Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

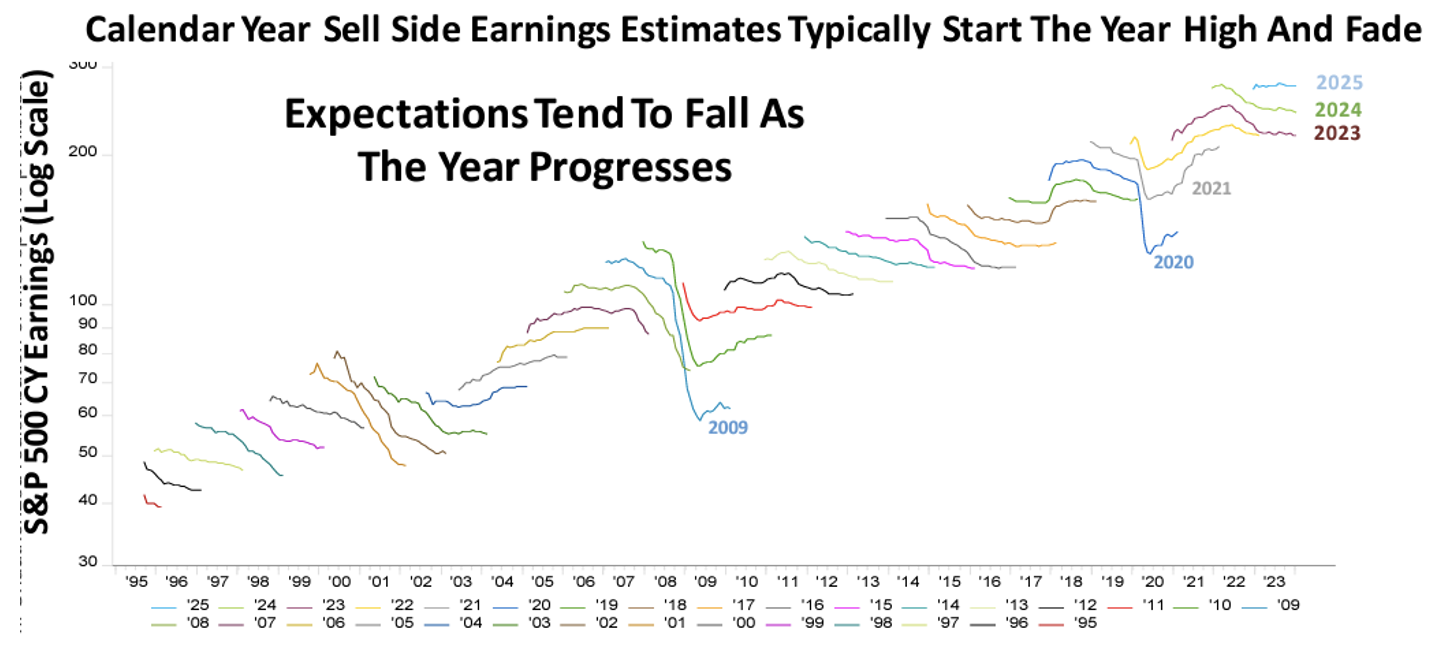

Dave: The typical pattern for earnings estimates is to start high and fade throughout the year

Source: Piper Sandler as of 02.16.2024

Source: Piper Sandler as of 02.16.2024

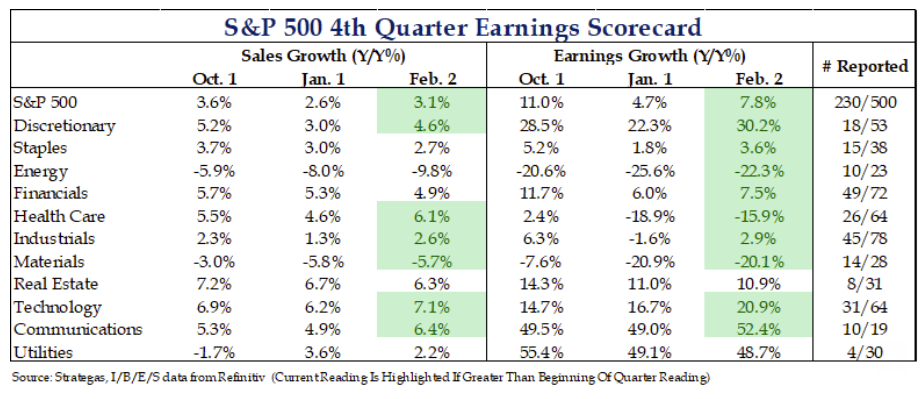

Brad: but so far in 2024, sales have generally been above estimates, and earnings even more above

