Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

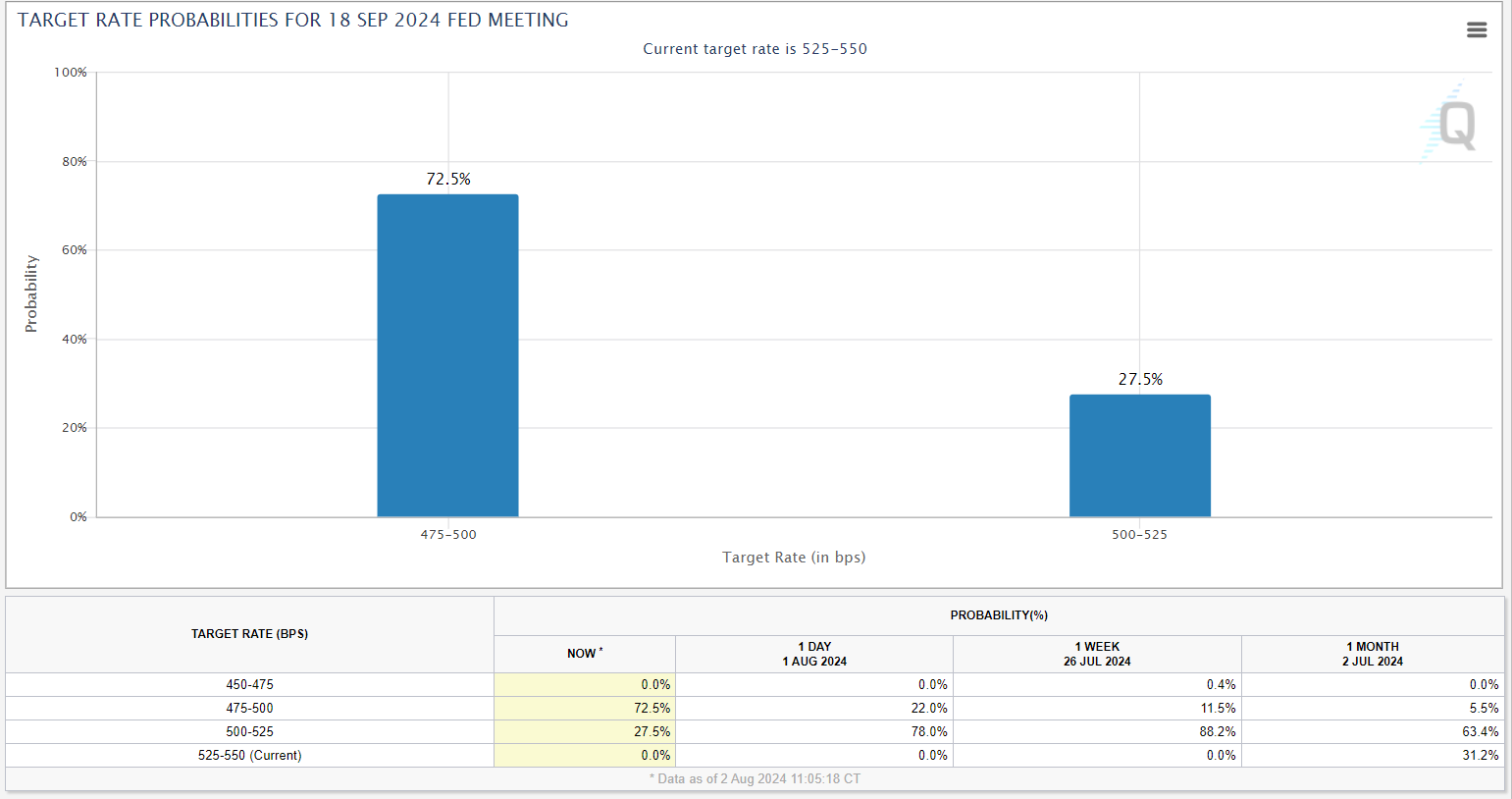

Beckham: It only took a week for markets to go from an 11% chance to a 72% chance of 50 bps of rate cuts by the September FOMC meeting

