Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

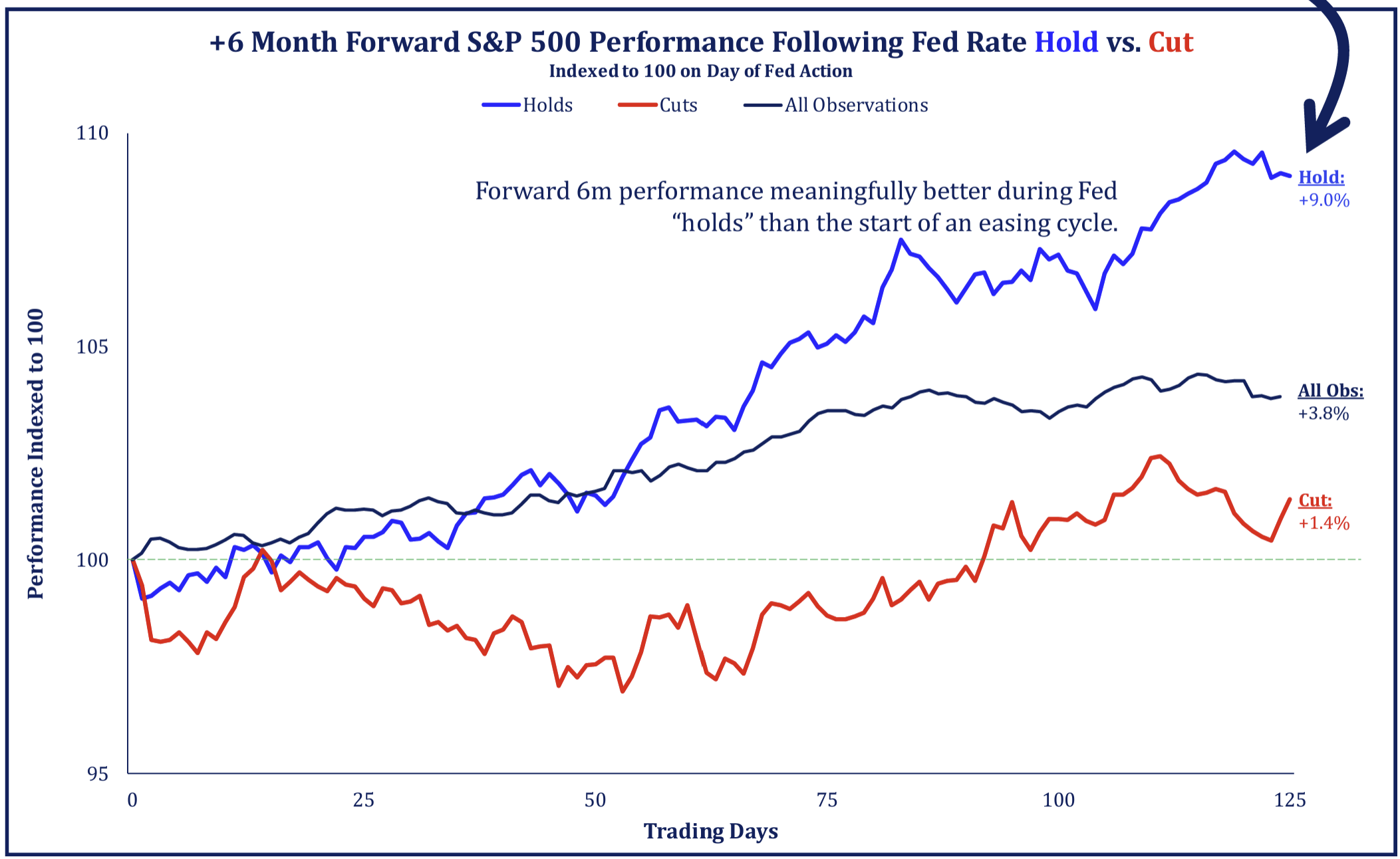

Dave: Markets are currently obsessed with the idea of multiple rate cuts in 2024. Historically, rate “holds” have been friendlier to stocks than cuts

Source: Strategas as of 12.04.2023

Source: Strategas as of 12.04.2023

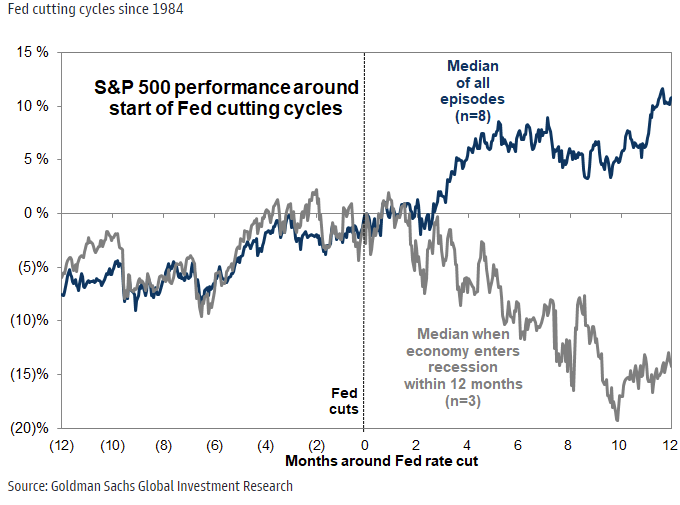

Brett: and even with cuts, performance has been much different depending on the economic outcomes

