Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

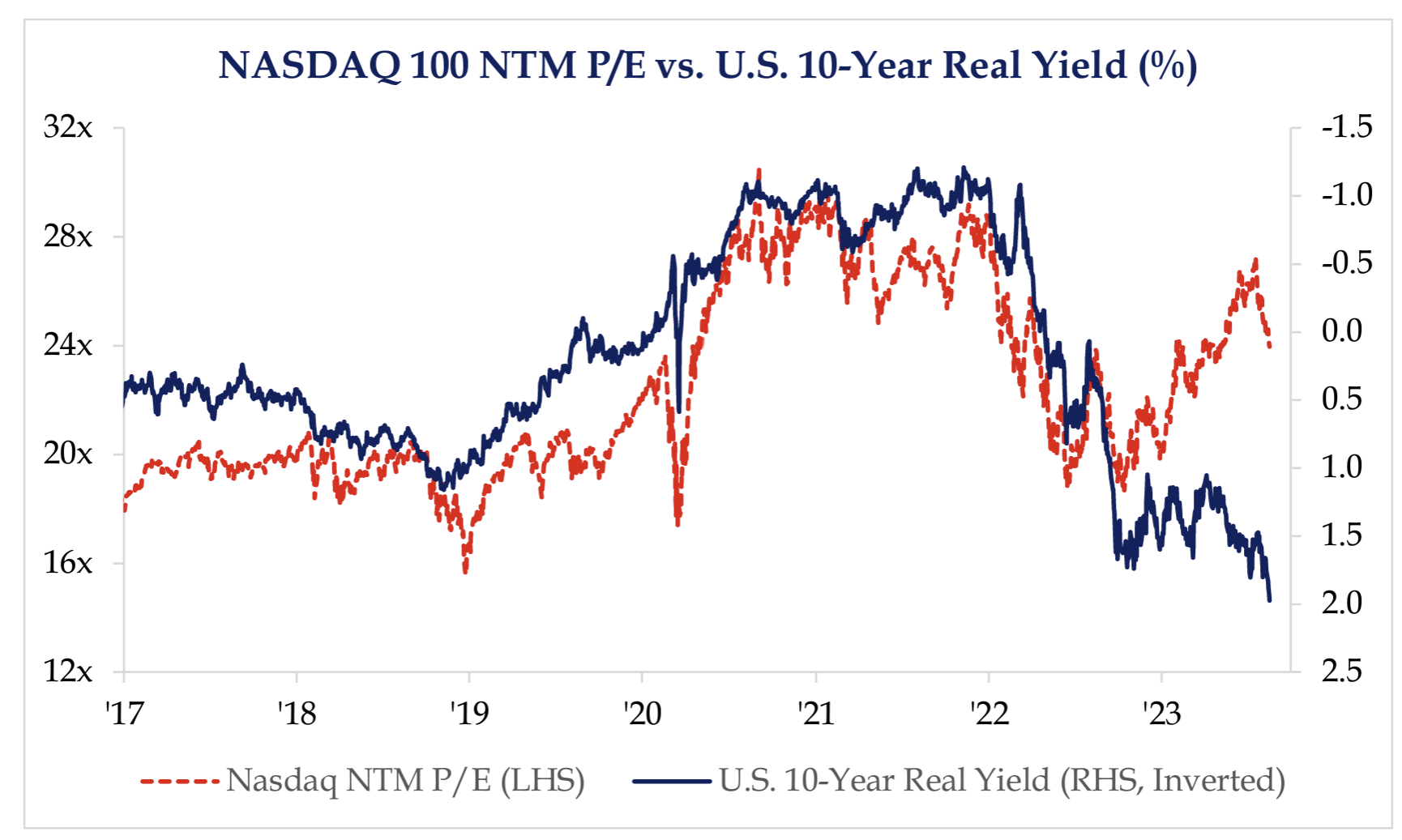

John Luke: It’s unusual for stocks to rally when real yields are screaming higher