Source: CME FedWatch Tool as of 08.02.2024

Source: CME FedWatch Tool as of 08.02.2024

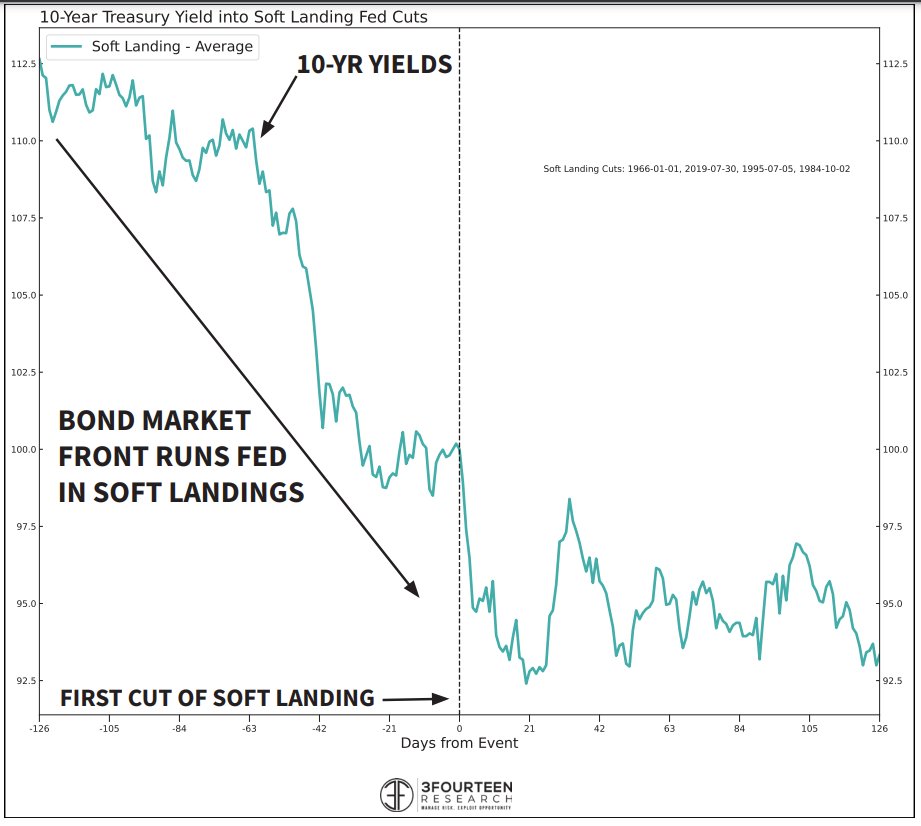

John Luke: as for the long-end of the curve, history says most of the price impact of a cutting cycle takes place into and during the first cut, at least in soft landings

Data as of 07.31.2024

Data as of 07.31.2024

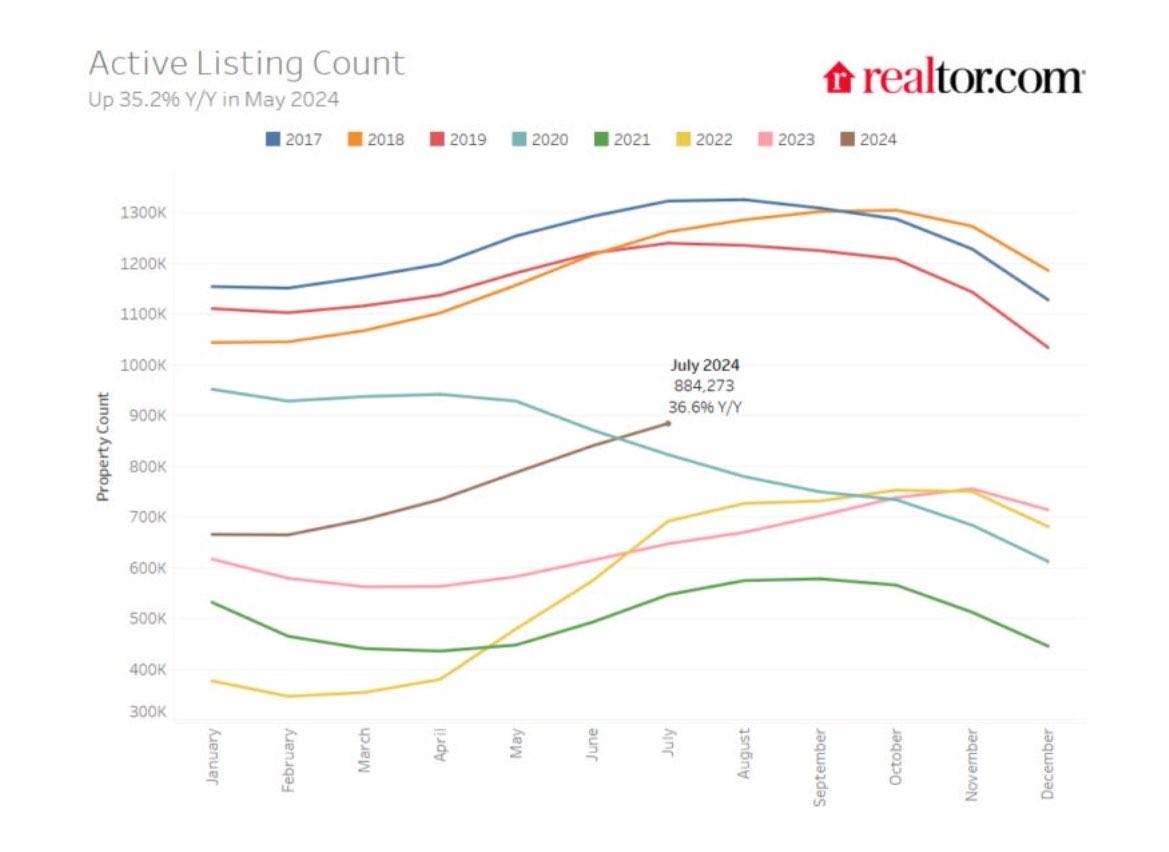

Brett: Home inventory has picked up from very low levels, hard to guess future prices but falling mortgage rates could trigger both demand and supply, for those who’ve been reluctant to give up their existing loan

