Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

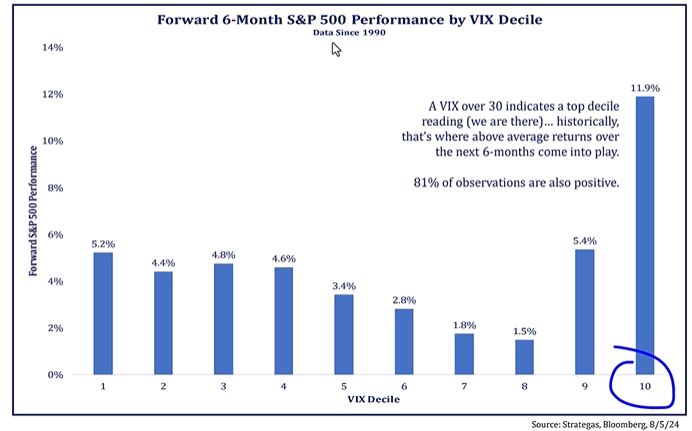

Dave: Stocks moved too, but the movement in the Volatility Index (VIX) was a top-decile event which has historically been favorable for forward returns

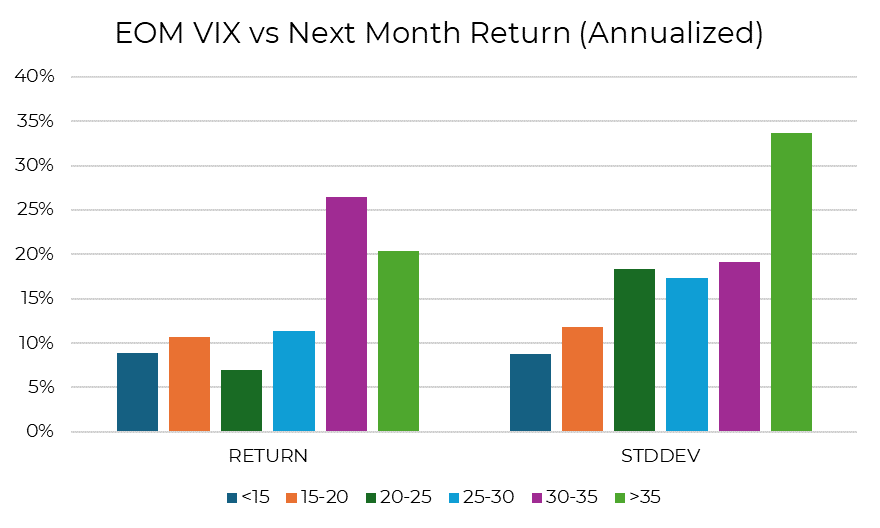

Brian: that said, the positive returns from high VIX readings have also come with extreme volatility in the periods ahead

