Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

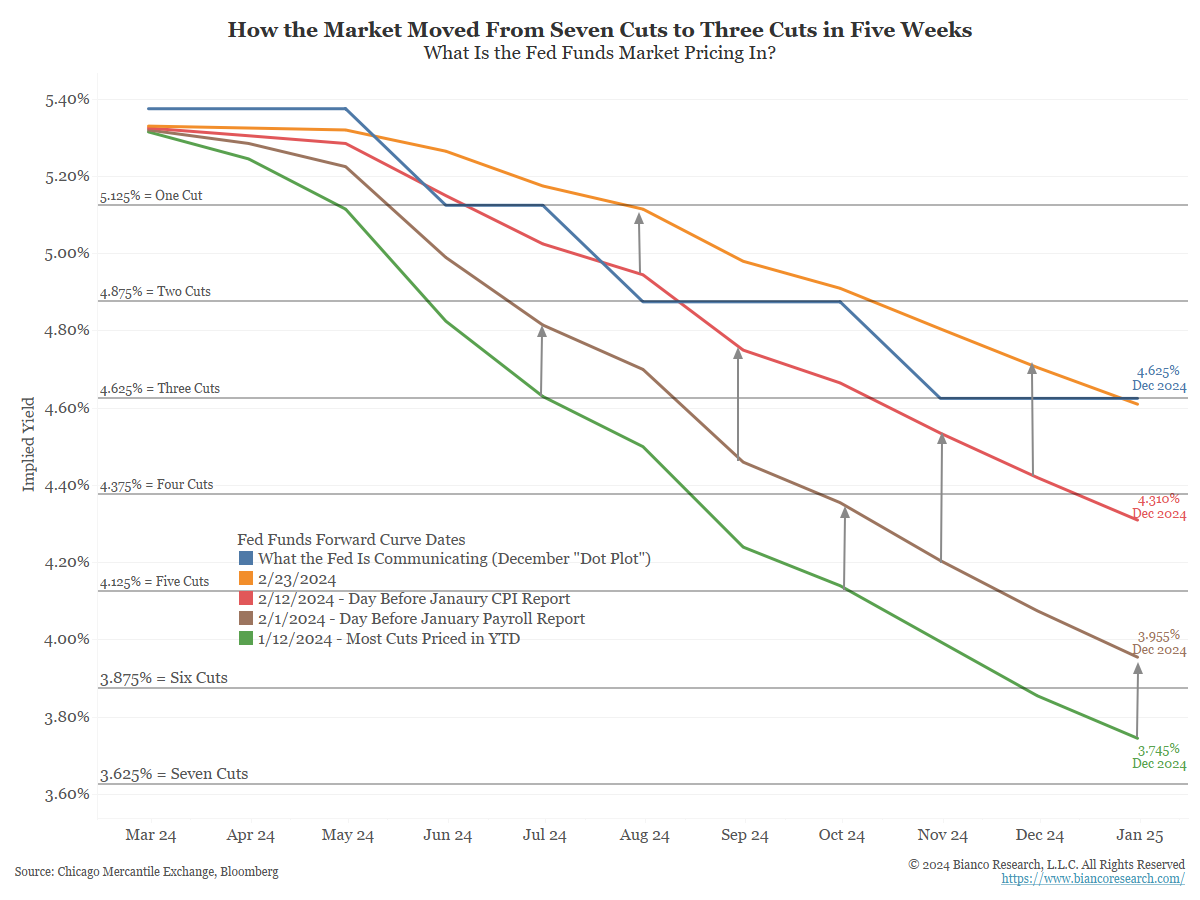

John Luke: Rate expectations have changed dramatically in a few short weeks

Data as of 02.23.2024

Data as of 02.23.2024

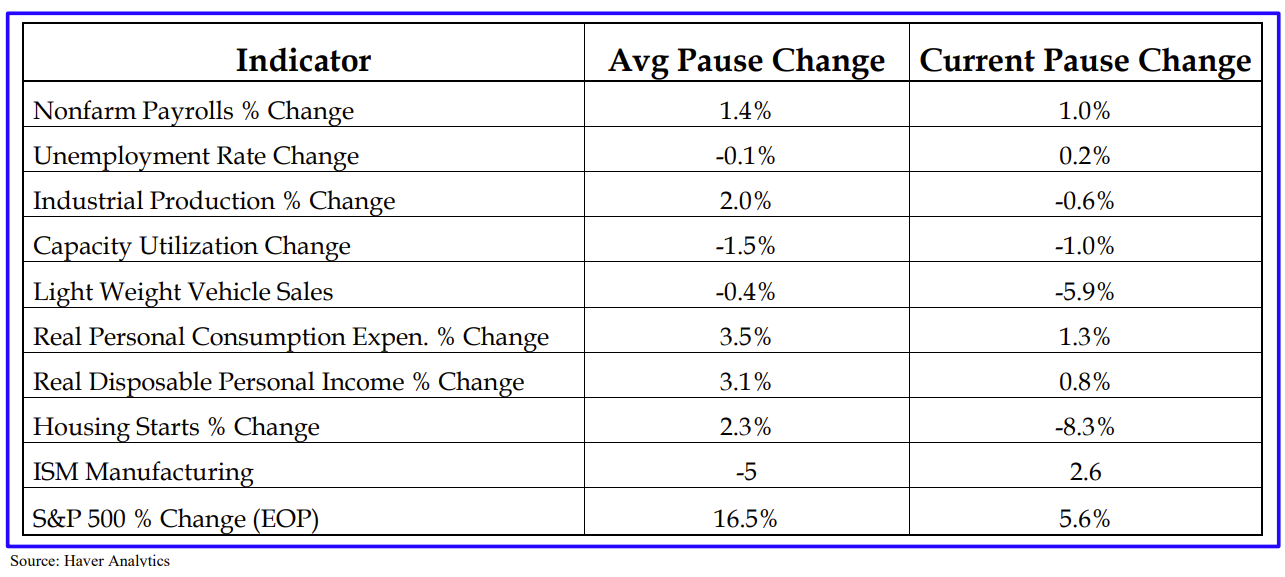

Brett: A pause in a Fed rate-hiking cycle has generally been good for stocks; the stats in this pause have been a bit underwhelming