Data as of August 2023

Data as of August 2023

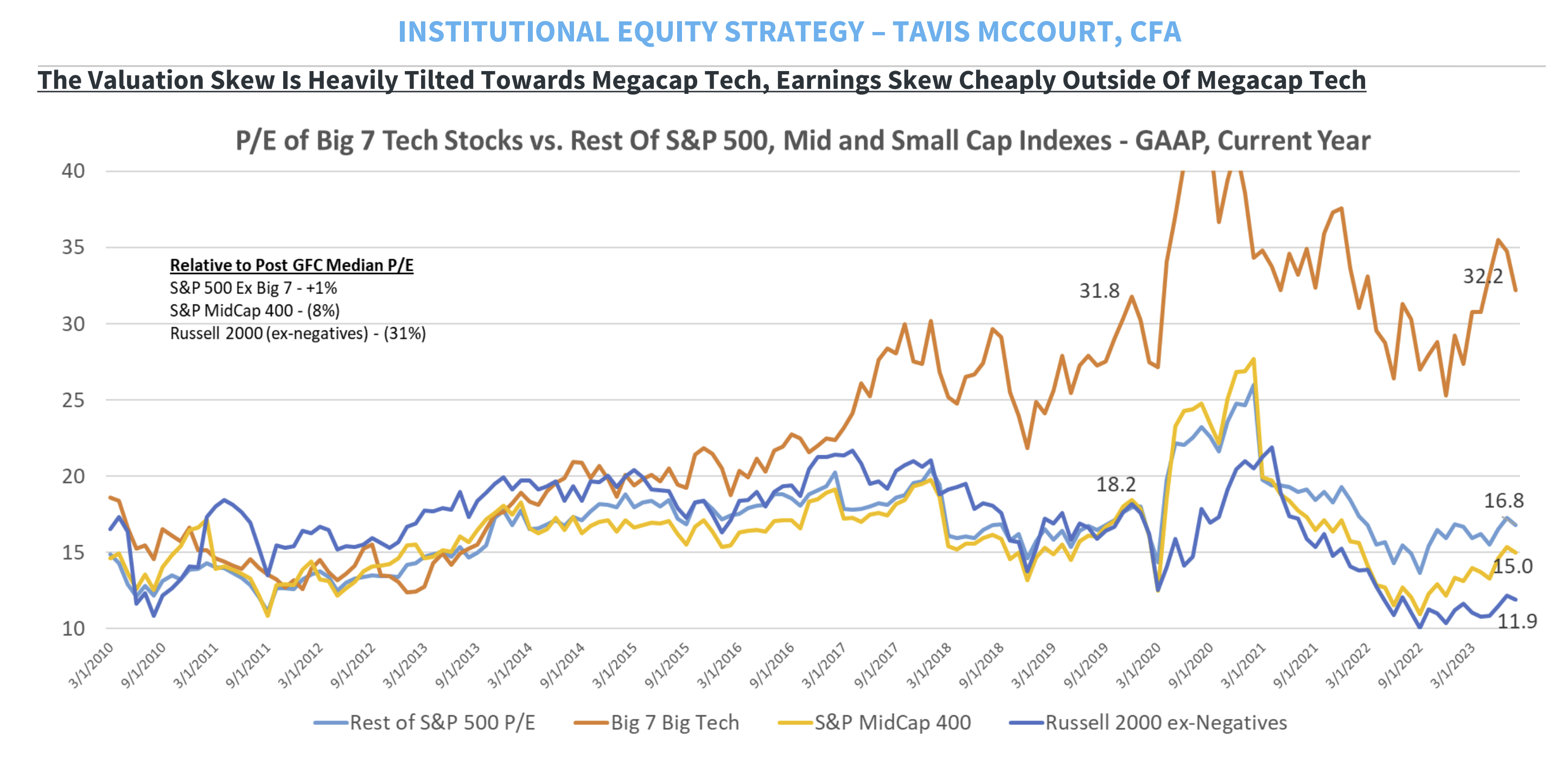

Dave: and it’s setting up a particularly extreme divergence in valuations of large, high-growth stocks

Source: Strategas as of 08.22.2023

Source: Strategas as of 08.22.2023

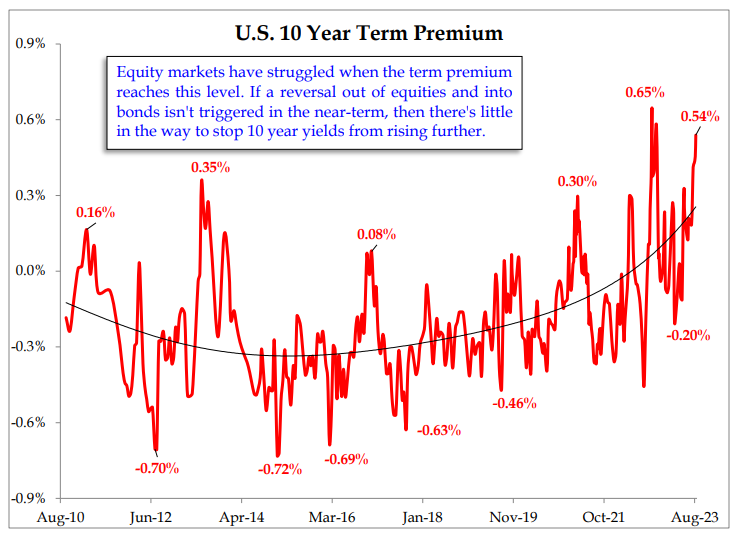

John Luke: on top of that, term premiums in Treasuries are now reaching levels that have coincided with resistance for equity rallies

