Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

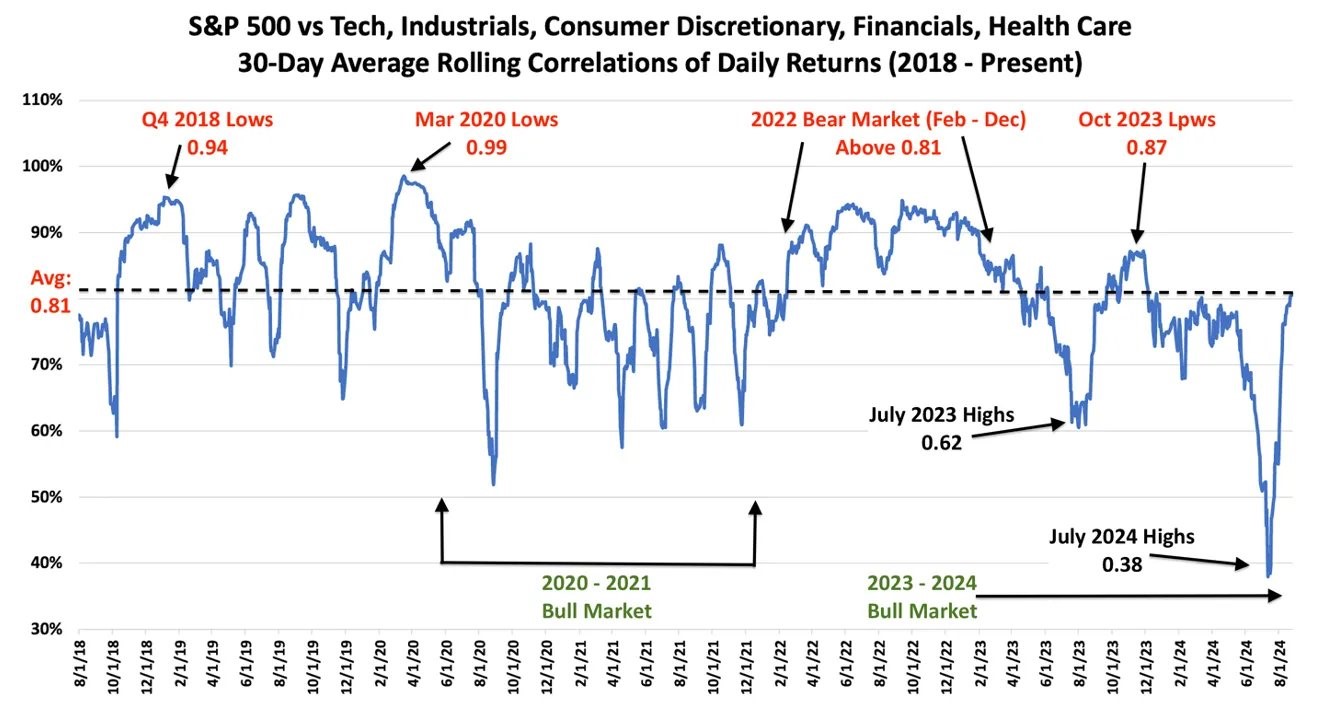

Arch: The market action of the past month has restored sector correlations back to the midpoint of their recent patterns

