Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

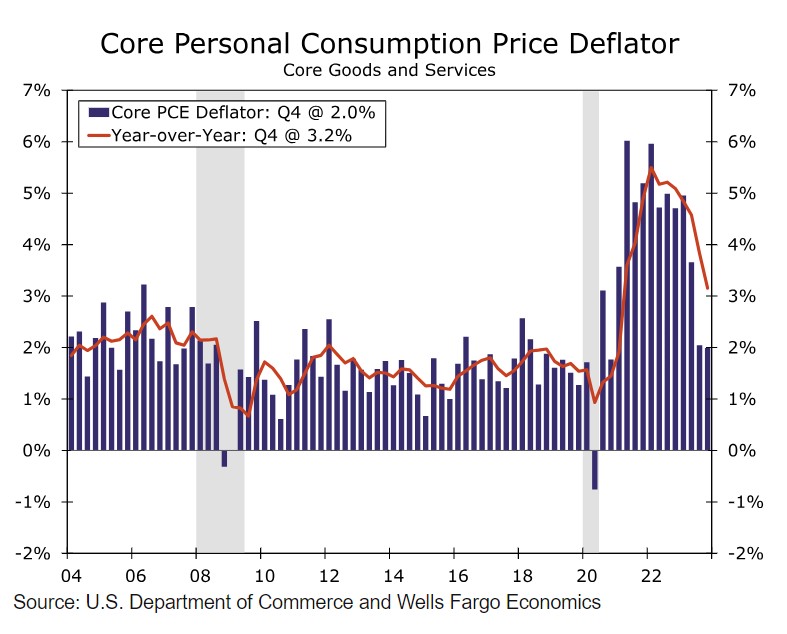

Brett: Core Personal Consumption Expenditures (PCE) is said to be the Fed’s favorite indicator, and it’s getting into their target range

