Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

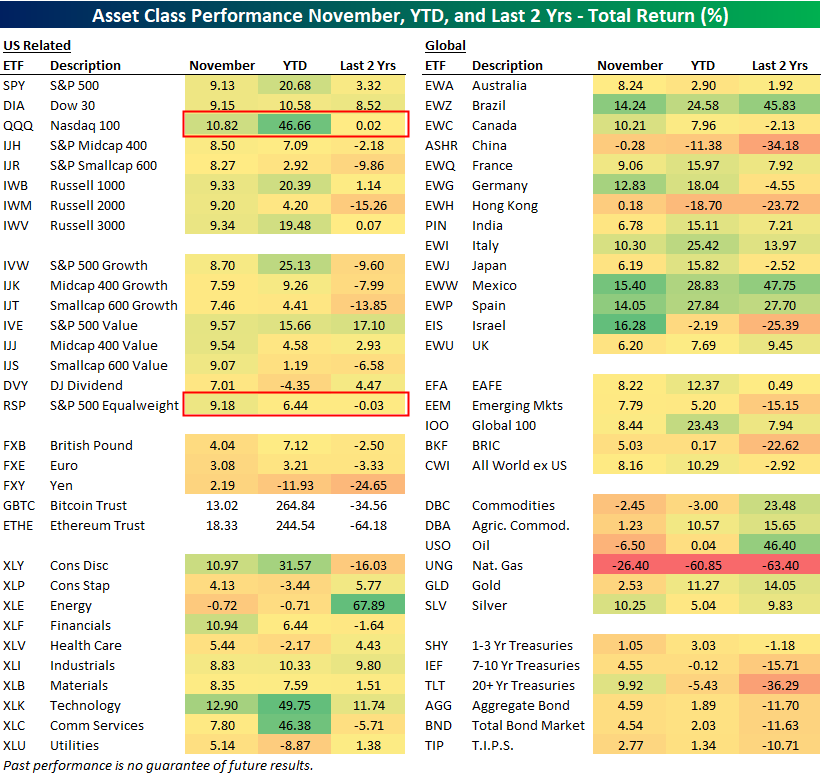

Beckham: We just completed a 2 year period where both the NASDAQ 100 and S&P 500 Equal Weight were flat. Lot of noise for no progress!

Source: Bespoke as of 11.30.2023

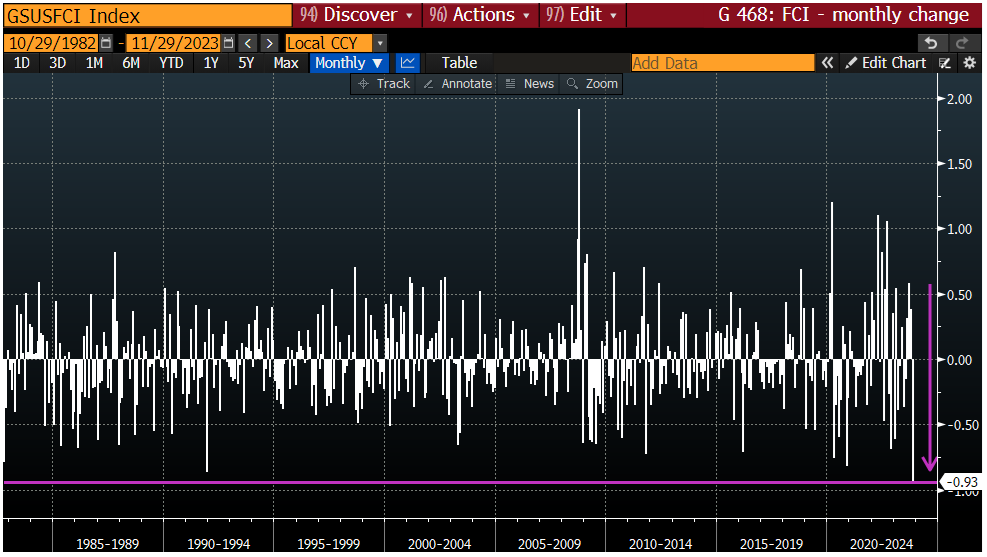

Brad: that said, November delivered the biggest monthly ease in financial conditions of the past 40 years

