Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fill the puzzle of evidence:

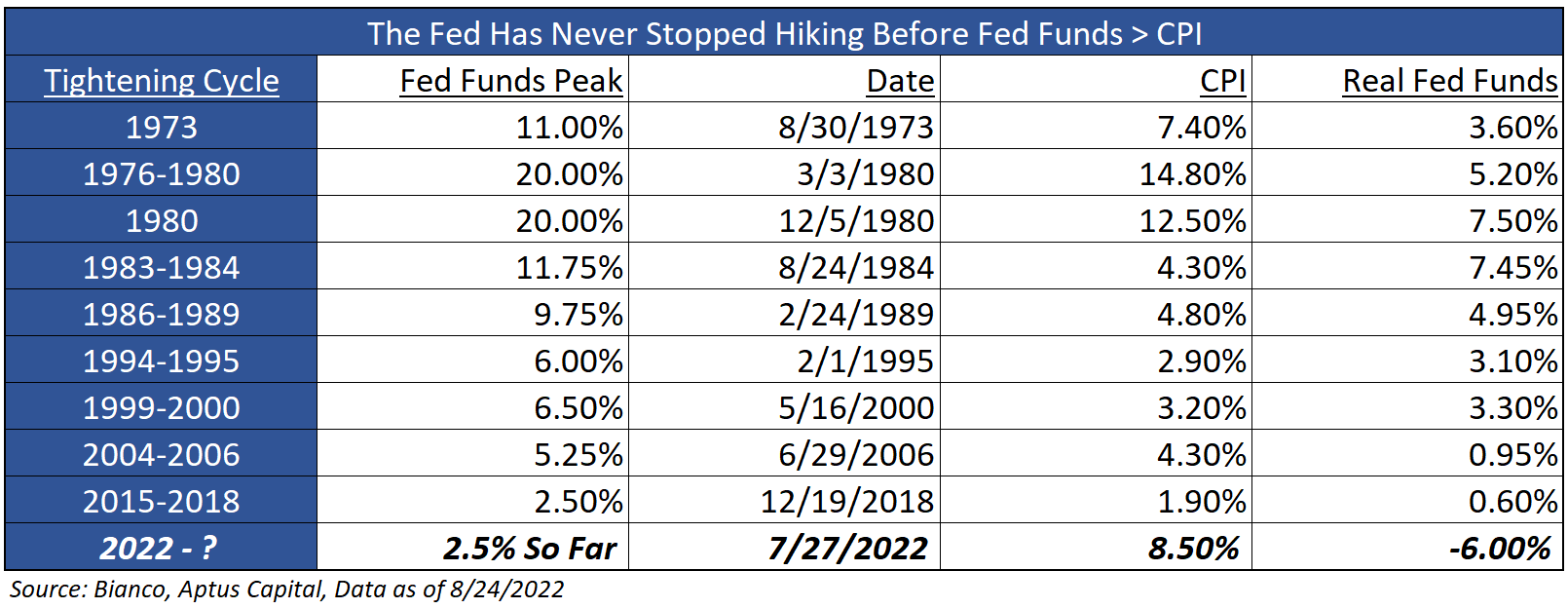

Dave: Where will Fed Funds and CPI intersect?

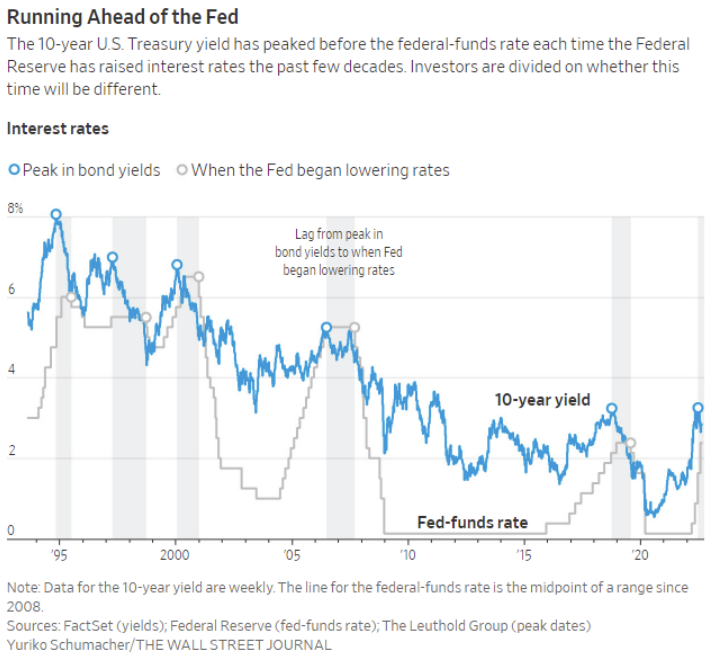

JL: and will the 10 year bond again give us clues to when the hiking cycle may end?

