Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

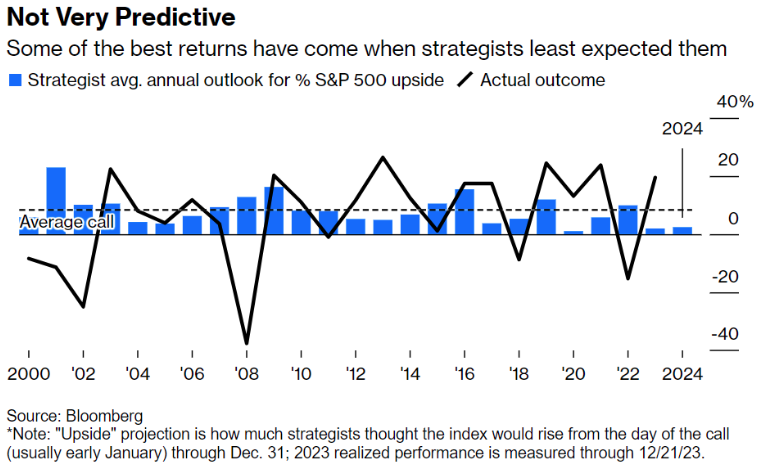

Joseph: Like last year, Wall Street strategist targets are quite conservative for 2024

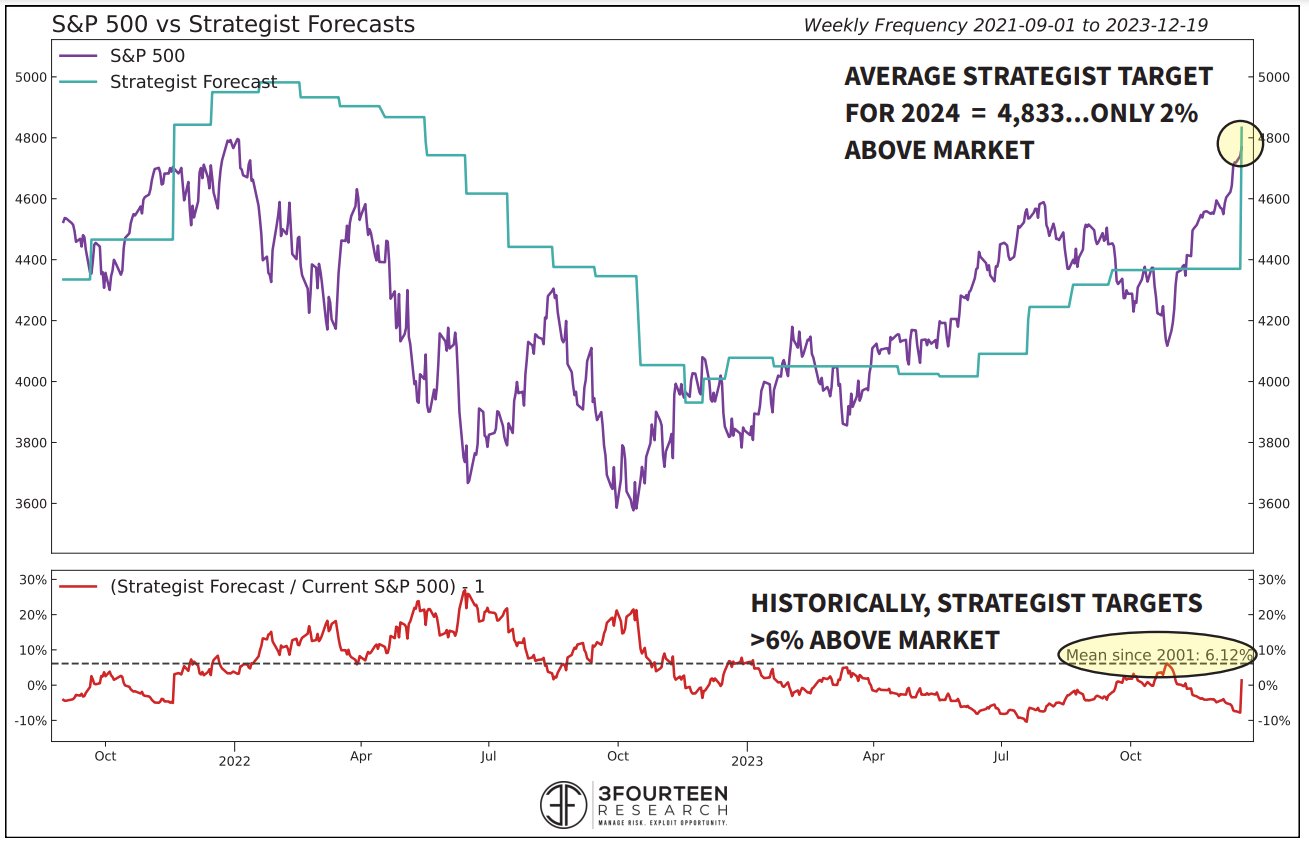

Brett: and in the past few years they just seem to tag along with wherever prices currently stand