Data as of 01.25.2024

Data as of 01.25.2024

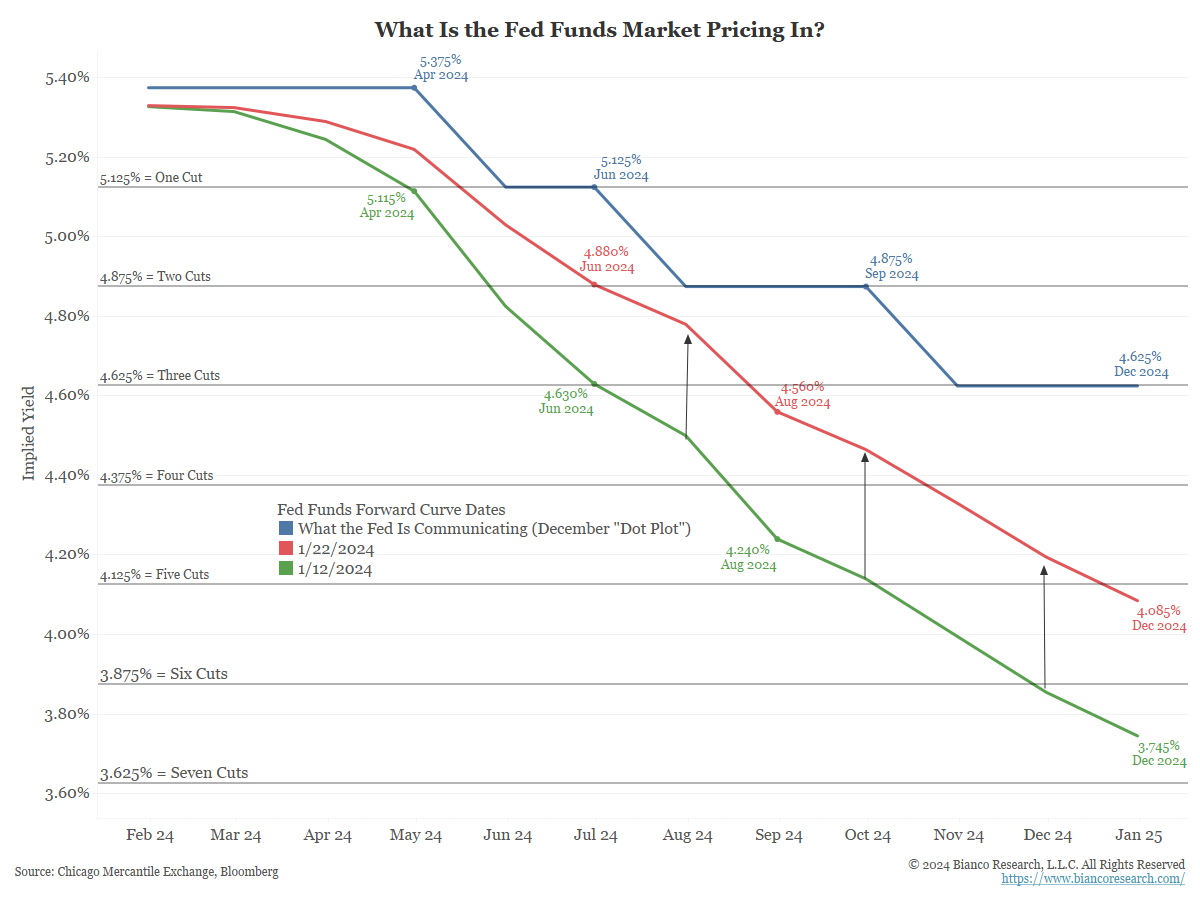

John Luke: that said, markets are actually expecting one fewer rate cut than they were two weeks ago

