Our team looks at a lot of research throughout the day. Here are a handful that we think are contributing to investor activity , from rate expectations to growth drivers to government spending and comparisons of foreign markets to ours. Enjoy!

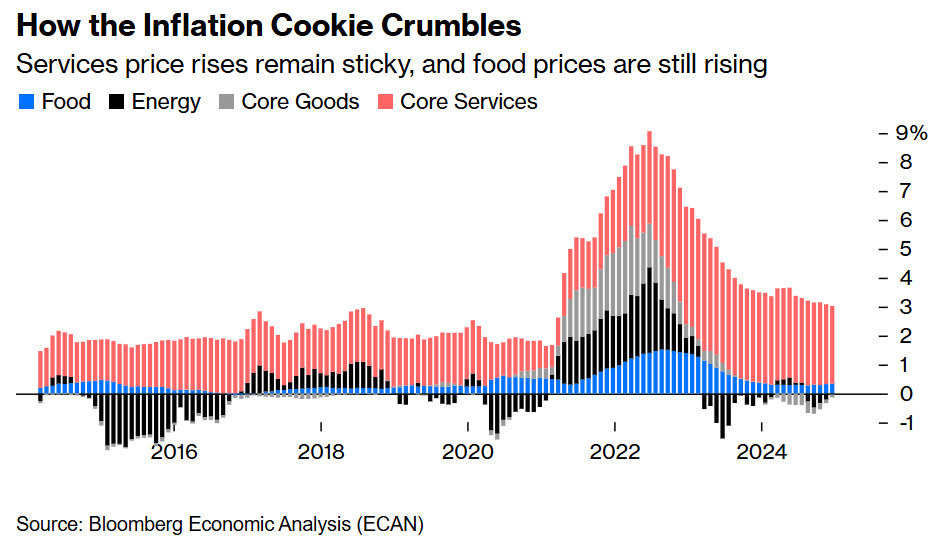

Joseph: The rate of inflation may not be falling, but stable in the 3% range seems to be acceptable to stocks, based on the post-CPI rally