Source: @WarrenPies as of 12.27.2023

Source: @WarrenPies as of 12.27.2023

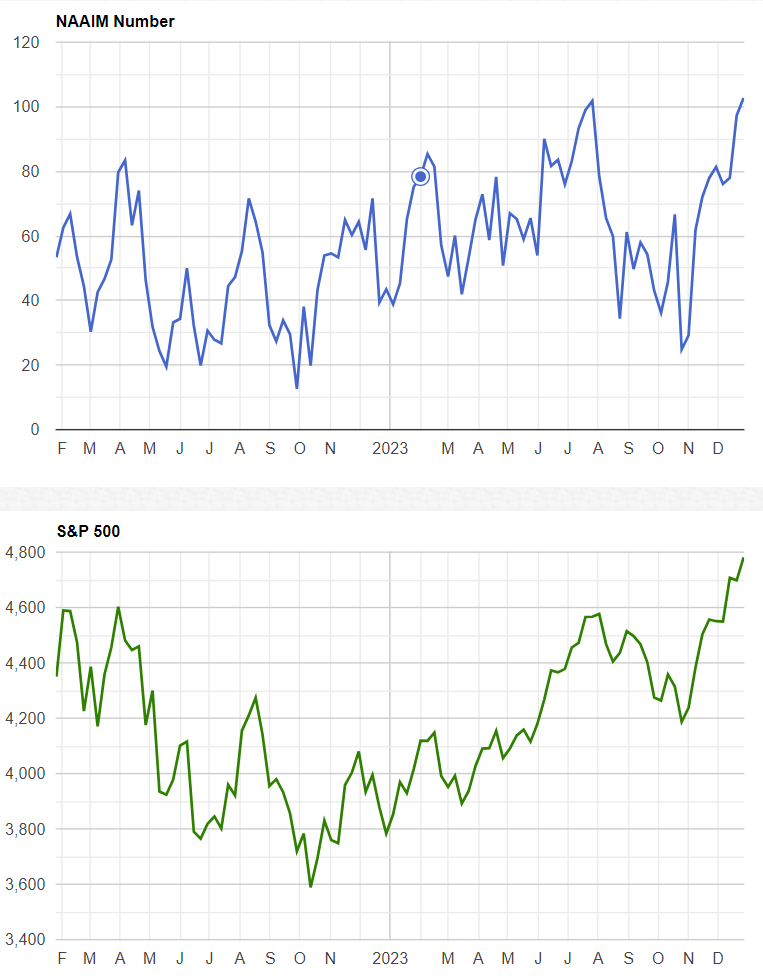

Beckham: confirmed by the wider population of active investment managers who seem to also just follow price

Source: National Association of Active Investment Managers as of 12.27.2023

Source: National Association of Active Investment Managers as of 12.27.2023

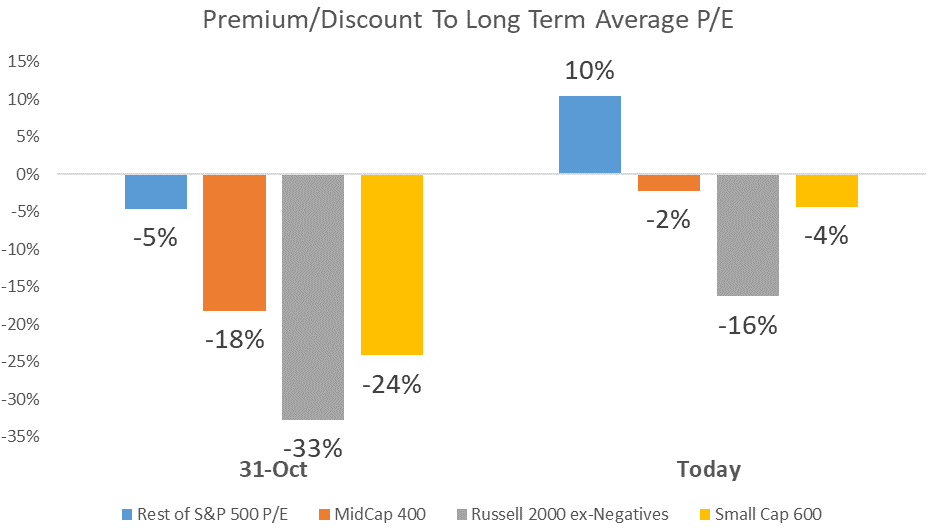

Joseph: In just a few weeks, the huge discount for small-cap equity valuations has shrunk to almost normal levels