Source: Aptus via Cboe as of 08.09.2024

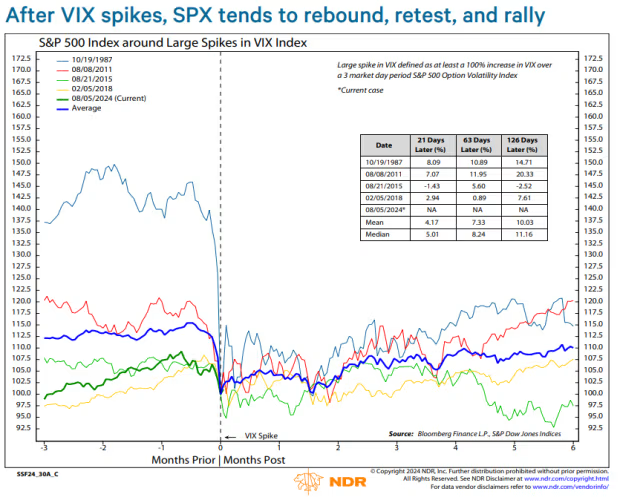

John Luke: though as we know, history may rhyme but it doesn’t exactly repeat

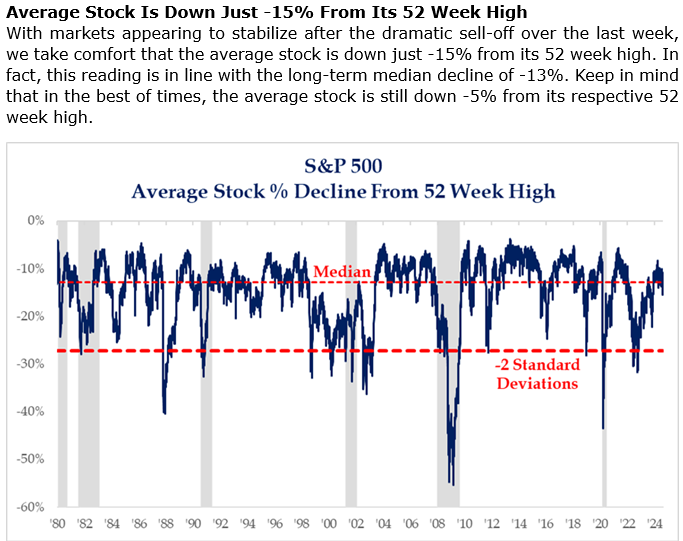

Brad: Now that megacap tech has come off of its highs, the drawdown for the average stock is not that far off from normal, especially given the recent drawdown in the indices

Source: Strategas as of 08.07.2024

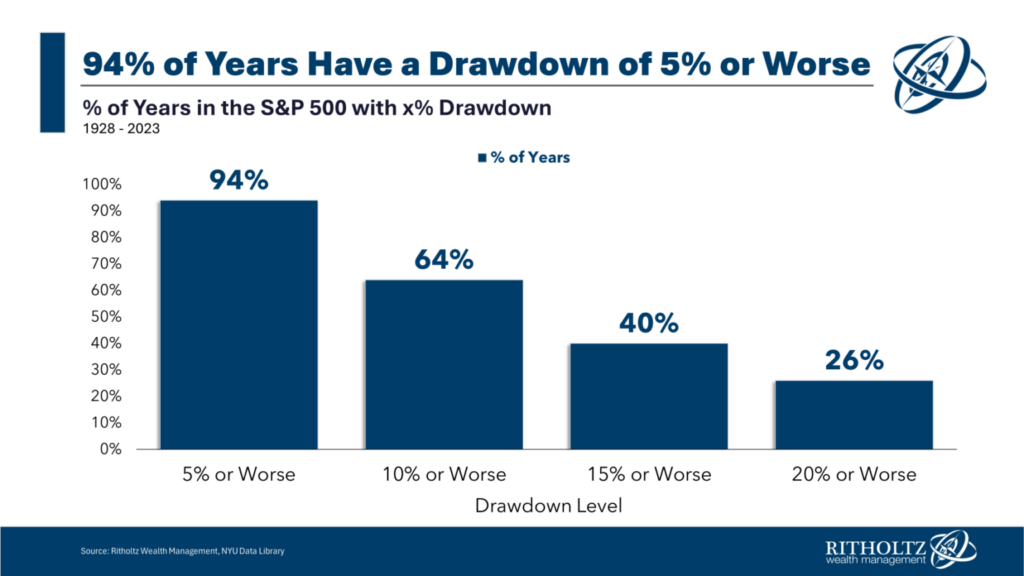

Brian: and index drawdowns in line with what we’ve seen happen in most years

Data as of January 2024

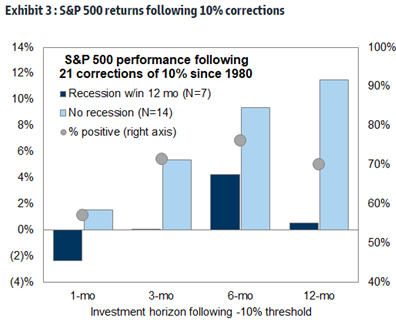

Brad: what matters for investors is sticking around for the long-term benefits that are often even higher after these drawdowns, especially when recession is avoided

