Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

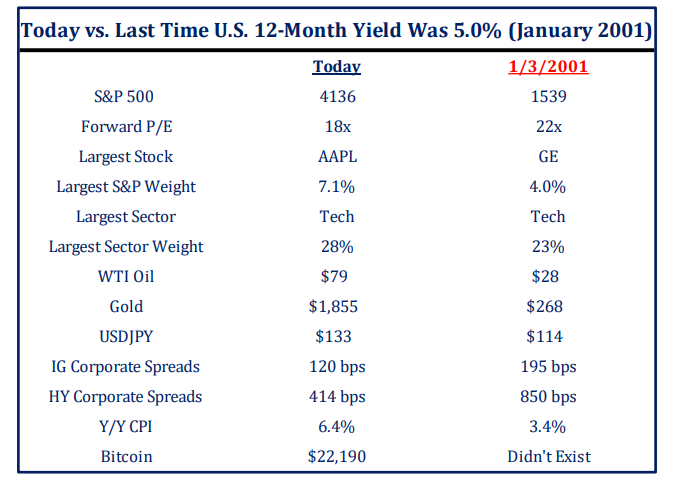

John Luke: It’s been awhile since 5% rates were an option for investors, things looked different back then

Source: Strategas as of 02.14.2023

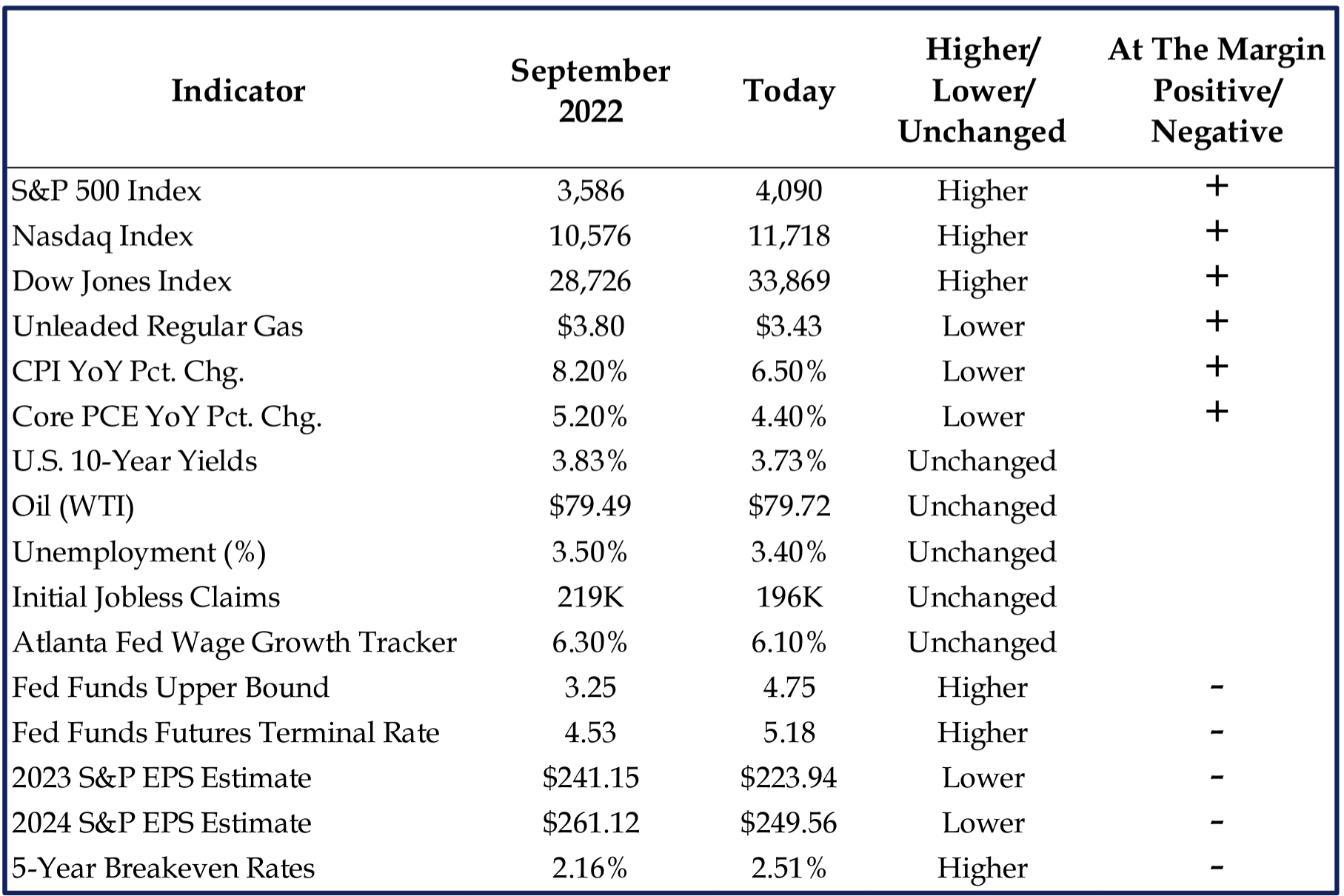

Dave: and over the past few months stocks have risen despite adverse changes in rates (higher) and earnings (lower)

