Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

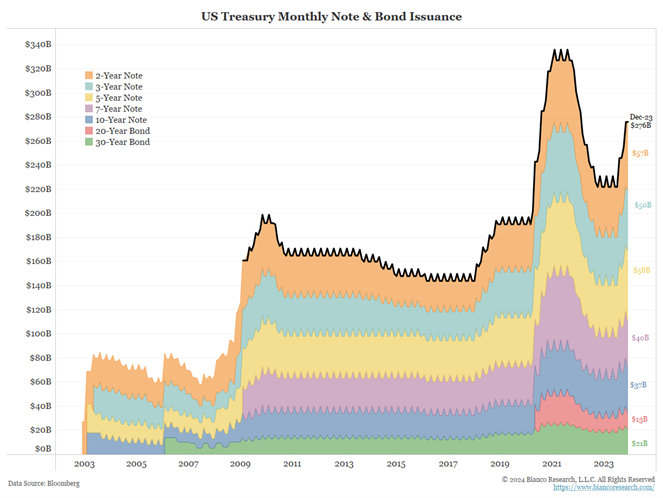

John Luke: Before the FOMC meeting, markets took comfort that Treasury borrowing needs wouldn’t expand in the first half of 2024

Data as of January 2024

Data as of January 2024

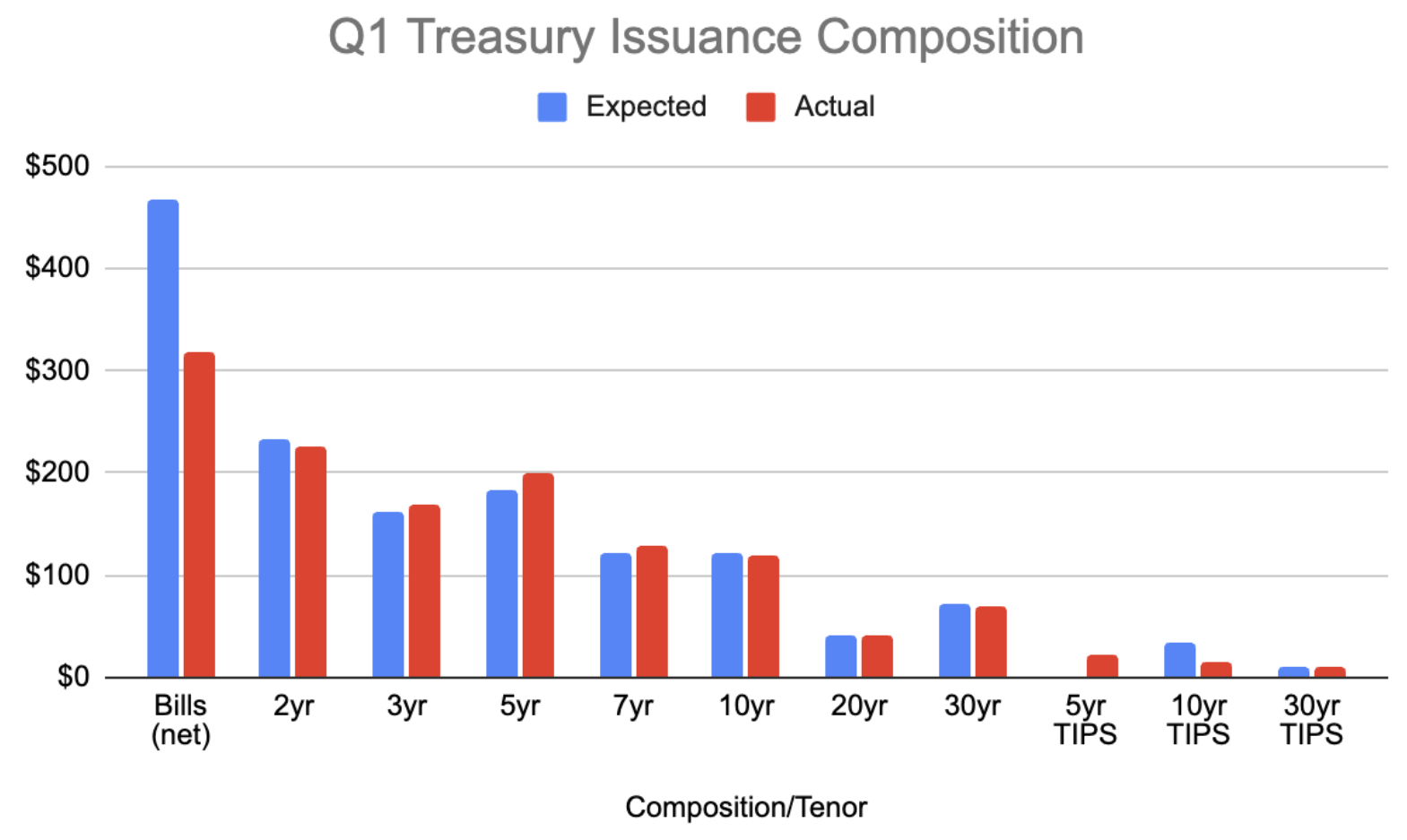

Beckham: and even a sizable reduction in expectations for the use of short-term bills

