Our team looks at a lot of research throughout the day. Here are a handful that we think are contributing to investor activity , from rate expectations to growth drivers to government spending and comparisons of foreign markets to ours. Enjoy!

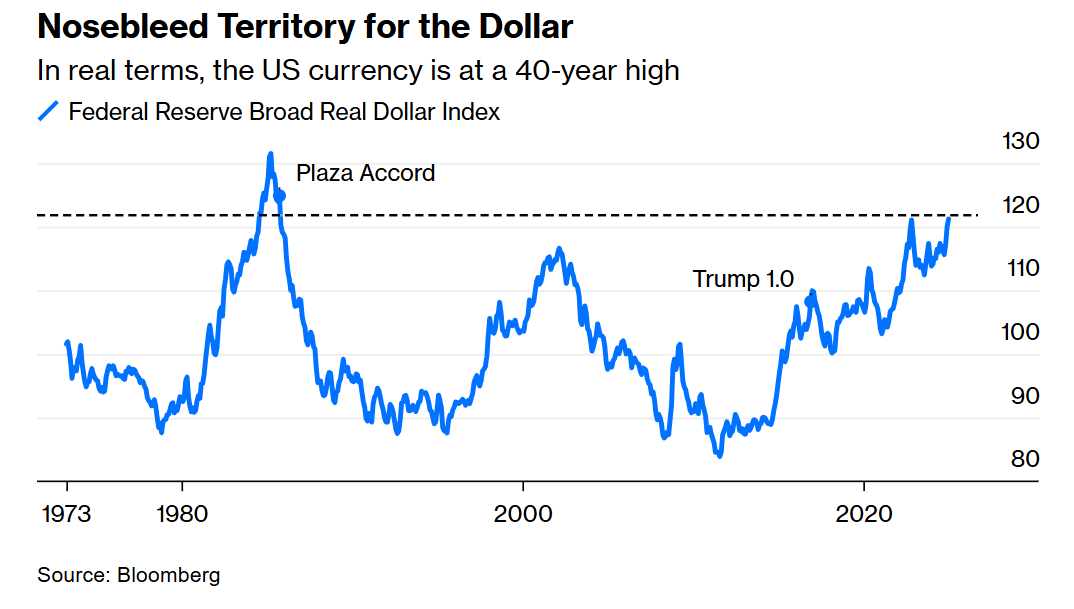

Joseph: The US Dollar has moved steadily higher for the past decade