Source: Raymond James as of 12.27.2023

Source: Raymond James as of 12.27.2023

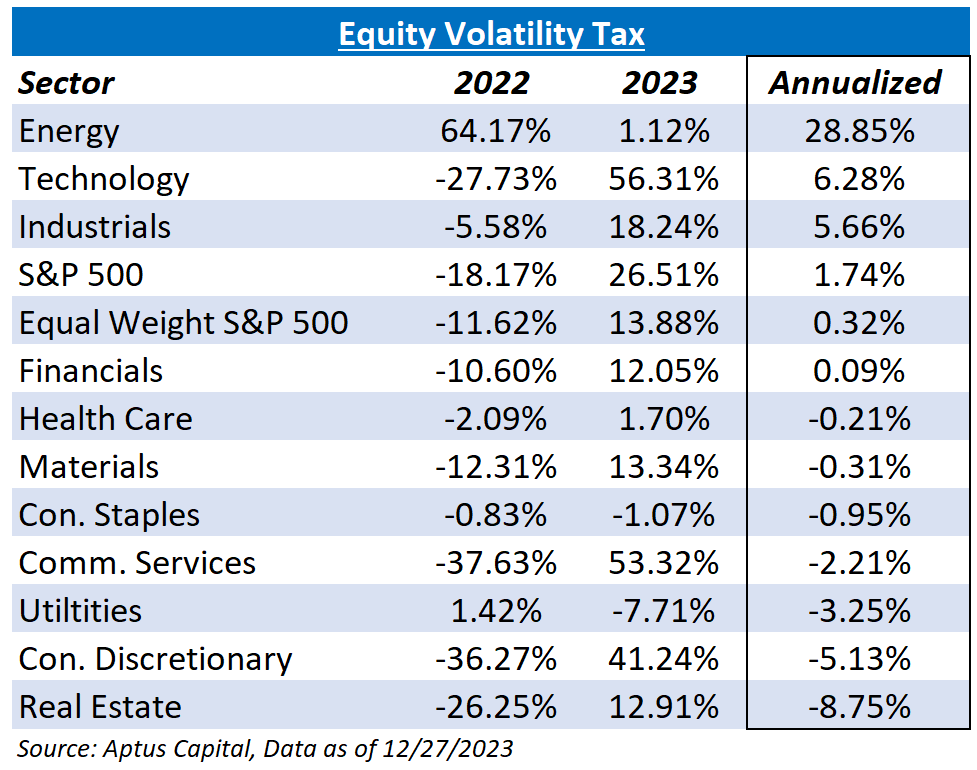

Dave: but the impact of this volatility is a major drag on compounded returns

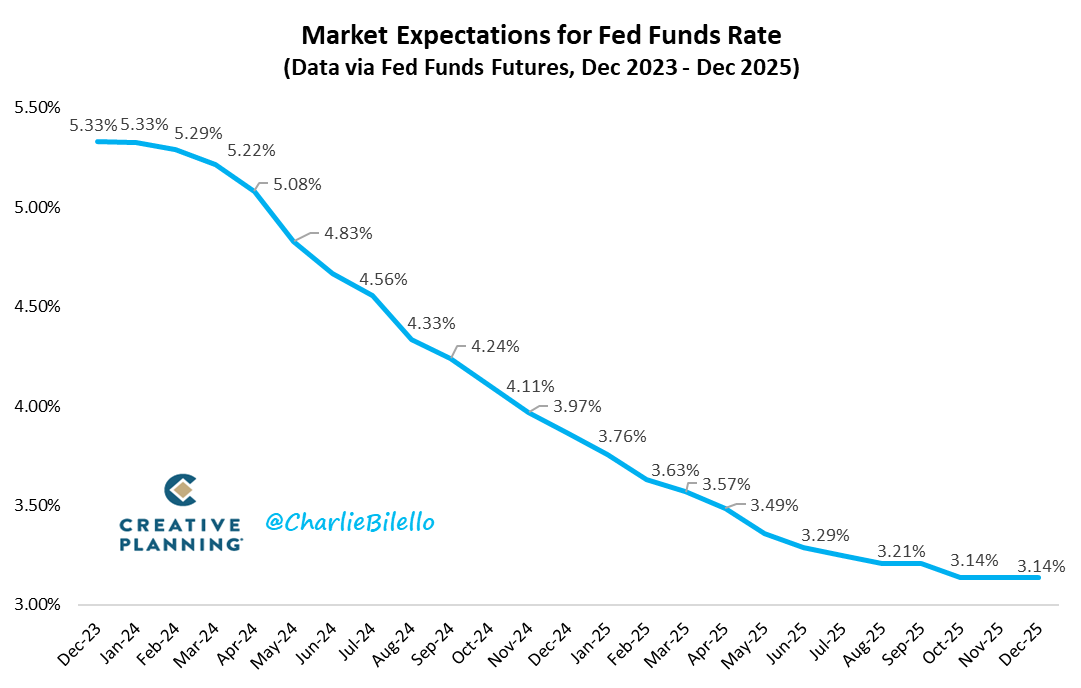

John Luke: Rate cut expectations for 2024 seem to have raced far ahead of reality