Source: Strategas as of 08.23.2023

Source: Strategas as of 08.23.2023

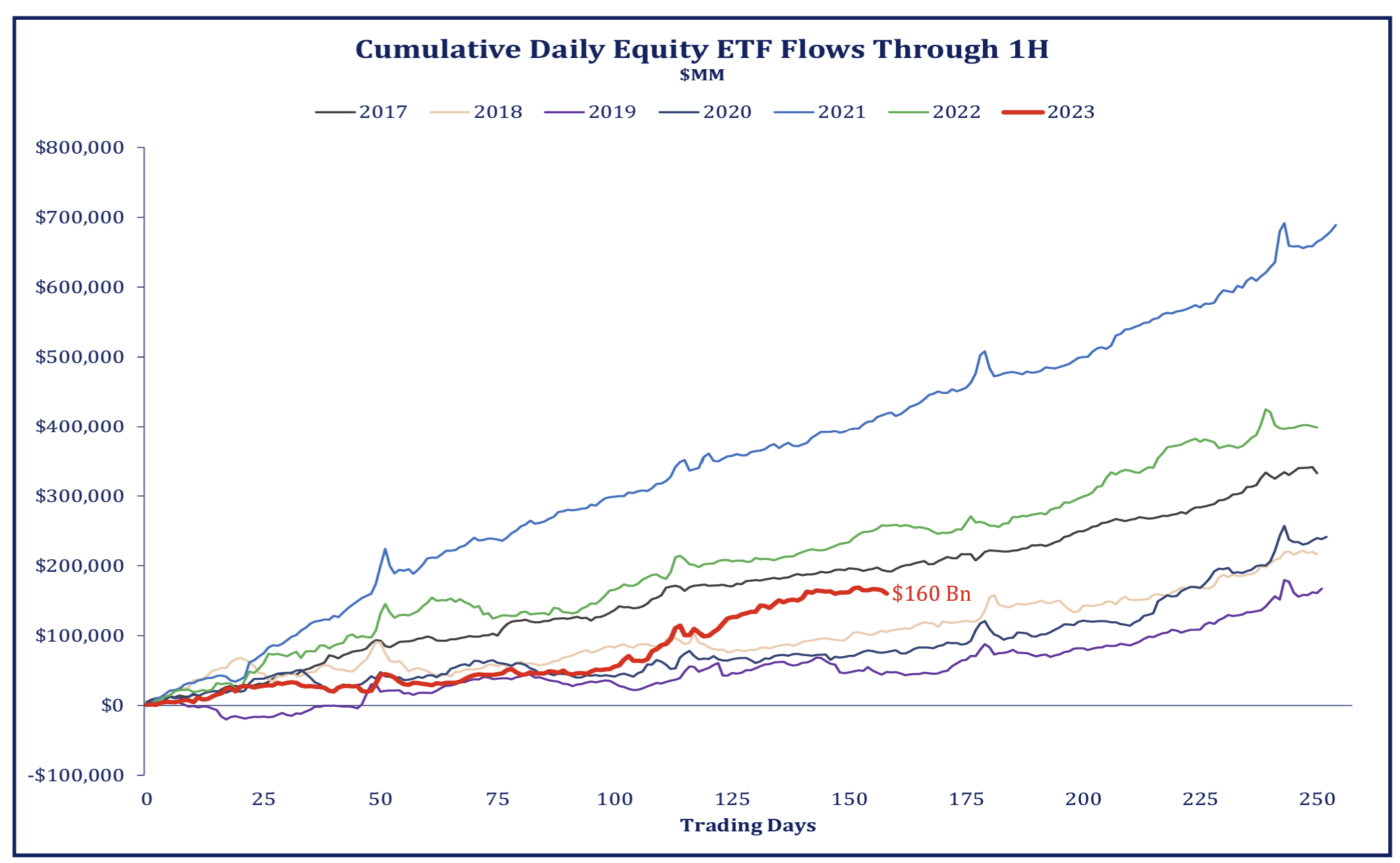

Dave: 2023 equity inflows have been relatively muted given the large first-half rally

Source: Strategas as of 08.21.2023

Source: Strategas as of 08.21.2023

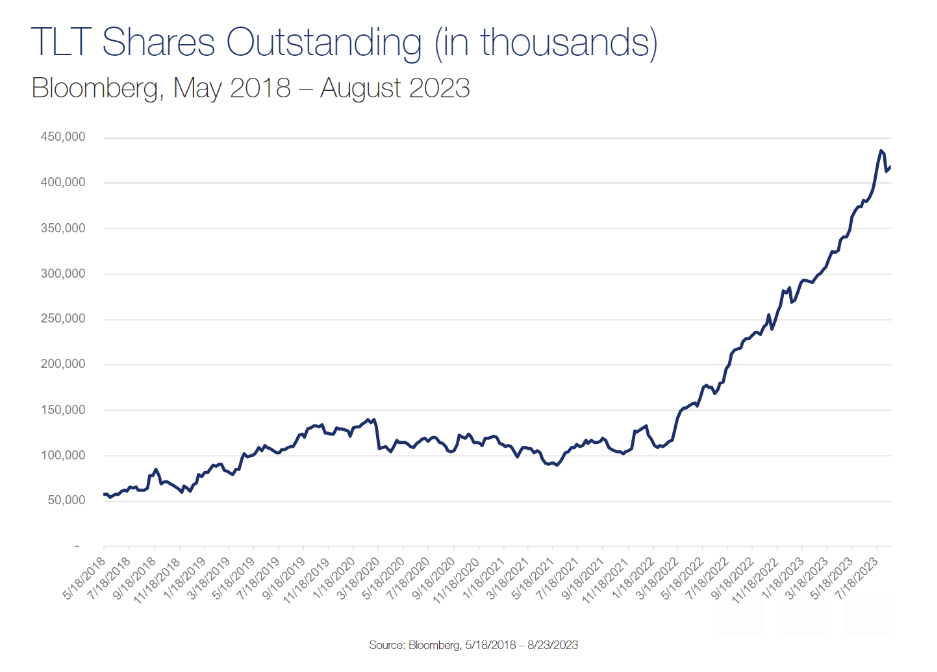

Dave: yet the go-to ETF for long-duration Treasury bonds has seen significant inflows throughout its bear market