Source: DataTrek as of 08.27.2024

Source: DataTrek as of 08.27.2024

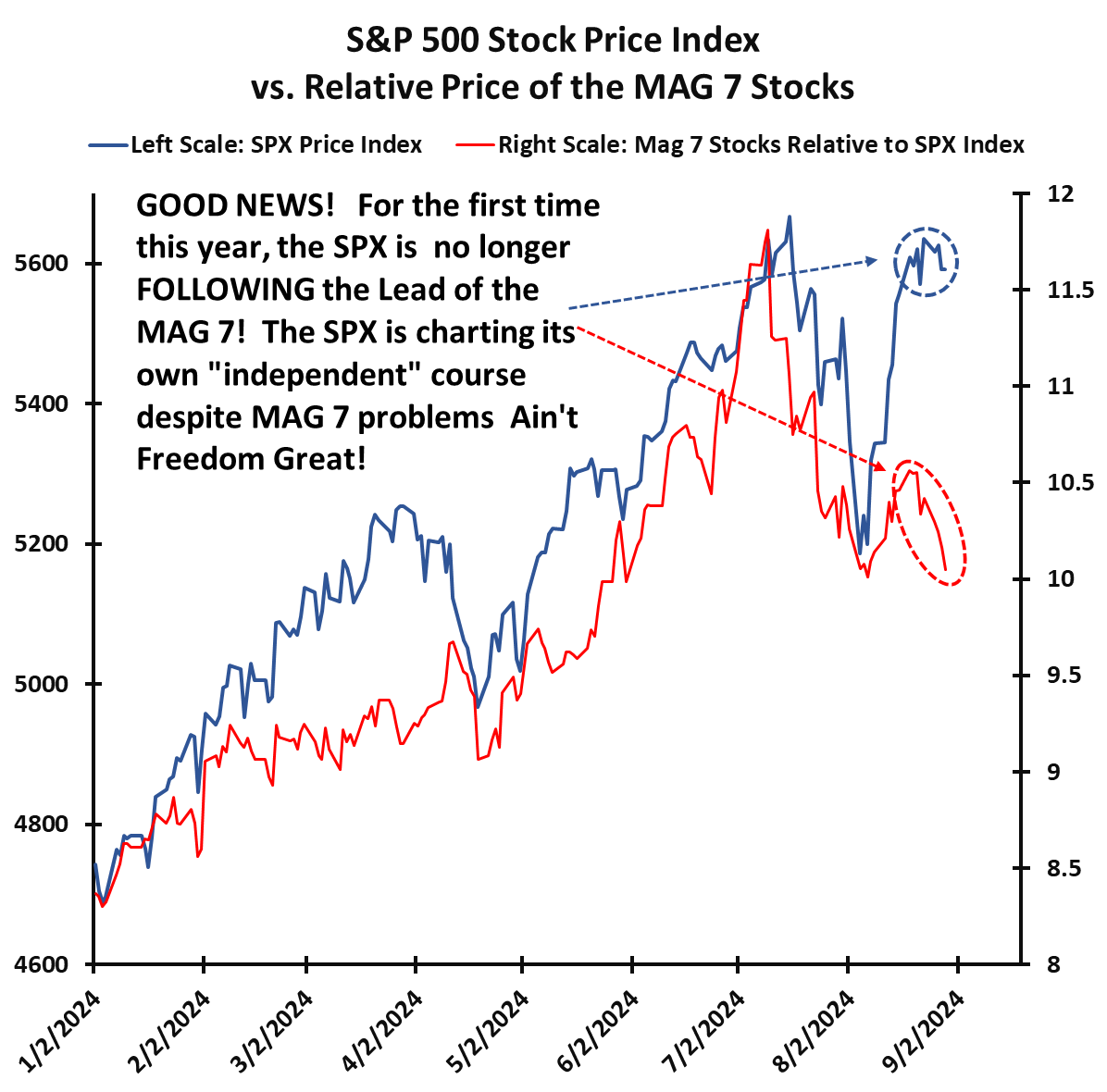

Brett: at the same time shaking free of the index chains held by the Mag 7

Source: Paulsen Perspectives as of 08.30.2024

Source: Paulsen Perspectives as of 08.30.2024

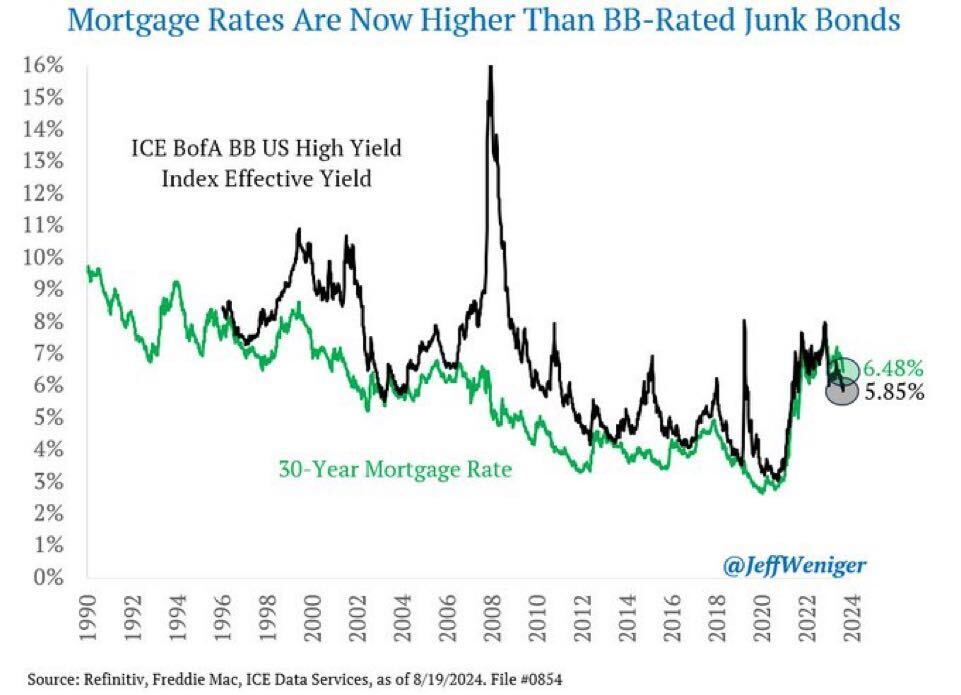

John Luke: The rates market is a collection of oddities right now, with high-yield debt getting more favorable treatment than mortgage borrowers

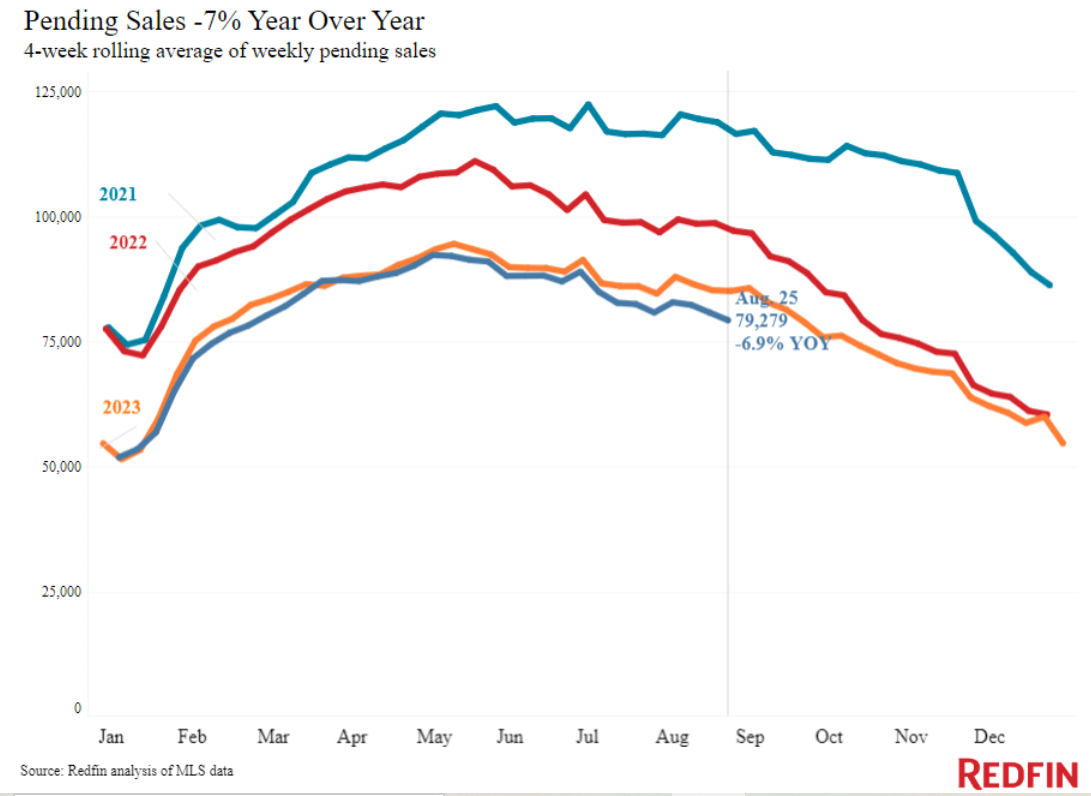

Brad: contributing to a lack of urgency among prospective homebuyers

Data as of 08.26.2024

Data as of 08.26.2024

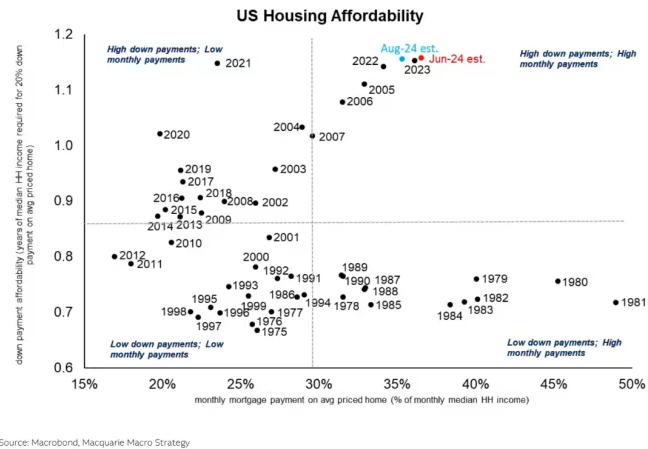

Joseph: Another obvious contributor to the is the broad rise in prices to go with those higher rates