Data as of 12.27.2023

Data as of 12.27.2023

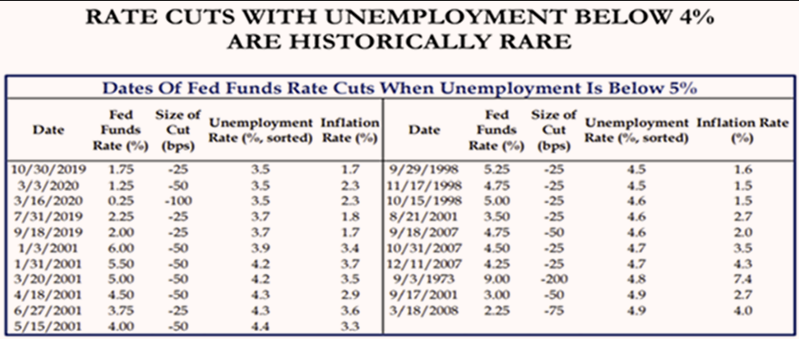

Dave: especially without a decent spike in unemployment

Source: Strategas as of 12.26.2023

Source: Strategas as of 12.26.2023

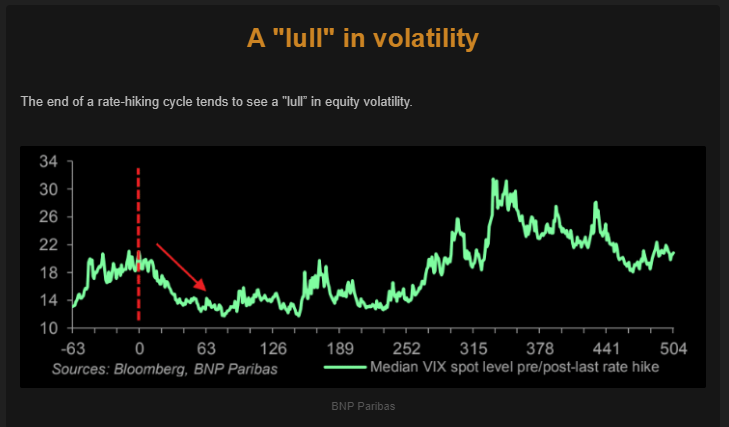

John Luke: and while rate cuts seem fun, history says that eventually market volatility makes a comeback

Source: The Market Ear as of 12.26.2023

Source: The Market Ear as of 12.26.2023

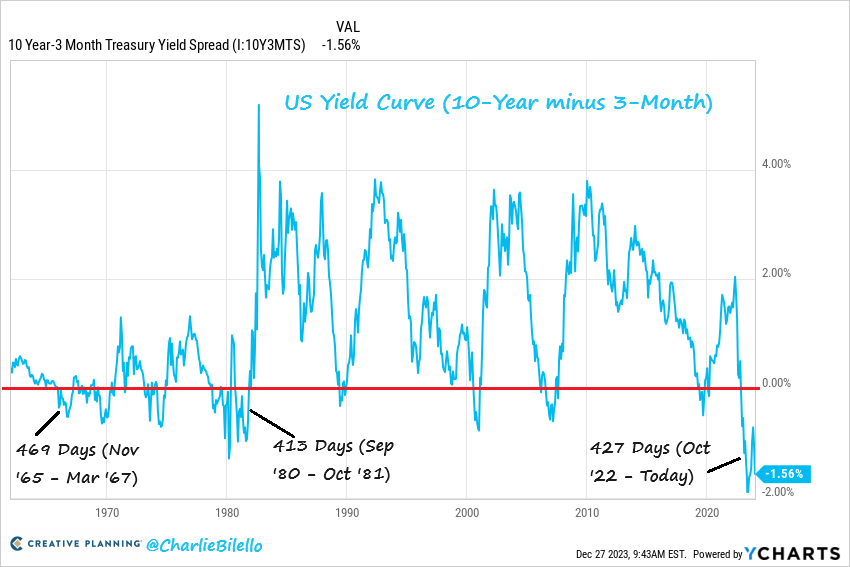

John Luke: Yield curve inversions have historically been a reliable precursor to recessions, and this is no quick inversion