Source: Strategas as of 02.14.2023

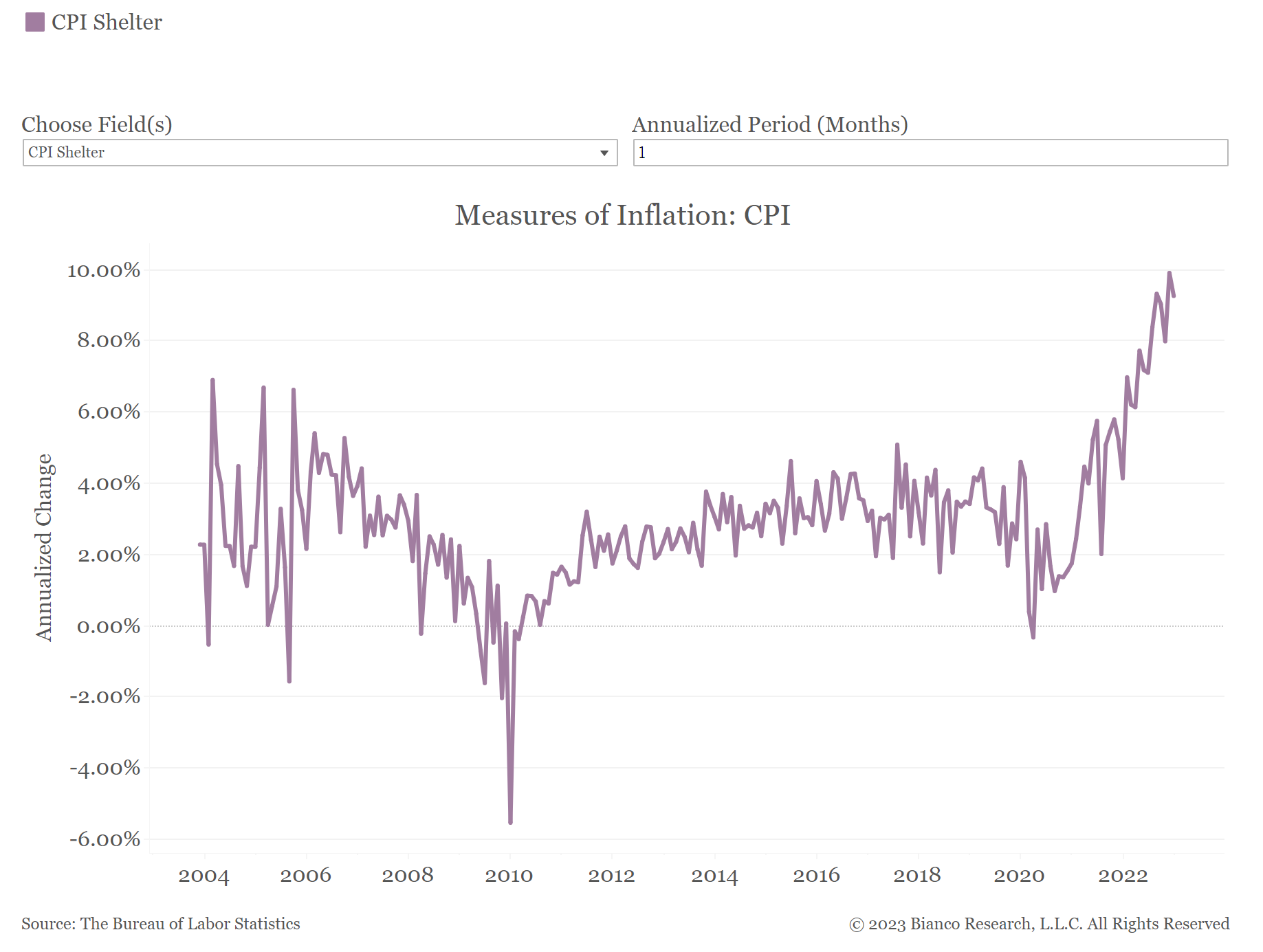

Dave: Shelter is the current discussion point in the inflation debate

