Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

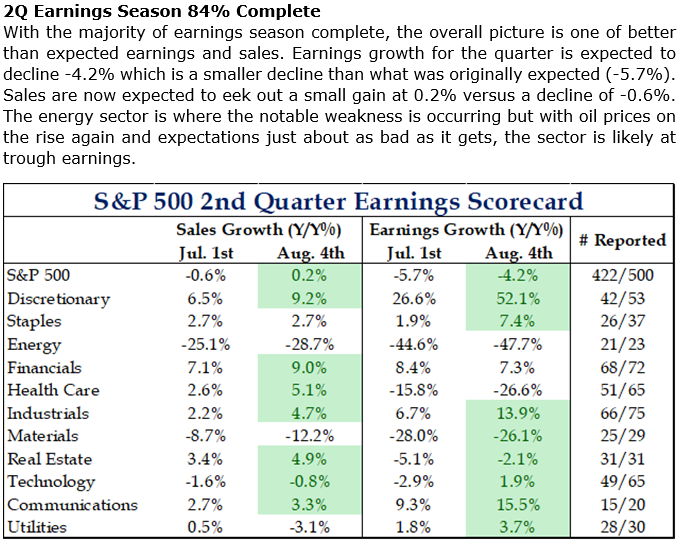

Brad: Most Q2 earnings are out, and it’s generally been better-than-expected

Source: Strategas as of 08.07.23

Source: Strategas as of 08.07.23

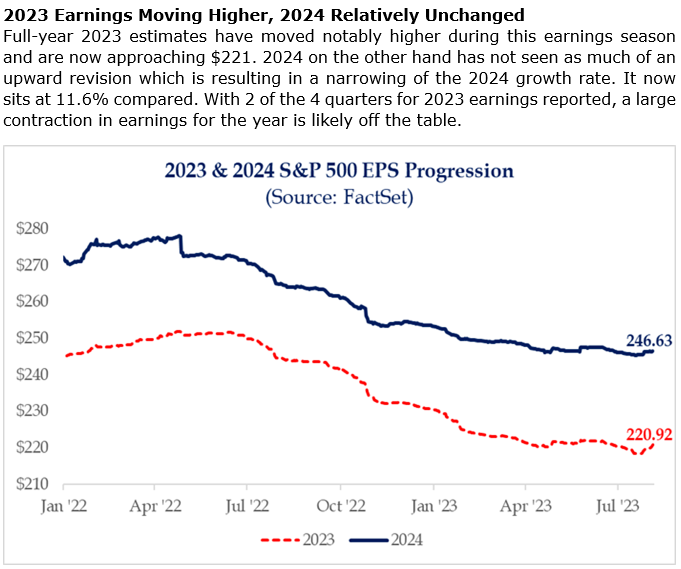

Brad: leading to a bump in Q3 and Q4 estimates but not much carry-through into 2024

