Our team looks at a lot of research throughout the day. Here are a handful that we think are contributing to investor activity, from earnings to tariffs to market breadth and comparisons of foreign markets to ours. Enjoy!

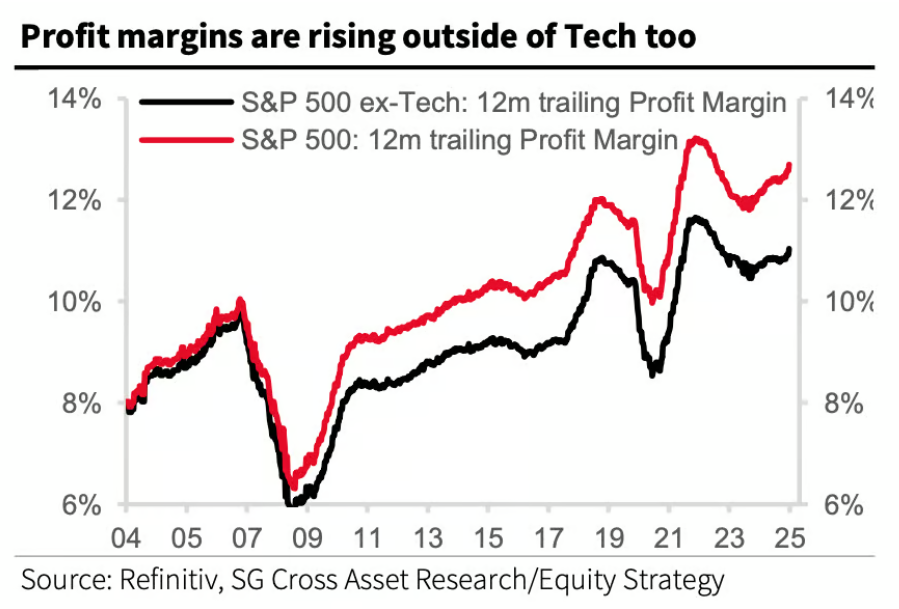

Beckham: It’s not just megcap tech that’s seeing profit margins on the rise

Via @SamRo as of 02.15.2025

