Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

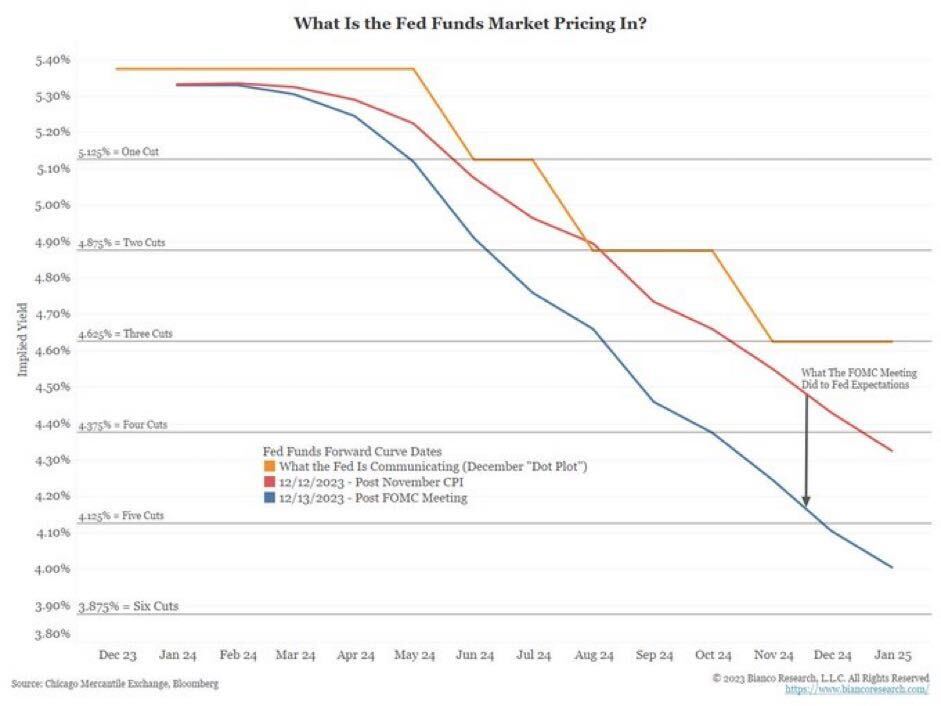

John Luke: The story of this week was the Fed, and how far out in front the market is in terms of rate cuts