Data as of November 2023

Data as of November 2023

John Luke: Not sure the recent drop in yields looks much different than the retracements that came before it

Source: Strategas as of 12.05.2023

Source: Strategas as of 12.05.2023

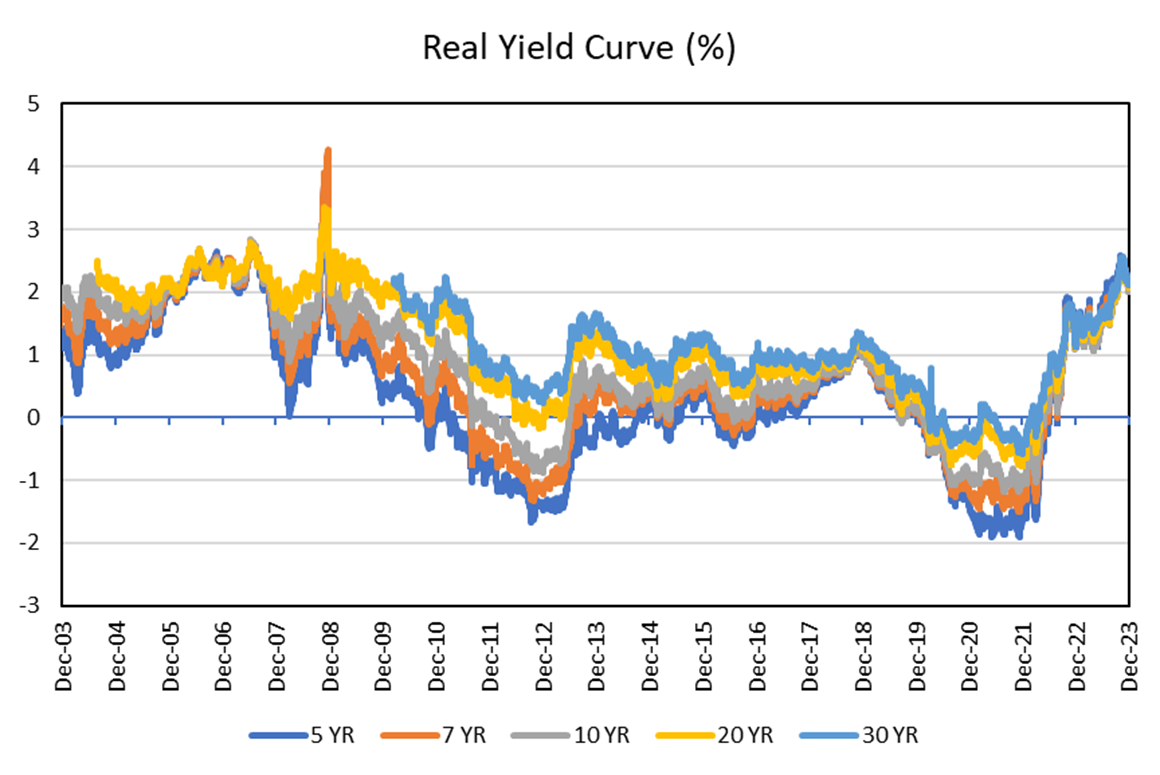

Brian: especially with the persistent rise in real yields from the historically negative levels of the COVID period