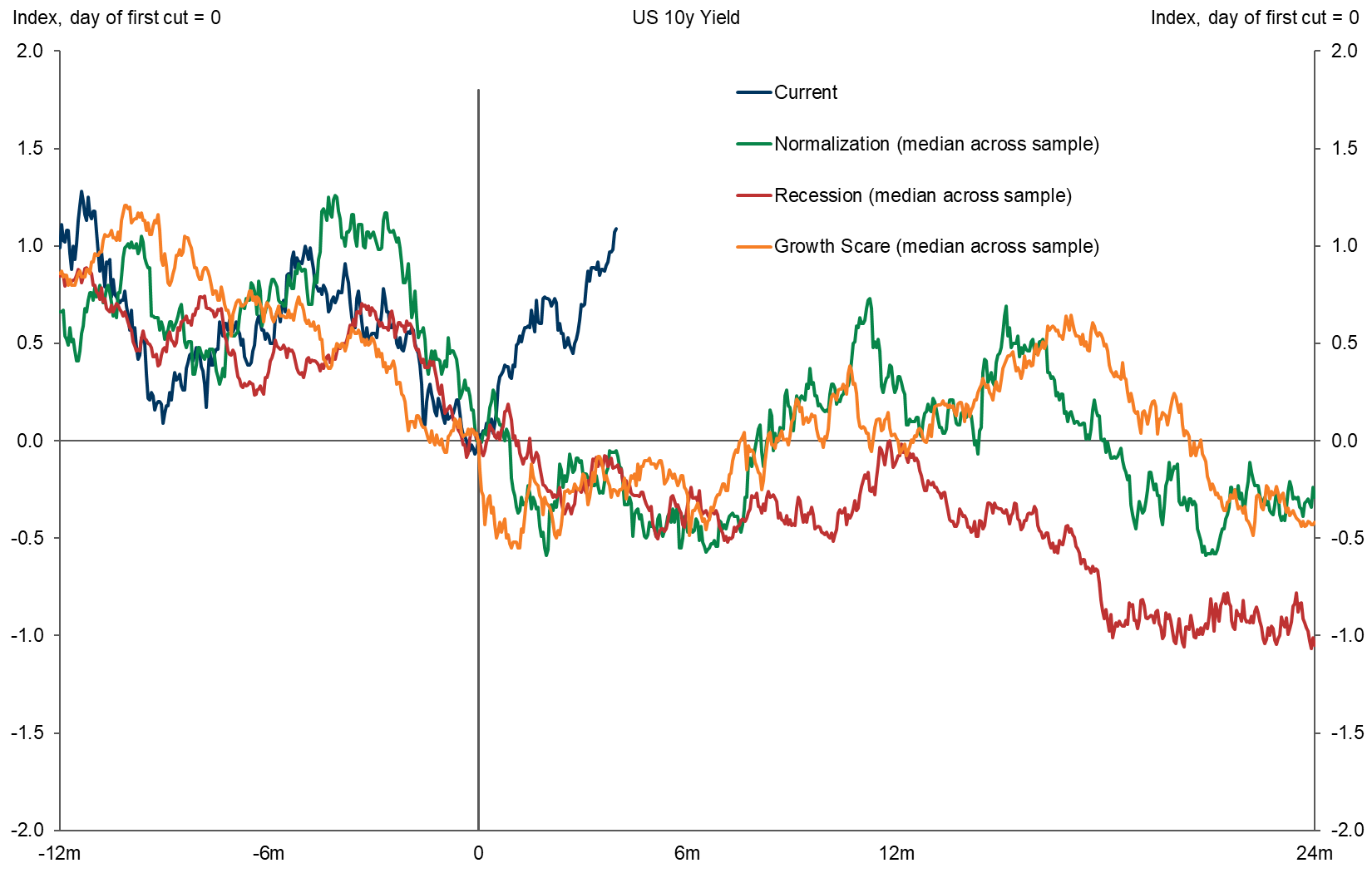

John Luke: but the path for 10 year Treasuries still stands out from past episodes

Source: Goldman Sachs as of 01.15.2025

Source: Goldman Sachs as of 01.15.2025

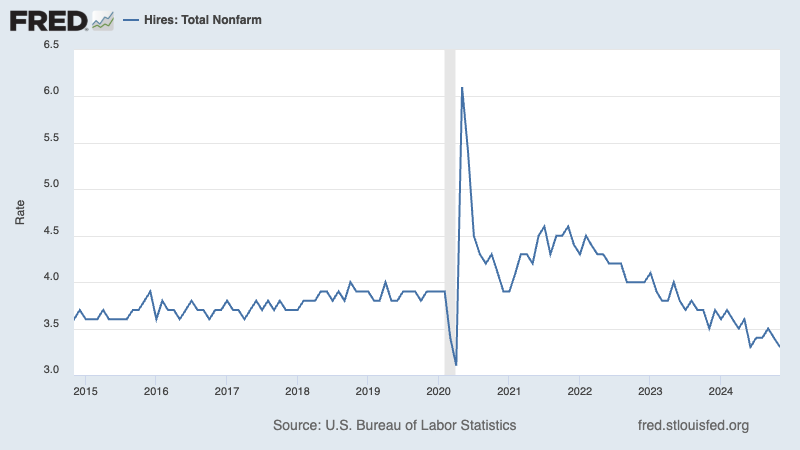

Beckham: Companies aren’t really cutting jobs, they’re just not hiring as aggressively as they did coming out of COVID

Source: Tker as of 01.10.2025

Source: Tker as of 01.10.2025

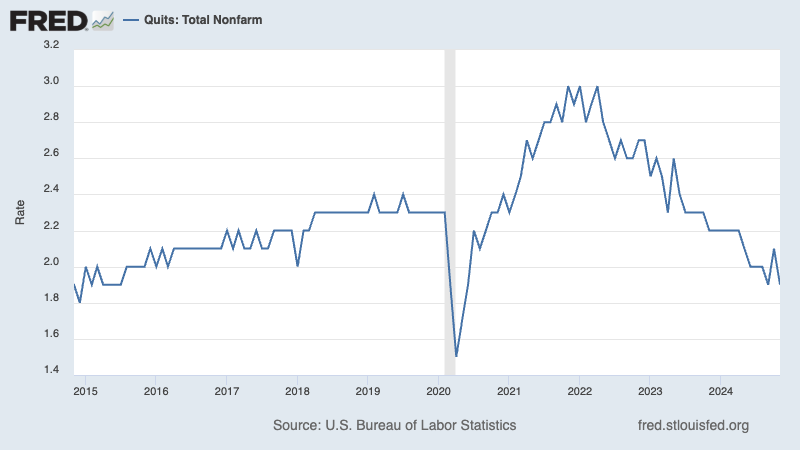

Beckham: and workers aren’t leaving their current jobs for better opportunities like they did in that period