Data as of July 2024

Data as of July 2024

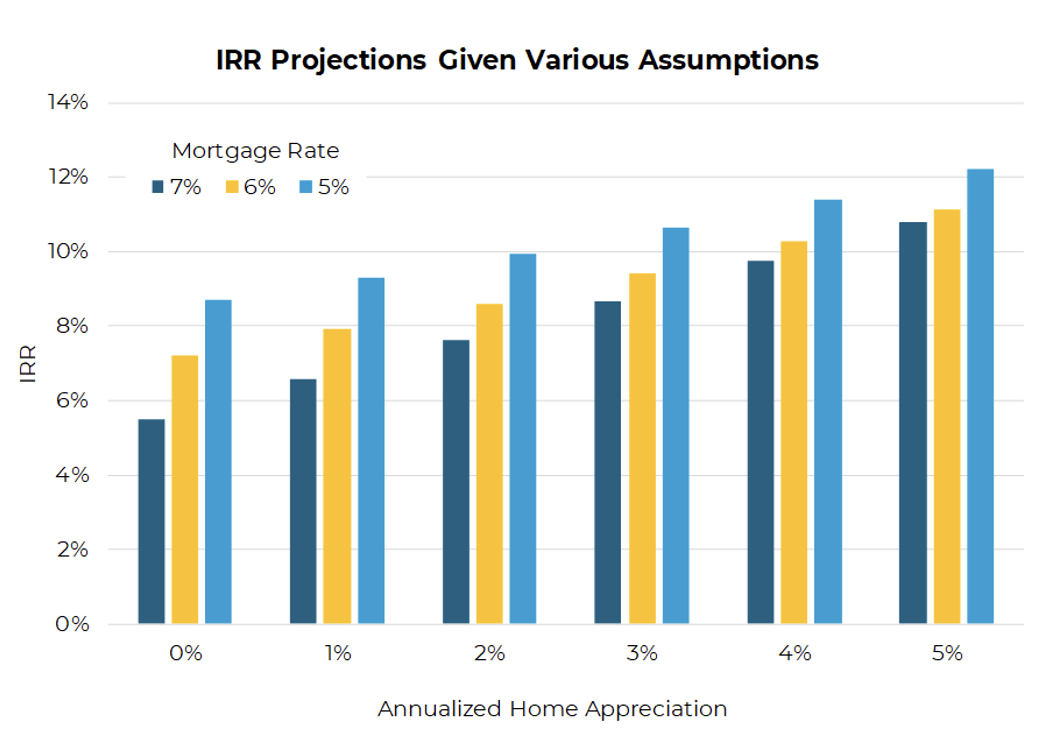

Brian: and rates play a big role in setting the total return potential of home ownership

