Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

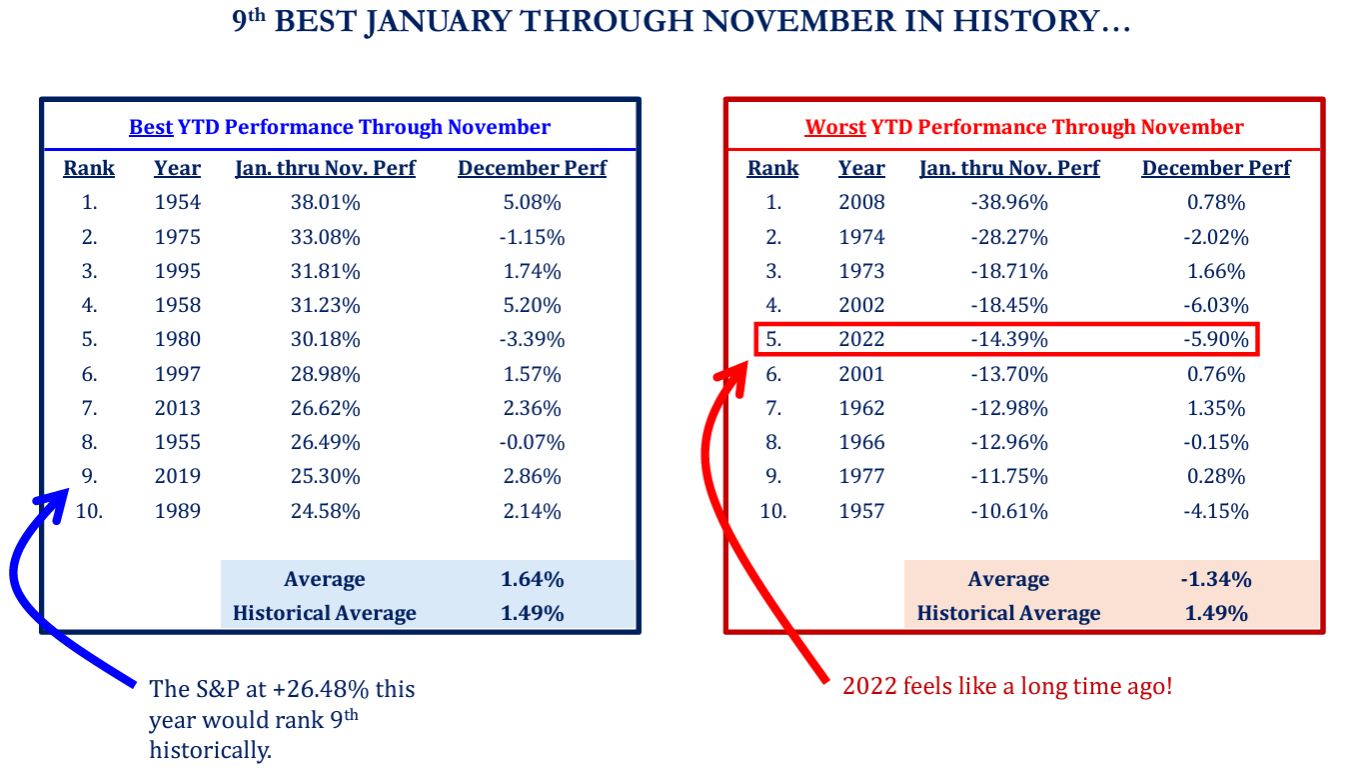

Dave: 2022 seems like a generation ago, historic in a different way

Source: Strategas as of 11.30.2024

Source: Strategas as of 11.30.2024

Dave: and the basement-dwellers of 2022 became the superstars of 2023 and 2024

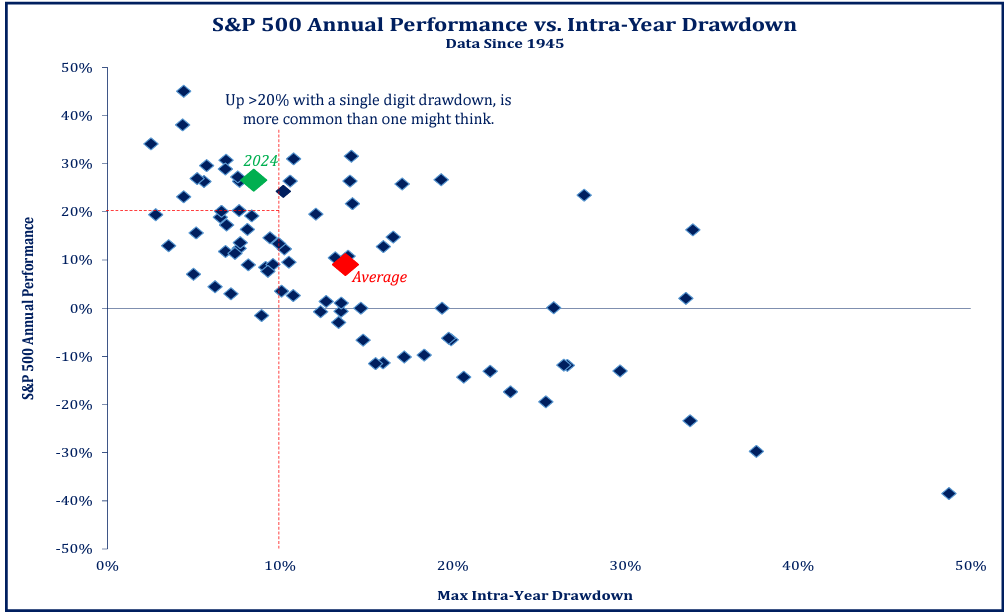

Beckham: Not only has 2024 been a spectacular year for stocks, it hasn’t really tested investors with selloffs

Source: Strategas as of 12.02.2024

Source: Strategas as of 12.02.2024

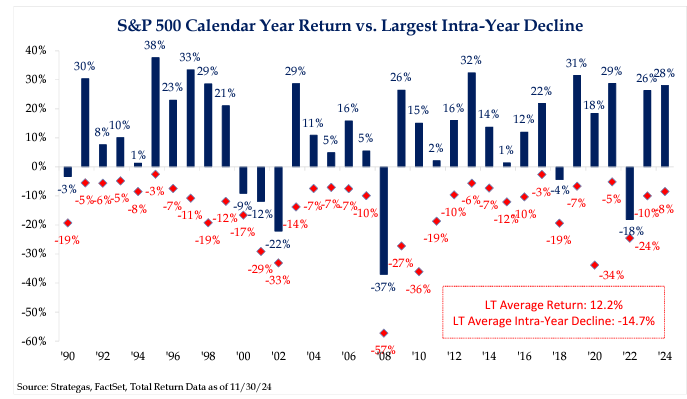

Brett: but in general, investors should be prepared for the larger drawdowns that come with owning stocks