Source: Marketwatch as of 08.26.2024

Source: Marketwatch as of 08.26.2024

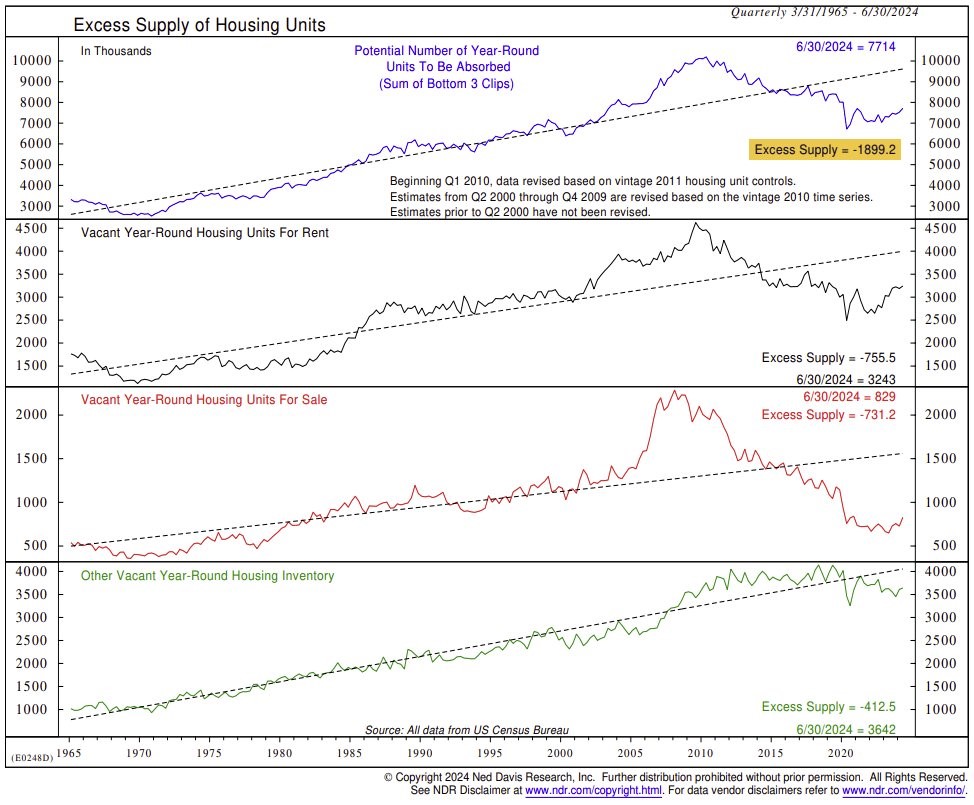

Beckham: with no help from the availability of existing homes for sale

Source: Ned Davis as of July 2024

Source: Ned Davis as of July 2024

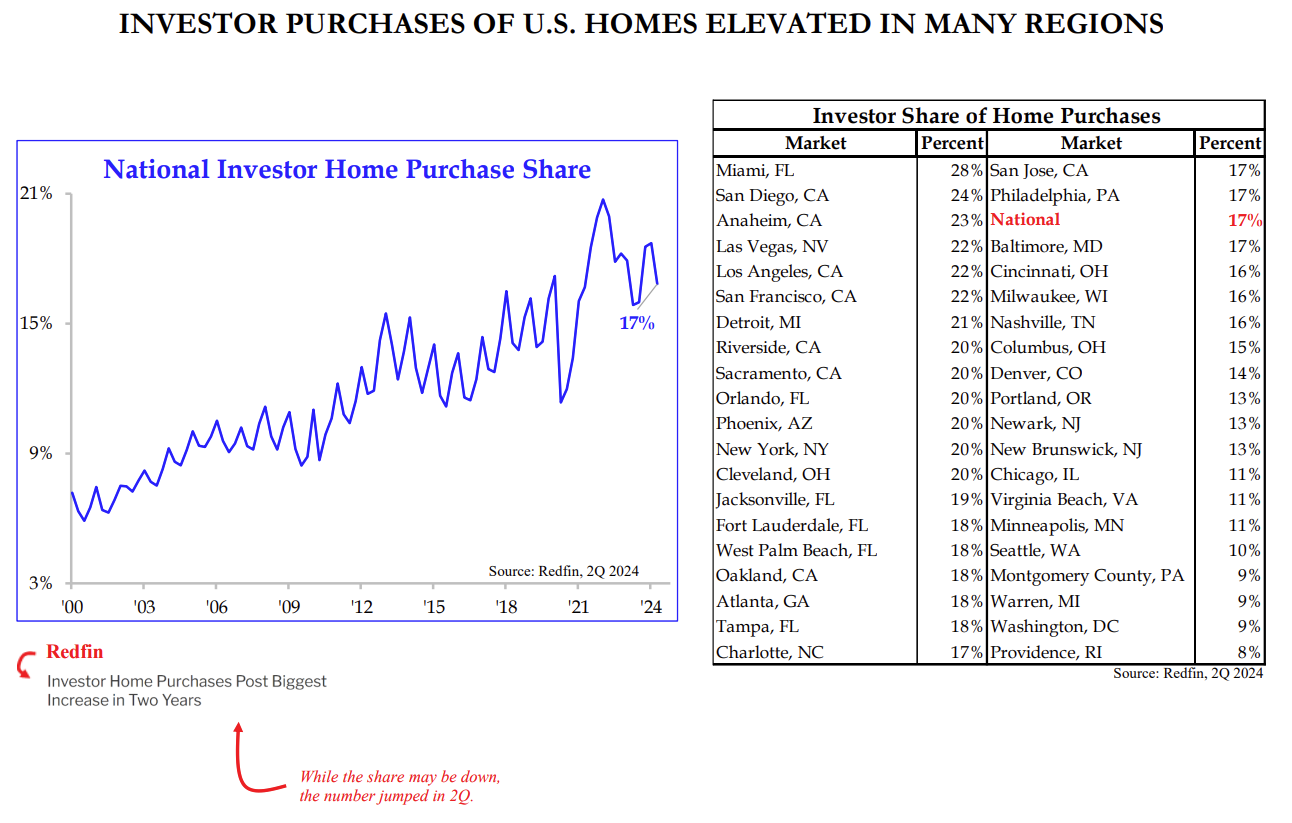

John Luke: There is another contributor to the challenging housing affordability, with investors crowding in