Source: Aptus Calculations

Source: Aptus Calculations

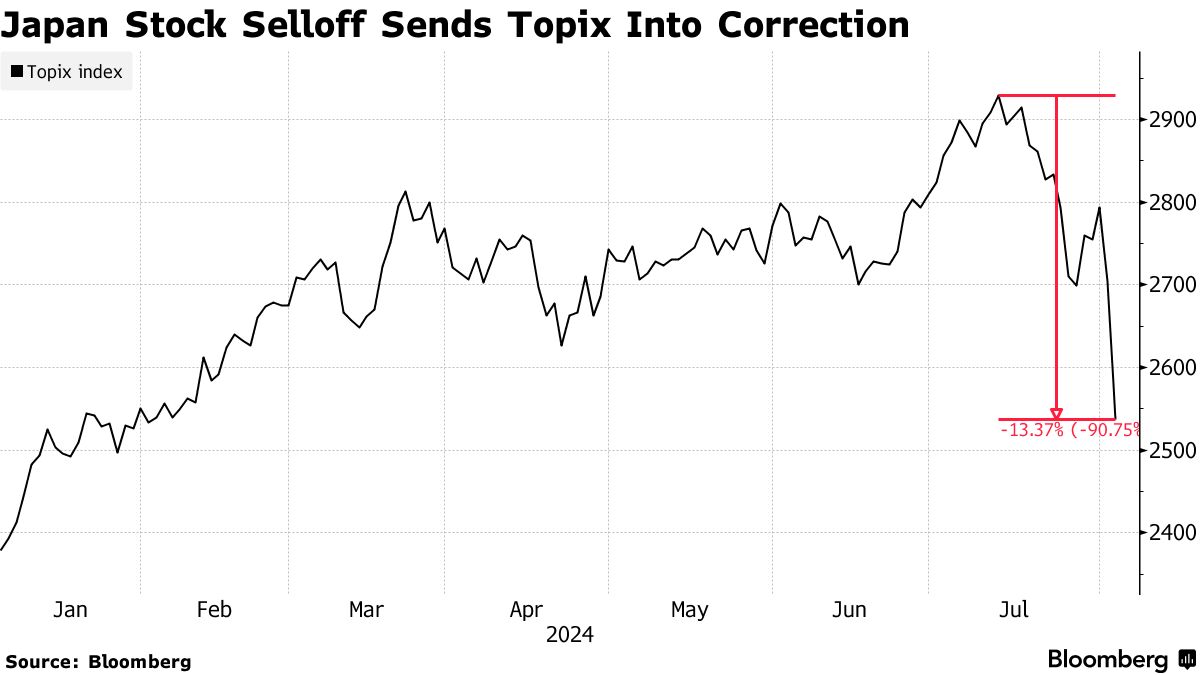

Joseph: Japanese stocks have quickly gone from leader to laggard in recent weeks

Data as of 08.01.2024

Data as of 08.01.2024

Arch: partly triggered by abrupt strength in the Japanese yen on higher rates

Source: Trading View as of 08.02.2024

Source: Trading View as of 08.02.2024

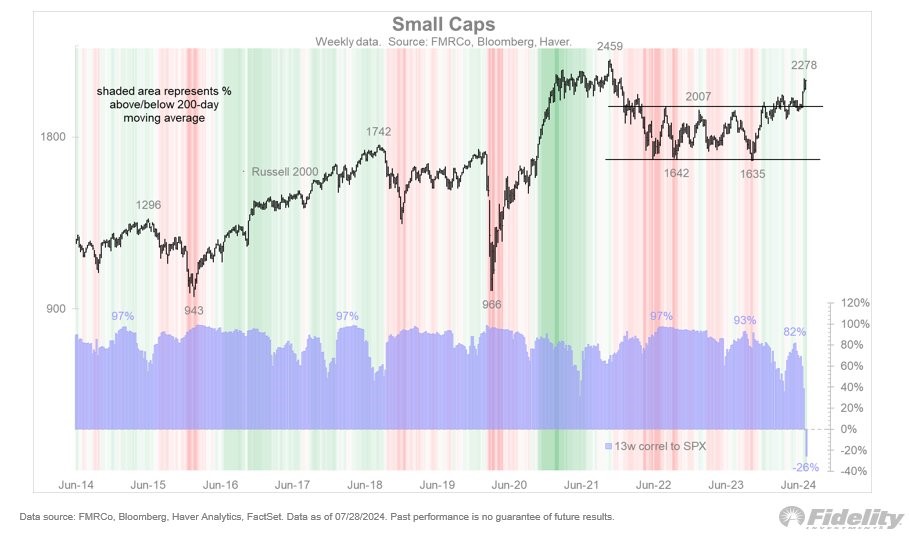

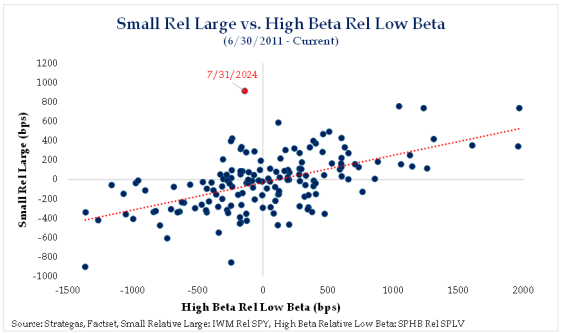

Brad: The splitting apart of the Russell 2000 and S&P 500 in recent weeks is quite the outlier

Joseph: with much of it driven by size not beta, even if Big Tech may be misclassified as higher beta to an extent

Data as of 07.31.2024

Data as of 07.31.2024

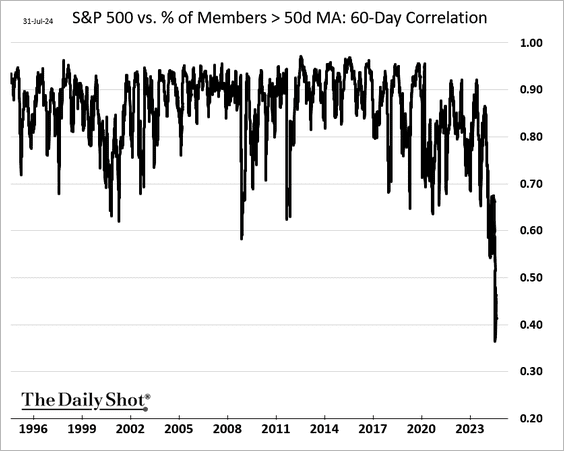

JD: but there’s no denying the massive dispersion that’s taken place, even inside the S&P 500 itself