Source: Reflexivity as of 01.31.2024

Source: Reflexivity as of 01.31.2024

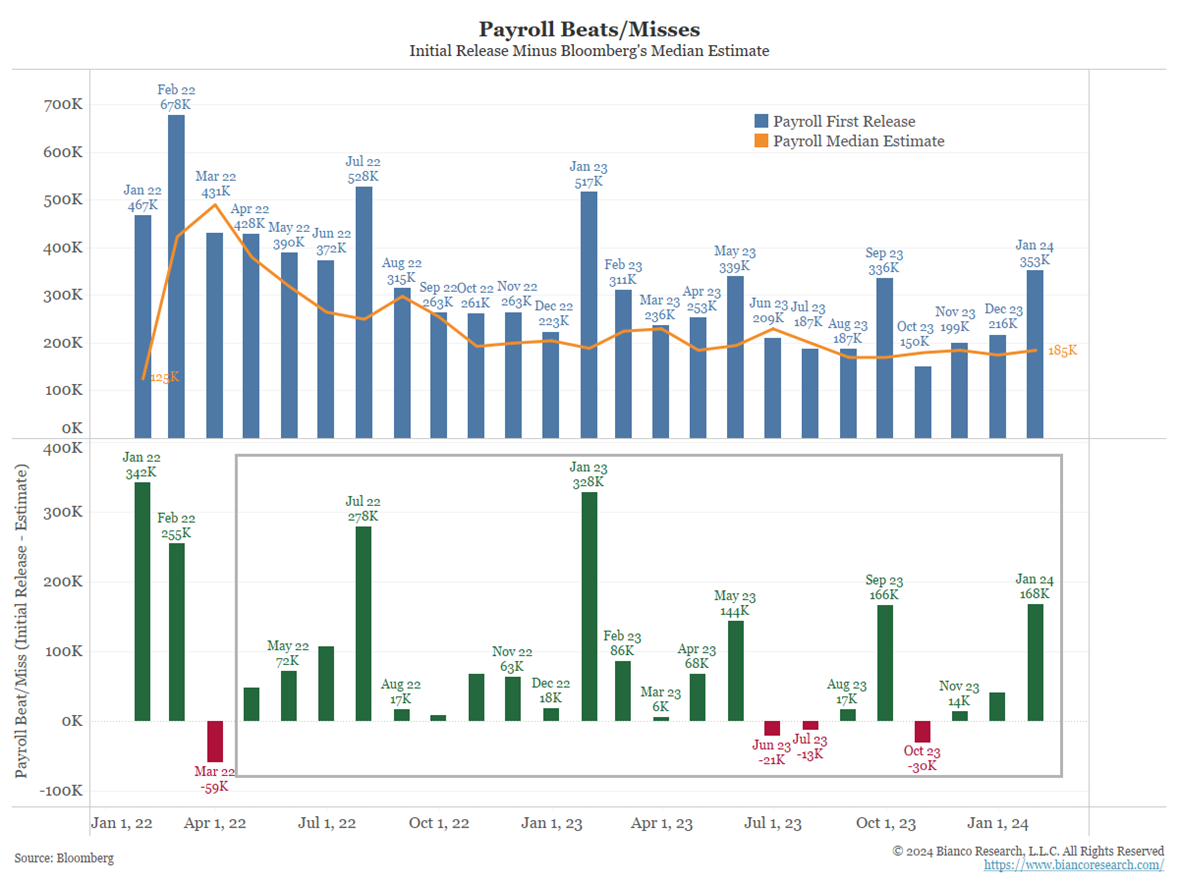

John Luke: The jobs report shocked the market, implying that the trough of this economic cycle might be behind us

Data as of 02.02.2024

Data as of 02.02.2024

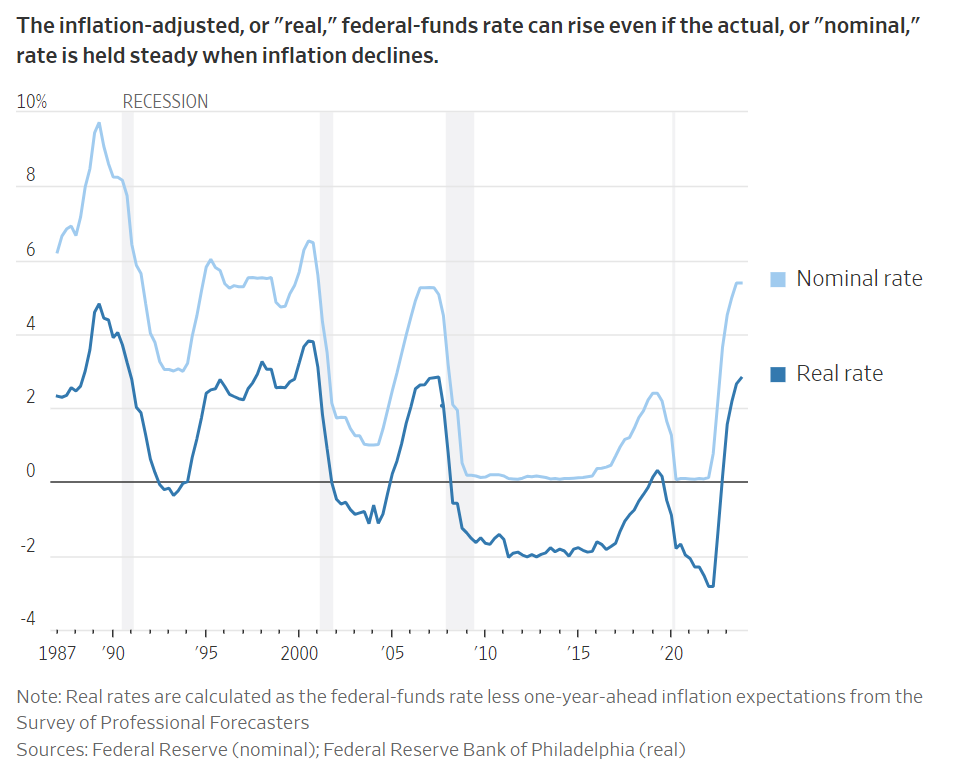

Brett: this despite a restrictive environment for real (nominal minus inflation) rate policy

