Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

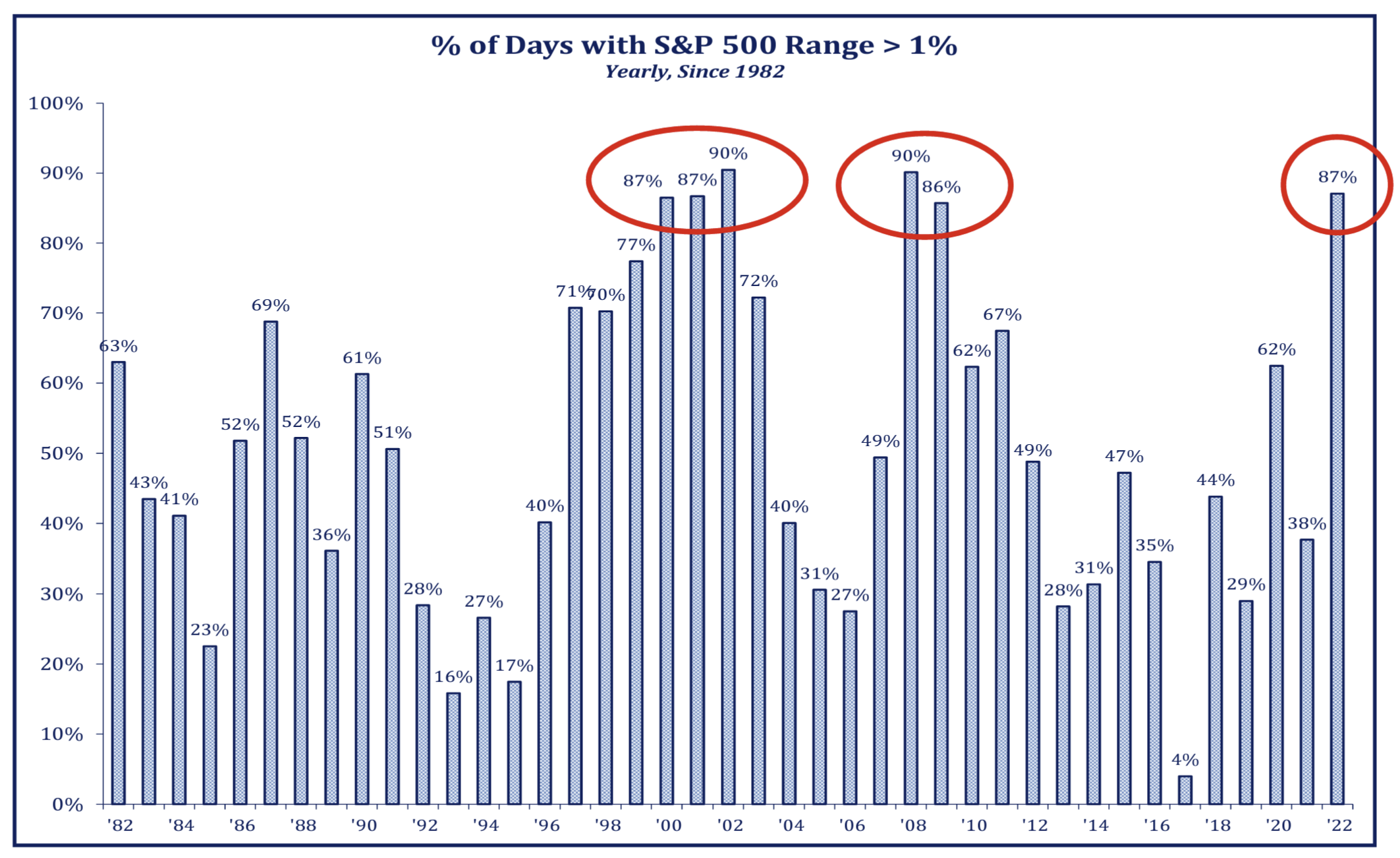

Dave: It’s been a year of really high day-to-day volatility

Source: Strategas as of 12.07.2022