Via @SamRo as of 02.15.2025

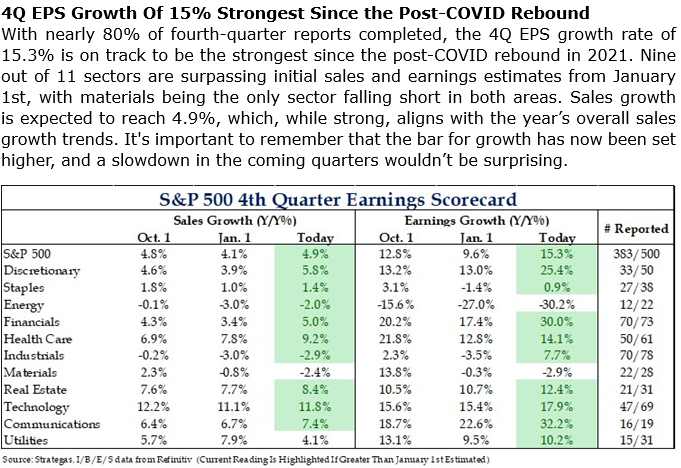

Brad: resulting in solid earnings on only slightly higher sales growth

Data as of 02.17.2025

Data as of 02.17.2025

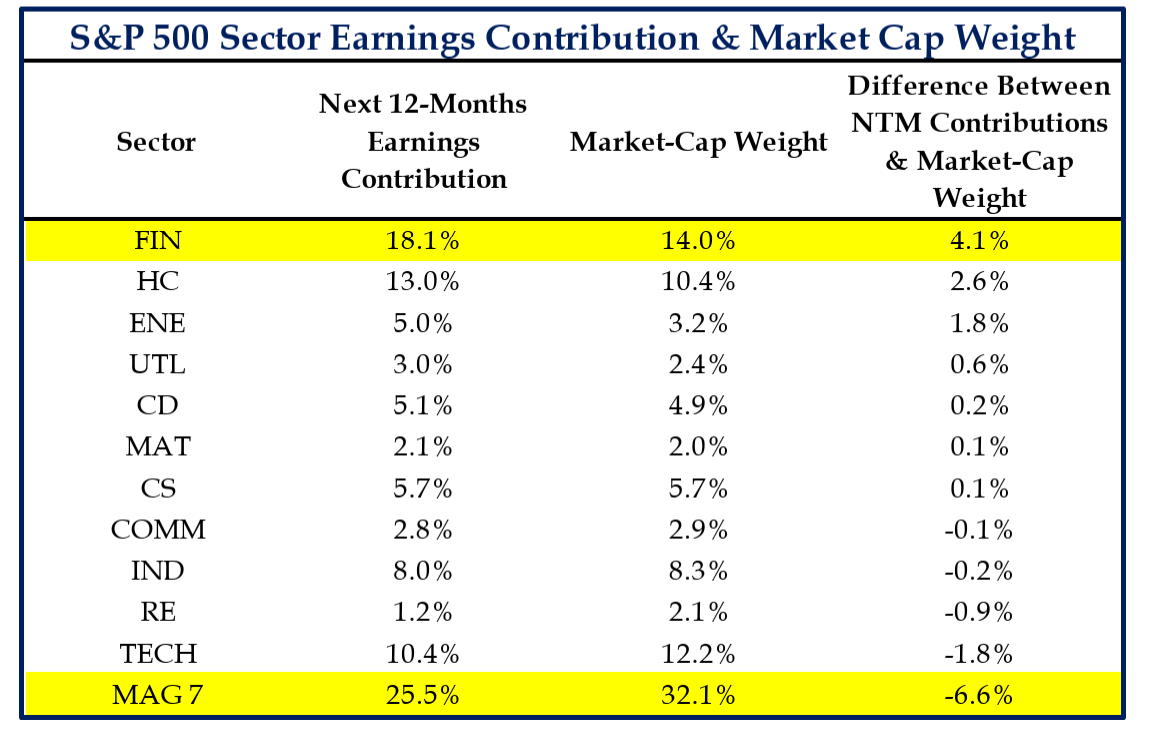

Dave: Megacap tech earnings comprise a huge chunk of overall S&P 500 earnings, but an even bigger chunk of market capitalization

