Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

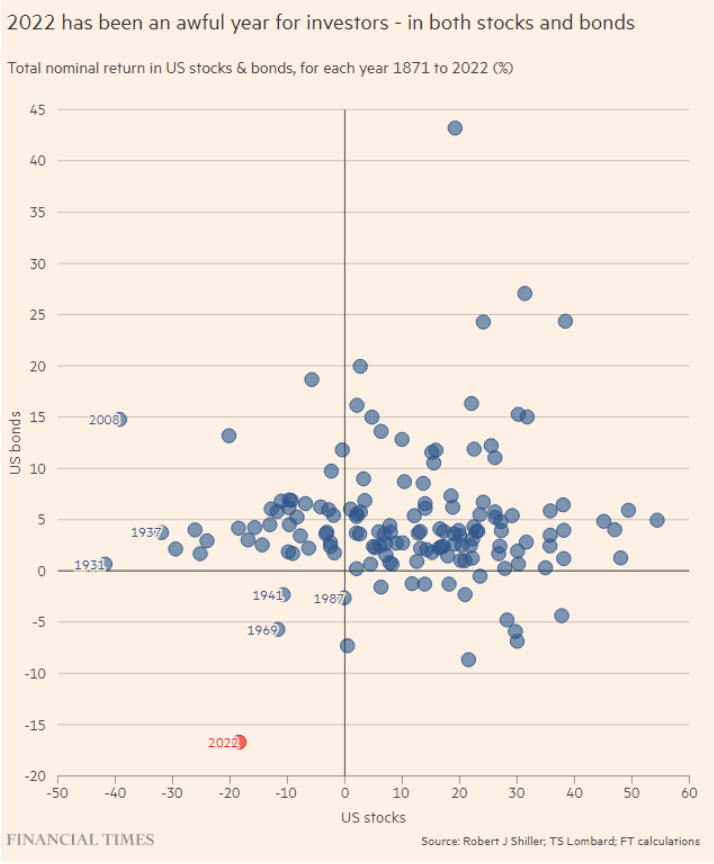

JL: This year stands alone in modern history, for its combination of stock / bond weakness

Data as of 11.30.2022

Data as of 11.30.2022

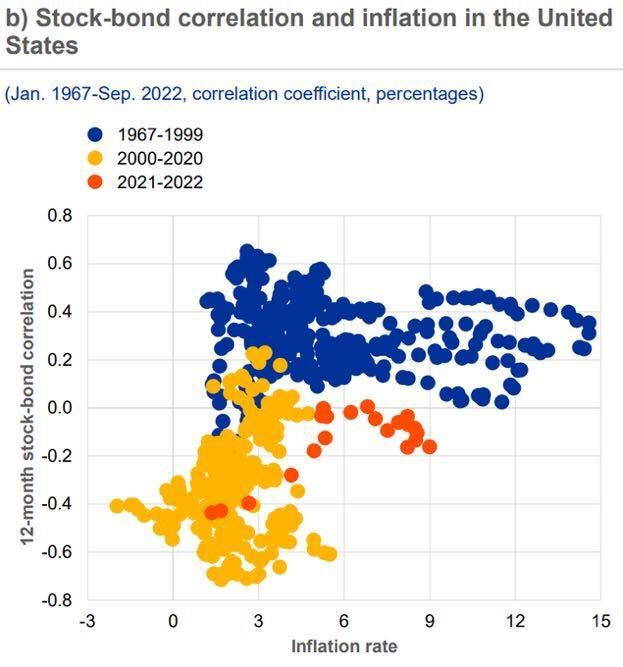

JL: with the negative correlation in recent ultra-low inflation years now returning to more typical patterns