Data as of 01.22.2024

Data as of 01.22.2024

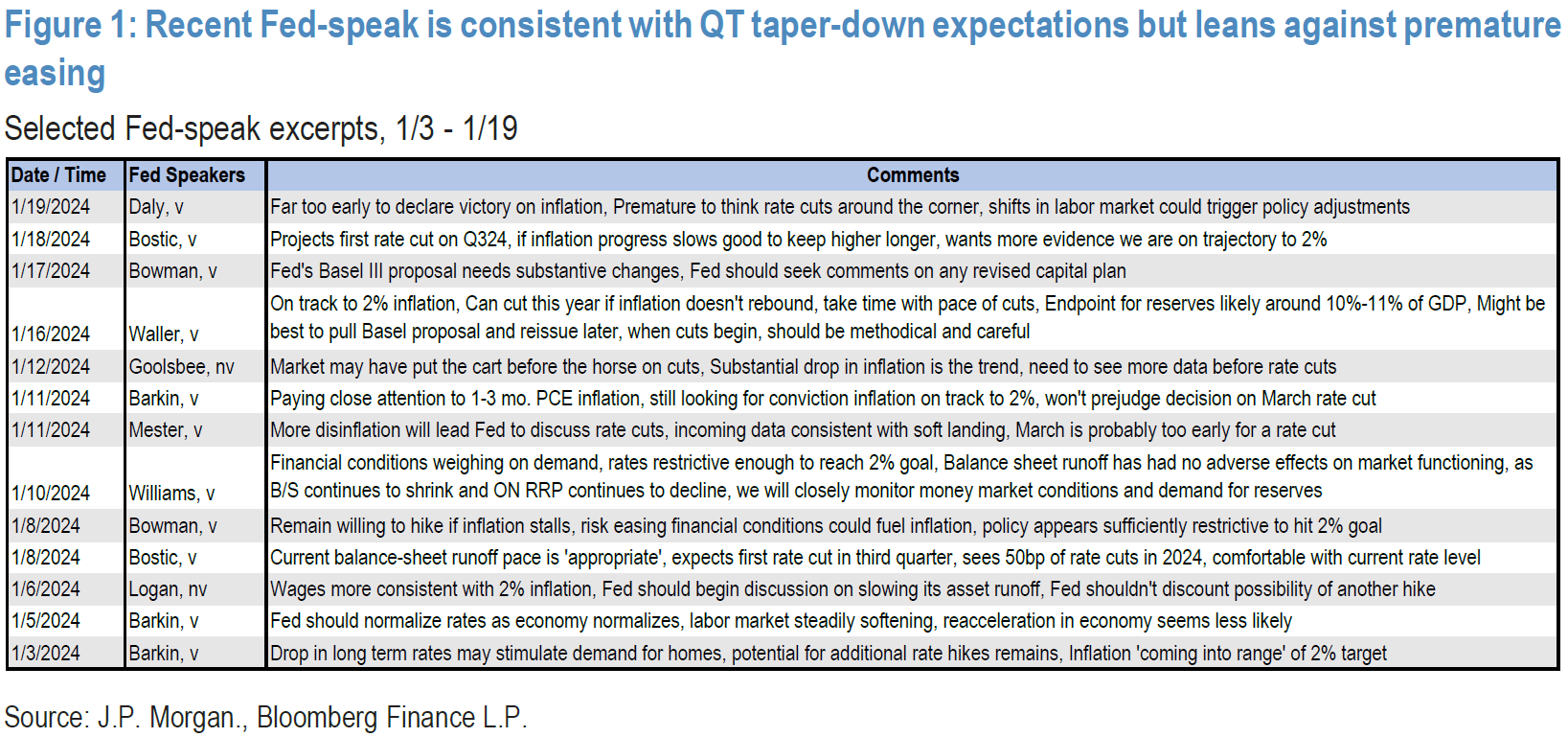

John Luke: and Fed speakers seem reluctant to embrace market expectations of significant rate cuts

Data as of 01.19.2024

Data as of 01.19.2024

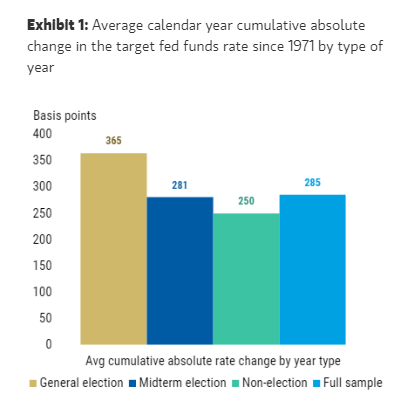

Dave: It’s generally accepted that the FOMC prefers to avoid being seen as political, but election years haven’t impacted their activity in the past