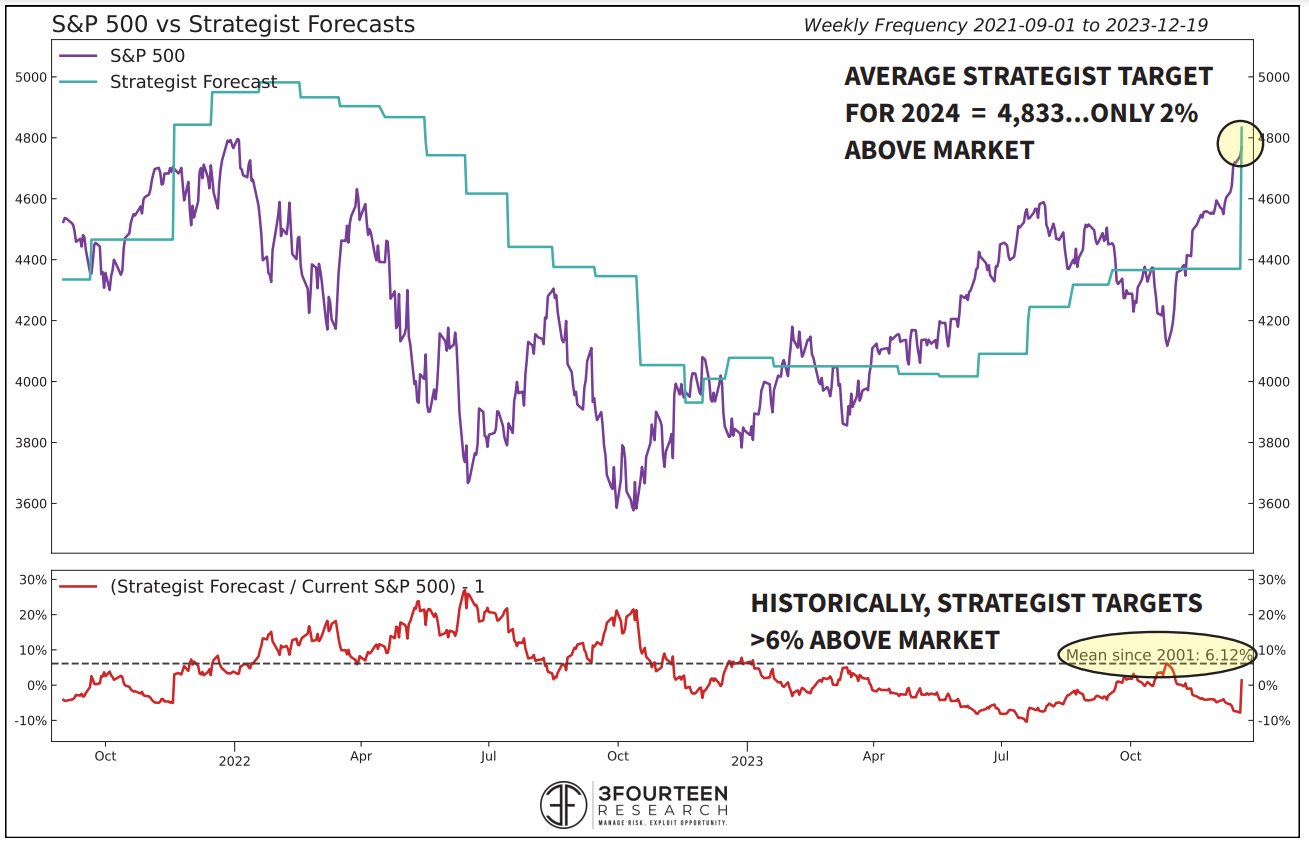

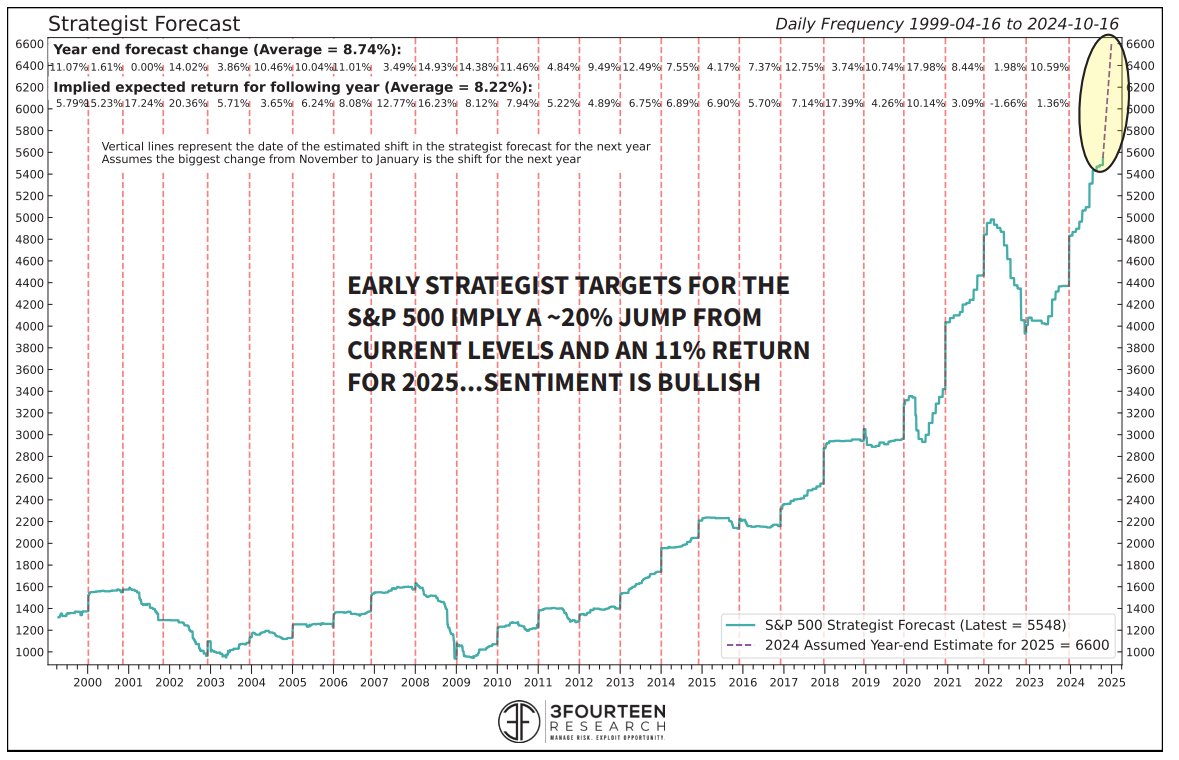

JD: The rally may have caught strategists flat-footed in 2024

Data as of December 2023

Data as of December 2023

JD: but they’re doing their best to prepare for good times in 2025!