Data as of 02.13.2024

Data as of 02.13.2024

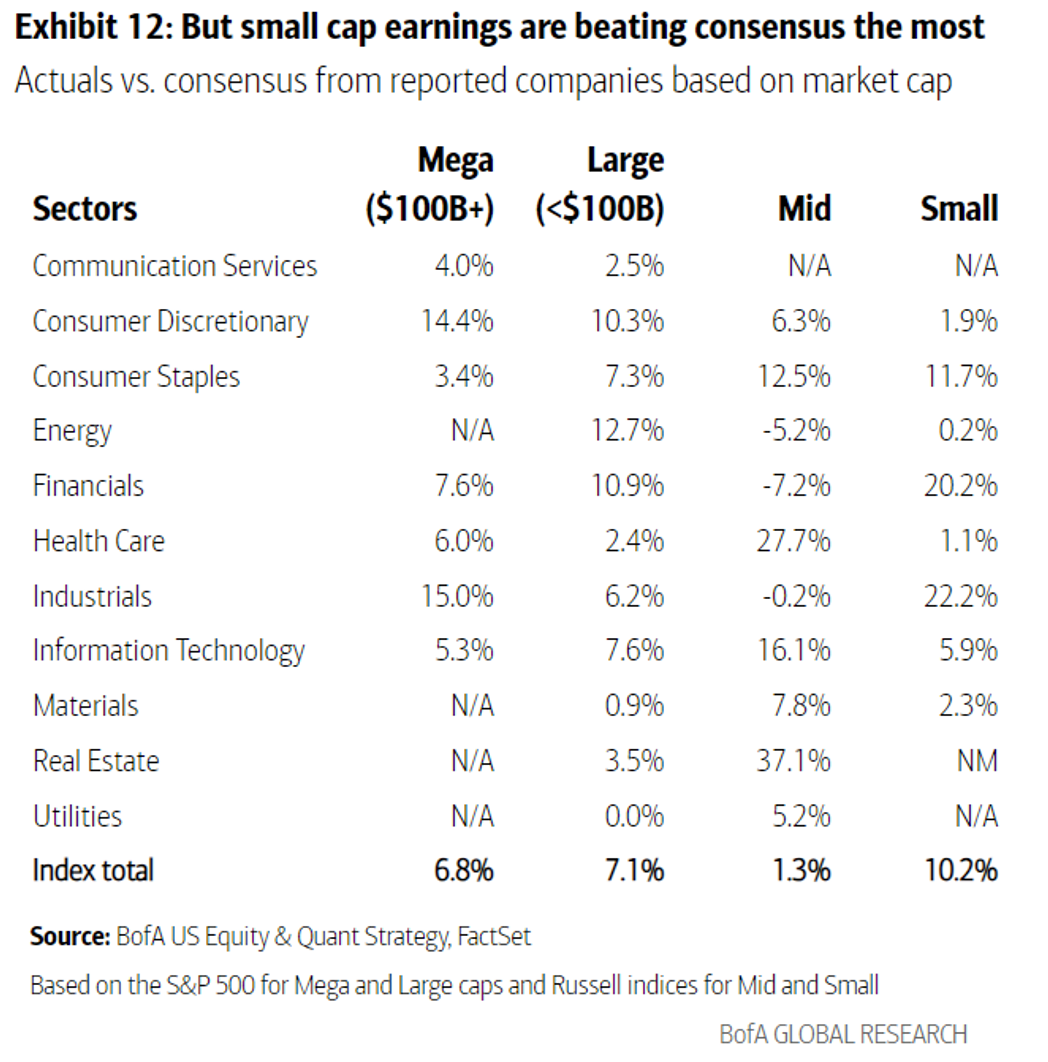

Dave: especially for small caps

Data as of 02.12.2024