Source: Strategas as of 02.16.2024

Source: Strategas as of 02.16.2024

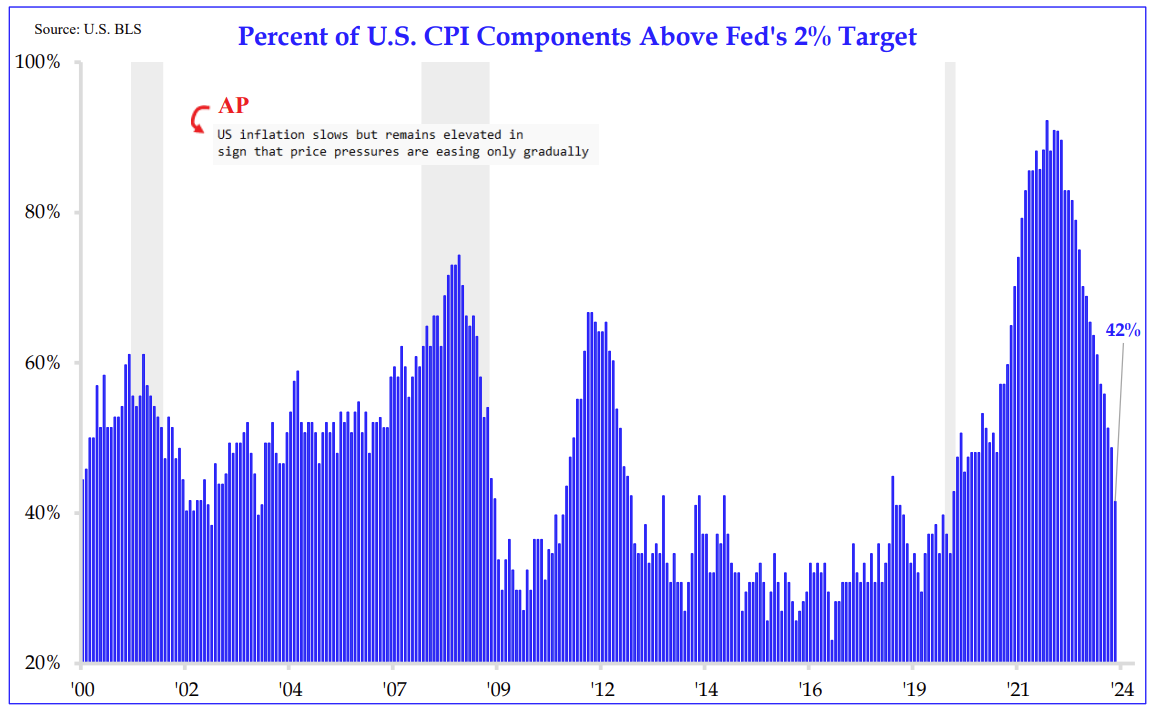

Joseph: Around half of the components in the inflation equation have settled in below the Fed’s 2% target