Source: Aptus via Department of the Treasury as of 12.01.2023

Source: Aptus via Department of the Treasury as of 12.01.2023

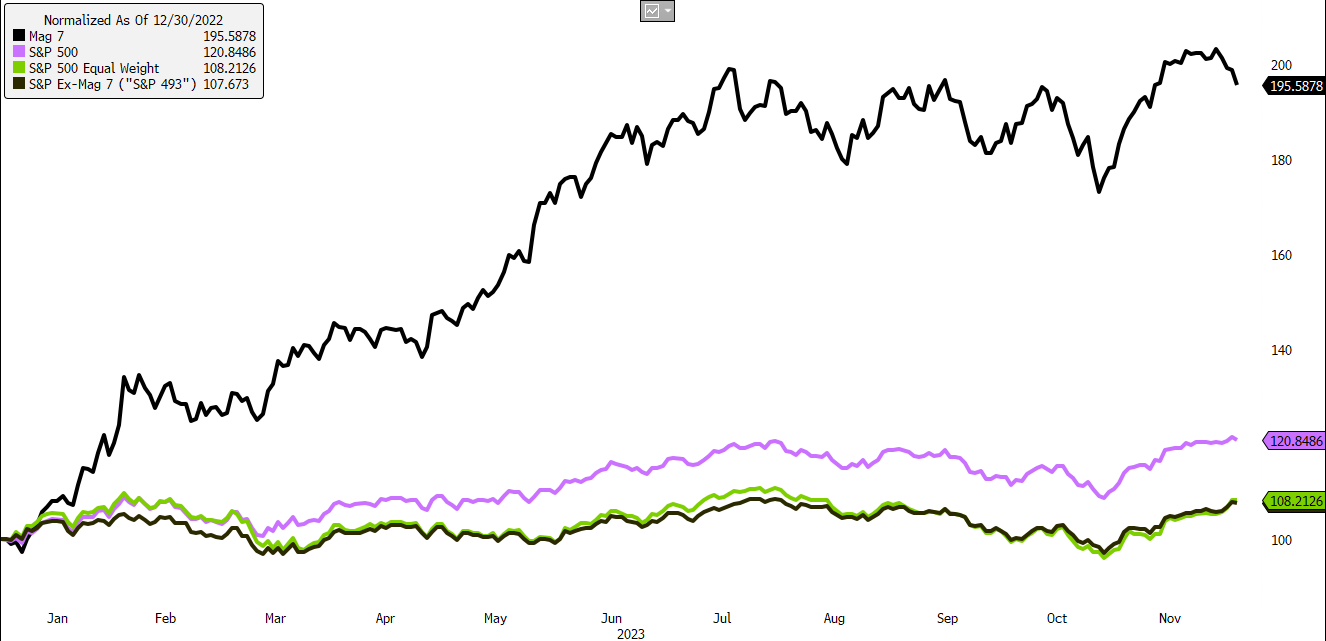

Brad: We’ve shown the 2023 dominance of the Mag Seven in a number of ways; here’s the 7 vs. the 493

Source: Bloomberg as of 12.06.2023

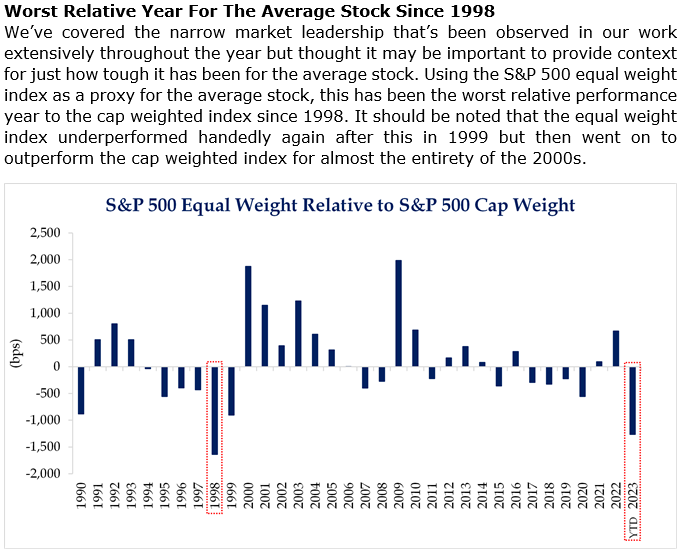

Brad: with the average stock having its worst performance of the 2000s relative to the cap-weighted S&P 500