Source: TKer as of 01.10.2025

Source: TKer as of 01.10.2025

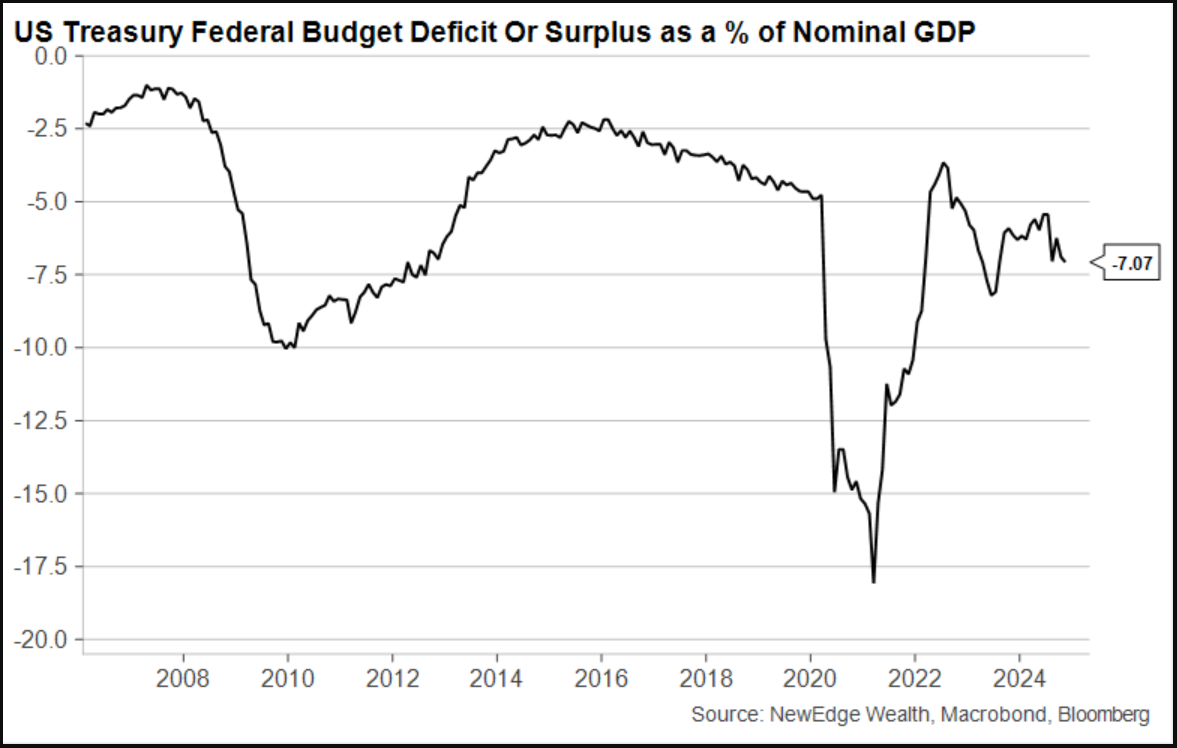

JD: The federal government continues to operate at a significant deficit, setting a high hurdle rate for future purchasing power

Data as of December 2024

Data as of December 2024

Joseph: thankfully, consumers are in much better shape with their collective finances

Source: Apollo as of 01.13.2025

Source: Apollo as of 01.13.2025

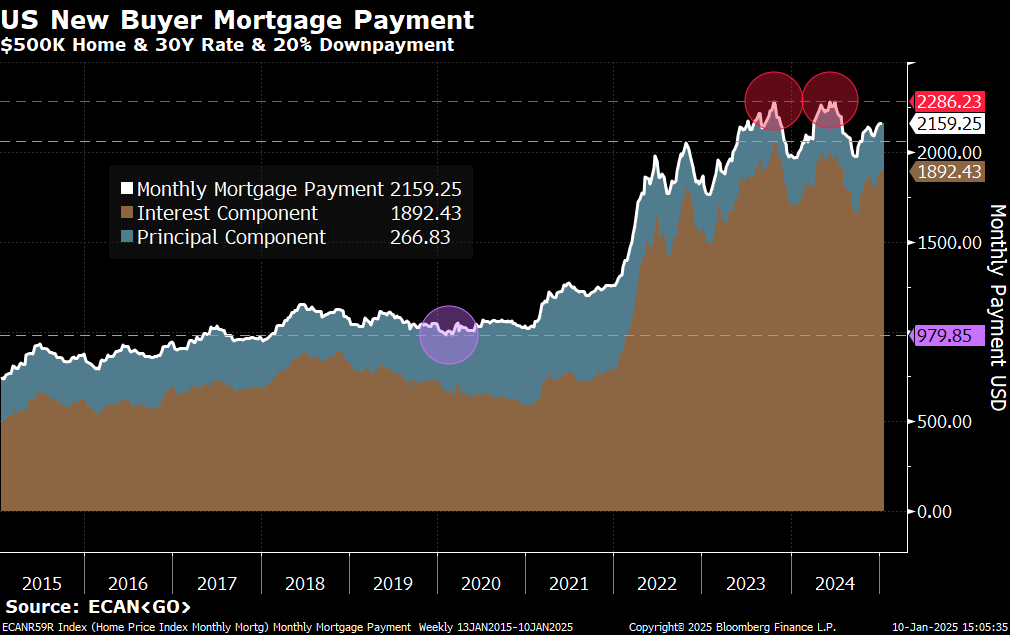

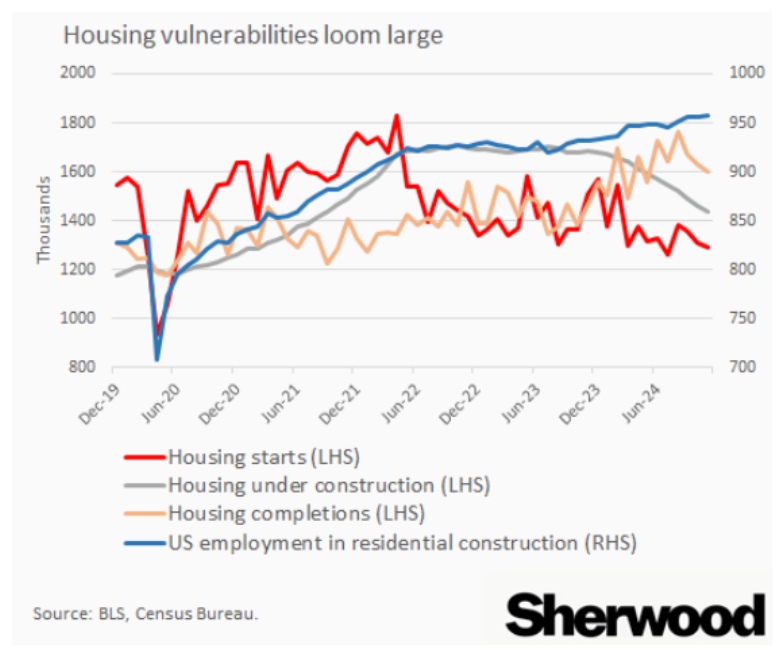

Brian: that said, for those not already owning homes it’s a tough market to enter

