Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

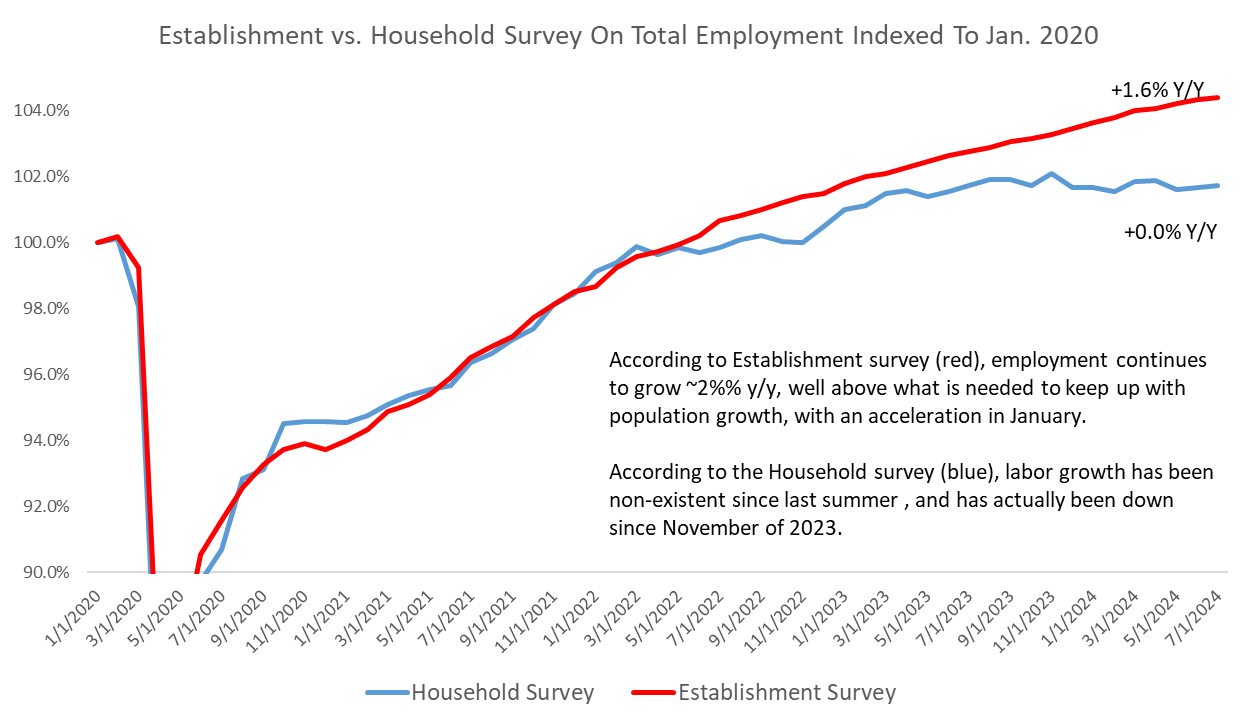

Dave: Overall job growth has been modest over the past year, likely somewhere between these two measurements

