Our team looks at a lot of research throughout the day. Here are a handful that we think are contributing to investor activity , from rate expectations to growth drivers to government spending and comparisons of foreign markets to ours. Enjoy!

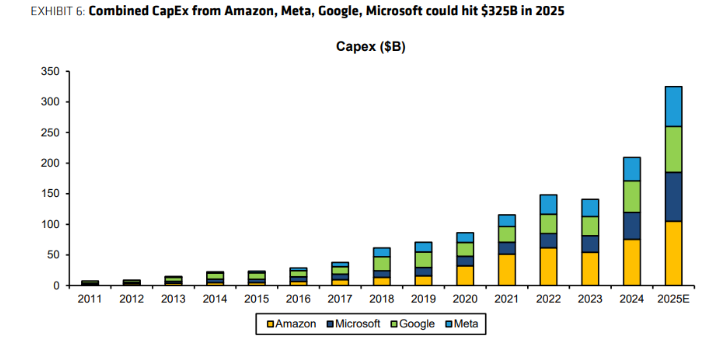

Dave: Post-DeepSeek, the focus on tech earnings calls is capital spending plans. Megacap earnings calls made it clear it’s only going higher

Source: Bernstein as of 02.07.2025

Source: Bernstein as of 02.07.2025

Joseph: and the total numbers across this group are mind-boggling

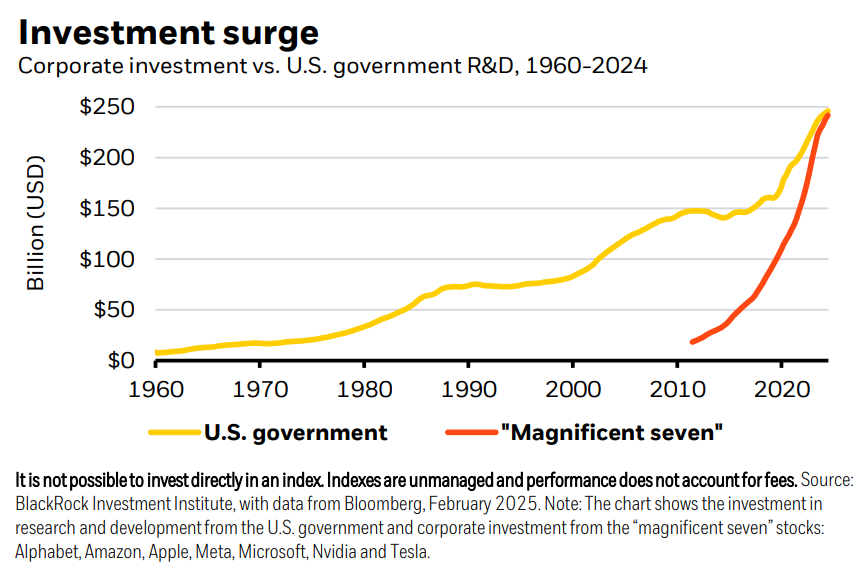

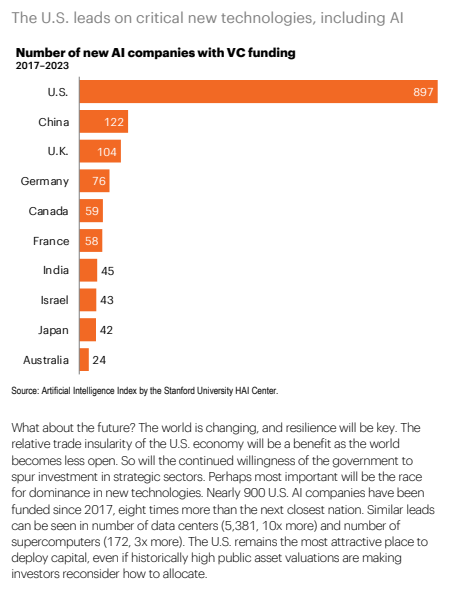

Brian: Artificial intelligence (AI) is obviously a specific focus of massive funding in the US and abroad