Source: Strategas as of 12.06.2023

Source: Strategas as of 12.06.2023

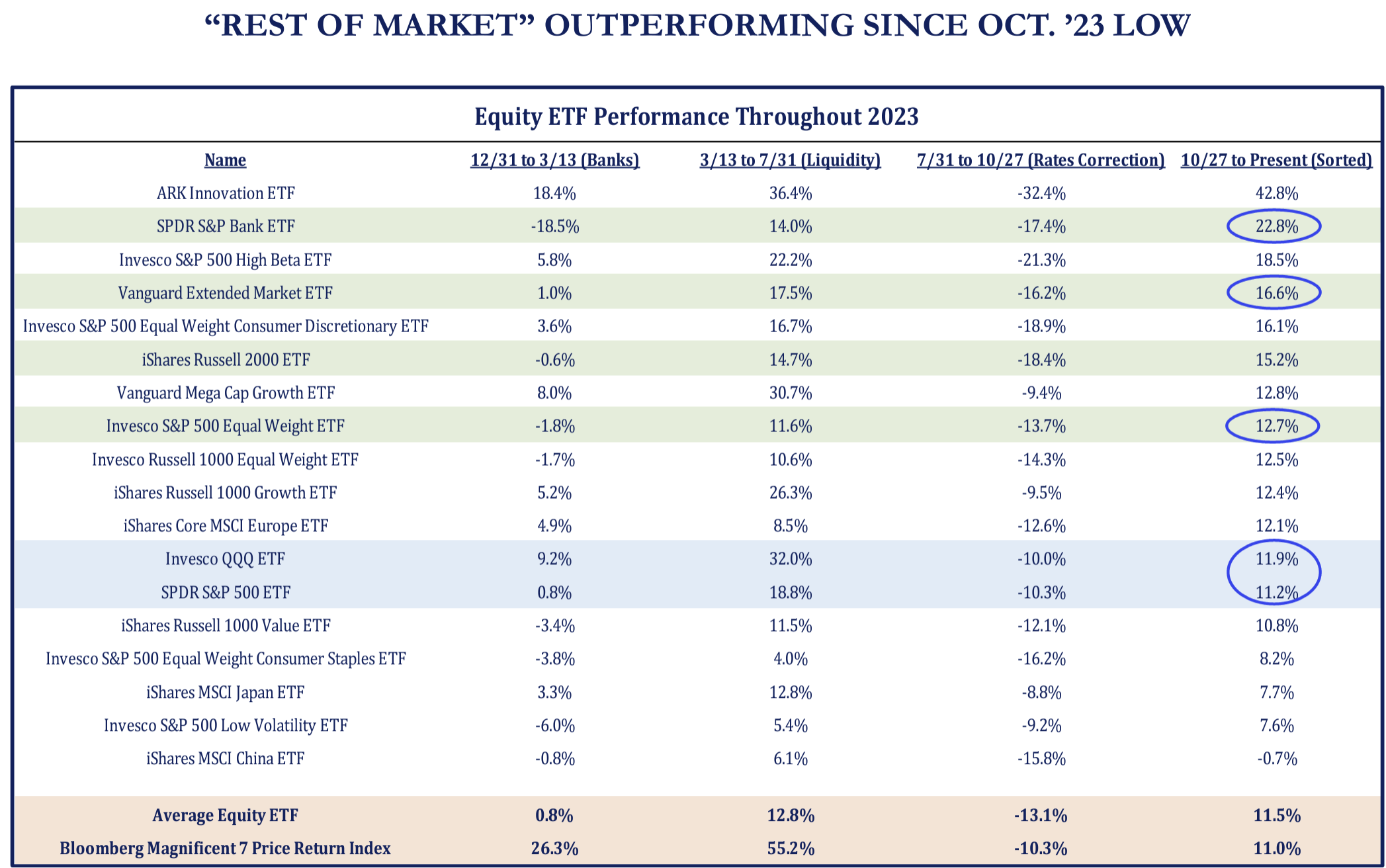

Dave: but since the October lows, the lagging has ended

Source: Strategas as of 12.05.2023

Source: Strategas as of 12.05.2023

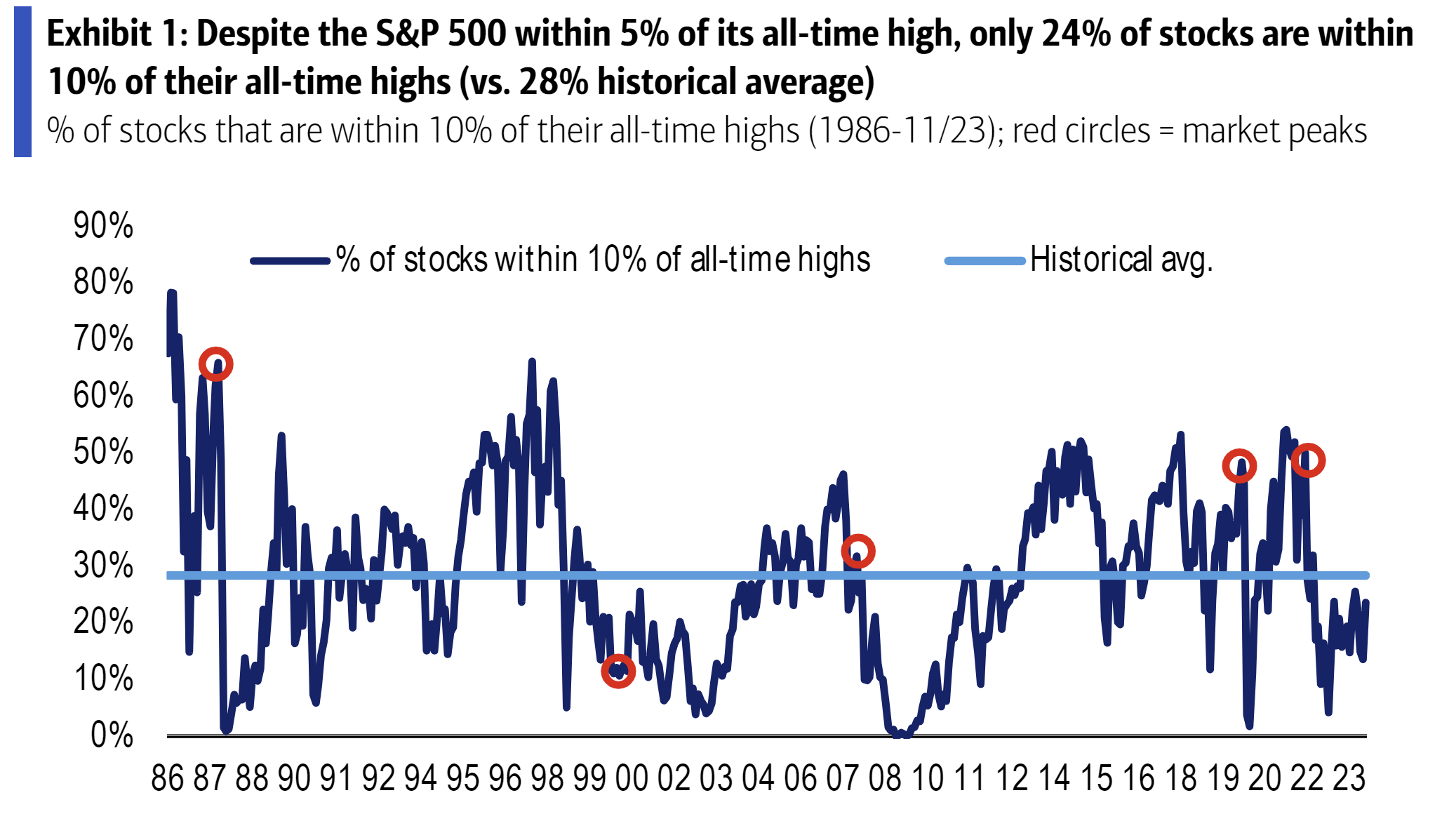

Dave: with plenty of room for the average stock to work its way back towards the 2021 highs