Source: Bianco as of 02.15.2023

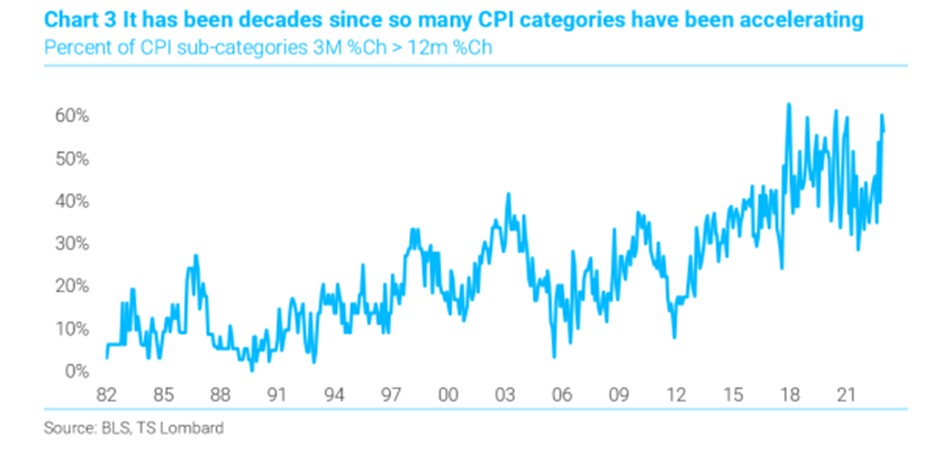

John Luke: but the price pressures are as hot as they’ve been across a number of areas