Source: Strategas as of 12.07.2022

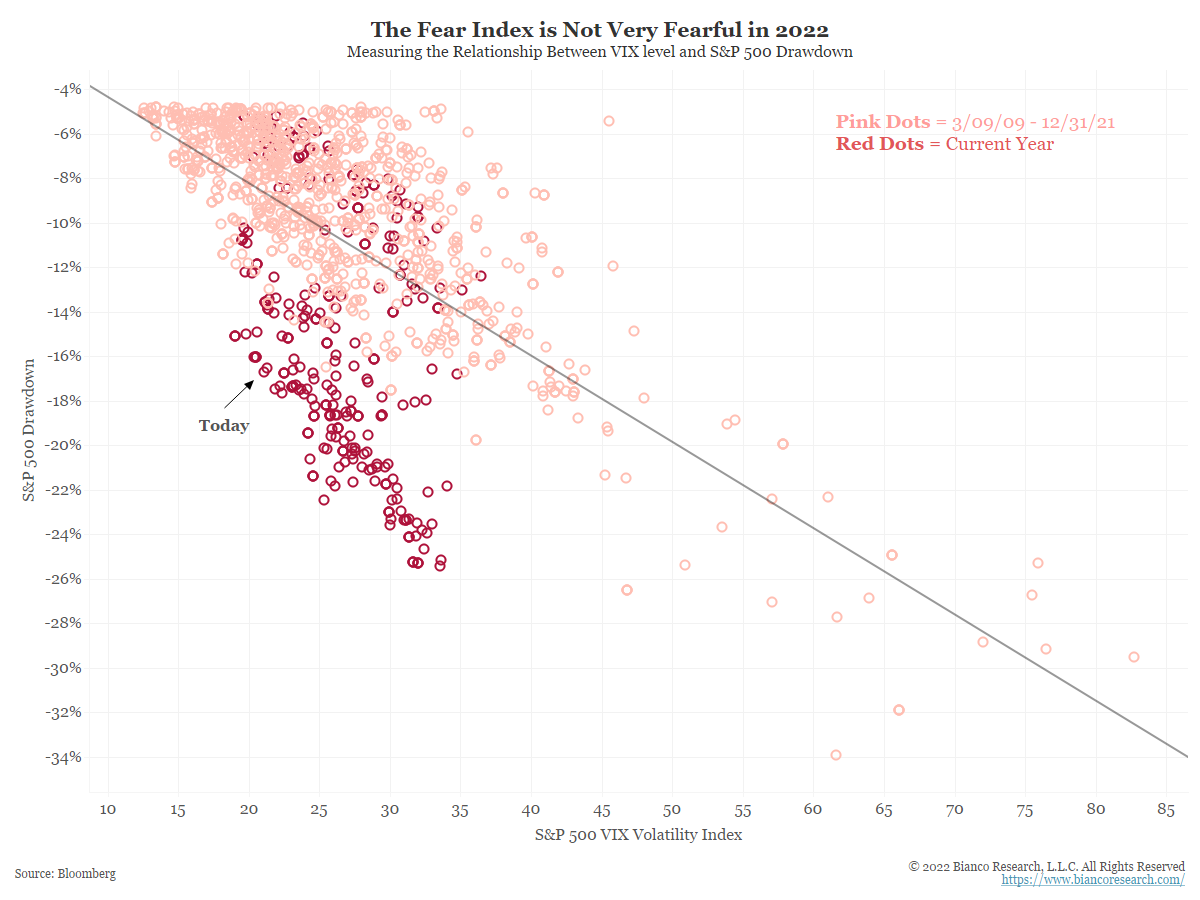

JL: but much more an uncertainty grind than a market of fear, with VIX restrained vs. prior drawdowns