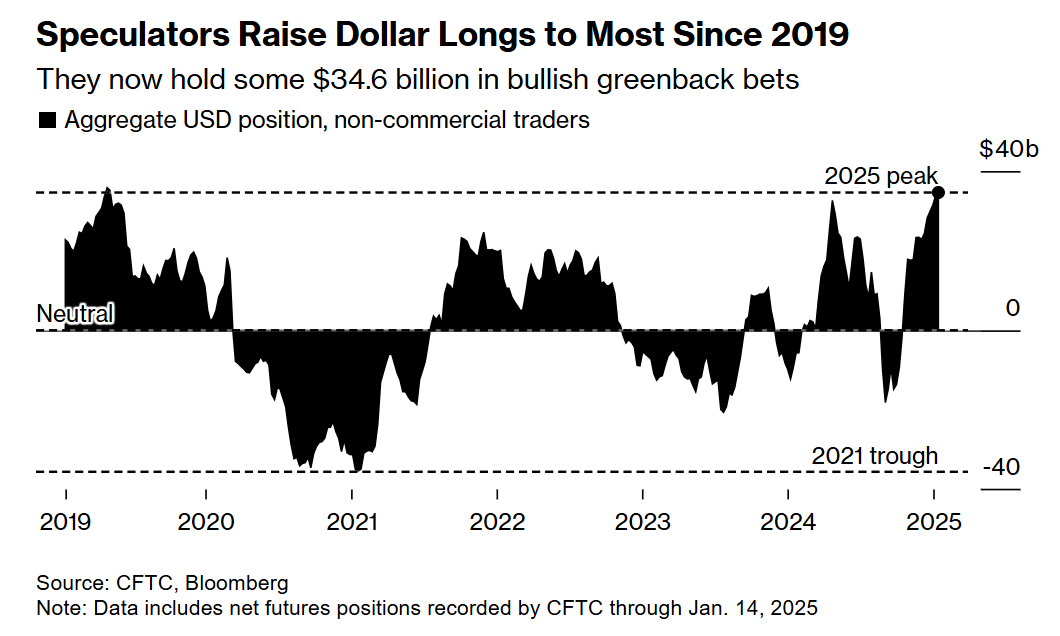

Data as of 01.17.2025

Data as of 01.17.2025

Arch: and its strength has not exactly gone unnoticed

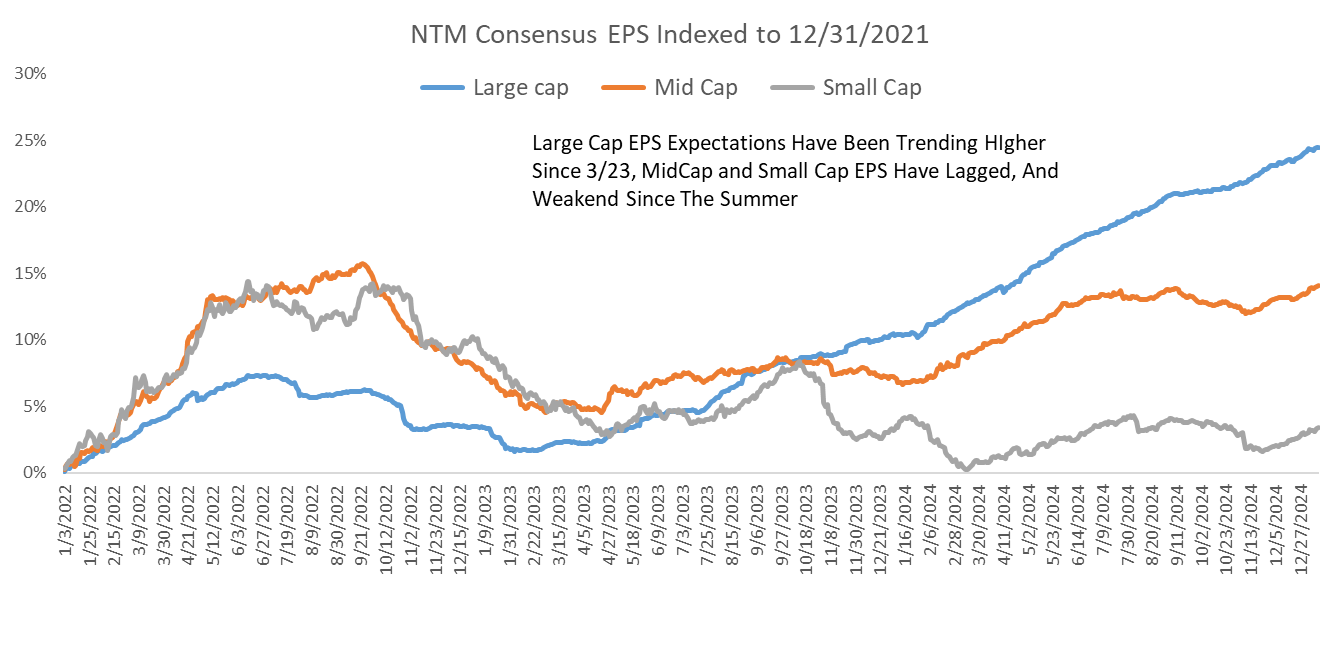

Dave: We’d all love to see small caps run higher, but large caps have been the home of better earnings