Source: Goldman Sachs as of 08.05.2024

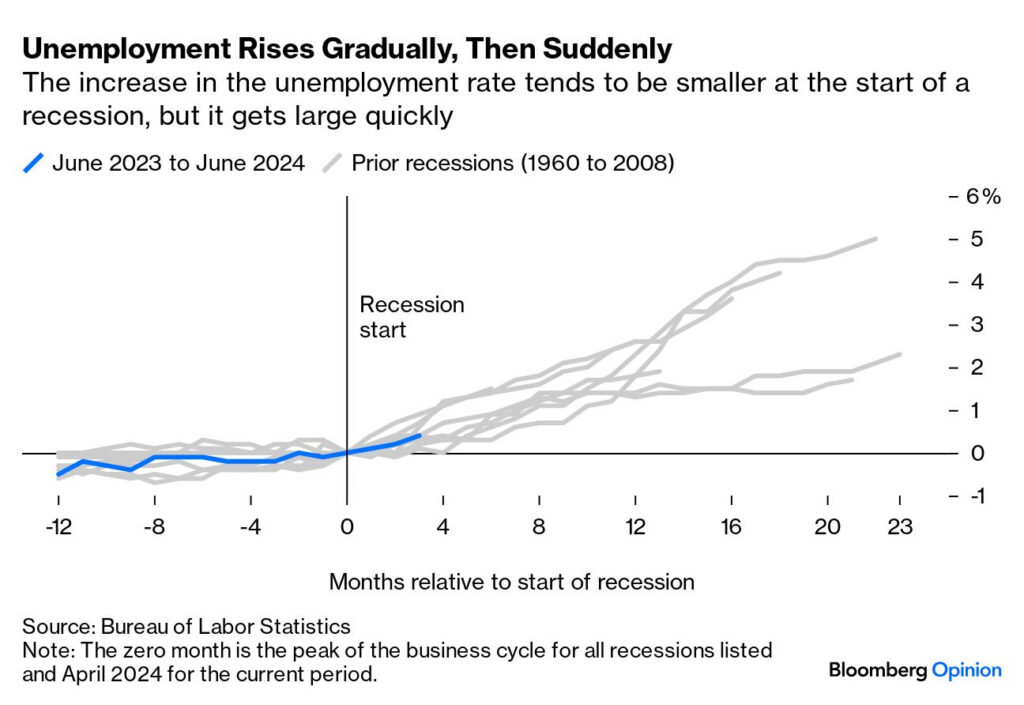

Joseph: With the yen carry episode seemingly behind us, the market’s obsession goes to the economy. Specifically, the employment side of the Fed’s mandate