Source: Goldman Sachs as of 12.01.2023

Source: Goldman Sachs as of 12.01.2023

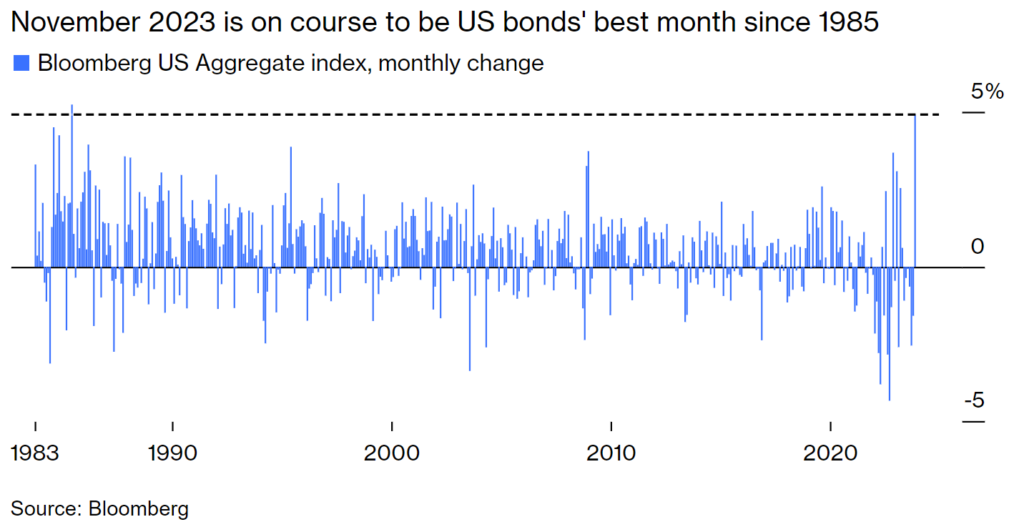

Brett: with bonds contributing a hefty portion of that easing

Data as of 11.29.2023

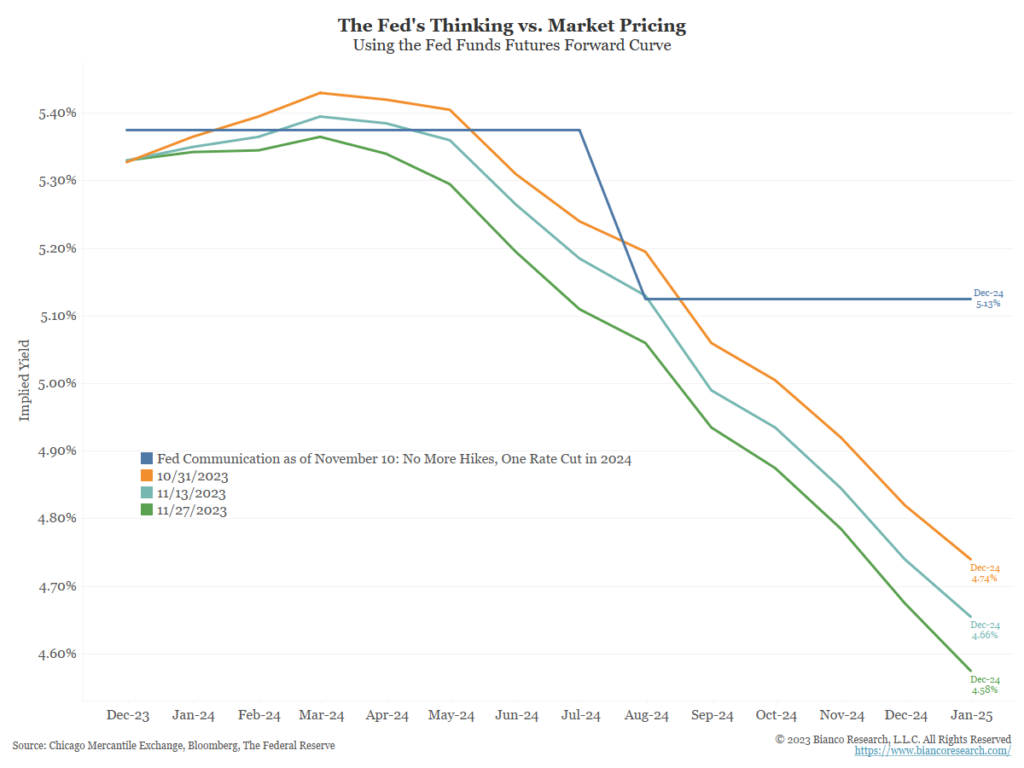

John Luke: Markets have jumped way out in front of the Fed, anticipating rate cuts in by the end of 2024