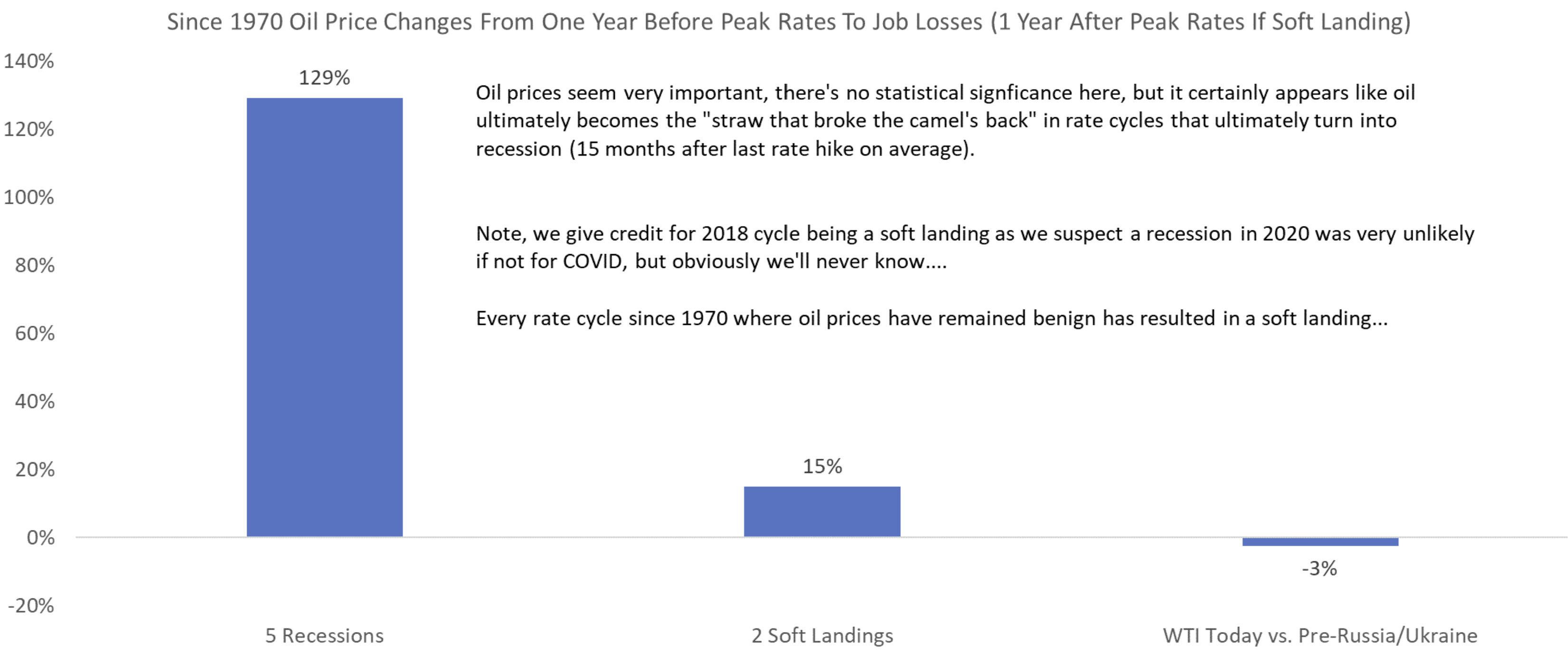

Dave: but don’t sleep on the price of oil as a distinguishing factor for recessions vs. soft landings