Data as of 02.12.2024

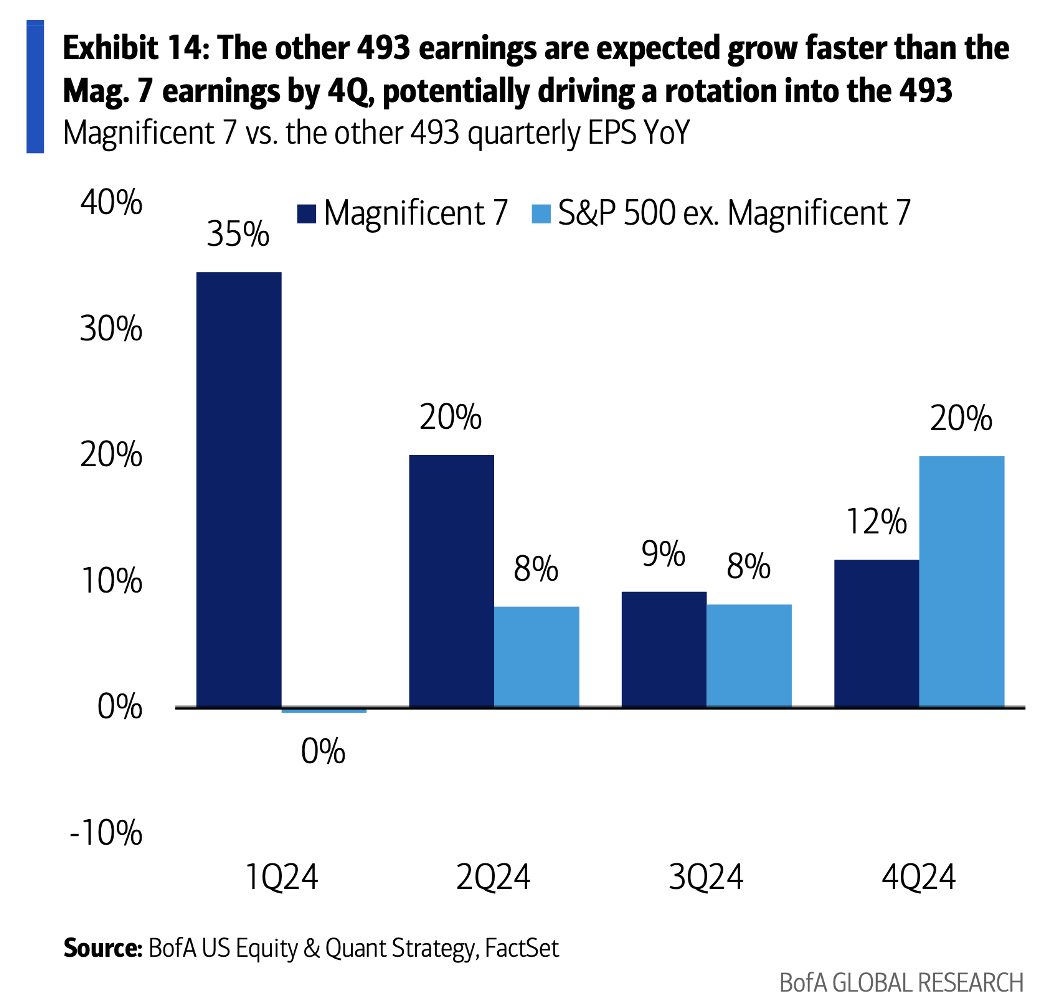

Brett: so maybe this will be the year that broader market earnings catch up to the megacap names