Data as of 11.27.2023

Data as of 11.27.2023

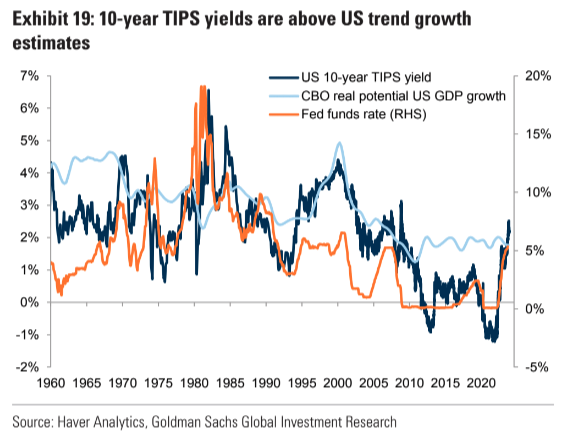

Brad: Real yields are still near the highest levels since the financial crisis

Data as of 11.25.2023

Joseph: but they’ve come off of the multi-year highs made throughout the fall

Data as of 11.28.2023

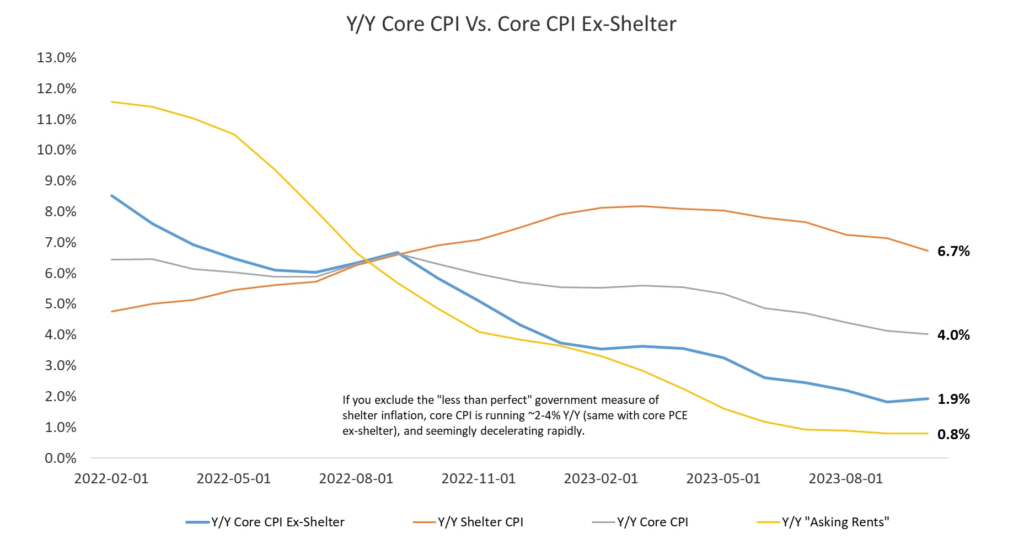

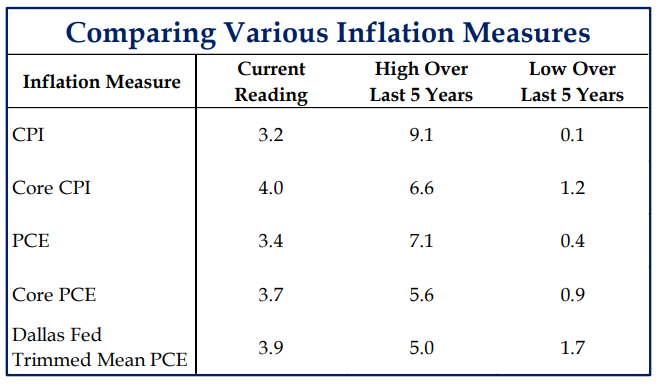

Dave: The catalyst for the November surge seems to be fresh comfort that the Fed has inflation under control