Data as of November 2024

Data as of November 2024

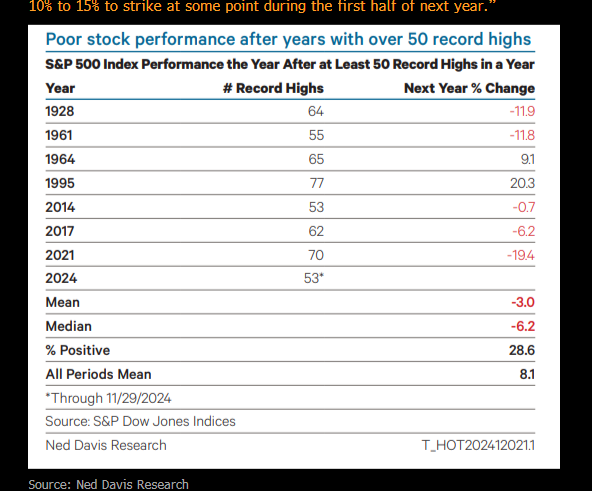

Dave: The strength of 2024 sets a high bar for the S&P 500 in 2025

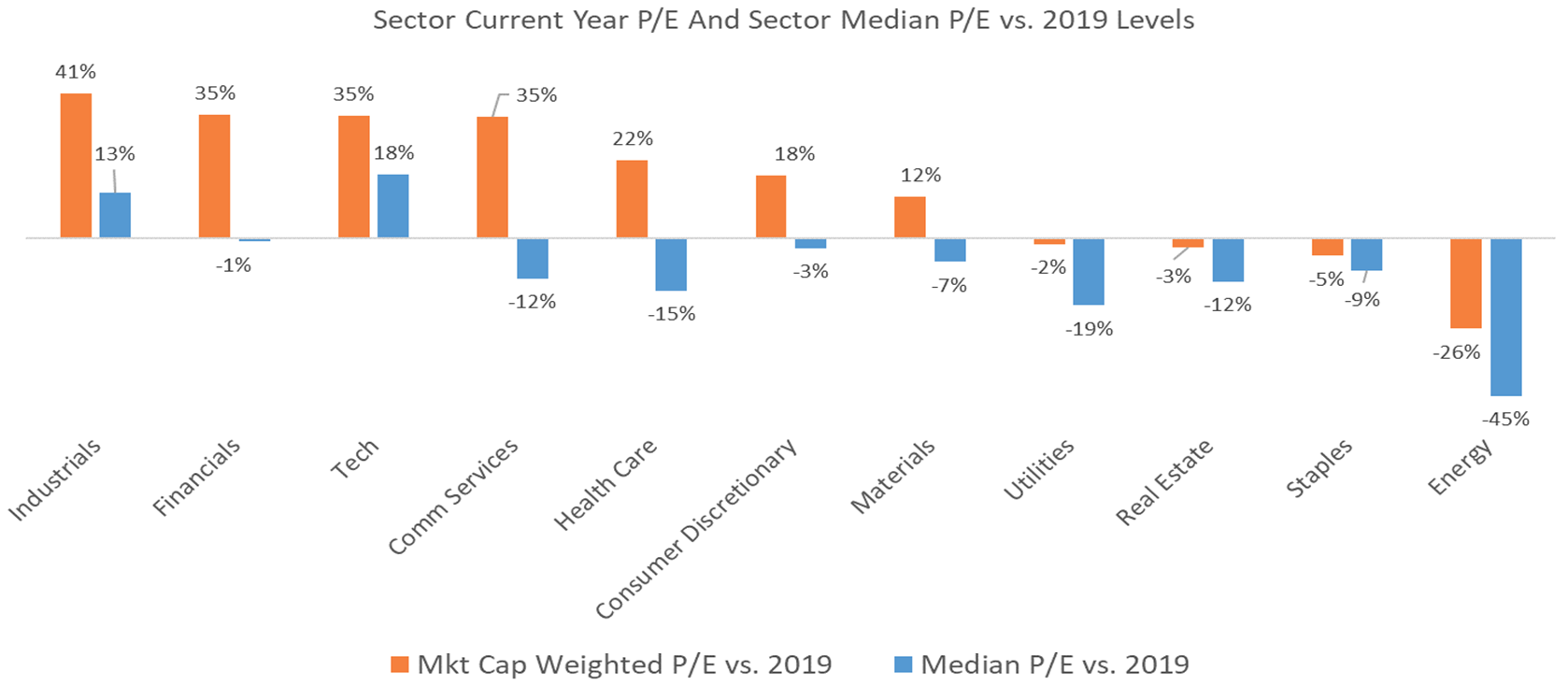

Joseph: but that doesn’t mean there aren’t areas of the market that offer better value than in the past

Source: Raymond James as of 12.05.2024

Source: Raymond James as of 12.05.2024

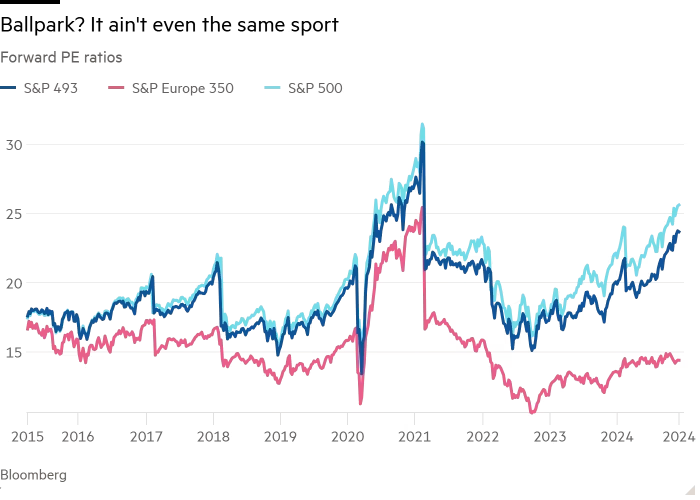

John Luke: Investors are also looking overseas for better value, but that’s been a tough game in recent years