Source: Raymond James as of 08.22.2024

Source: Raymond James as of 08.22.2024

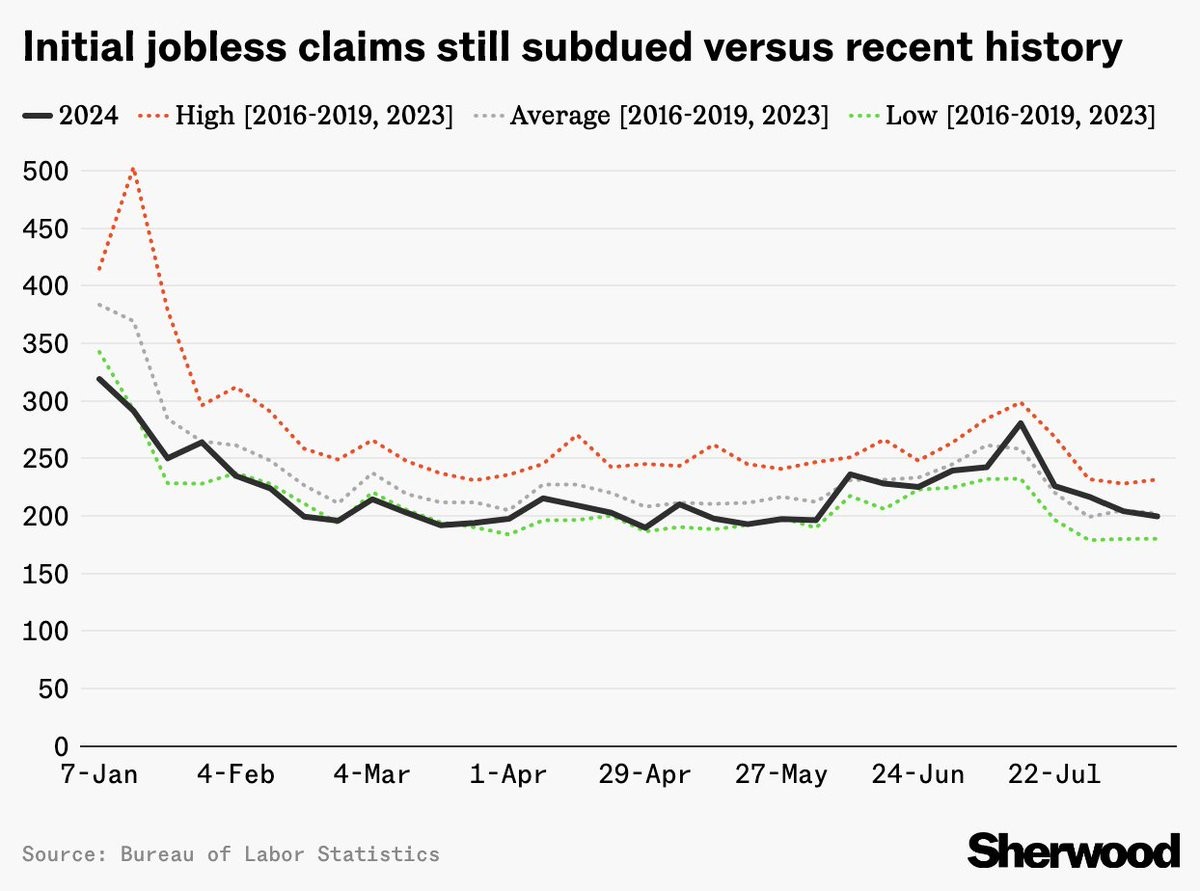

Brett: but actual job losses have remained tame versus recent history

Data as of 08.16.2024

Data as of 08.16.2024

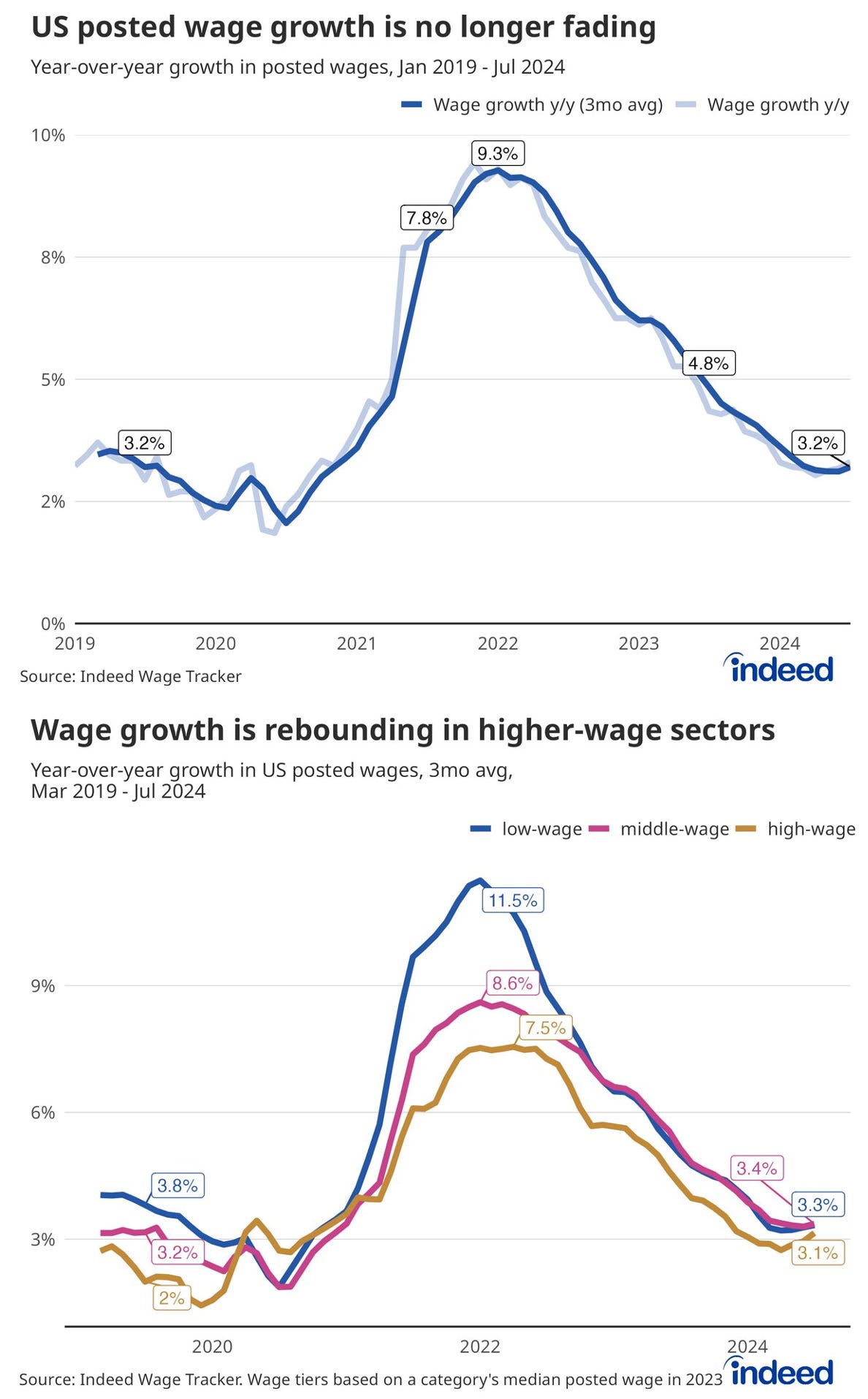

Beckham: and wage growth is showing signs of recharging after seeing its growth rate fall from the peak