Source: Strategas as of 02.21.2025

Source: Strategas as of 02.21.2025

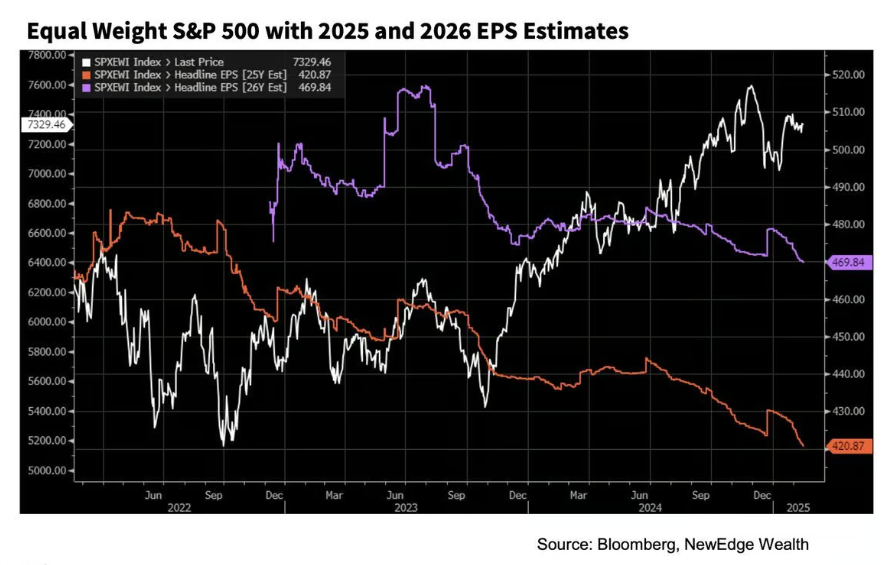

Joseph: and moving to equal-weighted earnings, the trend hasn’t been great

Data as of 02.18.2025

Data as of 02.18.2025

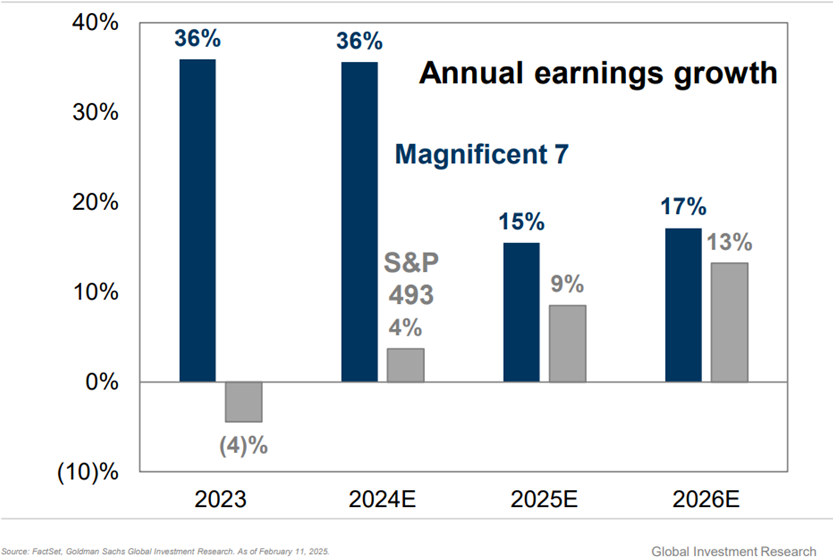

Brett: Maybe the earnings dominance vs. smaller stocks will finally shrink as 2025 unfolds