Data as of 12.05.2022

Data as of 12.05.2022

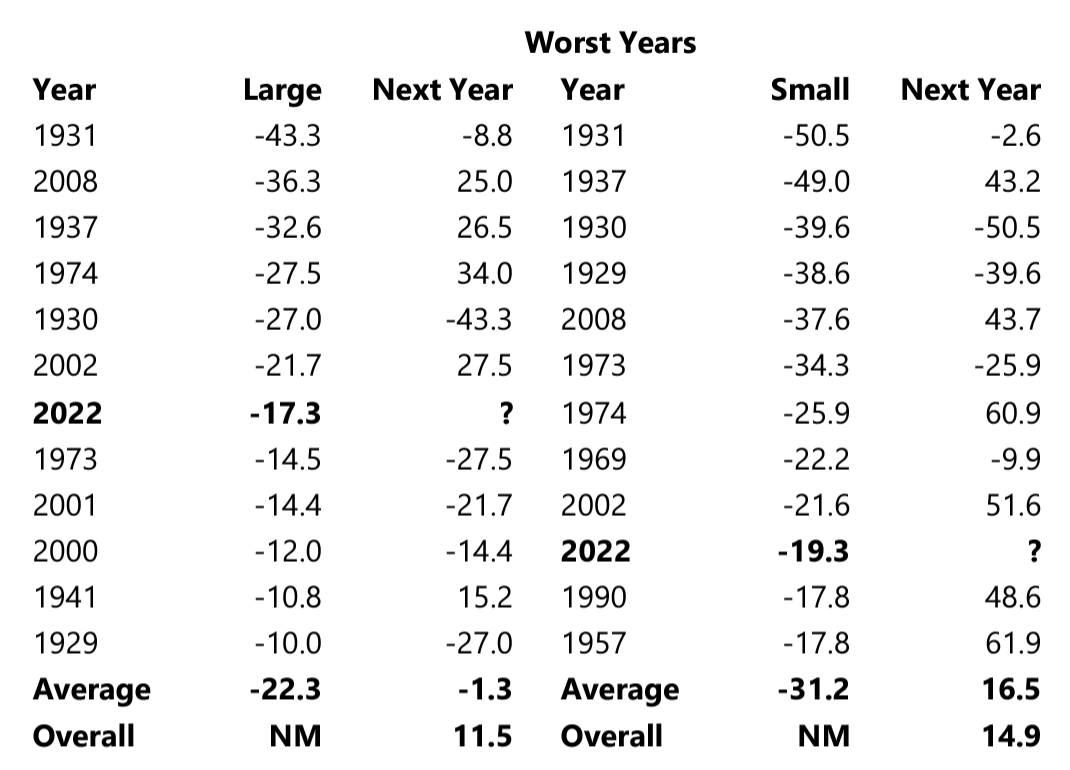

Dave: Obviously, a bad year for stocks as measured by the S&P 500

Source: Jefferies as of 12.07.2022

Source: Jefferies as of 12.07.2022

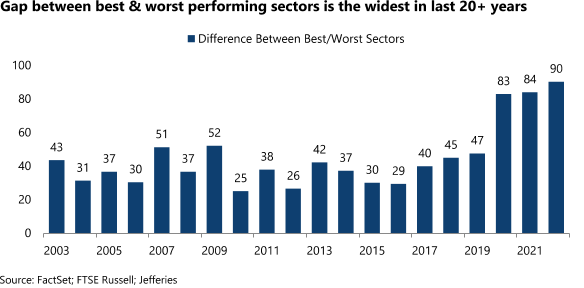

Dave: but within the indices, major dispersion in performance across sectors in recent years

