Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

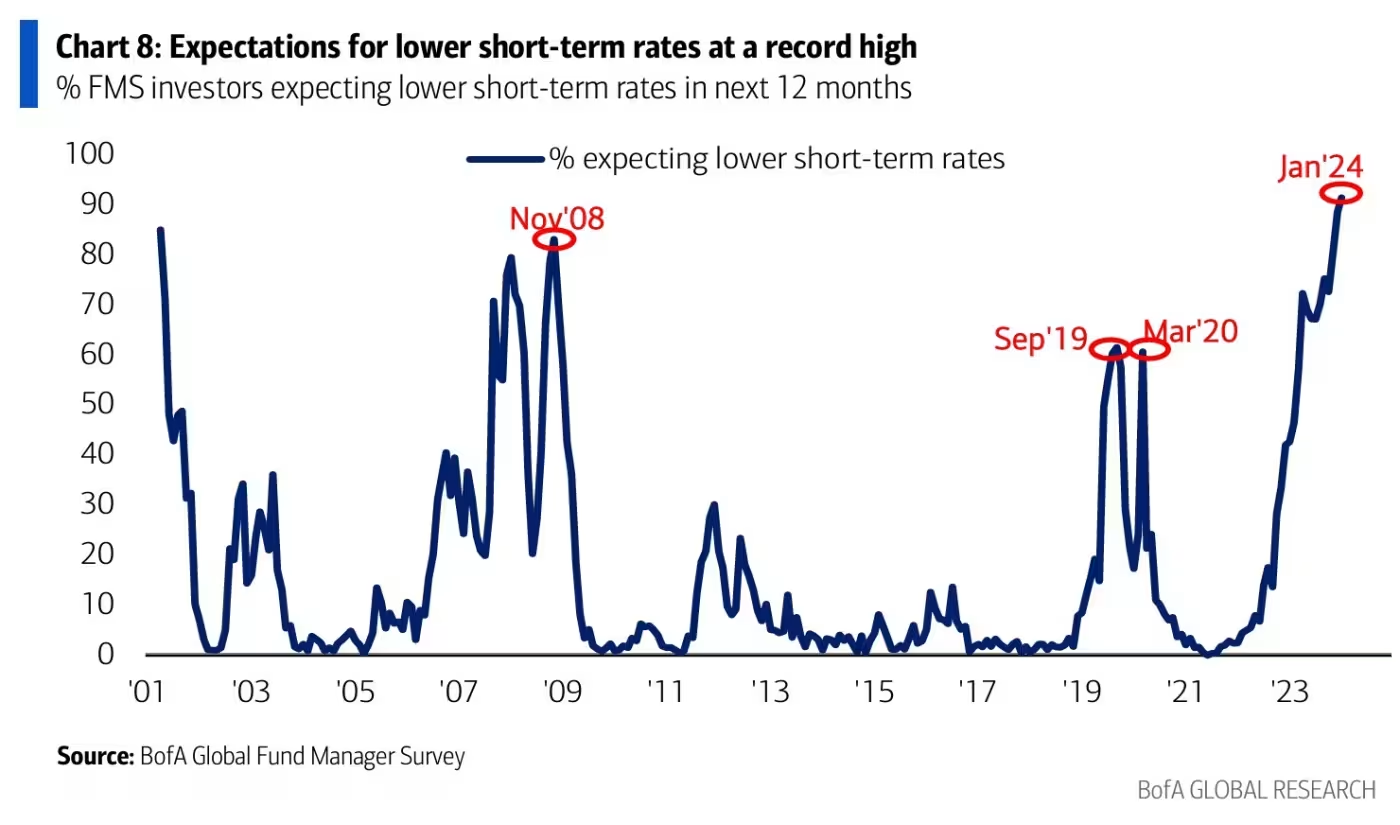

John Luke: It’s no secret that central banks plan to cut rates this year

Data as of 01.12.2024

Data as of 01.12.2024

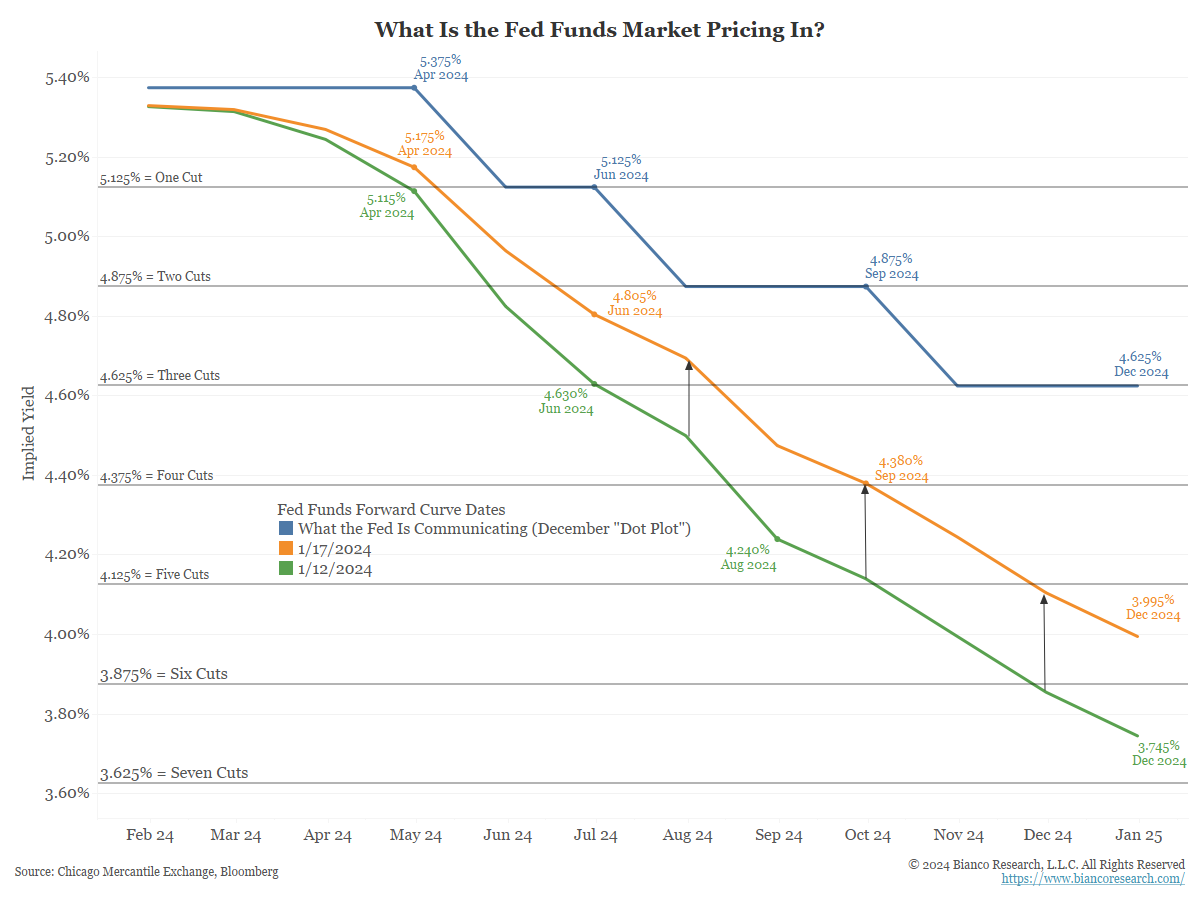