Source: Raymond James as of 11.27.2023

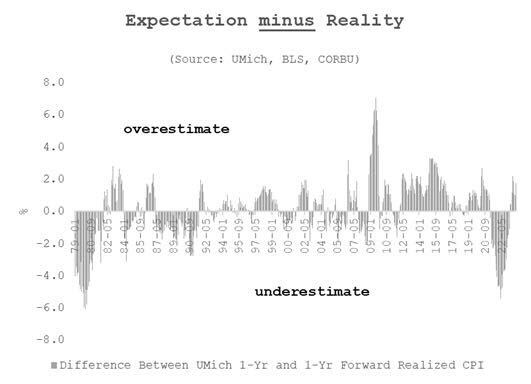

John Luke: as investors work back from an extreme period of underestimating inflation

Source: Corbu as of 11.24.2023

John Luke: though it will be interesting to see how things play out if the wide dispersion of monthly outcomes settles into something steadier

Source: Strategas as of 11.20.2023

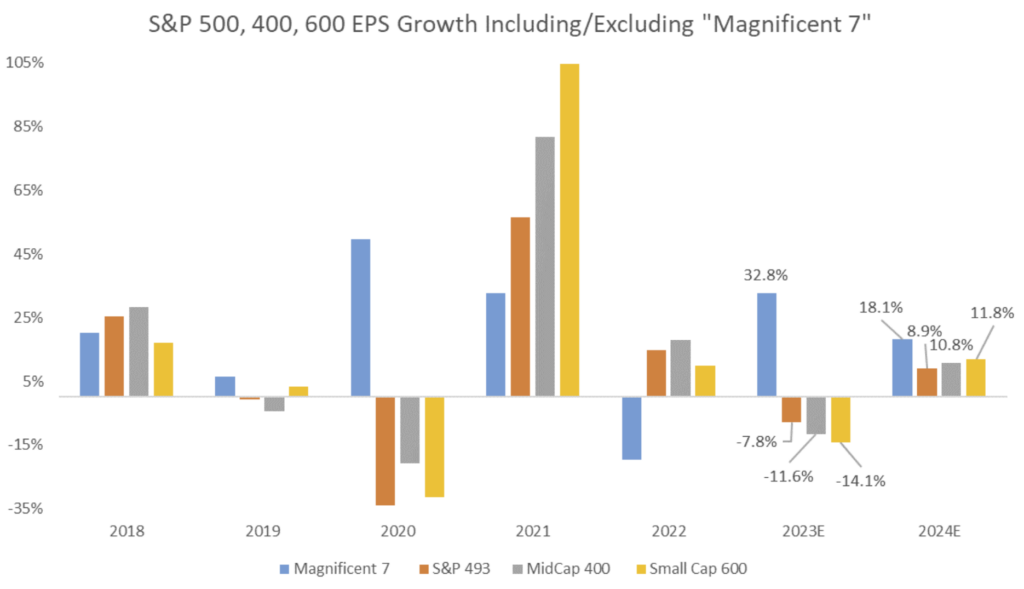

Dave: The other key piece to market outcomes is actual earnings. After major rotation between sectors and styles, markets are expecting things to converge in 2024