Data as of July 2024

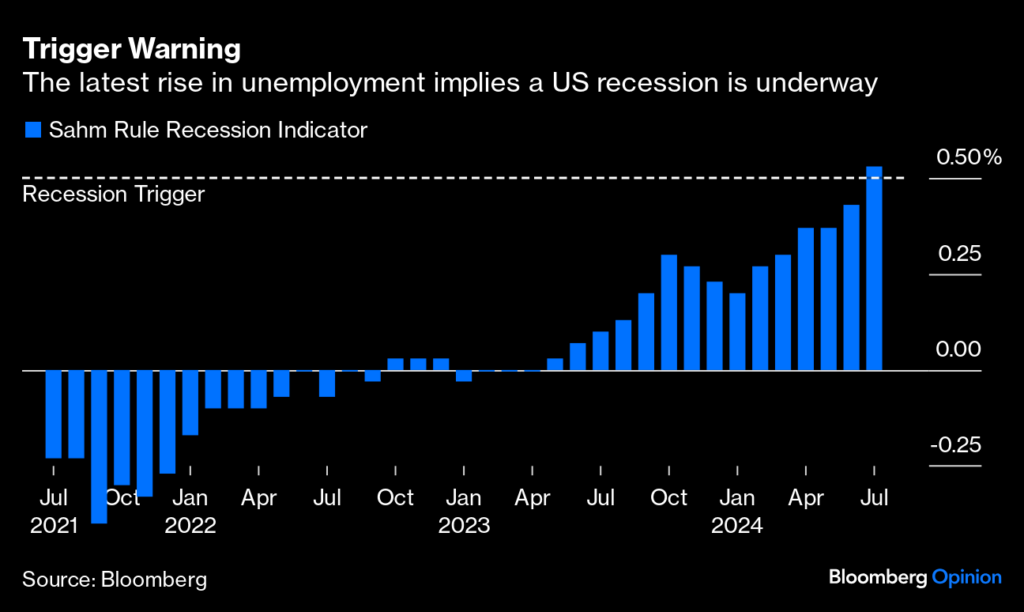

Brett: with the Sahm rule everyone’s latest indicator of the day

Data as of 08.02.2024

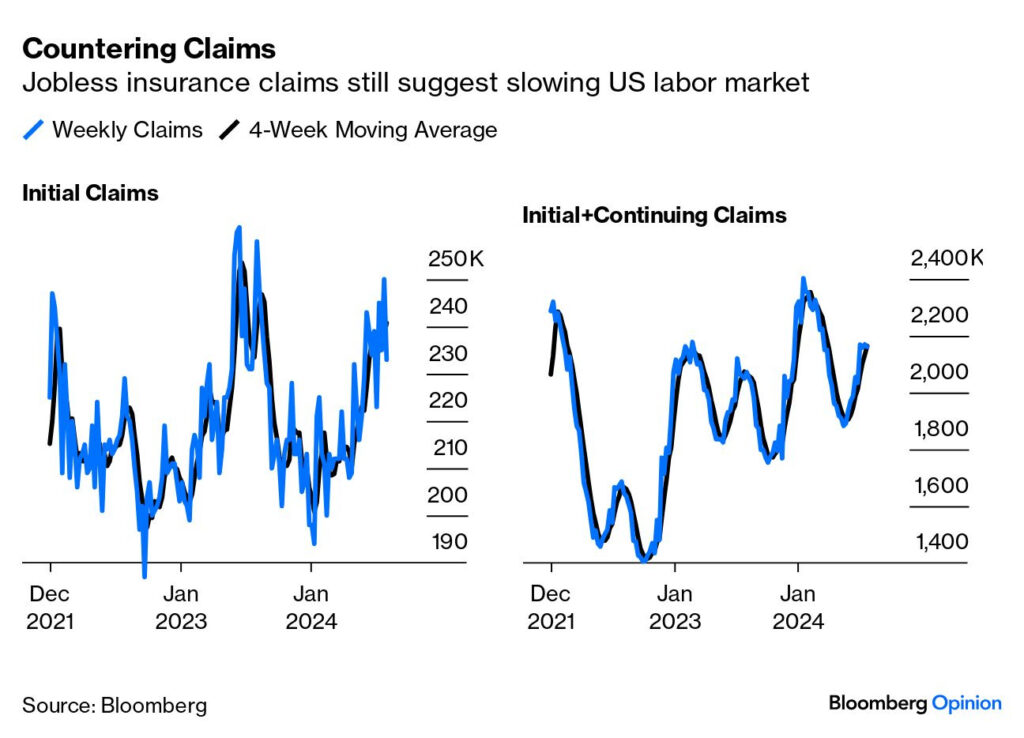