Source: WSJ as of 01.30.2024

Source: WSJ as of 01.30.2024

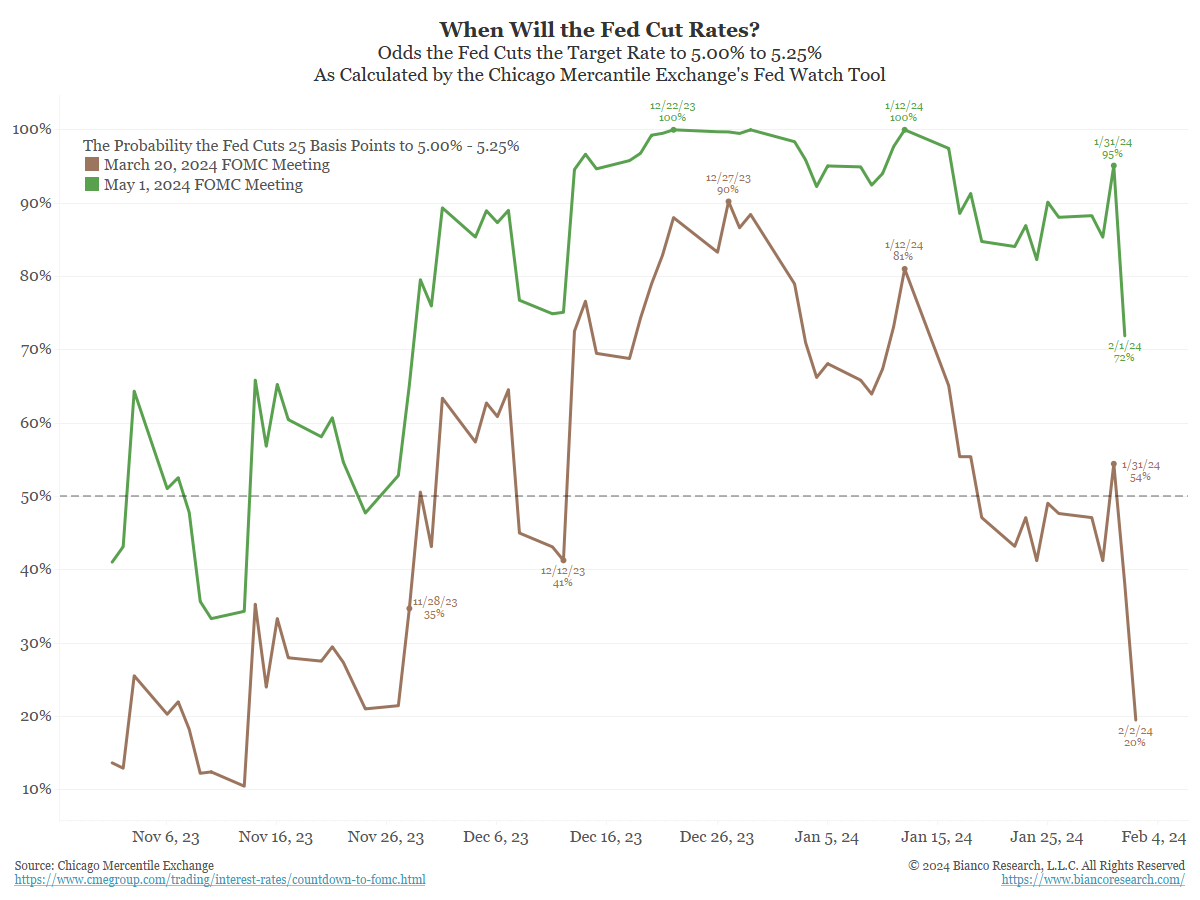

John Luke: yet significantly reducing the odds of a rate cut at the FOMC’s March meeting