John Luke: and US markets are way out in front of the FOMC in anticipating how many cuts can come in 2024

Data as of 01.17.2024

Data as of 01.17.2024

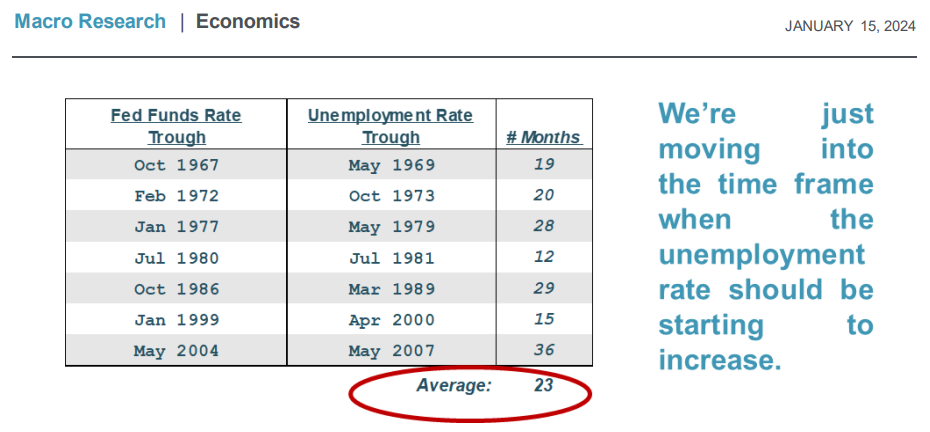

Beckham: We’re getting into the time window when unemployment has historically risen following a rate hike cycle