Source: Raymond James as of 01.22.2025

Source: Raymond James as of 01.22.2025

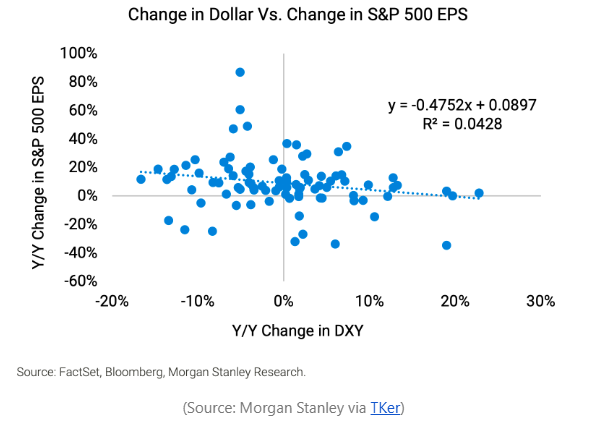

Brett: and where the dollar goes hasn’t had a historically consistent impact on earnings

Data as of December 2024

Data as of December 2024

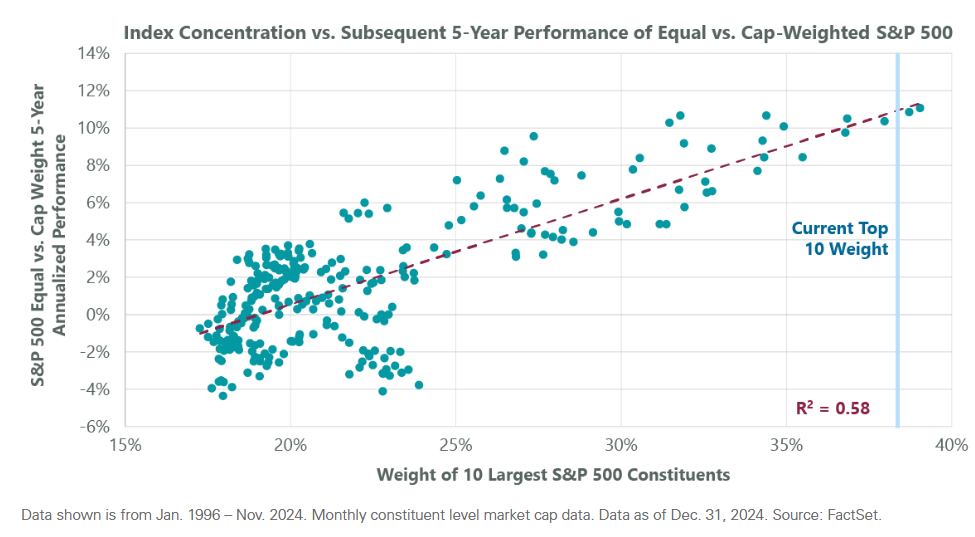

Brian: Smaller companies as measured by the equal-weight S&P 500 have done well after past instances of high market concentration

Chart via @lhamtil

Chart via @lhamtil

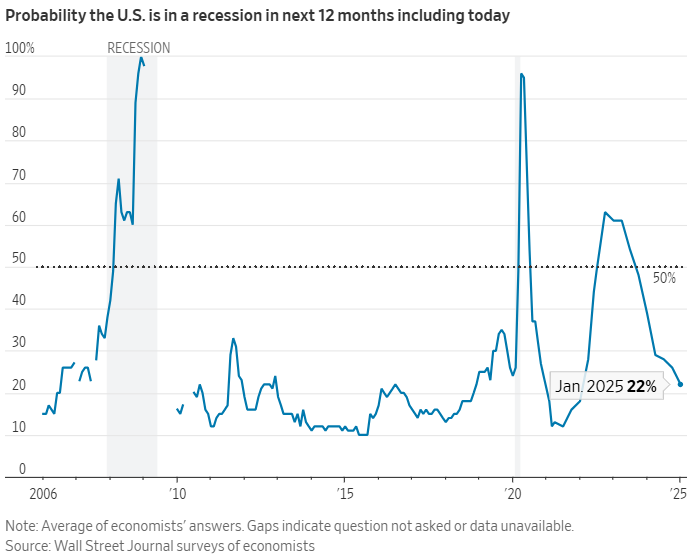

Brad: maybe avoidance of a recession can finally lend support to the broader market