Source: Raymond James as of 12.27.2023

Source: Raymond James as of 12.27.2023

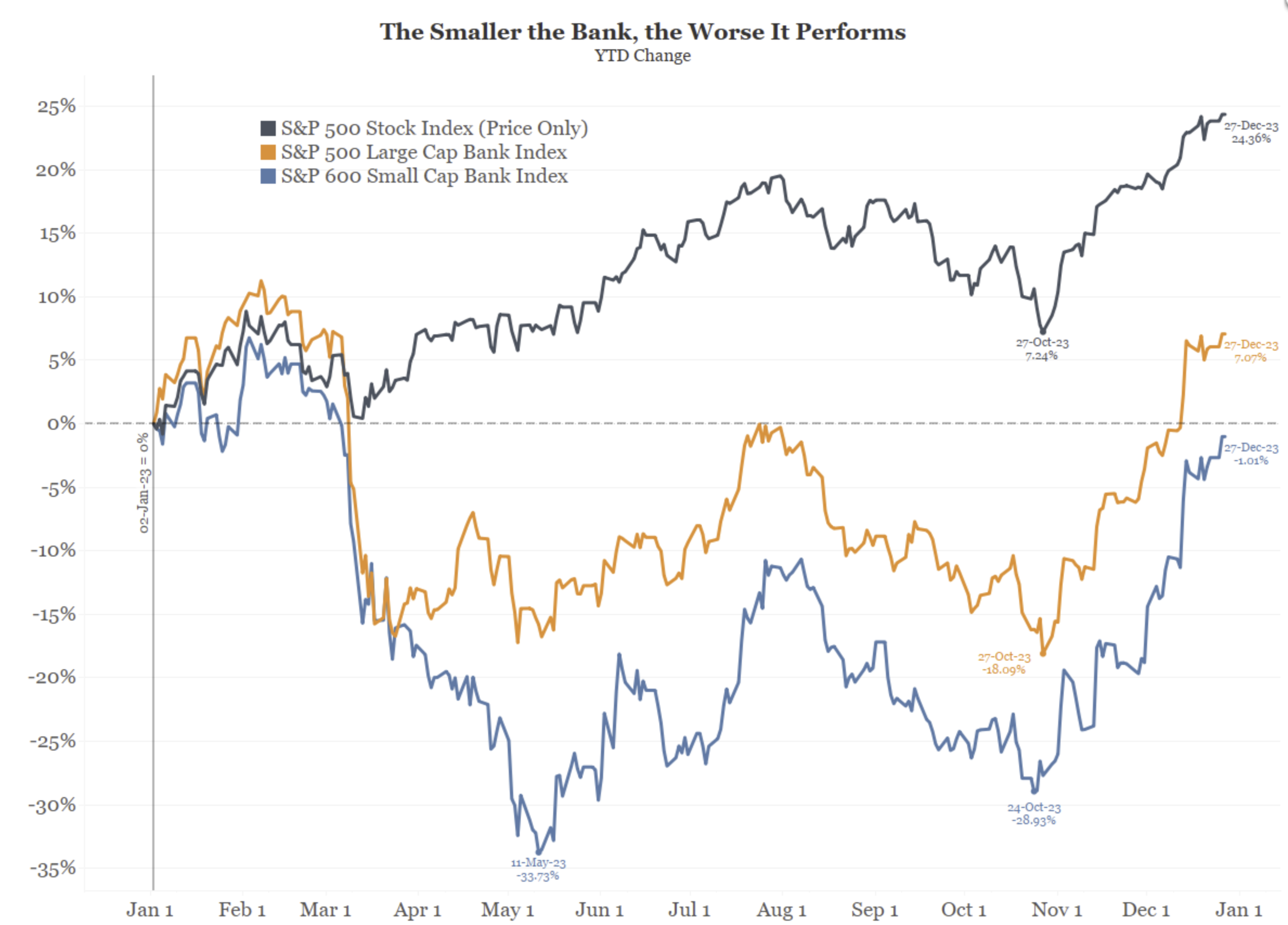

Dave: Small banks have been particularly weak performers this year

Source: Bianco as of 12.26.2023

Source: Bianco as of 12.26.2023

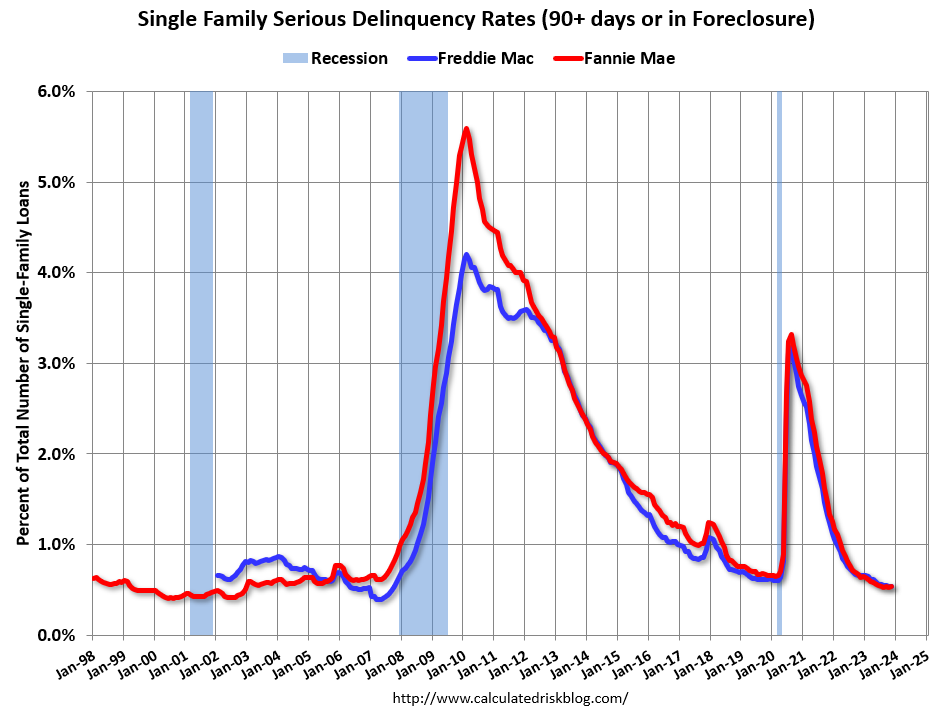

Brad: and would seem to be a large distinction between those lending for single-family