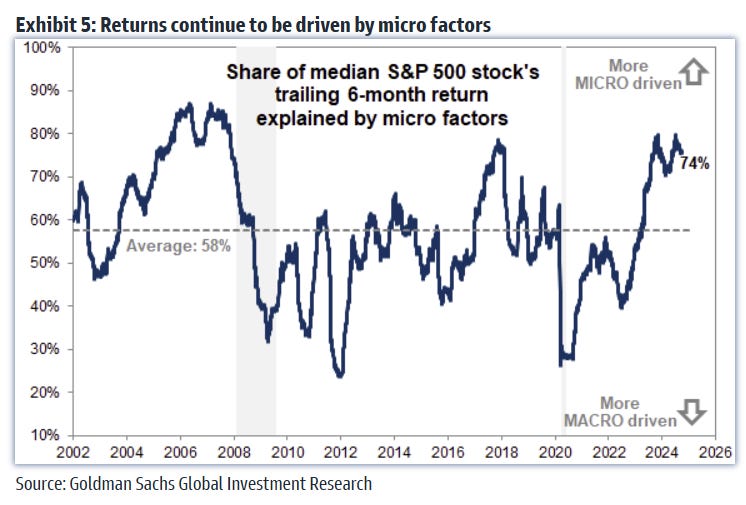

John Luke: as outcomes turn a bit more company-specific

Data as of January 2025

Data as of January 2025

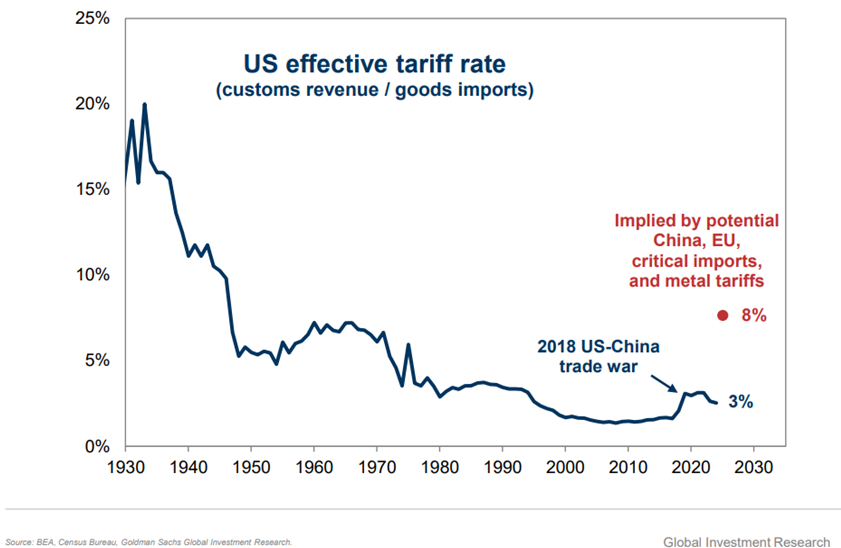

Brad: Wherever tariffs land, they’re coming from historically low levels

Data as of January 2025

Data as of January 2025