Source: BofA as of 12.04.2023

Source: BofA as of 12.04.2023

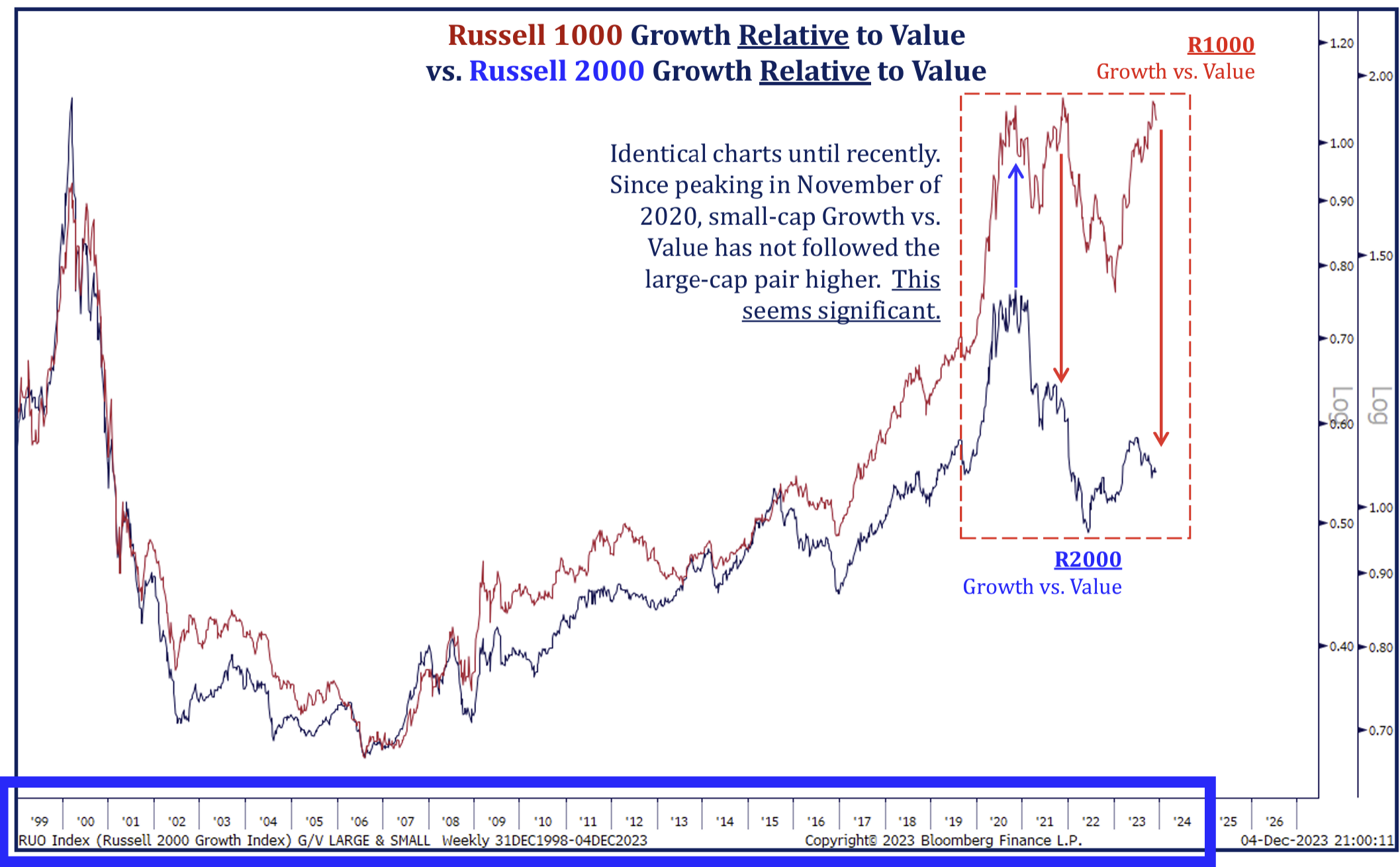

Dave: One oddity we’ve noticed is that small-cap growth hasn’t dominated small-cap value the way we’ve seen in large-cap stocks

Source: Strategas as of 12.05.2023

Source: Strategas as of 12.05.2023

Dave: perhaps from a mix of persistently low quality in small-cap growth relative to large, and the growing ranks of funds built to follow what’s been in favor