Data as of 02.12.2024

Data as of 02.12.2024

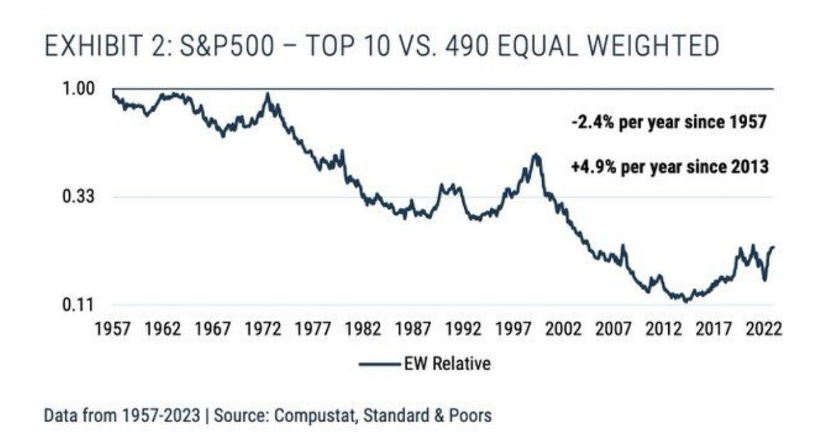

Brian: Megacap dominance was not a thing for most of the past 70 years

Data via GMO as of Jan 2024

Data via GMO as of Jan 2024

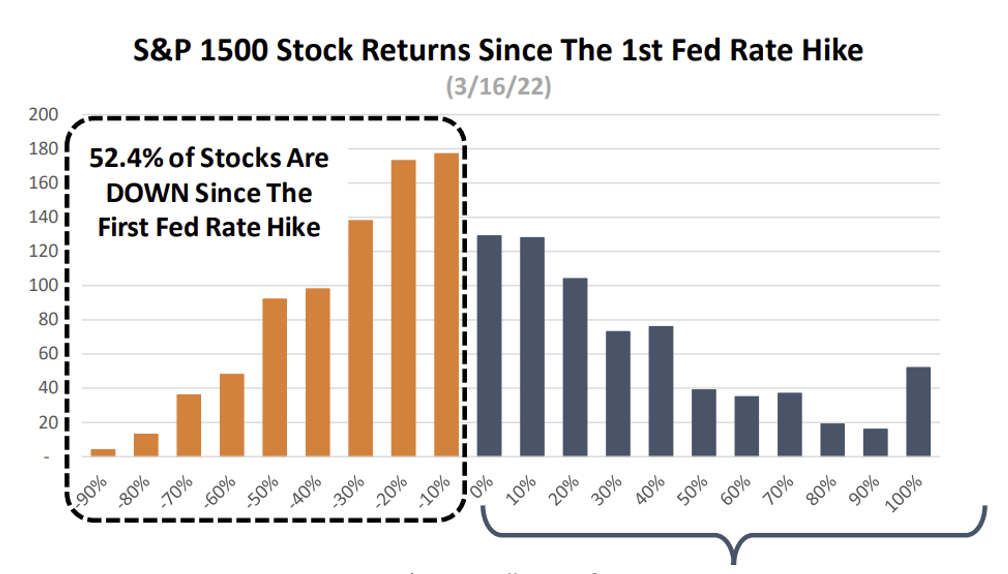

Dave: and you can clearly say the “average” stock hasn’t done much since rate hikes began in March 2022