Data as of 01.21.2025

Data as of 01.21.2025

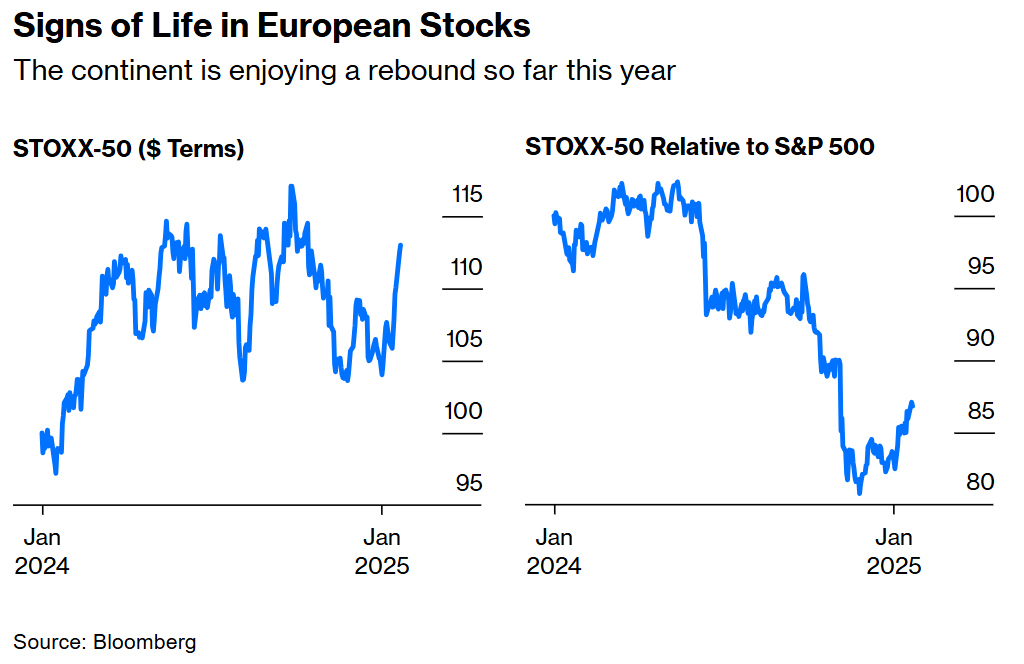

Beckham: European stocks have been left for dead, but have seen a resurgence in the past month