Data as of 08.19.2024

Data as of 08.19.2024

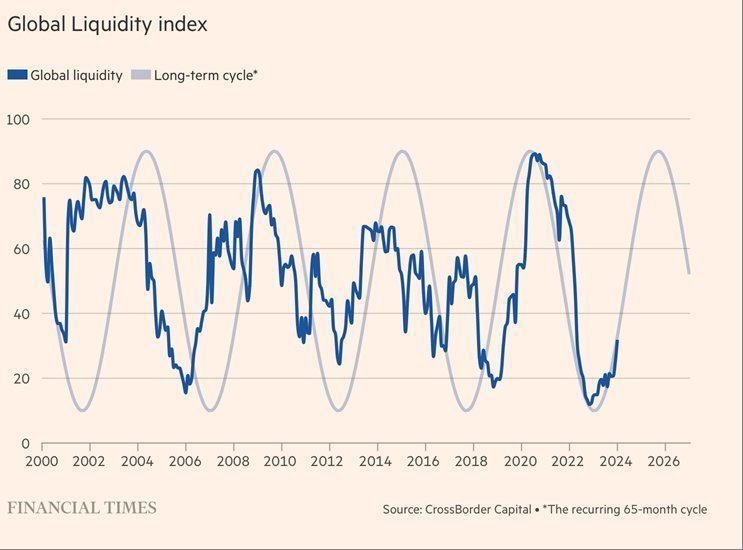

Joseph: The amount of money in the global economy is expanding again after a period of contraction

Data as of 08.18.2024

Data as of 08.18.2024

John Luke: at a time when the FOMC is about to begin a seemingly aggressive rate-cutting campaign