Source: Strategas as of 08.07.2023

Source: Strategas as of 08.07.2023

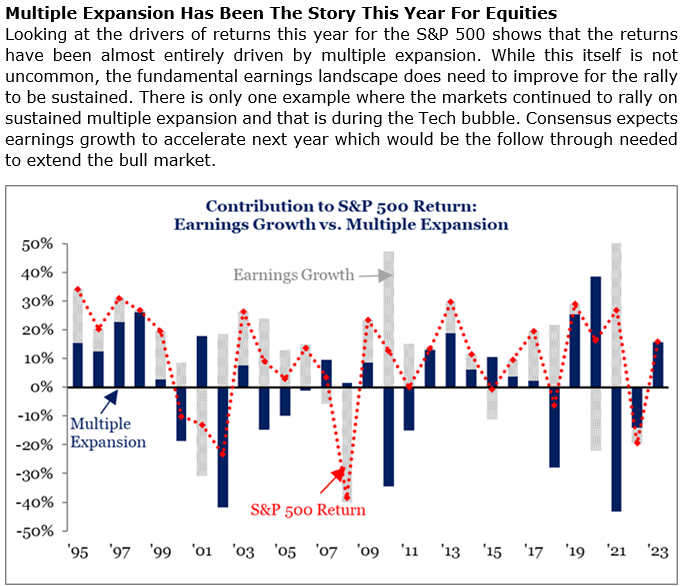

JD: Most of this year’s market advance has been due to P/E multiples expanding

Source: Strategas as of 08.09.2023

Source: Strategas as of 08.09.2023

Brad: leading to very low relative yields in stocks

Source: Strategas as of 08.08.2023

Source: Strategas as of 08.08.2023

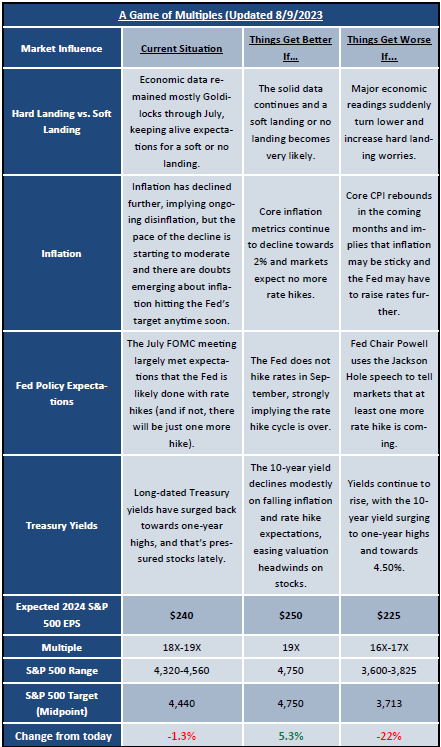

Joseph: and a tough comparison of near-term upside vs. downside

Source: Sevens Report as of 08.08.2023

Source: Sevens Report as of 08.08.2023

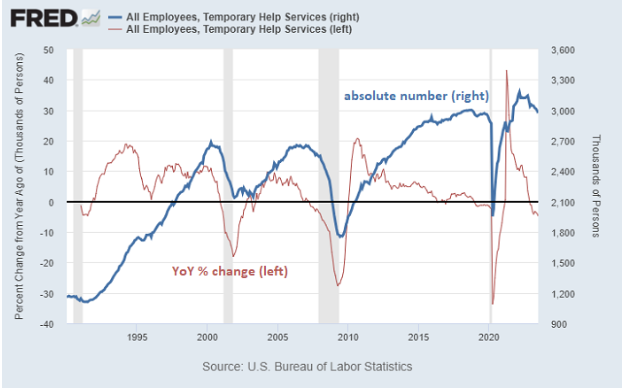

John Luke: A serious contraction in temporary employment has often been an indicator of labor weakness

Data as of July 2023

Data as of July 2023

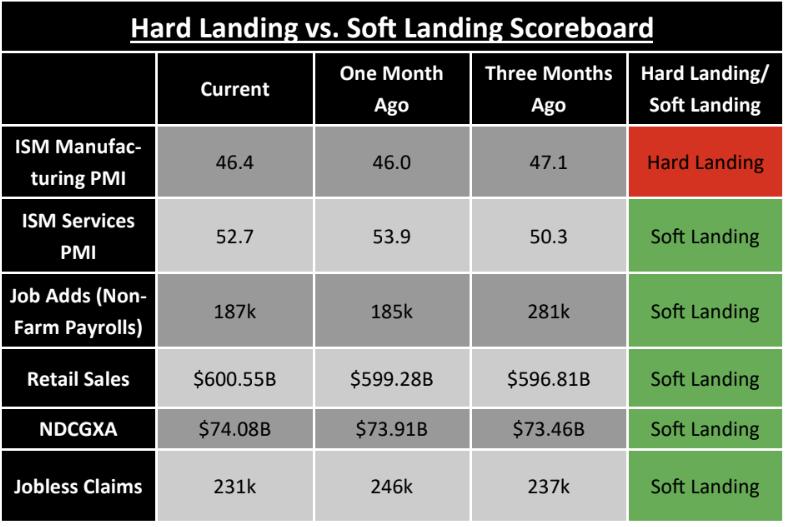

Dave: but the weight of the evidence for an actual soft landing continues to fall into place