Data as of March 2024

Data as of March 2024

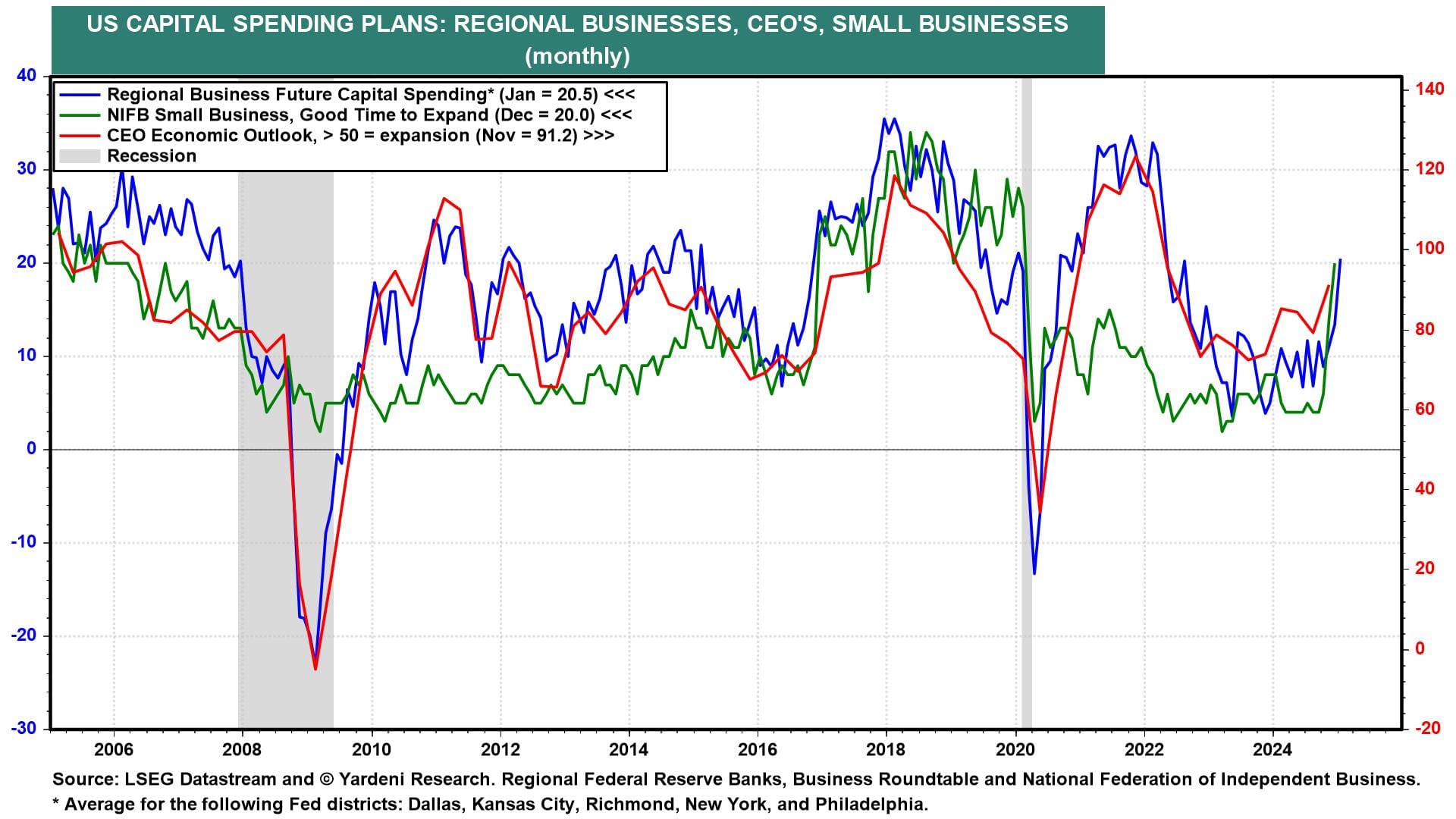

Beckham: but additional spending plans across the economy have jumped higher since the election