Source: Bloomberg as of 08.21.2024

Source: Bloomberg as of 08.21.2024

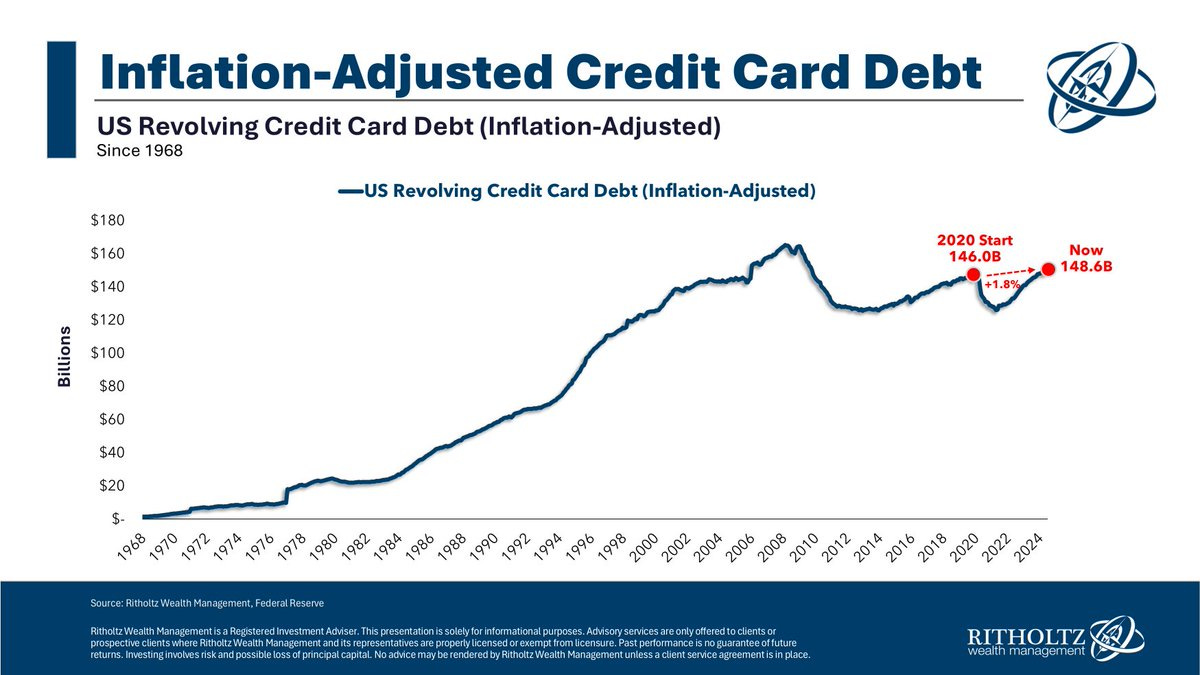

Arch: U.S. consumers as a whole appear to have learned the lessons of high-expense borrowing

Data as of July 2024

Data as of July 2024

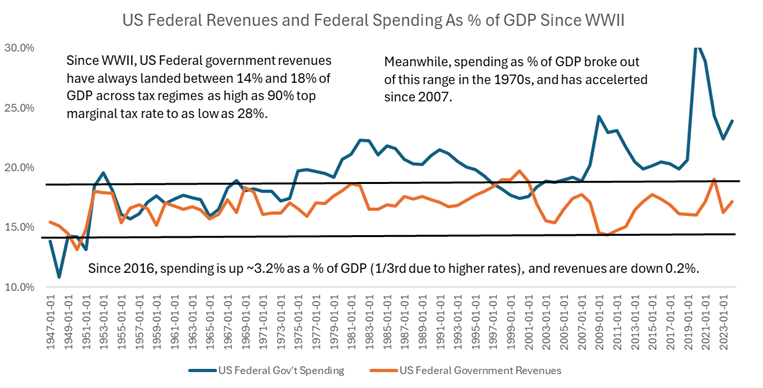

Brad: but our federal government hasn’t applied the same discipline to its budget