Source: Strategas as of 02.16.2024

Source: Strategas as of 02.16.2024

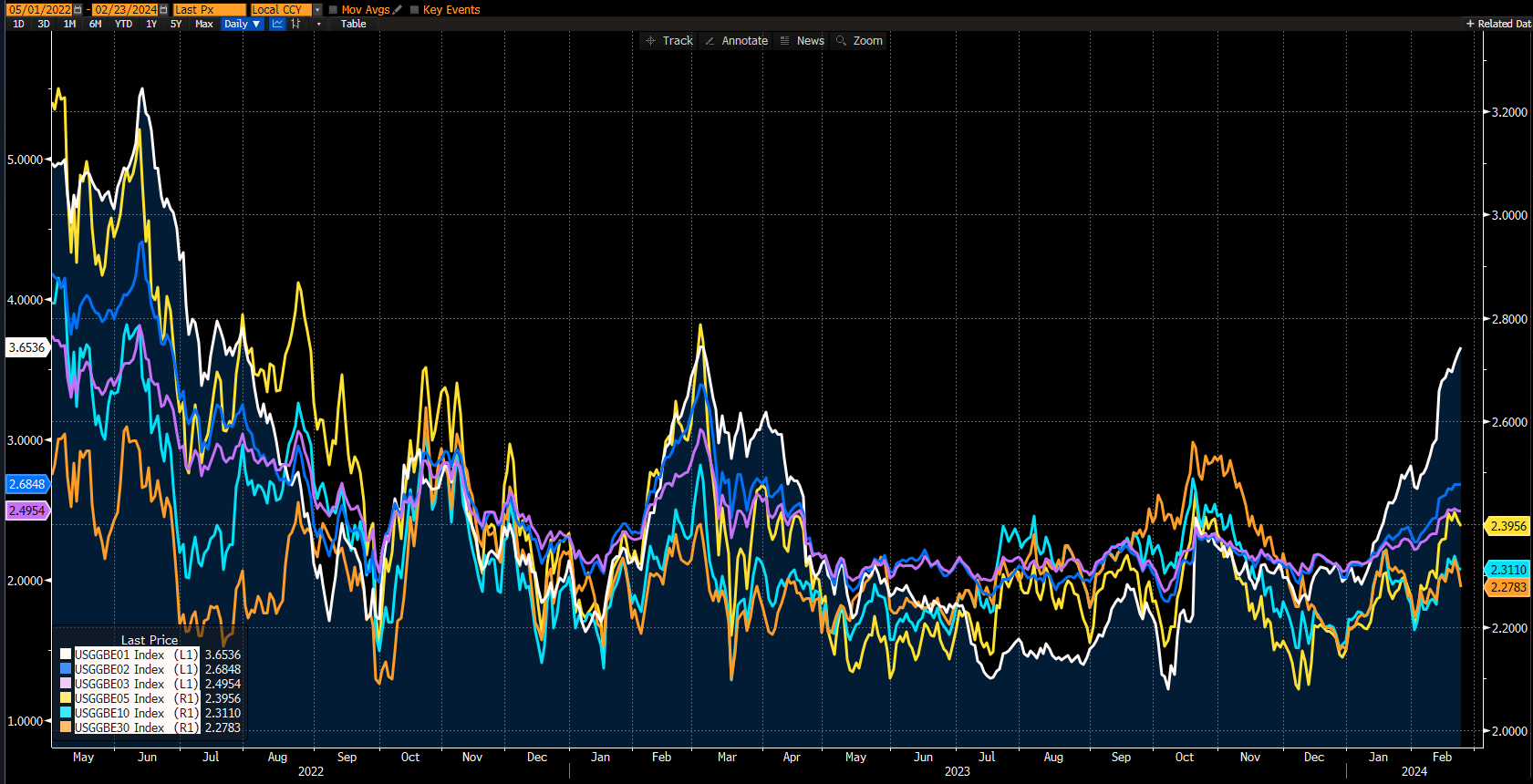

John Luke: yet near-term inflation expectations as measured by 1-year breakeven rates (white line) are moving higher