Data as of January 2025

Data as of January 2025

John Luke: Inflation measures are settling into a range just above 3%

Data as of January 2025

Data as of January 2025

Brian: though consumer expectations are detaching themselves to the upside

Data as of 02.07.2025

Data as of 02.07.2025

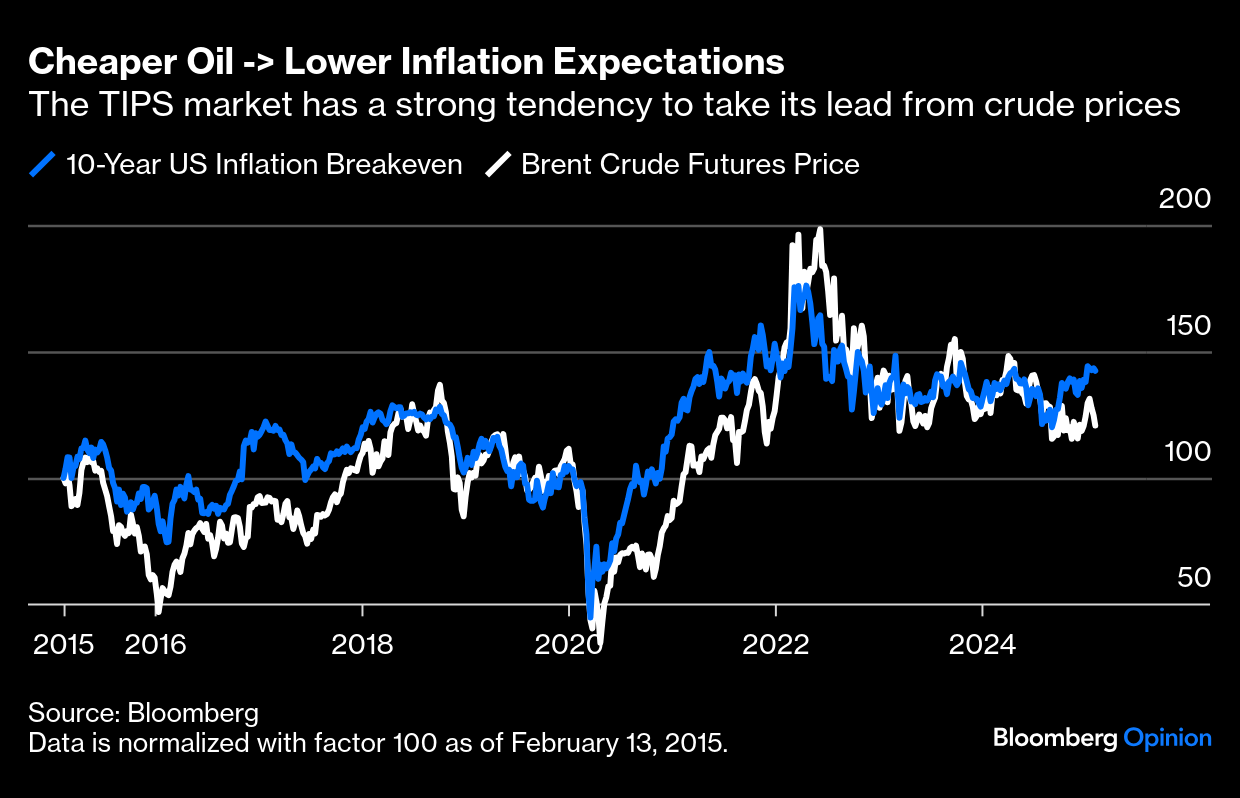

Joseph: Expectations by market participants generally follow along with the price of crude