Source: Raymond James as of 11.24.2023

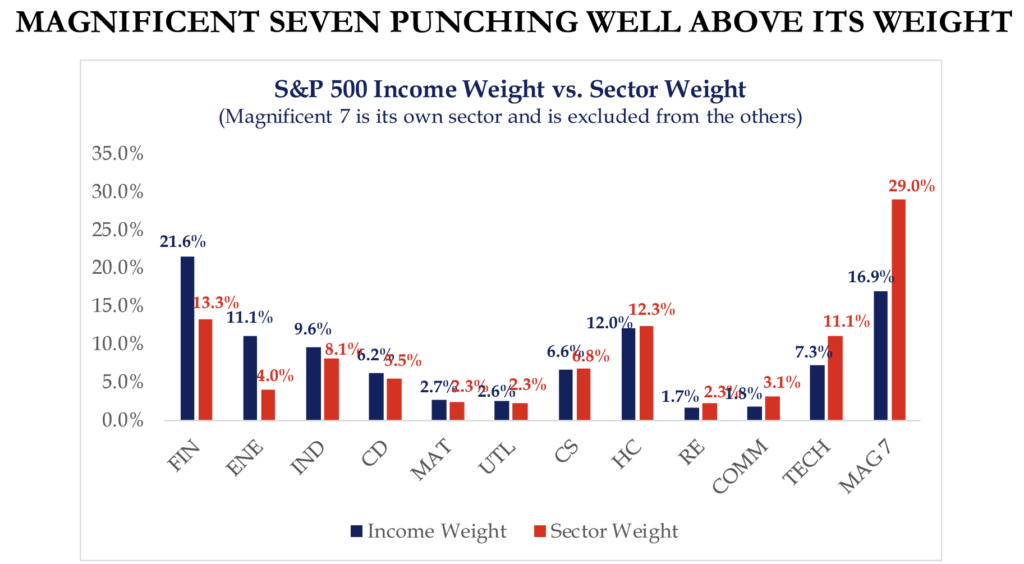

Dave: and while Mag 7 may have run well ahead of its earnings impact

Source: Strategas as of 11.27.2023

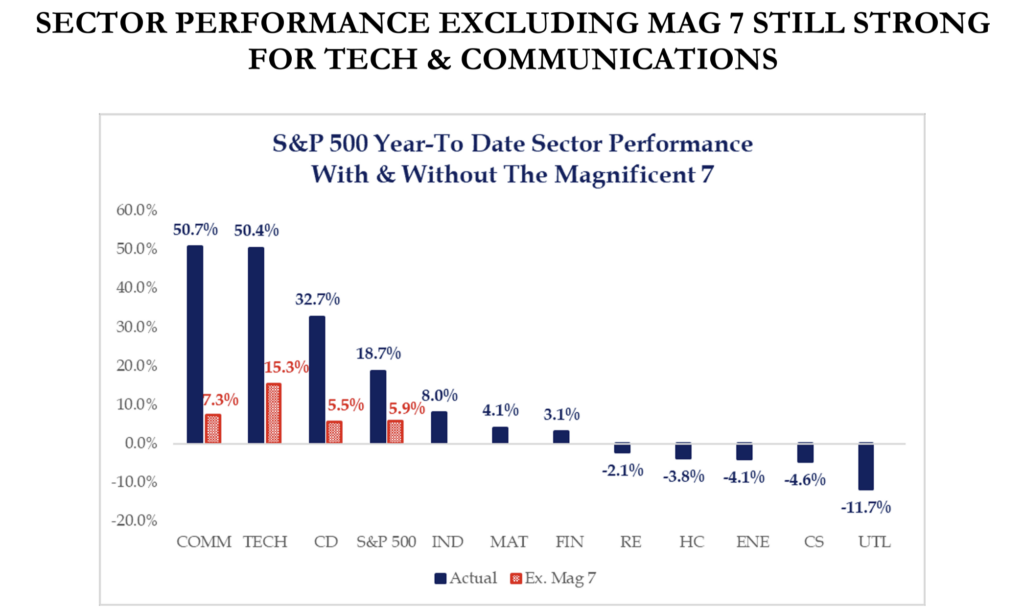

Dave: they’re part of sectors (tech/communications/consumer discretionary) that have also delivered the strongest earnings