Source: Piper Sandler as of 02.12.2024

Source: Piper Sandler as of 02.12.2024

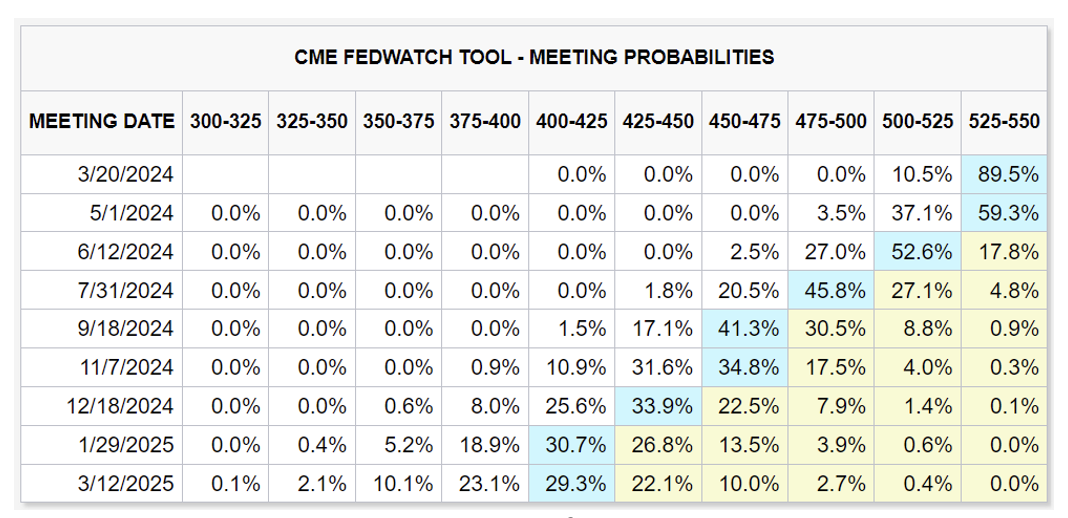

Joseph: Fed watchers have extended dates for the expected rate cut cycle

Source: CME as of 02.15.2024

Source: CME as of 02.15.2024

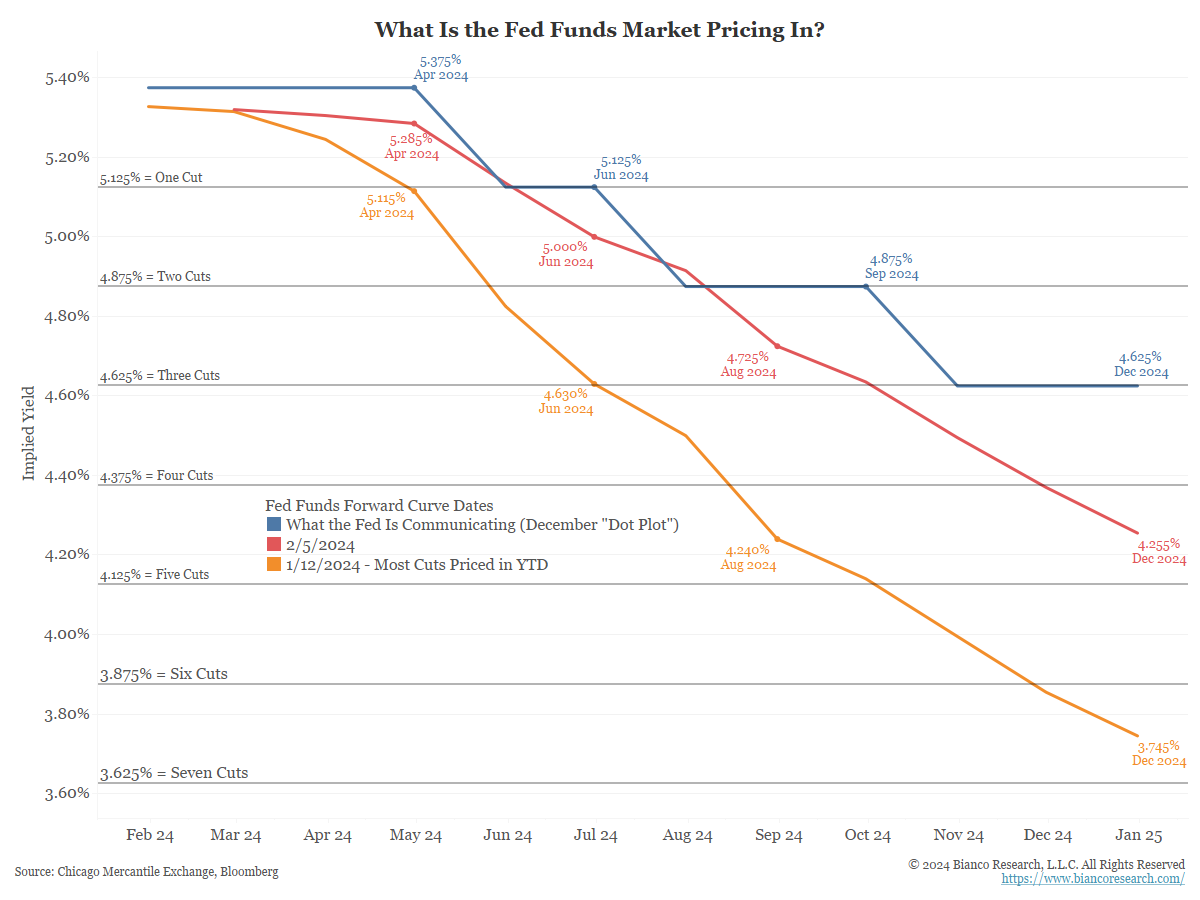

John Luke: though markets are still ahead of where the actual policy-makers seem to be