Data as of 02.04.2025

Data as of 02.04.2025

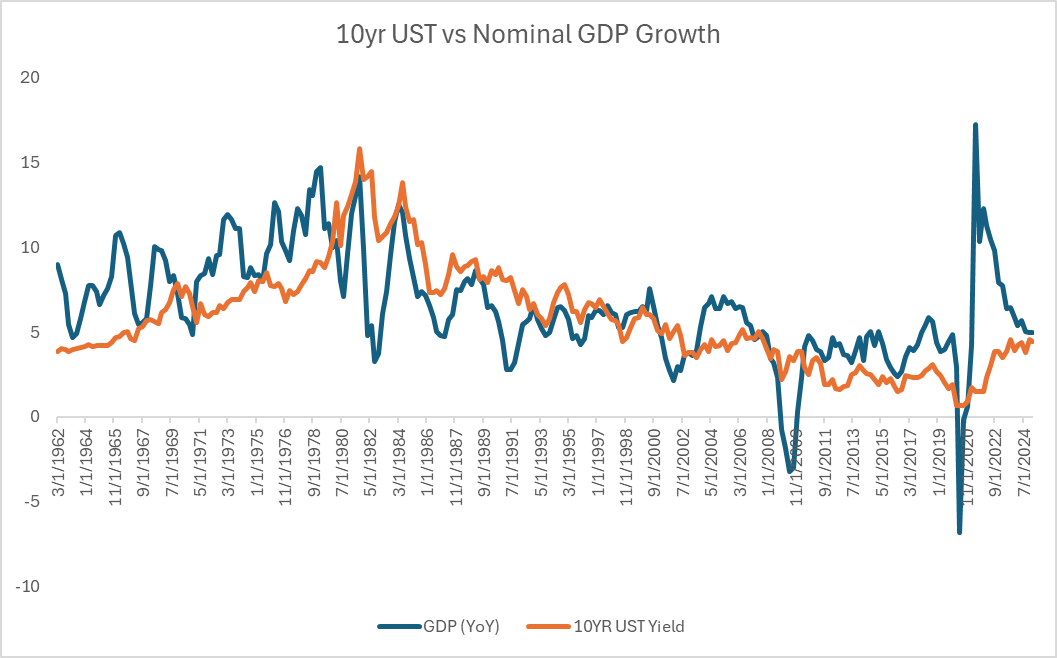

John Luke: and 10-Year Treasuries have historically kept a tight relationship with nominal growth