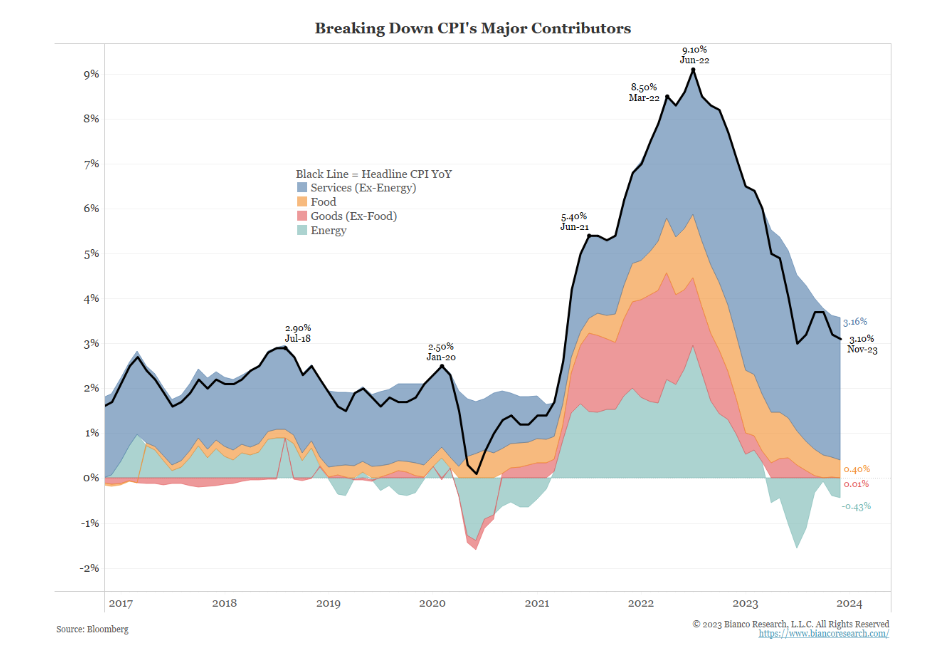

Source: Bianco as of 12.13.2023

Source: Bianco as of 12.13.2023

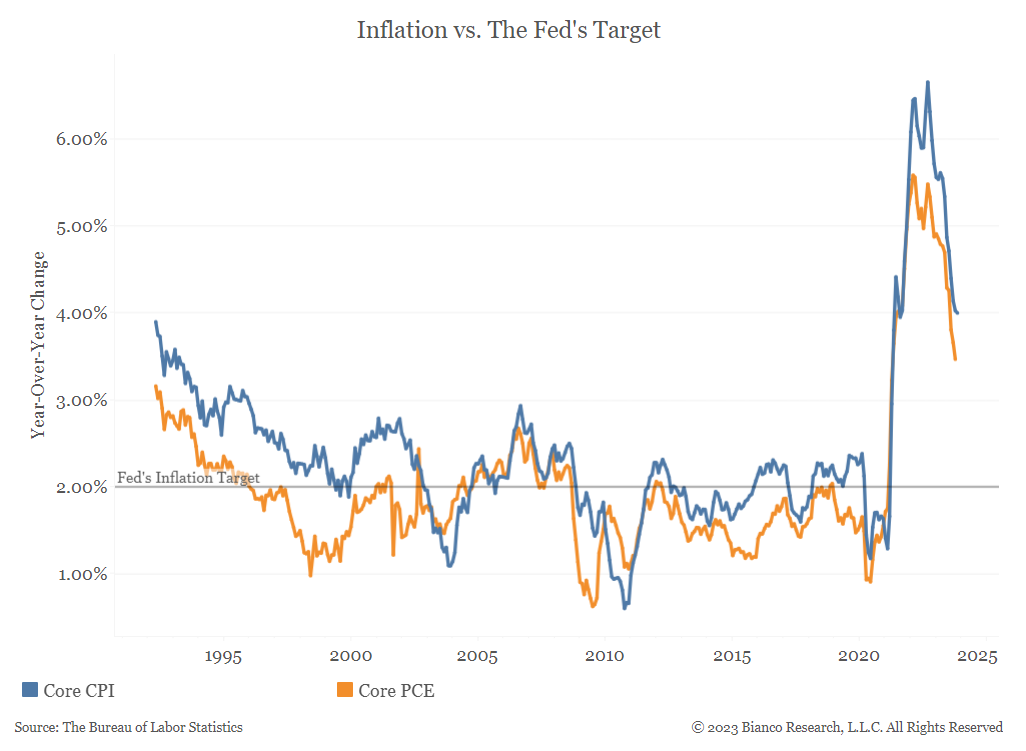

John Luke: and the market must be anticipating some immaculate disinflation to unfold in a hurry

Data as of Dec 2023

Data as of Dec 2023

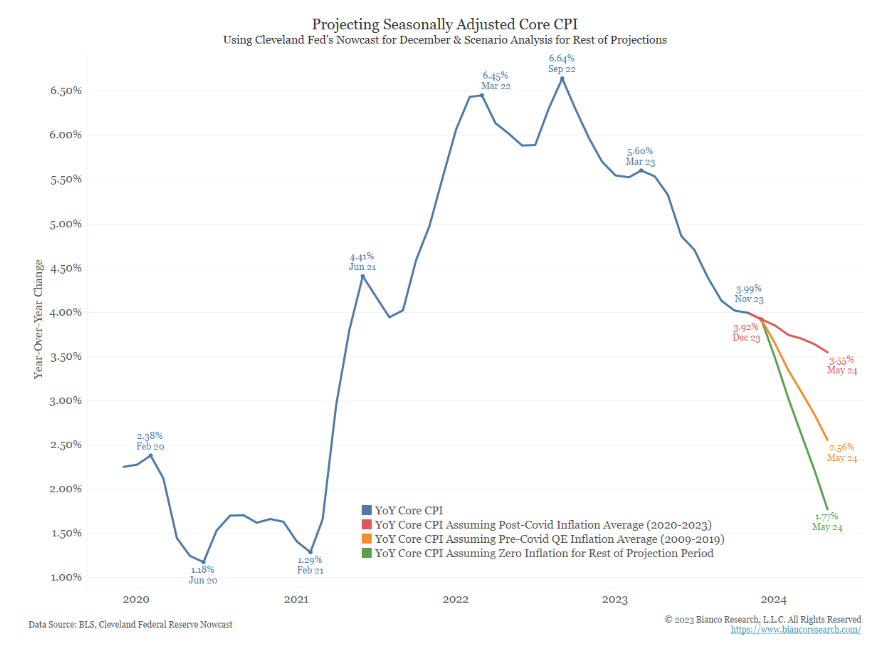

John Luke: which would require a string of 0% monthly readings to get to the stated 2% target

Data as of Dec 2023

Data as of Dec 2023

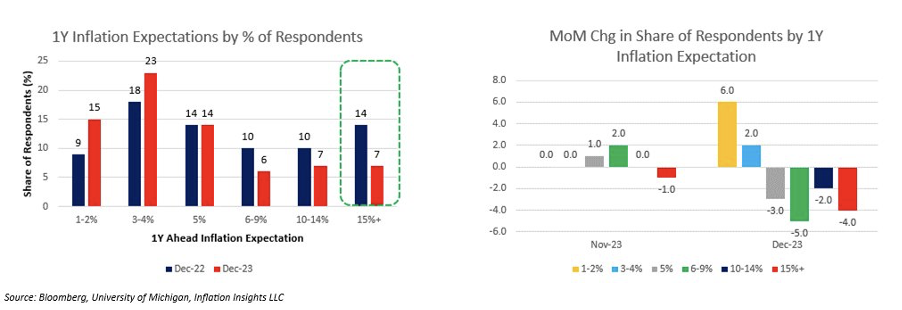

Brian: For the first time in awhile, consumer expectations for inflation are actually falling