Data as of 08.01.2024

Data as of 08.01.2024

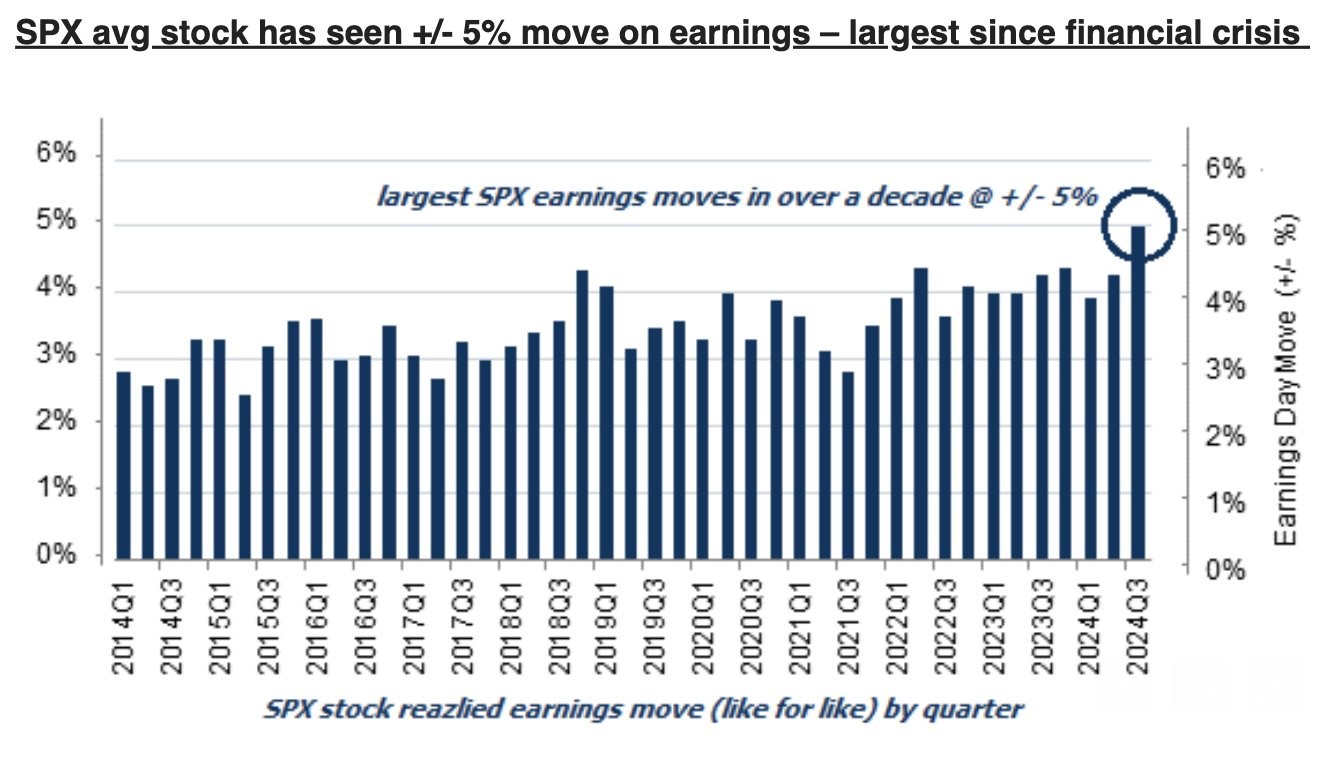

Beckham: Reactions to earnings results have been the wildest of the past decade

Source: @ljkawa as of 08.01.2024

Source: @ljkawa as of 08.01.2024