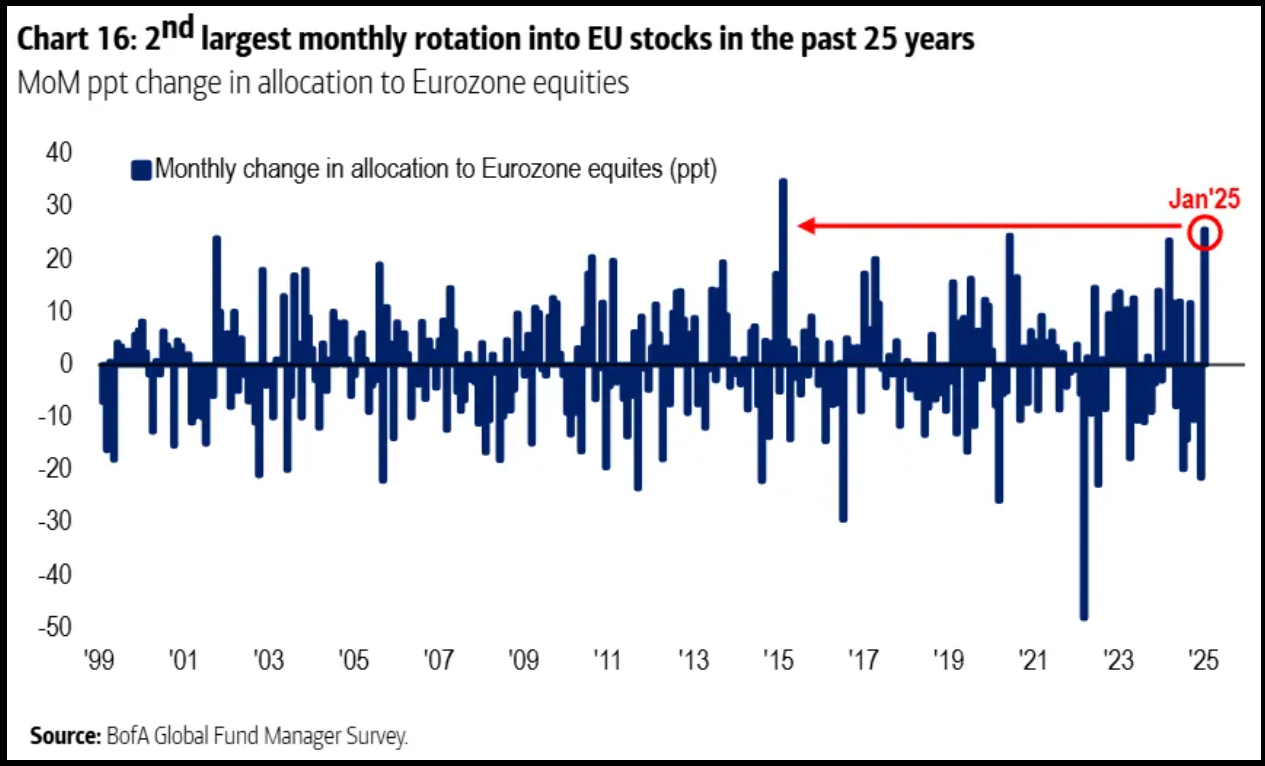

John Luke: perhaps reflecting another manager attempt at capturing the discount vs. US stocks

