Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

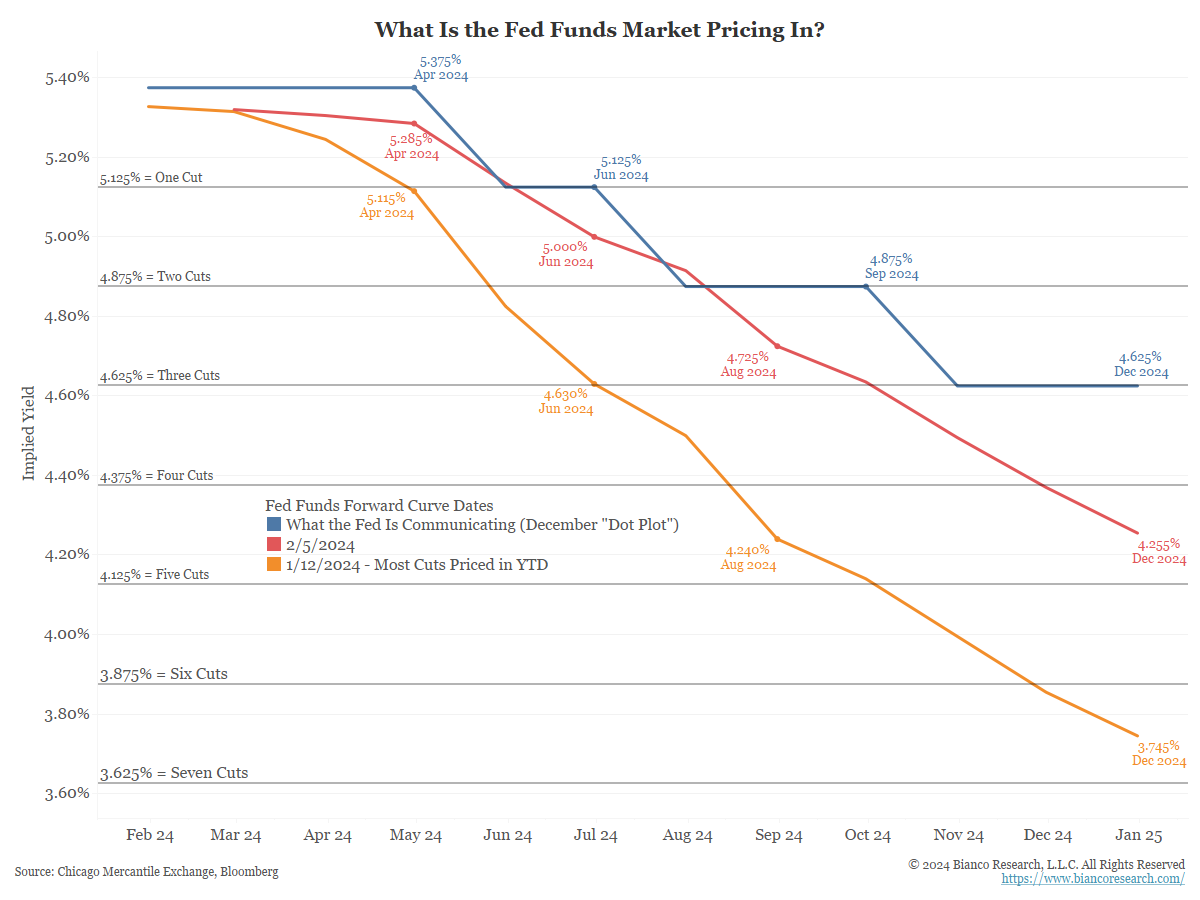

John Luke: Market expectations for 2024 interest rate cuts are slowly moving back towards FOMC guidance