Source: Goldman Sachs

Source: Goldman Sachs

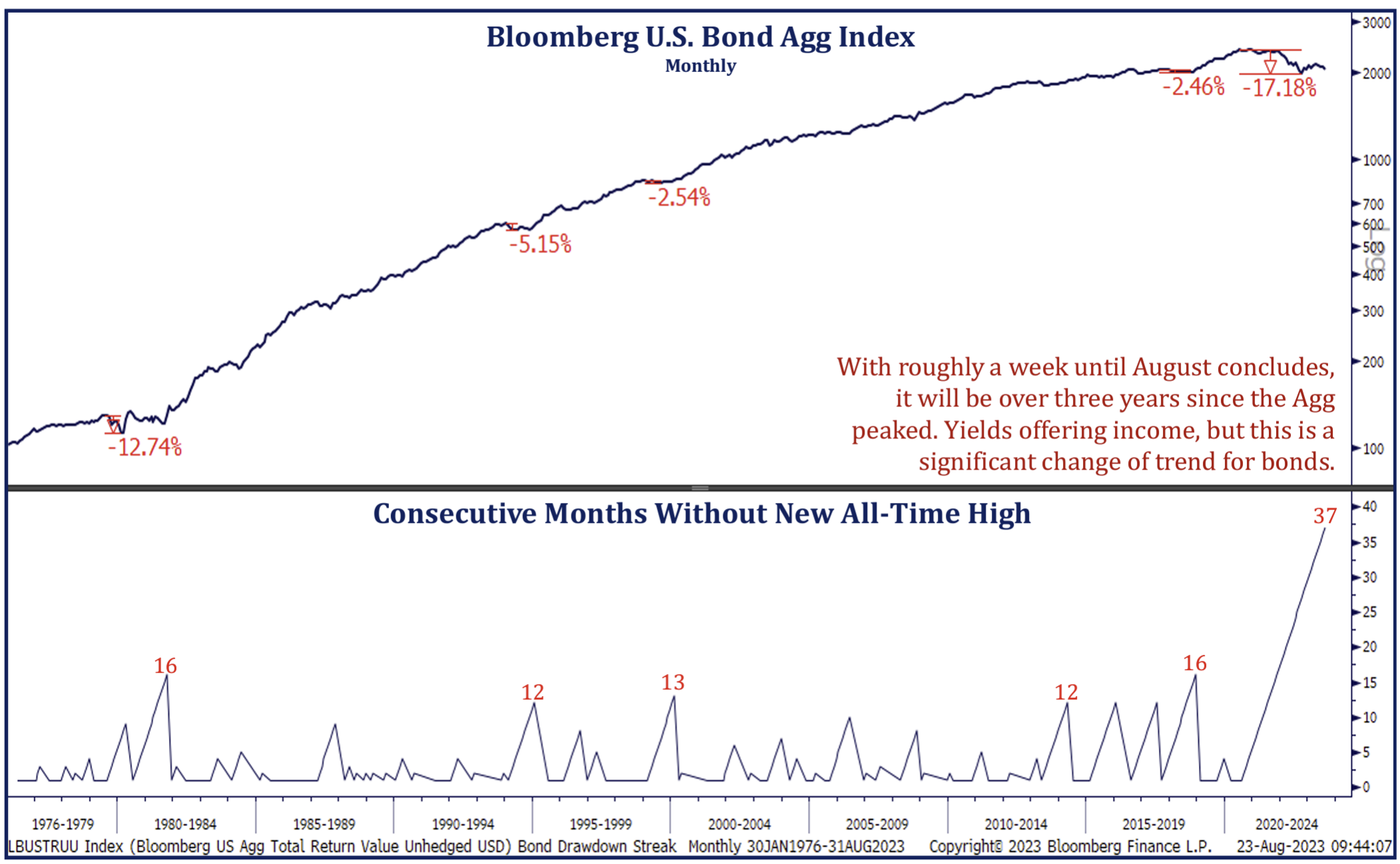

Dave: That bear market in bonds has been easily the longest of the “Agg Bond” era going back to the mid-1970s

Source: Strategas as of 08.23.2023

Source: Strategas as of 08.23.2023

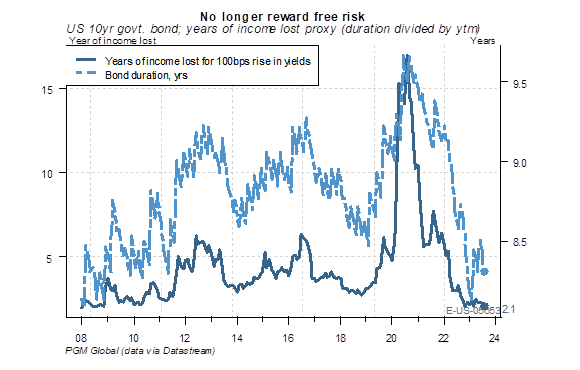

John Luke: the good news there is that bonds purchased today have significantly lower risk of price depreciation overcoming coupons