Source: Strategas as of 08.26.2024

Source: Strategas as of 08.26.2024

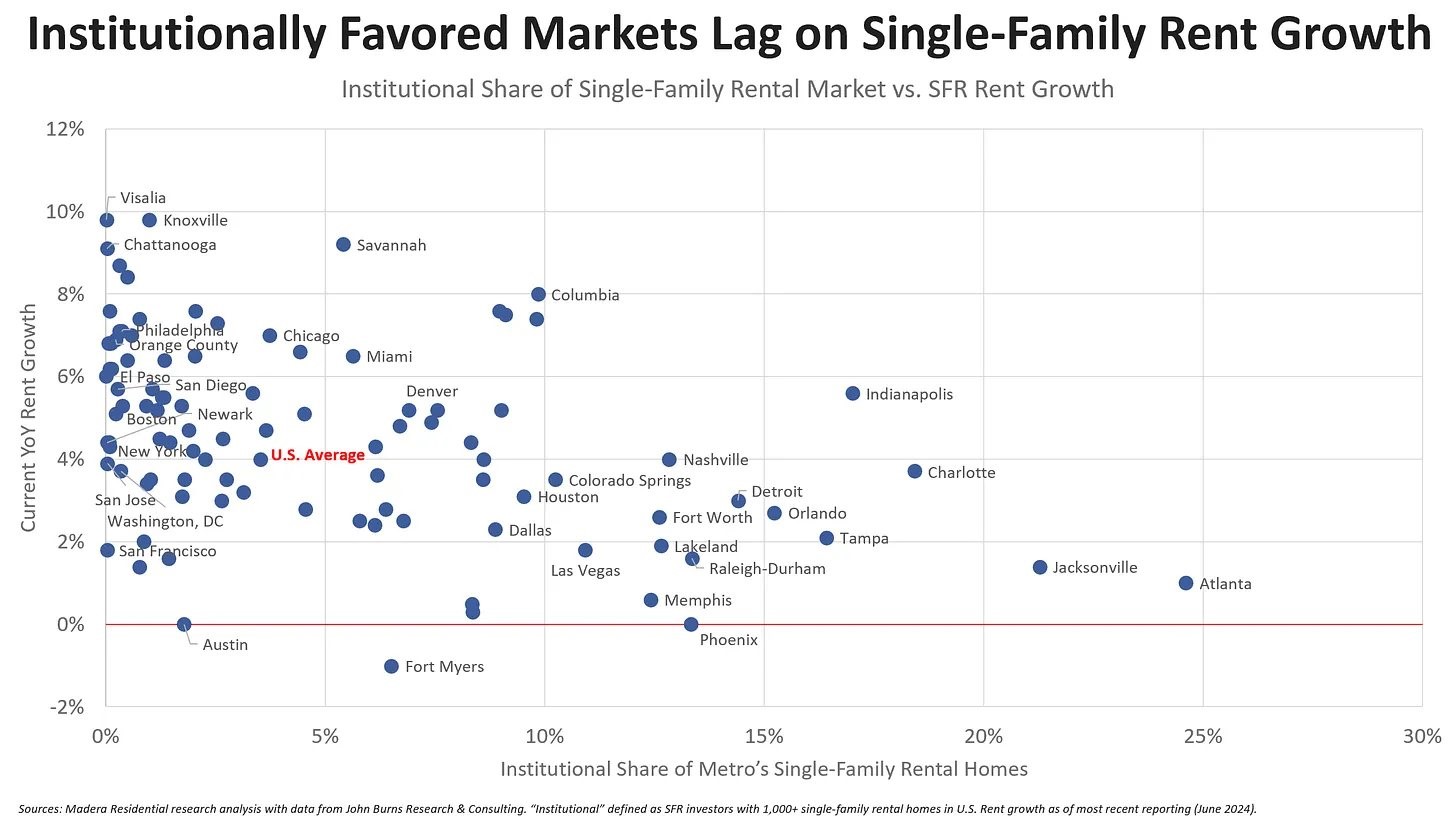

JD: spilling over into higher rent growth in markets dominated by investors and institutions

Data as of 08.28.2024

Data as of 08.28.2024

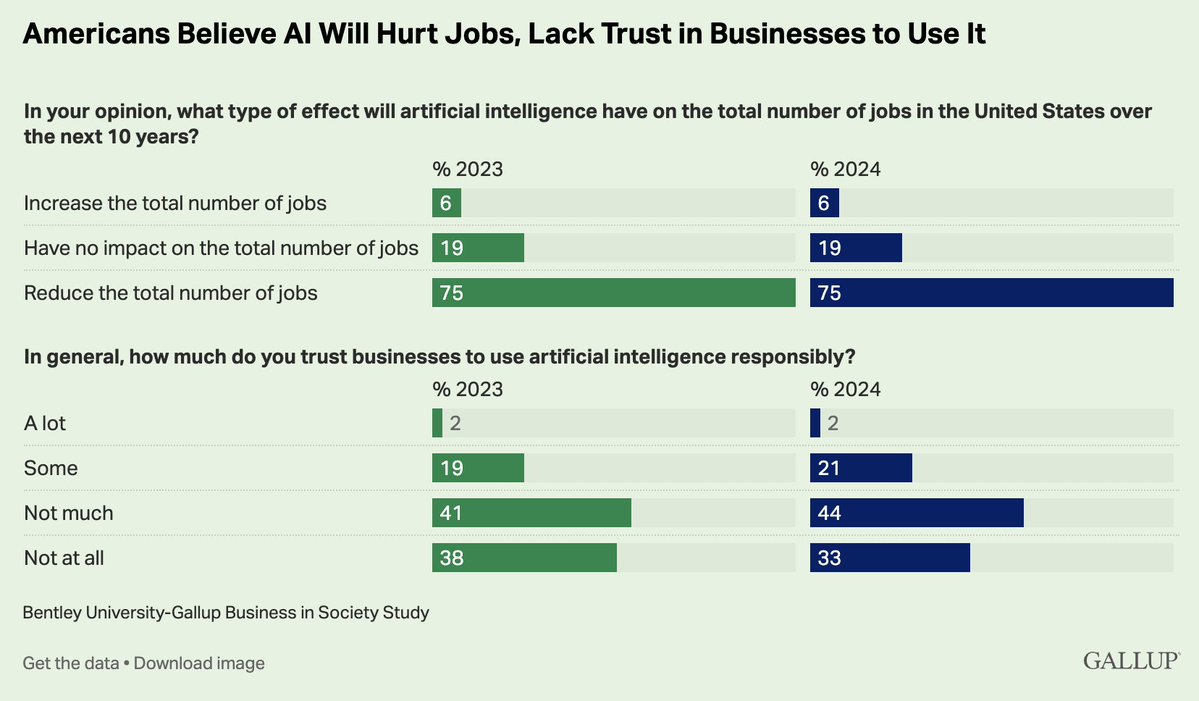

Brett: The general public has little faith that corporations will use artificial intelligence (AI) for the benefit of society