Source: Raymond James as of 08.21.2024

Source: Raymond James as of 08.21.2024

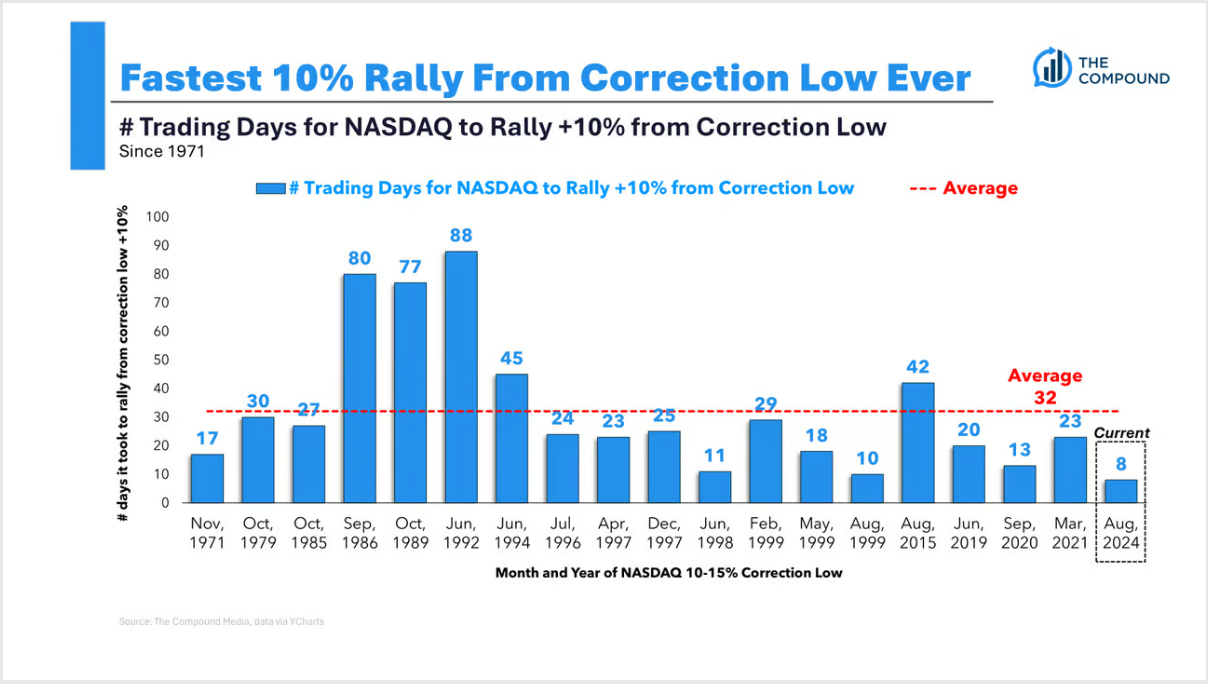

Beckham: The recovery of the 10% correction in NASDAQ stocks was easily the fastest on record