Source: Strategas as of 11.27.2023

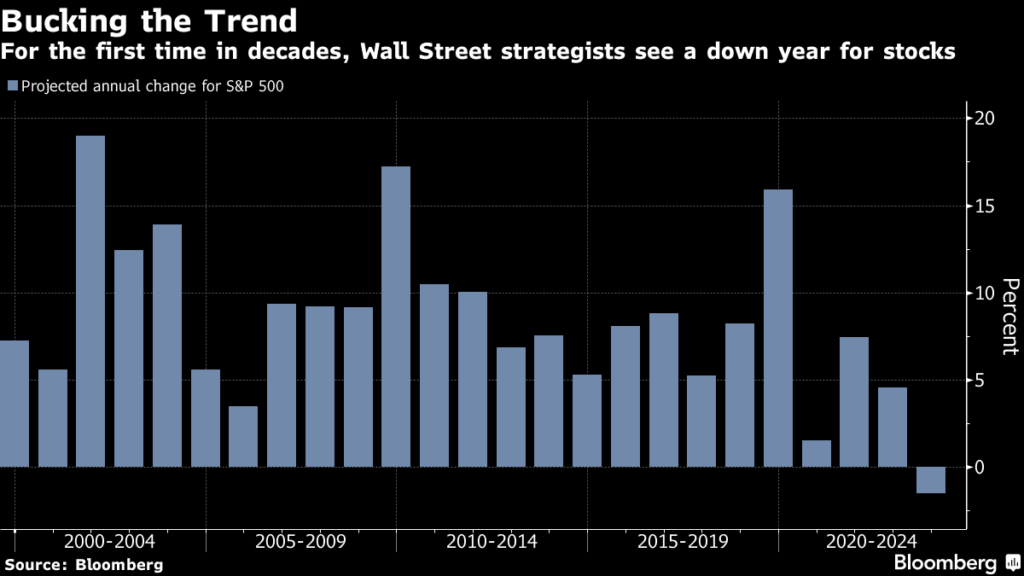

Joseph: Before we share Wall Street’s 2024 Strategist Targets, let’s revisit their 2023 forecasts

Data as of 12.07.2022

John Luke: so take these with a grain of salt

Data as of 11.27.2023

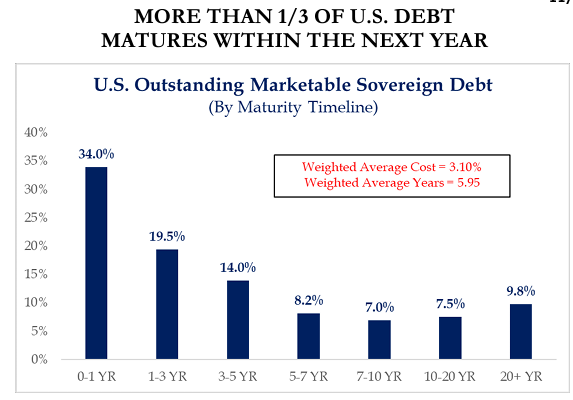

Brad: One thing to consider in the rates market is the impact of the huge US government debt maturing in the next 12 months

Source: Strategas as of 11.27.2023

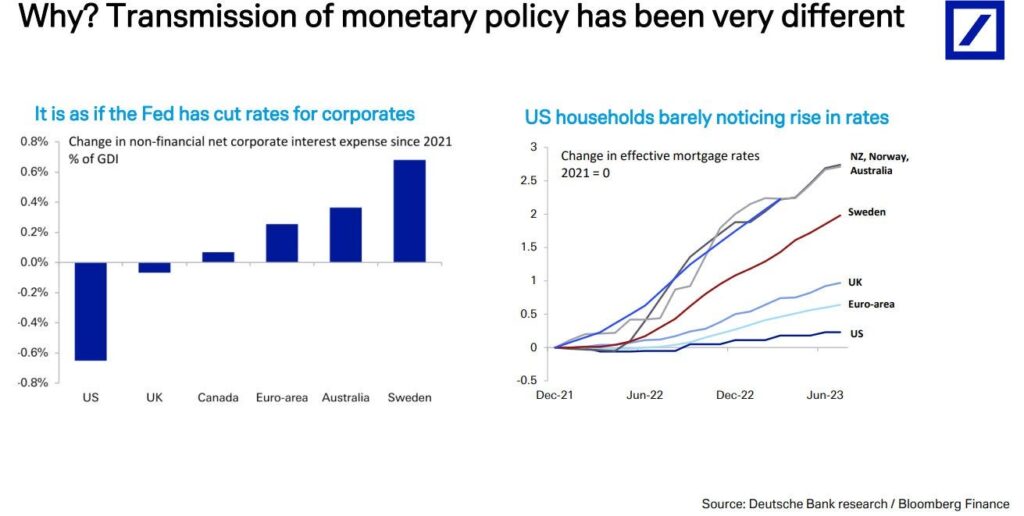

Brett: but thankfully many US corporations and consumers have been relative beneficiaries of the higher rate cycle

Data as of November 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-2.