Data as of 02.02.2024

Data as of 02.02.2024

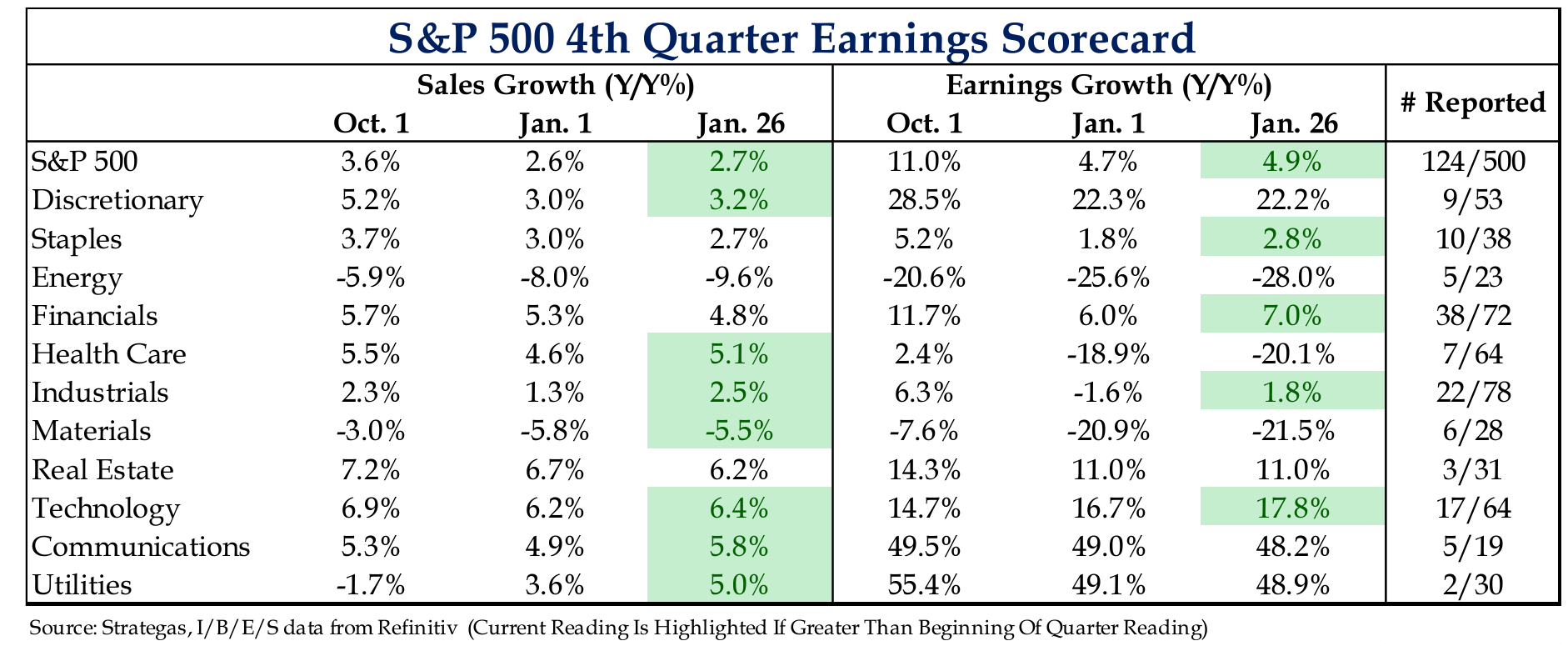

Dave: On the earnings front, reports are trickling in and technology is the only area where earnings estimates have moved higher since October