Data as of 02.05.2024

Data as of 02.05.2024

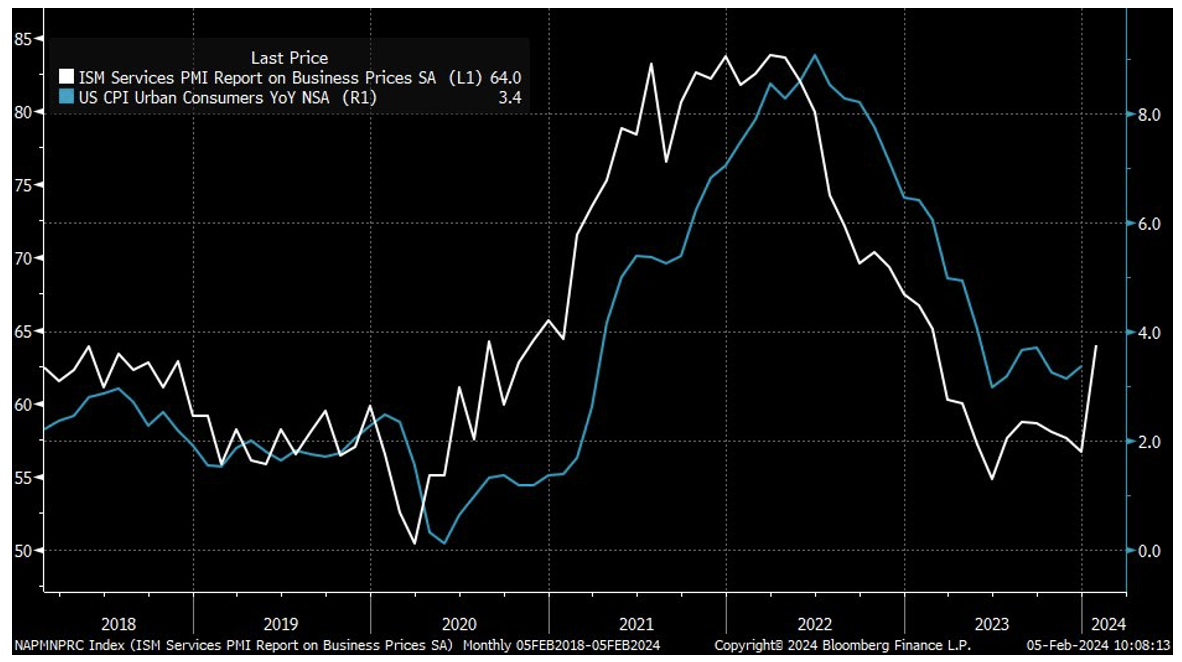

John Luke: as the underlying economy is producing data indicating that the inflation battle is still underway

Source: Bloomberg as of 02.05.2024

Source: Bloomberg as of 02.05.2024

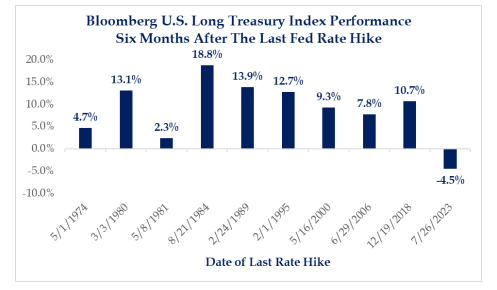

Dave: and long bonds are suffering as a result, relative to historical post-hiking cycle performance