Data as of 12.11.2023

Data as of 12.11.2023

John Luke: likely a result of gas prices pulling the “goods” piece of inflation falling back into flat range

Data as of Dec 2023

Data as of Dec 2023

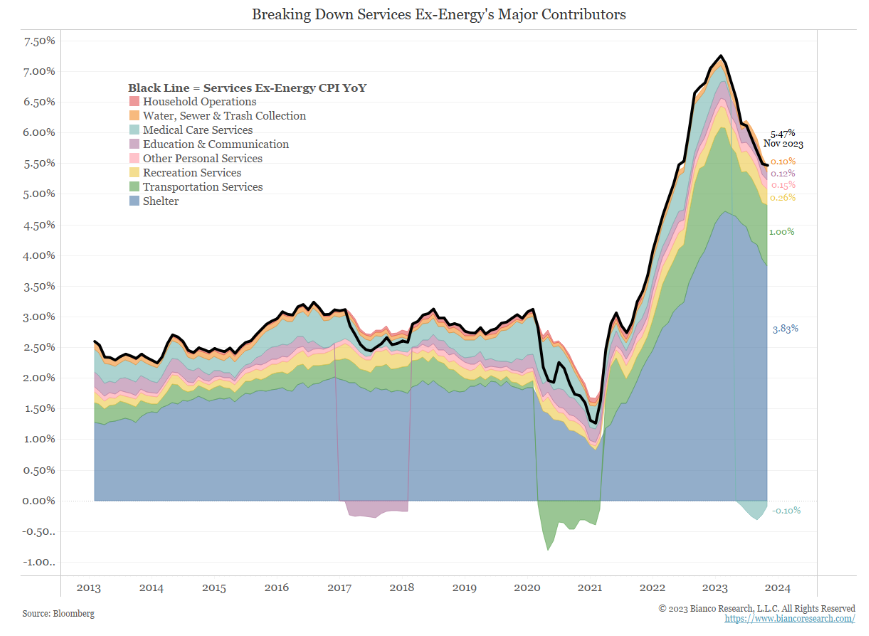

John Luke: with shelter currently the stickiest part of the inflation equation

Data as of Dec 2023

Data as of Dec 2023

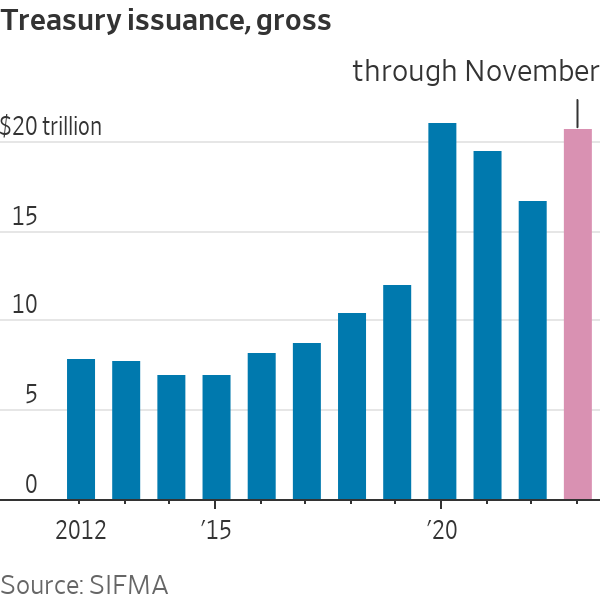

John Luke: The US Treasury Department is issuing a ton of debt to cover higher government spending