Data as of 01.29.2024

Data as of 01.29.2024

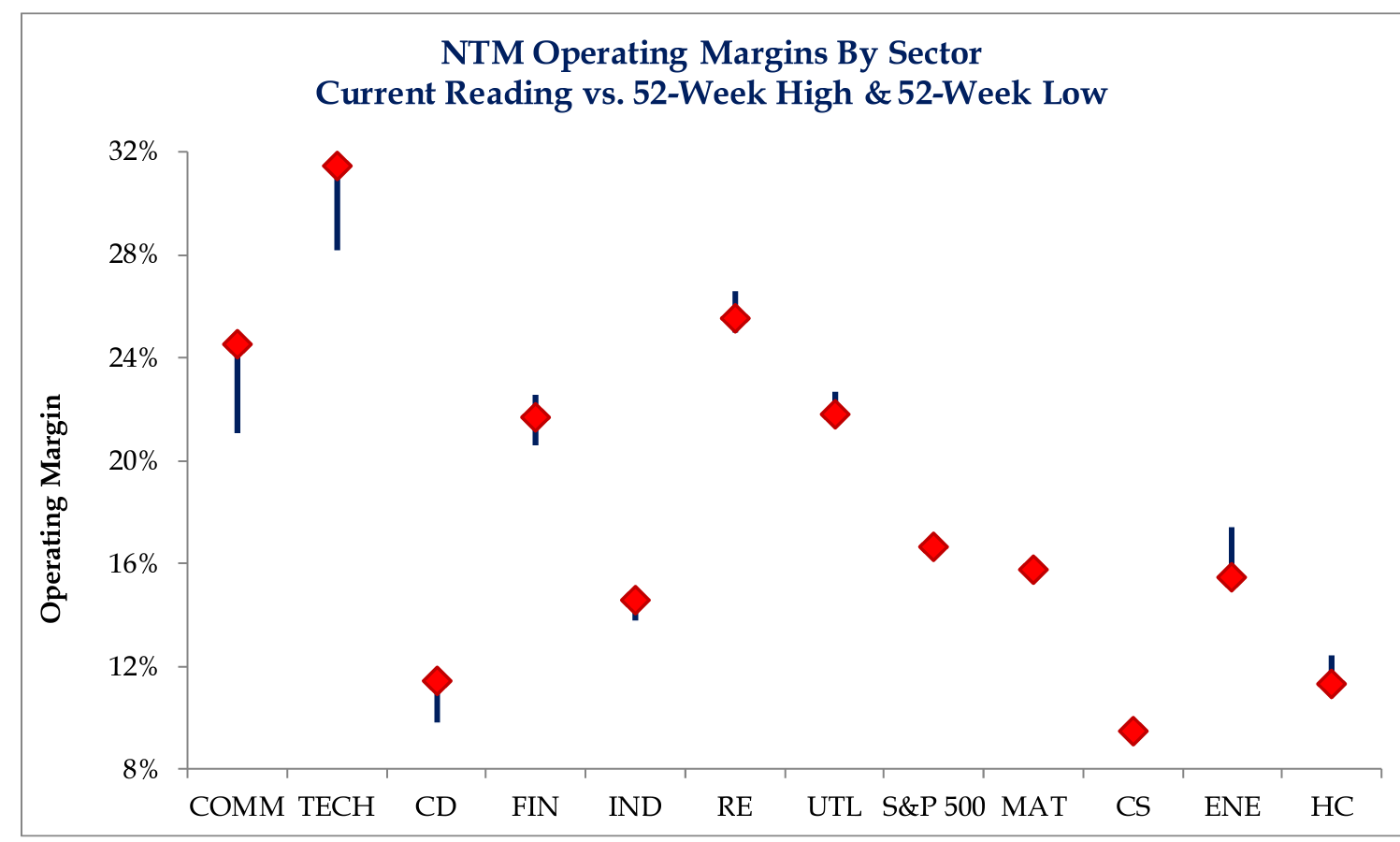

Dave: this is partly due to maintaining high expectations for profit margins relative to other sectors

Source: Strategas as of 01.30.2024

Source: Strategas as of 01.30.2024

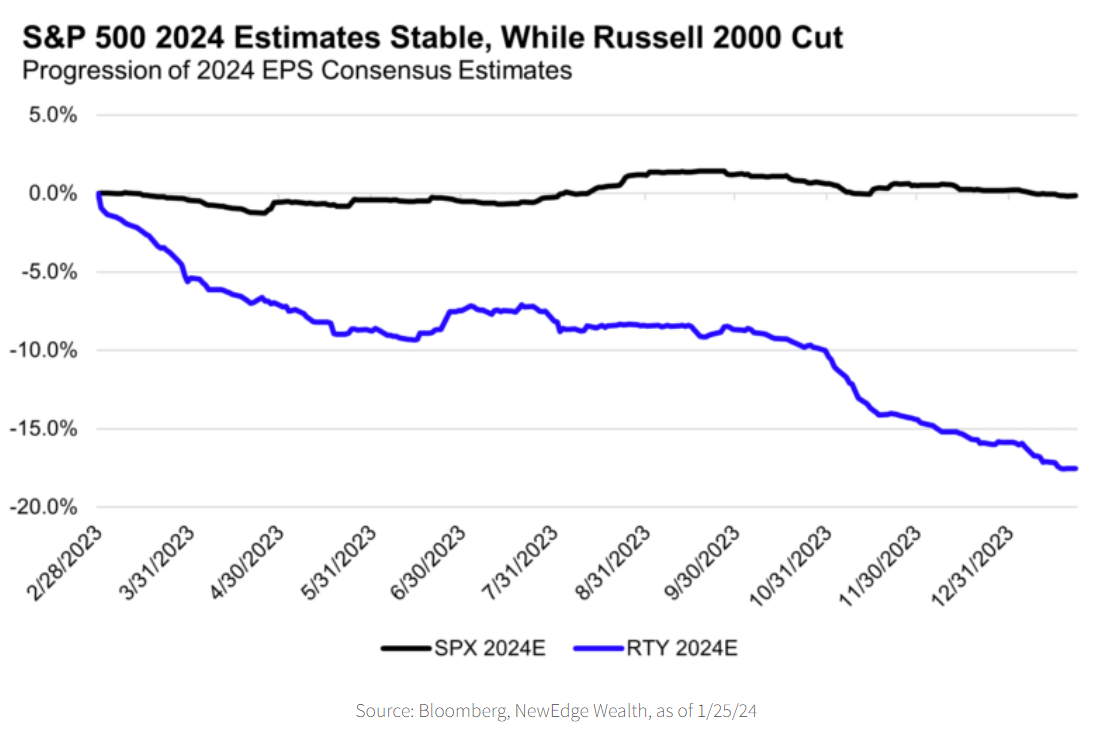

Brian: and a huge difference between stocks classified as growth vs. those classified as value

