Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

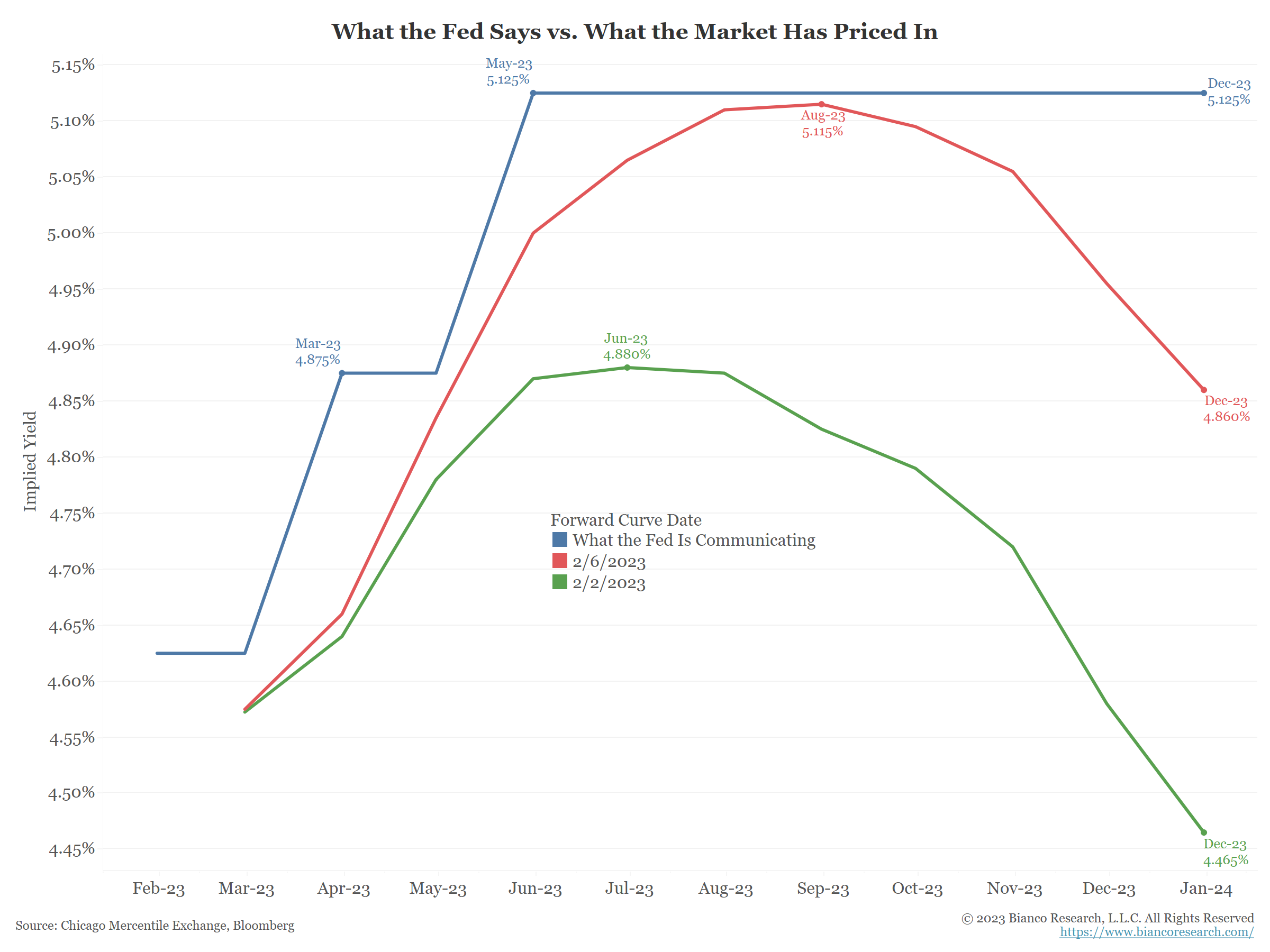

John Luke: Fed Funds expectations are still bouncing around on Fed talk / speculation

Source: Bloomberg as of 02.06.23

John Luke: but what remains consistent is the disconnect b/w the Fed and market expectations