Data as of 12.05.2022

Data as of 12.05.2022

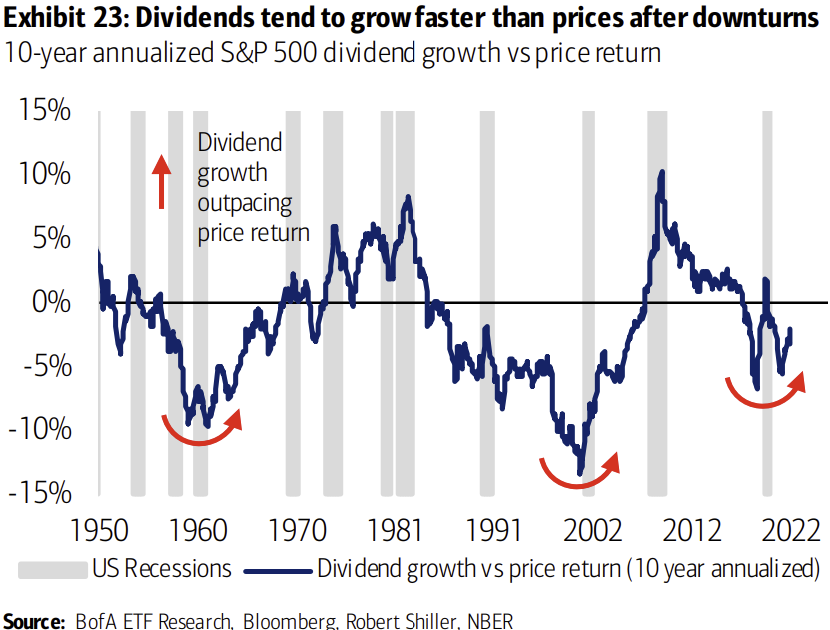

Dave: Dividends have often played a key role coming out of downturns

Data as of 12.01.2022

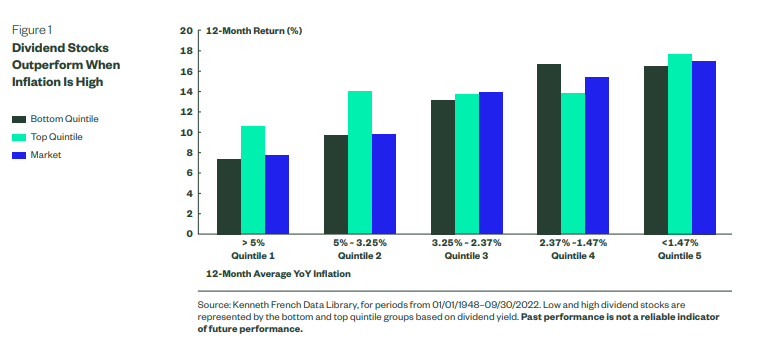

Beckham: which lines up well with our current environment of high inflation

Source: SSGA as of 10.01.2022

Source: SSGA as of 10.01.2022

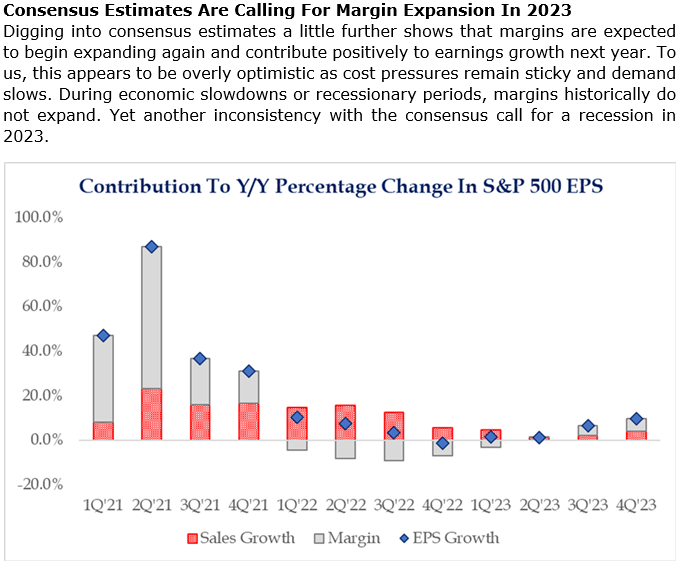

Brad: Forecasts for rising margins seems a bit questionable given wage pressures and Fed rate policy