Data as of July 2024

Data as of July 2024

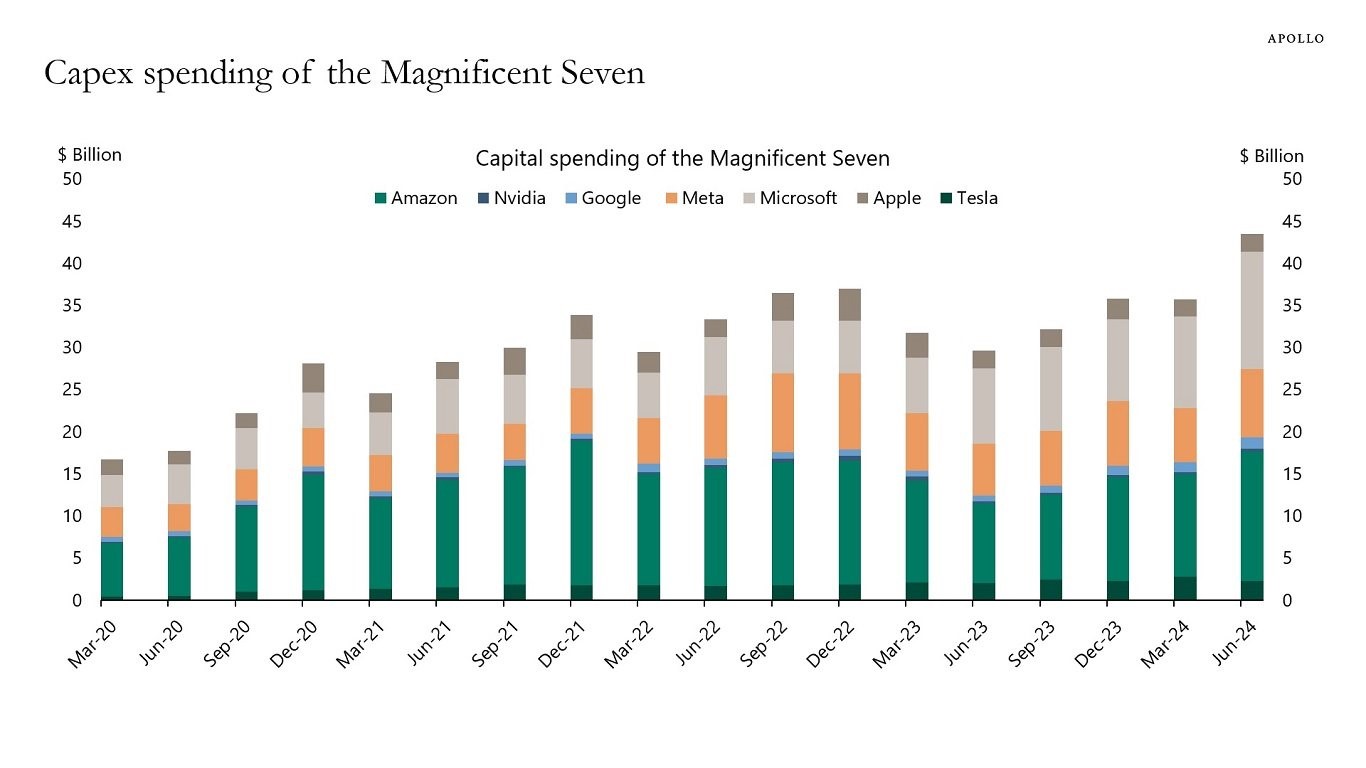

Dave: but the biggest of the big are shoveling money into new projects, heavily centered on AI

