Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from broadening attempts to profitability, earnings and non-earnings, and midterms and the economy. Stay safe out there this weekend!

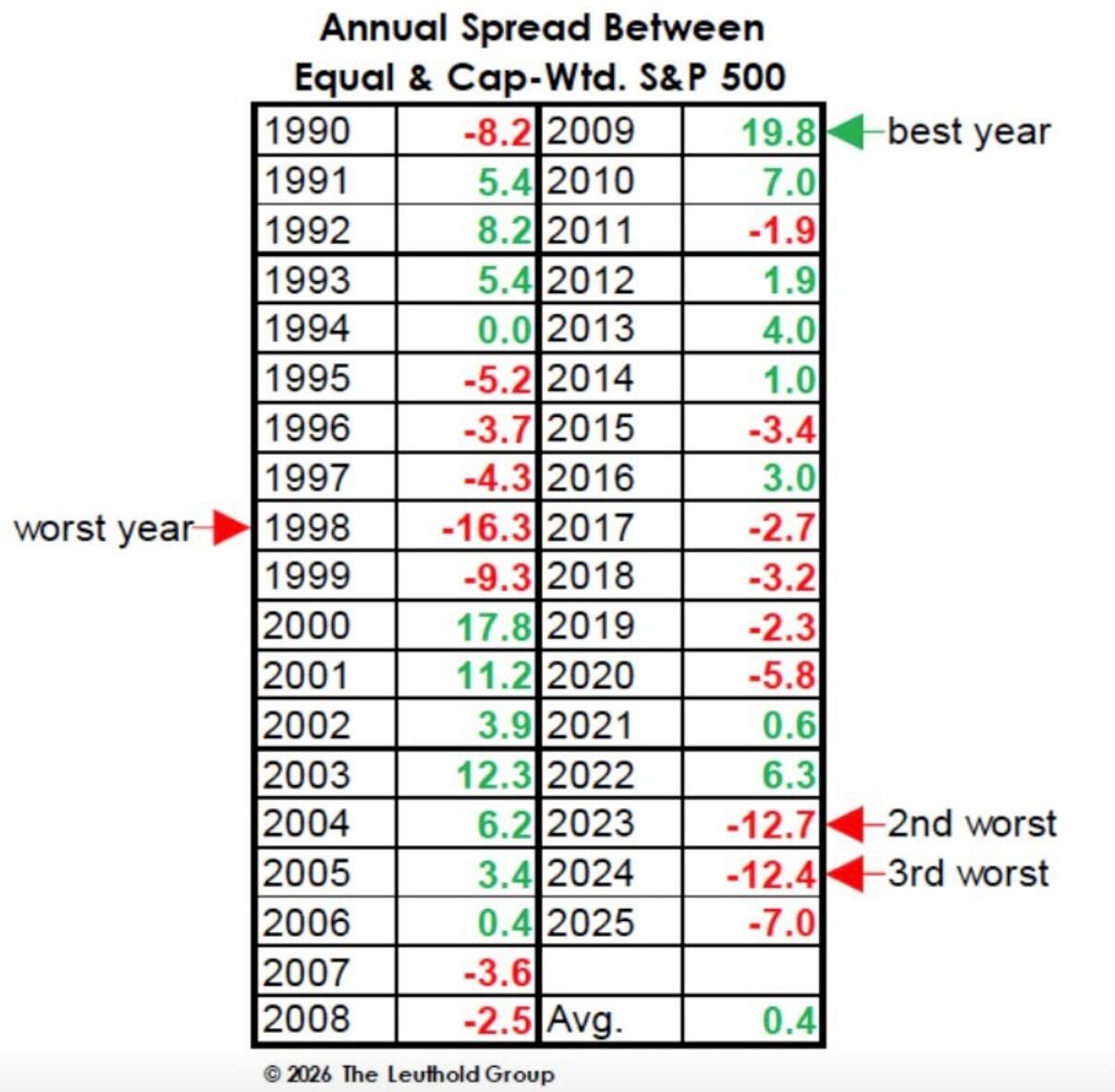

Brian: The recent stretch of underperformance by the broader market has been historic

