Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fill the puzzle of evidence:

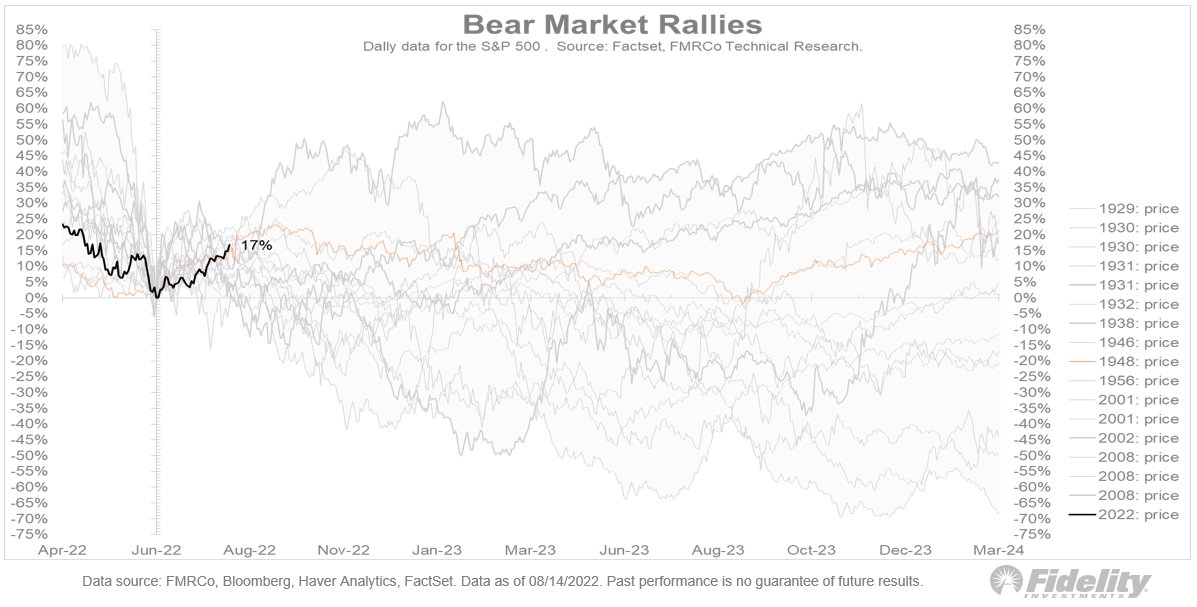

Derek: We’ve had quite a bounce in equities since mid-June, how does it compare to previous bear market rallies

