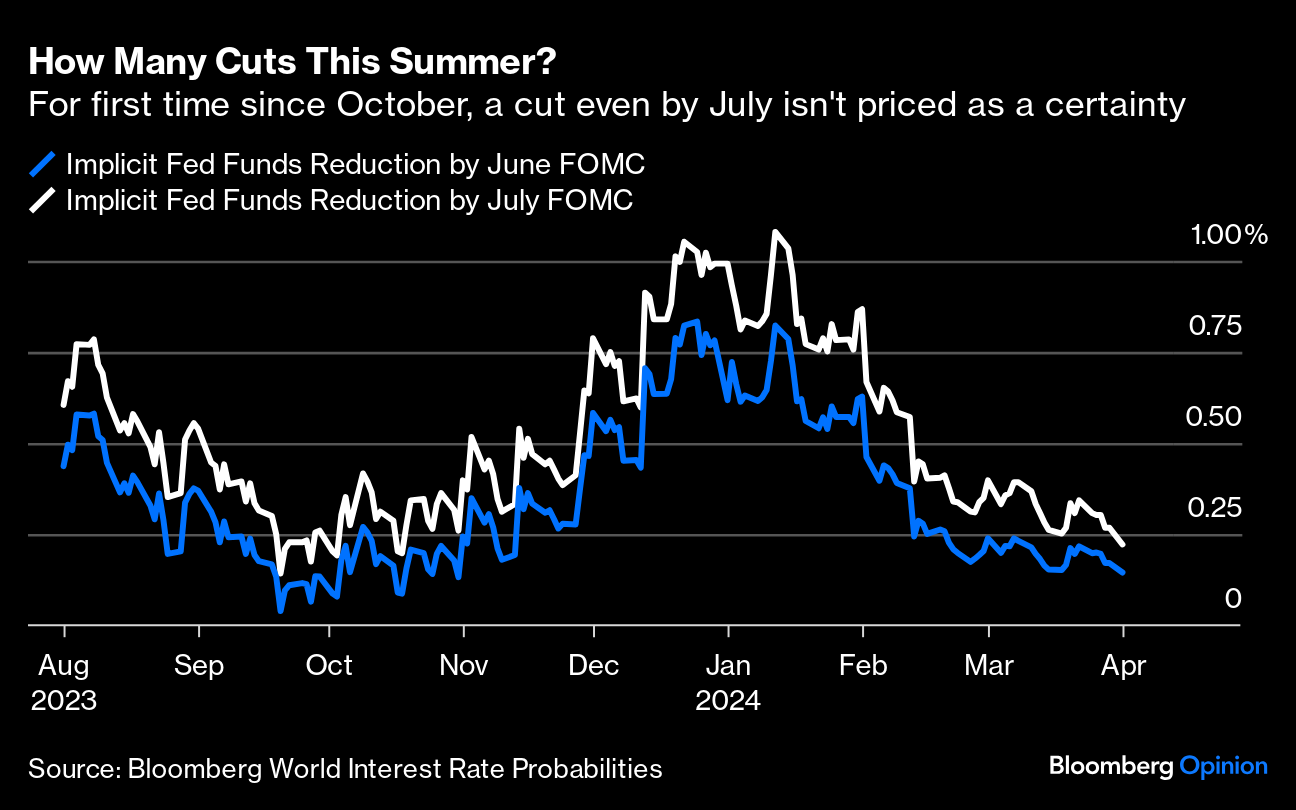

Joseph: a far cry from thoughts of seeing 3-4 cuts by summer, as expected by markets at the turn of this year