Source: Bloomberg as of 02.05.2025

Source: Bloomberg as of 02.05.2025

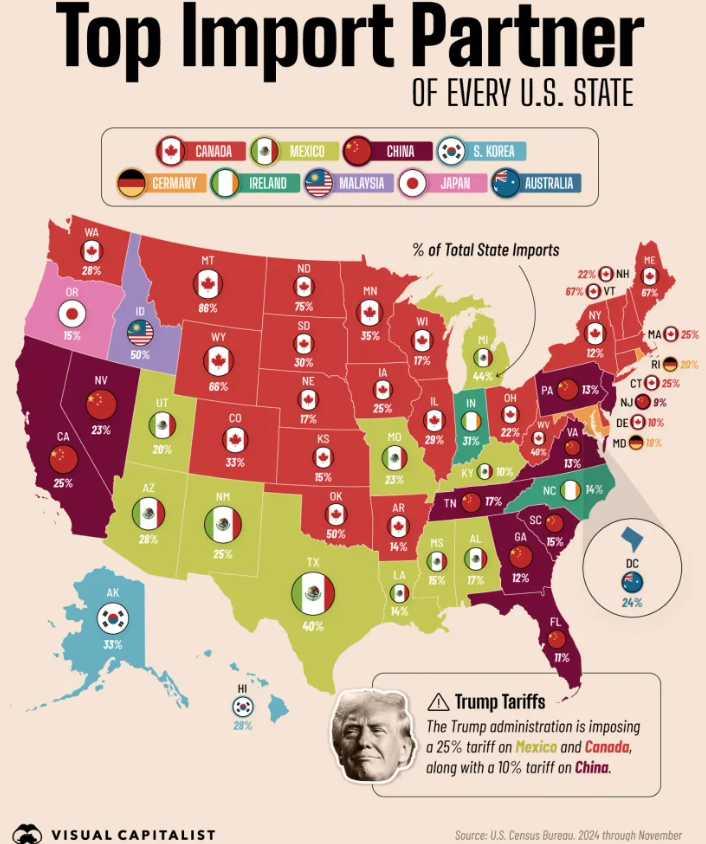

Brett: Tariffs can impact some state economies more than others

Data as of December 2024

Data as of December 2024

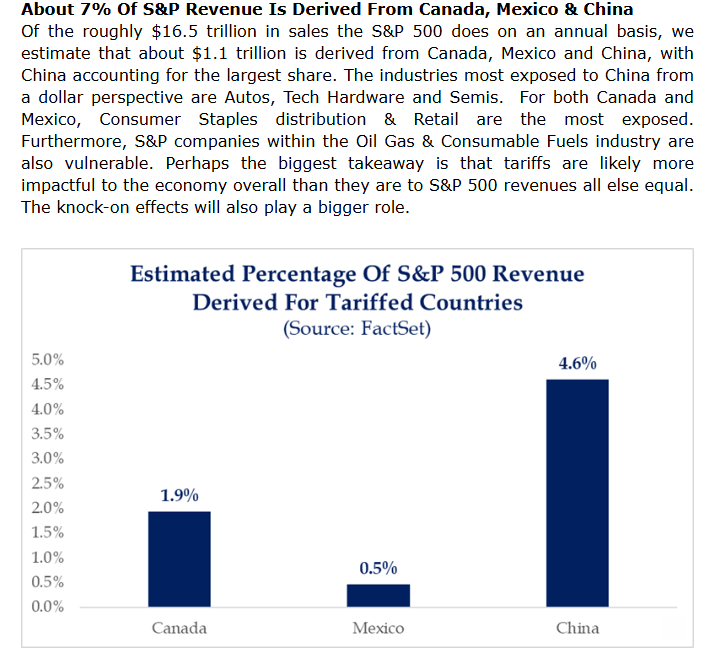

Dave: but aren’t as impactful to S&P 500 earnings

Source: Strategas as of 02.04.2025

Source: Strategas as of 02.04.2025

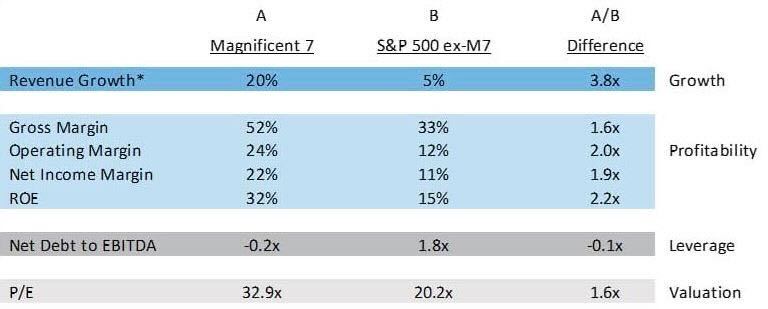

John Luke: Stories are recycled daily about the weight carried by Mag 7 stocks, but the fundamentals have justified the dominance

Source: Advisor Perspectives as of 01.30.2025

Source: Advisor Perspectives as of 01.30.2025

Brad: and past episodes of high concentration have had little impact on future index returns

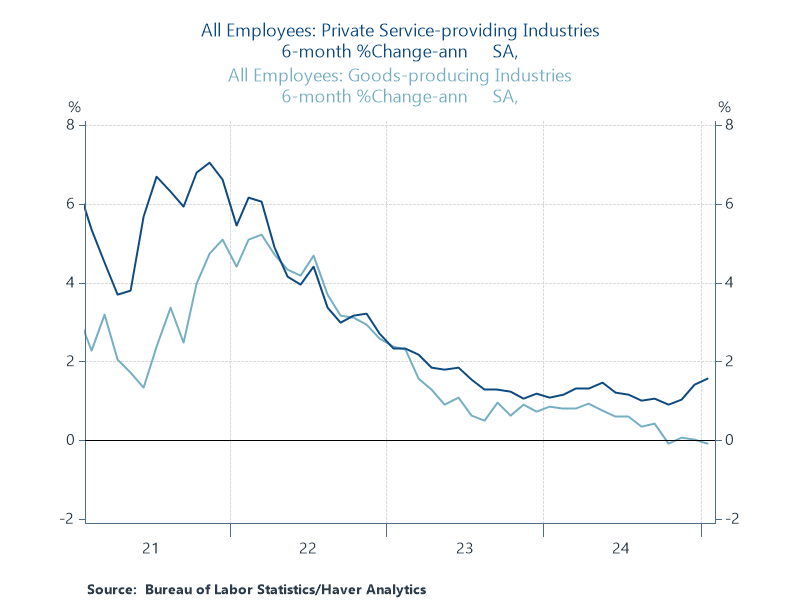

Arch: The past few months have shown a separation in employment between companies focused on services vs. goods