Source: Apollo as of July 2024

Source: Apollo as of July 2024

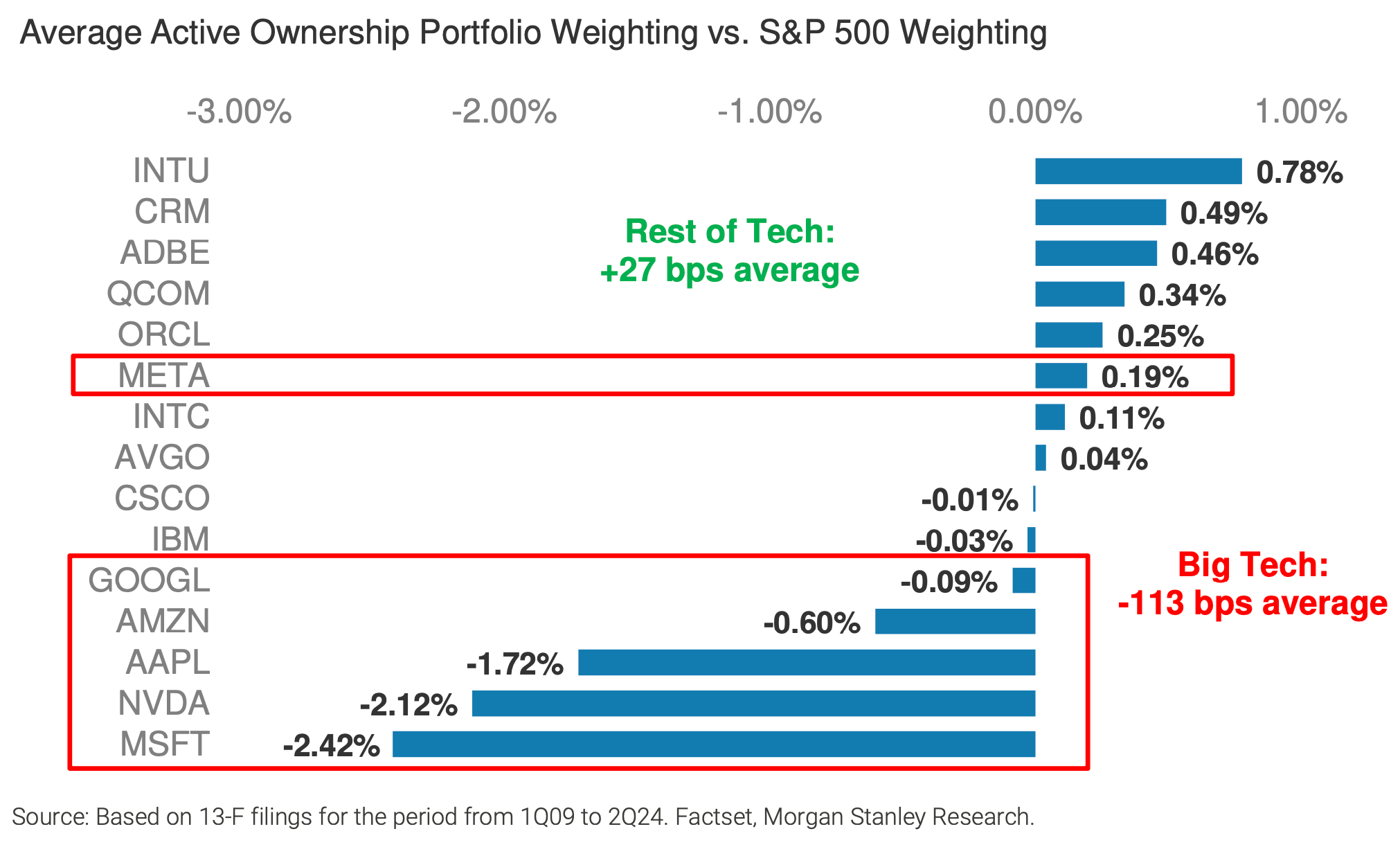

Brad: Speaking of the Mag 7, active funds just can’t bring themselves to market-weight position sizes