Source: Strategas as of 02.04.2024

Source: Strategas as of 02.04.2024

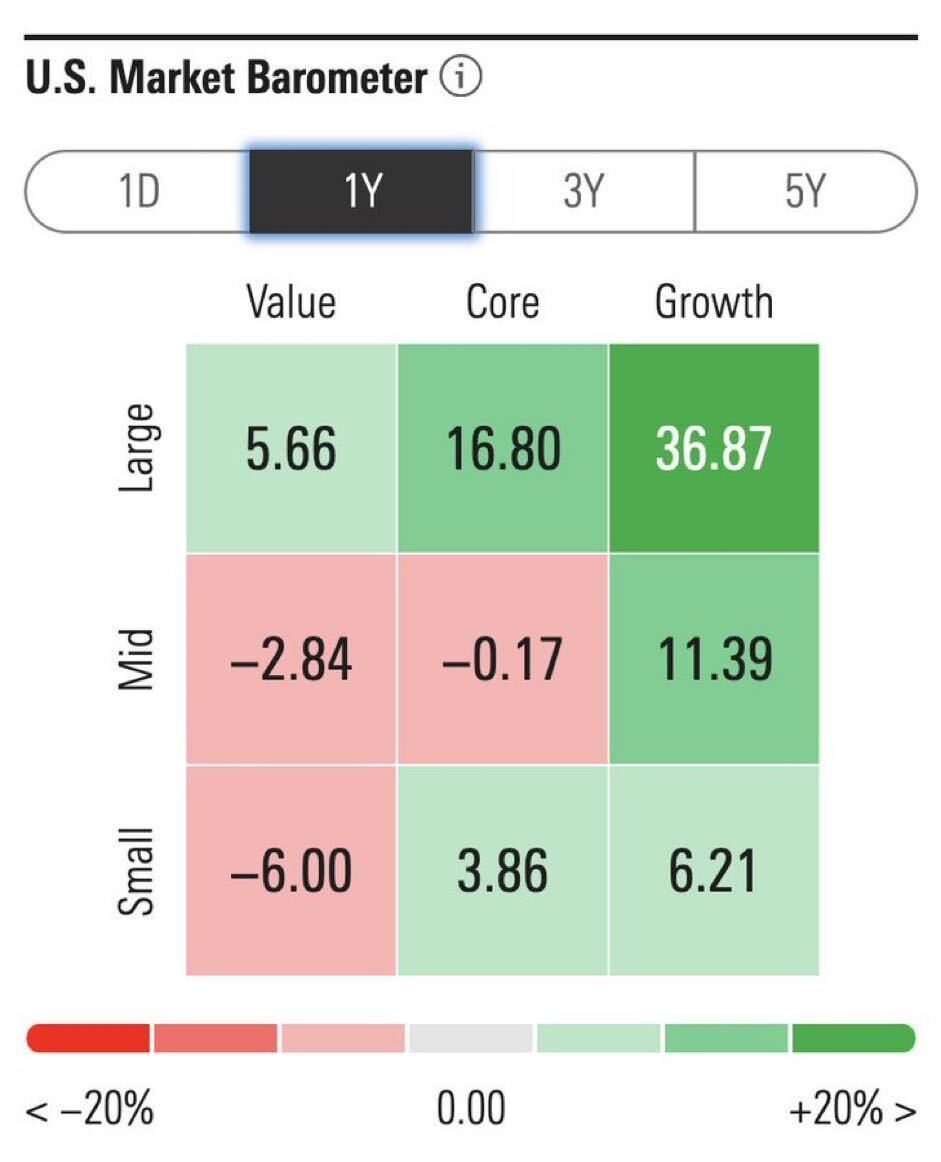

John Luke: Large growth continues to dominate

Source: Morningstar as of 02.05.2024

Source: Morningstar as of 02.05.2024

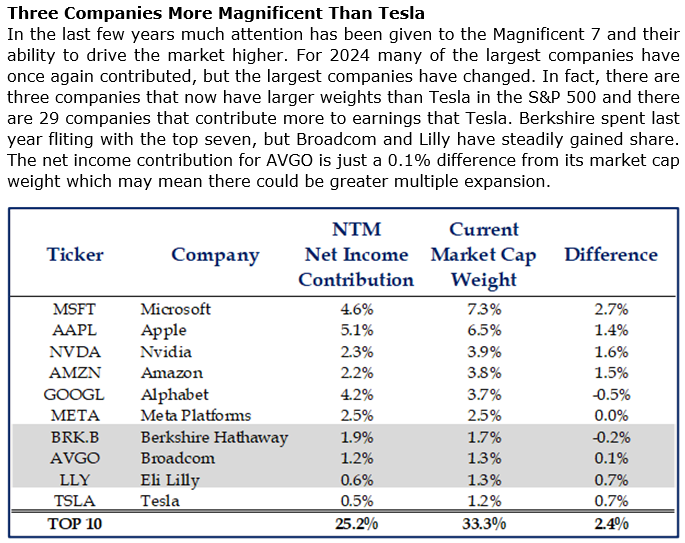

Brad: but one of the “Mag 7” is losing its place

Source: Strategas as of 02.06.2023

Source: Strategas as of 02.06.2023

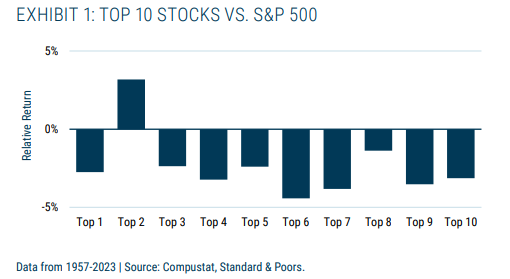

Brian: which is something that has often occurred in the following year for the largest market-cap companies