WSJ as of 12.10.2023

WSJ as of 12.10.2023

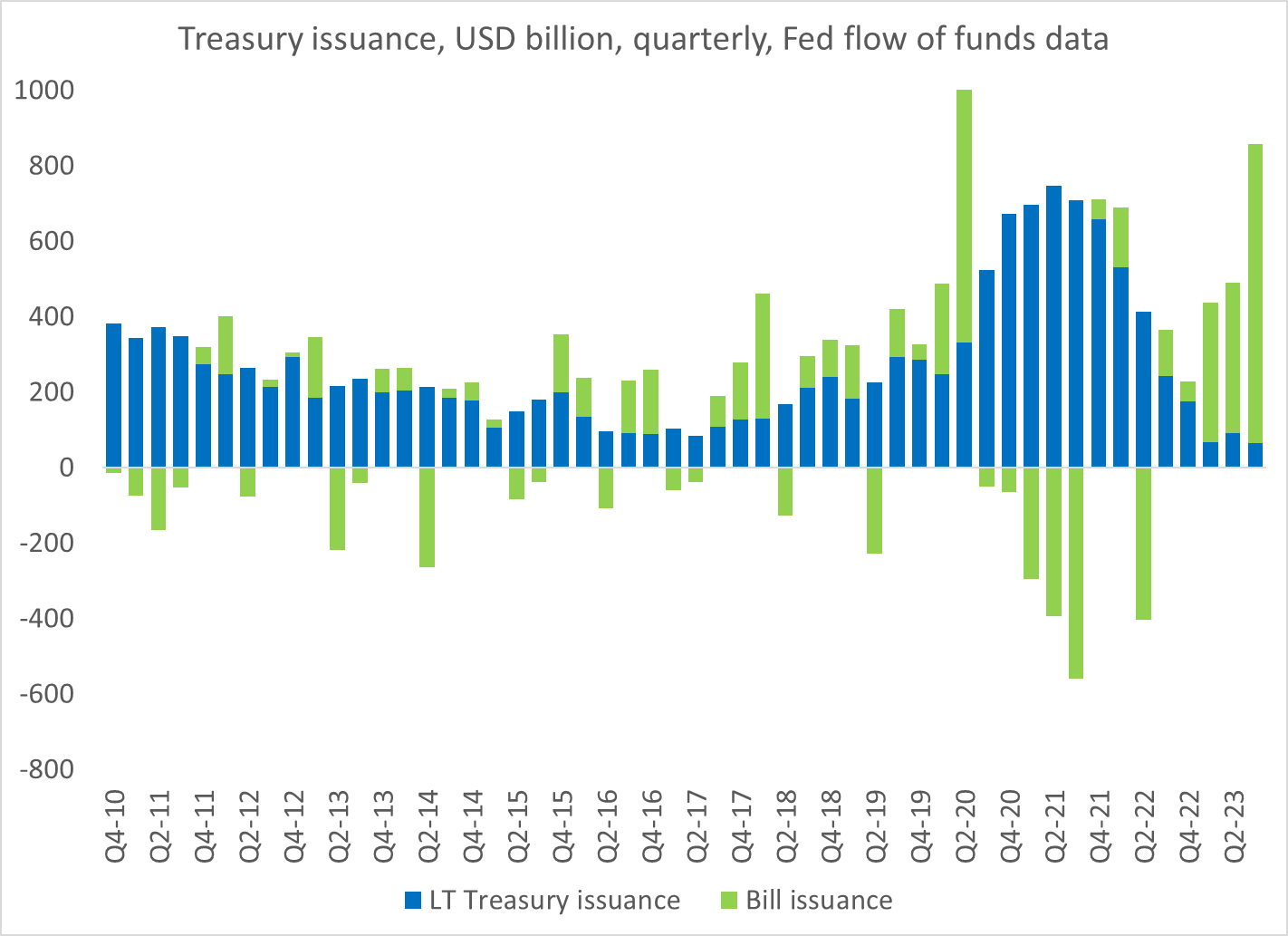

Joseph: mostly with short-term T-bills in hopes of longer-term rates falling back down

Source: @BradSetser as of Nov 2023

Source: @BradSetser as of Nov 2023

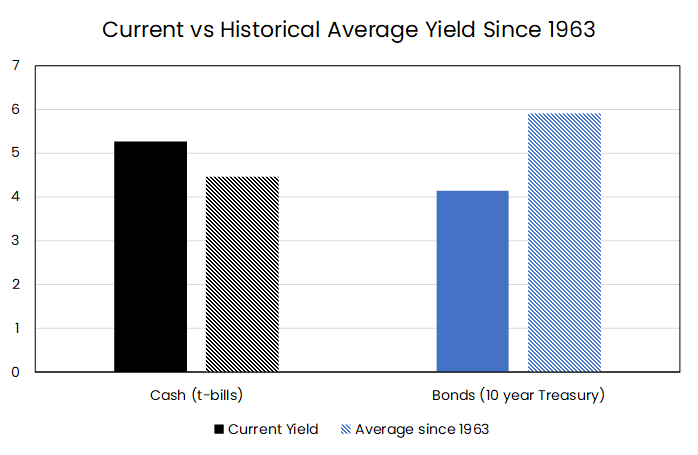

Brian: meanwhile, the inverted curve means those usually cheaper T-bills are still yielding more than longer-term bonds