Data as of 02.07.2025

Data as of 02.07.2025

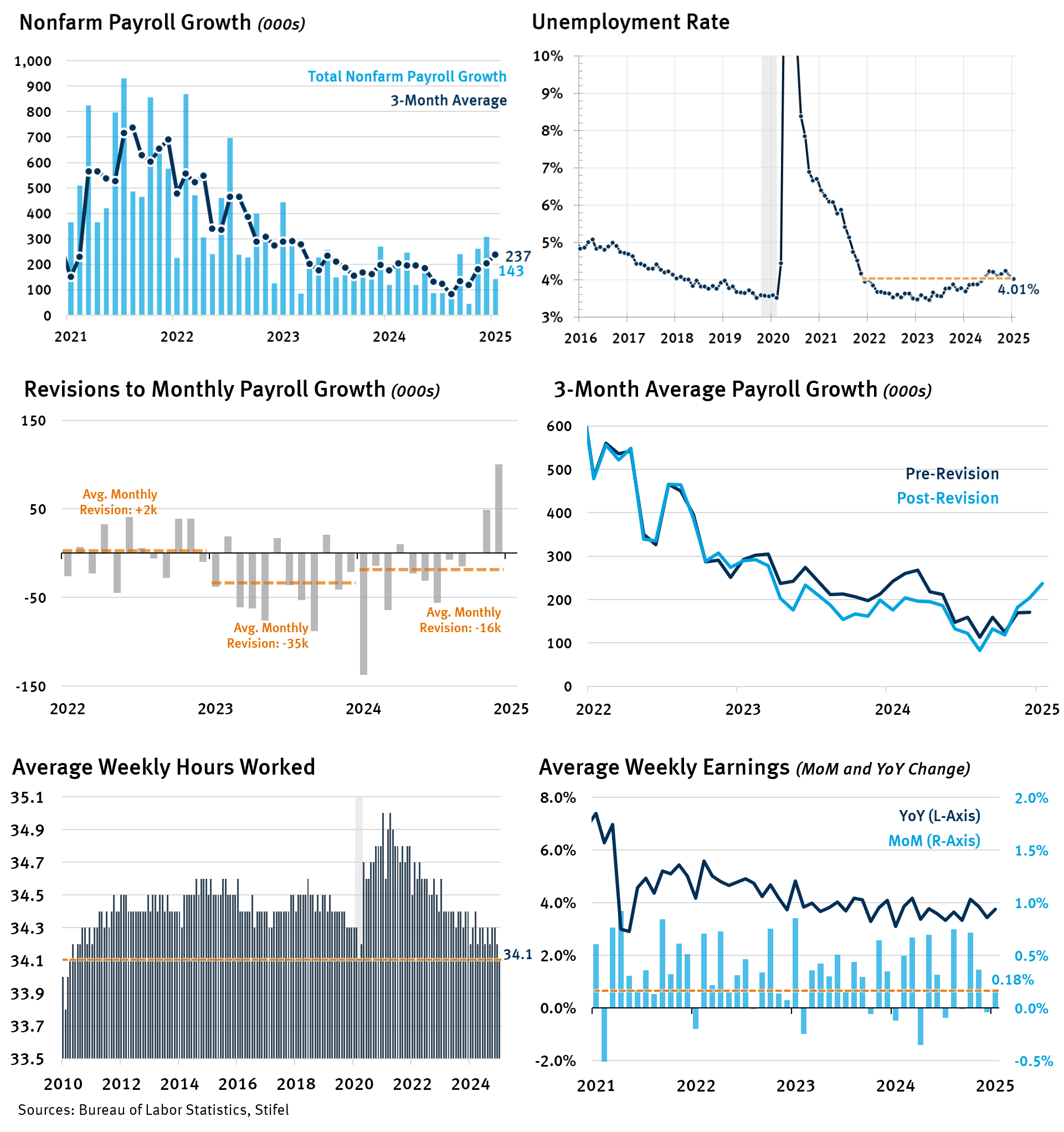

John Luke: and overall, the jobs situation would seem to keep the Fed in “wait and see” mode