Data as of December 2023

Data as of December 2023

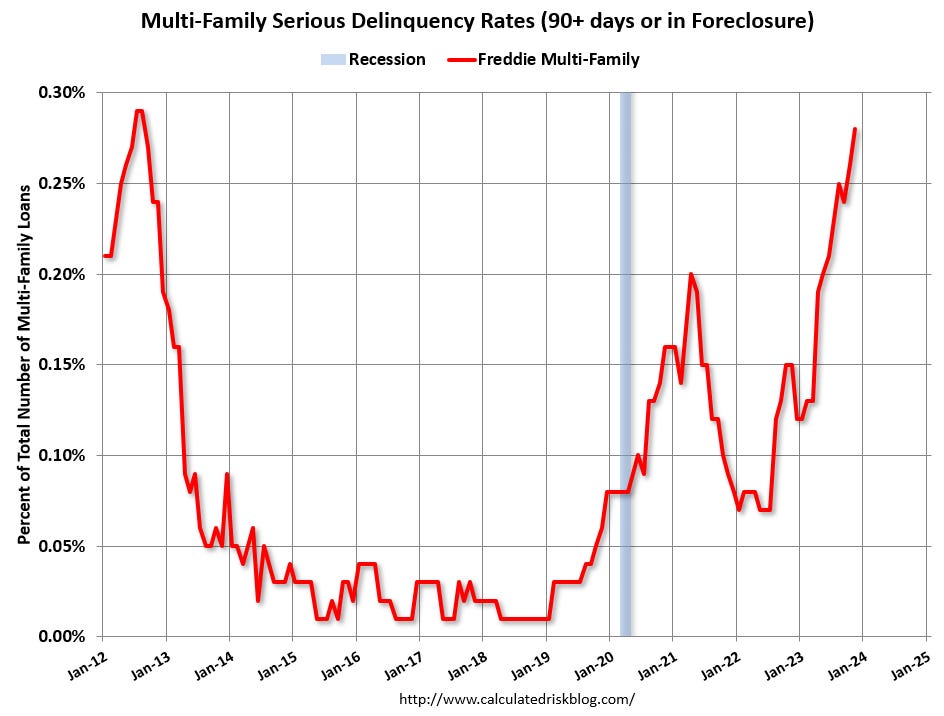

Brad: versus multi-family

Data as of December 2023

Data as of December 2023

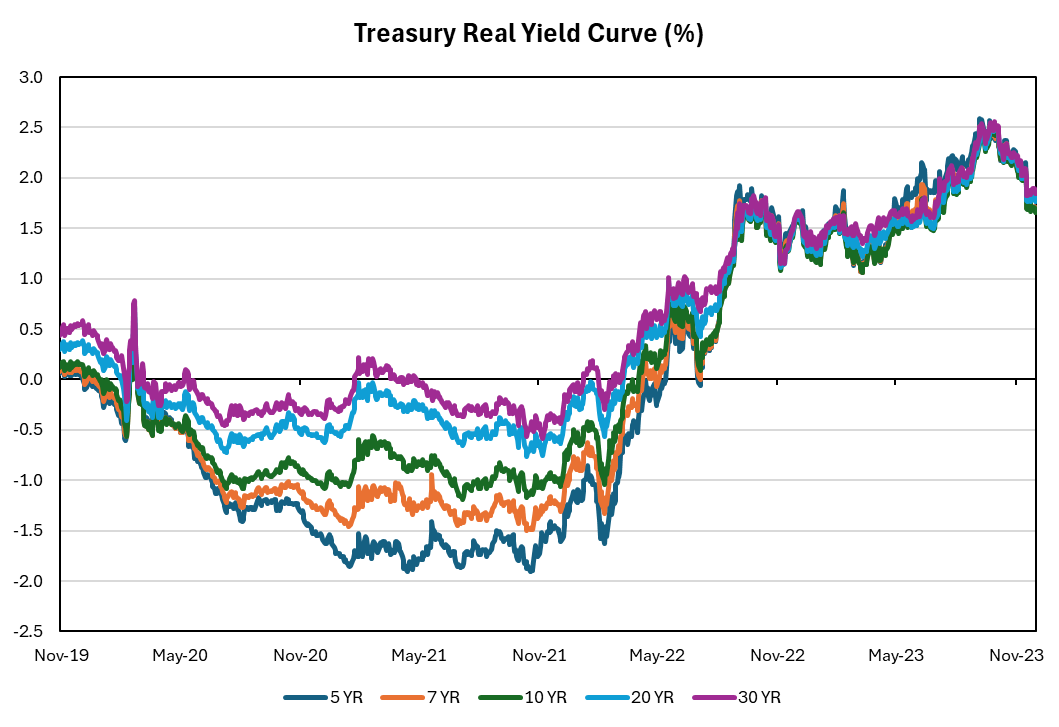

Brian: History will not look kindly on entities that locked in decades of negative real yields for their “safe” money