Data as of 02.13.2024

Data as of 02.13.2024

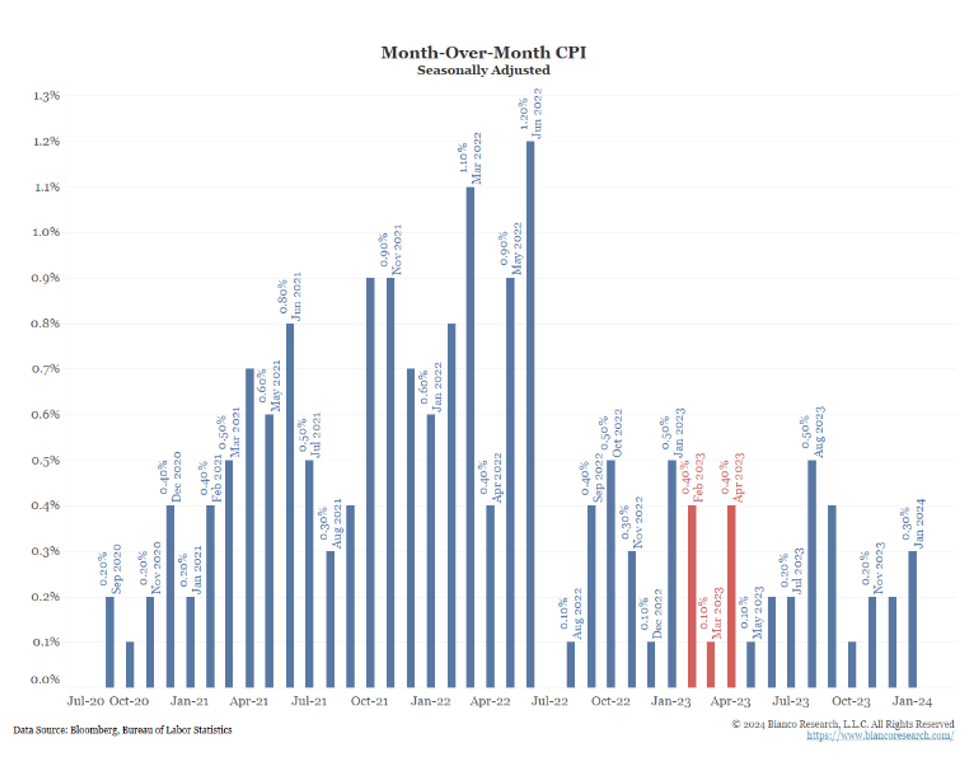

Dave: as the level of inflation measured by monthly CPI has generally come down from the highs of 2022

Data as of 02.13.2024

Data as of 02.13.2024

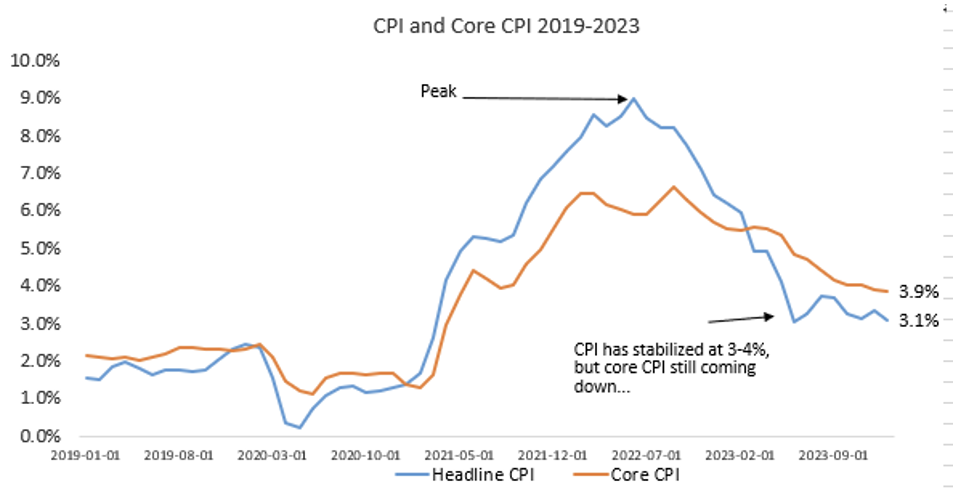

Dave: it’s the flattening of the disinflationary move that has markets revisiting those expectations