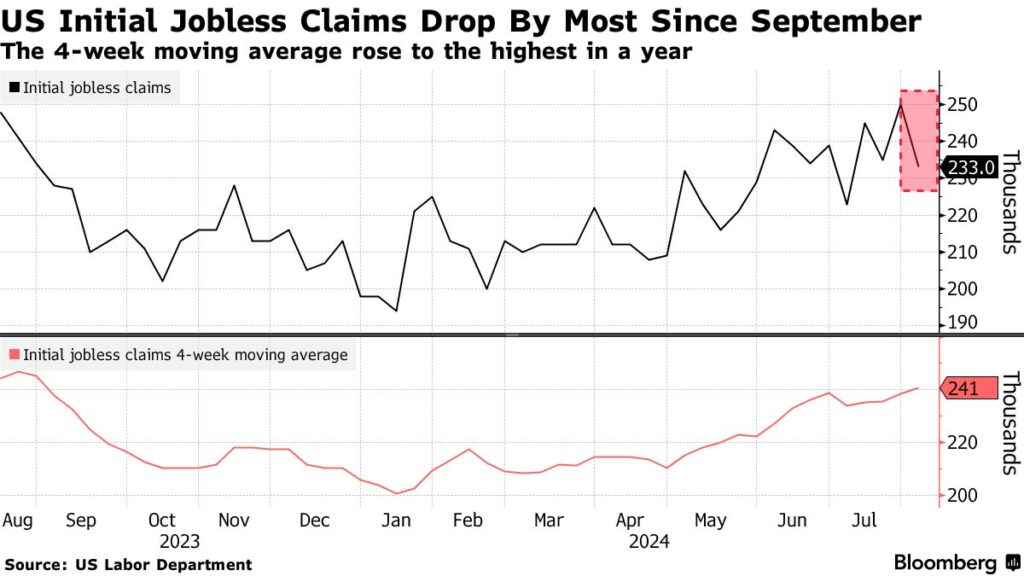

Arch: And while jobless claims may be trending up from historic lows

Data as of 08.08.2024

John Luke: they’re certainly not exploding, like some may have suggested in the past week