Data as of 02.15.2023

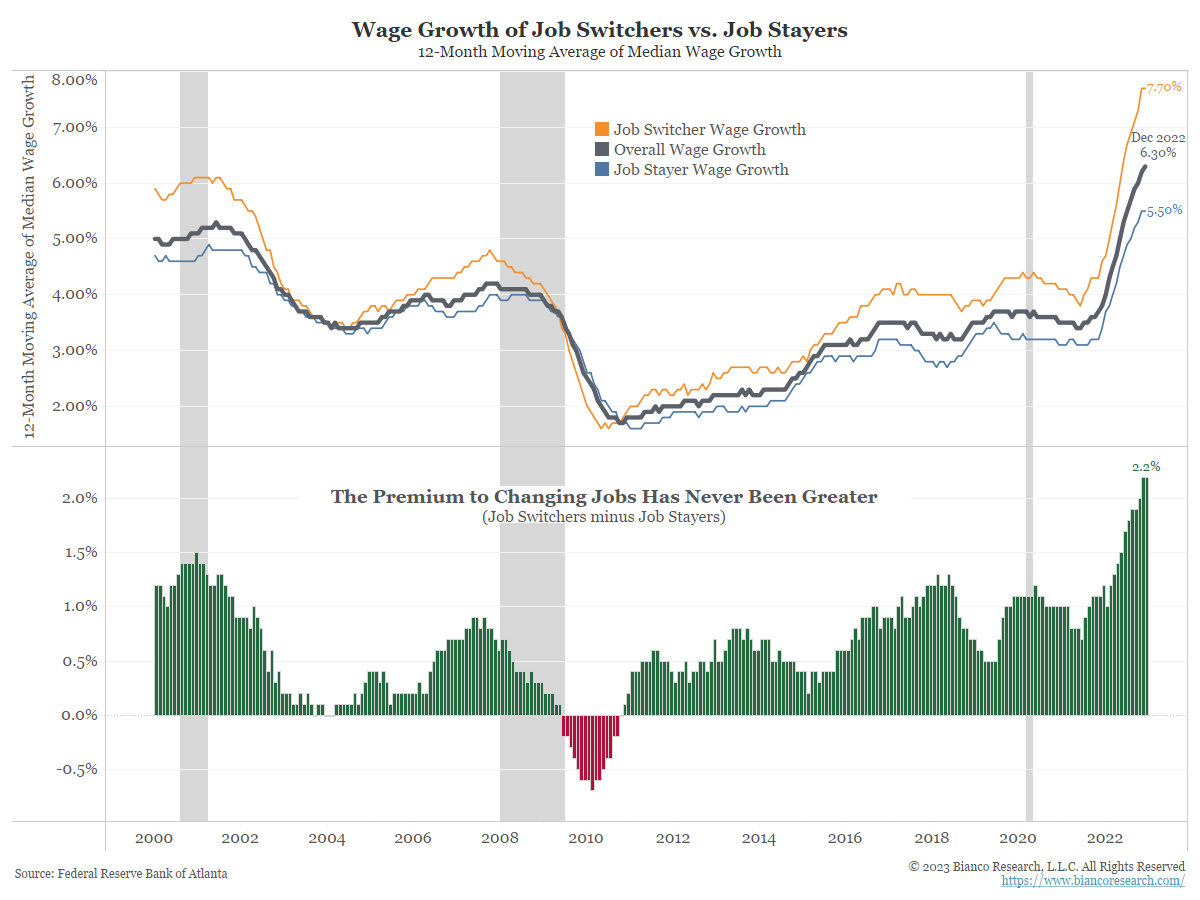

John Luke: and job switchers are having no problem getting pay raises

