Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and why:

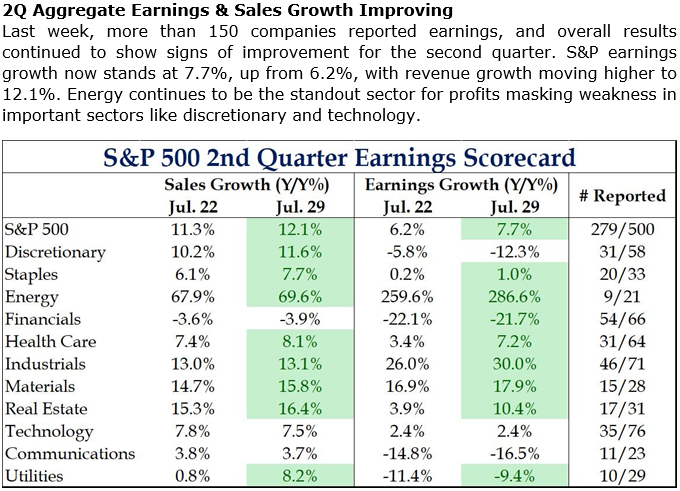

Brad: Earnings continue to be solid for S&P companies, sales even stronger

Source: Strategas as of 08.01.2022

Source: Strategas as of 08.01.2022

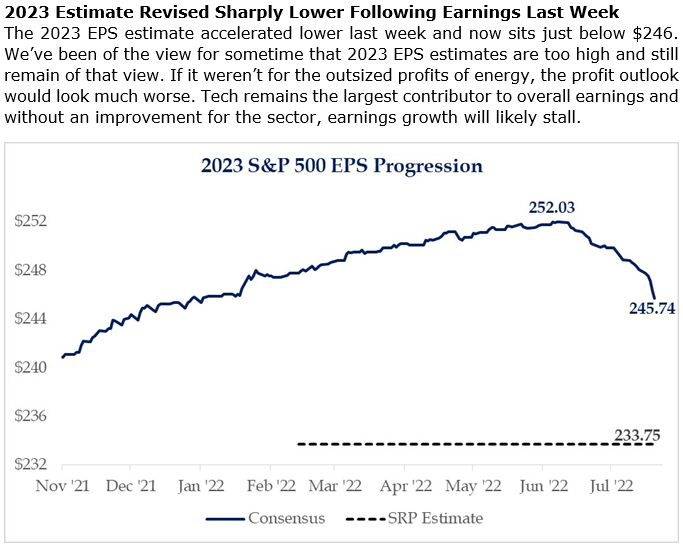