Data as of 08.19.2024

Data as of 08.19.2024

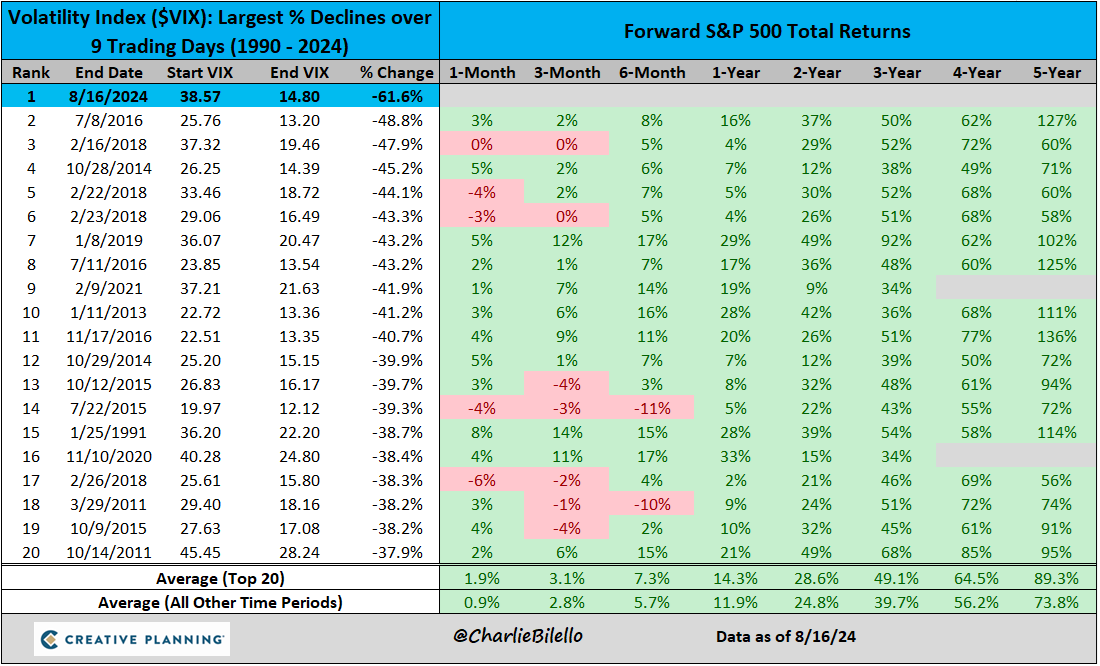

Brett: coinciding with the largest VIX decline in history

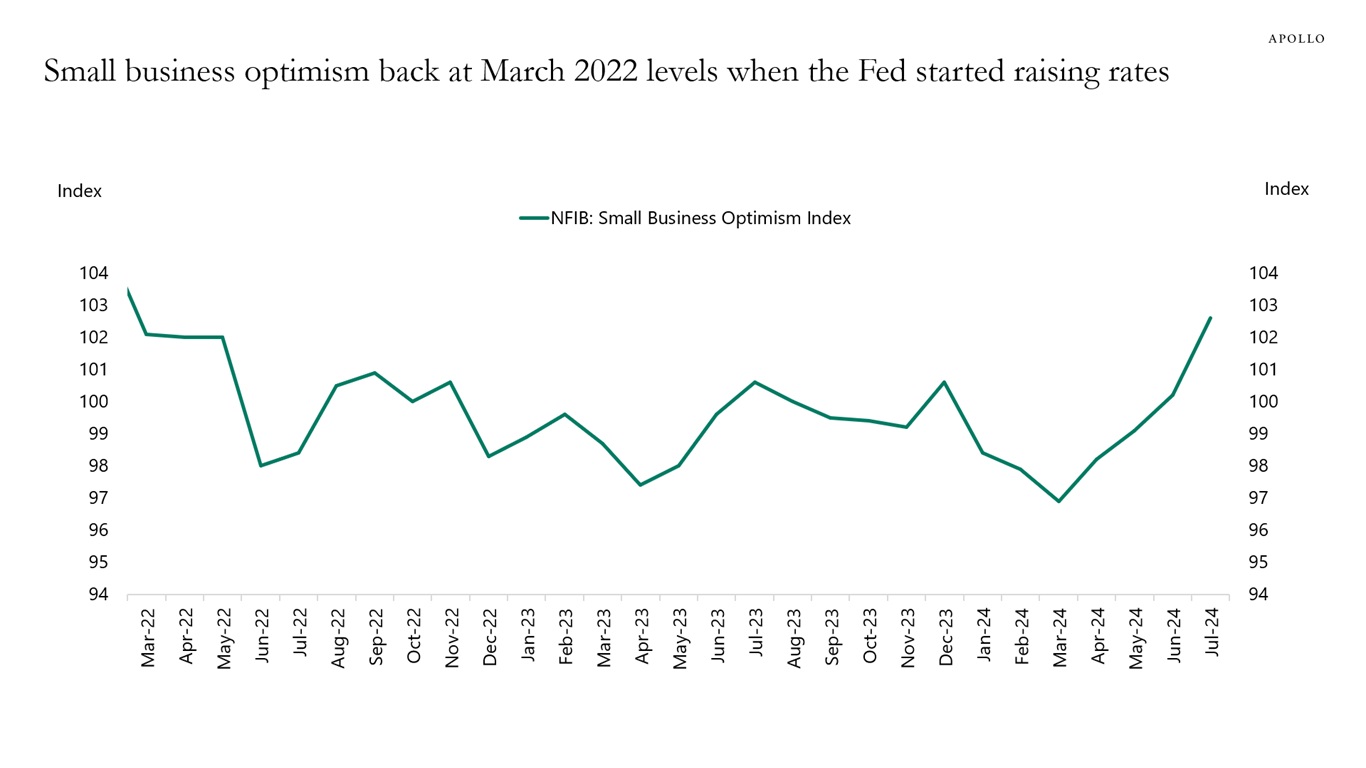

Brad: Small business owners are seeing renewed optimism

Source: Apollo as of 08.19.2024

Source: Apollo as of 08.19.2024

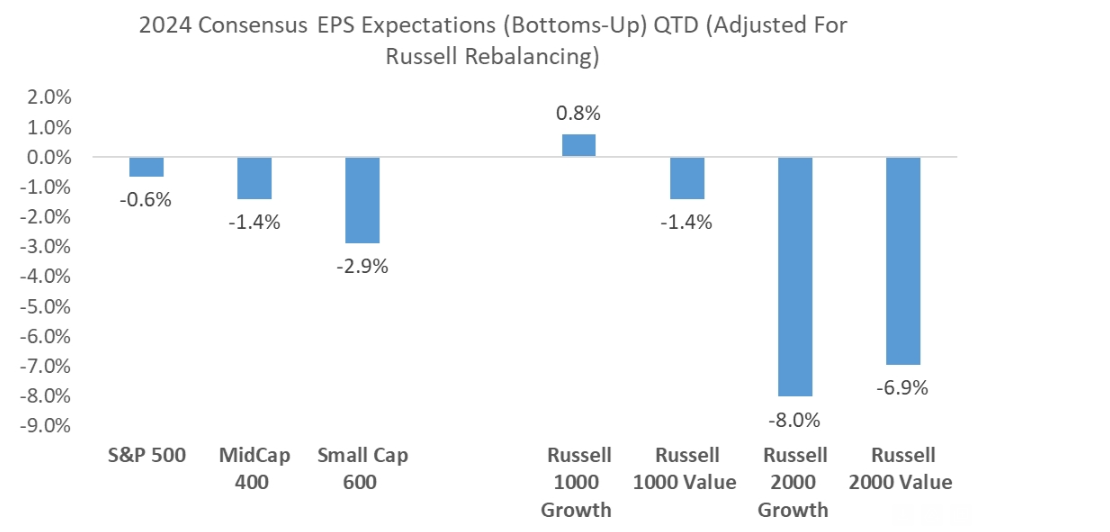

Dave: though that’s not yet translated into better earnings for publicly-traded smaller companies