Data as of 02.13.2023

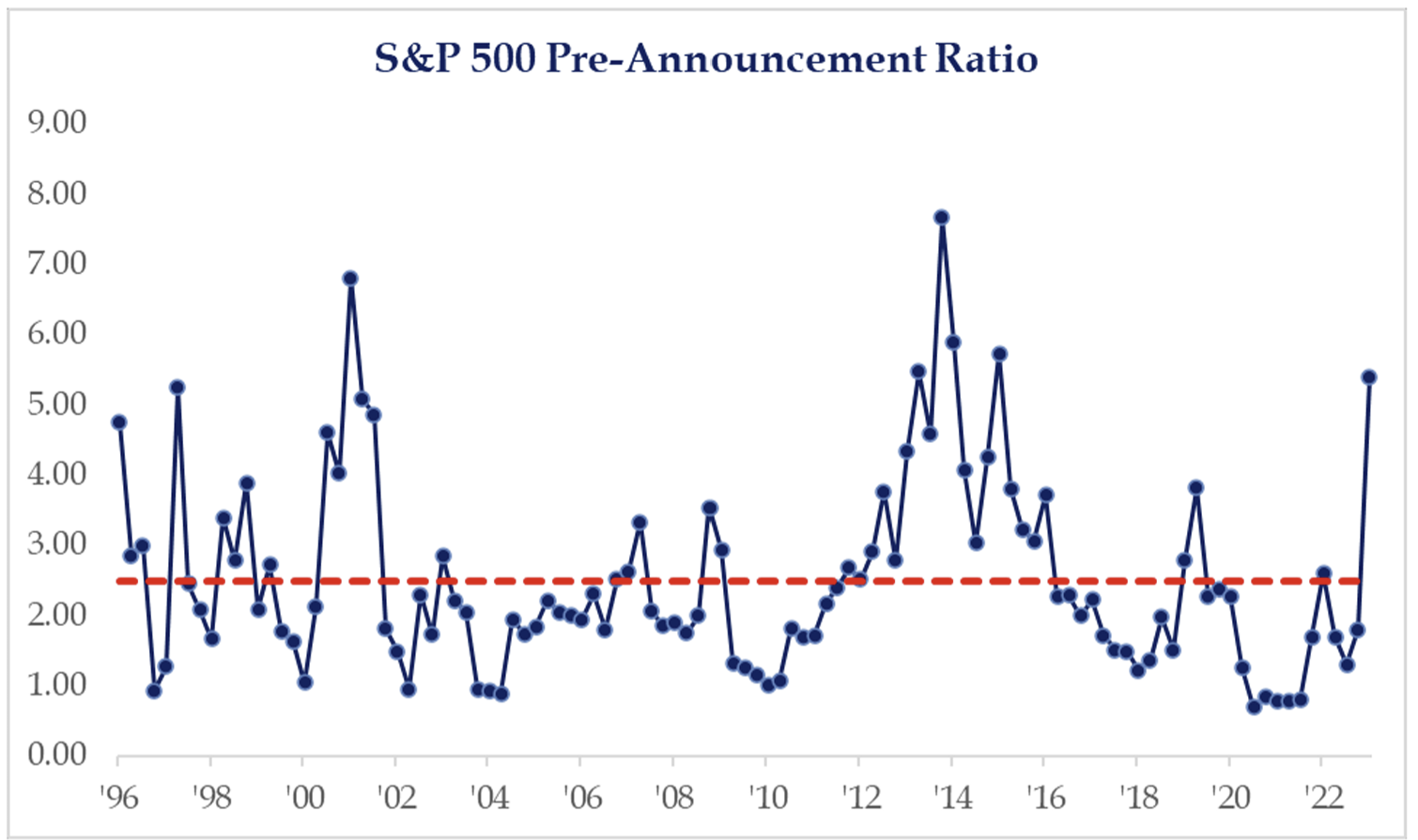

Dave: 2023 has started with a high number of earnings pre-announcements relative to the past