Brett: leaving homebuilders less likely to build without clear signs from buyers

Data as of December 2024

Data as of December 2024

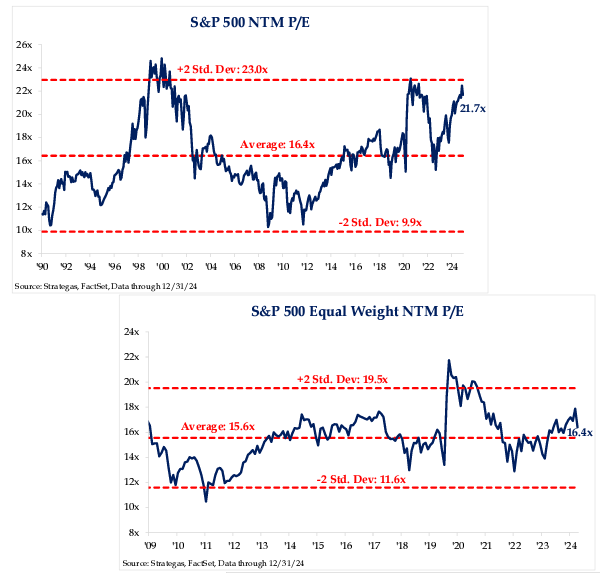

Dave: Valuations outside of megacap tech remain much closer to historic norms

Brad: and maybe the catalyst will arrive this year as the business gap reverts

Source: NewEdge as of 01.13.2025