Dave: and the short-term attempts to reverse course have ultimately failed

Source: Raymond James as of 01.20.2026

Source: Raymond James as of 01.20.2026

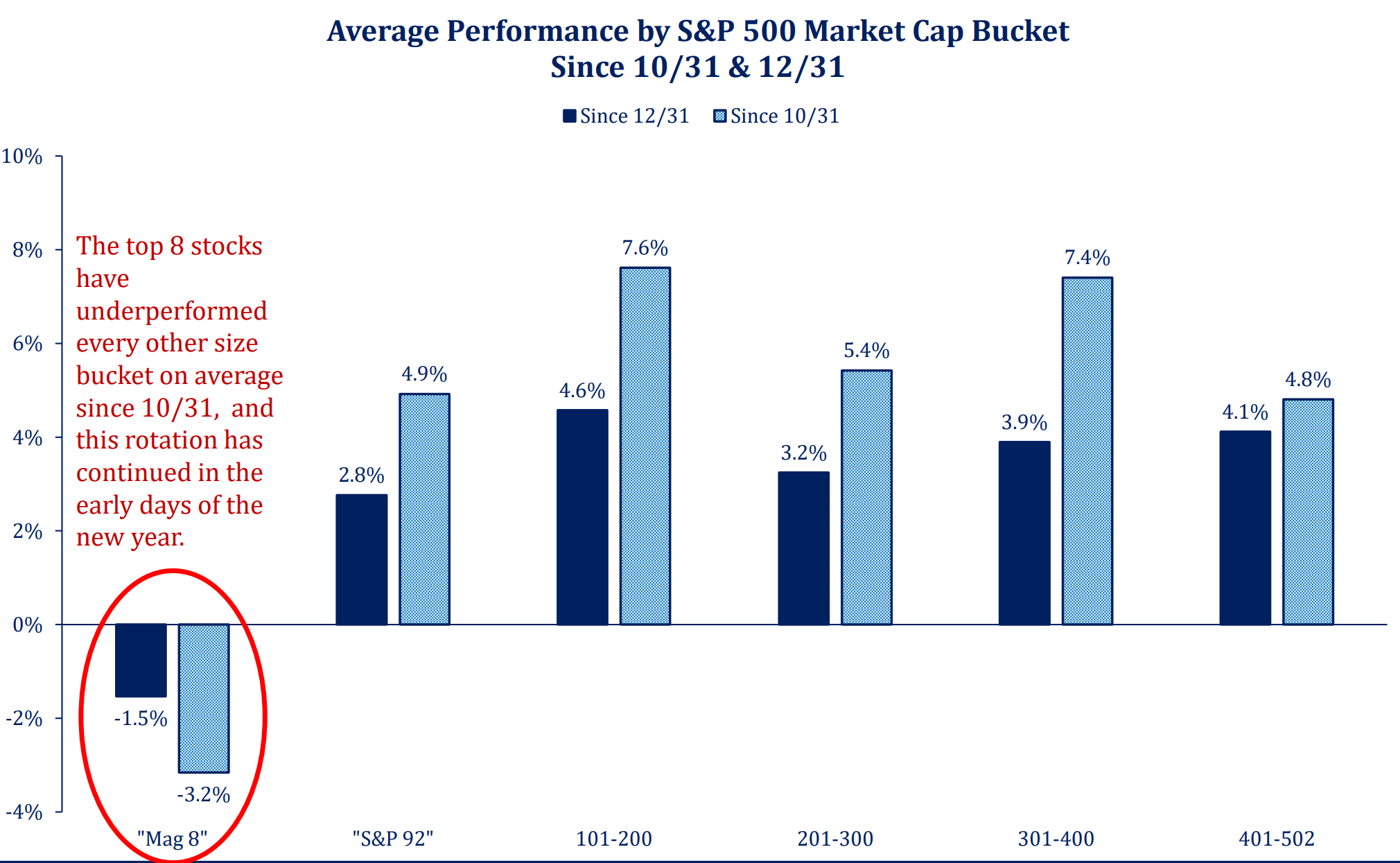

Dave: so will this attempt to reach beyond the megacaps stick?