Source: Strategas as of 12.05.2023

Source: Strategas as of 12.05.2023

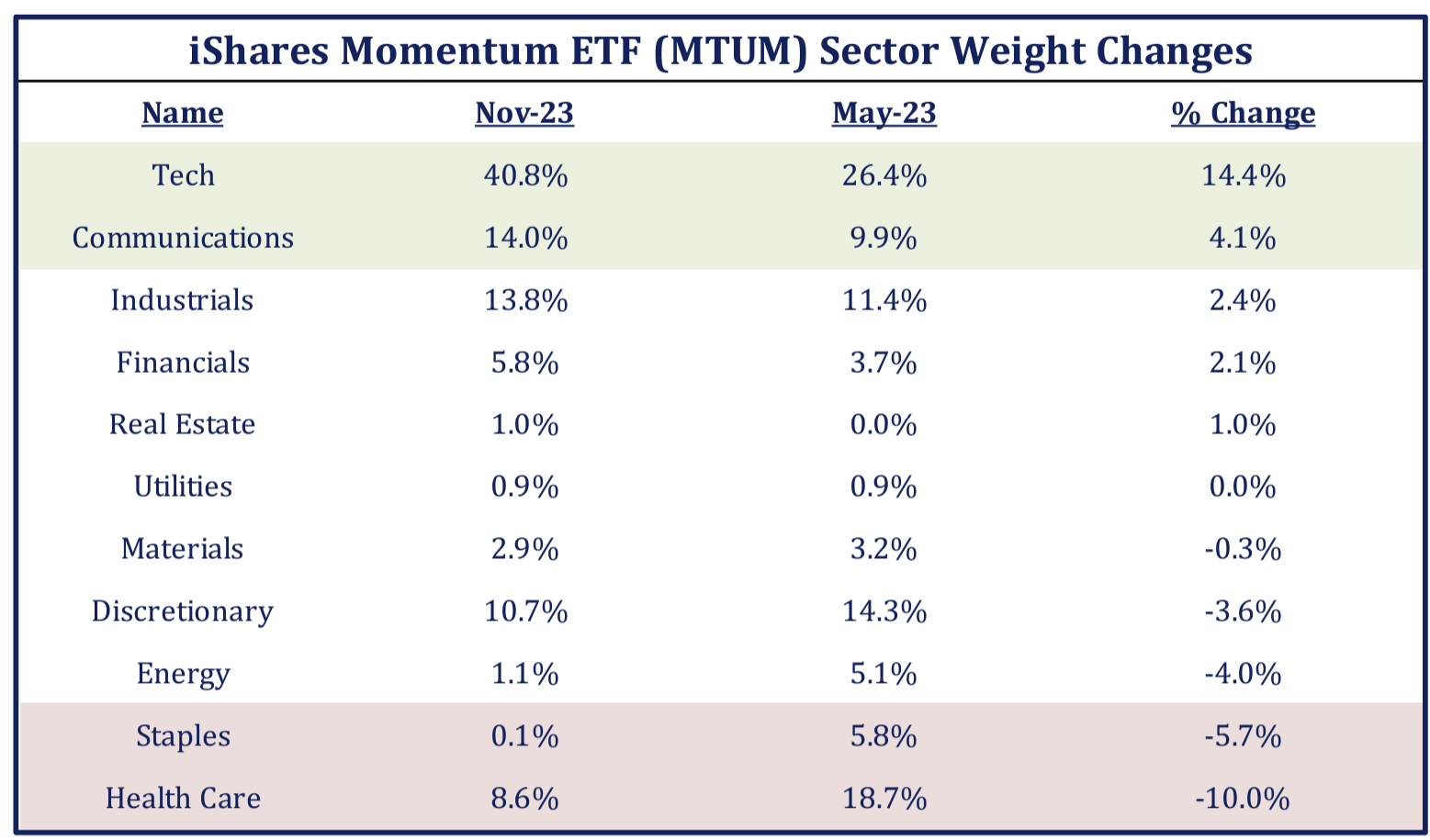

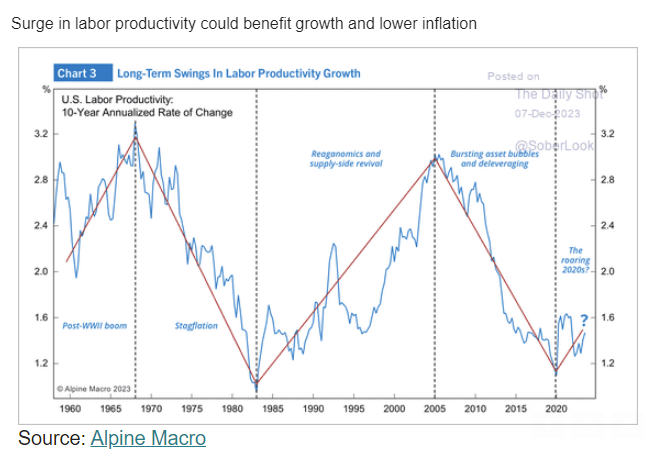

Dave: A developing story could be the emerging rise in US labor productivity from the lowest levels in 40 years