Source: Raymond James as of 08.19.2024

Source: Raymond James as of 08.19.2024

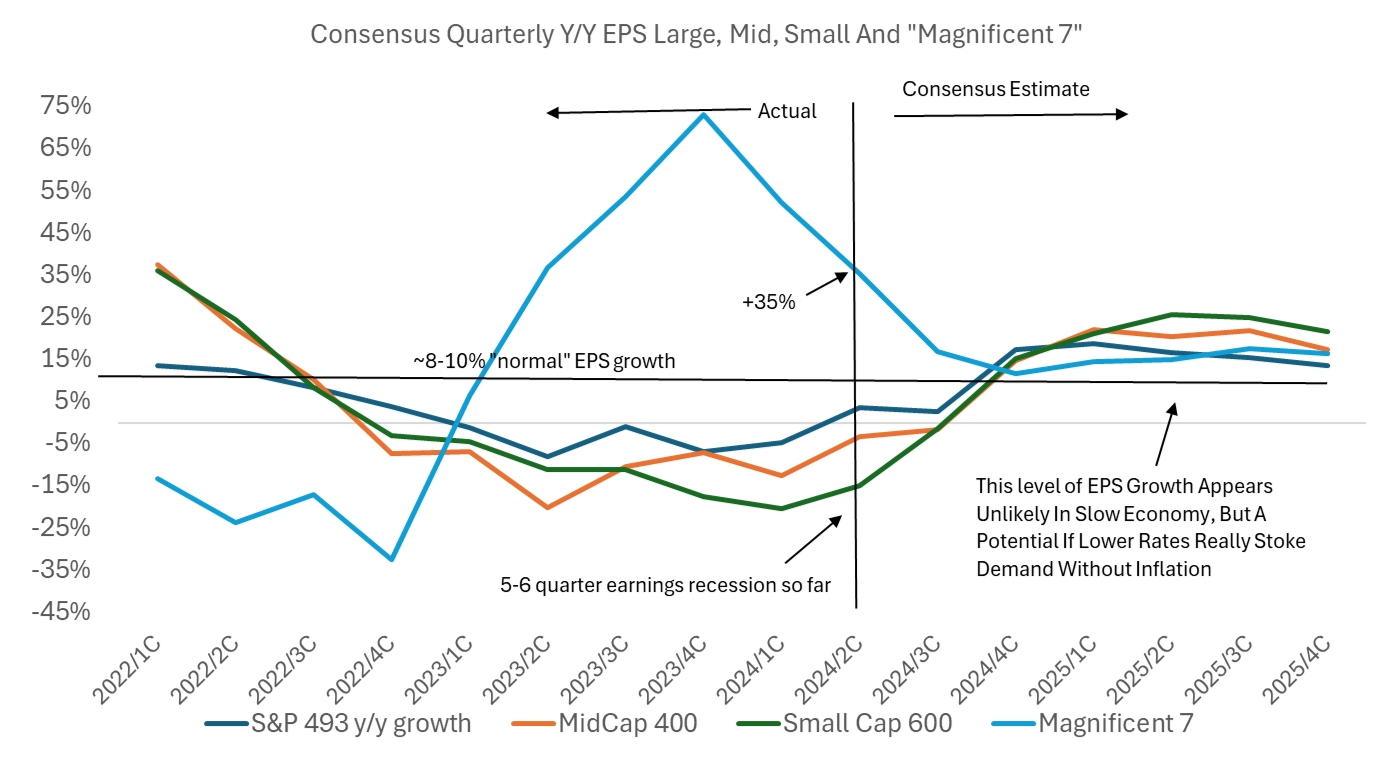

Dave: And while we’re waiting for this earnings gap to narrow and even disappear

Source: Raymond James as of 08.19.2024

Source: Raymond James as of 08.19.2024

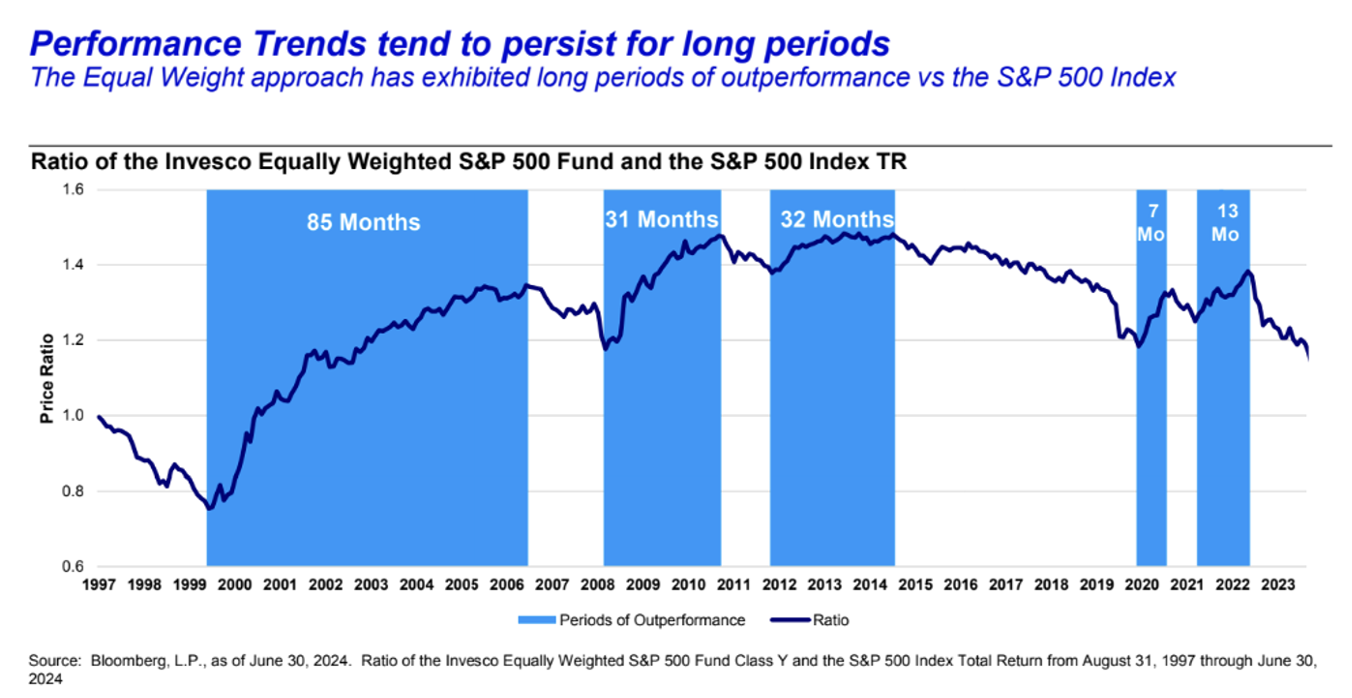