Source: GMO as of Jan 2024

Source: GMO as of Jan 2024

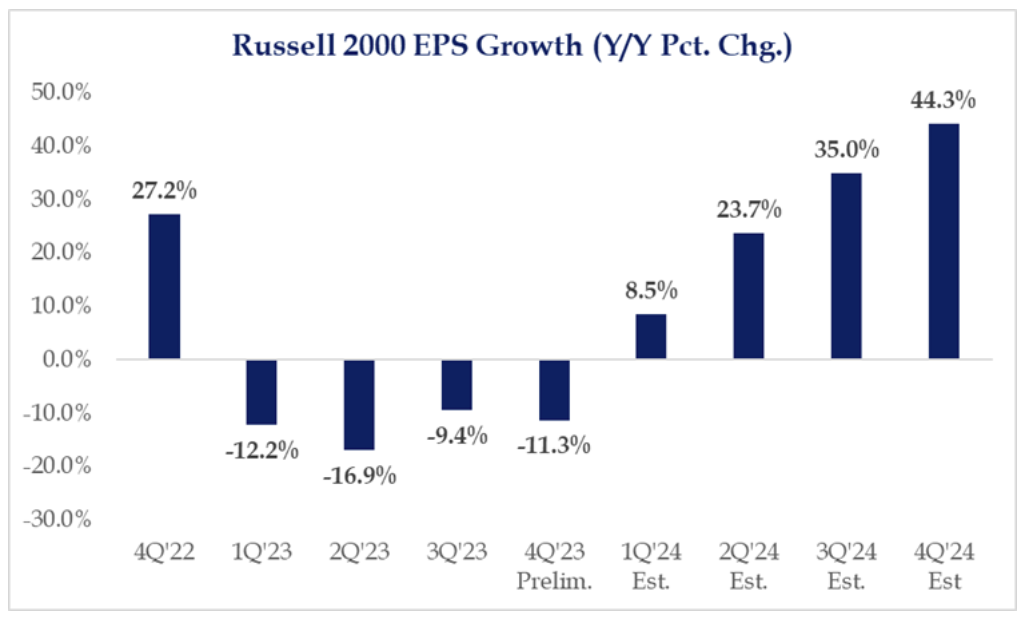

Dave: and looking out a few quarters shows the possibility of some serious earnings gains for smaller companies

Source: Strategas as of 02.07.2023

Source: Strategas as of 02.07.2023

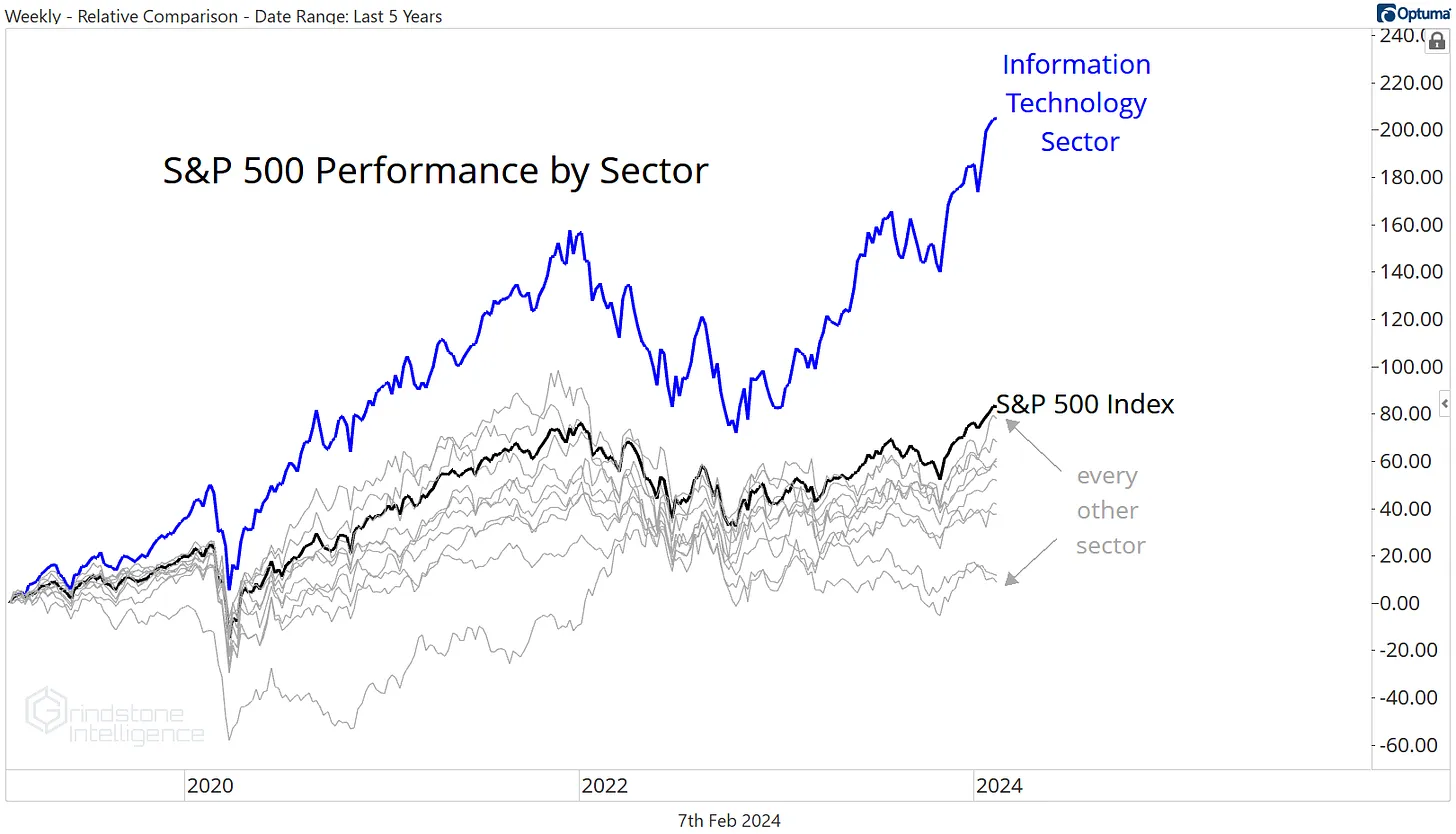

Beckham: It’s not a surprise to see how far ahead tech is, at the expense of all other sectors