Data as of November 2023

Data as of November 2023

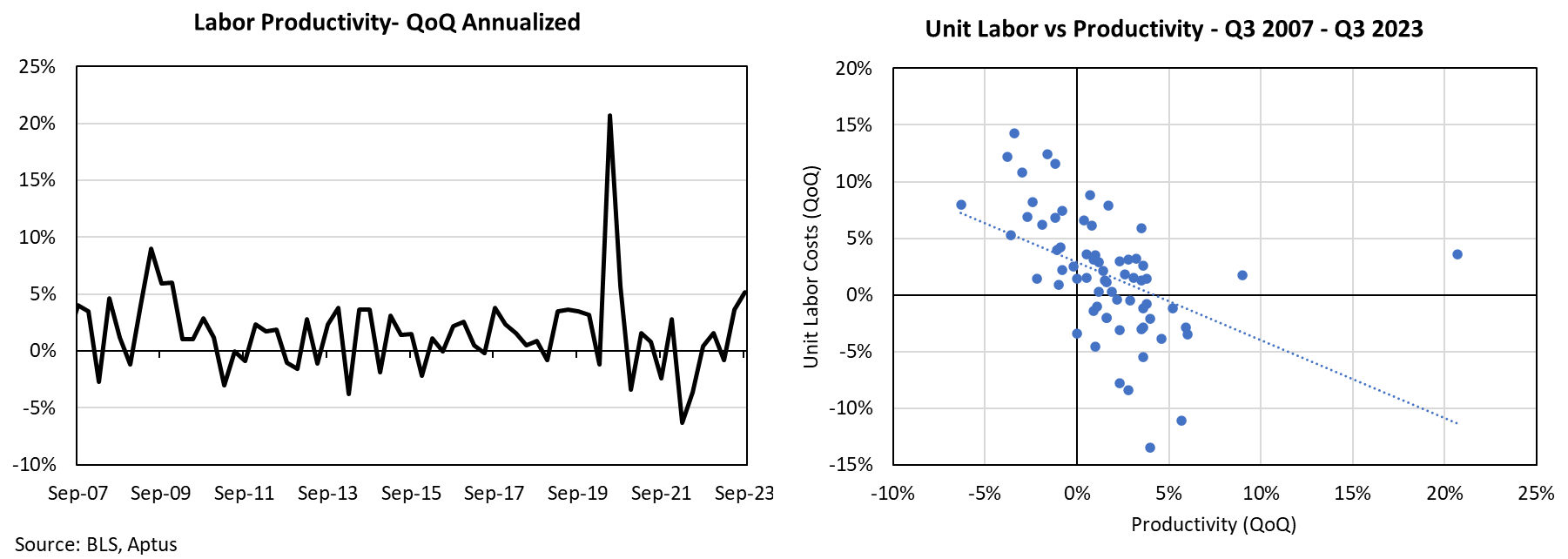

Brian: perhaps a factor that could keep unit labor costs from extending recent gains

Data as of 09.30.2023

Data as of 09.30.2023

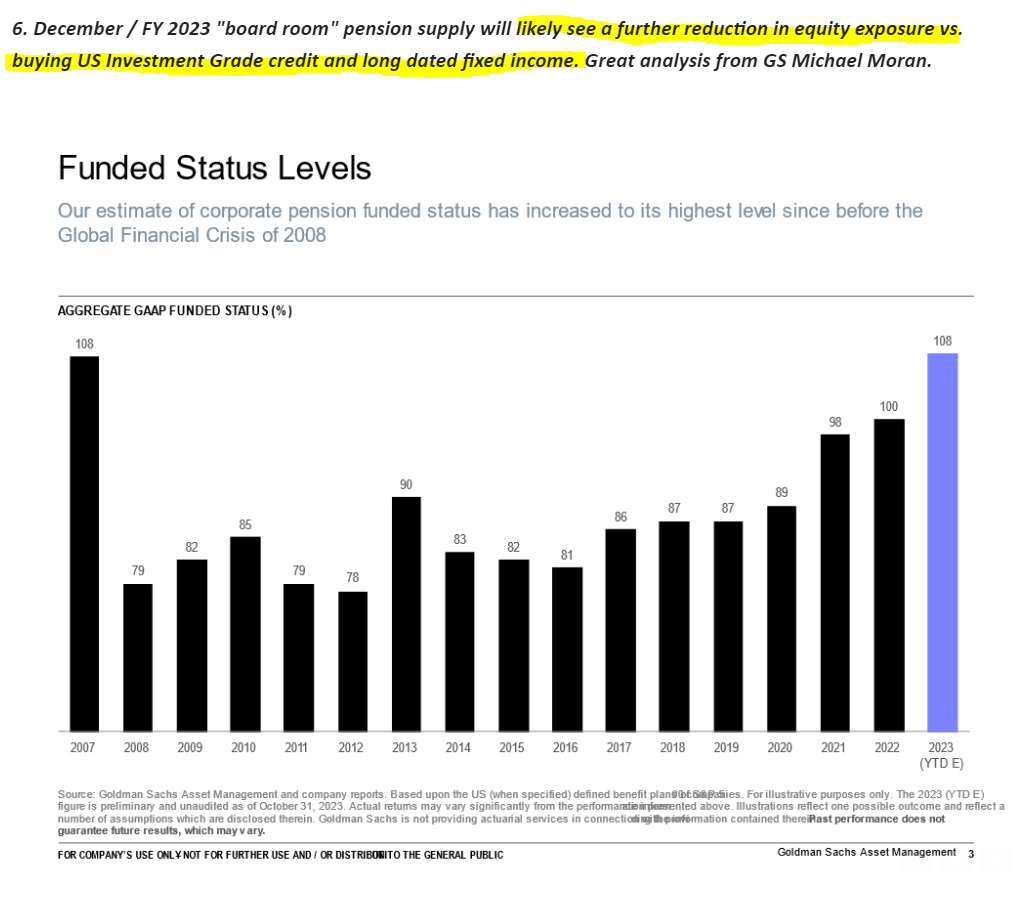

Joseph: A December rally in stocks seems to be the consensus call, but it’s important to consider the funding needs of major participants like corporate pensions