Data as of 01.21.2025

Data as of 01.21.2025

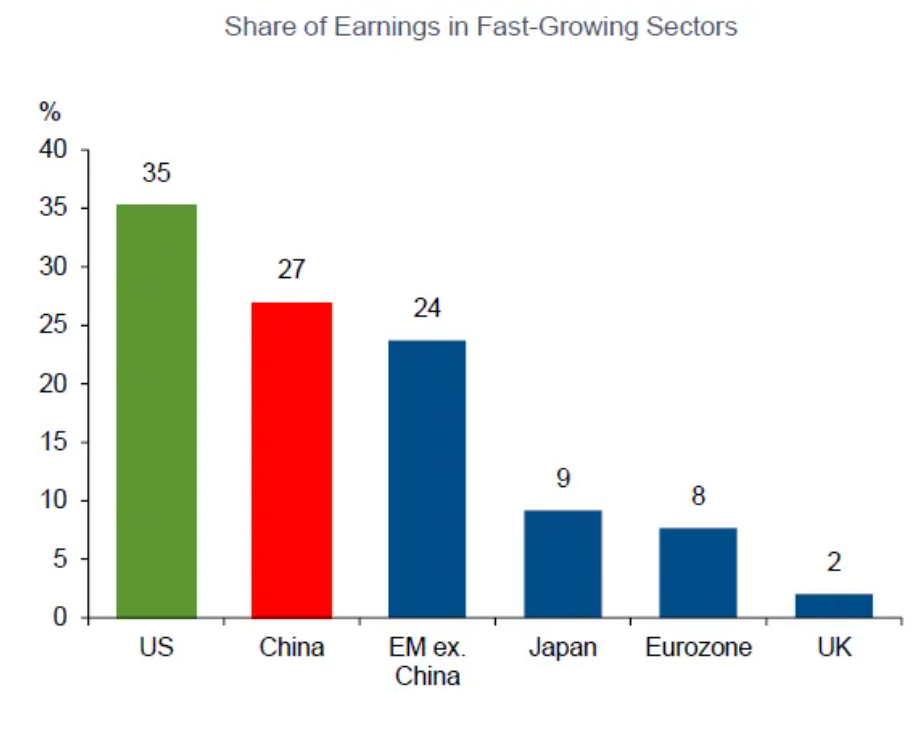

Dave: The challenge for European stocks is the reliance on low-growth sectors relative to more dynamic economies