Data as of 12.02.2024

Data as of 12.02.2024

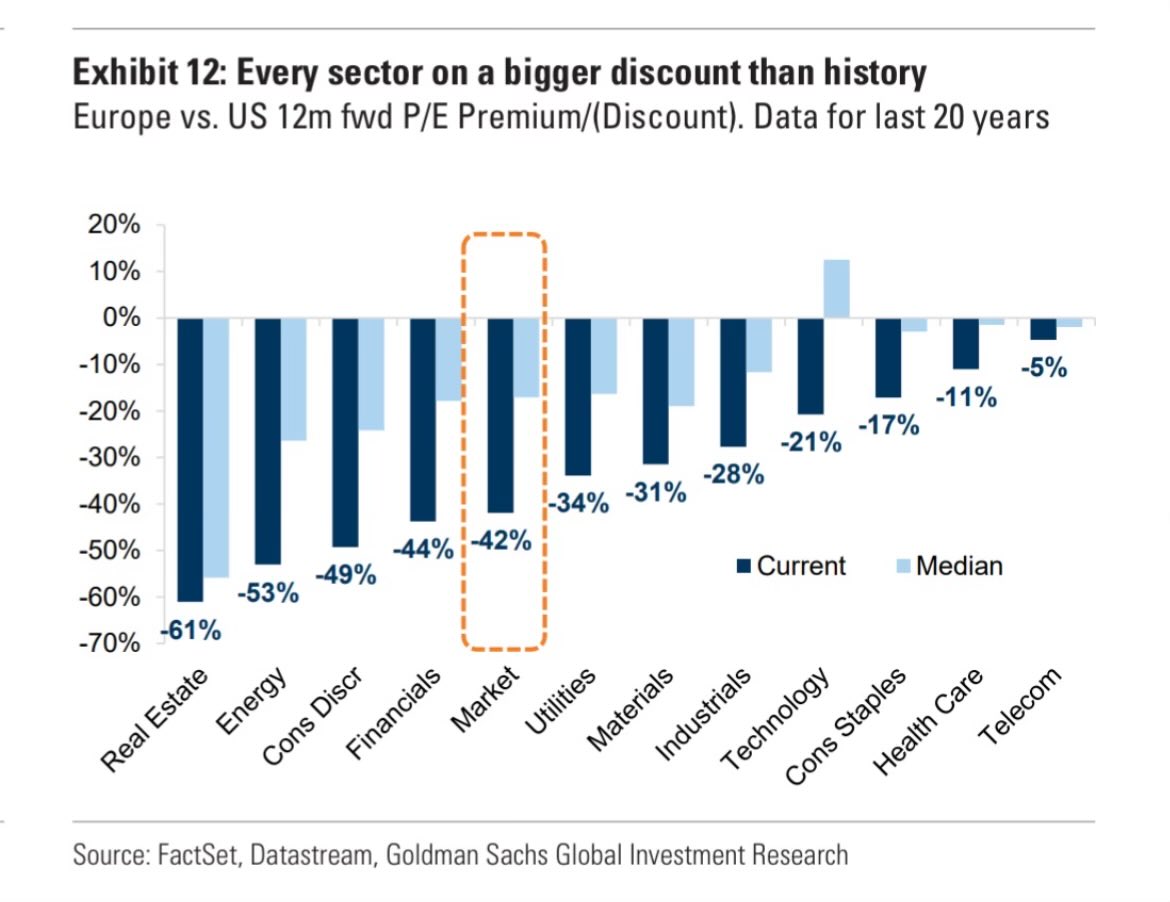

Brad: which also translates at the sector level

Data as of 11.27.2024

Data as of 11.27.2024

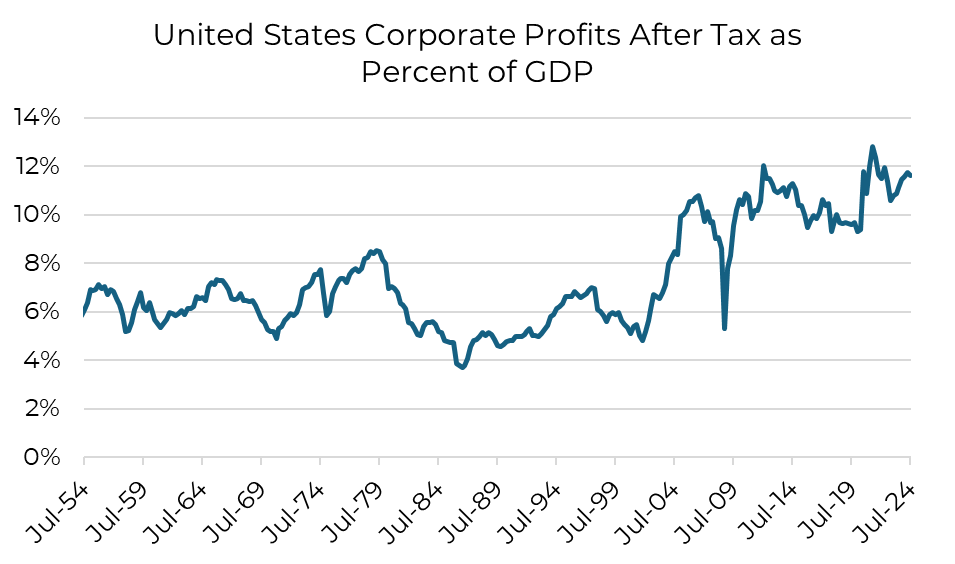

Brian: The greater force in U.S. market dominance has been a relentless march higher in profits