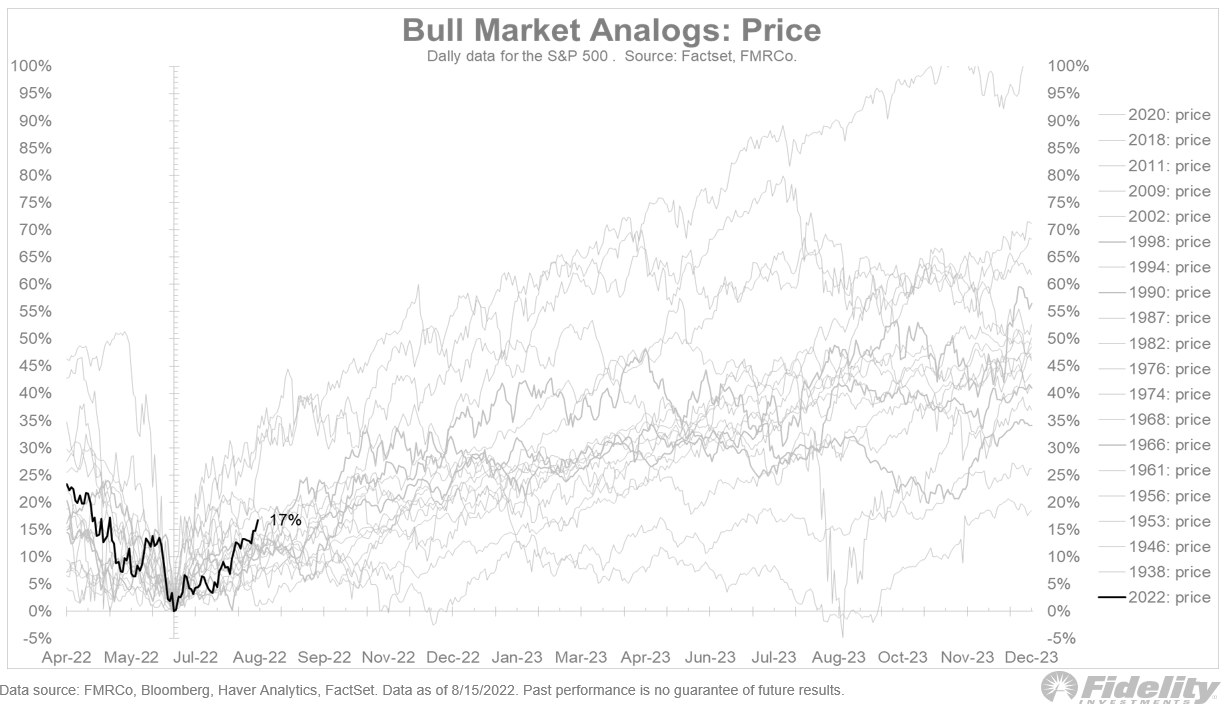

…or new bull markets?

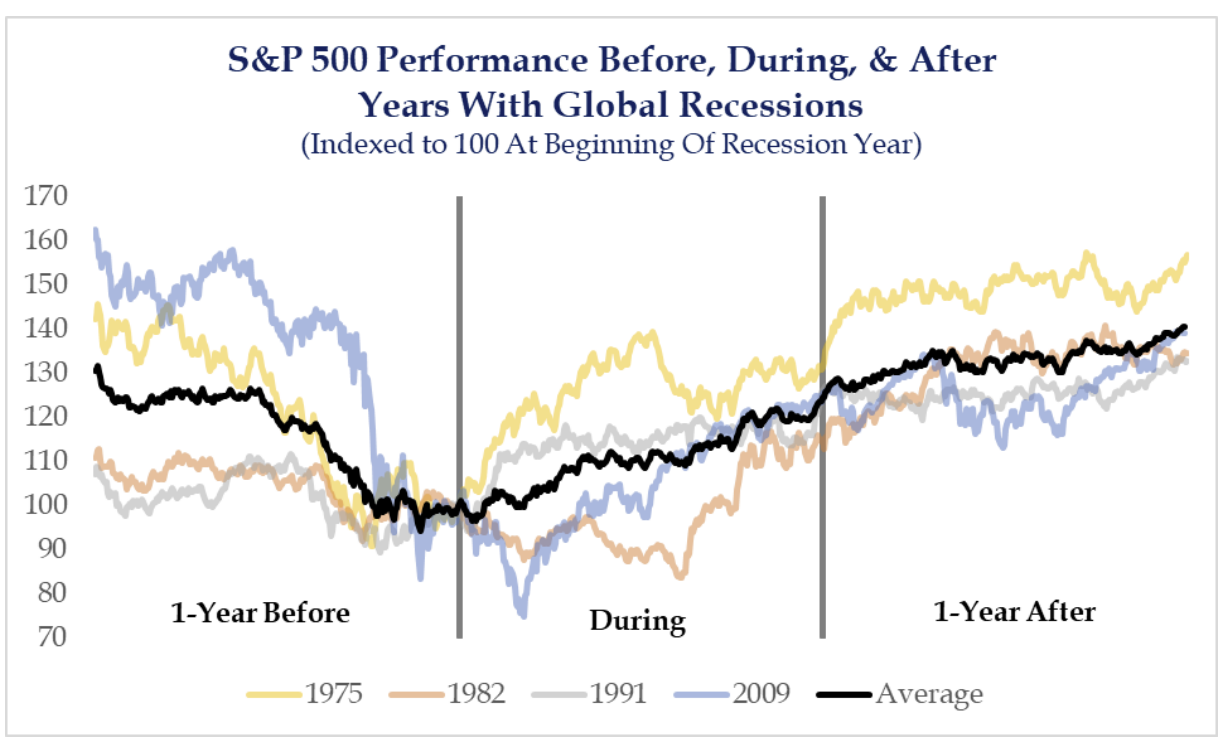

Dave: Hard to say, but there has been a pattern of stocks bottoming before or during the recession not after

Source: Strategas 08.17.2022

Source: Strategas 08.17.2022

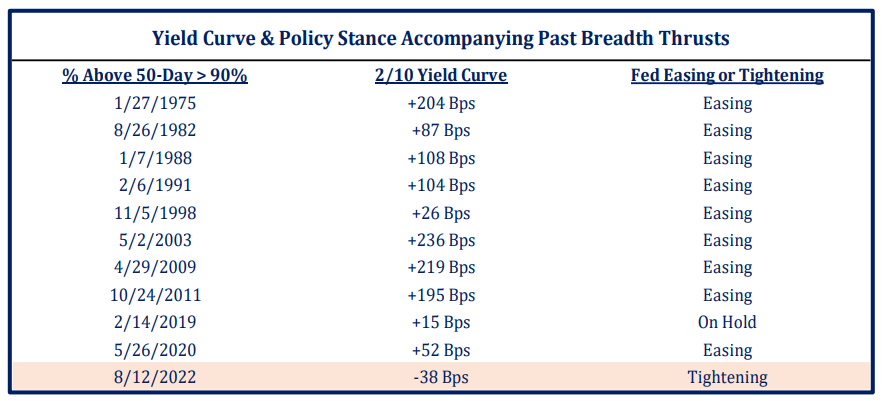

JL: We’ve seen folks note the “breadth thrust” that has signaled new bull runs, but prior instances occurred with the yield curve as a tailwind not headwind