Data as of 04.02.2024

Data as of 04.02.2024

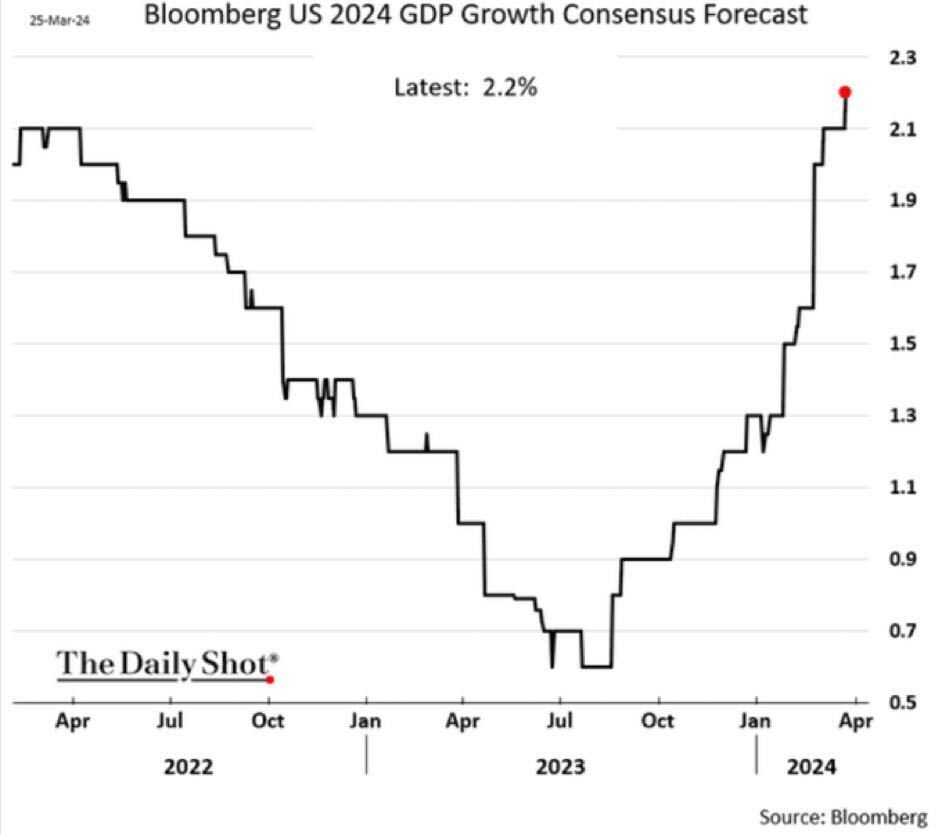

John Luke: Contrasting the delay of expected rate cuts is the persistent rise in GDP estimates