Data as of 08.08.2024

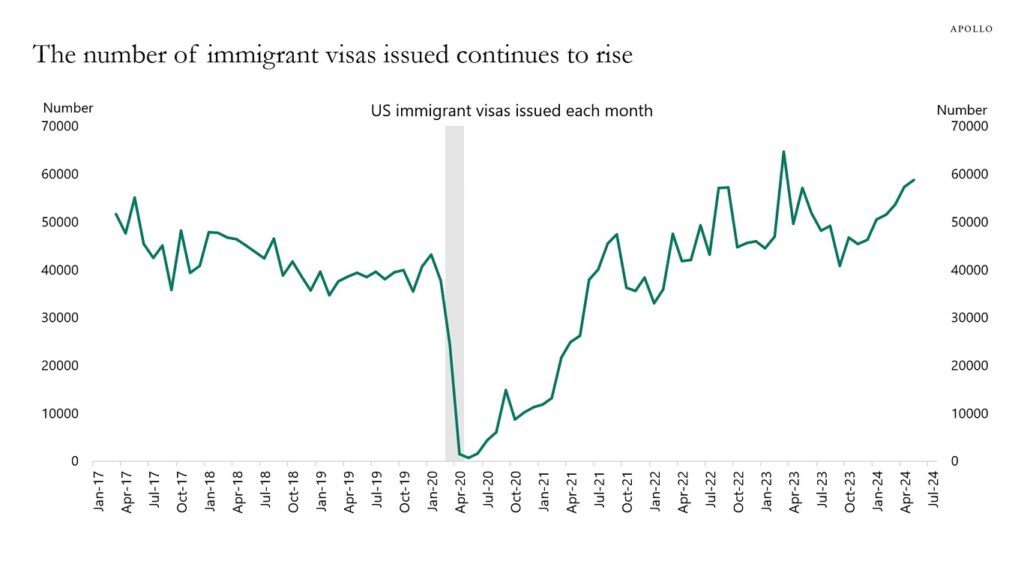

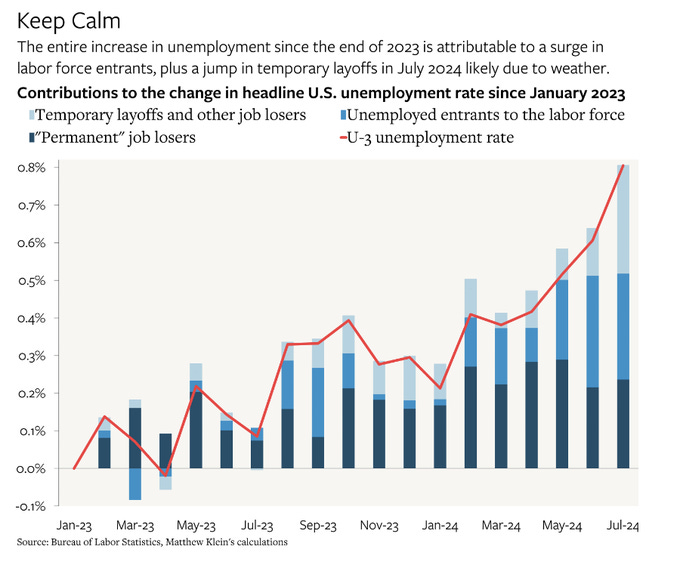

John Luke: and much of the rise in the unemployment rate has come from immigration, legal and otherwise, driving expansion of the labor force

Source: Apollo as of July 2024

Beckham: and many of the layoffs have been seasonal and/or temporary in nature

Data as of July 2024

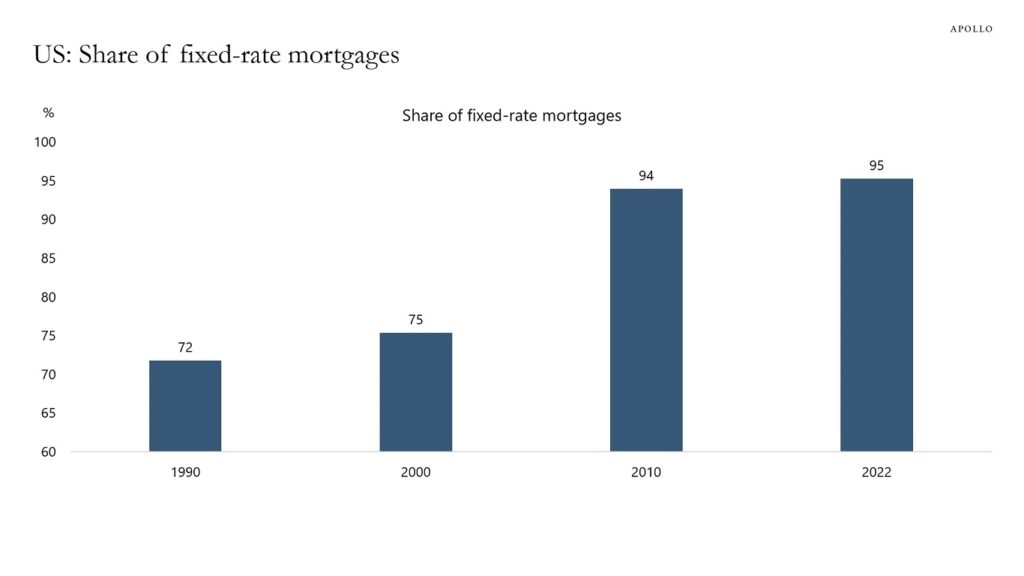

Dave: One obvious reason for the Fed being less impactful on the economy is the higher share of fixed rate debt among consumers and corporations, particularly homeowners