Source: Grindstone Intelligence

Source: Grindstone Intelligence

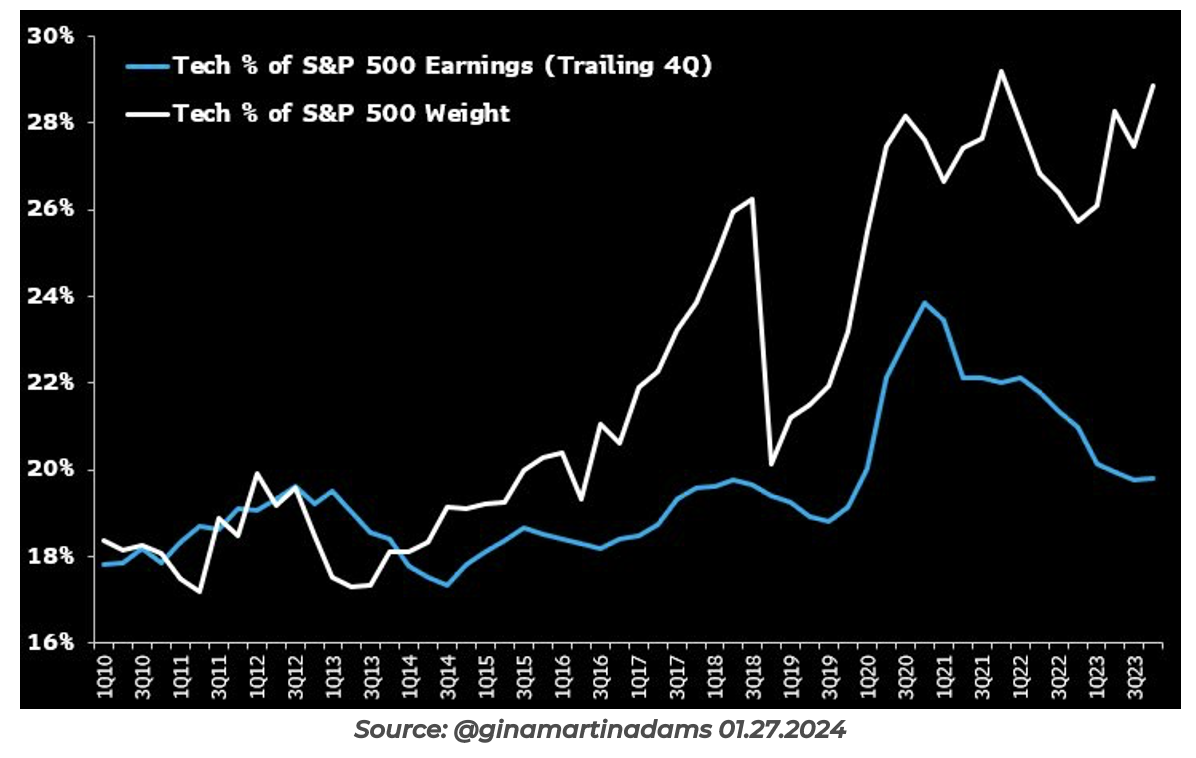

John Luke: but now prices for technology stocks have raced far ahead of their own earnings

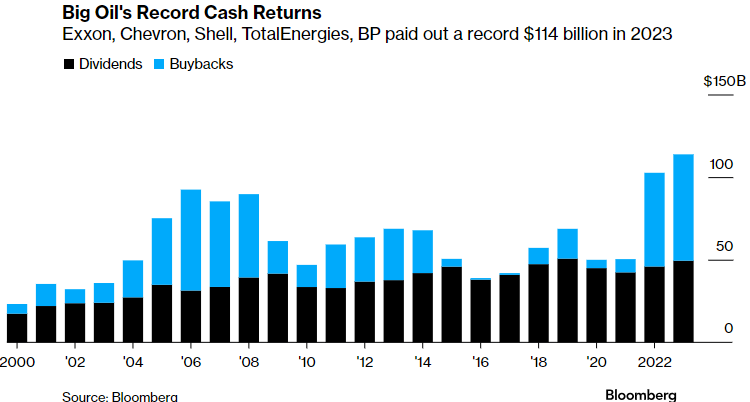

Joseph: while the neglected energy companies shovel cash flow into buybacks and dividends