Data as of 04.02.2024

Data as of 04.02.2024

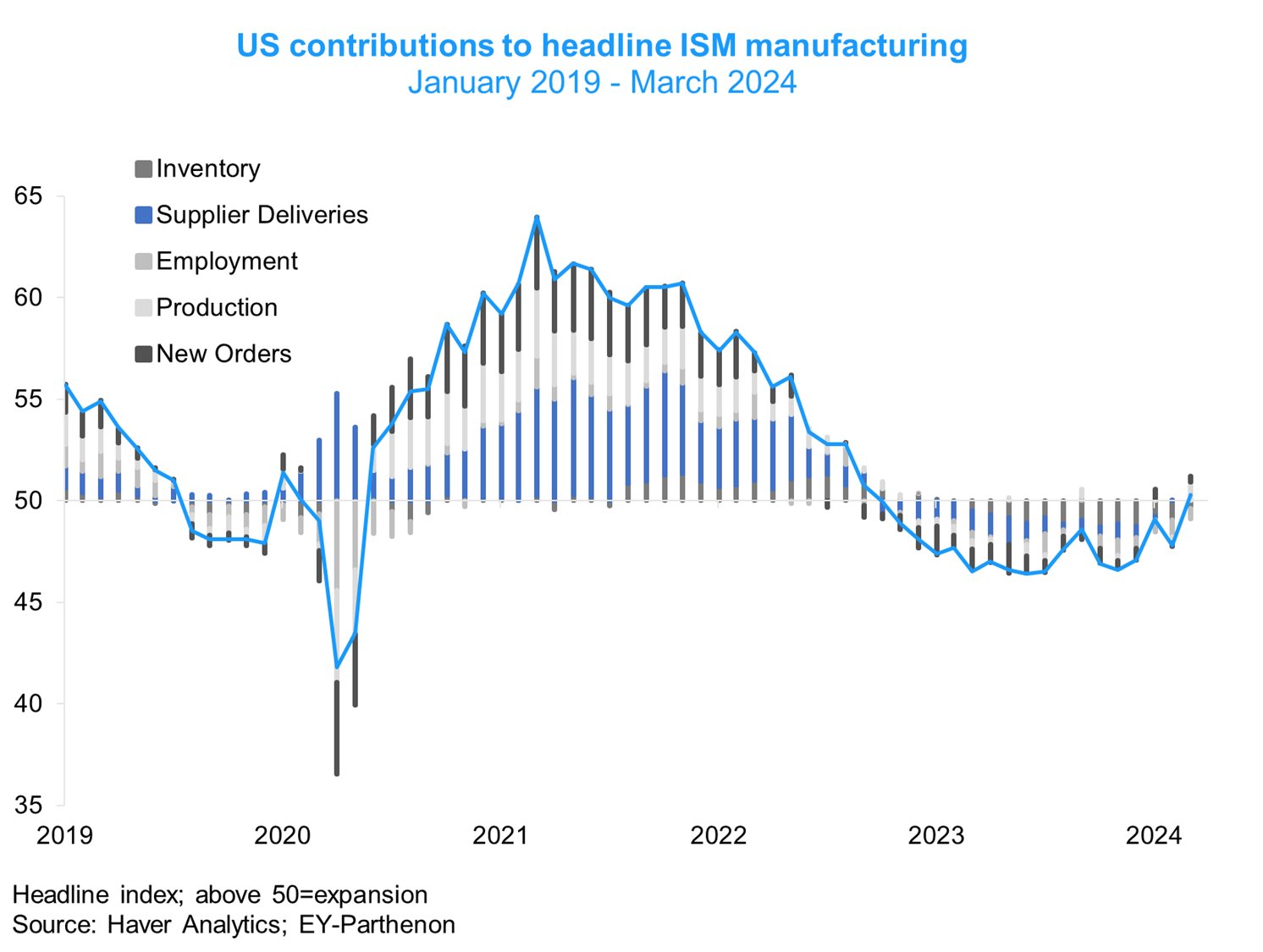

Brett: which is somewhat coincident with a trough and rise in the ISM Manufacturing Survey

Data as of 04.01.2024

Data as of 04.01.2024

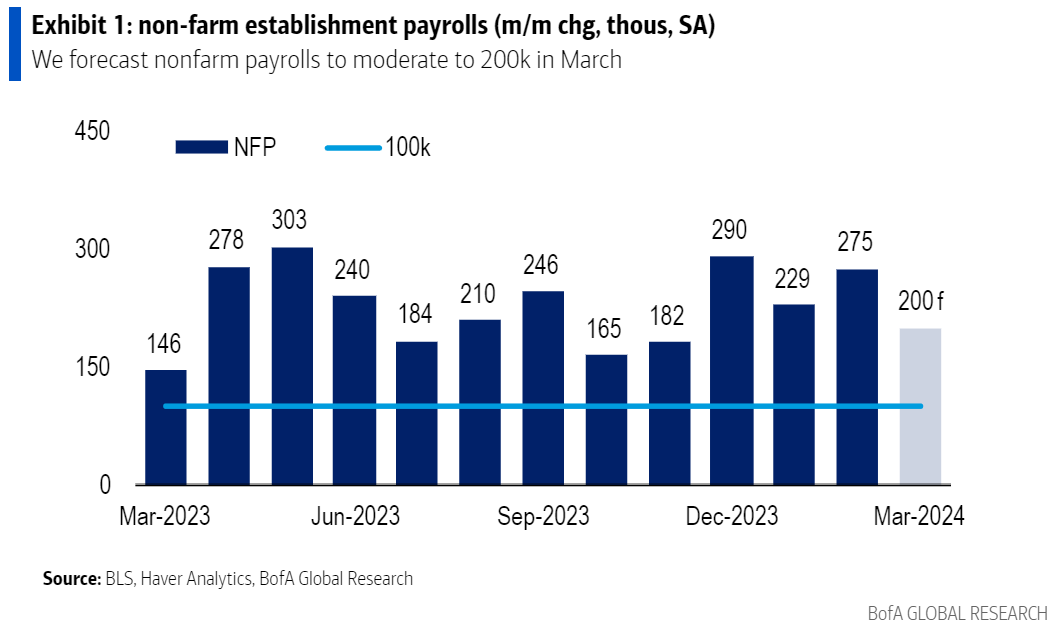

Dave: and a steady increase in non-farm payrolls month after month (March preliminary read came in at 300k)