Source: Strategas as of 02.14.2023

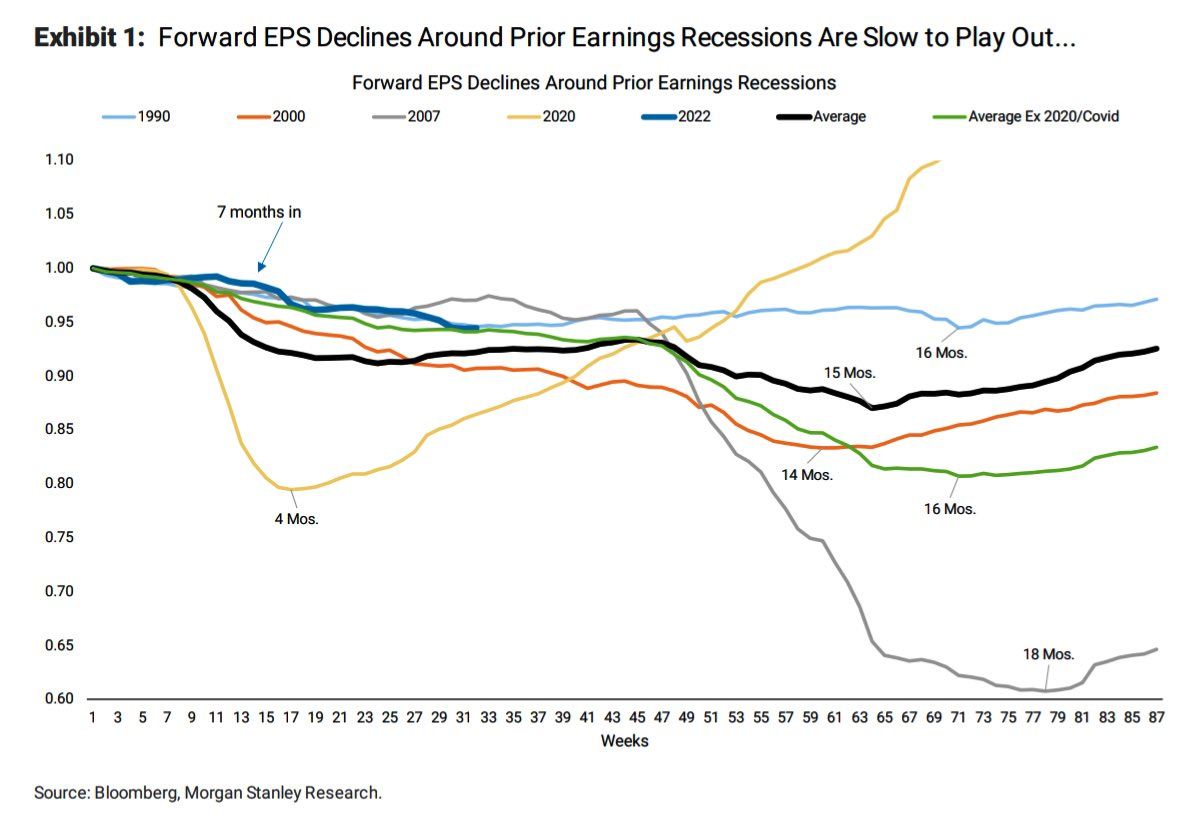

Dave: and earnings shortfalls sometimes take awhile to turn into actual recessions