Data as of 10.31.2023

Data as of 10.31.2023

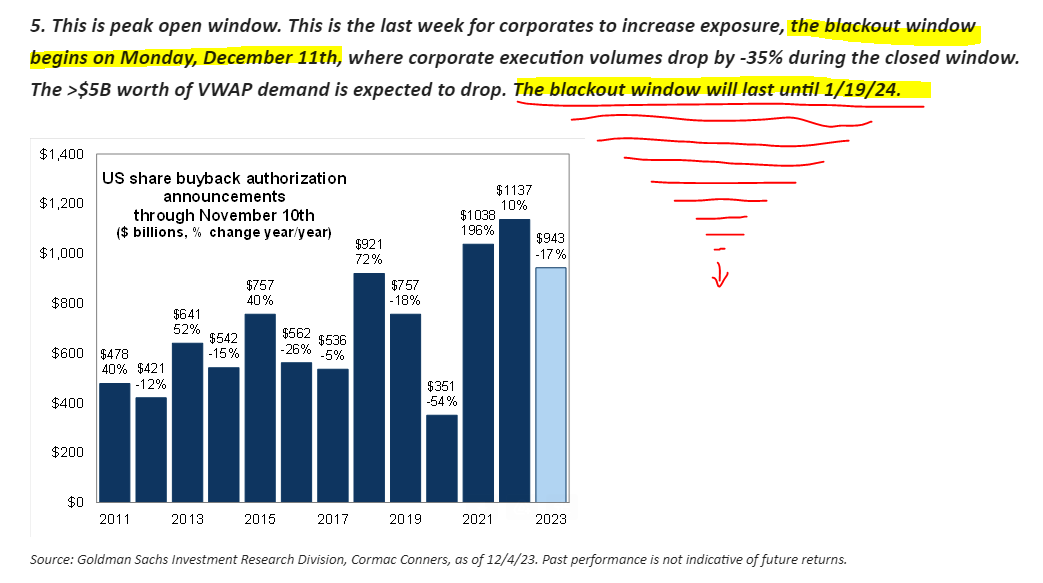

Mark: and we also know that the corporate stock buyback window is about to close until earnings season in mid-January

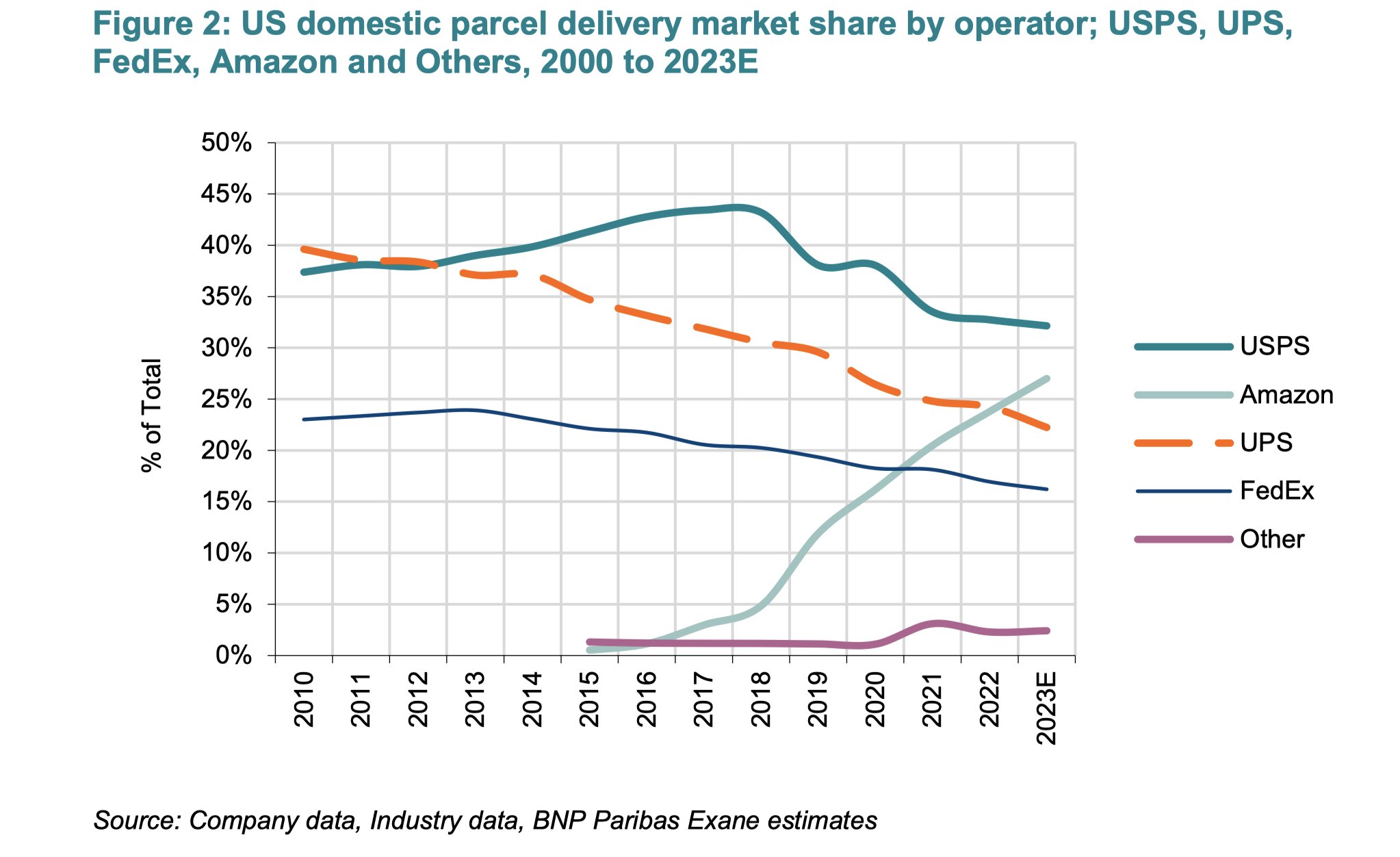

Beckham: Sometimes you just need to sit back and marvel at the power of a company on a mission. Amazon takes on an oligopoly and is winning

Data as of September 2023

Data as of September 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-13.