Data as of 04.01.2024

Data as of 04.01.2024

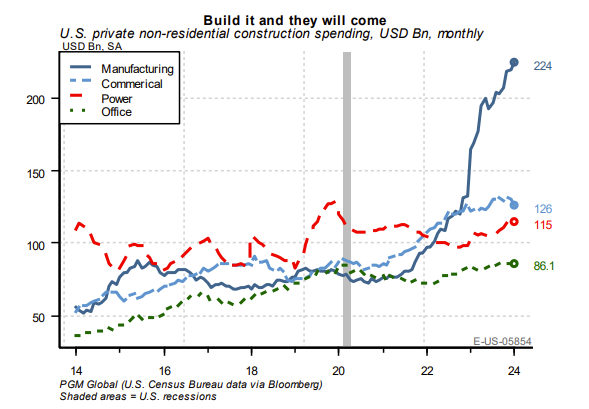

Joseph: High levels of construction in manufacturing facilities are surely part of the equation, running at a $2 trillion annualized pace

Data as of March 2024

Data as of March 2024

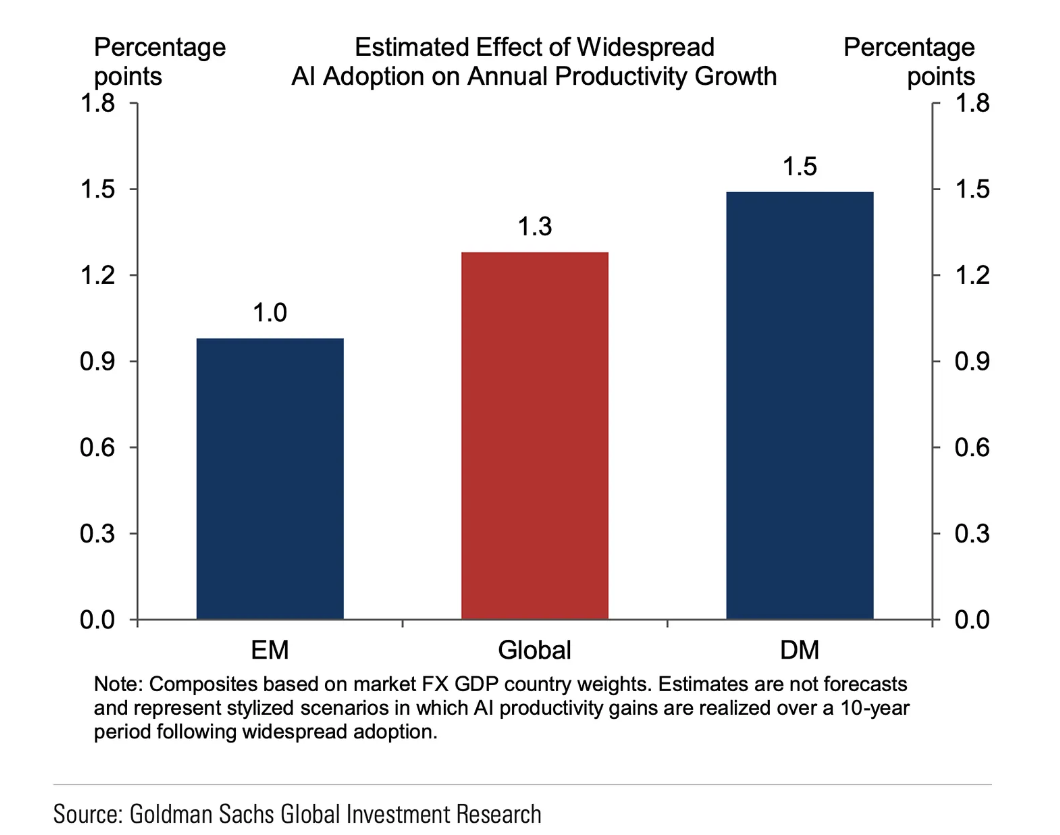

Beckham: it’s also hard to deny the impact of artificial intelligence (AI) on overall productivity levels, which feeds into growth