Source: Bianco as of 02.06.23

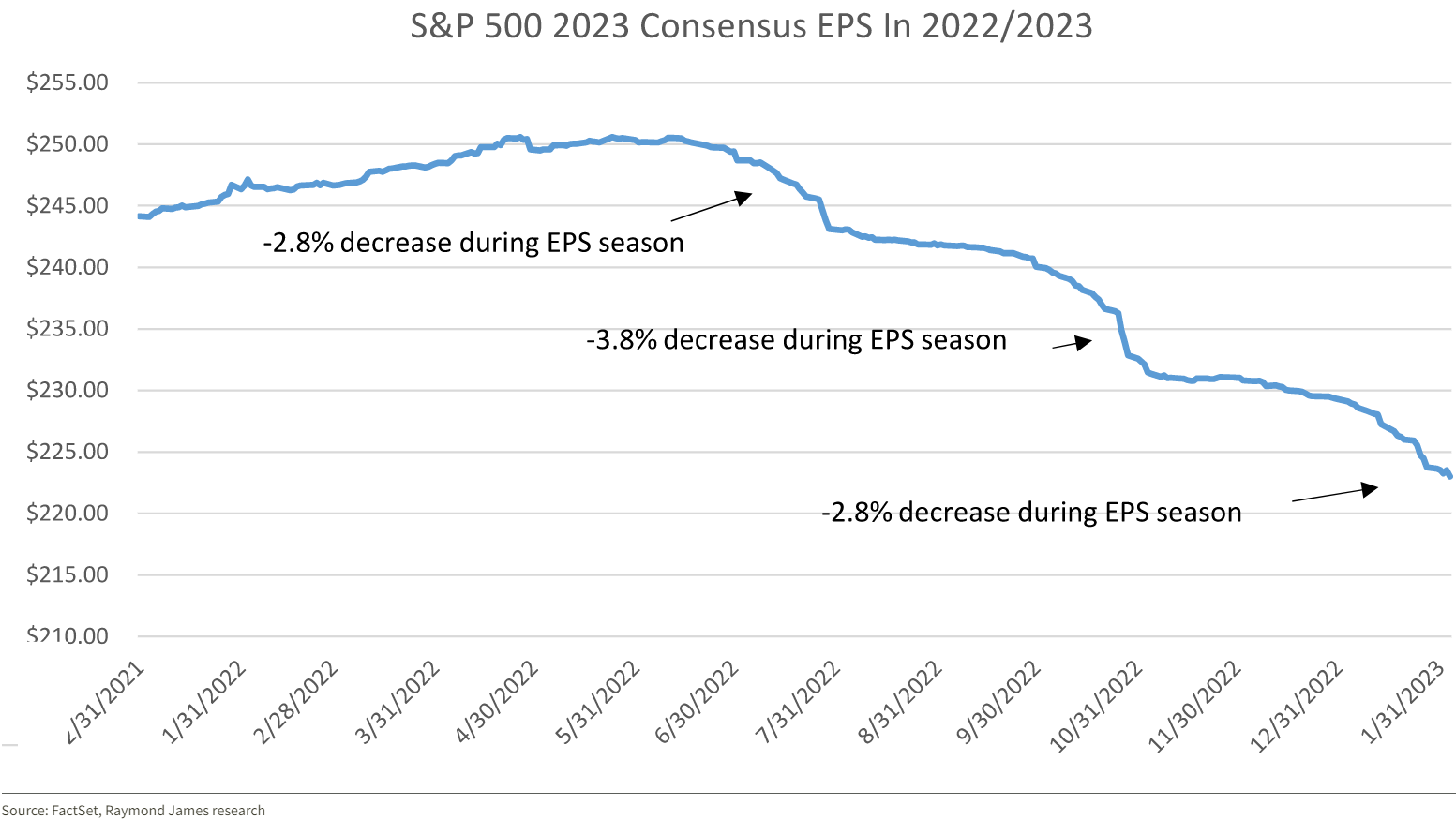

Brad: Another clear pattern is future earnings estimates falling as earnings season progresses

Data as of 02.06.23

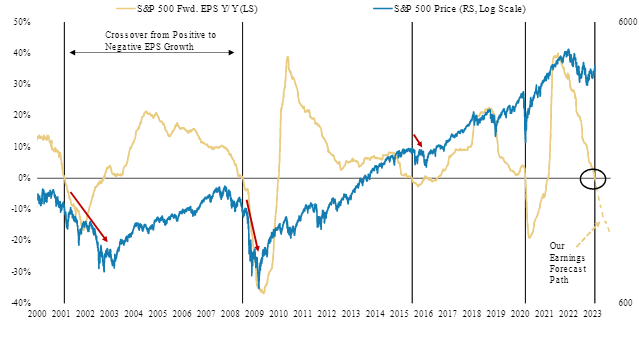

Dave: which is leading to a forward earnings crossing negative, a bad omen for equities in recent instances