Data as of August 2023

Data as of August 2023

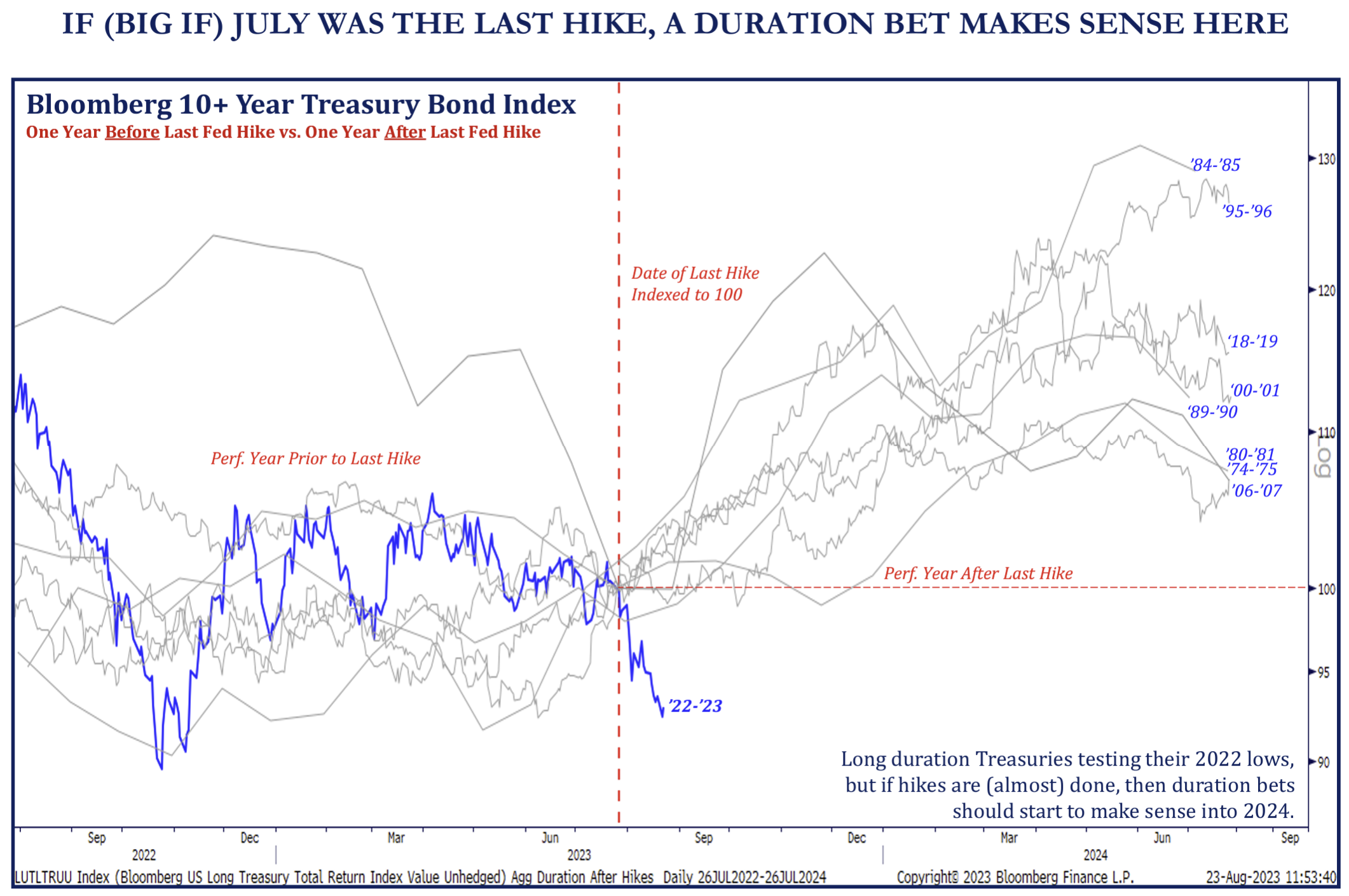

Dave: and MAYBE the history of hiking cycles ending could remove the rate headwind faced by bondholders

Source: Strategas as of 08.23.2023

Source: Strategas as of 08.23.2023

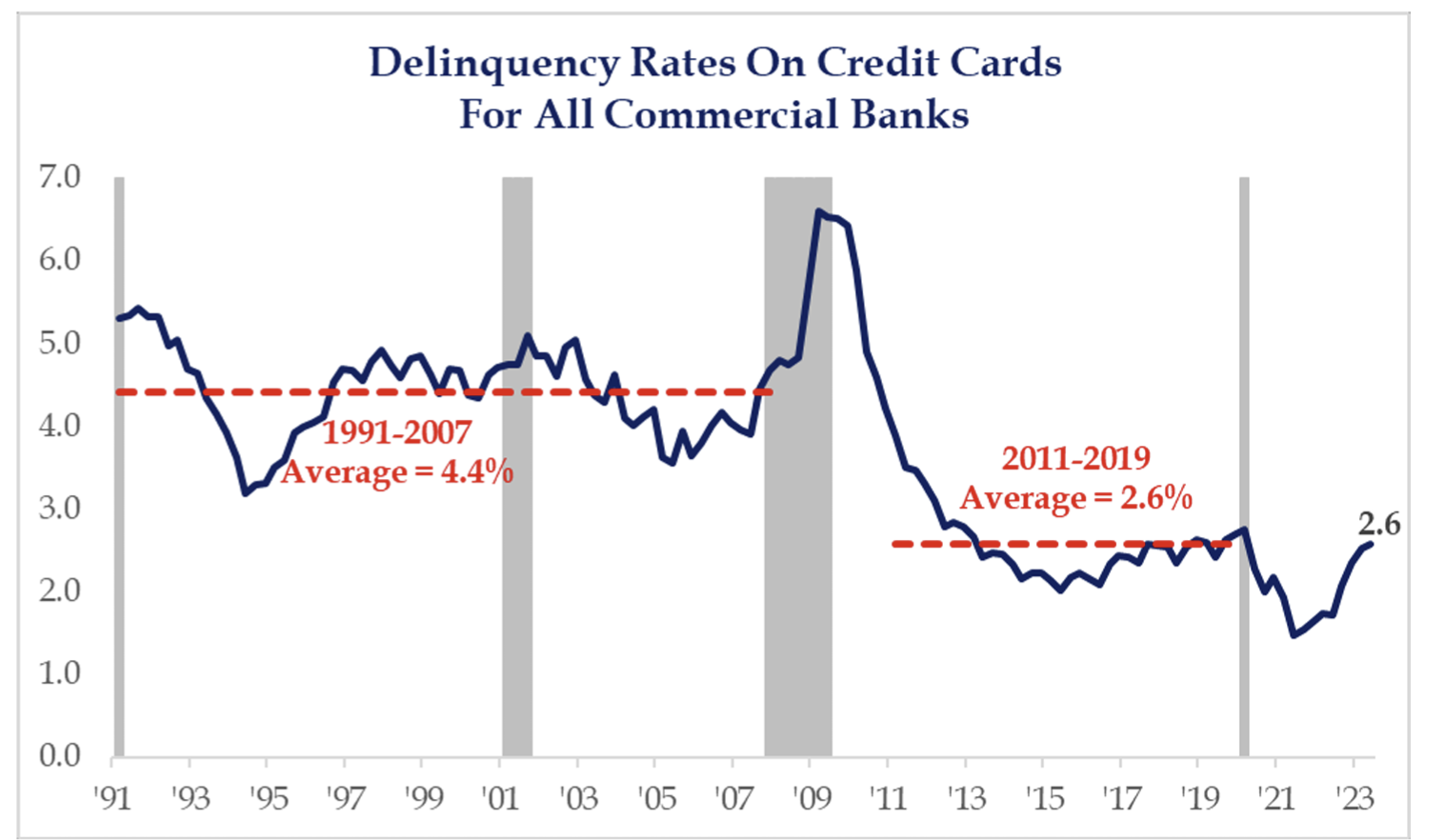

Dave: Credit card delinquencies are rising a bit, but only from very low levels to average levels