Data as of March 2024

Data as of March 2024

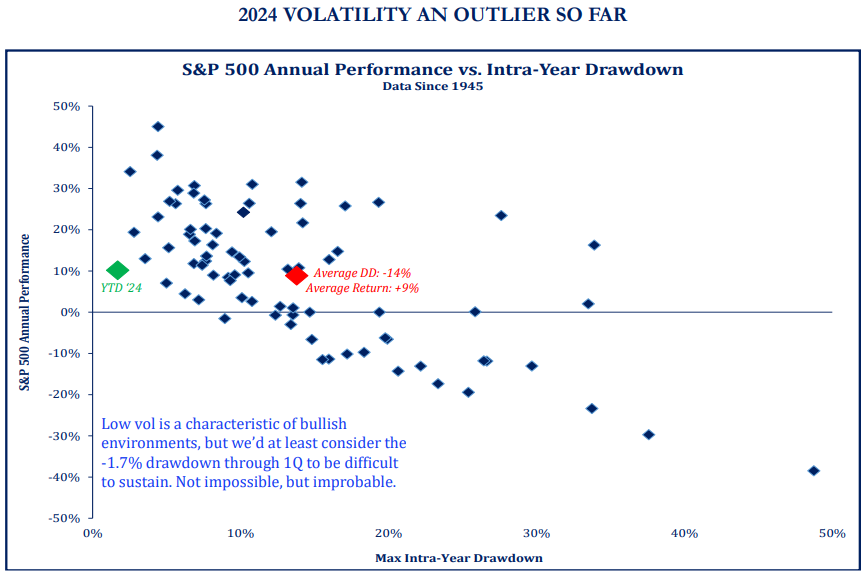

Dave: The first three months of 2024 have been pretty extreme in terms of return generated per unit of volatility

Source: Strategas as of 04.02.2024

Source: Strategas as of 04.02.2024

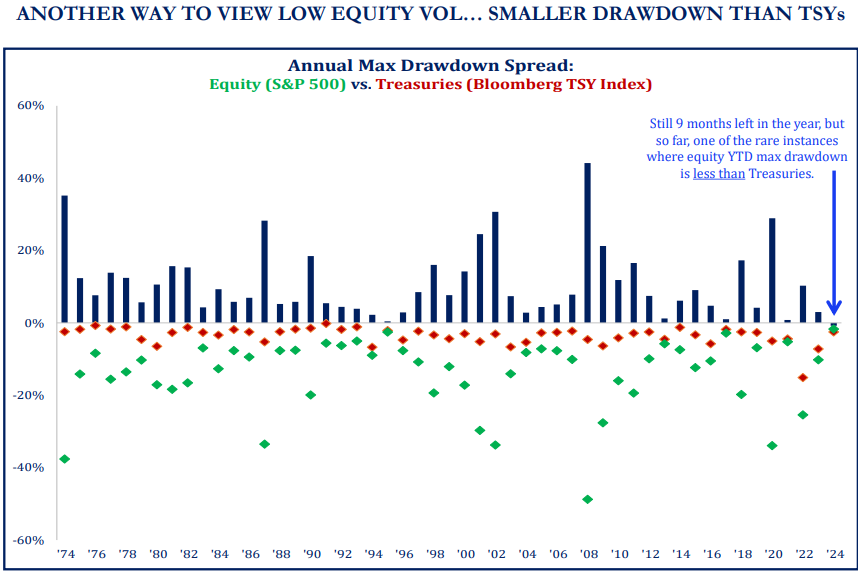

Dave: even more pronounced when you consider the volatility in the “safe” bond market relative to stocks