John Luke: it’s important to remember that when “large vs. small” cycles turn they can stick for awhile

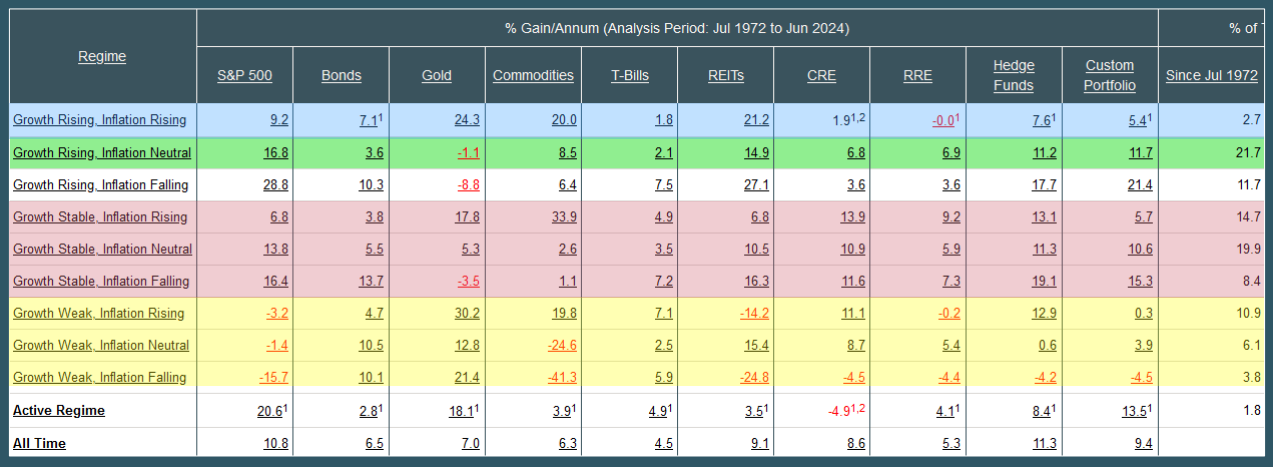

John Luke: We’ve been fixated on inflation, let’s not forget that growth is what ultimately drives the price of risk assets

Source: Ned Davis as of 08.12.2024

Source: Ned Davis as of 08.12.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-25.