Source: The Fed Guy as of 11.30.2022

Source: The Fed Guy as of 11.30.2022

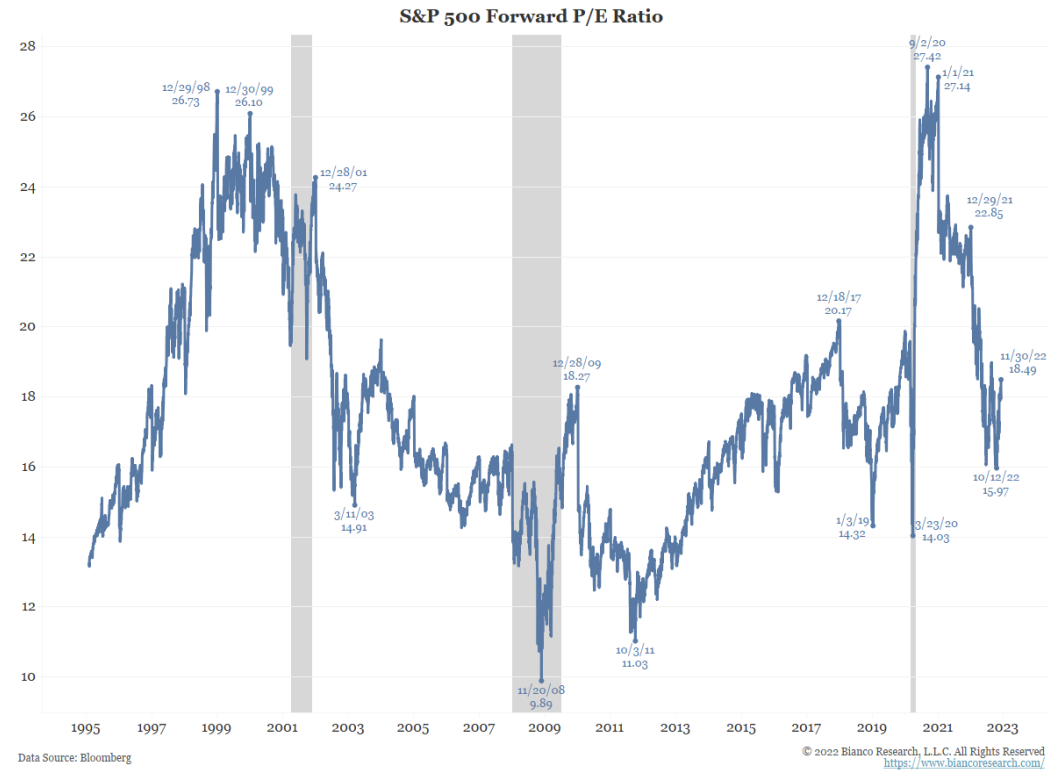

JL: Valuations have come down from extreme readings

Source: Bianco as of 11.30.2022

Source: Bianco as of 11.30.2022

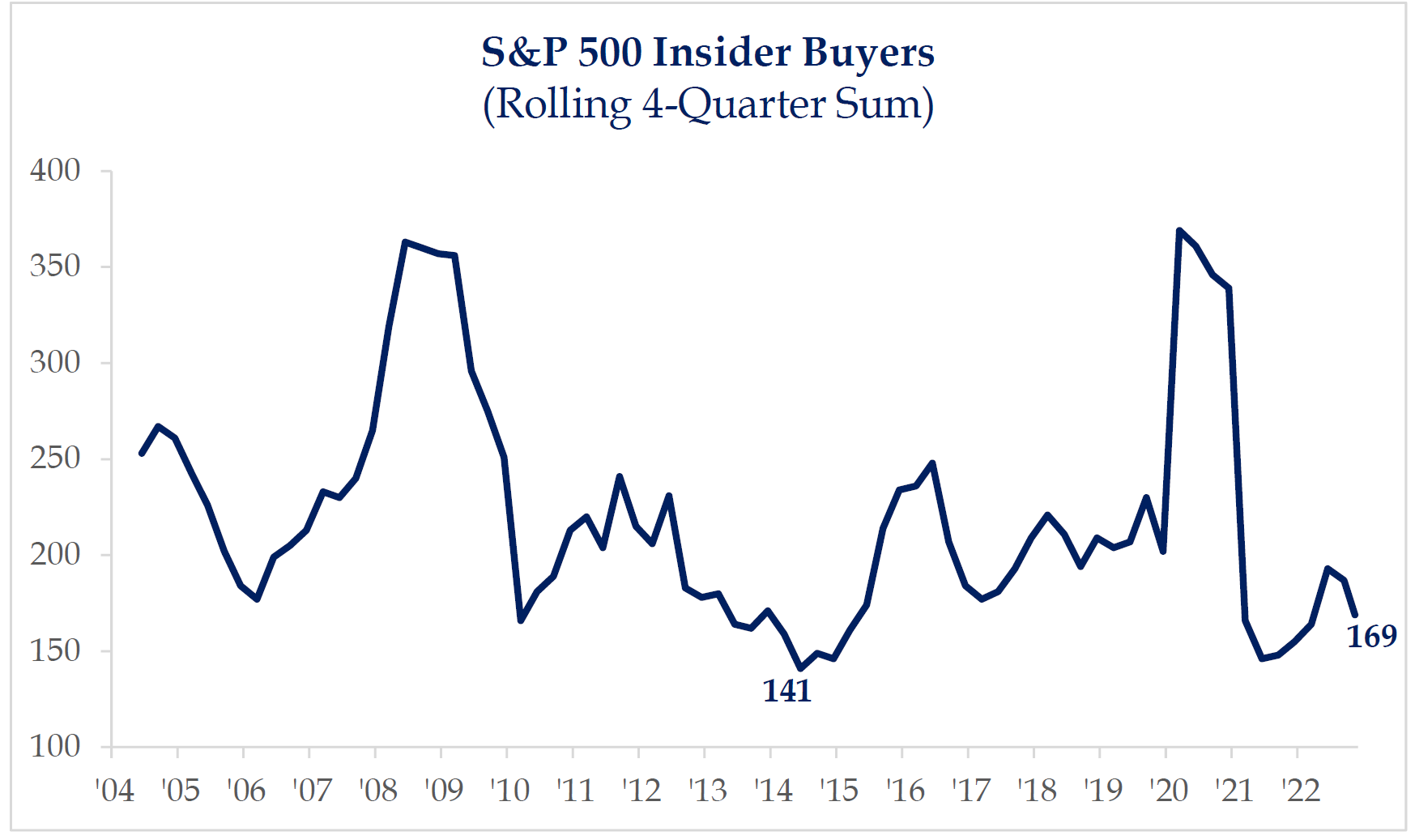

Dave: but apparently not enough to motivate insiders to step up their buying

Source: Strategas as of 11.30.2022

Source: Strategas as of 11.30.2022