Source: Strategas as of 04.02.2024

Source: Strategas as of 04.02.2024

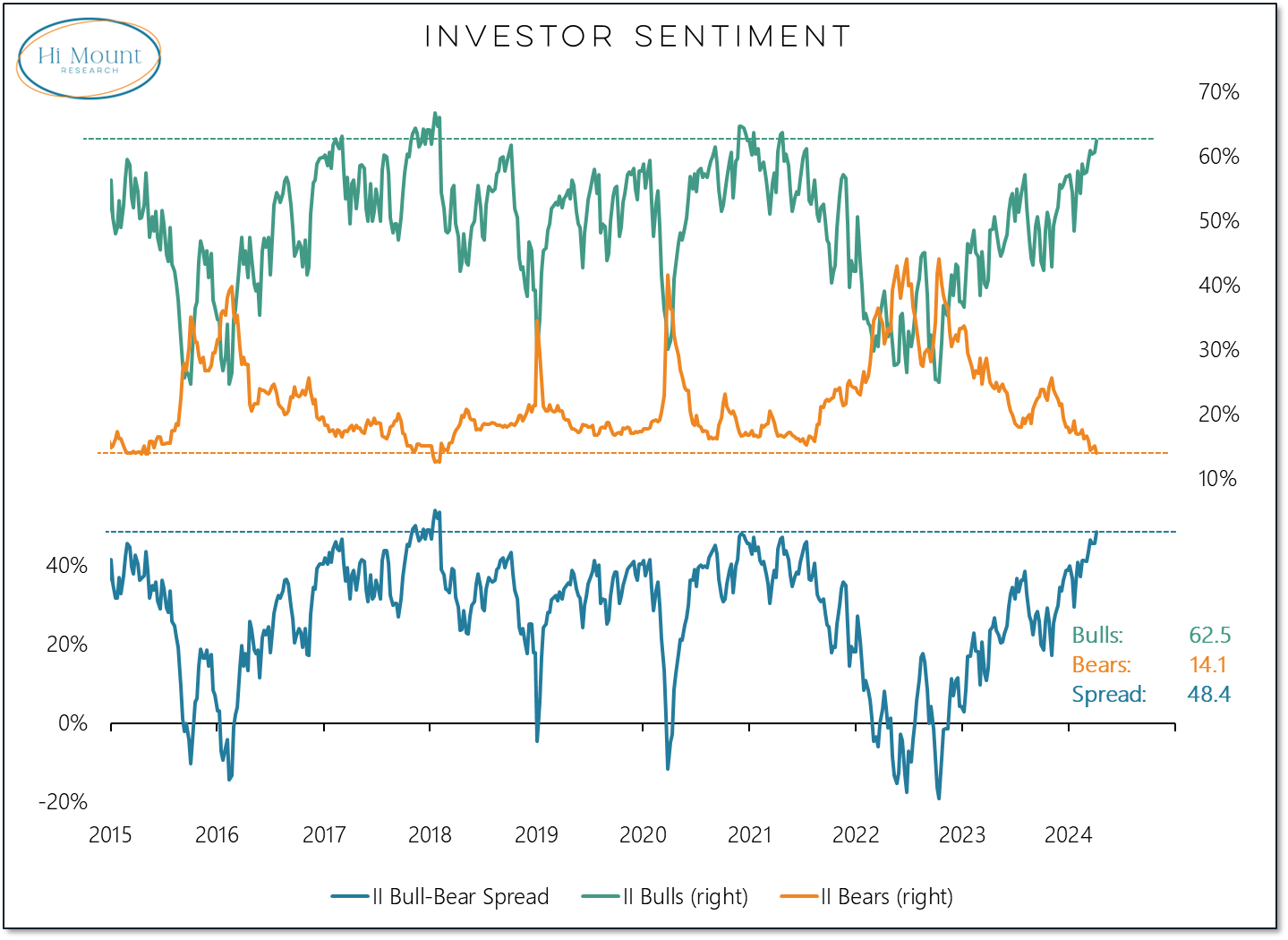

Brad: The story of a positive equity trend with low volatility has not gone unnoticed, and potentially adds a level of drawdown risk to consider