Source: Goldman Sachs as of December 2024

Source: Goldman Sachs as of December 2024

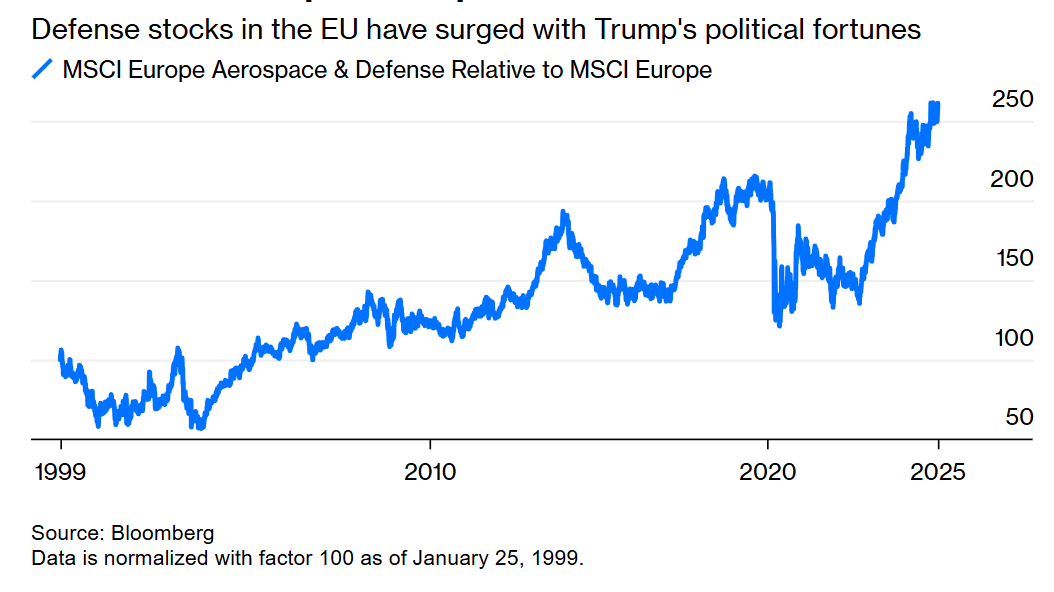

Beckham: but aerospace and defense stocks have led the way in the recent advance

Data as of 01.17.2025

Data as of 01.17.2025

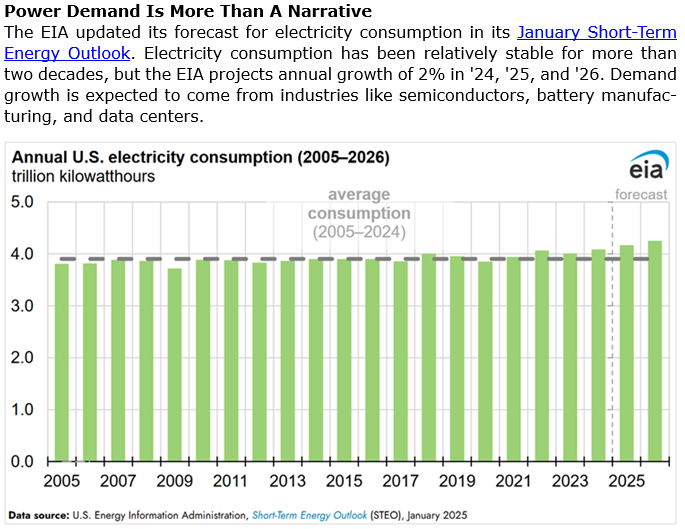

Brad: Speaking of historically low growth, electricity generation has been consistently slow but is seeing an upturn as technology needs advance

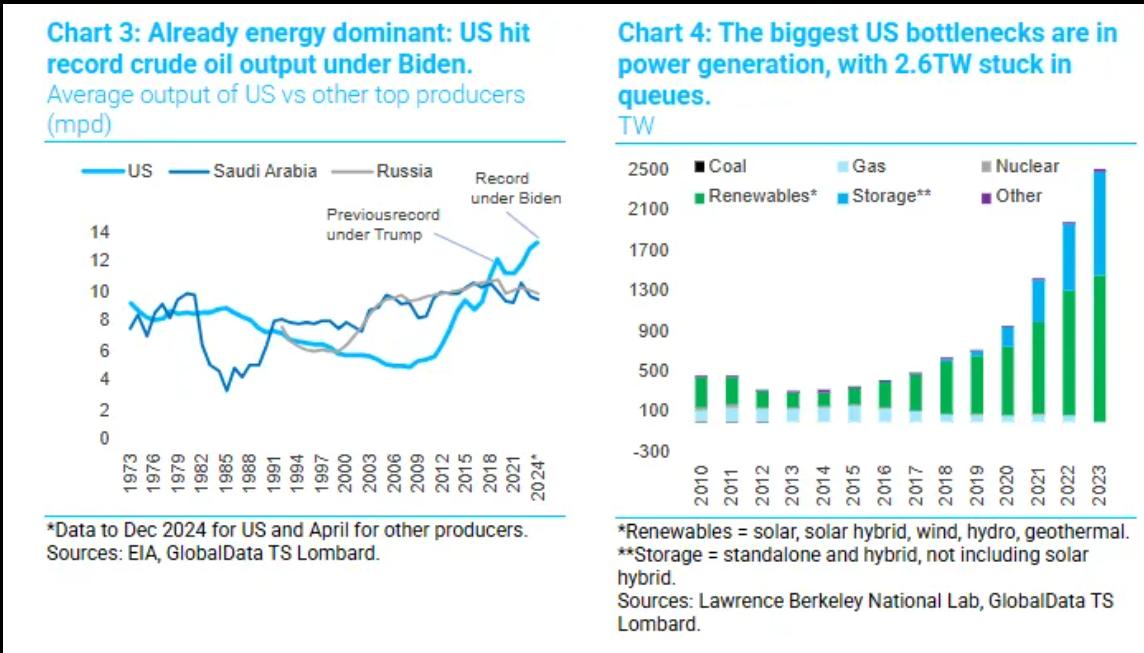

Joseph: and with crude oil production surging, power generation is becoming the obstacle to maximizing industrial growth