Data as of 02.10.2023

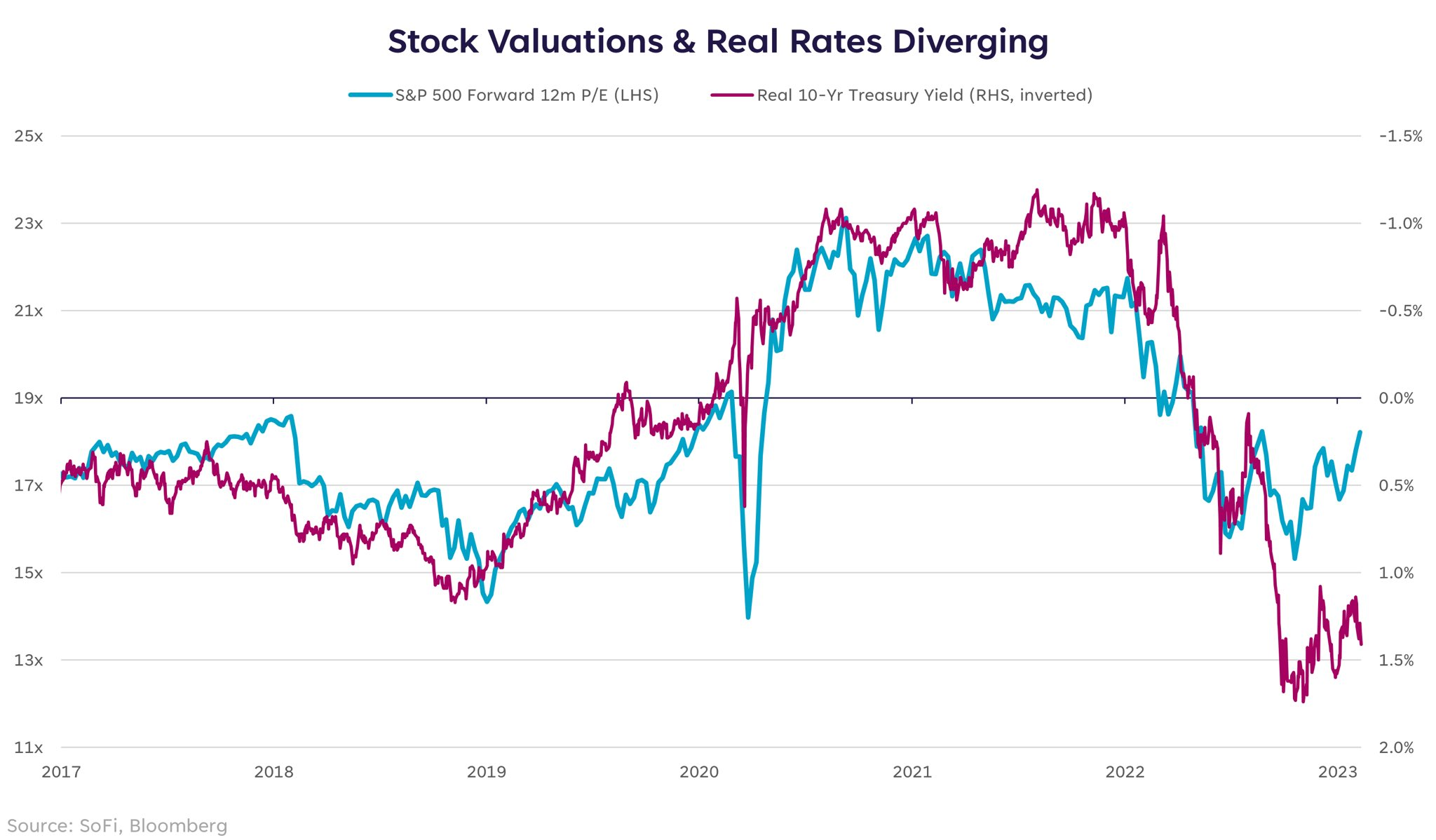

John Luke: Equity valuations have remained stubbornly high given the lift in real yields

Data as of 02.10.2023

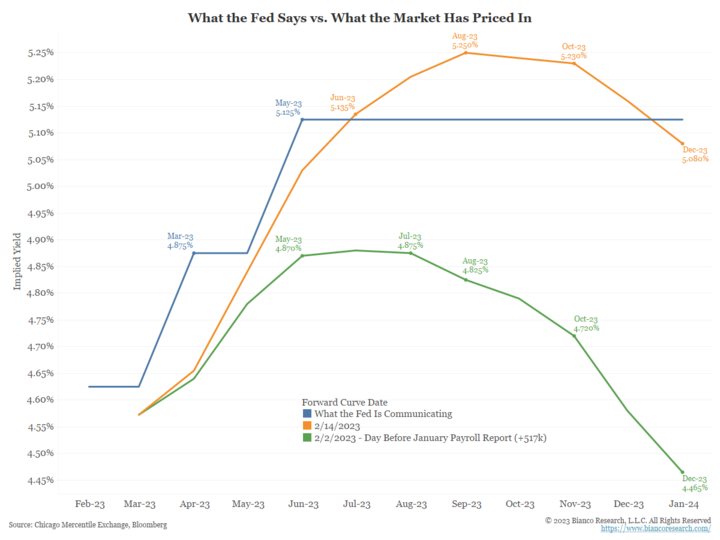

John Luke: We share this one regularly: Is the bond market FINALLY believing what the Fed keeps telling them?

Source: Bianco, as of 02.15.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2302-21.