Source: Aptus via Bloomberg as of 02.22.2024

Source: Aptus via Bloomberg as of 02.22.2024

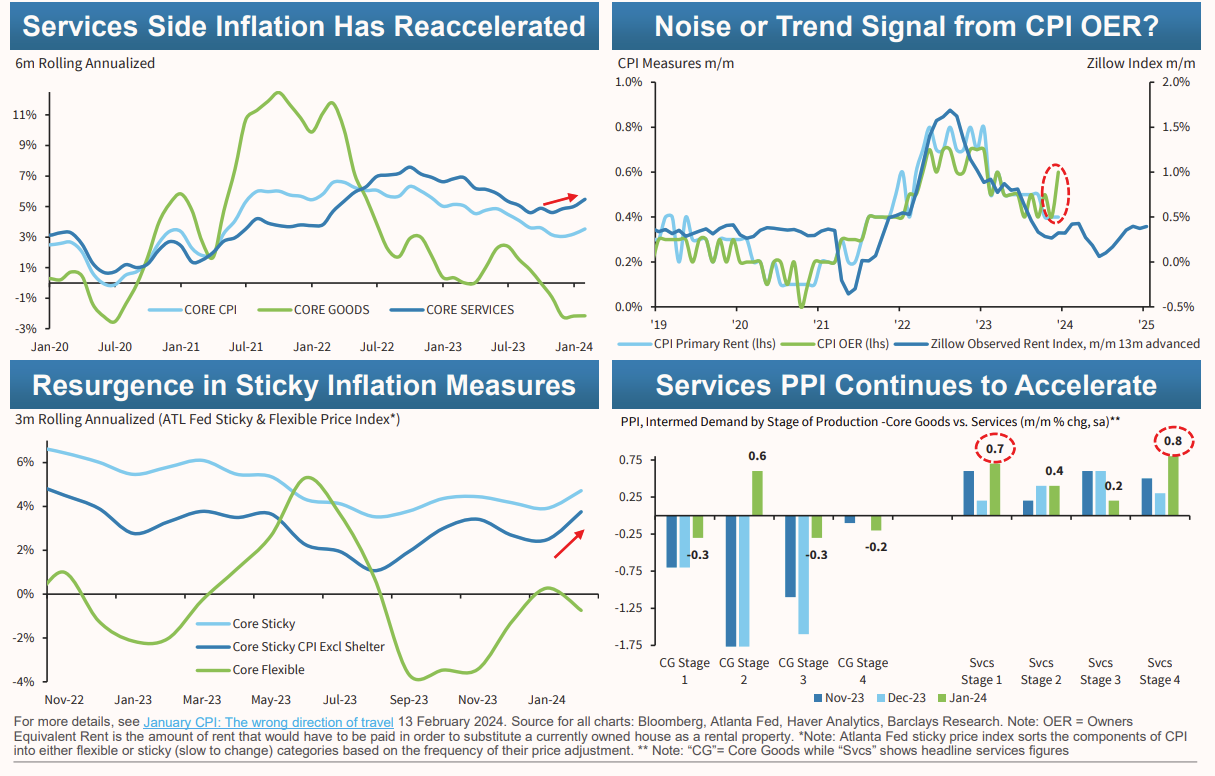

John Luke: driven by the stickier components of inflation

Source: Barclays as of 02.13.2024

Source: Barclays as of 02.13.2024

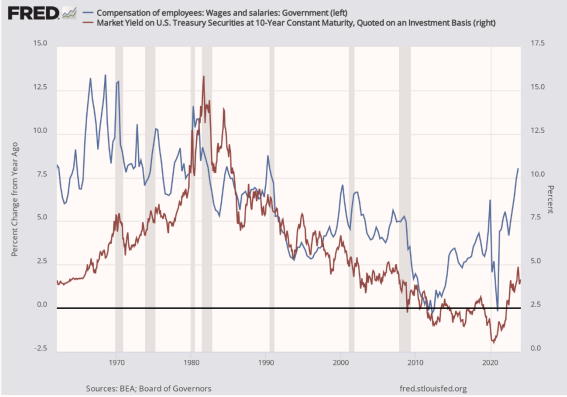

John Luke: as we see wage growth far in advance of prevailing interest rates

Source: Luke Groman as of 02.21.2024

Source: Luke Groman as of 02.21.2024

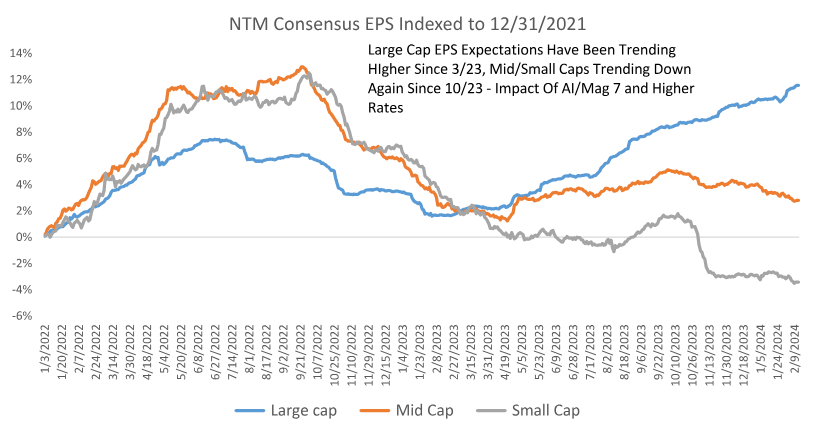

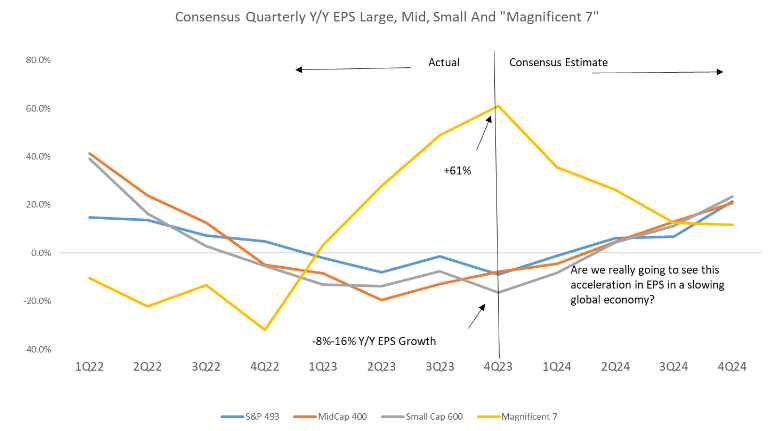

Dave: Mag 7 earnings have been the main driver of growth for S&P 500 total earnings

Source: Raymond James as of 02.22.2024

Source: Raymond James as of 02.22.2024

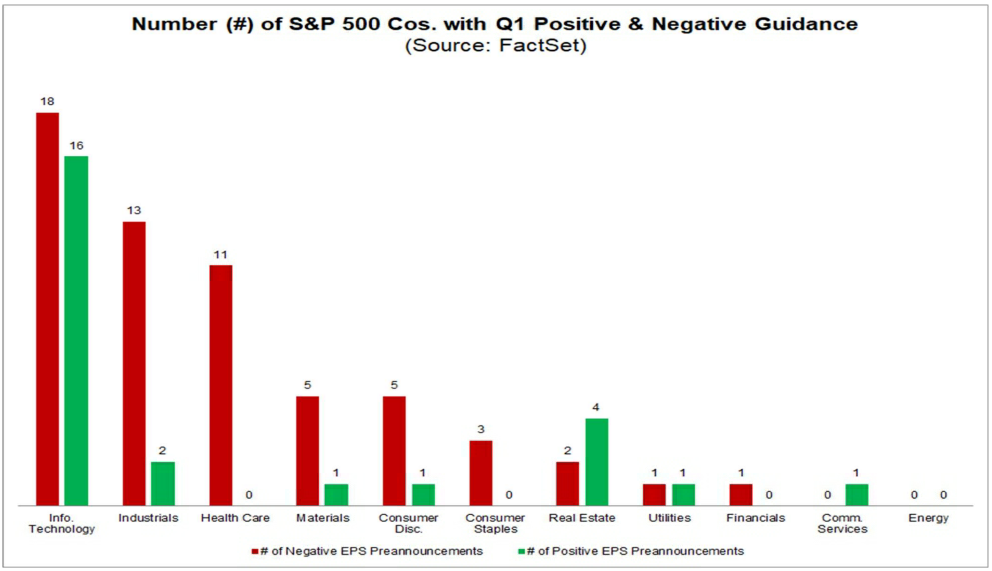

Beckham: and with the average stock guiding towards lower earnings in the quarter ahead

Source: FactSet as of 02.16.2024

Source: FactSet as of 02.16.2024

Dave: is there really a path to the (much) higher S&P 500 earnings estimates for 2024?