Source: Strategas as of 12.05.2022

Source: Strategas as of 12.05.2022

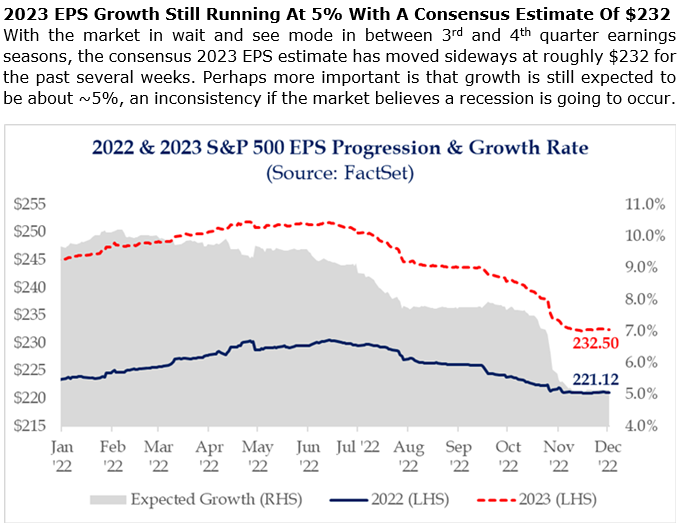

Brad: putting 2023 earnings estimates at risk of being trimmed more aggressively

Source: Strategas as of 12.05.2022

Source: Strategas as of 12.05.2022

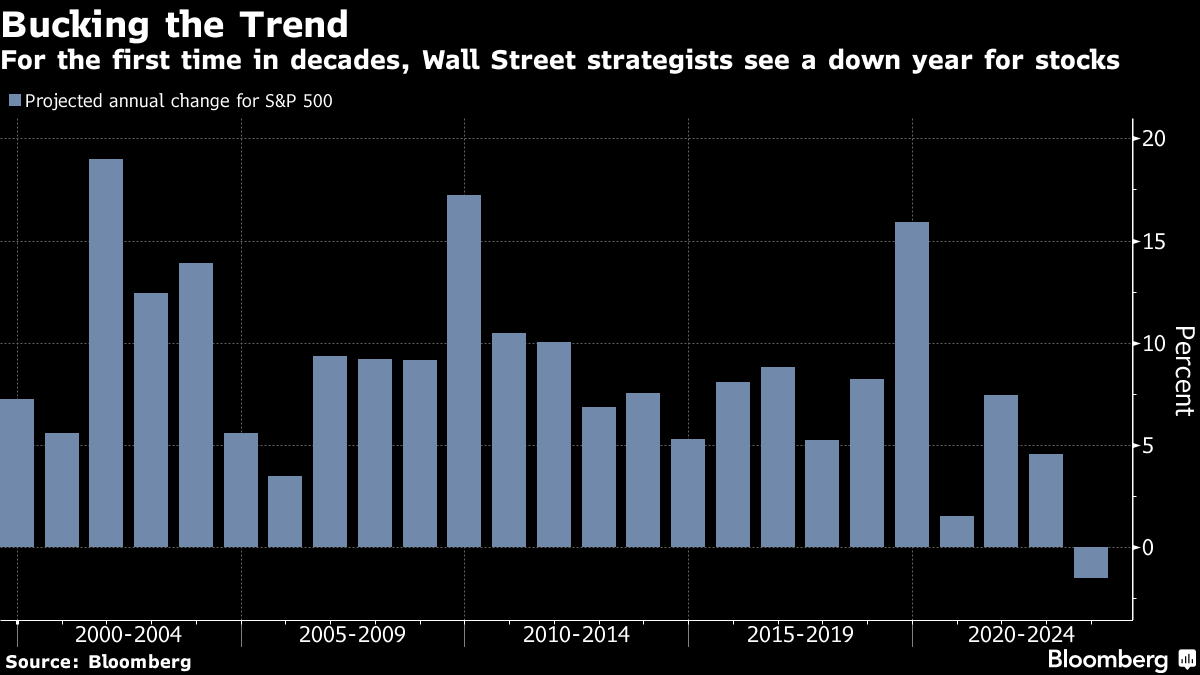

Joseph: Speaking of 2023, it’s been a long time since Wall Street strategists expected lower prices in the year ahead

Data as of 12.07.2022

Data as of 12.07.2022

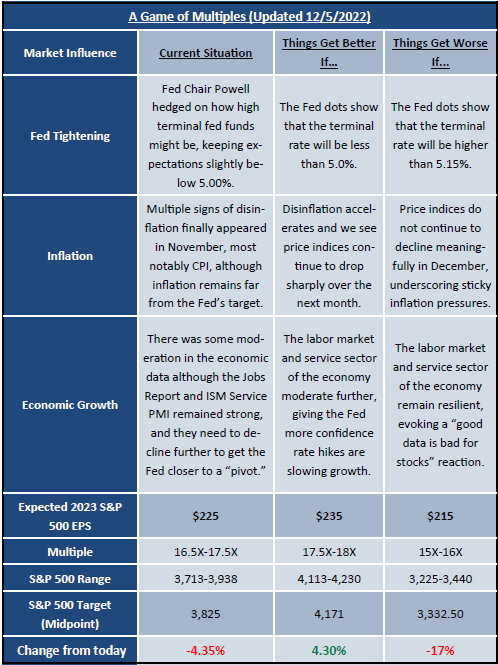

Brad: and given impact of higher discount rates on valuation, it’s not hard to see why

Source: Sevens Report

Source: Sevens Report

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2212-13.