Source: Sevens Report as of 08.11.2023

Source: Sevens Report as of 08.11.2023

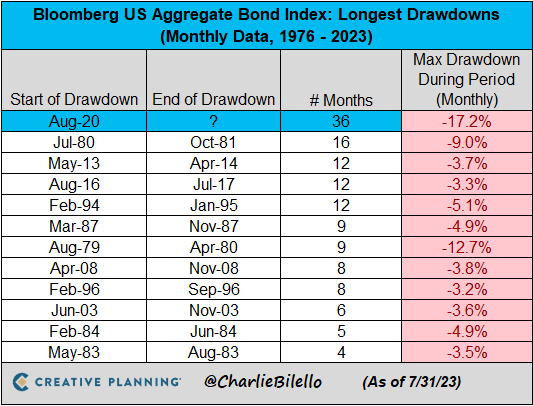

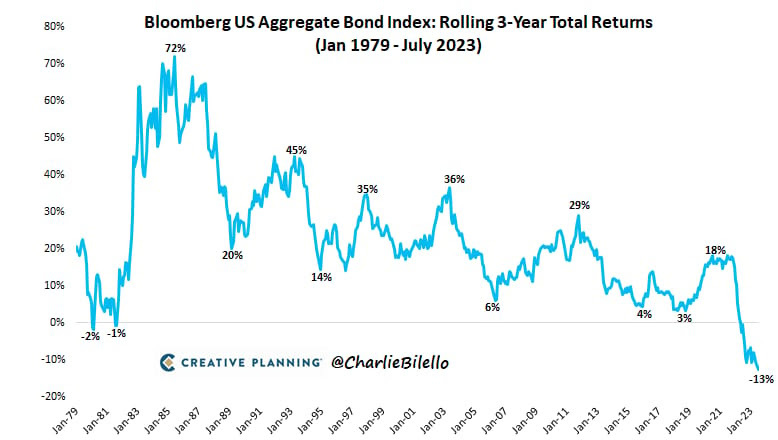

John Luke: The downturn in bond prices has been the longest since the Aggregate Bond index was launched

John Luke: with a pretty ugly impact on the fixed income portion of portfolios

Source: Charlie Bilello as of 08.07.2023

Source: Charlie Bilello as of 08.07.2023

John Luke: Ironically, money continues to flow into the big T-bond ETF despite the poor performance

Source: Strategas as of 08.08.2023

Source: Strategas as of 08.08.2023

John Luke: perhaps giving hedge funds confidence in expecting lower bond prices/higher yields

Data as of August 2023

Data as of August 2023

John Luke: The current battle with CPI has been mostly won, but secular cycles can see multiple iterations

Source: Market Ear as of July 2023

Source: Market Ear as of July 2023

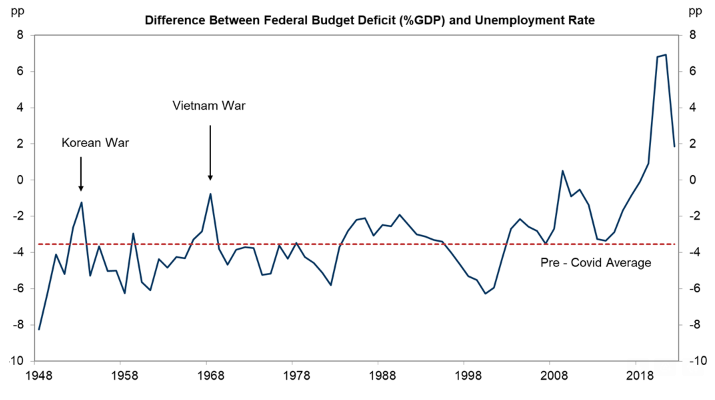

John Luke: especially with the unprecedented fiscal boost during the COVID shutdowns

Source: Goldman Sachs as of 08.10.2023

Source: Goldman Sachs as of 08.10.2023

John Luke: resulting in much higher interest expense for the US government to finance the fiscal boost

Data as of August 2023

Data as of August 2023

Joseph: Beyond the obvious concern for people and property, another reason to hope for a light hurricane season

Data as of July 2023

Data as of July 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-13.