Source: Raymond James as of 02.22.2024

Source: Raymond James as of 02.22.2024

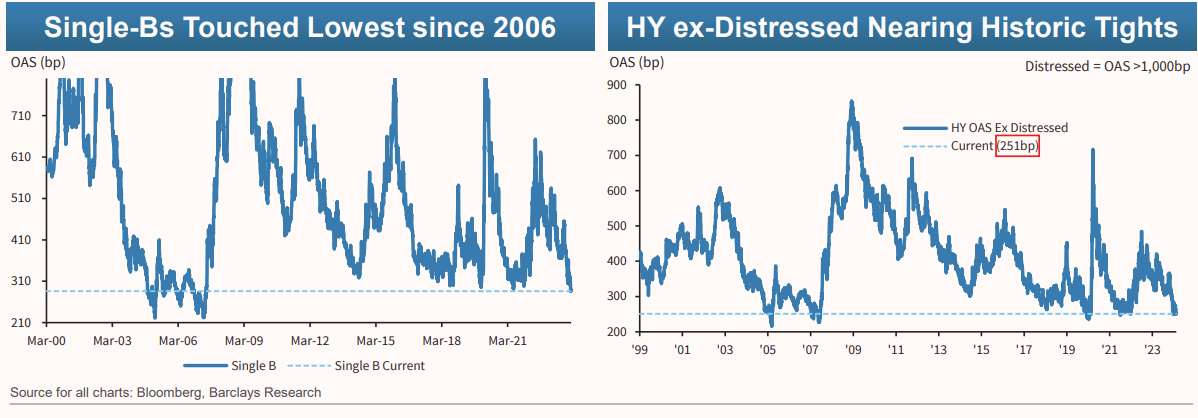

John Luke: Credit spreads are as tight as they generally get

Source: Barclays as of 02.16.2024

Source: Barclays as of 02.16.2024

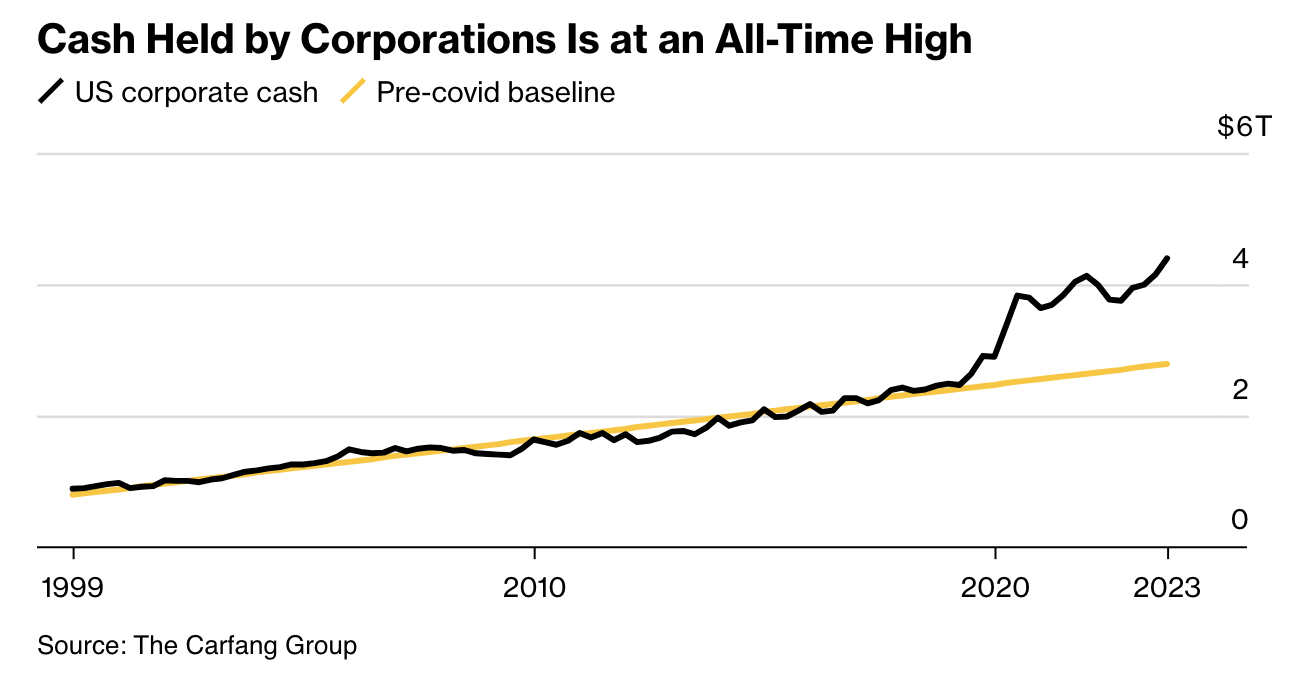

Beckham: as large corporations sit on mounds of cash

Source: Bloomberg as of January 2024

Source: Bloomberg as of January 2024

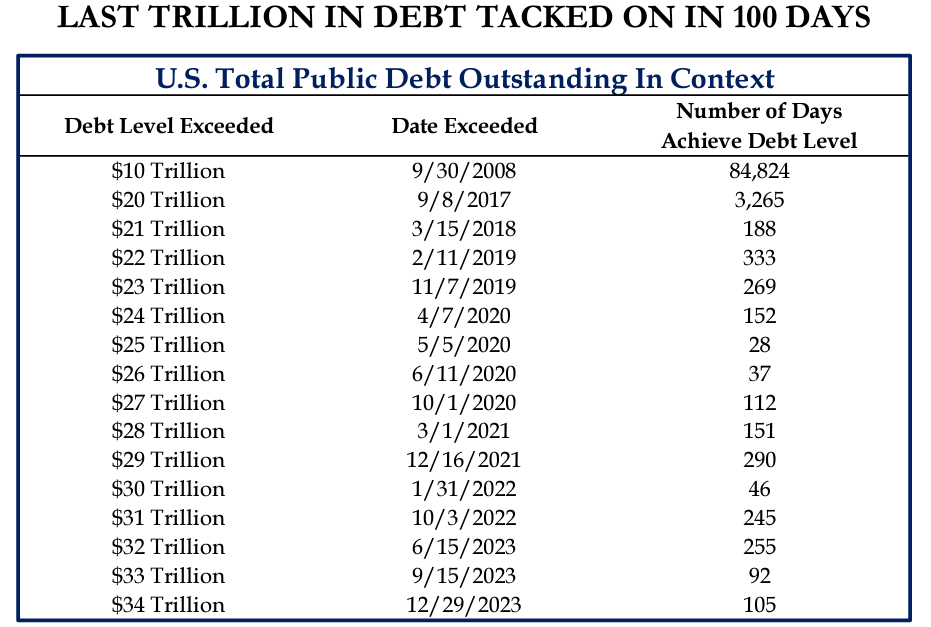

Brad: and US government securities offer very little additional comfort given the growing level of debt