Source: PSC as of 02.06.23

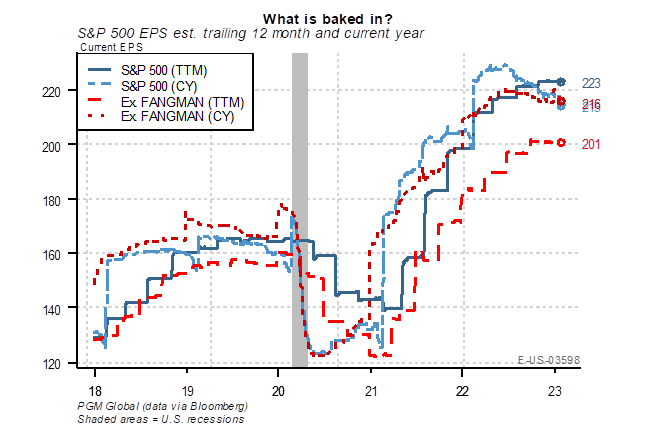

John Luke: Optimists take note, take out the FANGMAN stocks and forward earnings are forecasting 7.5% growth this year

Source: PGM as of 02.06.23

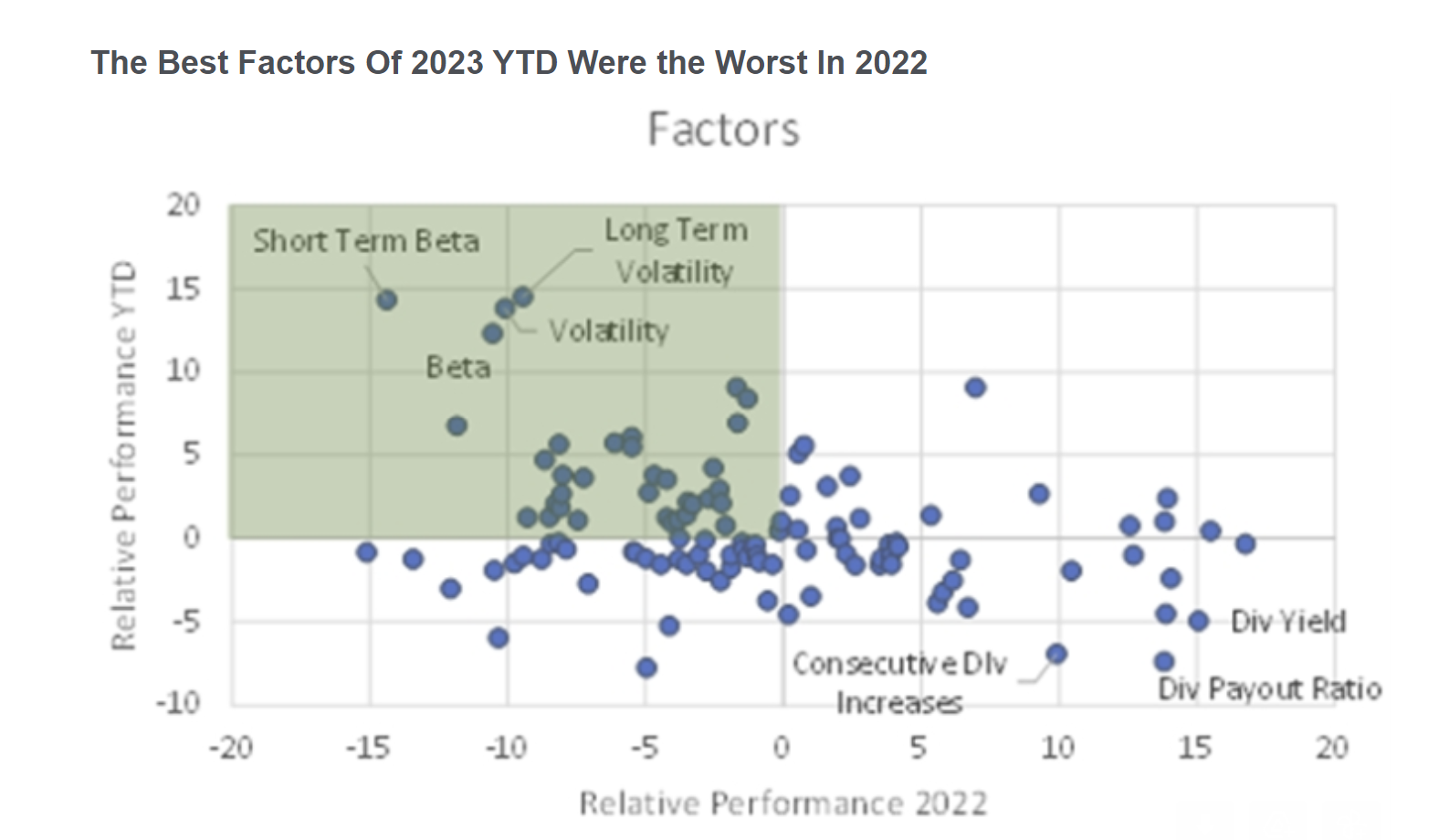

Dave: Early 2023 has been really weird, with junk racing FAR ahead of non-junk

Source: PSC as of 02.08.23

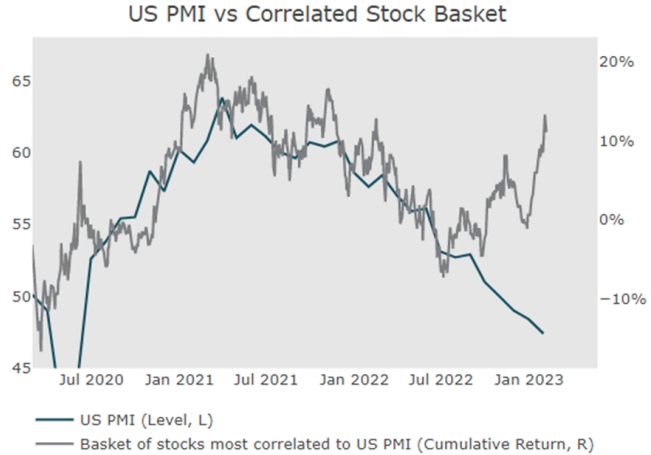