Dave: … that said, forward earnings estimates are starting to come down

Source: Strategas 08.01.2022

Source: Strategas 08.01.2022

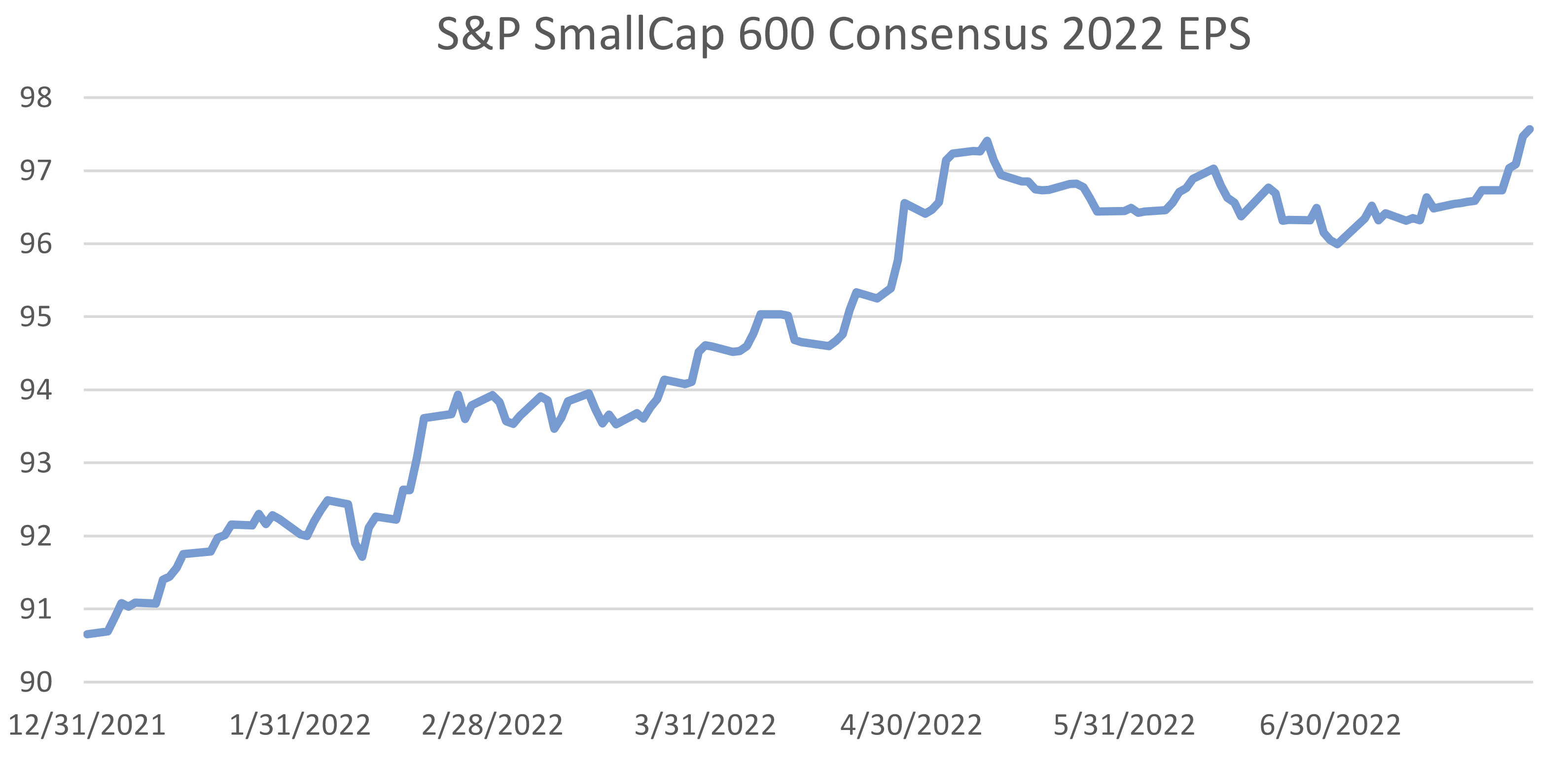

Dave: Contrasting that, estimate for small-cap companies are actually on the rise