Source: Morgan Stanley as of 01.24.2024

Source: Morgan Stanley as of 01.24.2024

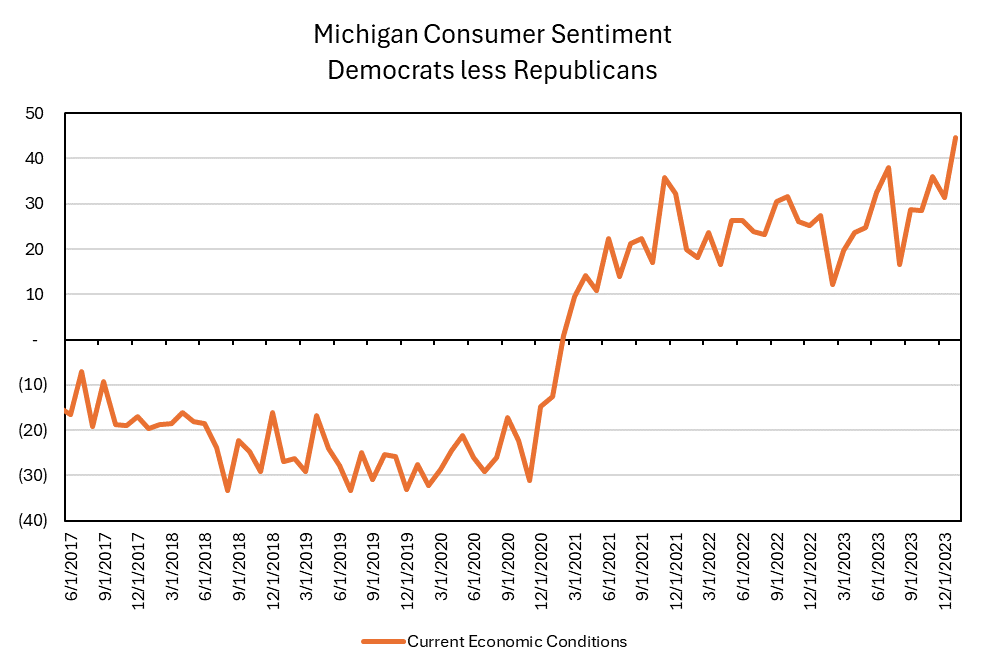

Brian: That said, no matter what they do there will be plenty of people accusing them of taking sides

Source: Aptus as of 01.22.2024

Source: Aptus as of 01.22.2024

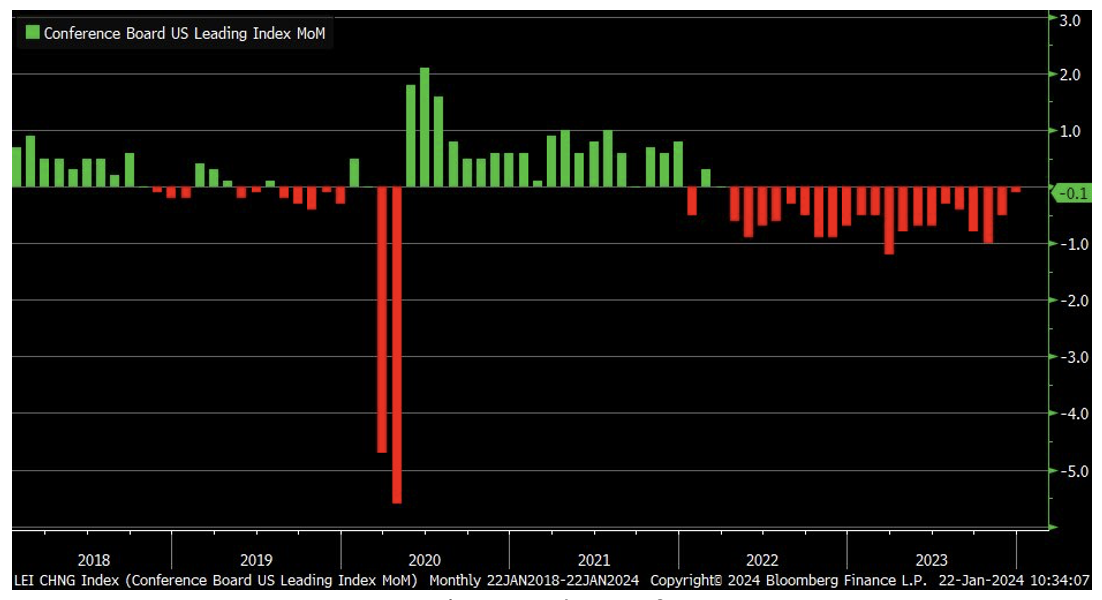

Beckham: Making the Fed’s job trickier is the evidence that maybe the slowest economic conditions have already occurred