Source: Hi Mount as of 04.01.2024

Source: Hi Mount as of 04.01.2024

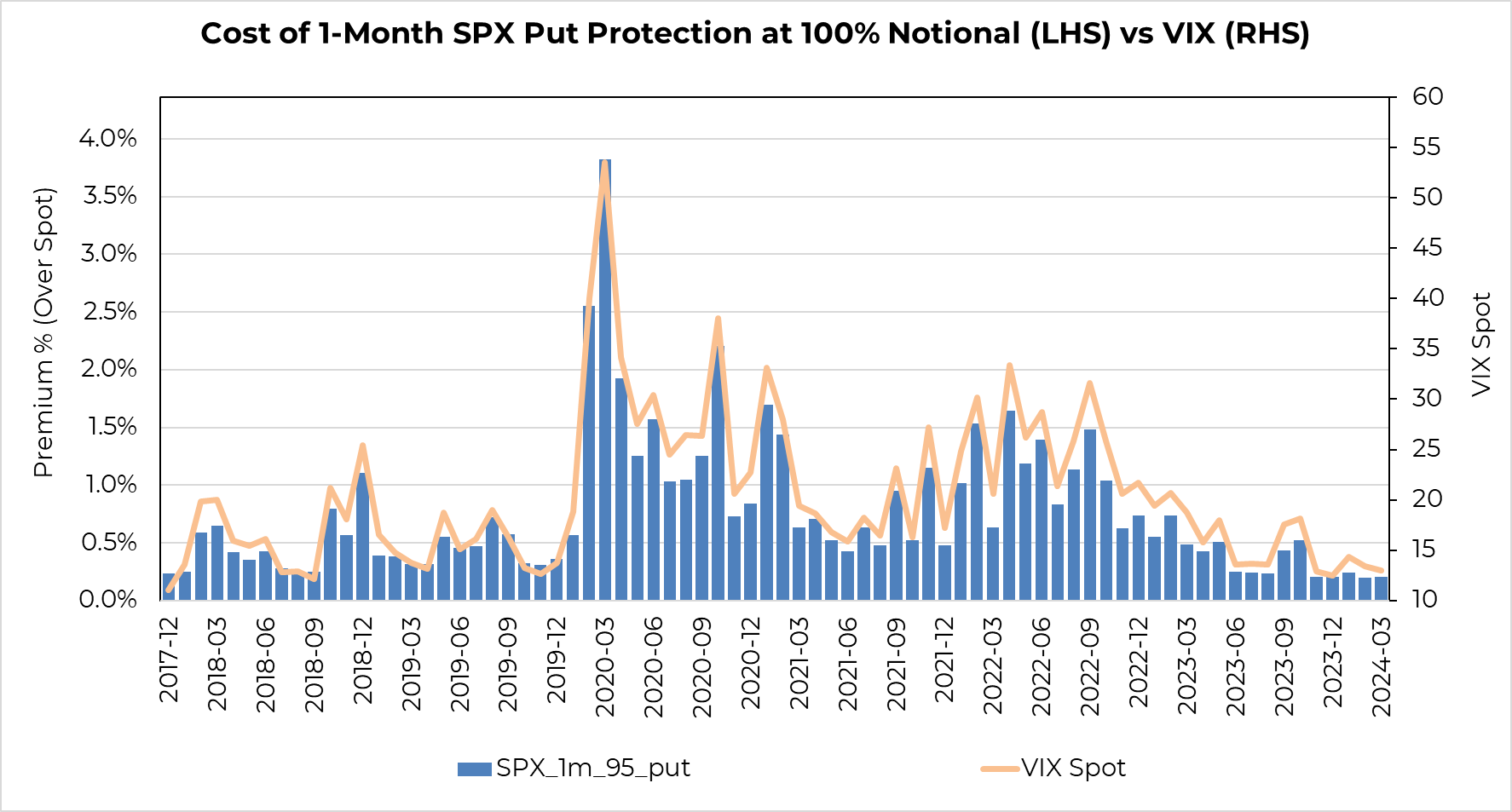

Brian: also seen as the ultra-low cost of hedging, which for a thoughtful investor can provide a nice opportunity to reduce risk without disrupting the strategic stock/bond allocation