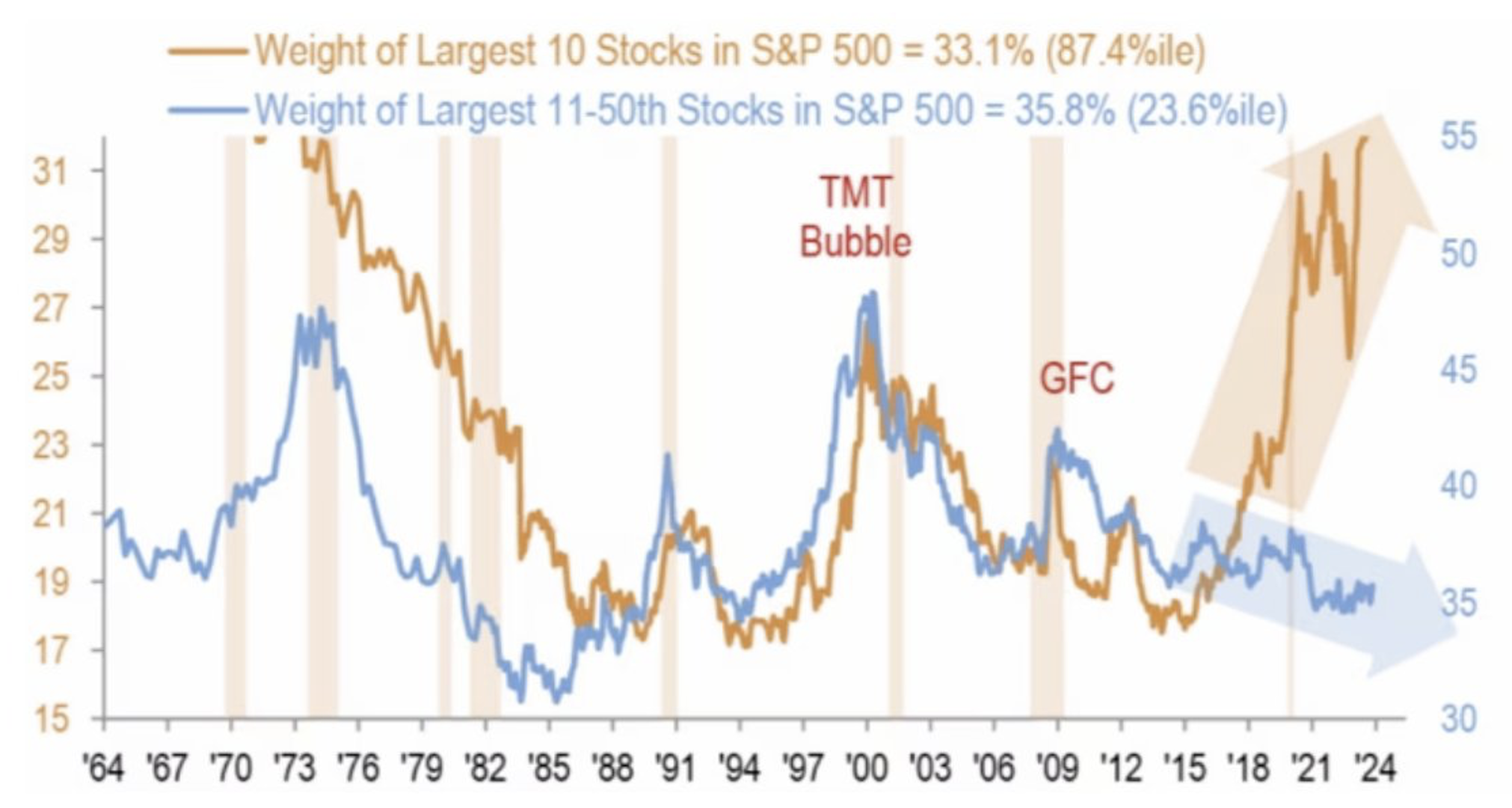

John Luke: The divergence between the largest stocks and even just “large” stocks continues to be historically extreme