Source: NewEdge as of 01.13.2025

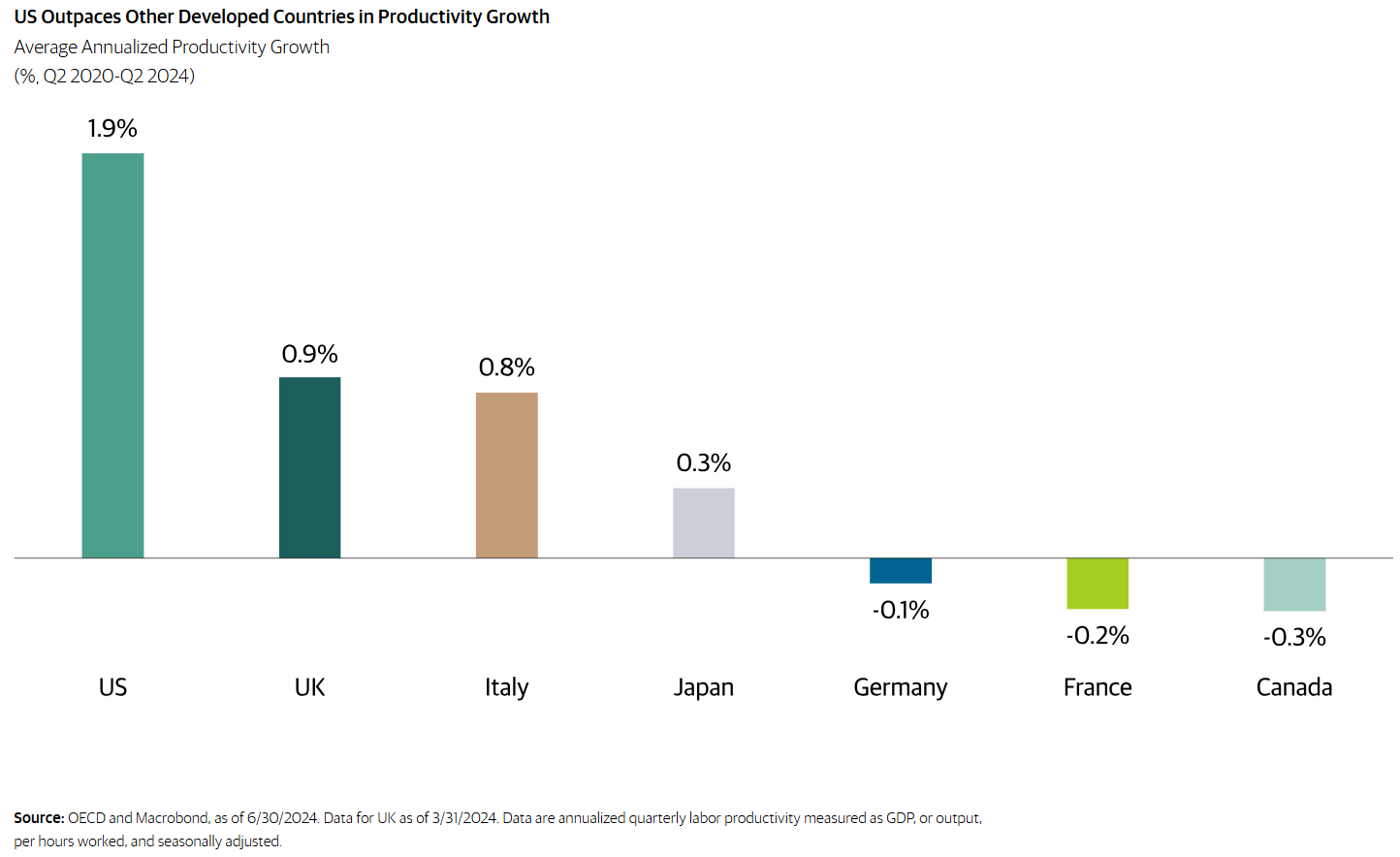

Arch: There are clear justifications for U.S. equity outperformance vs. most of the world

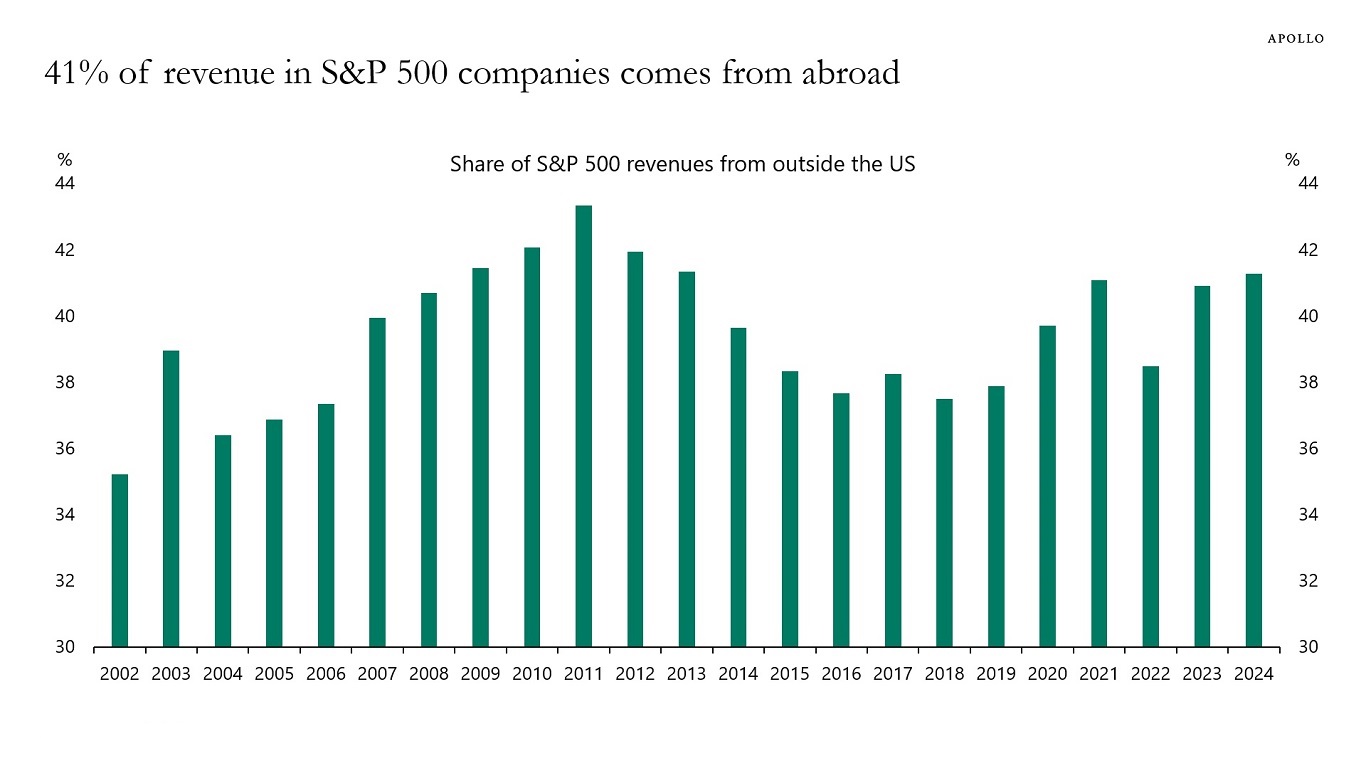

John Luke: but it’s important to note that owning US stocks doesn’t mean isolation from good or bad conditions around the globe