Source: Piper Jaffray as of 01.15.2024

Source: Piper Jaffray as of 01.15.2024

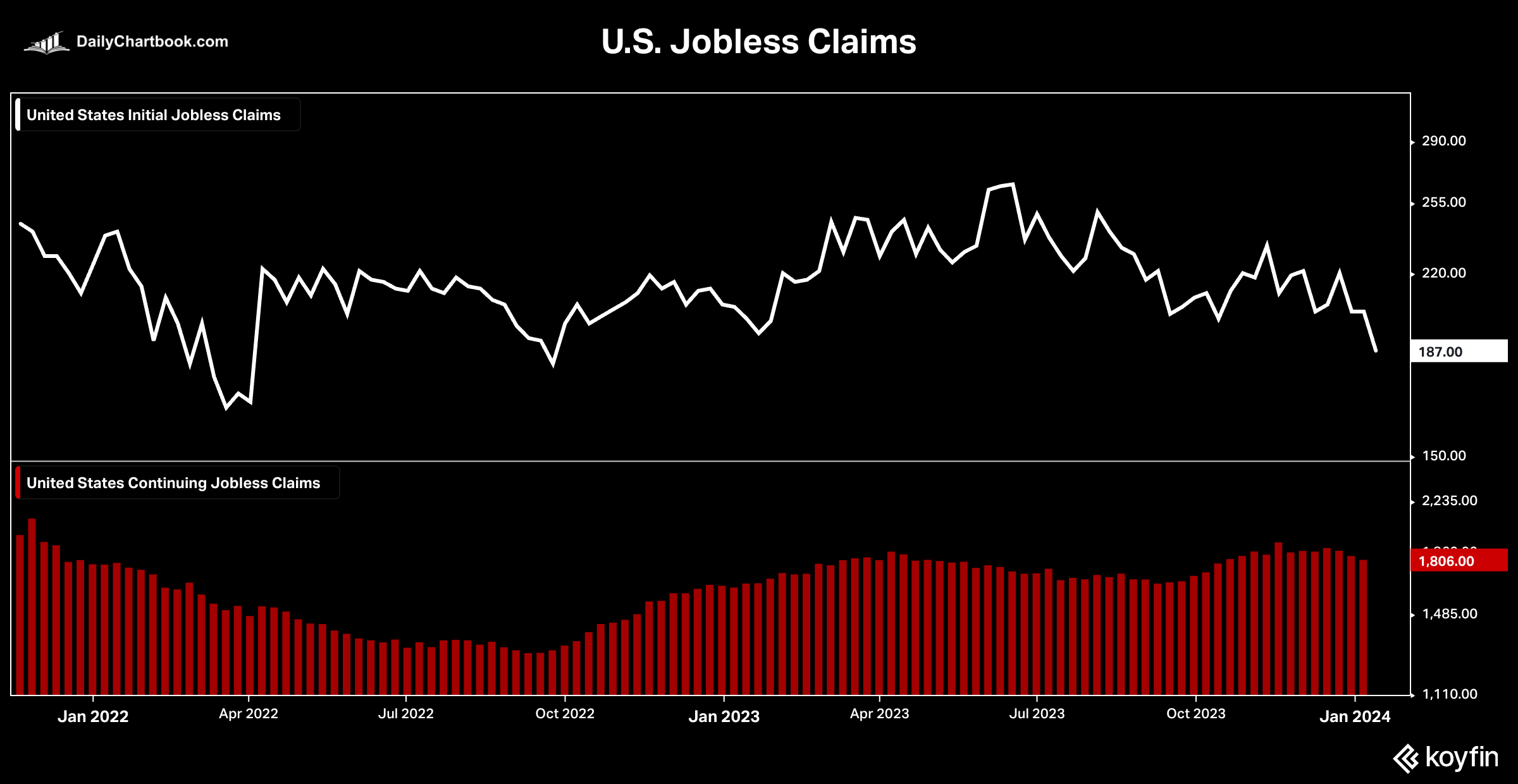

Brian: but there’s been no sign of sustained weakness in the job market

Source: Daily Chartbook as of 01.18.2024

Source: Daily Chartbook as of 01.18.2024

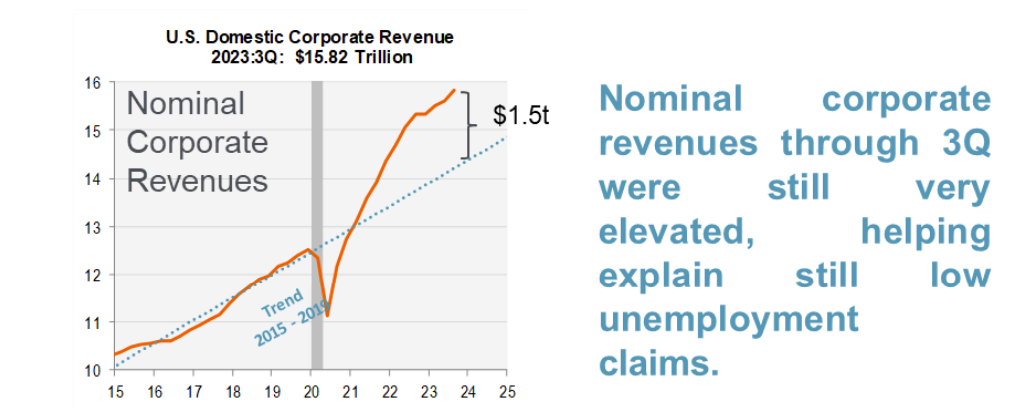

Dave: On top of that, the general trend in business activity is still well above its pre-COVID trendline