Data as of January 2024

Data as of January 2024

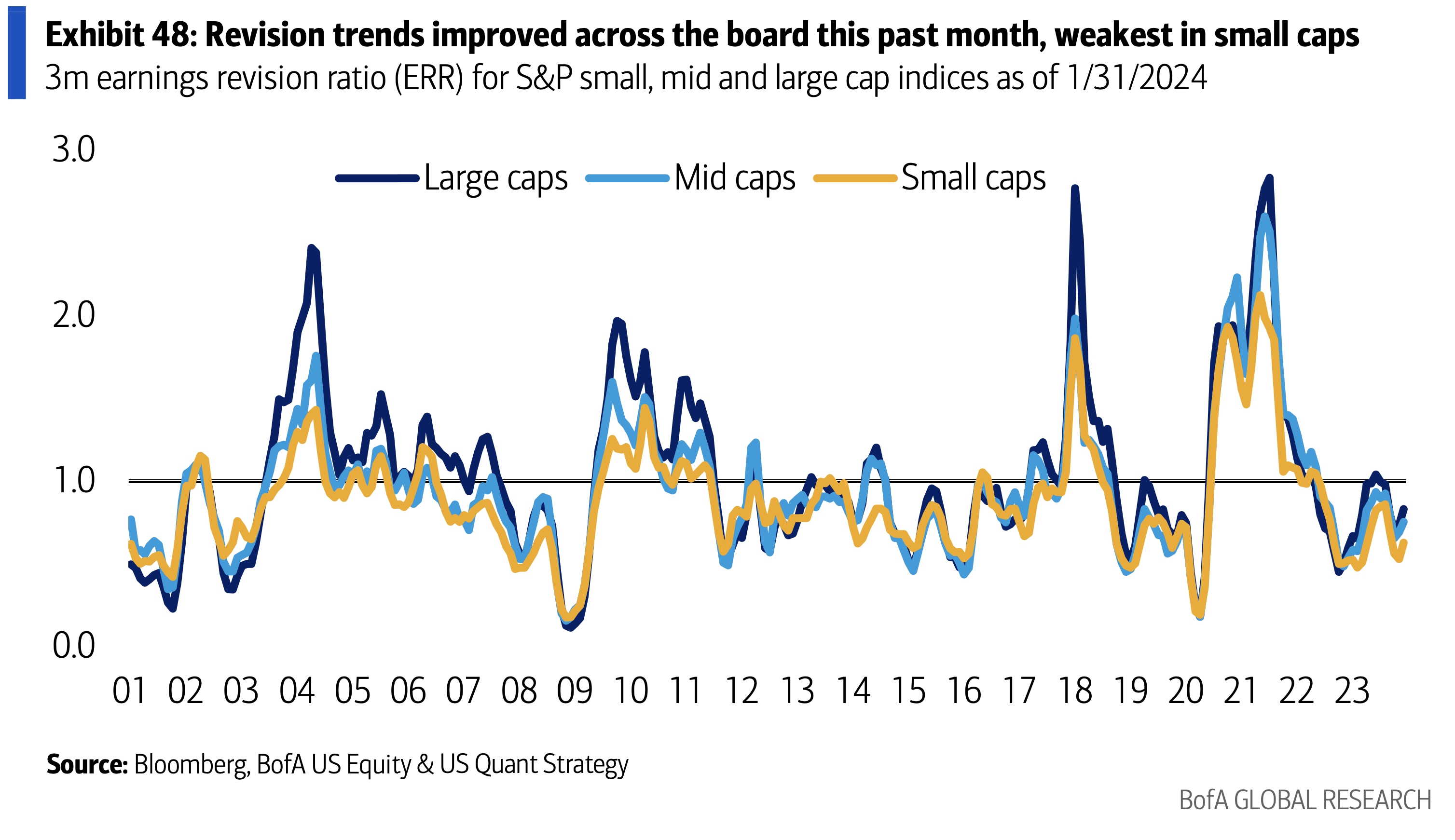

Dave: Earnings estimates are bumping slightly off of the bottom

Data as of 01.31.2024

Data as of 01.31.2024

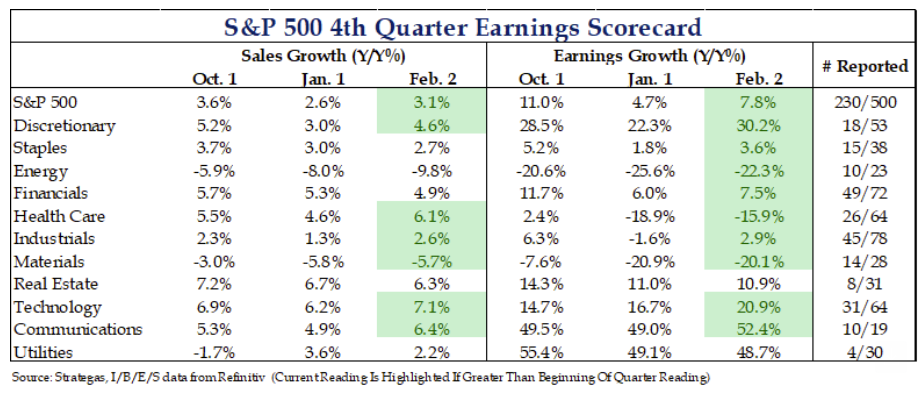

Brad: as the trickle of reports turns into a flood, and shows better growth than expected a month ago