Source: Apollo as of December 2024

Source: Apollo as of December 2024

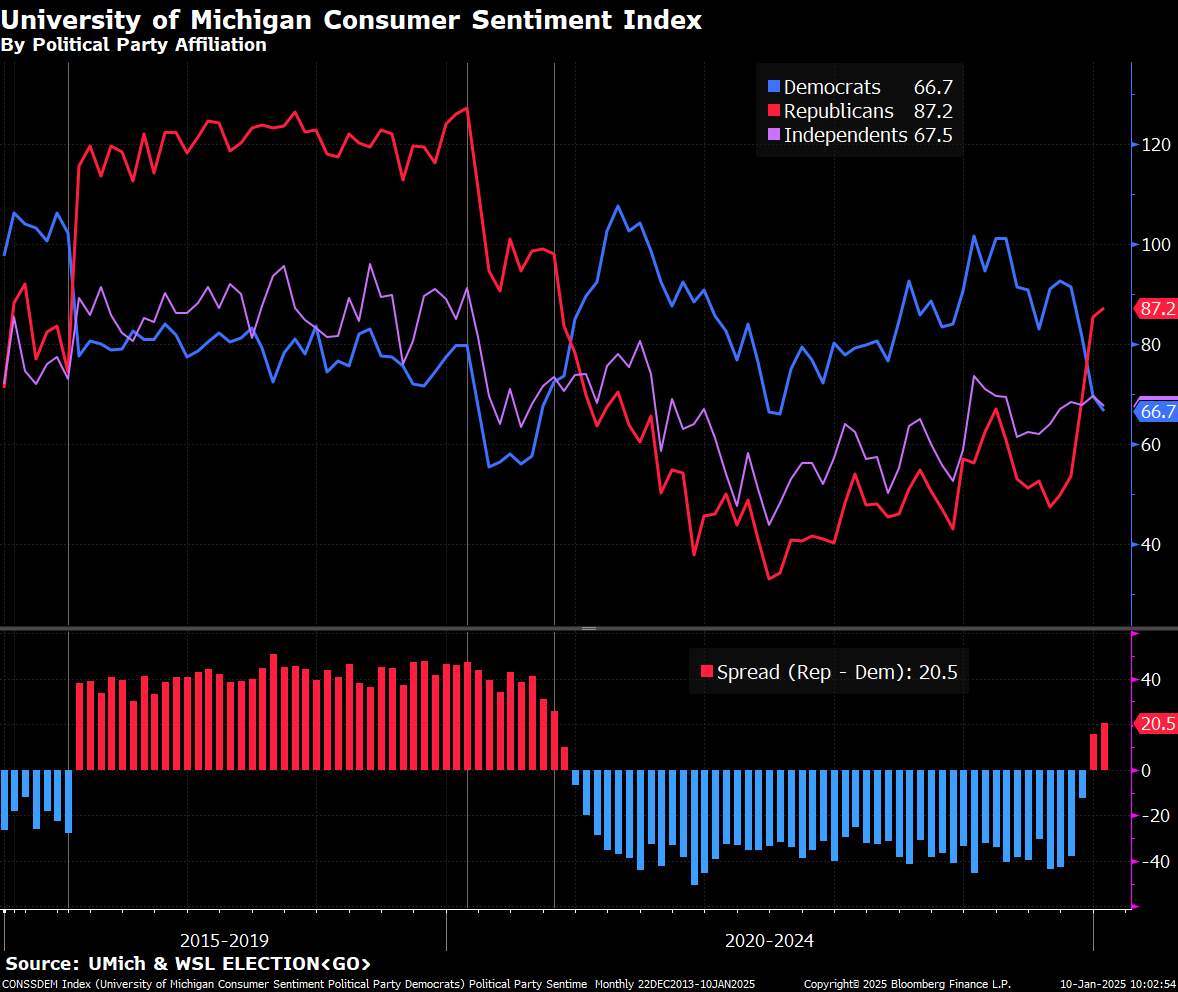

Brian: When it comes to consumer psychology, politics plays a heavy role in the way people feel about the economy