Source: Piper Jaffray as of 01.15.2024

Source: Piper Jaffray as of 01.15.2024

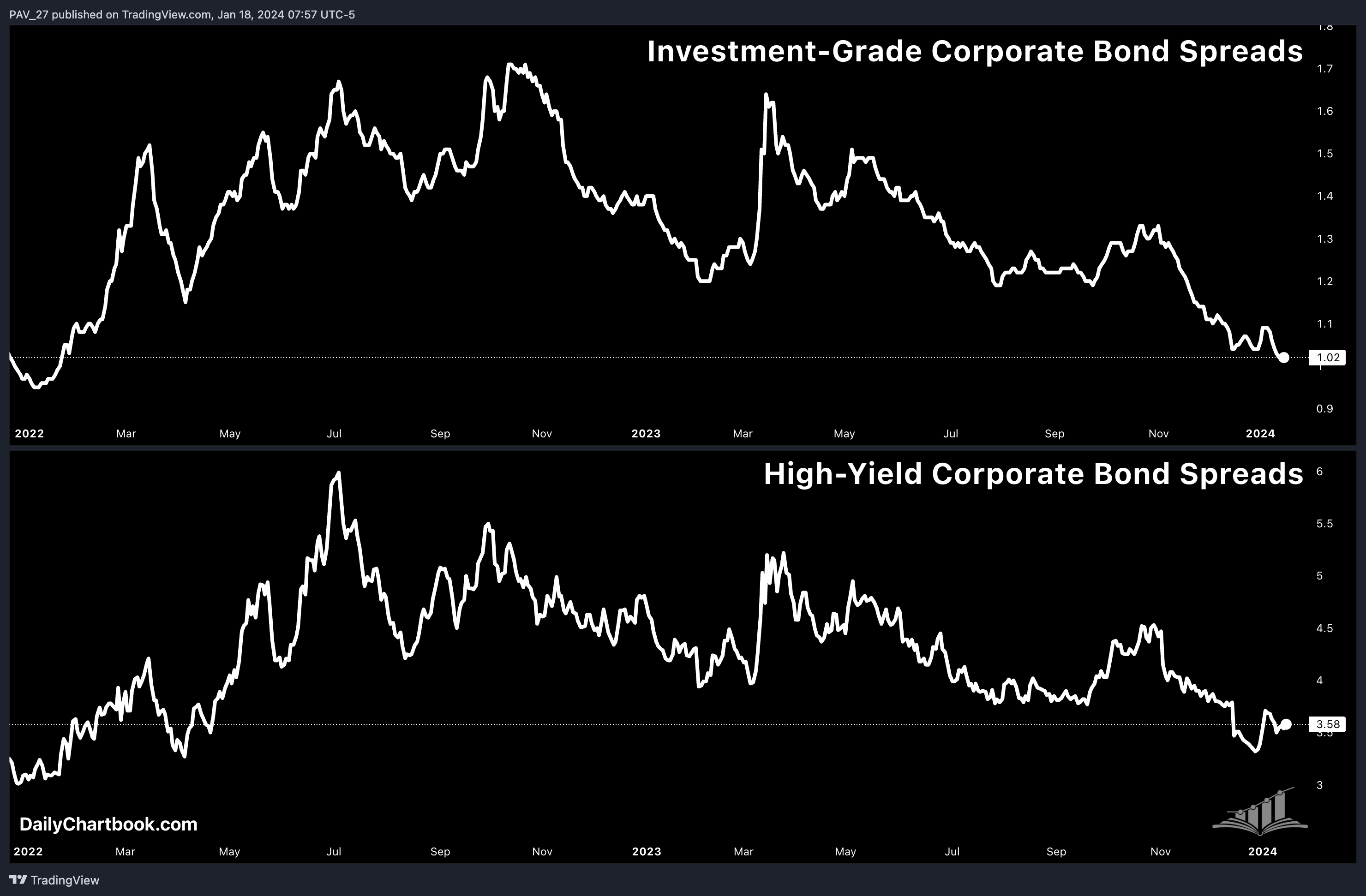

John Luke: and credit spreads are still signaling zero trouble in the economy

Source: Daily Chartbook as of 01.18.2024

Source: Daily Chartbook as of 01.18.2024

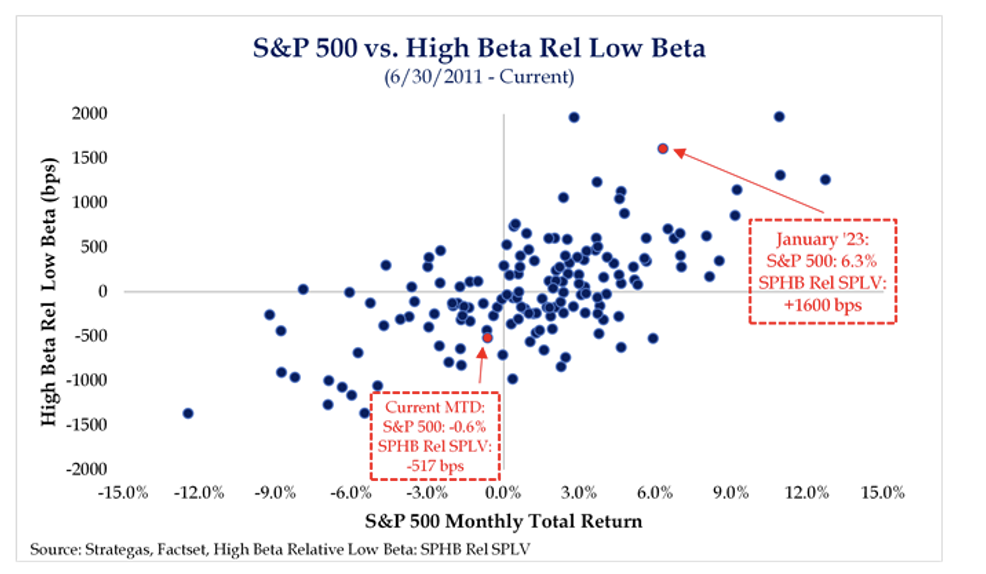