Source: Strategas as of February 2024

Source: Strategas as of February 2024

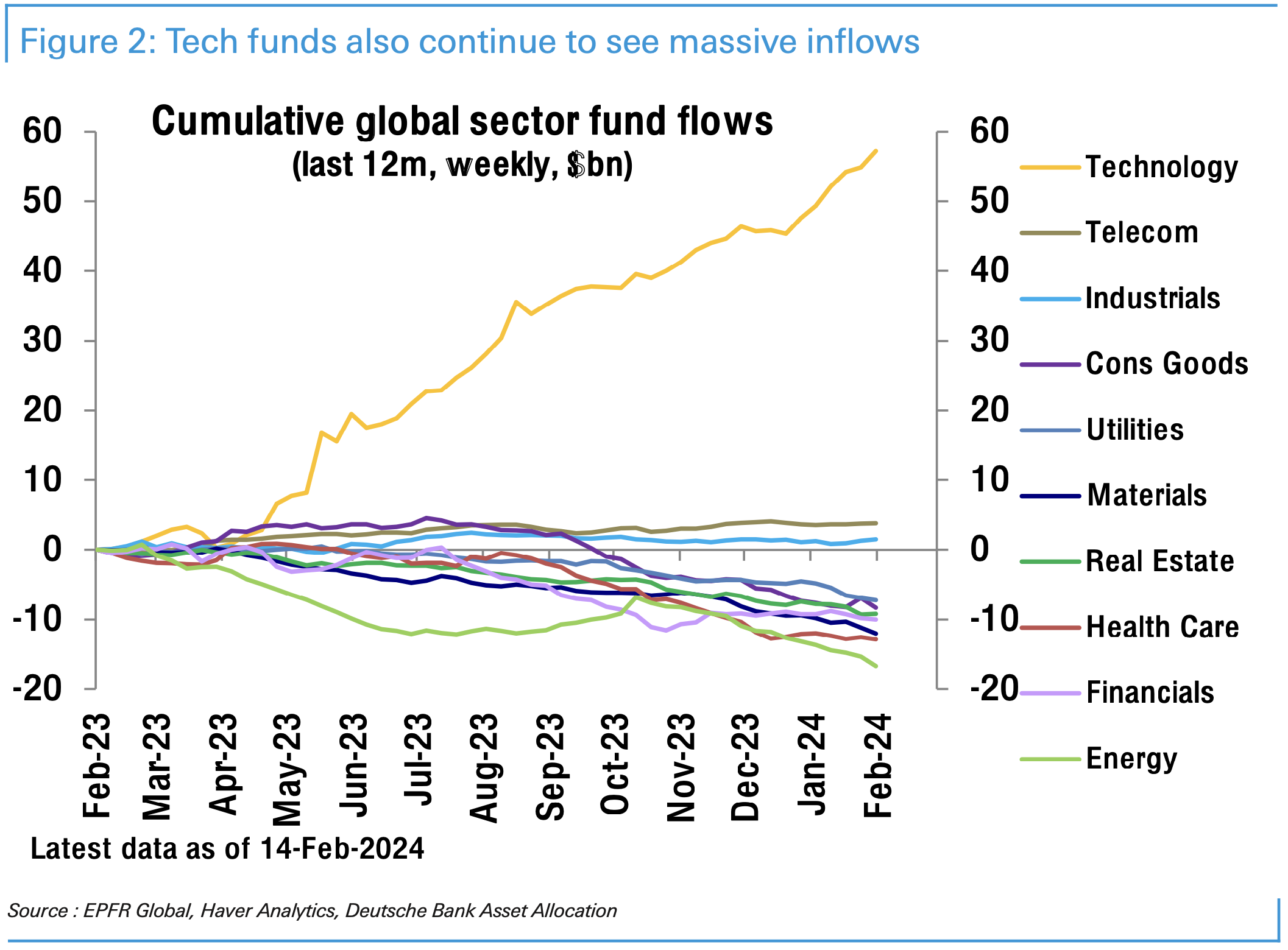

Dave: Technology funds continue to grab assets at the expense of just about every other group

Data as of 02.16.2024

Data as of 02.16.2024

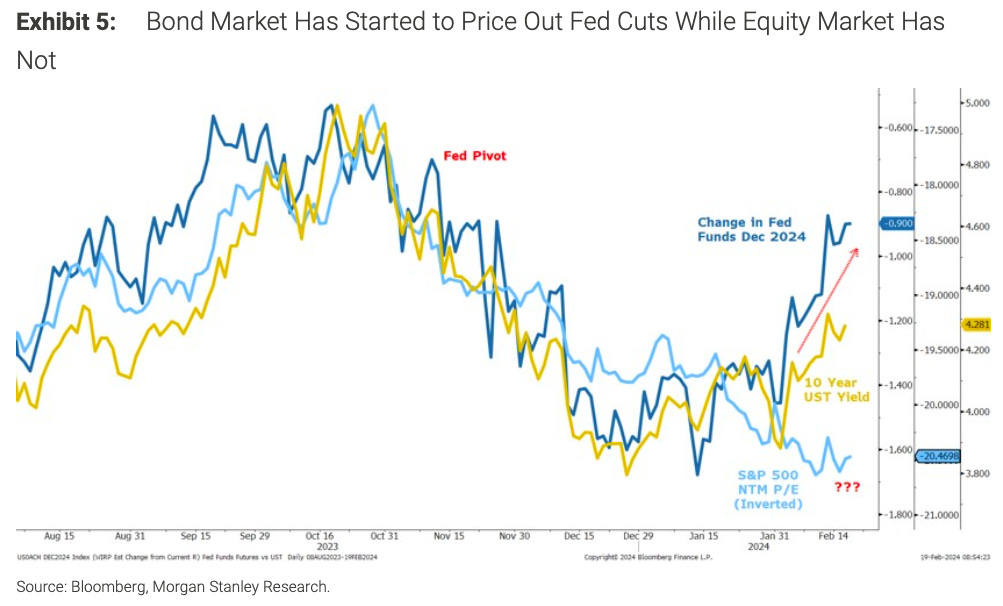

Brian: as rising rates have seemingly disappeared as a threat to stocks in general