Source: Strategas as of 08.17.2022

Source: Strategas as of 08.17.2022

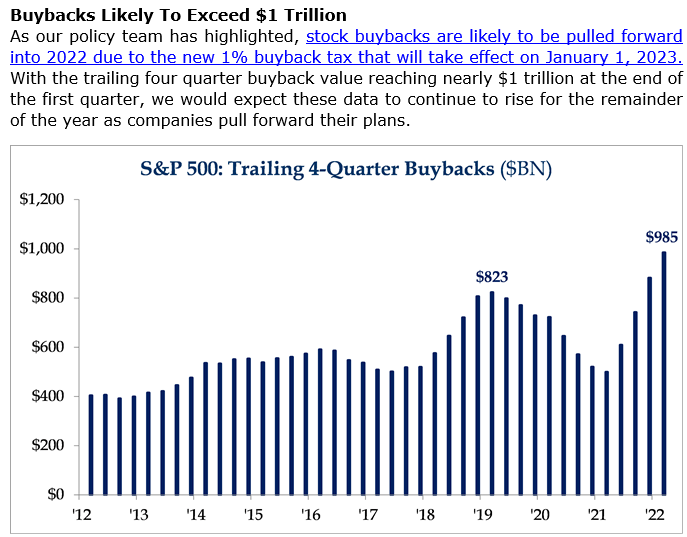

Brad: Buybacks are rising…

Source: Strategas 08.18.2022

Source: Strategas 08.18.2022

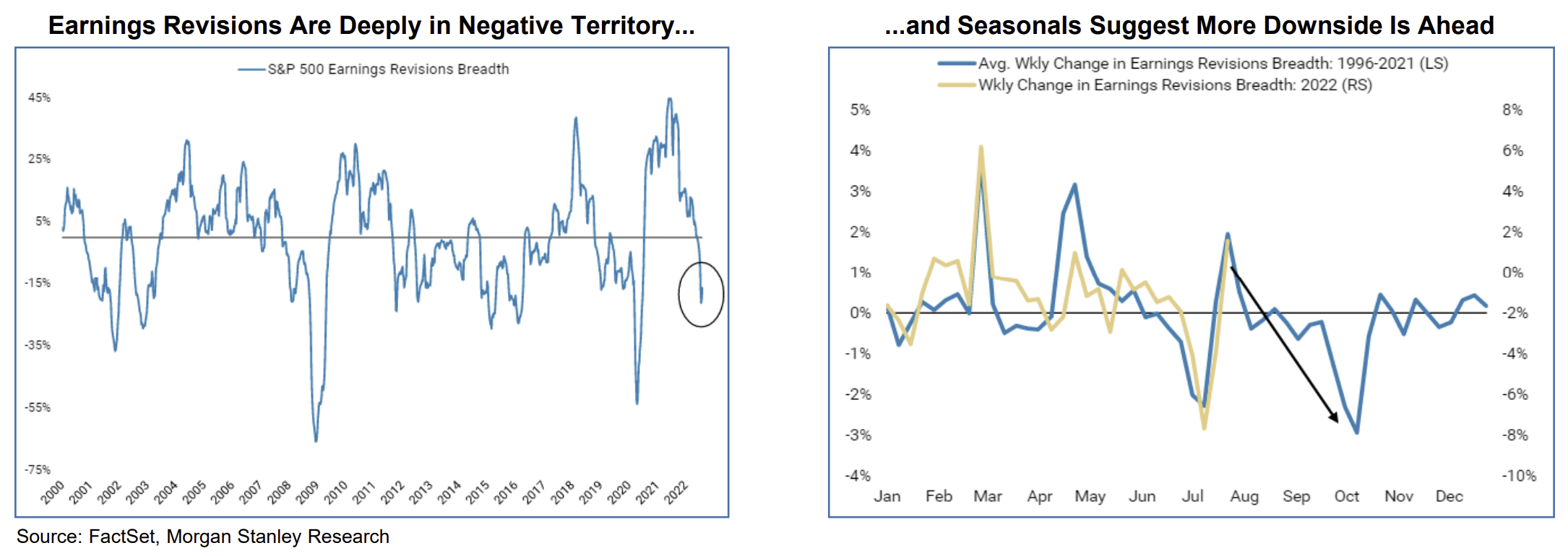

Dave: …but earnings estimates are falling

Data as of 08.15.2022