Data as of 08.22.2022

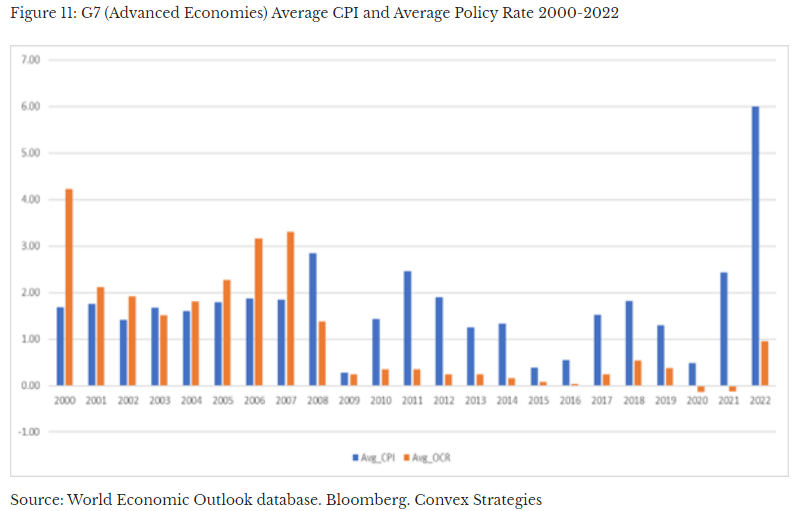

JL: Either way, global central banks have a long way to go to get in gear with traditional rate policy