Source: Apollo as of June 2024

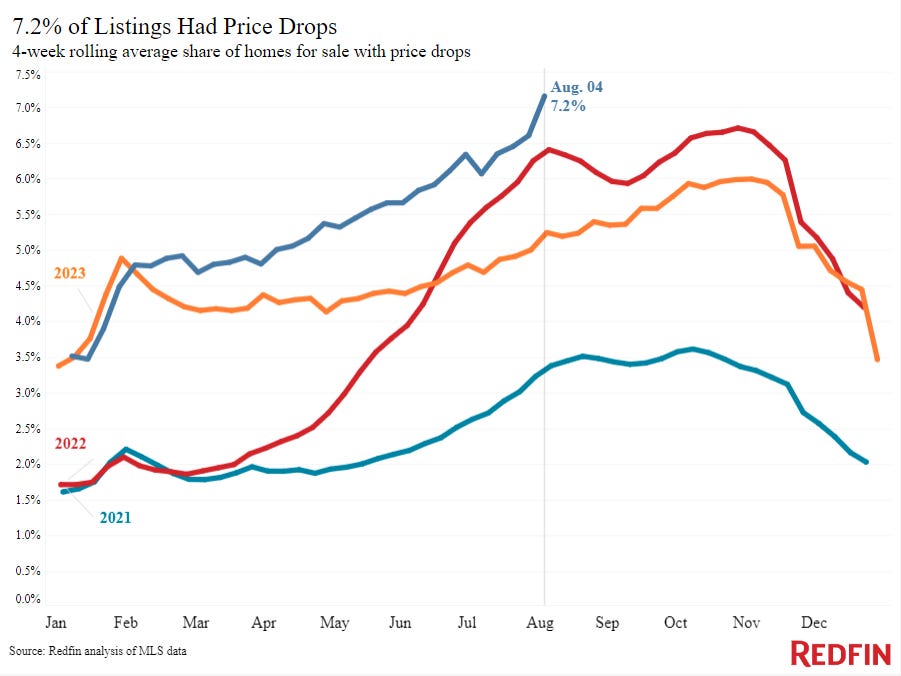

Brad: with mortgage-holders reluctant to leave their COVID-era mortgages behind, at least until the recent fall in mortgage rates

Data as of 08.04.2024

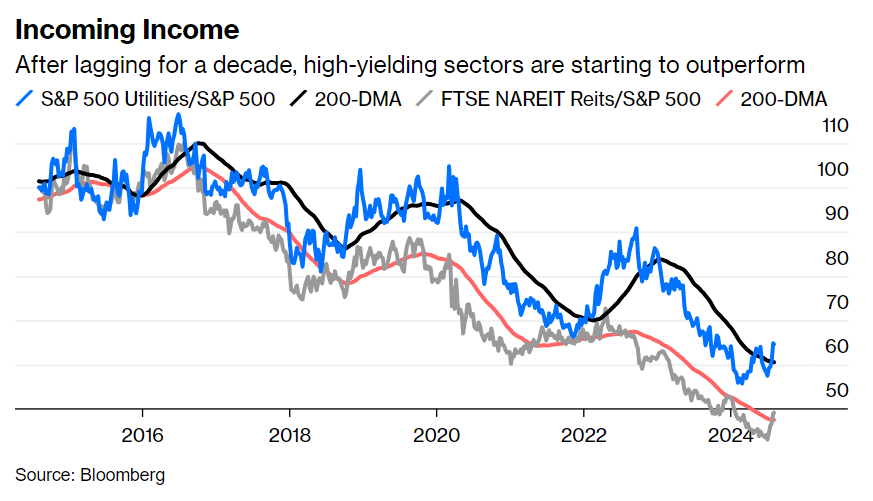

John Luke: Another impact of the recent fall in rates has been better performance by yield-driven equities

Data as of 08.07.2024

Dave: part of a trend away from the megacap tech leadership since the tame inflation reports in July