Data as of 02.16.2024

Data as of 02.16.2024

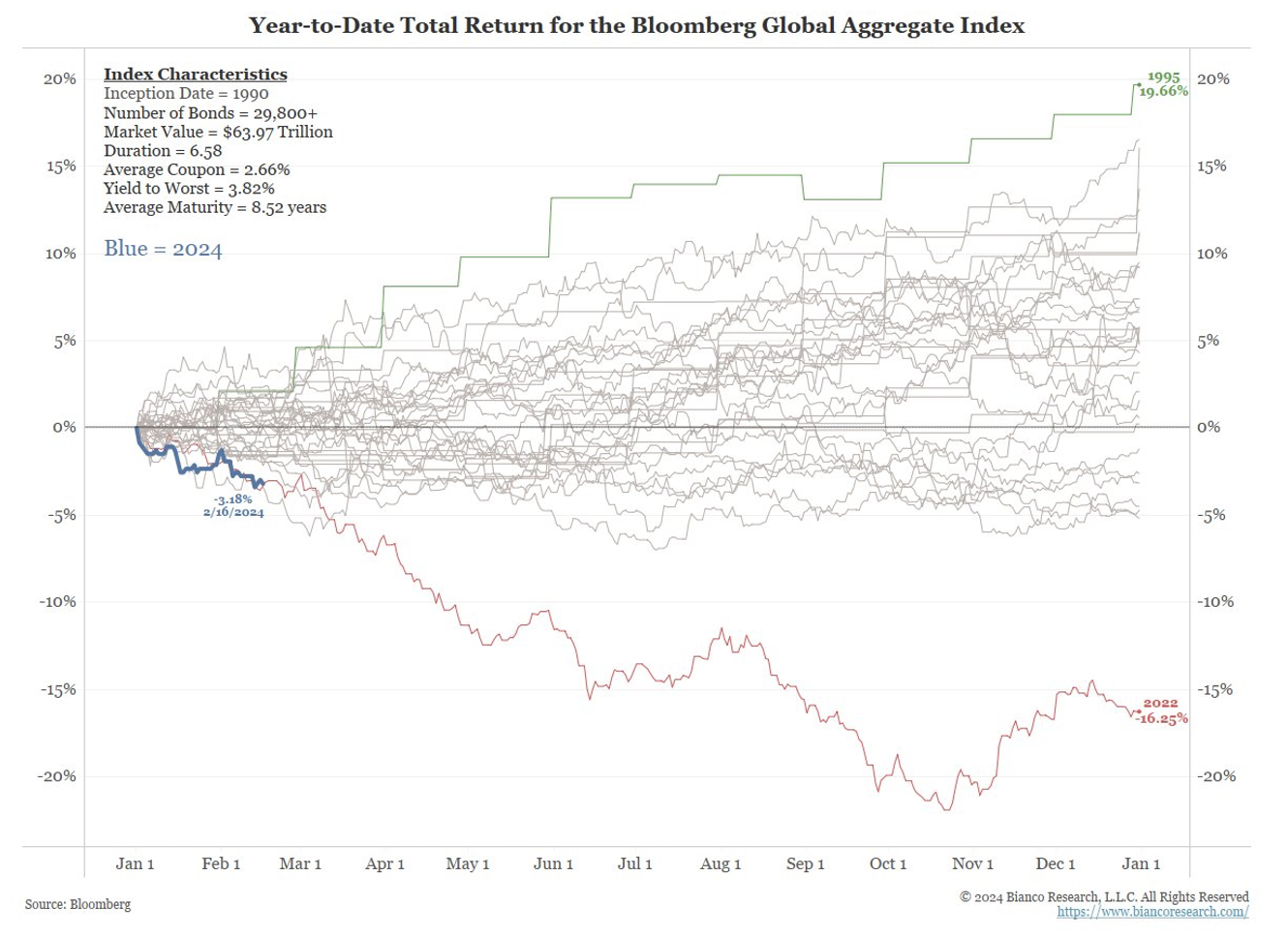

John Luke: Bonds are again off to a historically poor start to the year

Data as of 02.16.2024

Data as of 02.16.2024

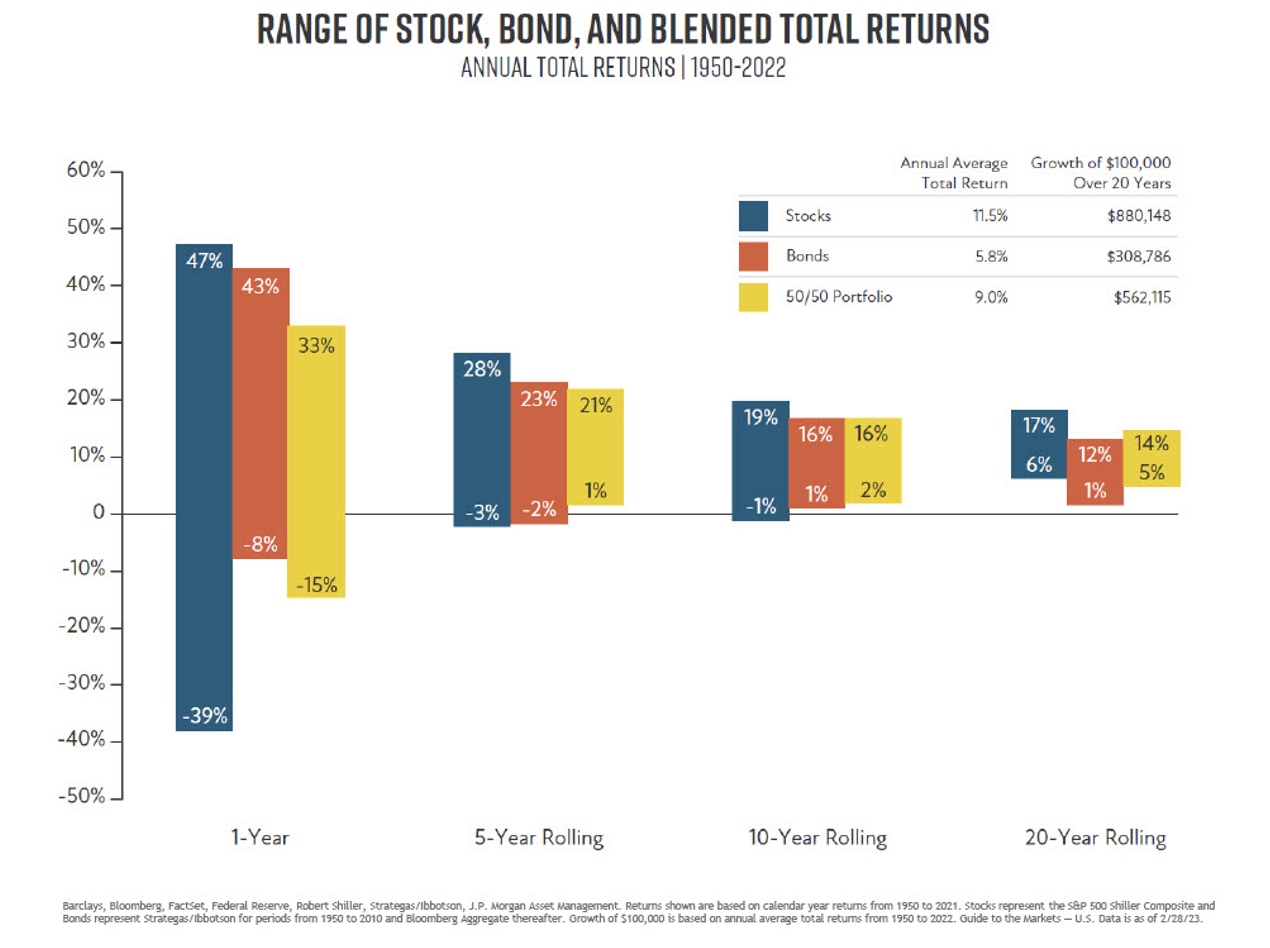

Brad: reinforcing the feedback loop attracting assets to where they’ve been treated better over the long term

Source: Money, Simplified as of January 2024

Source: Money, Simplified as of January 2024