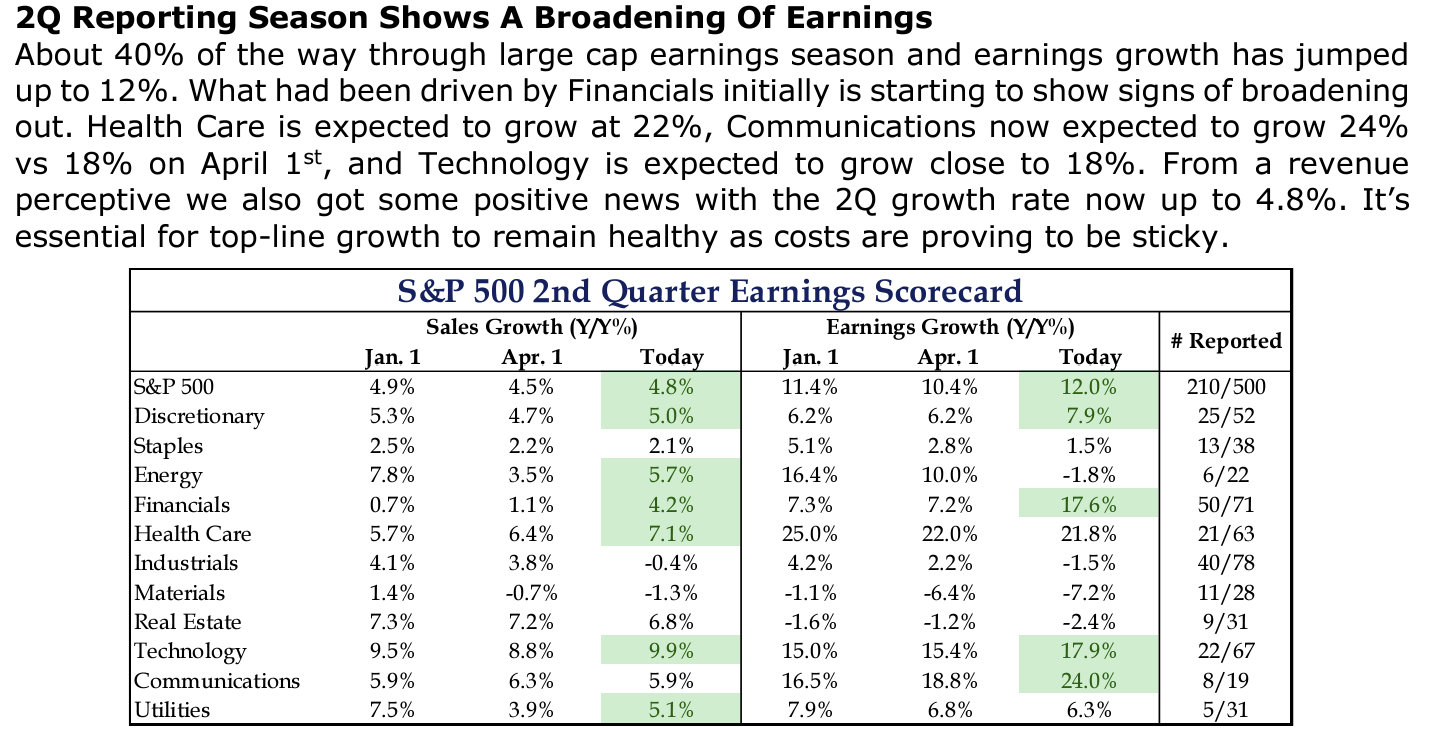

Dave: though in general, results have been solidly above expectations

Source: Strategas as of 07.30.2024

Source: Strategas as of 07.30.2024

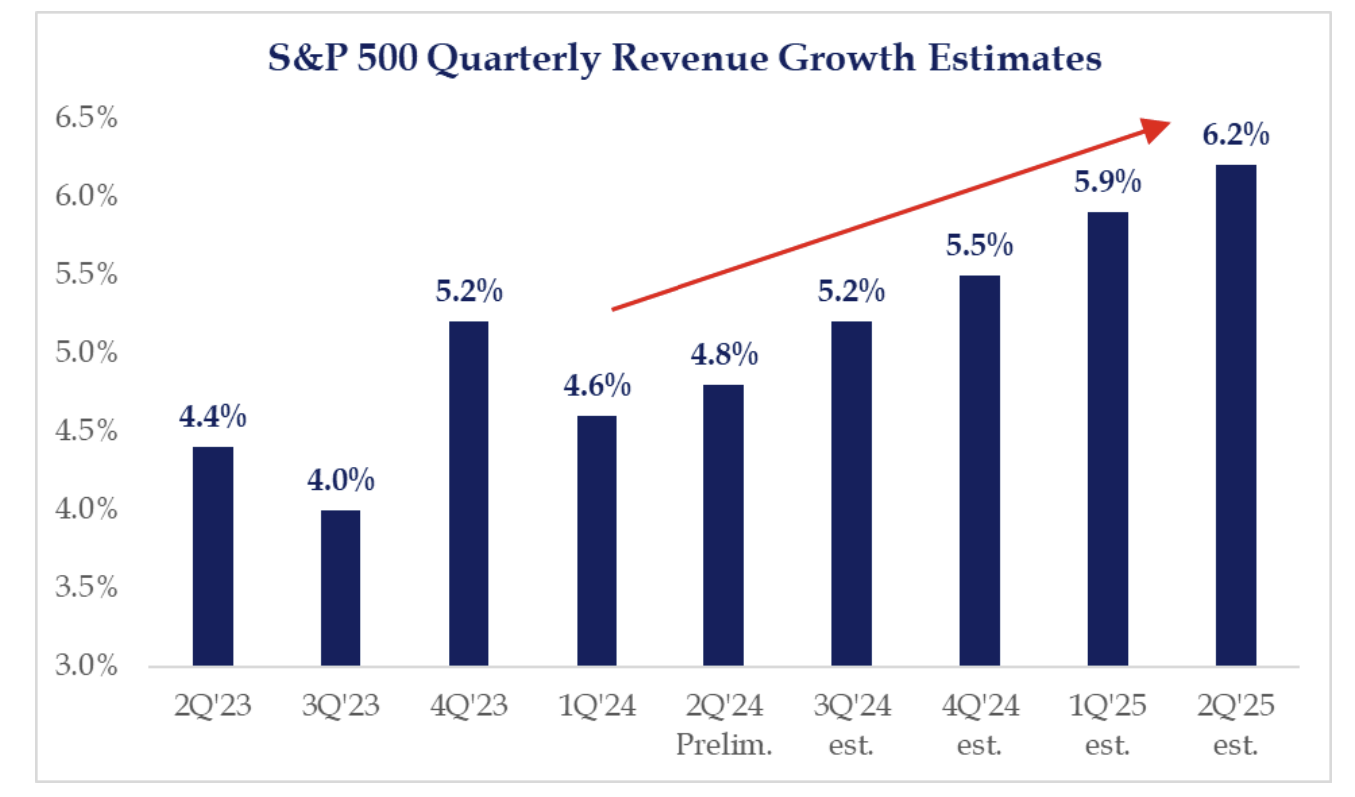

Dave: with future sales growth estimates trending steadily higher