Source: Aptus as of November 2024

Source: Aptus as of November 2024

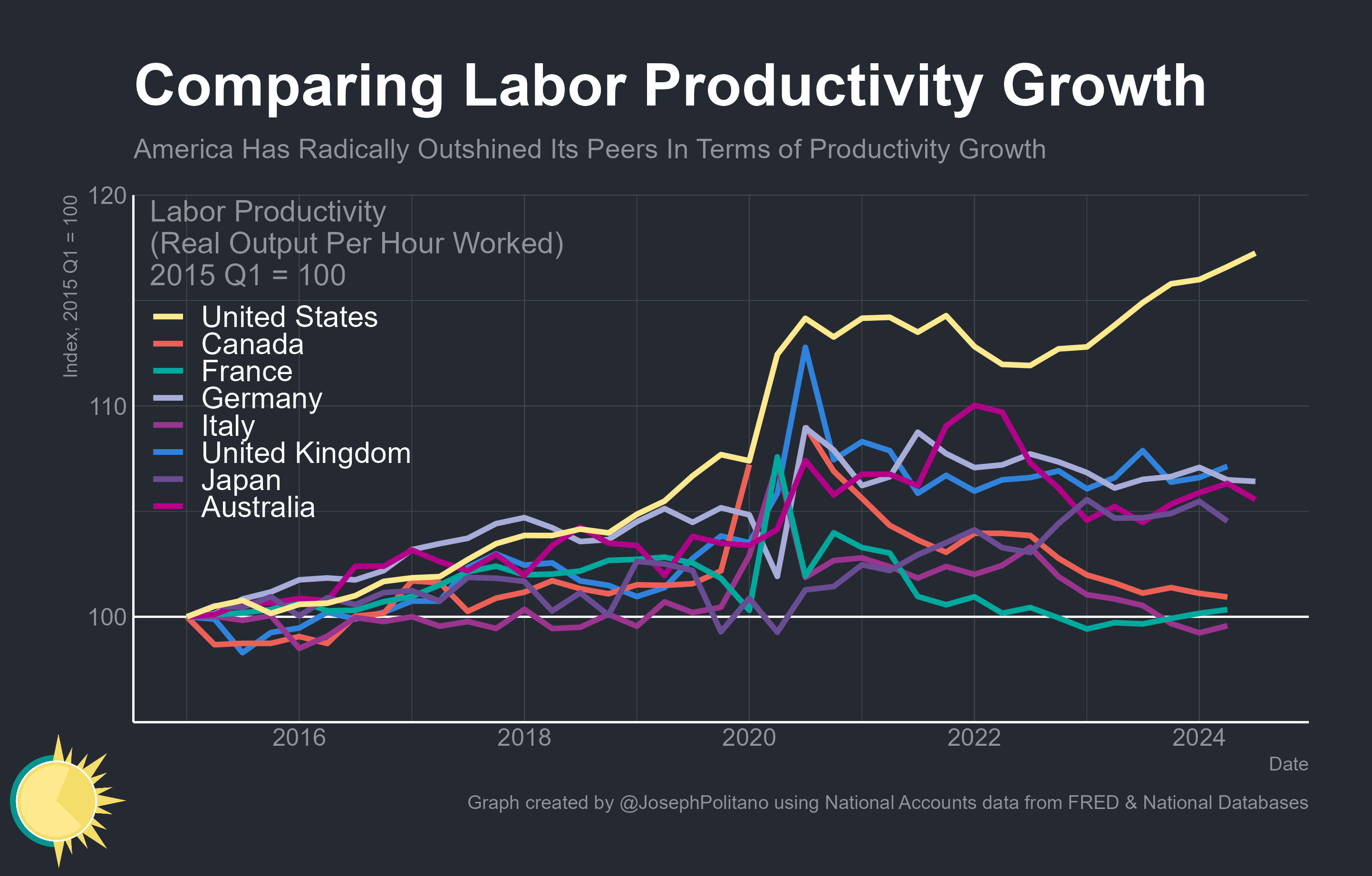

Arch: driven in recent years by superior productivity among U.S. workers

Data as of November 2024

Data as of November 2024

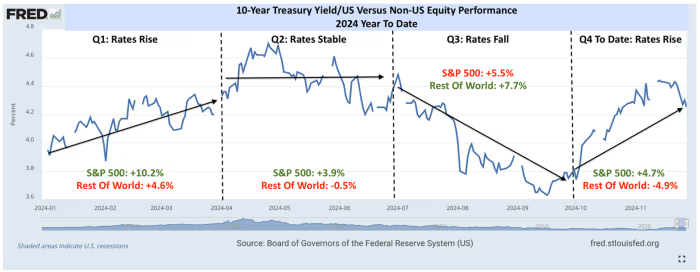

John Luke: The fate of non-US stocks has recently been tied to US rate movements

Source: DataTrek as of 12.02.2024

Source: DataTrek as of 12.02.2024

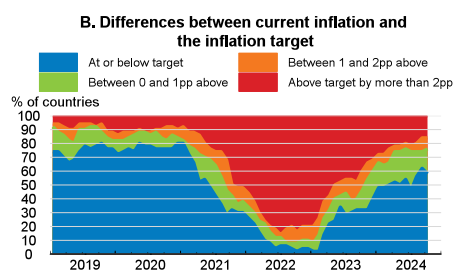

John Luke: this despite most countries making their own significant progress in getting inflation back to acceptable levels