Source: Strategas as of 08.23.2023

Source: Strategas as of 08.23.2023

Beckham: partly due to the good fortune of acquiring mortgages pre-2022

Source: Bloomberg as of 08.22.2023

Source: Bloomberg as of 08.22.2023

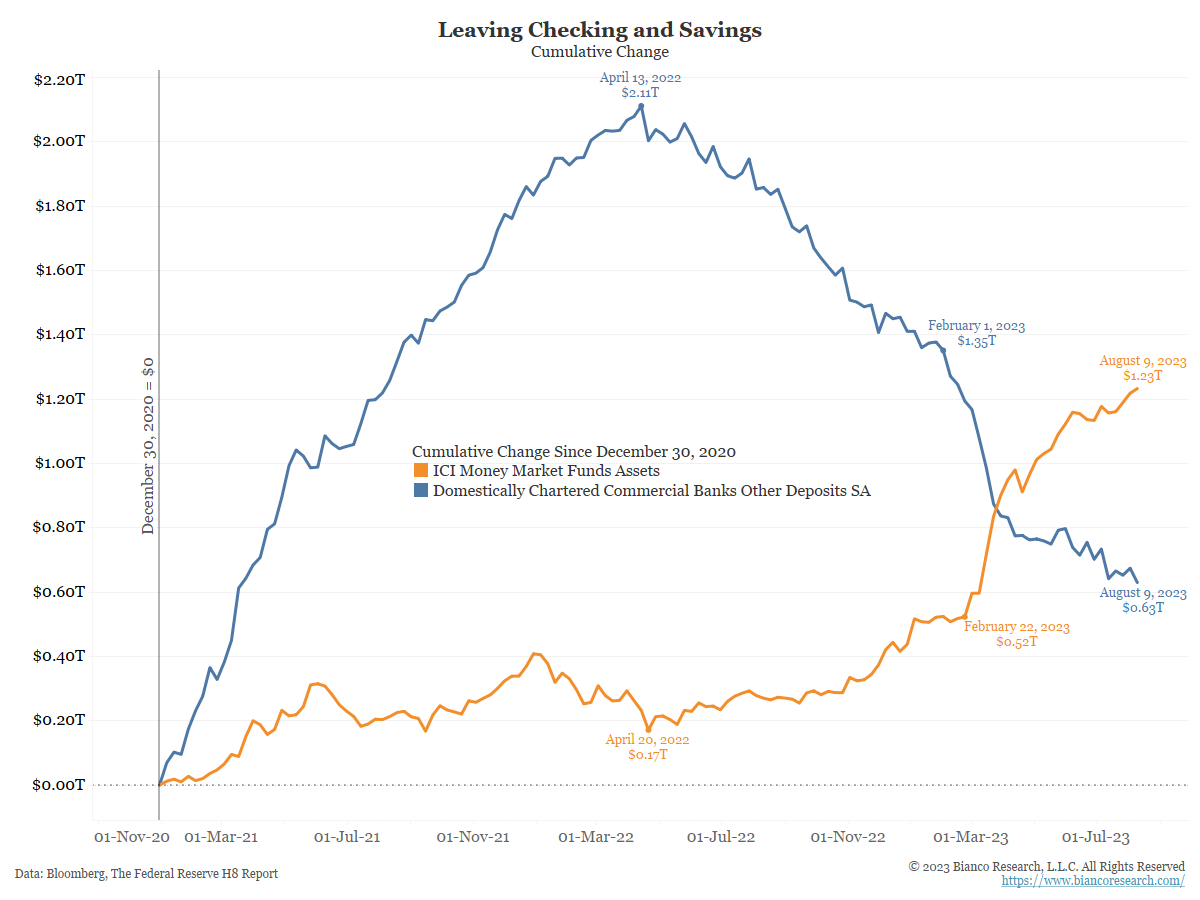

Dave: buy also being more savvy in moving money from where it’s treated poorly (bank sweep) to where it’s treated better (money markets)