Source: Strategas as of 07.30.2024

Source: Strategas as of 07.30.2024

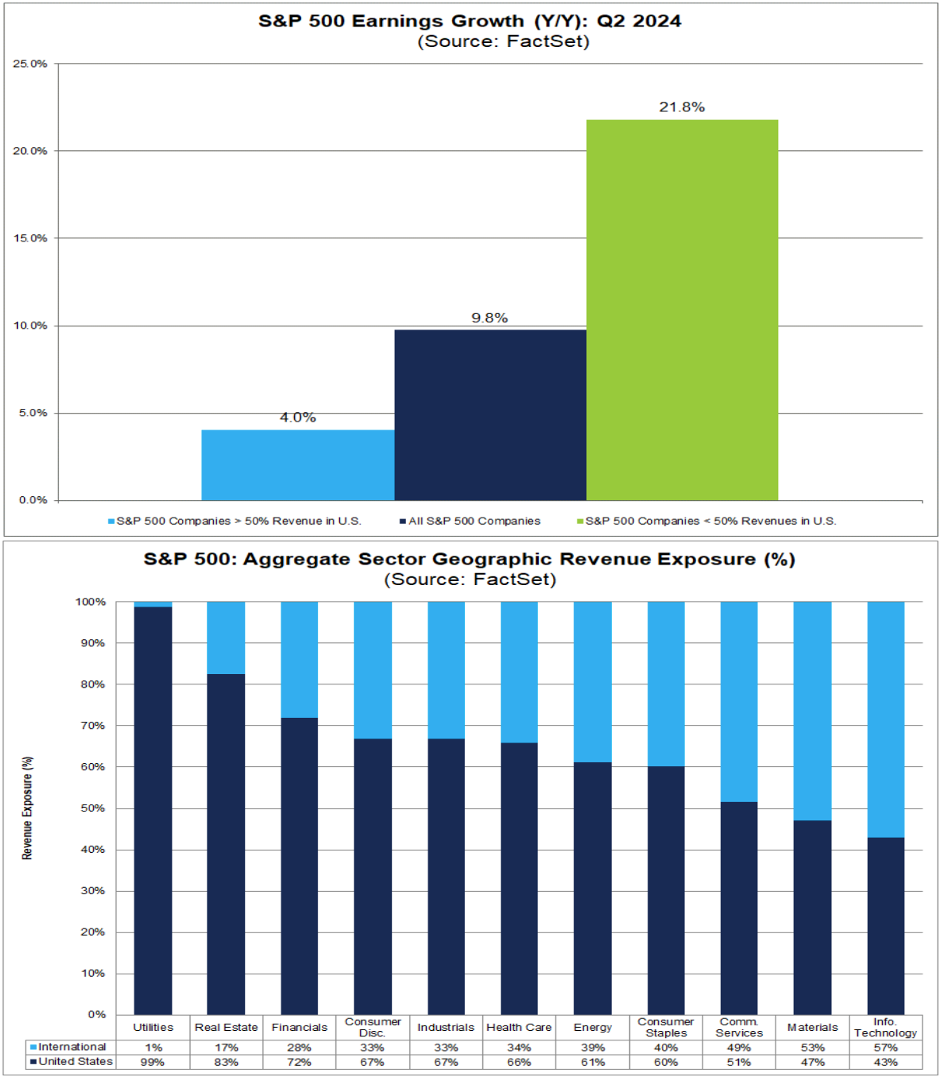

Brad: Companies sourcing a larger share of their revenues overseas are seeing the highest growth rates