Source: @M_McDonough as of 01.10.2025

Source: @M_McDonough as of 01.10.2025

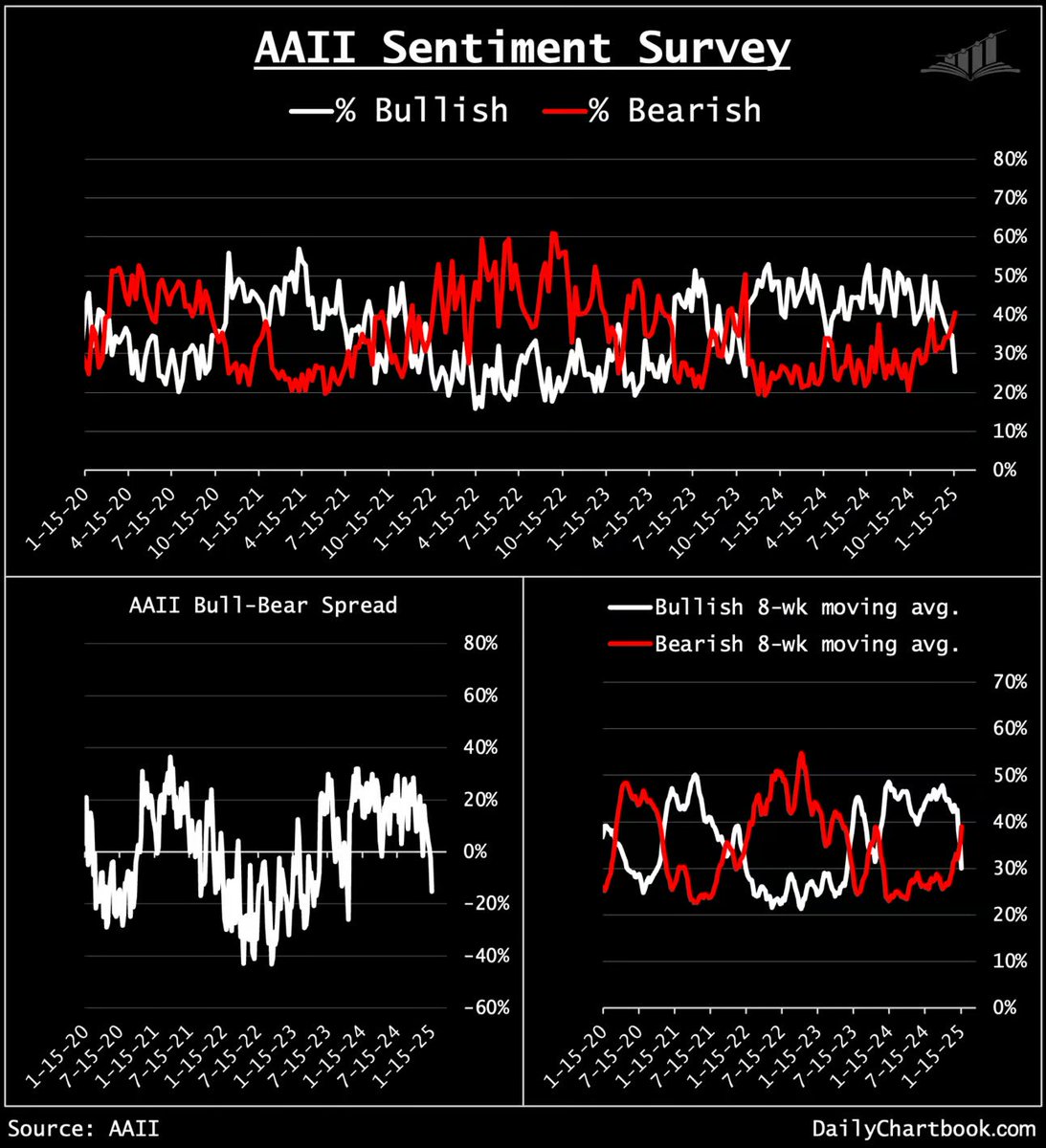

Dave: and speaking of sentiment, it didn’t take much of a selloff to create a fresh wall of worry for stocks