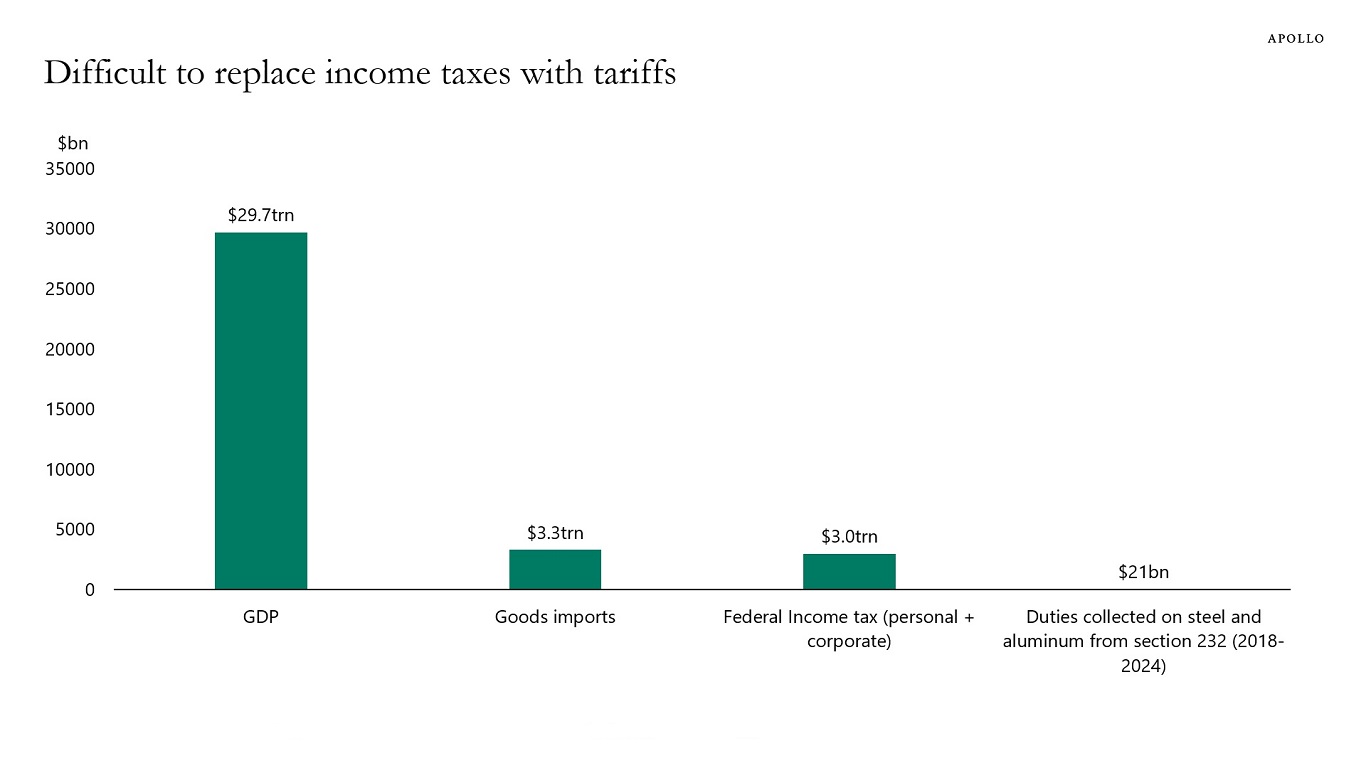

Arch: and will make up a tiny fraction of the overall economy

Source: Apollo as of 02.20.2025

Source: Apollo as of 02.20.2025

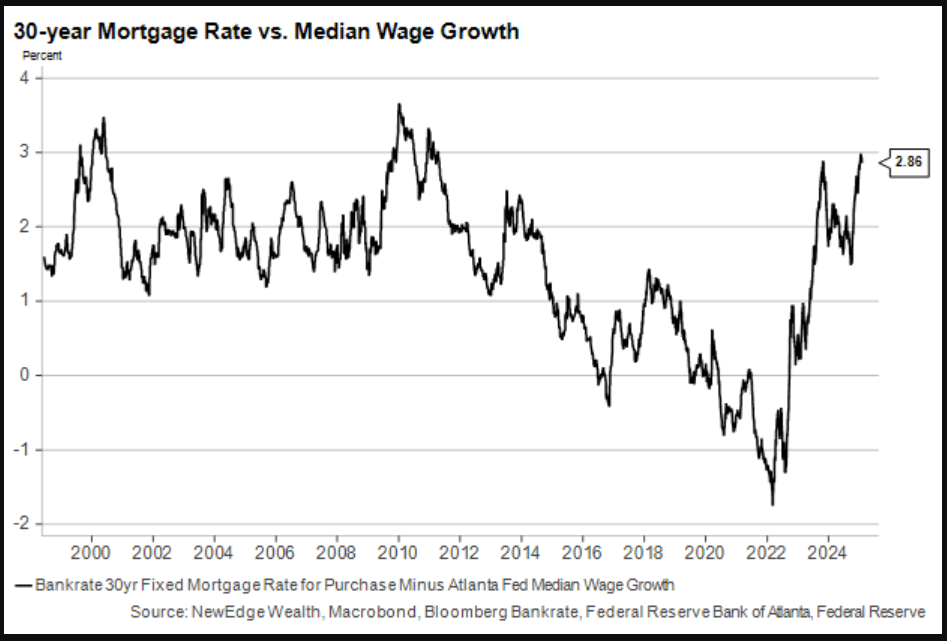

Beckham: Housing’s struggles are not surprising given the sharp rise in rates relative to income growth