Source: Aptus via FRED as of Dec 2023

Source: Aptus via FRED as of Dec 2023

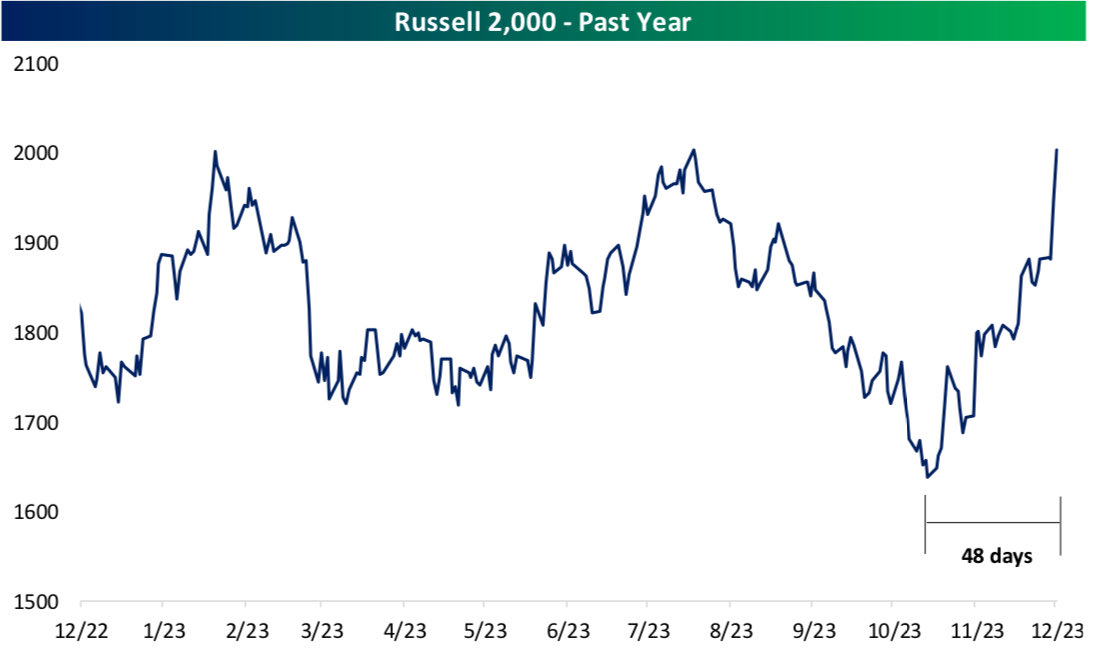

Brett: Wild turn of events, this is the fastest turn in at least 4 decades for the Russell 2000 to go from a 52-week low to a 52-wk high