Source: Strategas as of 01.16.2026

Source: Strategas as of 01.16.2026

Brad: The biggest challenge for smaller stocks is their inferior profitability as a group, relative to the biggest of the big

Brett: and ultimately, profitability is a key input to valuation support

Source: Sandbox Daily as of 01.21.2026

Source: Sandbox Daily as of 01.21.2026

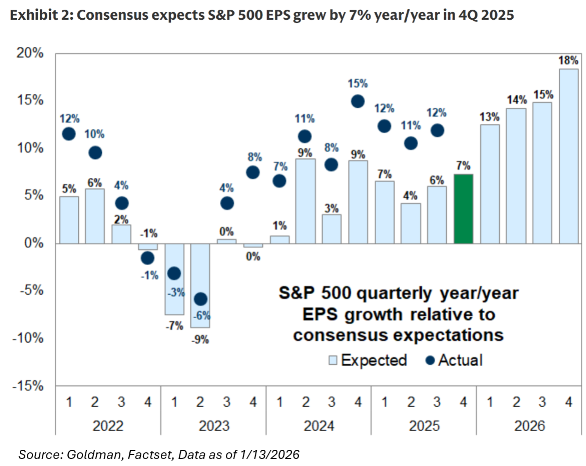

Dave: Recent earnings seasons have far surpassed initial expectations

John Luke: with a wide range of price outcomes based on company-specific results

Data as of 01.15.2026

Data as of 01.15.2026

Dave: It’s been one of the longer stretches of non-earning small caps outperforming profitable ones

Jake: with the disparity only growing

Source: Apollo as of 01.20.2026

Source: Apollo as of 01.20.2026

Ten: It’s a midterm year, which has tended to be the weakest of the 4 years in a presidential cycle

Source: Bloomberg

Source: Bloomberg

John Luke: with summer doldrums the period is most exposed to investor anxiety

Data as of 01.16.2026

Data as of 01.16.2026

John Luke: That said, avoiding recessions has been a key determinant of outcomes

Data as of 01.16.2026

Data as of 01.16.2026

John Luke: with a similar “no recession” qualification in easing cycles

Beckham: Thankfully, consumers are generally sitting in a strong position

Brad: and a large amount of federal stimulus is further supporting the economy

Source: Strategas as of 01.15.2026

Source: Strategas as of 01.15.2026

John: We’ve seen some reluctance from investors to finance new AI spending, but overall credit appetite remains healthy

Source: Apollo as of 01.22.2026

Source: Apollo as of 01.22.2026

Brian: with credit spreads the tightest they’ve been this century

Data as of 01.21.2026

Data as of 01.21.2026

John Luke: and bonds as a whole showing much less angst than in recent years

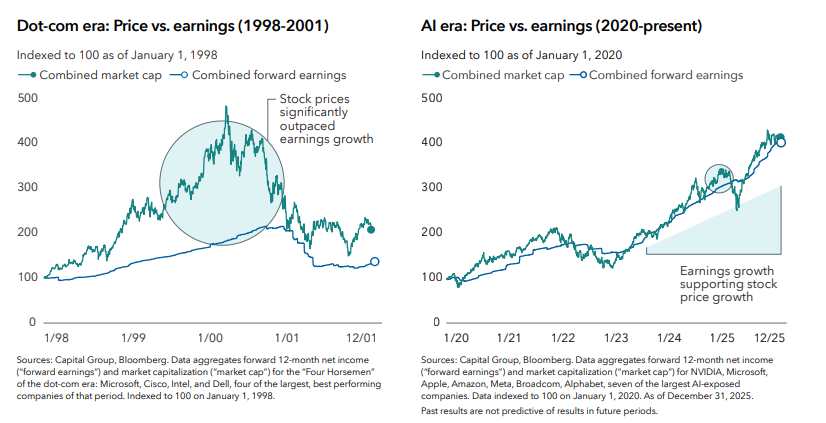

Joseph: Some in the media like to call the AI boom a repeat of the dotcom bubble, but this cycle has been much more closely tied to actual earnings

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2601-34.