Brad: High beta stocks have really lagged in the early days of 2024

Data as of 01.16.2024

Data as of 01.16.2024

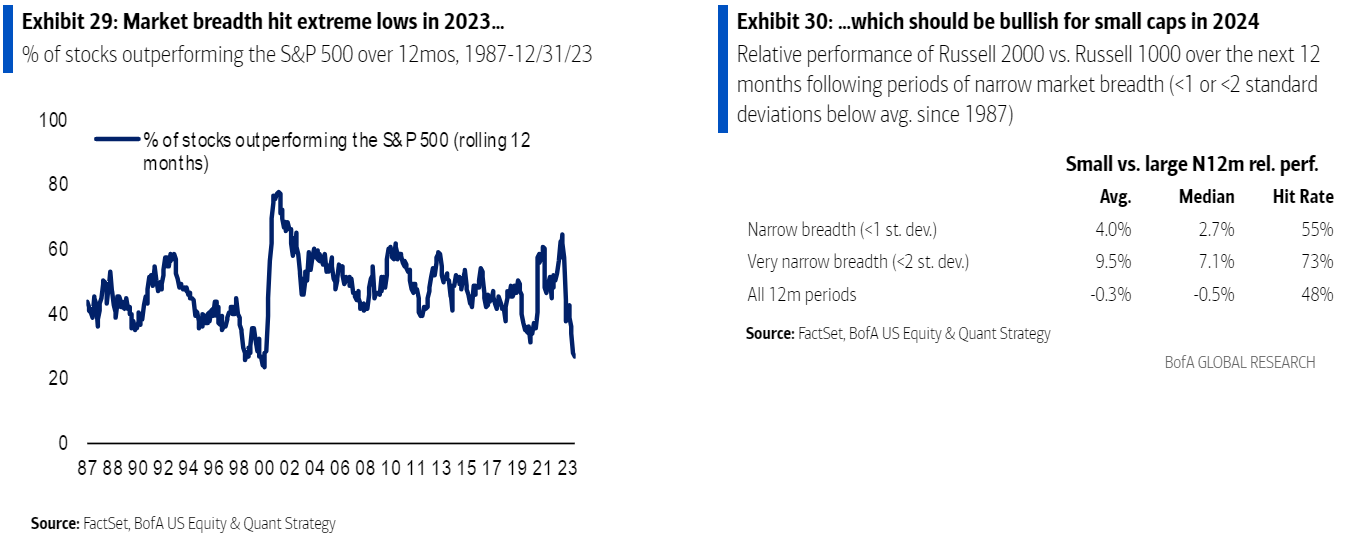

Brad: but smaller stocks have often done well following periods of poor market breadth, with 2023 one of the most pronounced divergences