Source: Bespoke as of 12.14.2023

Source: Bespoke as of 12.14.2023

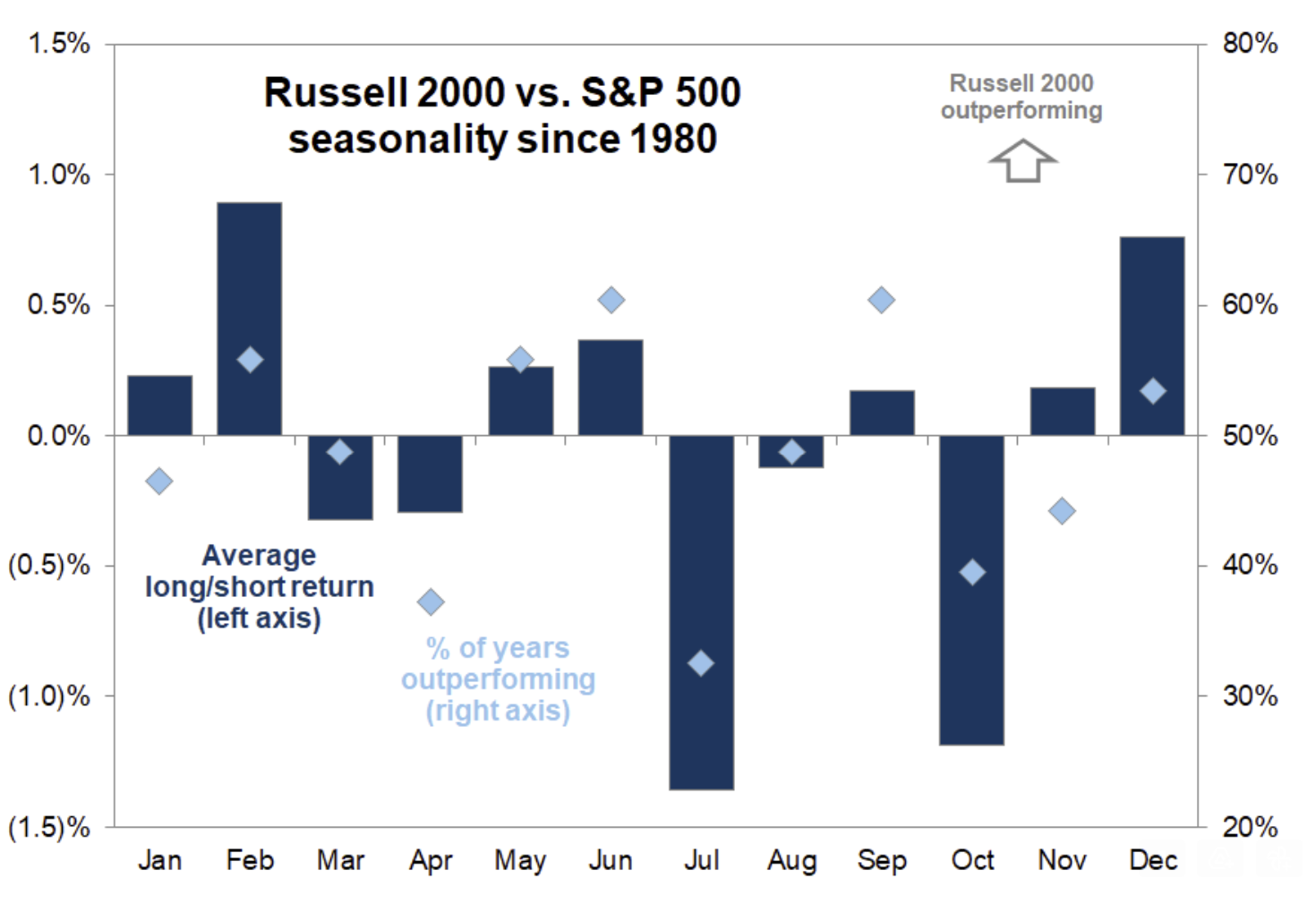

Dave: and seasonal tendencies have probably played a role in supporting the move

Source: Goldman Sachs as of 12.06.2023

Source: Goldman Sachs as of 12.06.2023

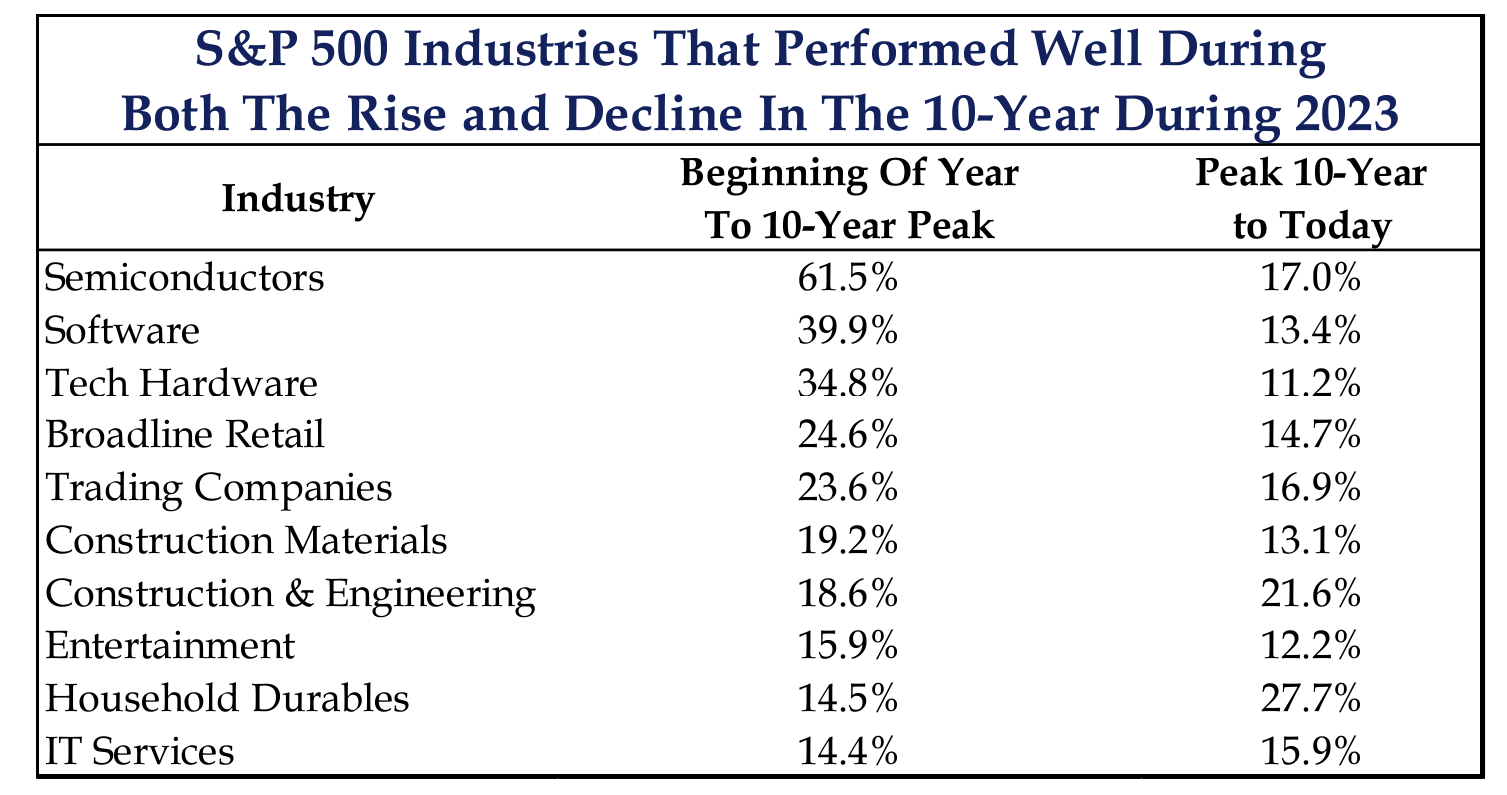

Dave: The move in rates has driven the market at times, but there are a handful of groups that have thrived no matter the rate environment