Data as of 02.15.2025

Data as of 02.15.2025

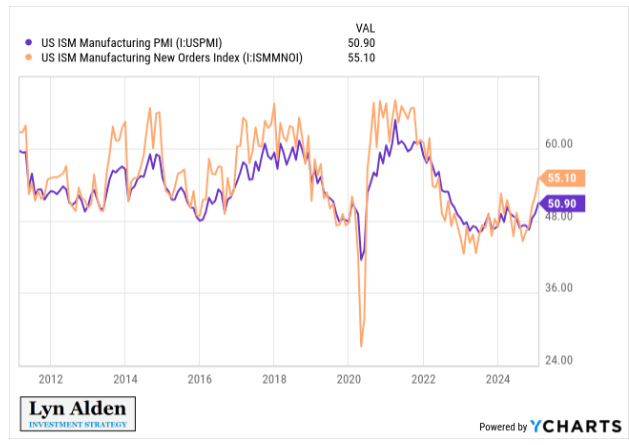

John Luke: but manufacturing is seeing new signs of resurgence

Data as of 02.14.2024

Data as of 02.14.2024

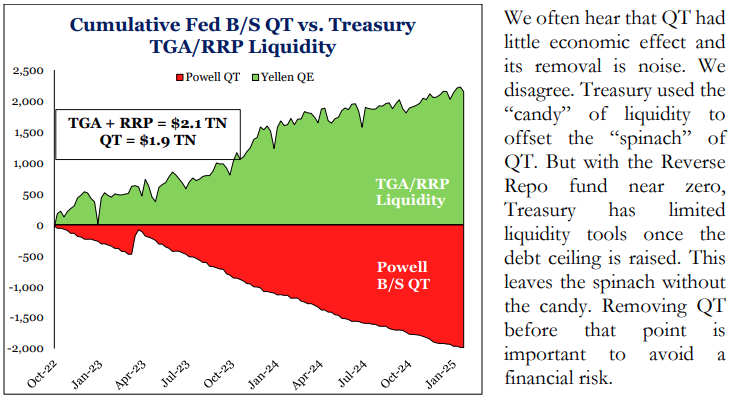

Joseph: and quantitative tightening (QT) might be looking at a break, as monetary policy levers shift

Source: Strategas as of 02.15.2025

Source: Strategas as of 02.15.2025

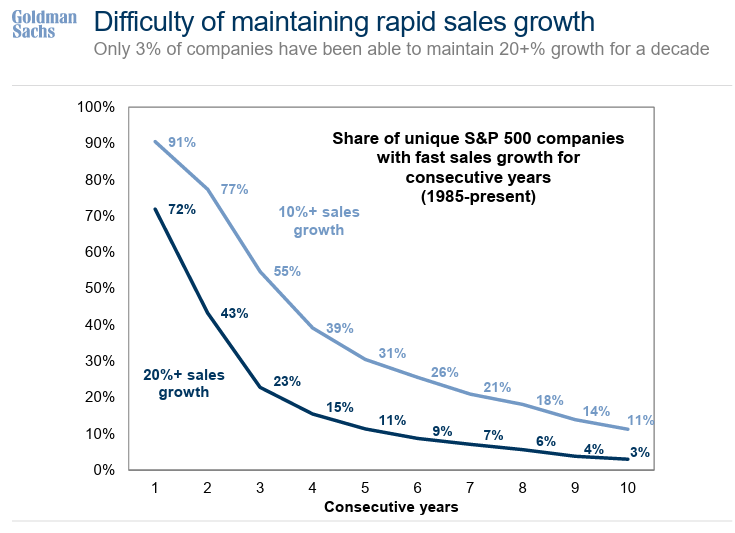

John Luke: Explosive earnings growth is hard for companies to sustain

Source: Goldman Sachs as of January 2025

Source: Goldman Sachs as of January 2025

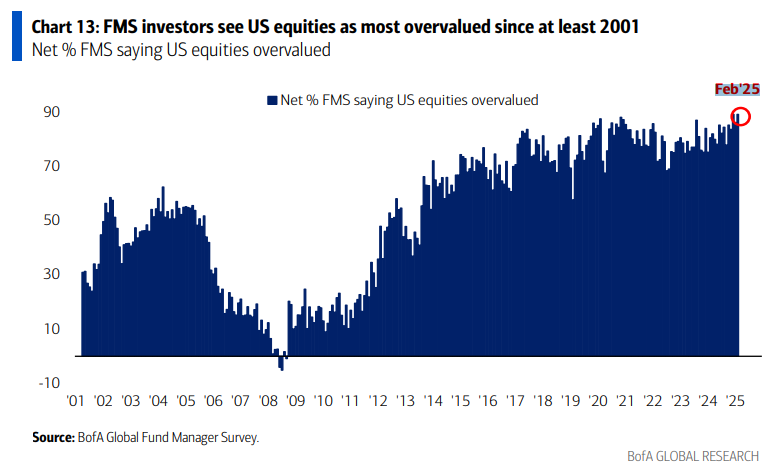

Brian: unlike the concern that US stocks are overvalued vs. peers, which has persisted throughout the past 10 years