Data as of December 2023

Data as of December 2023

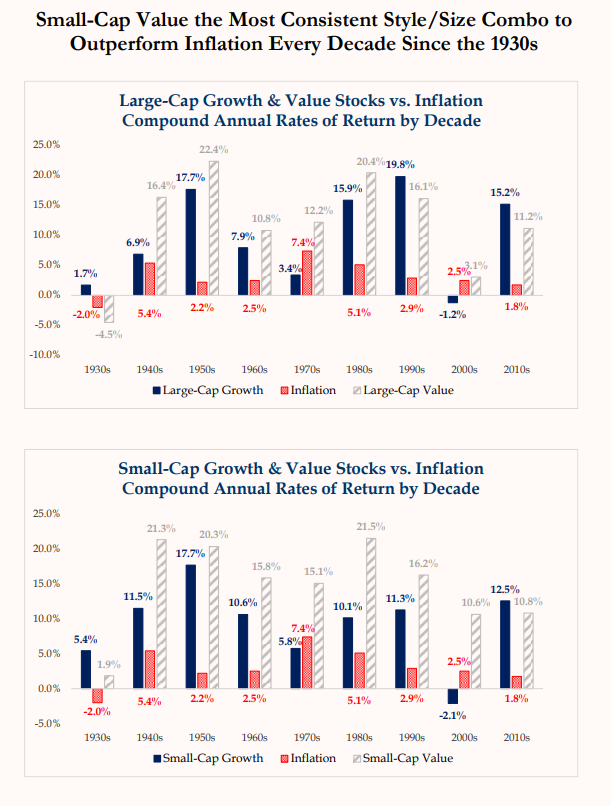

John Luke: and while it’s yet to stick in this decade, small caps have been very reliable in keeping up with inflation

Source: Strategas as of December 2023

Source: Strategas as of December 2023

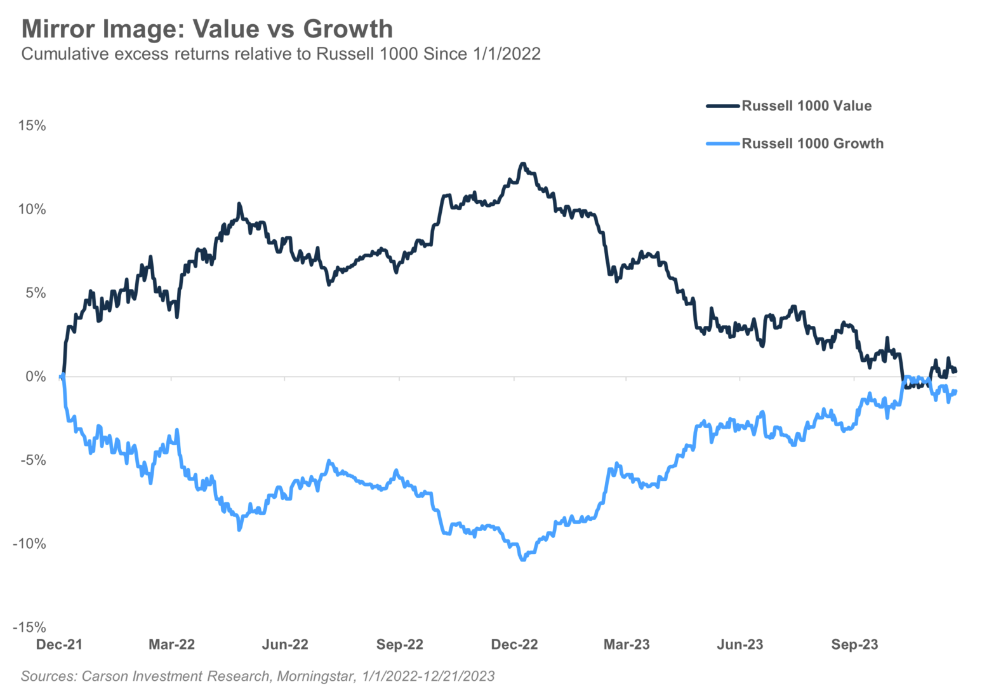

Joseph: Besides small vs. large, there’s been a clearly diverging path between growth and value these past two years

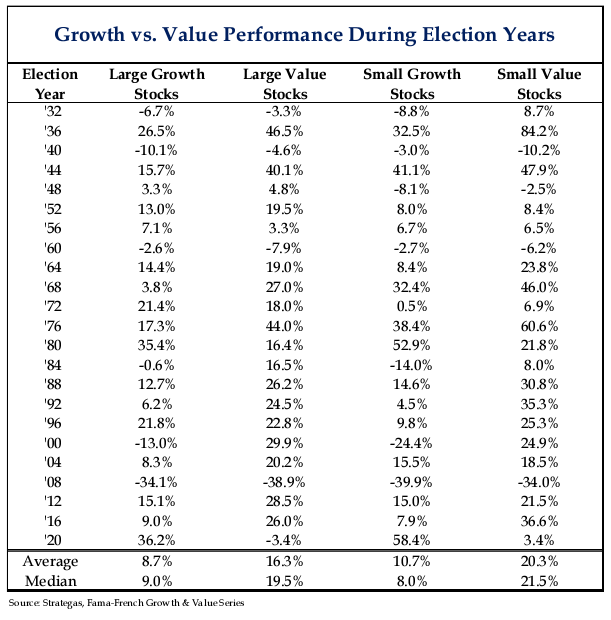

Dave: and on balance, value stocks have historically held an edge in election years such as 2024