Data as of 07.26.2024

Data as of 07.26.2024

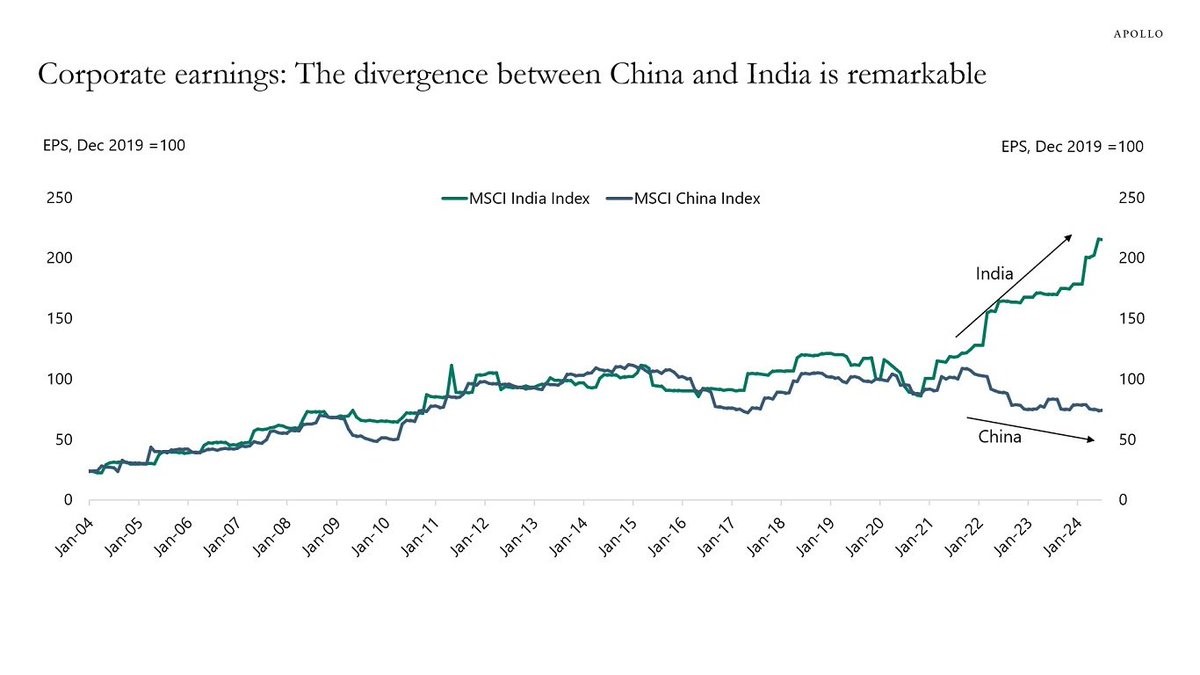

John Luke: and it’s pretty clear in the data which highly-populated economy is actually growing

Source: Apollo as of 08.01.2024

Source: Apollo as of 08.01.2024

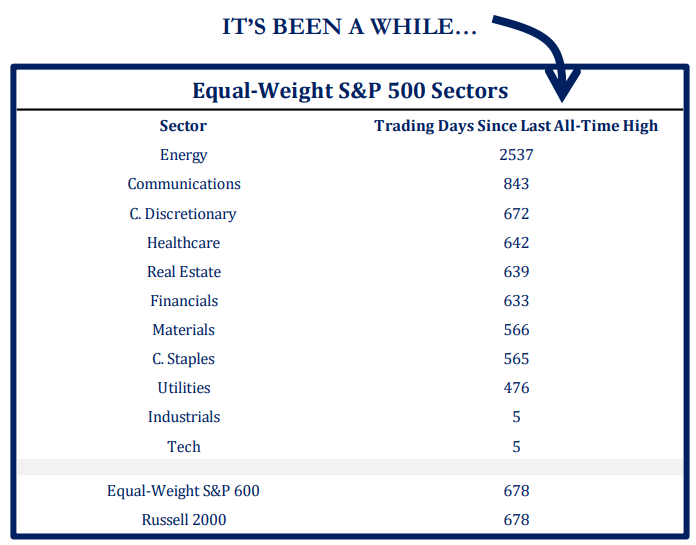

Dave: With the pullback currently underway in stocks, it looks like these high-water marks will stay valid for a bit, awaiting fresh leadership

Source: Strategas as of 07.25.2024

Source: Strategas as of 07.25.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-6.