Data as of 02.14.2025

Data as of 02.14.2025

JD: It wasn’t expected by many at the time, but holding stocks from the exact pre-COVID peak has worked out just fine for investors

Via Raymond James as of 02.18.2025

Via Raymond James as of 02.18.2025

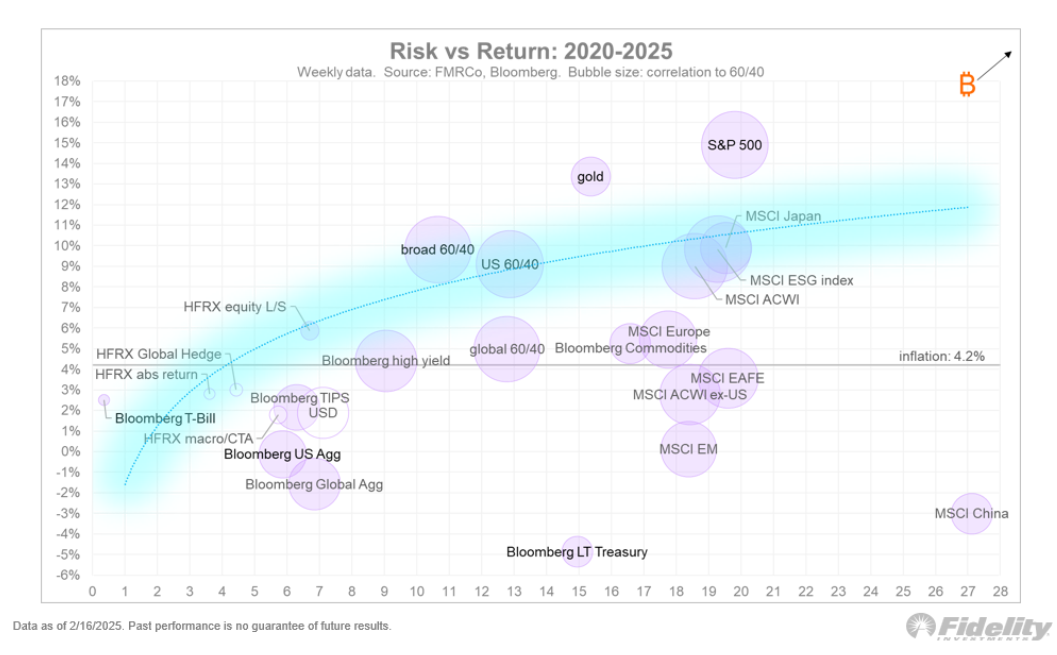

Arch: and when you include returns vs. volatility, S&P 500 performance has been even more impressive

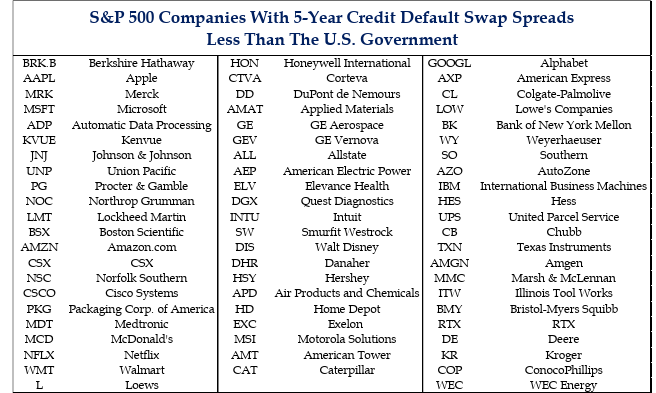

Dave: The business fundamentals of US companies paint a strong case for the dominance of US stocks over every major asset class

Source: Strategas as of 02.17.2025

Source: Strategas as of 02.17.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-19.