Data as of December 2023

Data as of December 2023

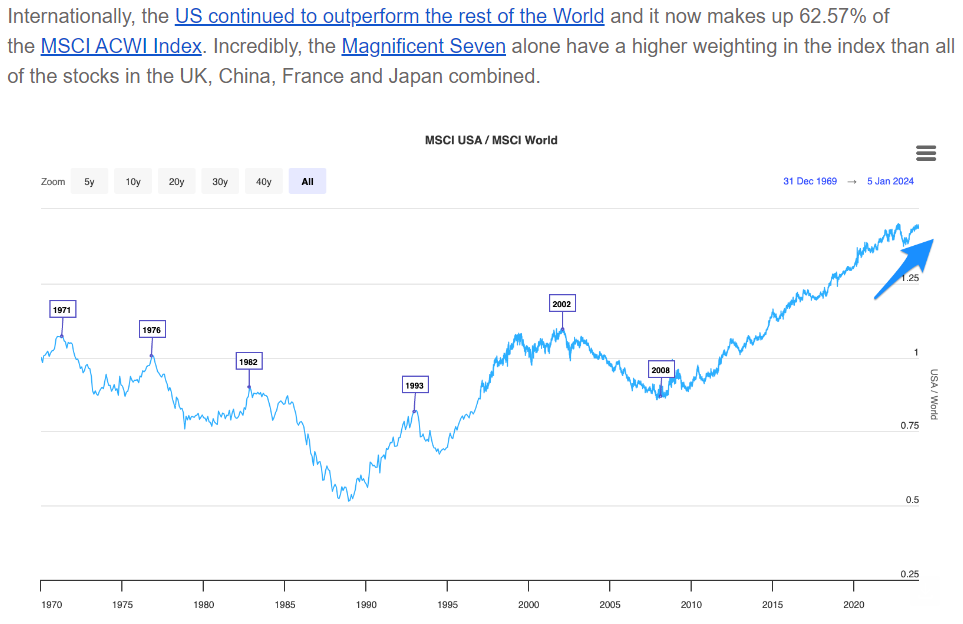

Brett: The US continues to grow in its domination over global investment benchmarks