Source: JPM as of January 2024

Source: JPM as of January 2024

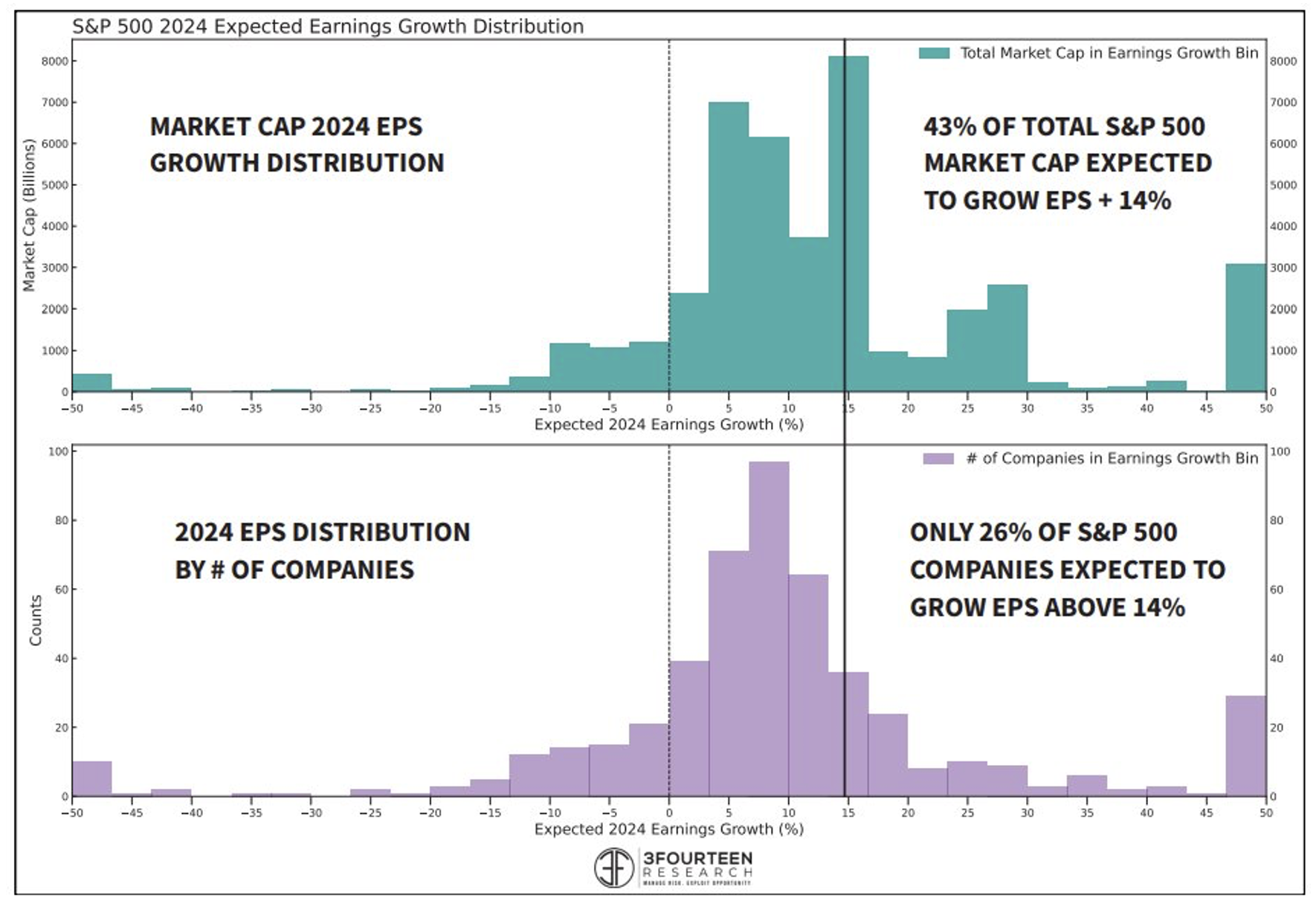

John Luke: but you can still make the case that company fundamentals are a justifiable driver of this massive divergence

Data as of 01.30.2024

Data as of 01.30.2024

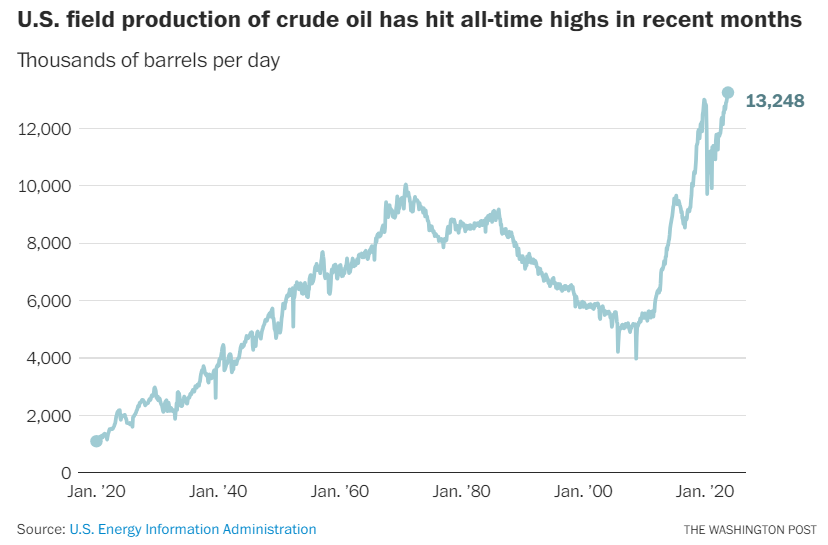

Joseph: Despite more conservative capital allocation by energy companies, production has reached all-time highs