Data as of July 2024

Data as of July 2024

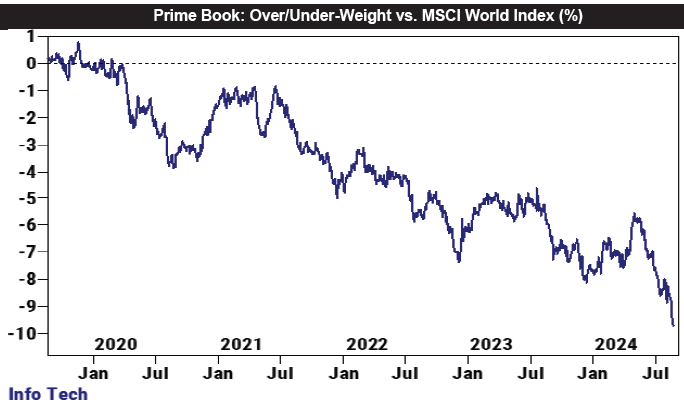

Mark: and hedge funds continue to look outside of tech for opportunity

Source: Goldman Sachs as of 08.26.2024

Source: Goldman Sachs as of 08.26.2024

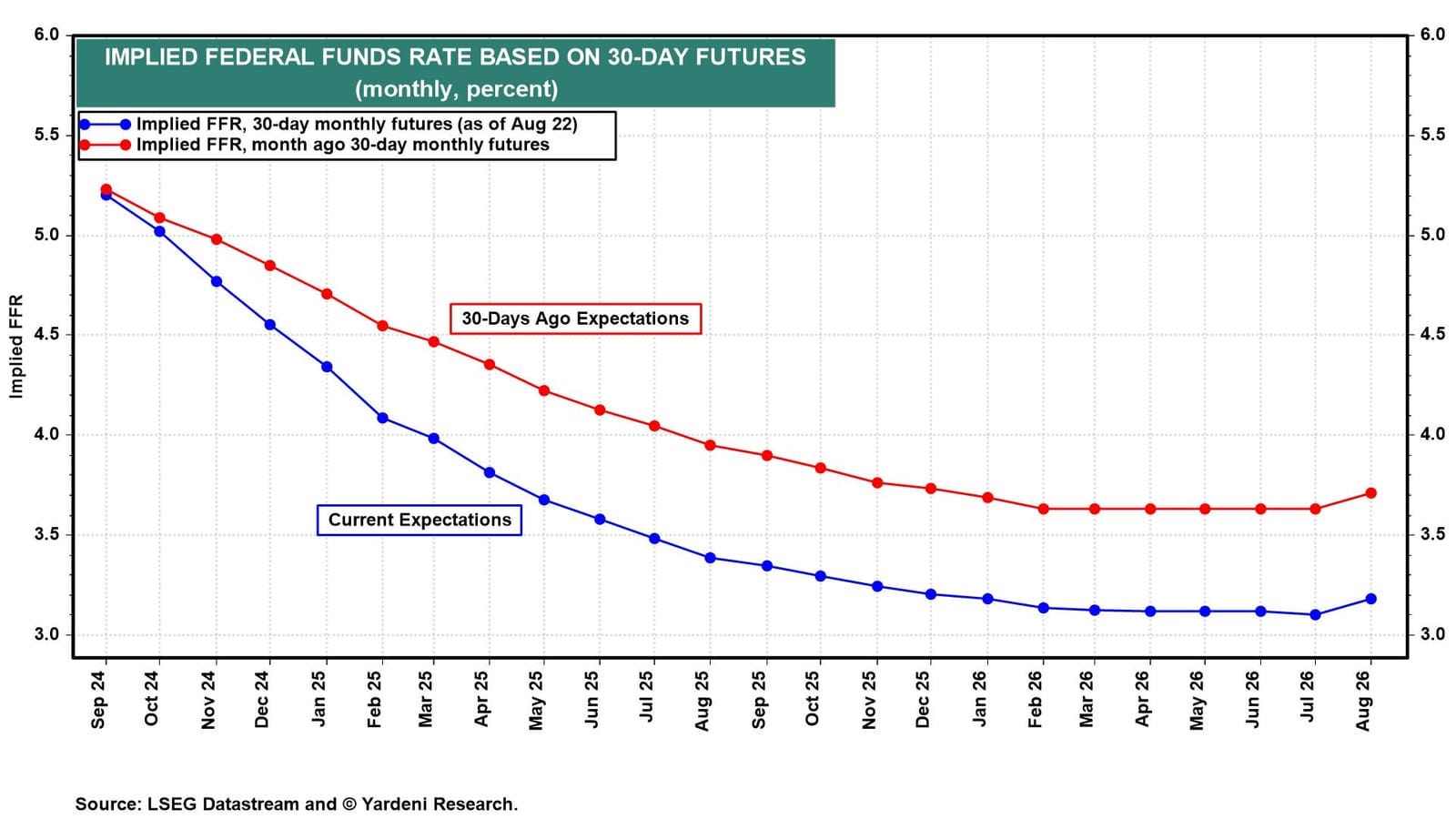

John Luke: Expectations have settled in for a sustained set of FOMC rate cuts

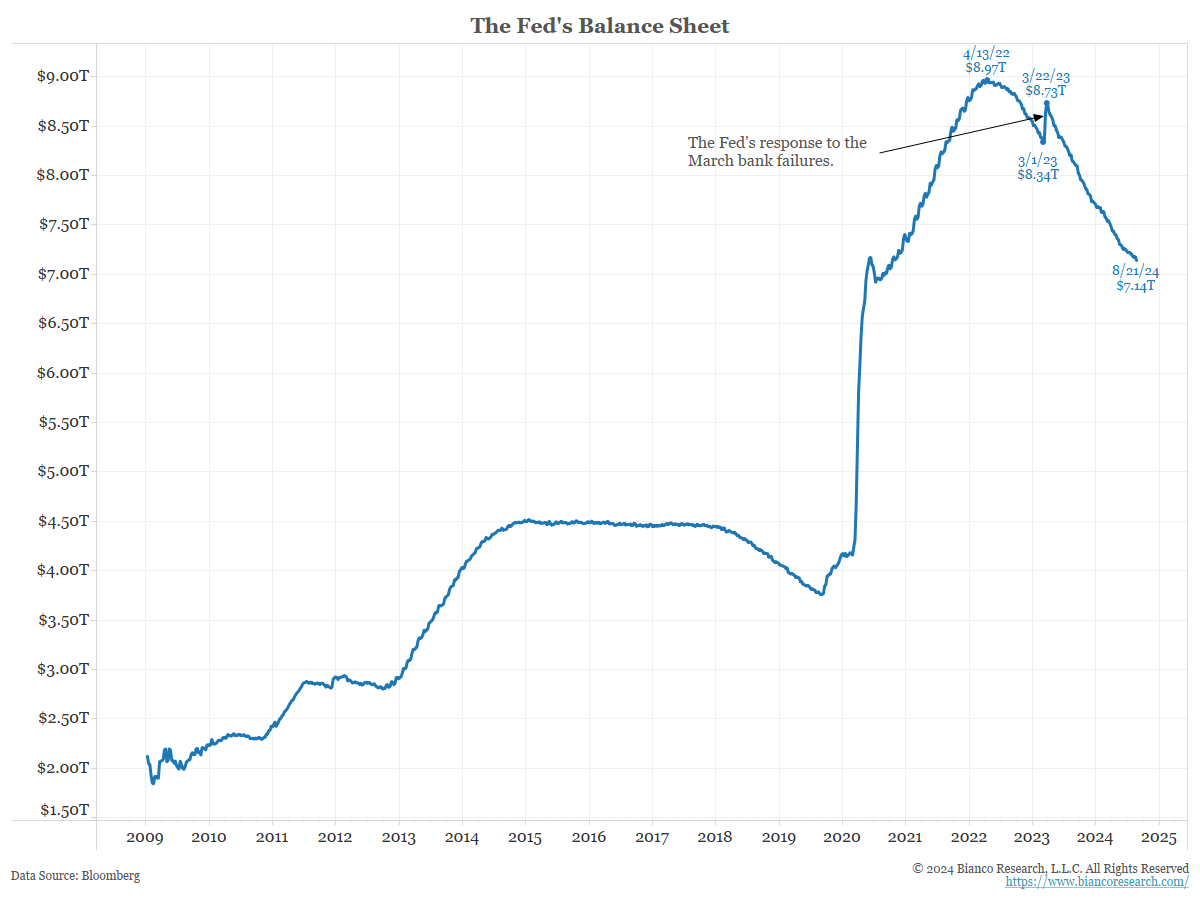

John Luke: but questions remain around plans for tackling the massive Fed balance sheet

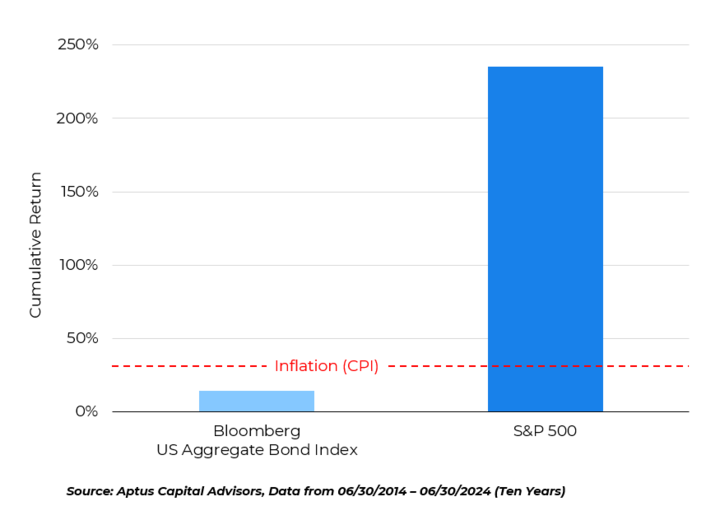

Brian: Stocks have done the job that bonds haven’t been able to do, not only protecting purchasing power but raising living standards for holders