Source: Raymond James as of 08.01.2022

Source: Raymond James as of 08.01.2022

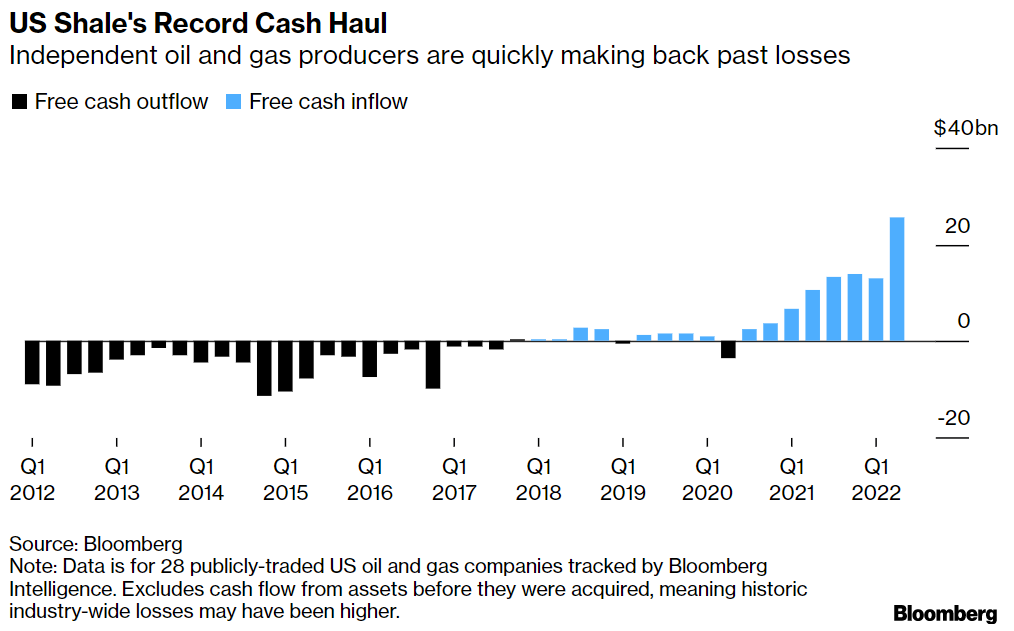

Joseph: Shale companies have become major cash generators in recent years

Source: Bloomberg 08.01.2022

Source: Bloomberg 08.01.2022

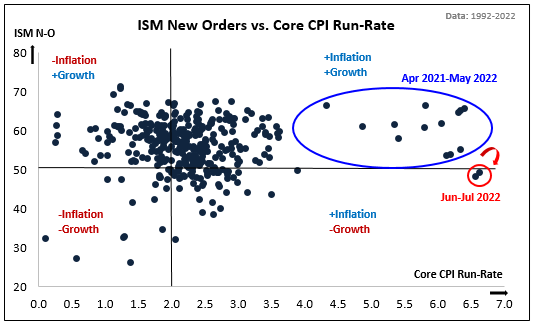

Joseph: Our economy is certainly testing the traditional measures of stagflation

Source: Jeffries as of 08.01.2022

Source: Jeffries as of 08.01.2022

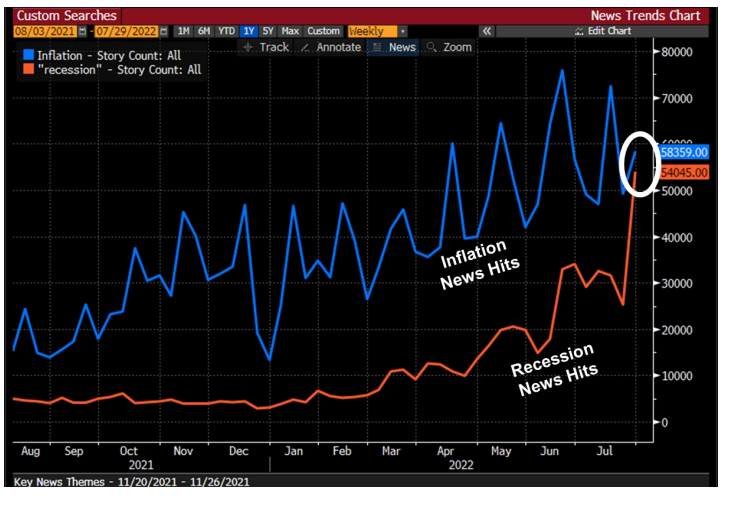

Beckham: And web searches for “recession” are starting to overtake “inflation”