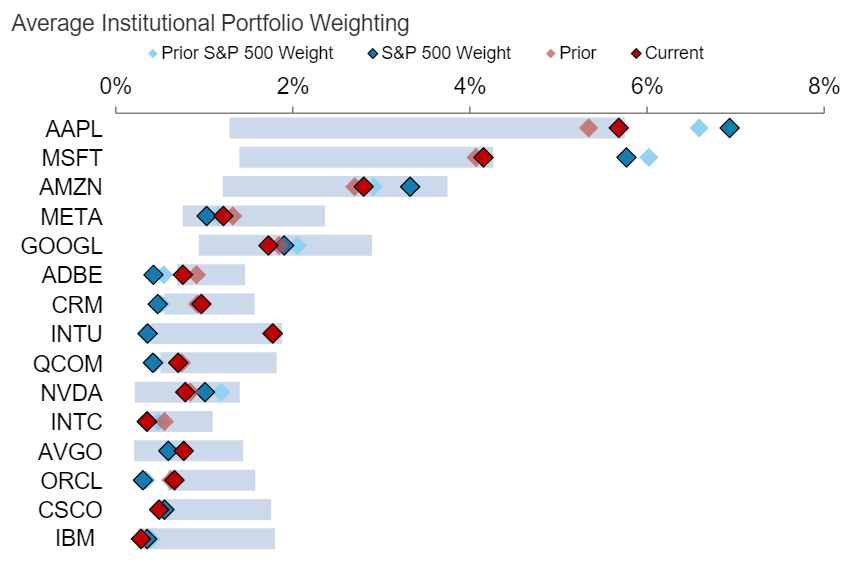

Dave: It may feel like every fund is loaded with megacap tech, but institutions as a whole are holding them at less than index weights

Source: Morgan Stanley as of 11.28.2022

Source: Morgan Stanley as of 11.28.2022

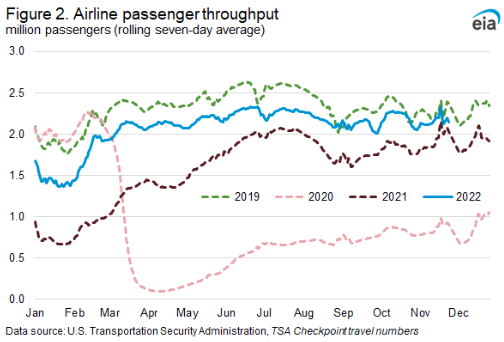

Joseph: Airline passenger load has just about caught up to pre-pandemic levels. Interesting caveat, jet fuel usage is still 12% lower, meaning flights are more packed