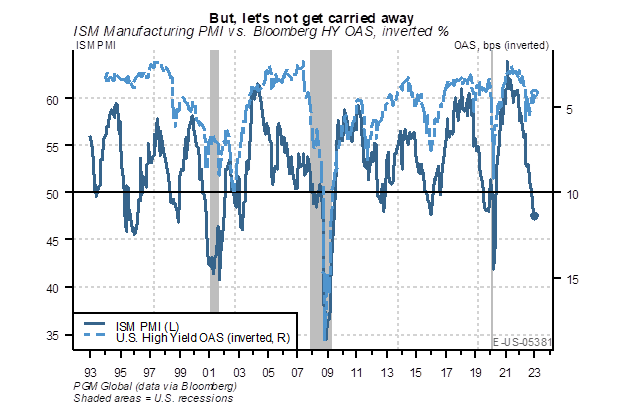

Joseph: and this despite PMIs contracting, which generally leads to quality > junk

Source: Piper as of 02.08.2023

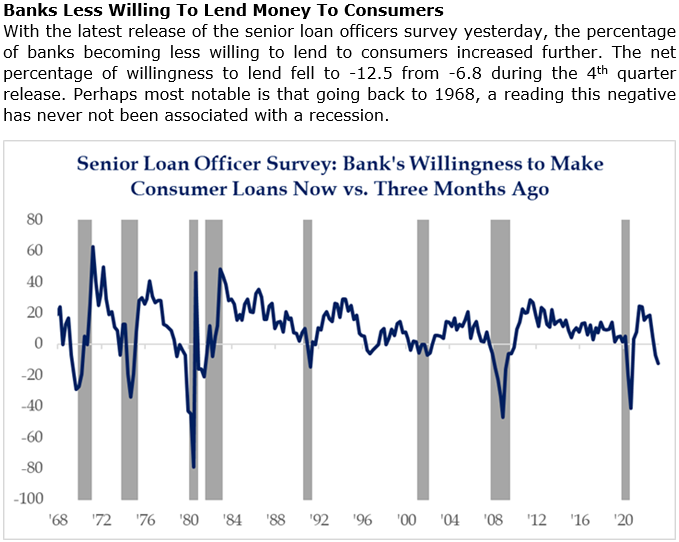

Brad: Bank lending standards have tightened

Source: Strategas as of 02.06.2023

John Luke: but this tightening isn’t showing up in extra compensation for buyers of high yield