Source: Raymond James as of 02.14.2024

Source: Raymond James as of 02.14.2024

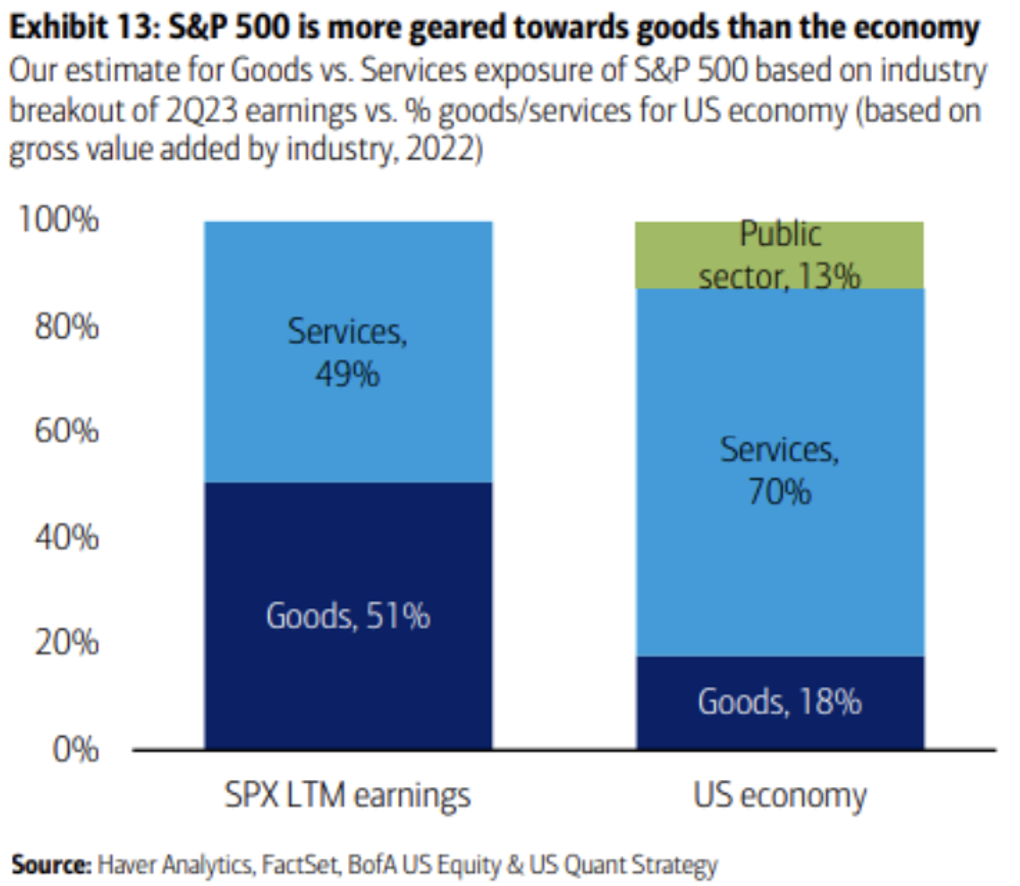

Dave: Goods reflect a far heavier piece of the S&P 500 than they do in the service-heavy US economy