Source: Strategas as of 12.11.2023

Source: Strategas as of 12.11.2023

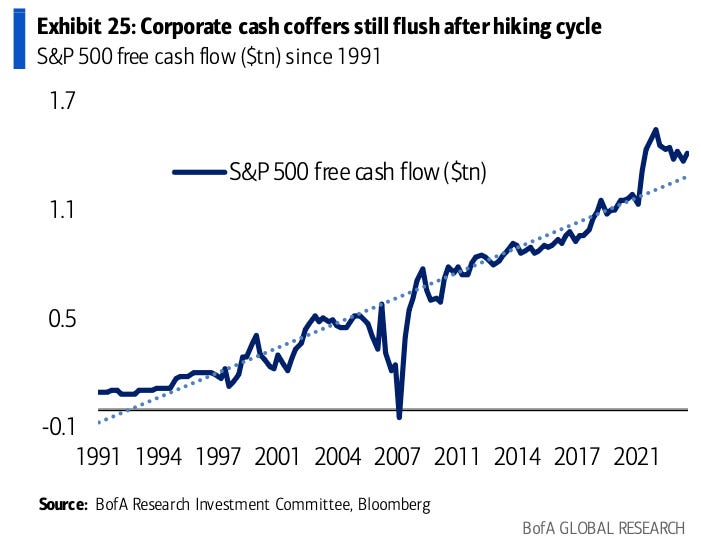

Beckham: and as a whole, S&P 500 companies are generating cash at a high rate

Data as of November 2023

Data as of November 2023

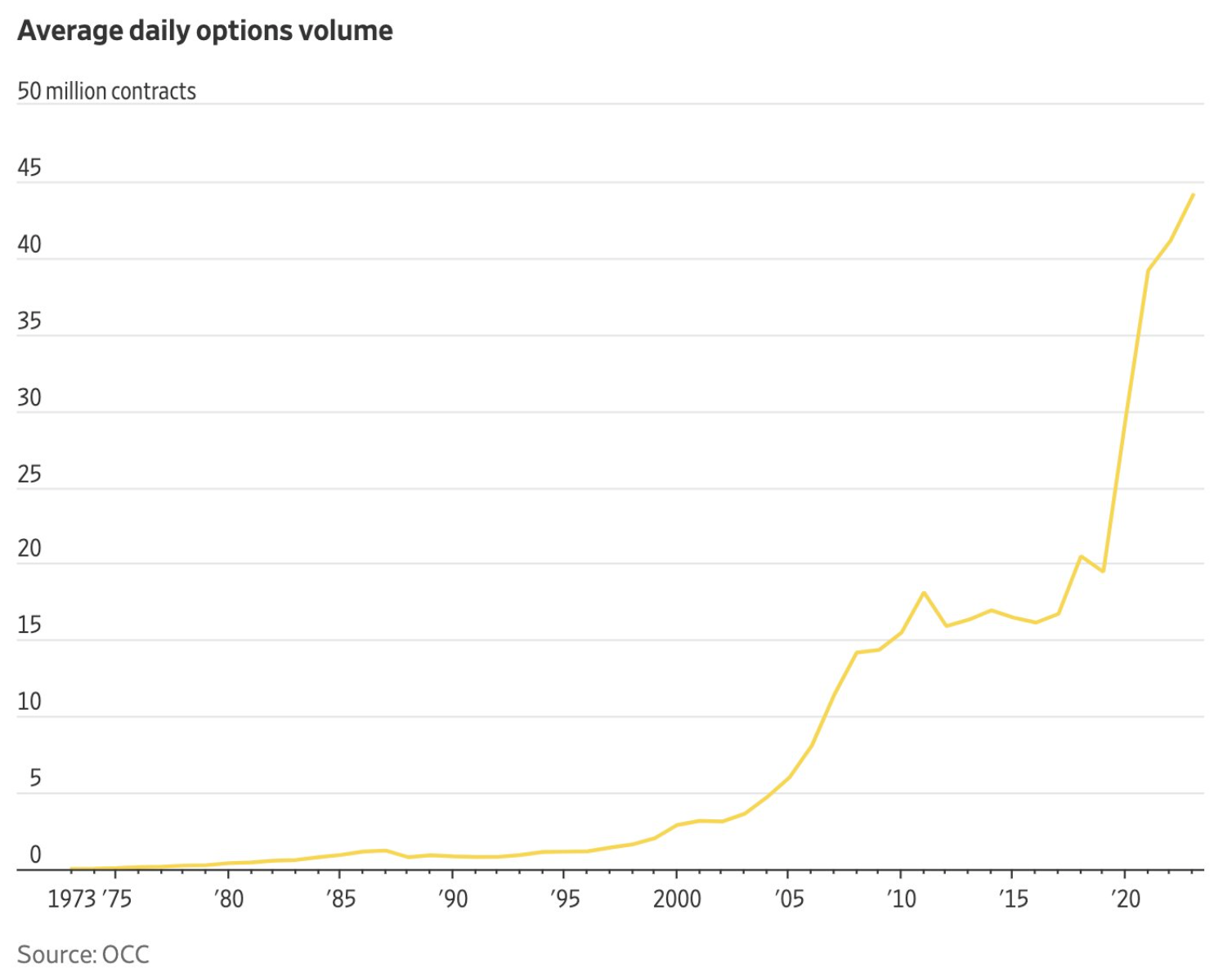

Mark: The market for options grew throughout the 2010s, but has really exploded in the past few years