Data as of 08.16.2022

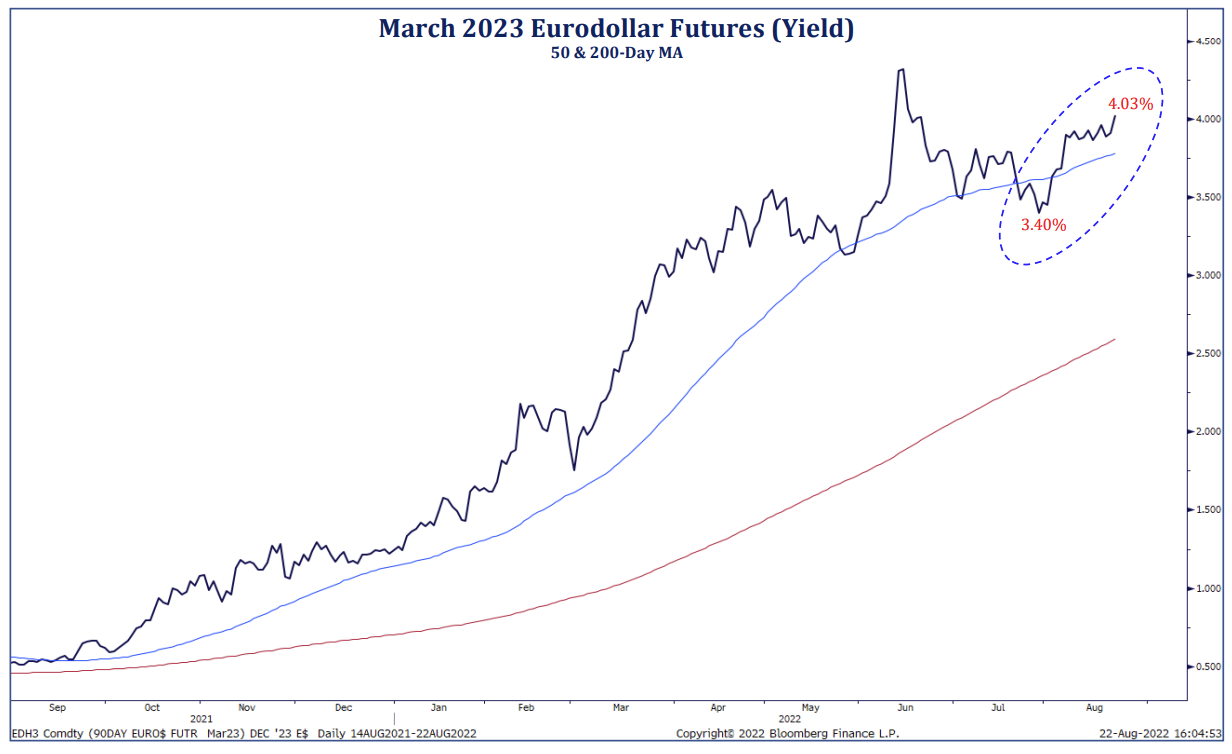

JL: The real rates market is starting to factor in hikes for longer

Data as of 08.22.2022

Data as of 08.22.2022

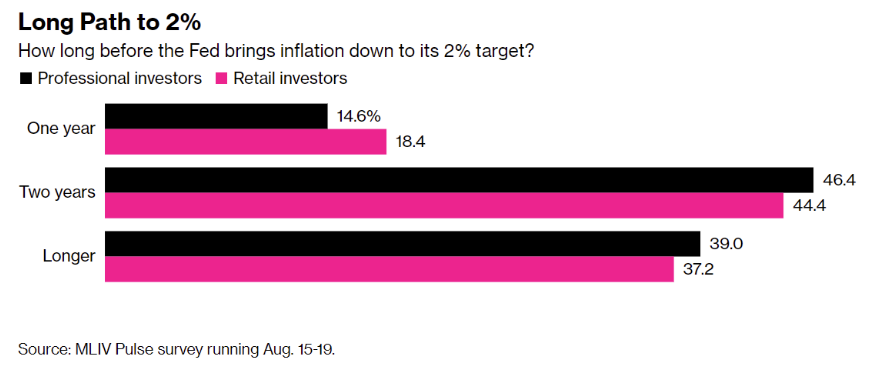

JL: …as investors push out expectations of when inflation can approach the Fed’s stated 2% inflation target