Source: @LizAnnSonders as of 01.22.2024

Source: @LizAnnSonders as of 01.22.2024

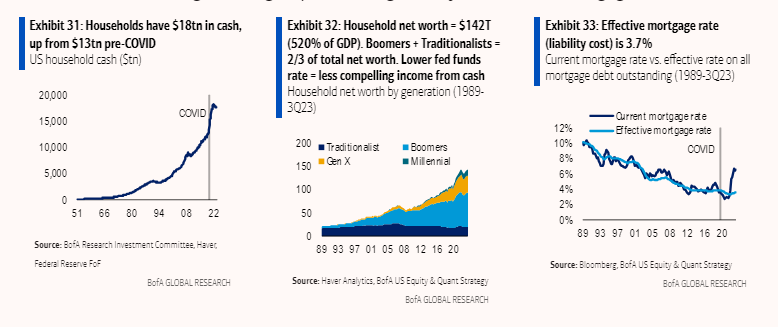

John Luke: as US consumers in general are sitting with very strong balance sheets

Data as of December 2023

Data as of December 2023

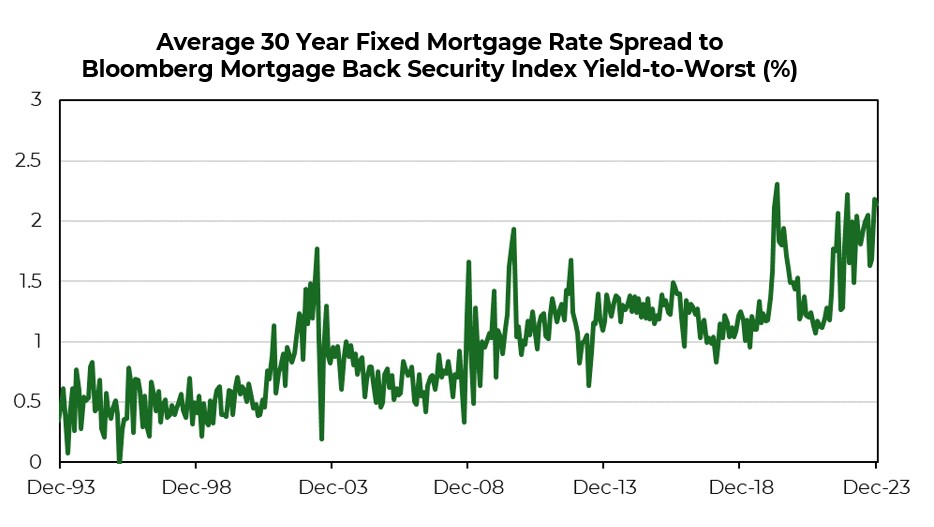

Brian: While the cost of mortgages relative to actual mortgage-backed bonds remains well above historic norms