Source: OECD as of November 2024

Source: OECD as of November 2024

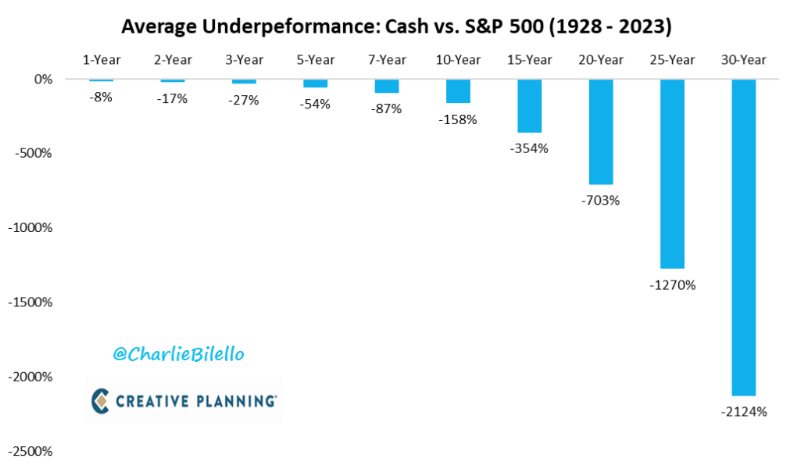

Brad: Cash has historically been a huge drag for investors, with the impact compounding over longer periods

Data as of January 2024

Data as of January 2024

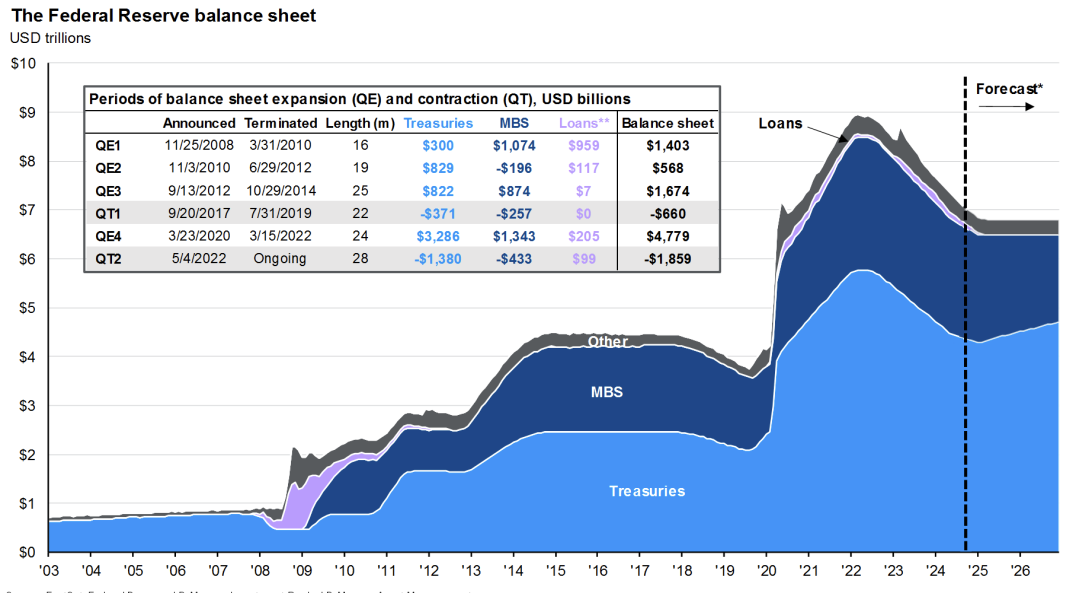

John Luke: and with our Federal Reserve becoming one of the larger holders of our debt, cash is unlikely to be helpful in the future either

Source: JP Morgan as of November 2024

Source: JP Morgan as of November 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2412-10.