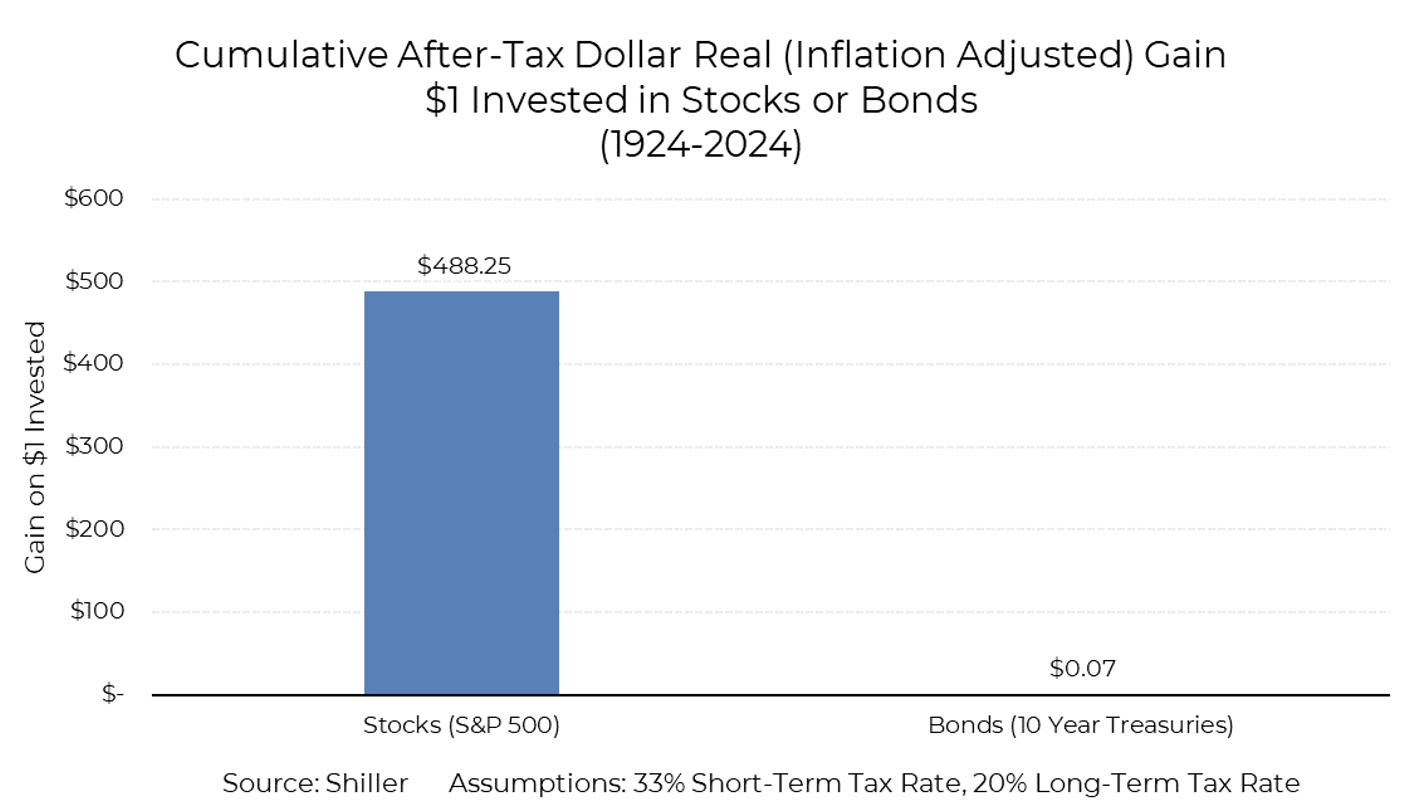

Brian: and the picture is just as lopsided when extending back to the Roaring 1920s

Data as of 06.30.2024

Data as of 06.30.2024

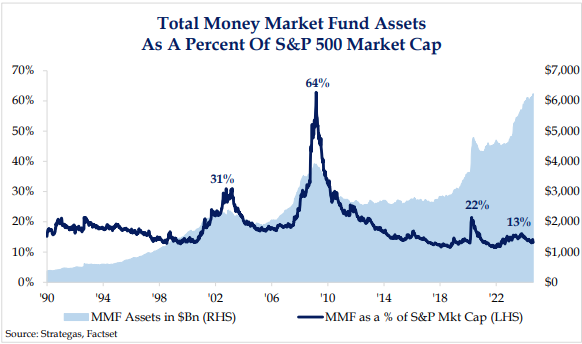

Joseph: As a percentage of overall market value, “cash on the sidelines” isn’t exactly a huge source of support for stocks

Data as of July 2024

Data as of July 2024

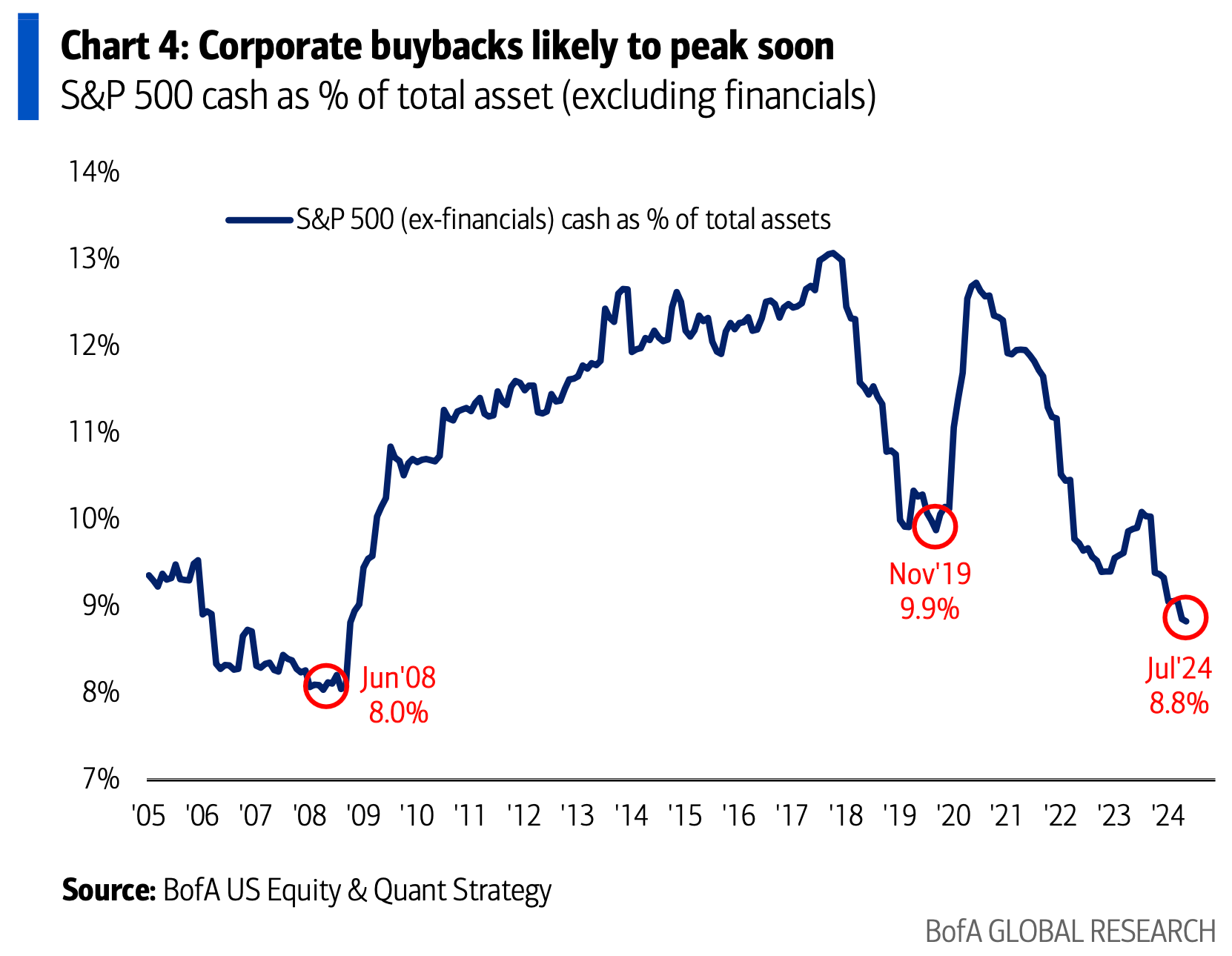

Beckham: and even corporations have been putting their large cash flow to work instead of letting it sit, collecting interest

Data as of July 2024

Data as of July 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-27.