Data as of Jan 2024

Data as of Jan 2024

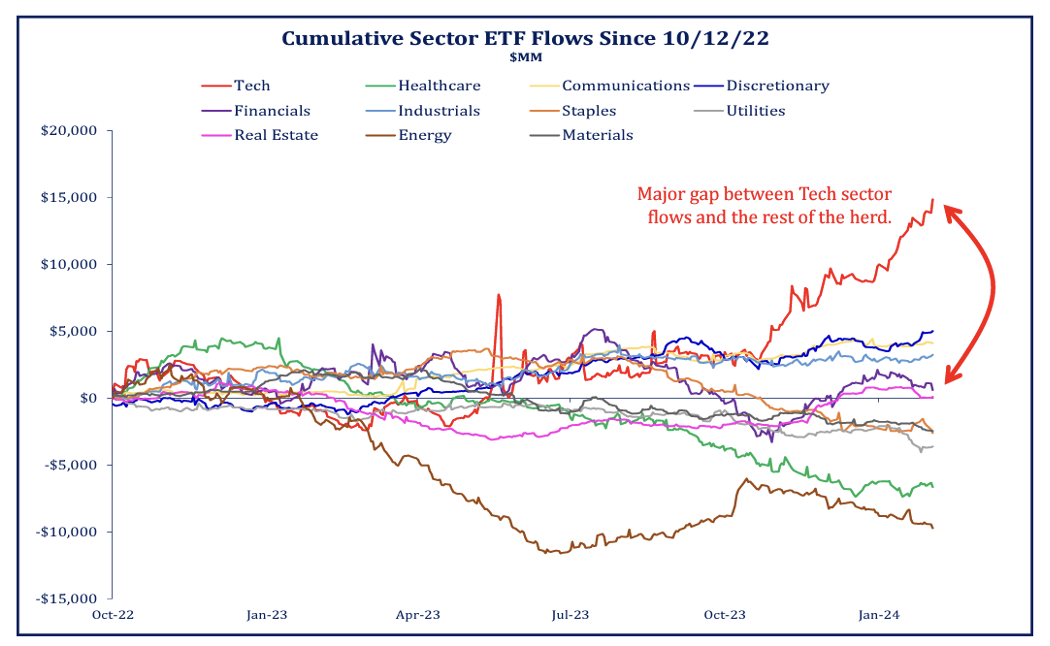

Dave: No surprise but money is following the hottest sector of the market

Source: Strategas as of February 2024

Source: Strategas as of February 2024

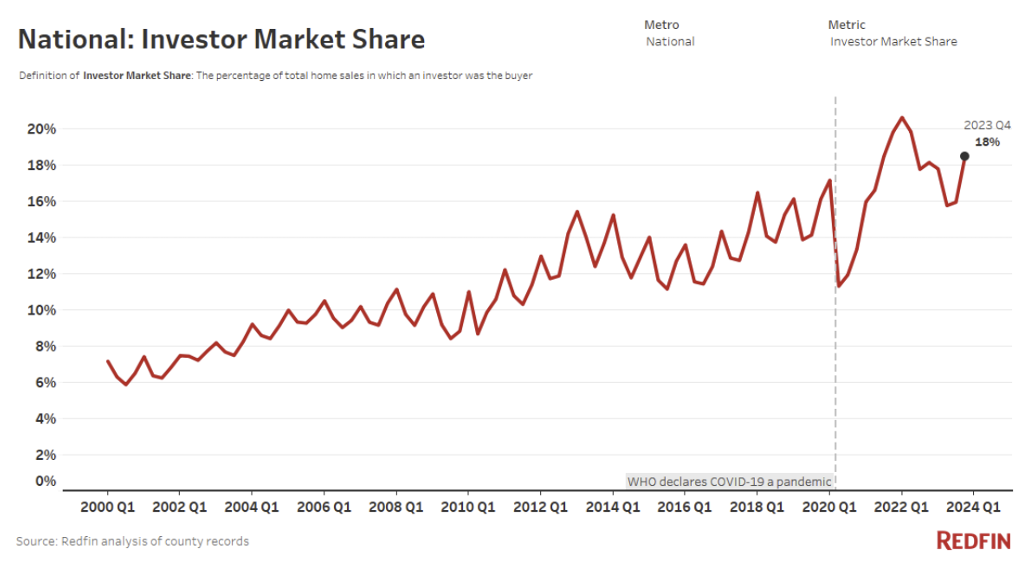

Beckham: We know shelter has been sticky in the inflation measures, with investors continuing to own more of the market than in the past

Data as of January 2024

Data as of January 2024

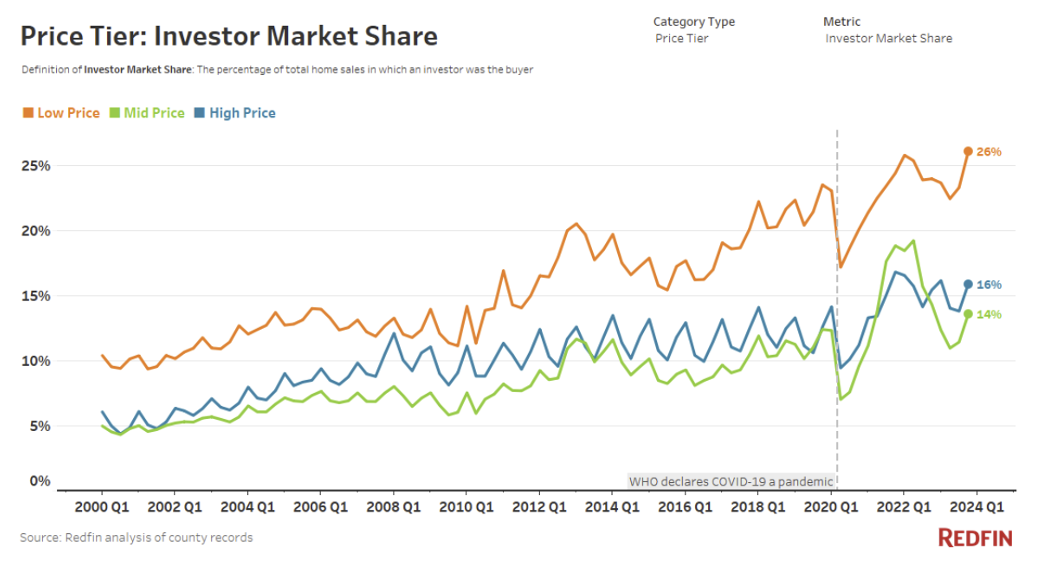

Beckham: with investors gradually crowding individuals out of the starter home market

Data as of January 2024

Data as of January 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2402-15.