Data as of December 2024

Data as of December 2024

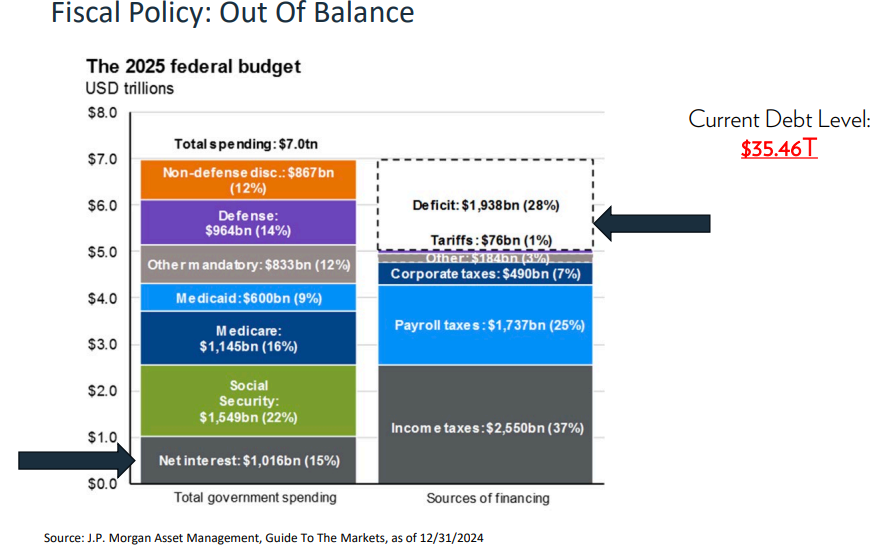

John Luke: We hope DOGE can find opportunities to save money, but most of the government spending is baked in at levels higher than revenues

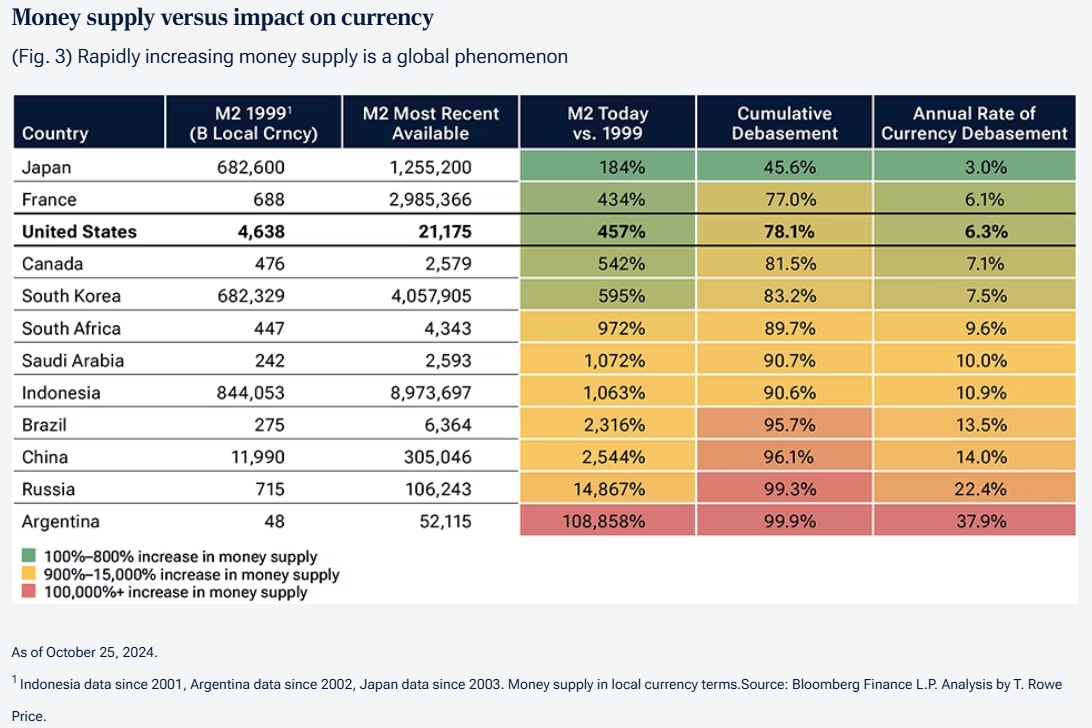

Brett: meaning most countries including ours will continue to borrow money and eat away at purchasing power

This set of charts paints an evolving picture of where we’ve been and where we might go. As always, we’ll continue monitoring and interpreting the evidence to help navigate what’s ahead.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-41