Data as of December 2023

Data as of December 2023

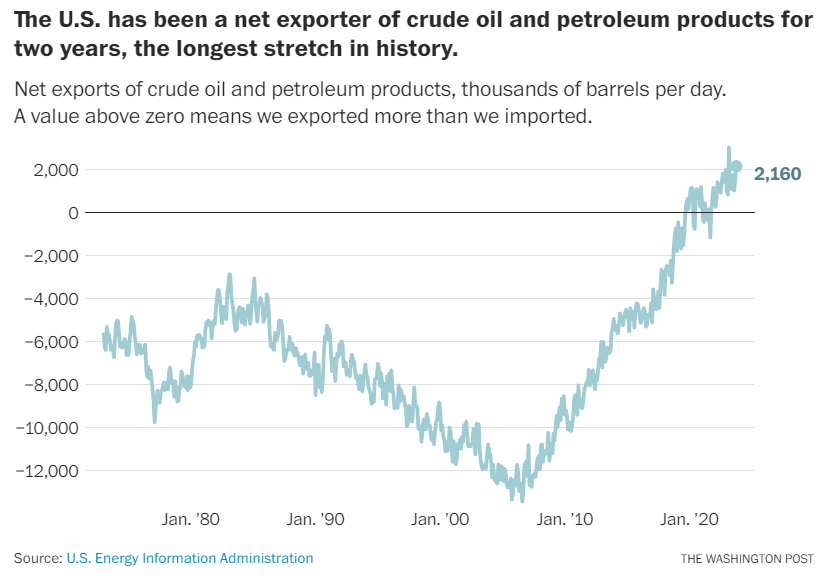

Joseph: putting the US in a rare position of being a net exporter of crude

Data as of December 2023

Data as of December 2023

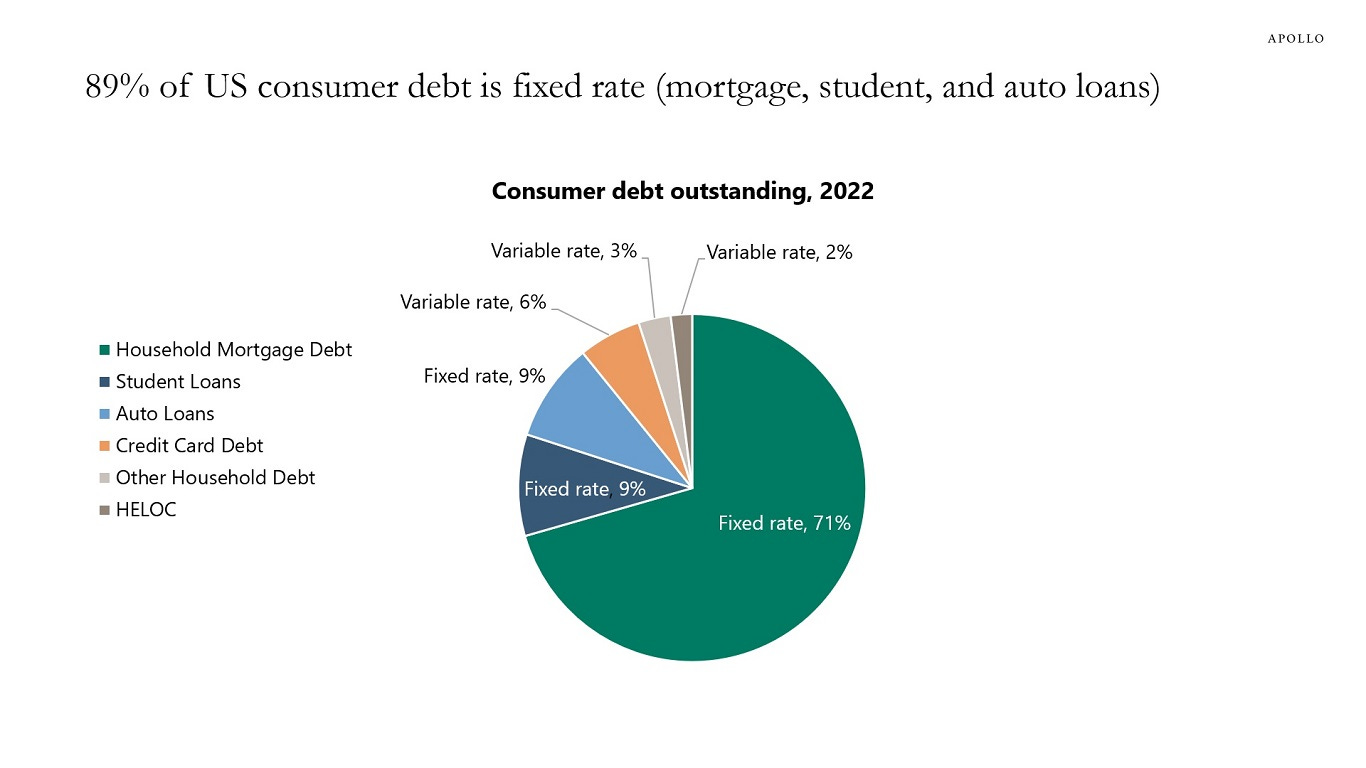

Brad: Most observers are now in agreement that consumers holding low-rate debt has reduced the economic impact of the Fed’s rate hikes

Source: Apollo as of December 2023

Source: Apollo as of December 2023

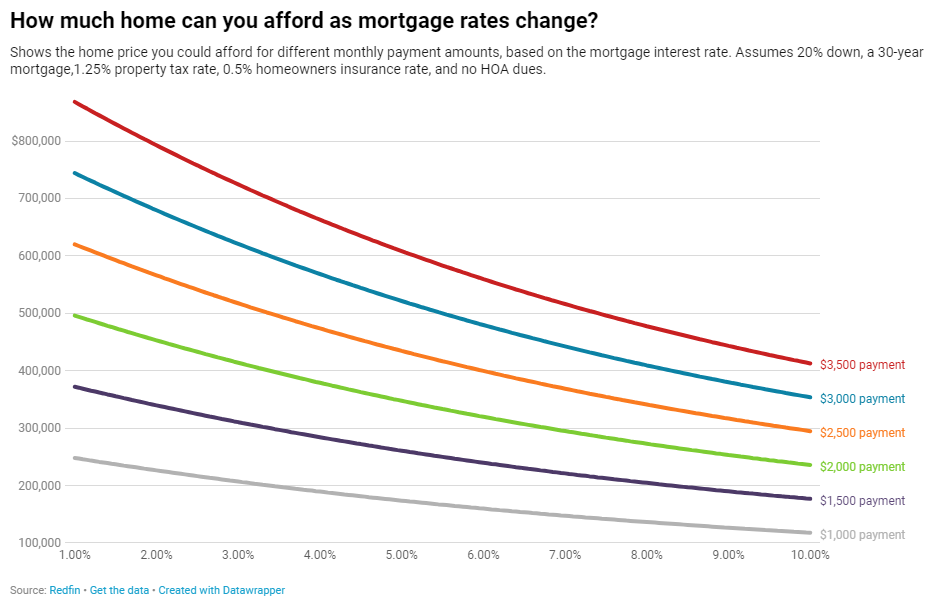

Brad: but that doesn’t mean there wouldn’t be increased housing activity if mortgage rates move lower

Data as of December 2023

Data as of December 2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2402-3.