Data as of 08.15.2022

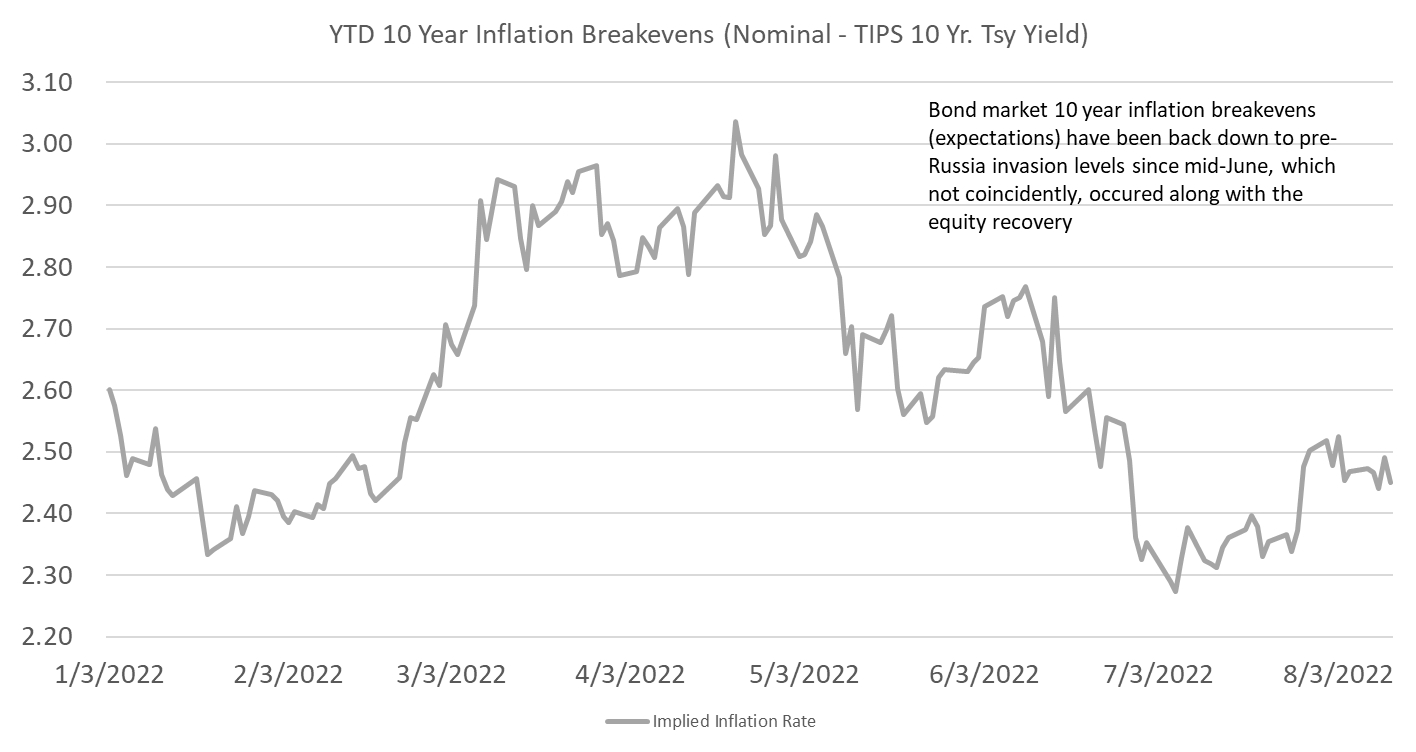

JL: Inflation expectations seem to be stabilizing…

Source: Raymond James as of 08.10.2022

Source: Raymond James as of 08.10.2022

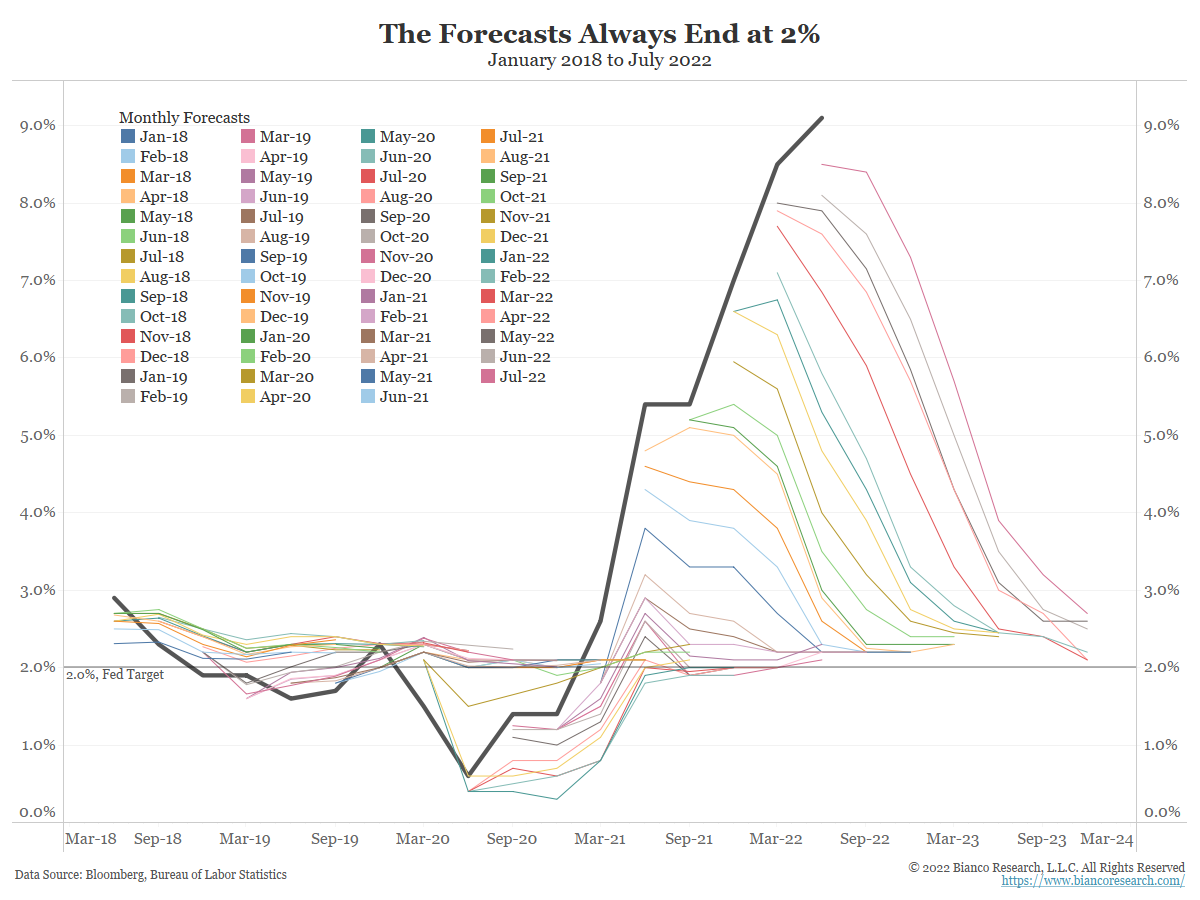

…though that could be a function of the “2% magnet” that Wall Street seems to always have in mind