Data as of 02.07.2025

Data as of 02.07.2025

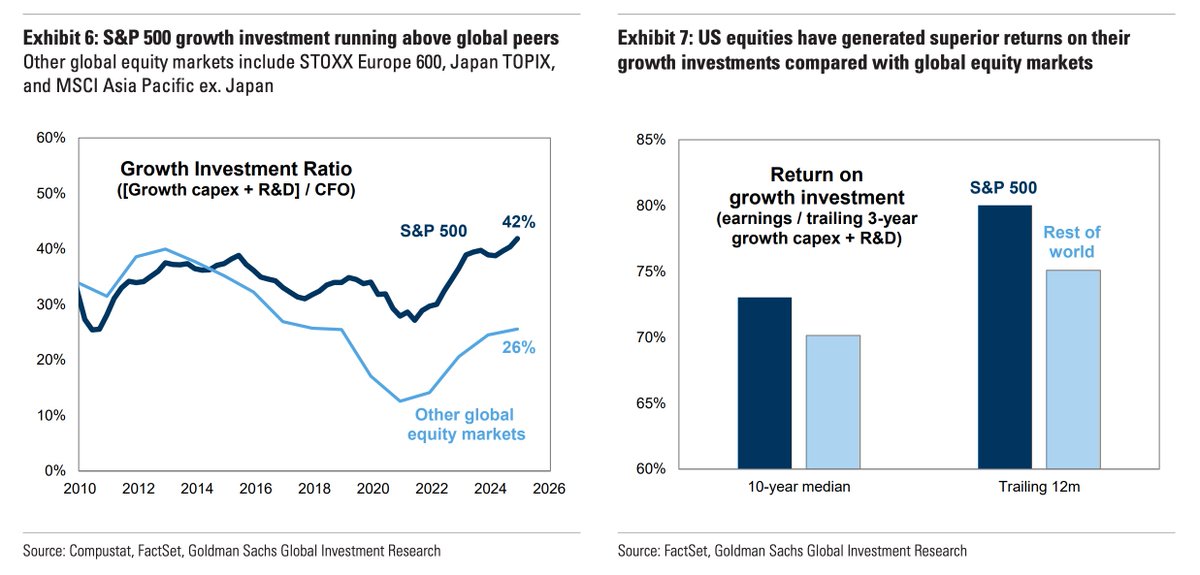

Brad: It remains hard to justify overweighting foreign stocks, given relative US business performance

Data as of January 2025

Data as of January 2025

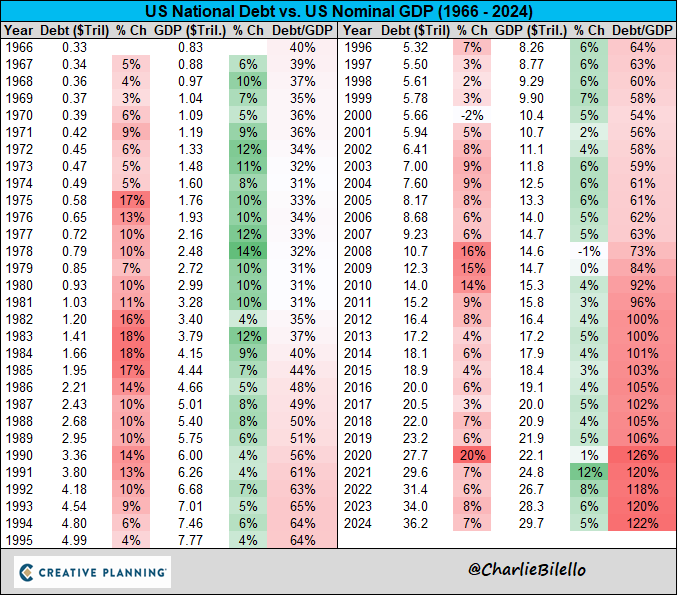

John Luke: but the rise in debt will need to be monitored if it crowds out private enterprise

Data as of January 2025

Data as of January 2025

These charts paint an evolving picture of where we’ve been and where we might go. As always, we’ll continue monitoring and interpreting the evidence to help navigate what’s ahead.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-11.