Source: Pavilion as of 02.06.2023

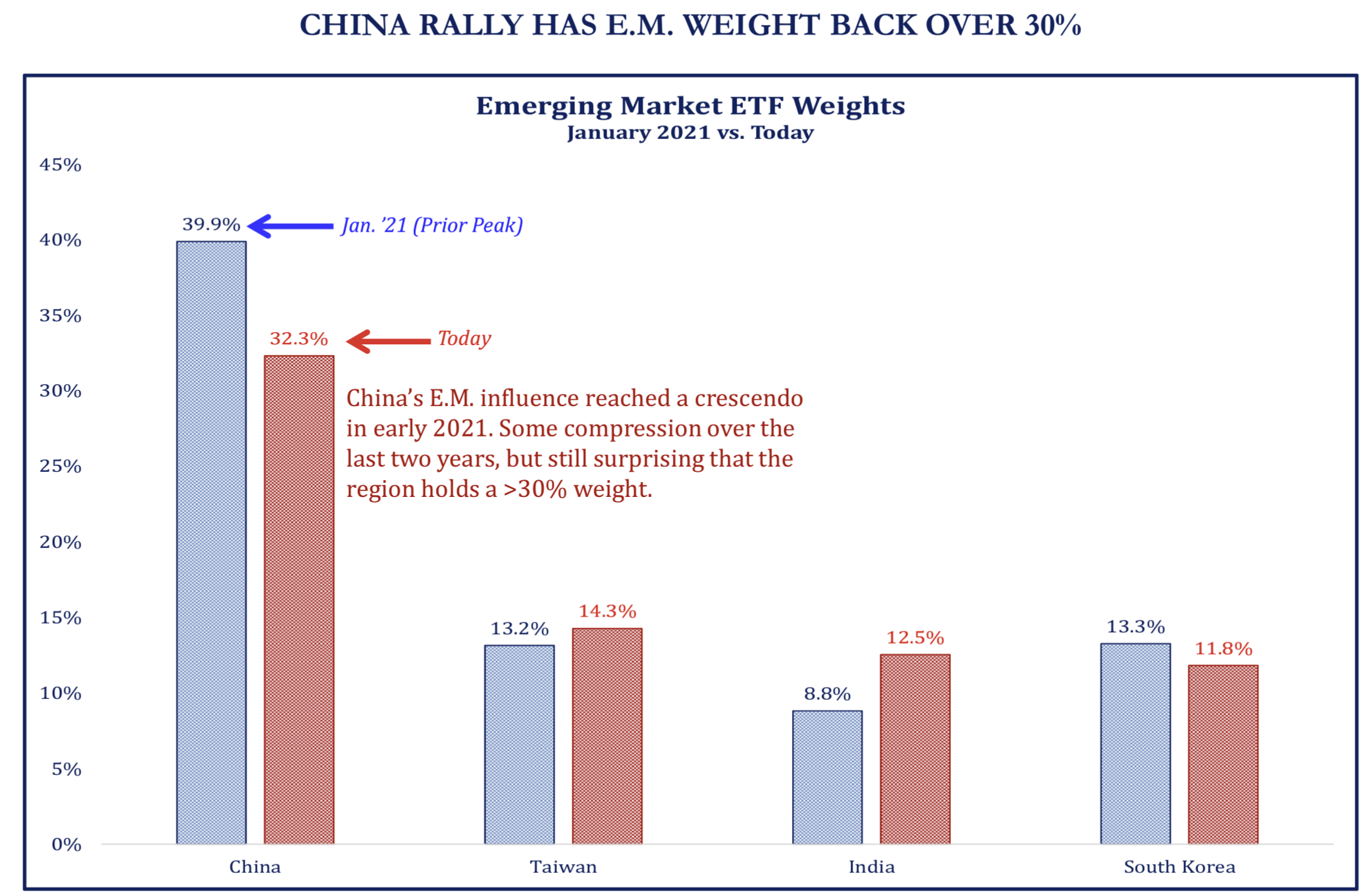

Dave: Buyers of emerging market indices are back to relying on China for a good chunk of the outcome

Source: Strategas as of 02.06.2023

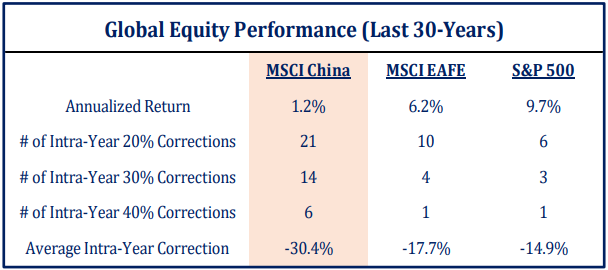

Brad: which should prompt holders to look at just how poorly China has treated investors

Source: Strategas as of 02.06.2023

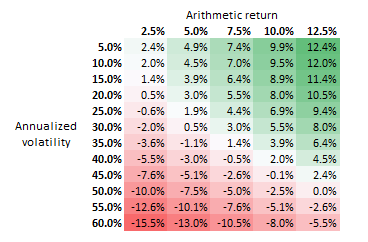

JD: Reminder, you eat compounded returns not average returns. And the volatility tax eats into your compounded returns

Source: Moontower as of 02.05.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2302-16.