Data as of 12.01.2022

Data as of 12.01.2022

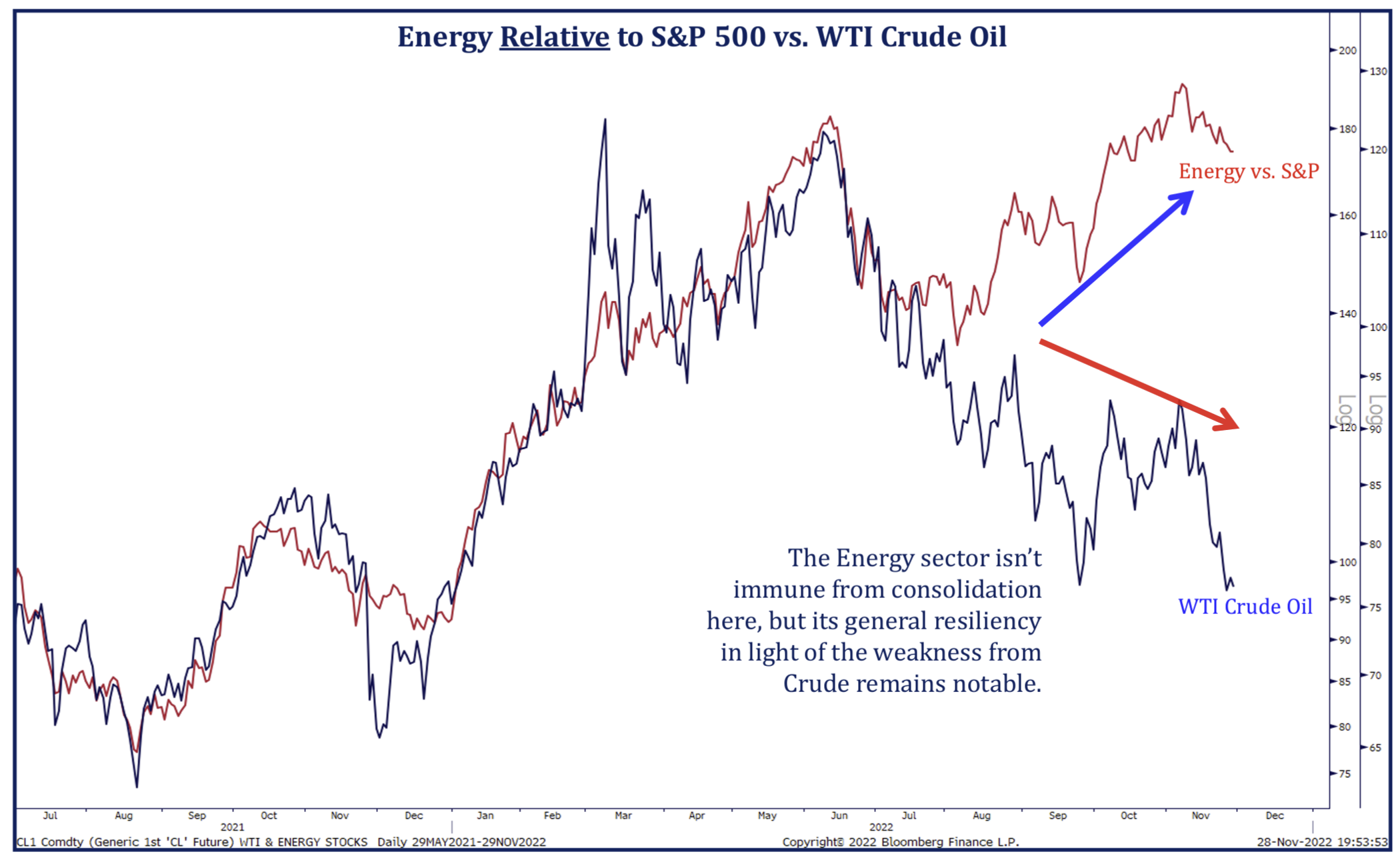

Dave: In another energy-related divergence, energy stocks have raced far ahead of gains in crude oil prices

Source: Strategas as of 11.28

Source: Strategas as of 11.28

Dave: Between low valuations and the inflation backdrop, small cap investors would love to see a repeat of 1970s behavior

Source: Bank of America 11.30.2022

Source: Bank of America 11.30.2022

Brad: and other places to consider, if the recently weakened dollar trend persists into 2023

Source: Strategas as of 12.01.2022

Source: Strategas as of 12.01.2022

Dave: We all know the Dow Jones Industrial Average has its quirks as a 30-stock price-weighted index. This year’s quirk is massive outperformance.

Source: Strategas as of 11.30.22

Source: Strategas as of 11.30.22

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. According to our Annual Survey of Assets, an estimated USD 15.6 trillion is indexed or benchmarked to the index, with indexed assets comprising approximately USD 7.1 trillion of this total (as of Dec. 31, 2021). The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2212-3.