Source: Piper Sandler as of 08.02.2022

Source: Piper Sandler as of 08.02.2022

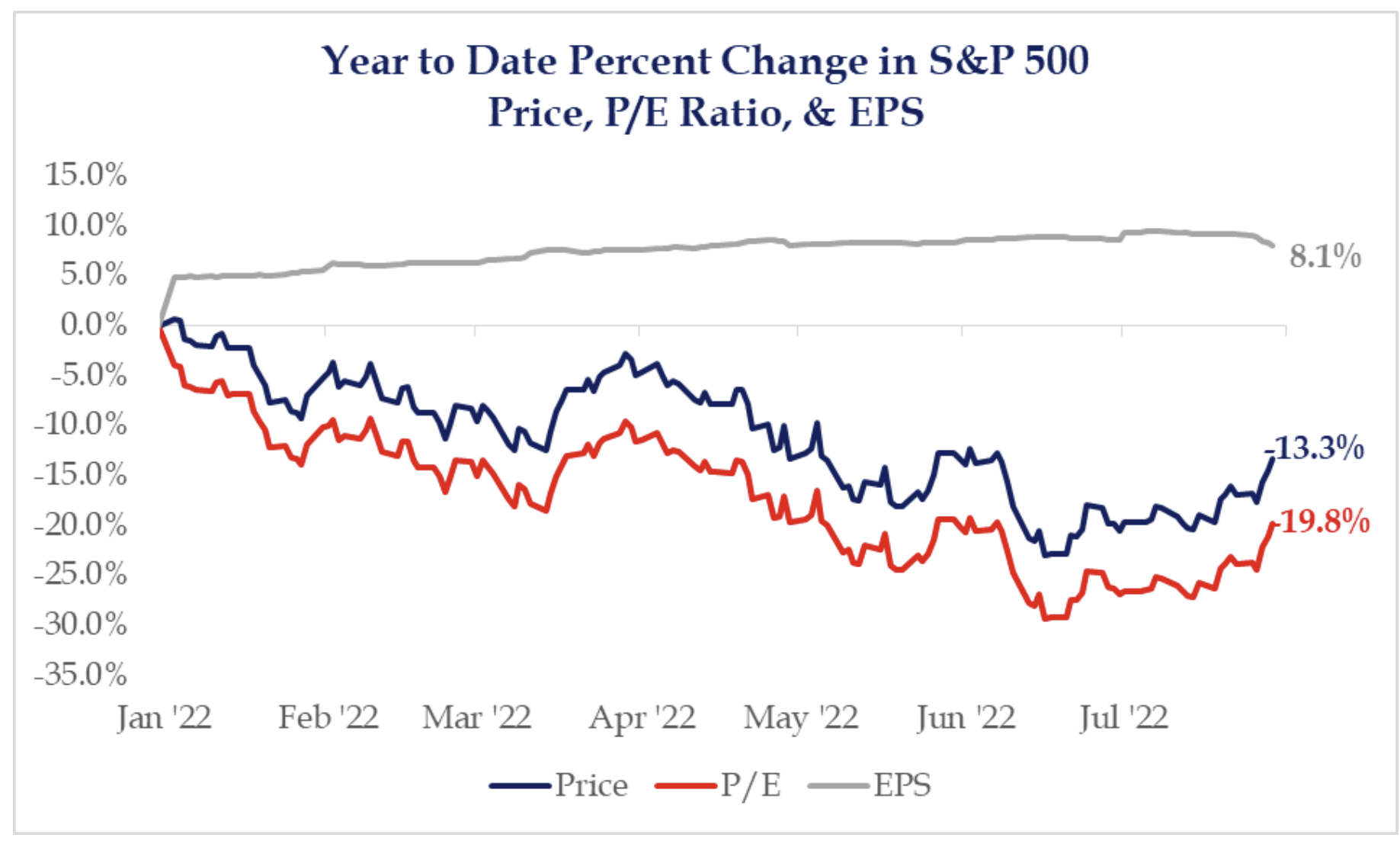

Dave: This year’s equity performance continues to be a story of valuation compression NOT earnings contraction

Strategas as of 07.29.2022

Strategas as of 07.29.2022

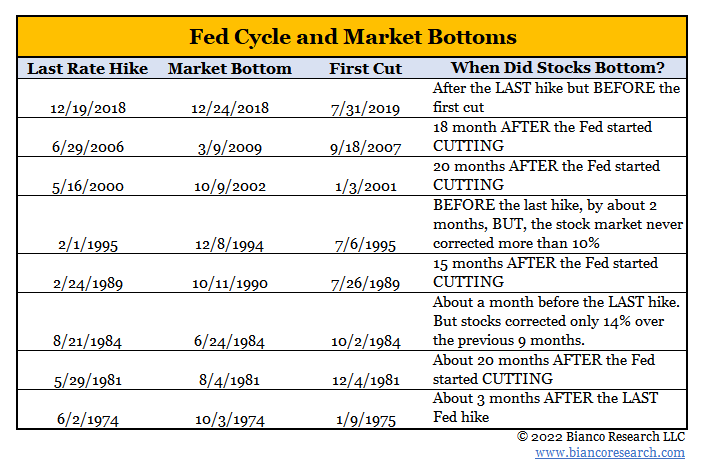

JL: If June was the bottom, it looked nothing like previous Fed-driven lows

Source: Bianco as of 08.04.2022

Source: Bianco as of 08.04.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2208-13.