Data as of 01.16.2025

Data as of 01.16.2025

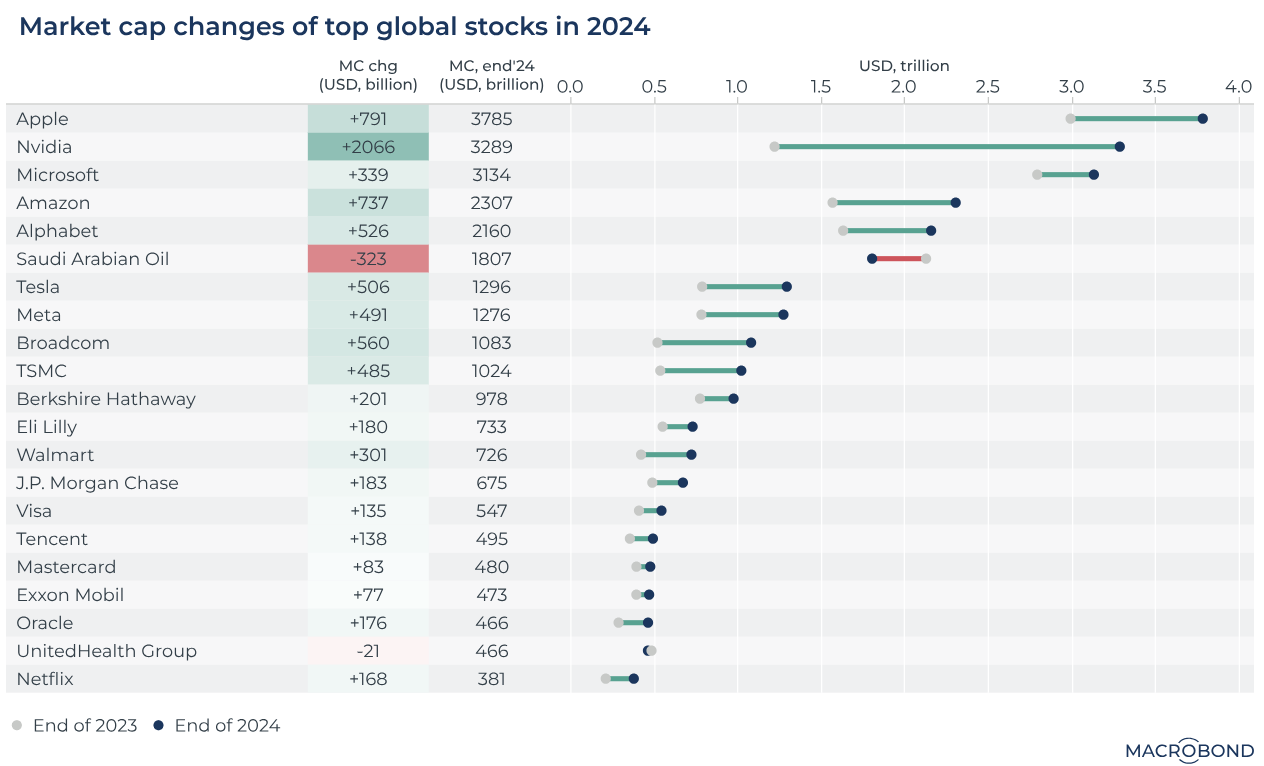

Brad: 2024 delivered some hefty gains to shareholders of megacap tech stocks

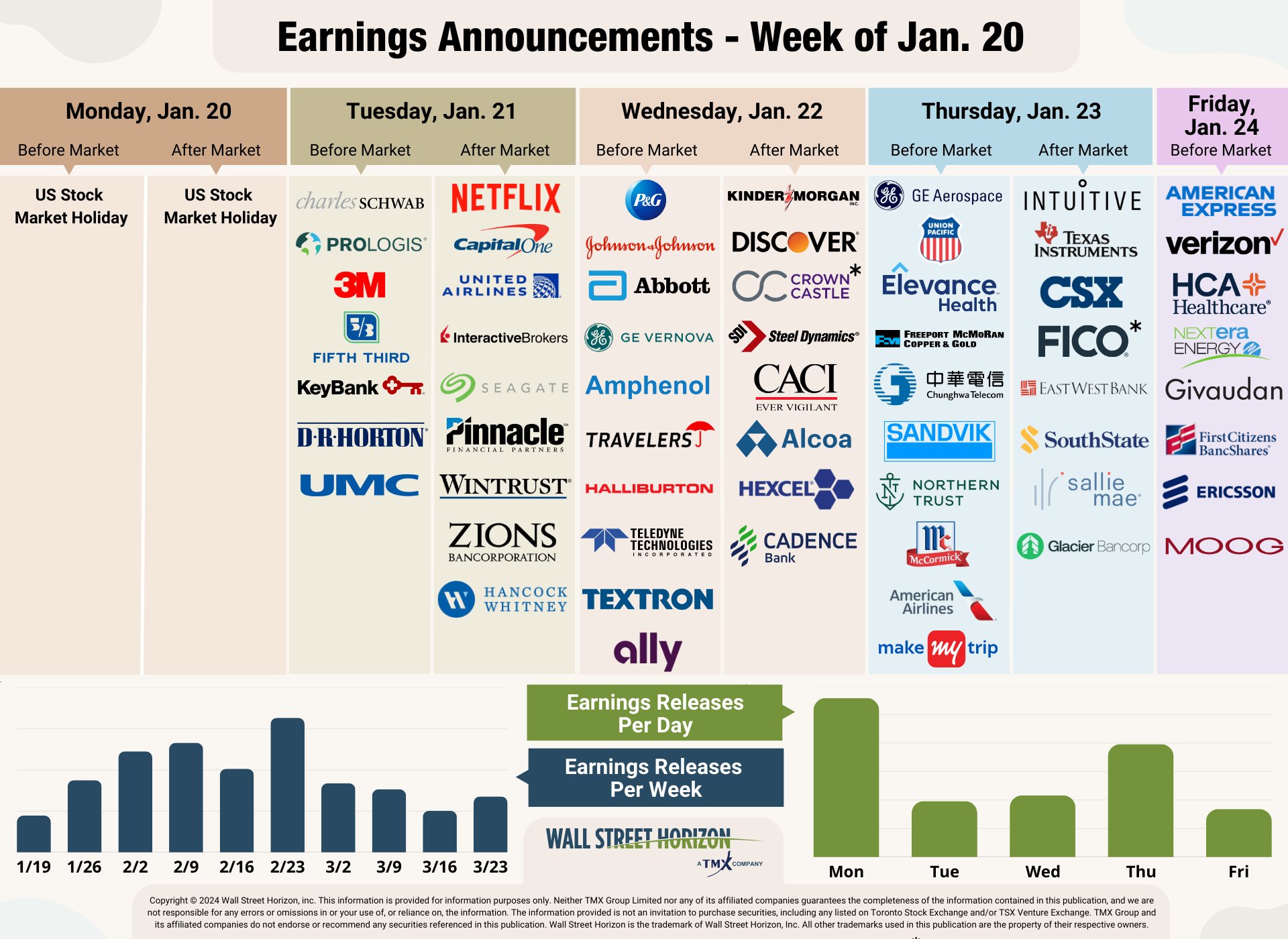

Dave: Earnings season kicked off with the banks, we’ll see more activity this week and then big tech the following week

Data as of 01.17.2025

Data as of 01.17.2025

This set of charts paints an evolving picture of where we’ve been and where we might go. As always, we’ll continue monitoring and interpreting the evidence to help navigate what’s ahead.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-26.