Source: Strategas 08.18.2022

Source: Strategas 08.18.2022

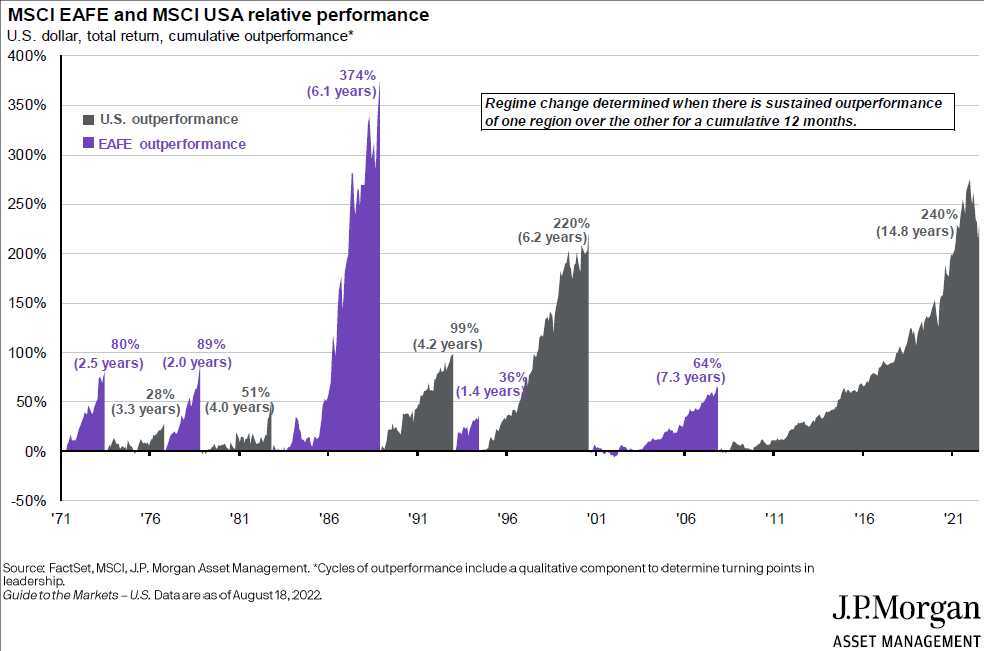

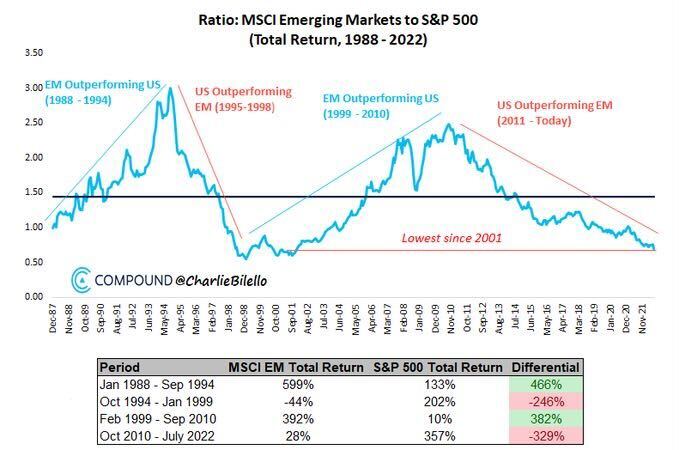

Brad: The international bear market vs. US stocks is now 15 years

JL: …and these periods of relative performance have historically run in cycles

Data as of 08.24.2022

Data as of 08.24.2022

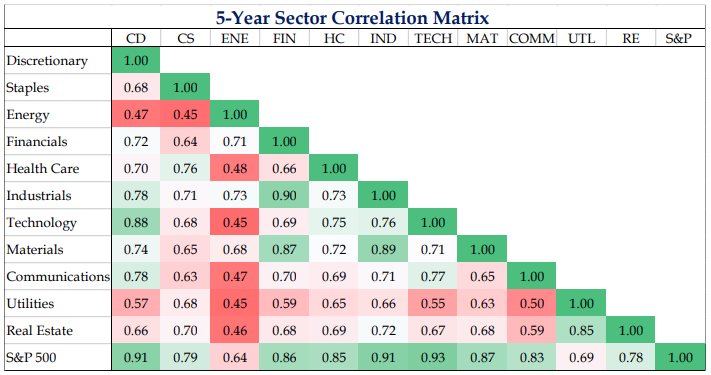

Joseph: Energy stocks have been a zig to the market’s zag in recent years

Source: Strategas as of 08.22.2022

Source: Strategas as of 08.22.2022

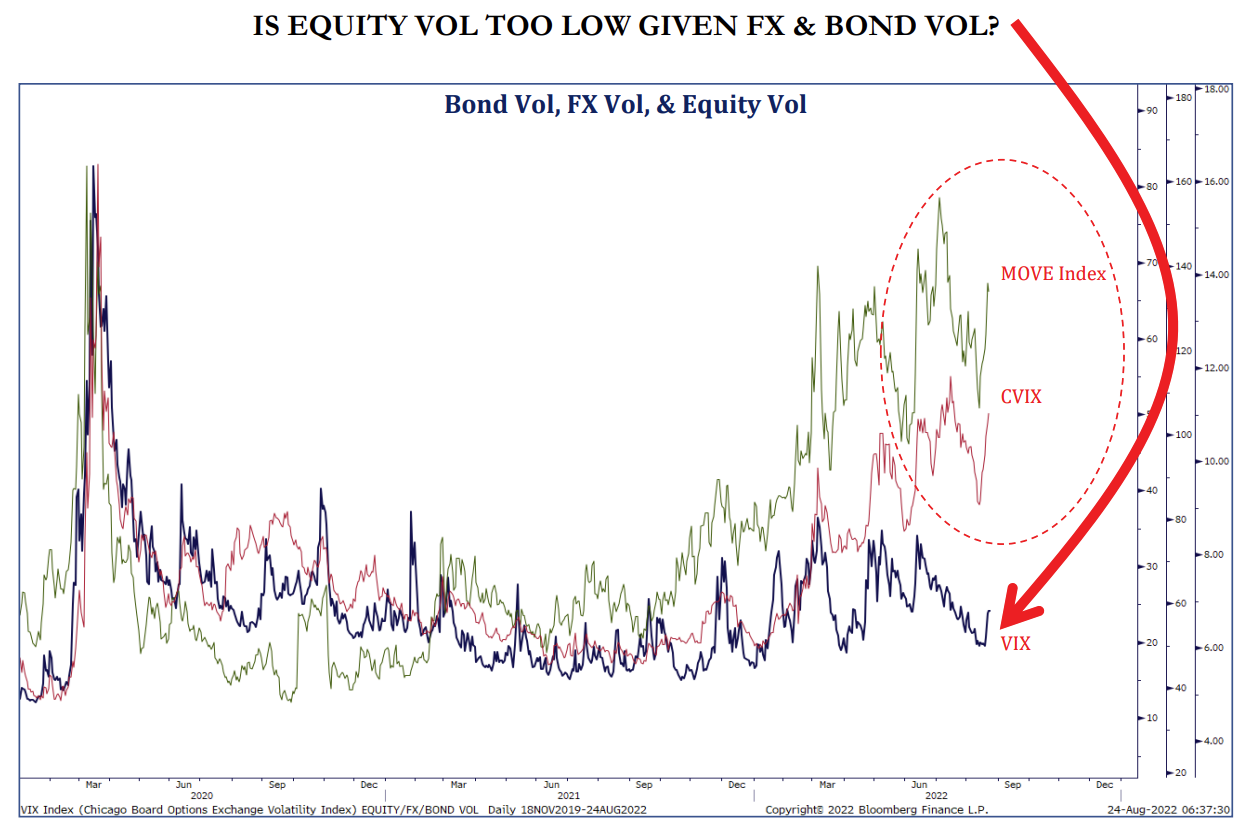

JL: It may not feel that way but equity volatility has been relatively tame compared to bonds and currencies

Source: Bianco as of 08.22.2022

Source: Bianco as of 08.22.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2208-27.