Data as of 08.07.2024

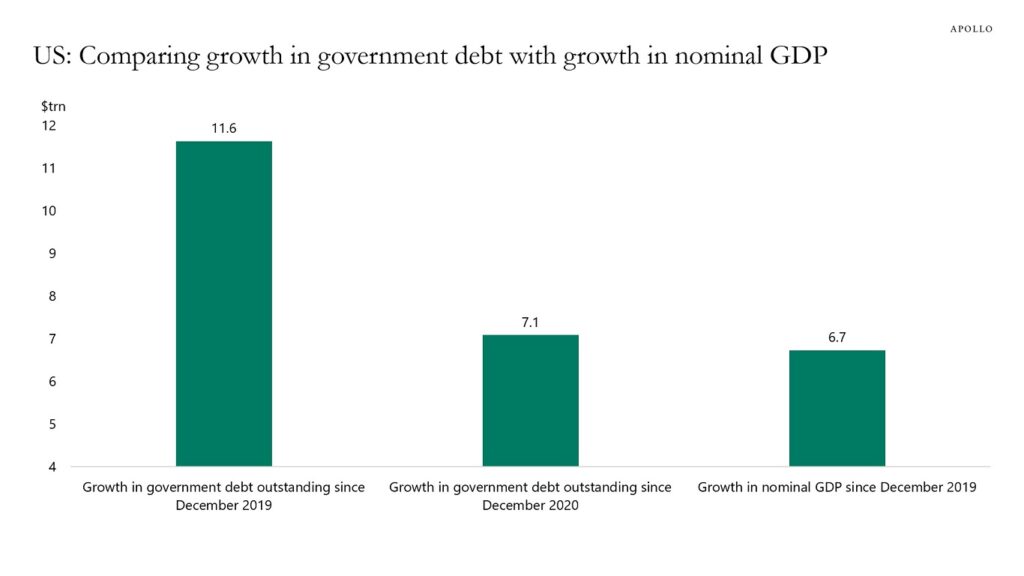

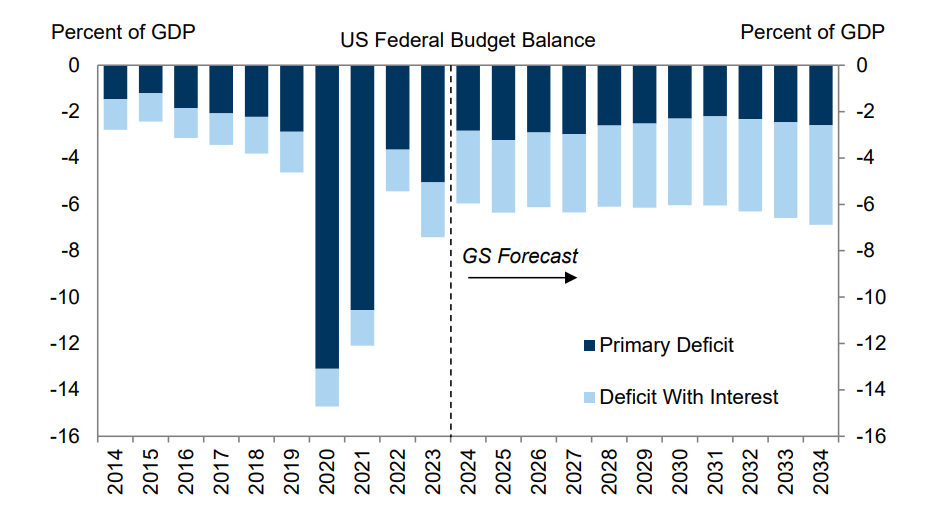

JD: The area where we think warrants a clearer perspective is the impact of the debt continually issued by the US government

Source: Apollo as of 08.02.2024

Dave: with more debt on the way to cover the deficits that are projected as far as anyone cares to look

Source: Goldman Sachs as of July 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-17.