Source: Bianco as of 08.09.2023

Source: Bianco as of 08.09.2023

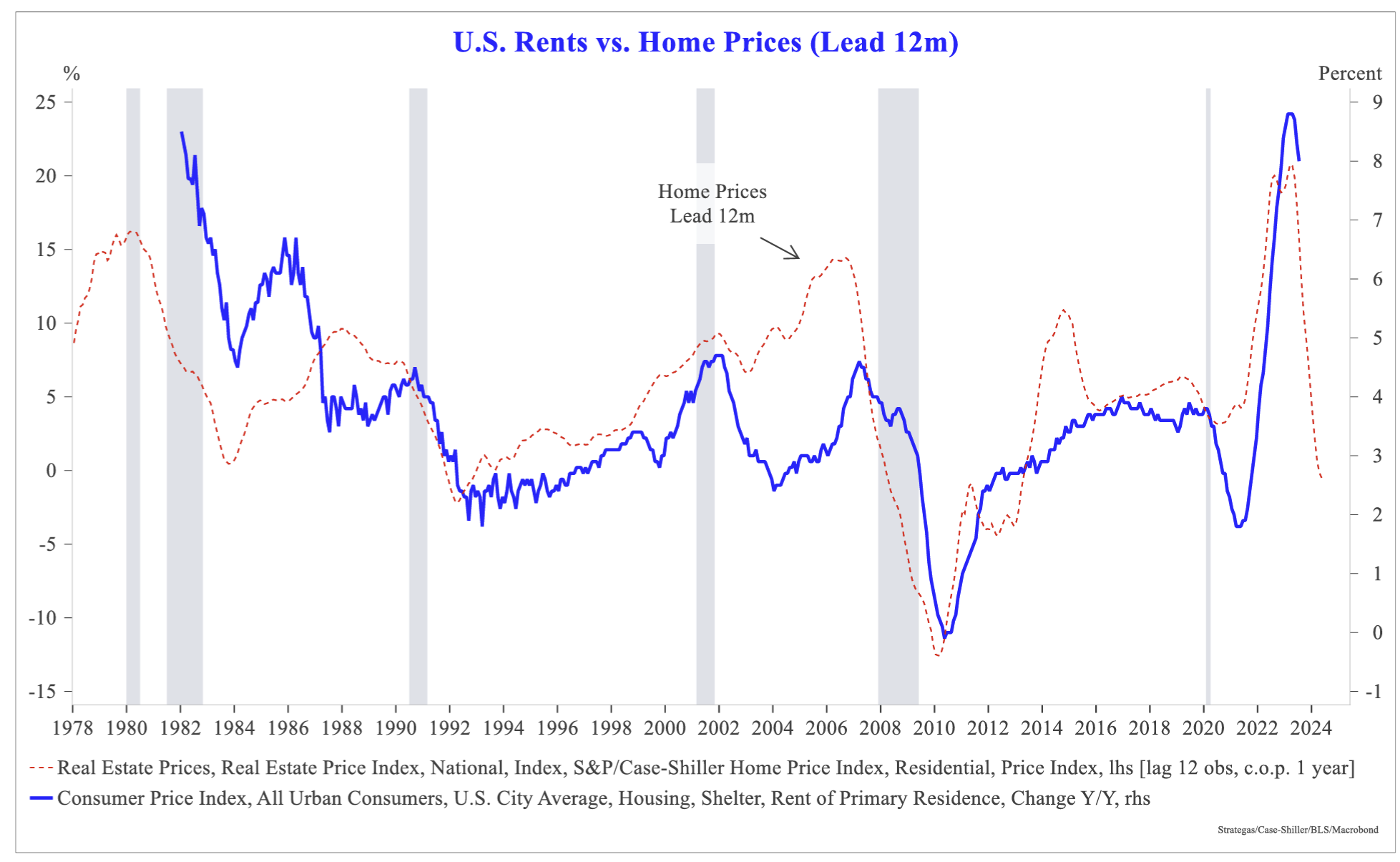

Dave: Stagnant home prices may foreshadow falling rents in the months ahead

Source: Macrobond as of 08.21.2023

Source: Macrobond as of 08.21.2023

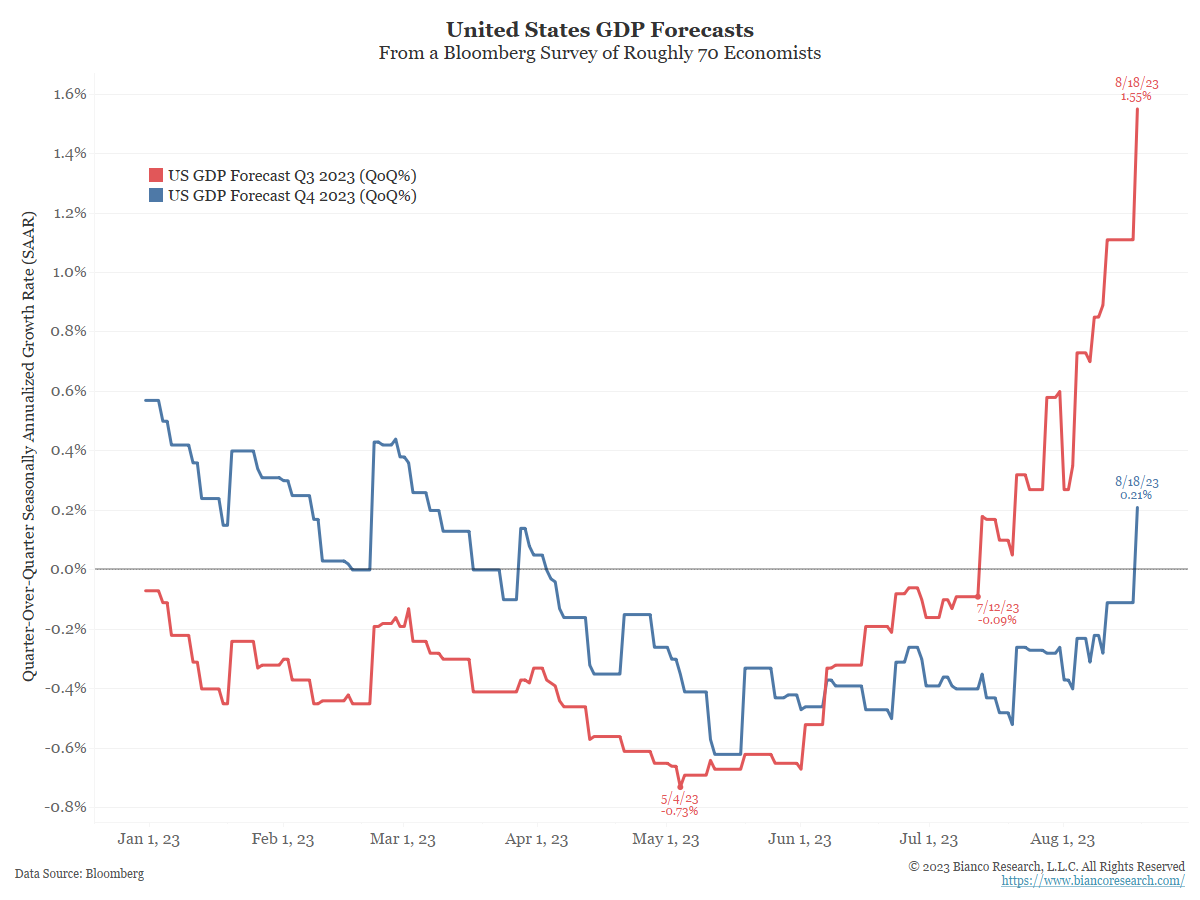

John Luke: but GDP forecasts are rising

Source: Bianco as of 08.18.2023

Source: Bianco as of 08.18.2023

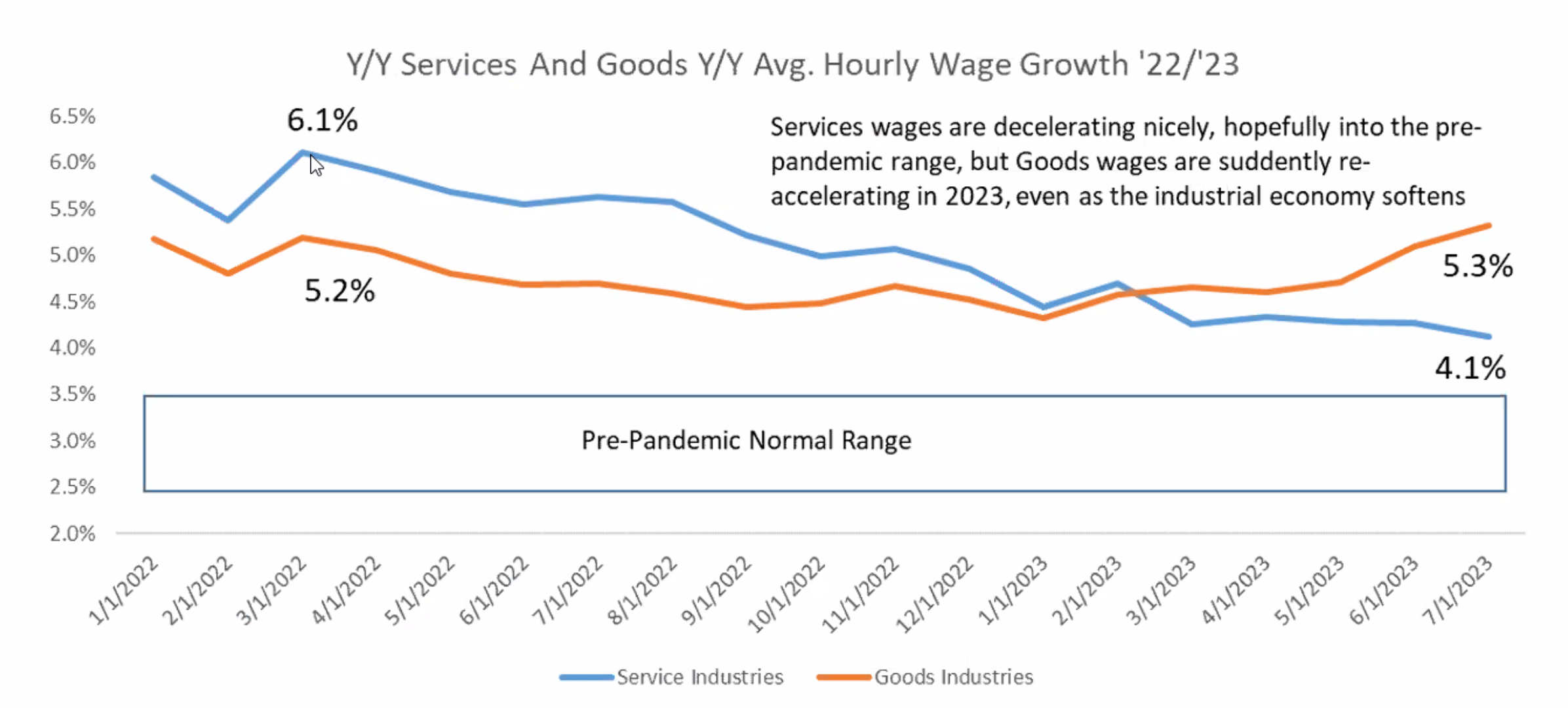

John Luke: and goods prices look ready to reclaim their spot as a drive of inflation

Source: Raymond James as of 08.23.2023

Source: Raymond James as of 08.23.2023

Dave: The world outside of a handful of megacap tech stocks carries much fairer valuations

Source: Raymond James as of 08.22.2023

Source: Raymond James as of 08.22.2023

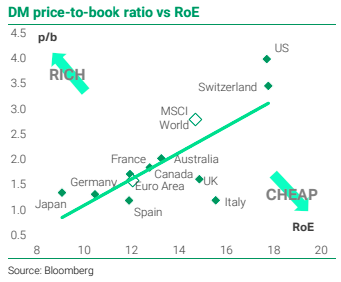

Joseph: but it’s important to remember that over the long haul, better companies and economies generally receive higher valuations

Source: TS Lombard as of August 2023

Source: TS Lombard as of August 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-21.