Source: Bianco as of 08.16.2022

Source: Bianco as of 08.16.2022

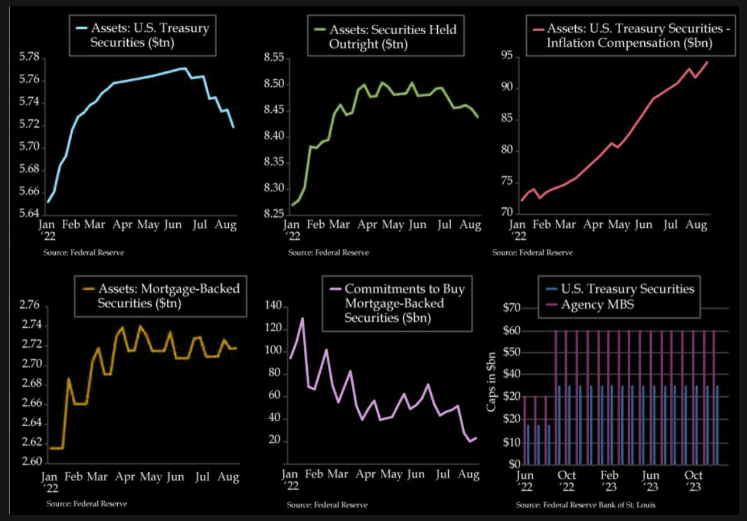

JL: Next up, Quantitative Tightening

Source: The Market Ear as of 08.18.2022

Source: The Market Ear as of 08.18.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2208-22.