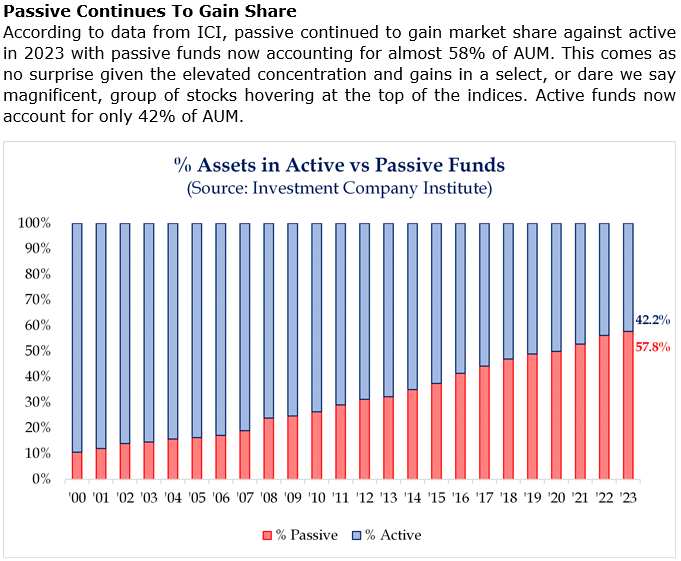

Brad: with more than half of each dollar now going into passive equity funds

Source: Strategas as of February 2024

Source: Strategas as of February 2024

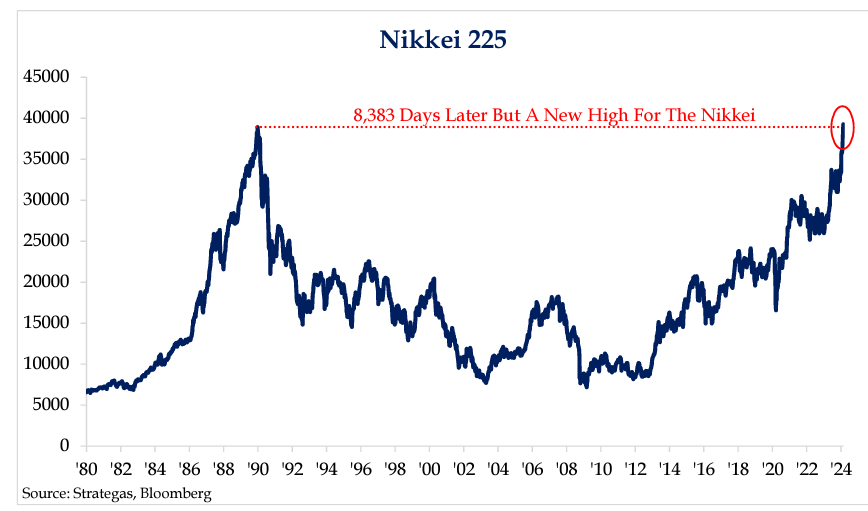

Dave: Wild to see, but the Japanese stock market has finally eclipsed its bubbly highs of 1989

Data as of 02.22.2024

Data as of 02.22.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2402-17.