Source: Longtermtrends as of 01.16.2024

Source: Longtermtrends as of 01.16.2024

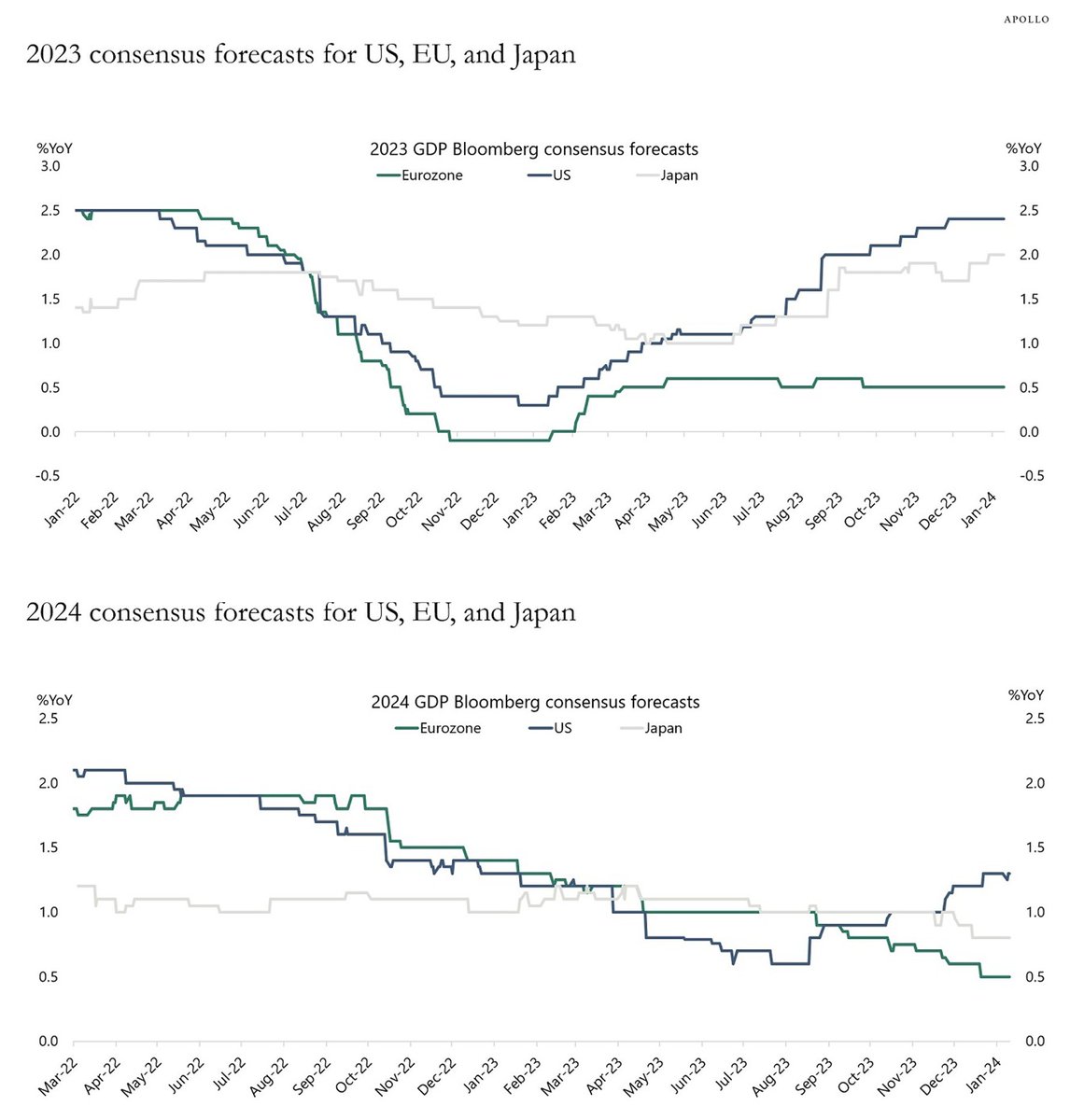

Brian: partly a result of our consistent edge in growth vs. most developed regions

Source: Apollo as of 01.12.2024

Source: Apollo as of 01.12.2024

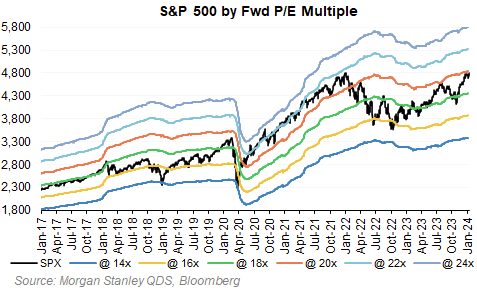

Mark: It’s wild to see forecasters multiply earnings by a P/E ratio to guess where stocks are fairly valued, the range of outcomes is just so wide

Data as of December 2023

Data as of December 2023

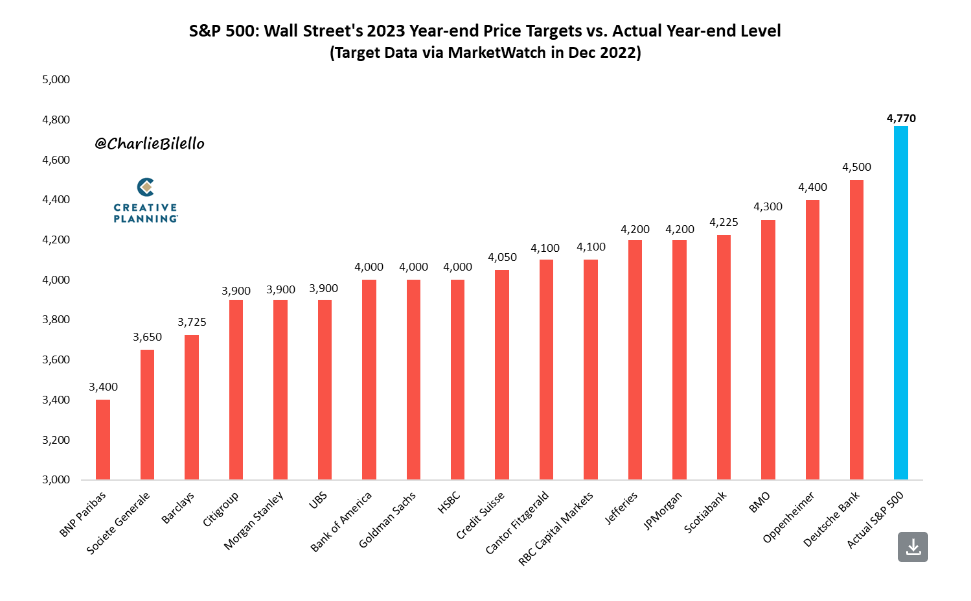

Brett: which is why we place zero value on where Wall Street “strategists” estimate future targets for stock prices

Data as of 12.29.2023

Data as of 12.29.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-30.