Data as of November 2023

Data as of November 2023

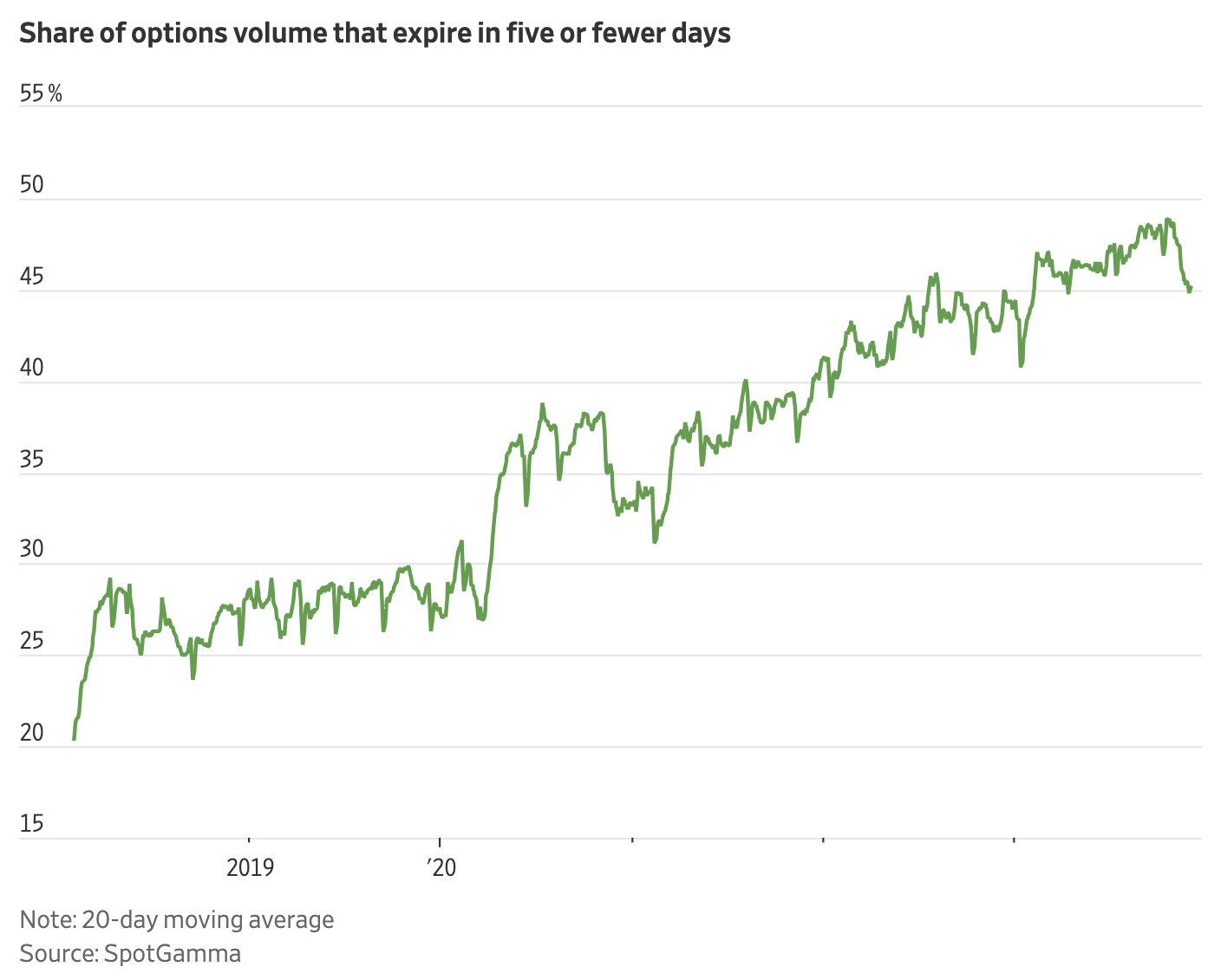

Brad: and the activity in shorter-term options has become a larger share of the growing activity

Data as of November 2023

Data as of November 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-21.