Source: Aptus as of December 2023

Source: Aptus as of December 2023

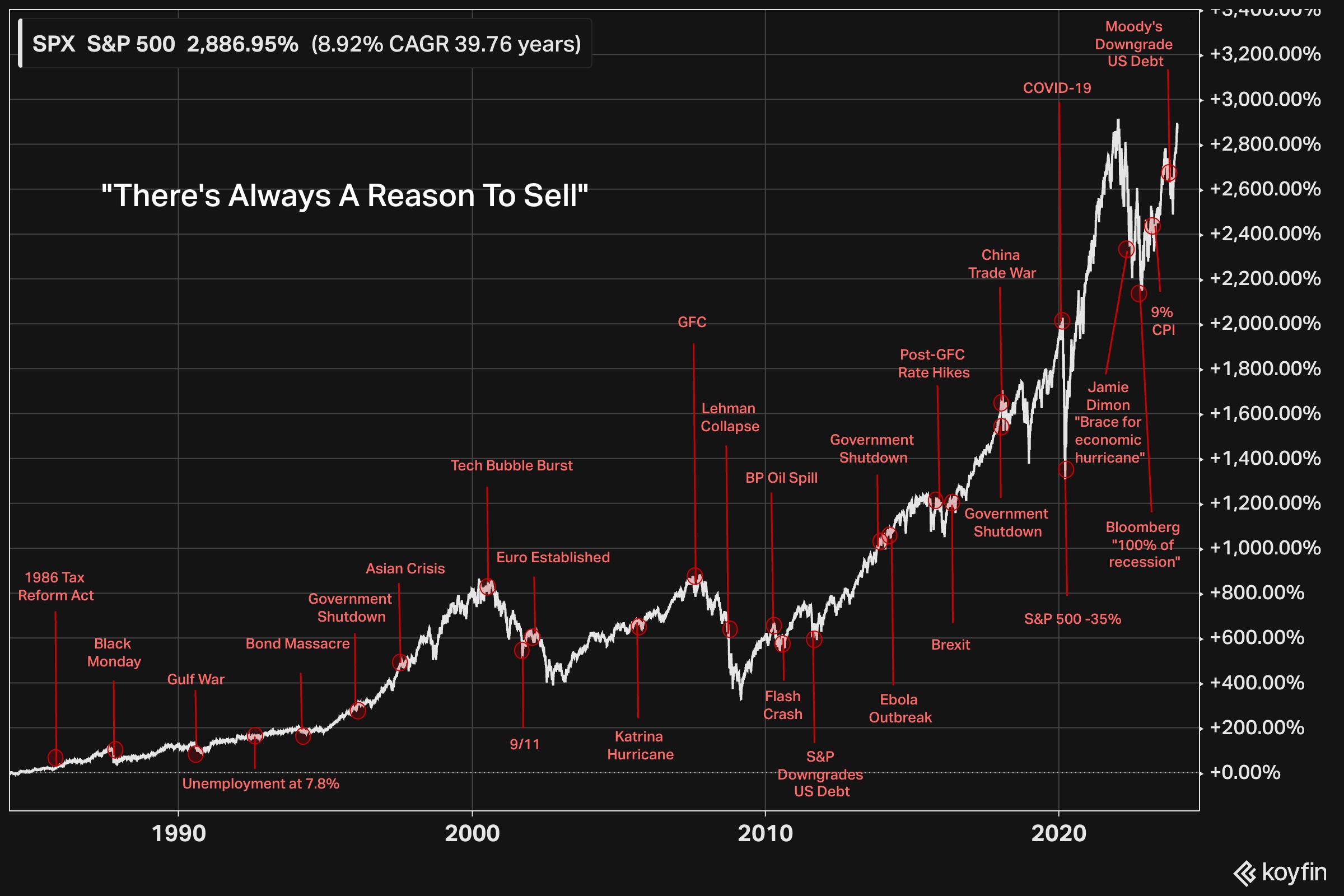

JD: It’s never a bad time for a reminder that clients will always have an excuse to bail but the best plan is the one they can stick with

Data as of December 2023

Data as of December 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-33.