Data as of 02.02.2024

Data as of 02.02.2024

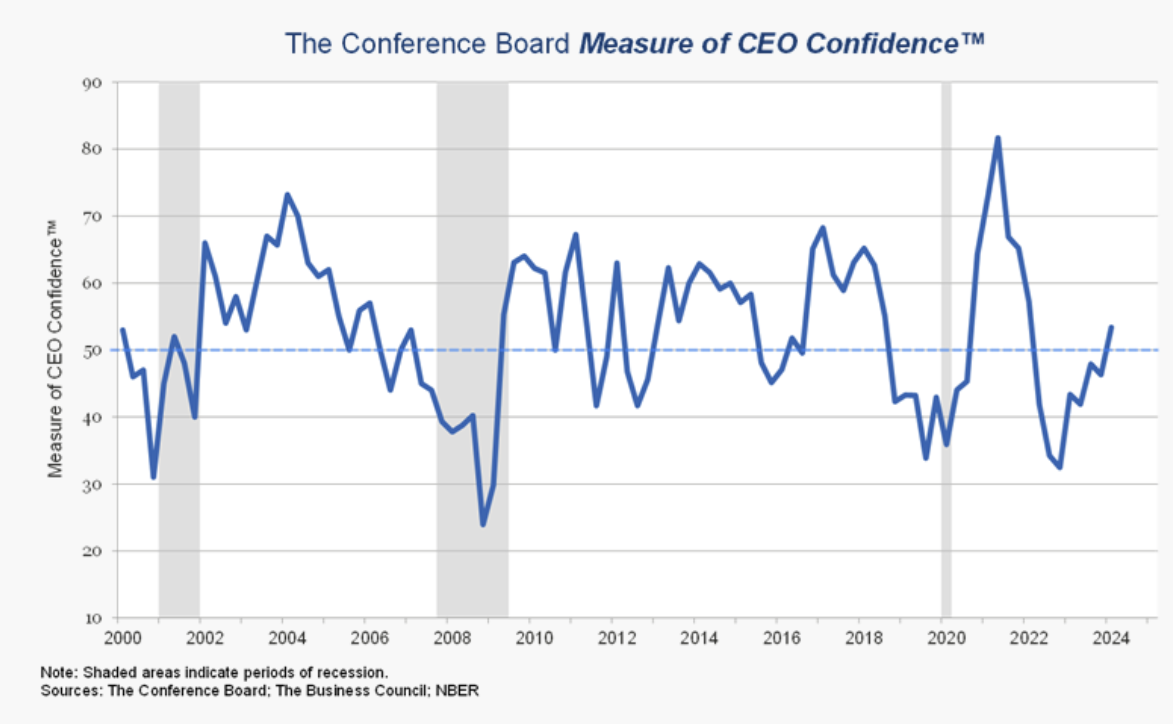

Brian: Confidence among corporate executives is moving nicely higher from multi-year lows

Data as of 02.08.2024

Data as of 02.08.2024

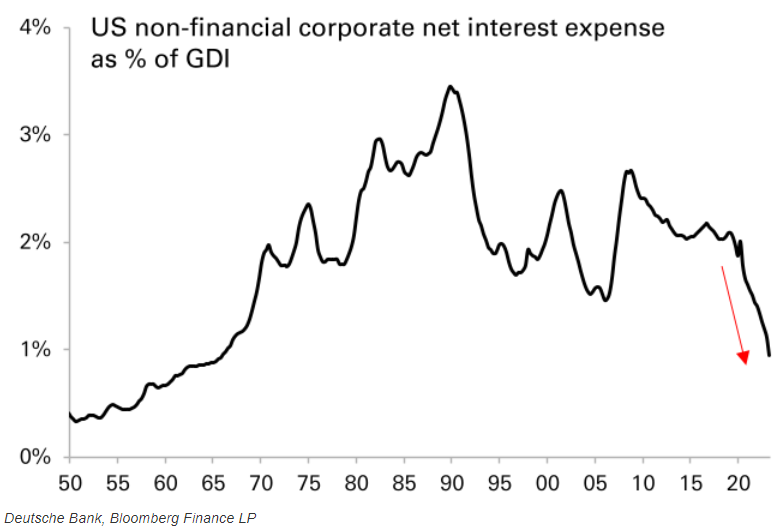

Beckham: as inflation worries fade but equally important, the general level of interest expense among corporations