Source: Aptus as of 04.01.2024

Source: Aptus as of 04.01.2024

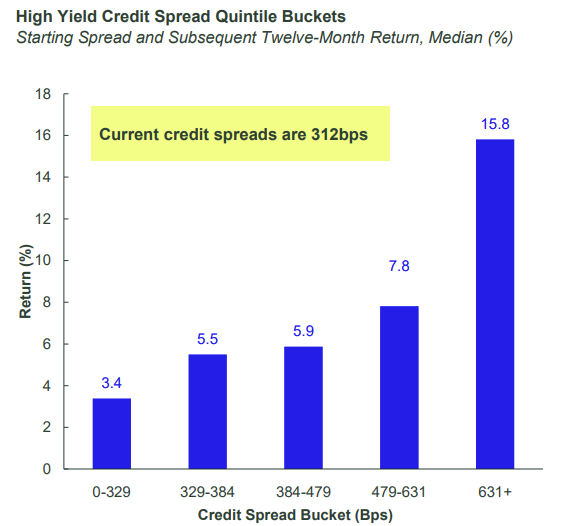

John Luke: As good as stocks have been, from a fundamental standpoint it seems the risk may ultimately be higher in higher-yielding bonds than in the broader equity market

Source: State Street as of March 2024

Source: State Street as of March 2024

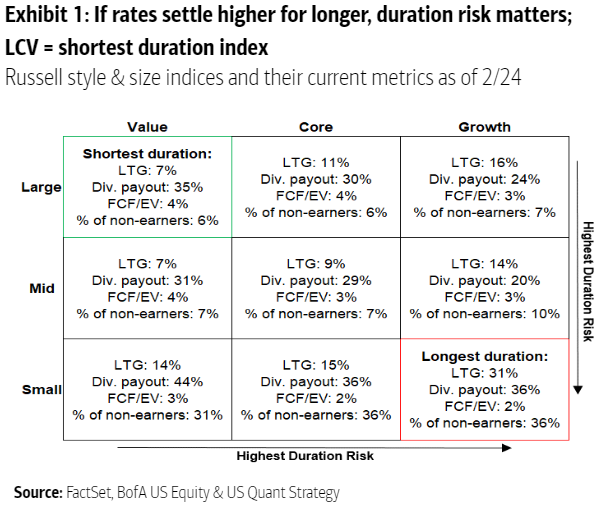

Brad: and when you break down by sector and style it’s amazing to see how important it is to be discriminating as you go out into smaller-cap stocks (1/3 are non-earners!)

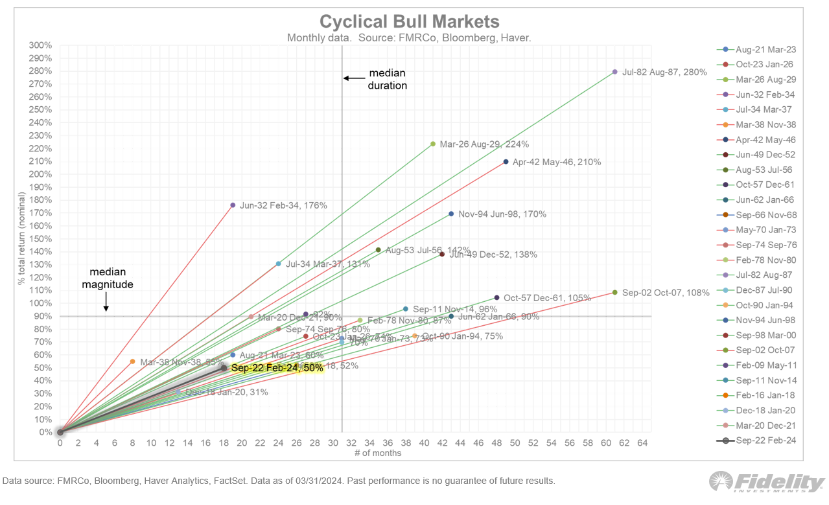

Brett: No one knows where stocks will end up in the coming years, but using history as a guide we should probably stay open-minded to a range of possibilities

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-19.