Data as of January 2024

Data as of January 2024

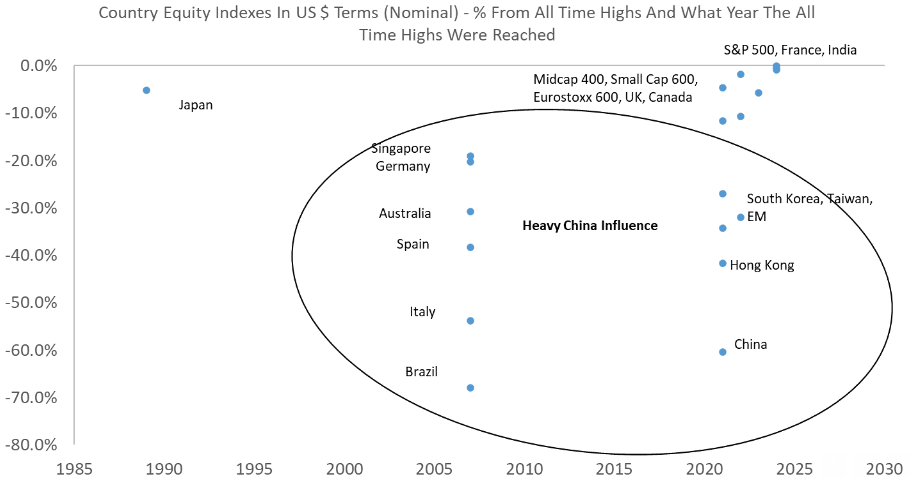

Joseph: Everyone knows most foreign markets have significantly lagged the U.S., but this pic shows an interest set of dynamics

Source: Raymond James as of 02.09.2024

Source: Raymond James as of 02.09.2024

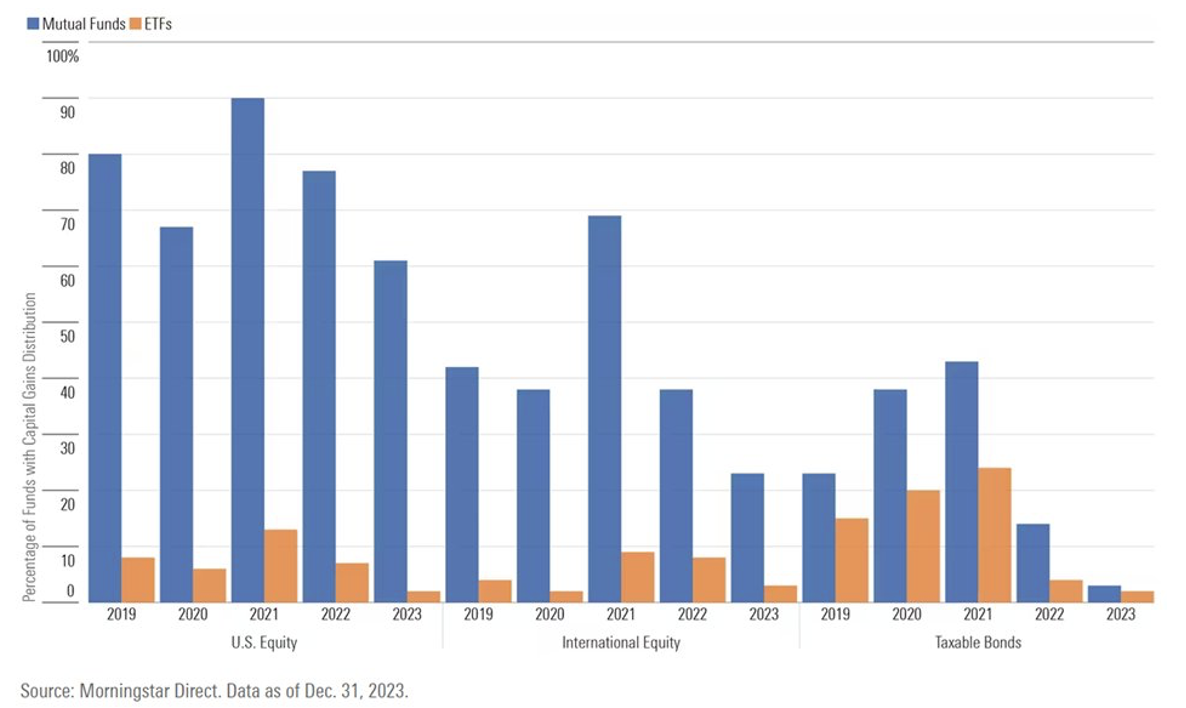

Brett: Regular reminder, ETFs operate with a different (better!) tax structure than mutual funds

Via @nategeraci

Via @nategeraci

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2402-11.