Source: Aptus as of 01.24.2024

Source: Aptus as of 01.24.2024

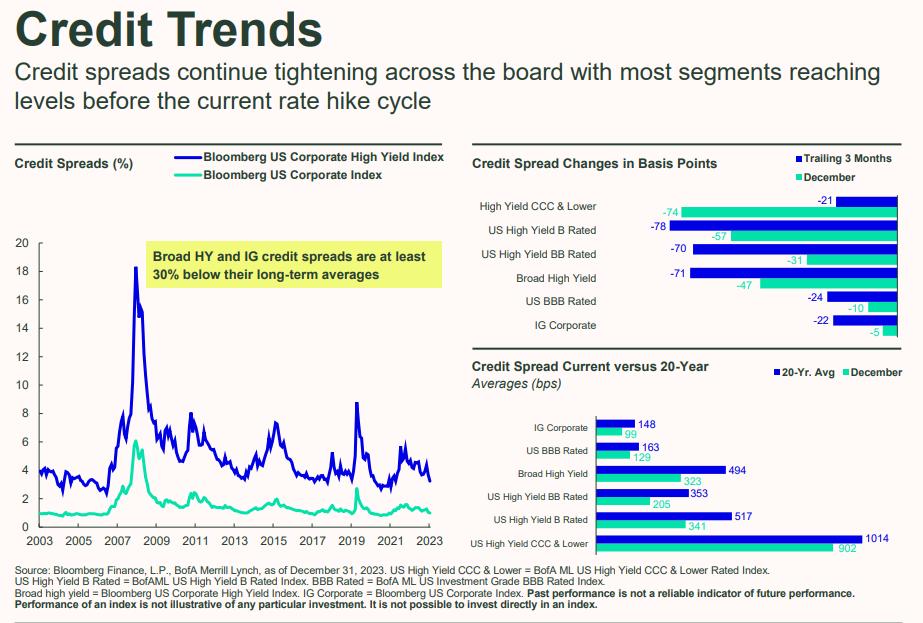

John Luke: corporate credit spreads are as low as they’ve been in years

Source: State Street as of 12.31.2023

Source: State Street as of 12.31.2023

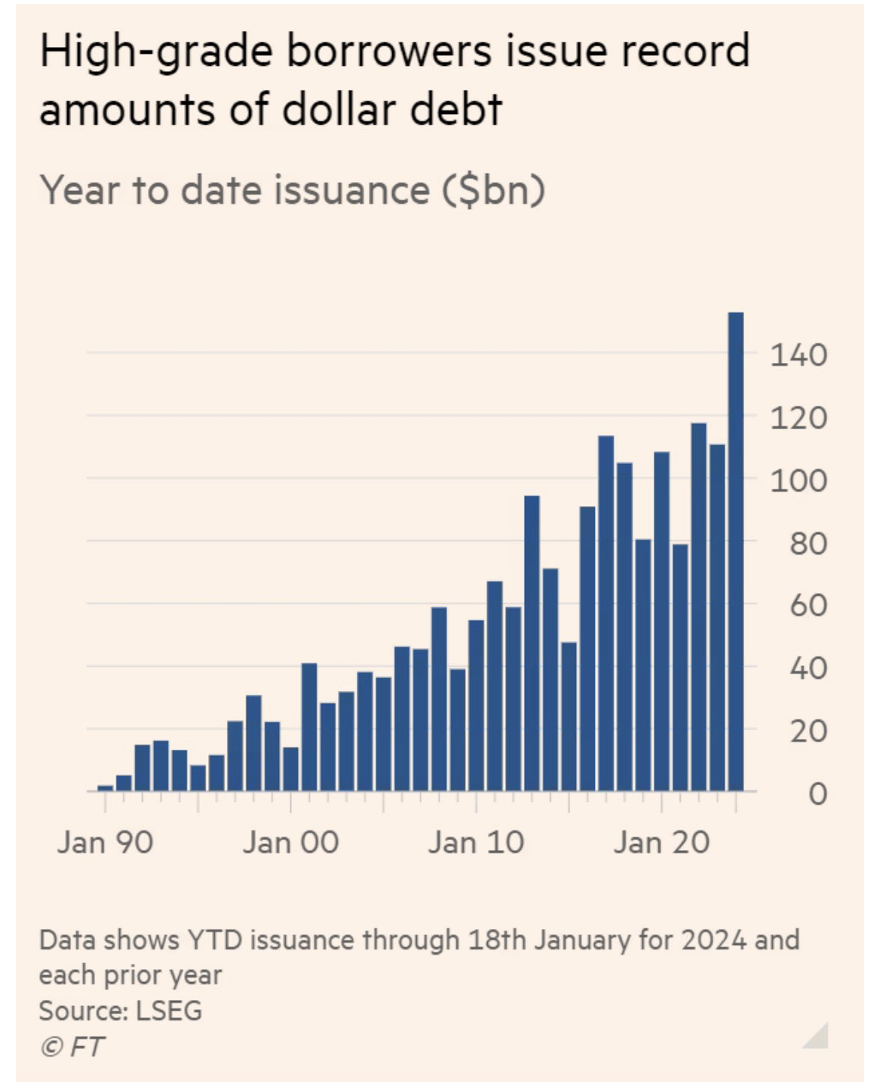

Joseph: leading corporations to issue debt at favorable levels

Source: Financial Times as of 01.18.2024

Source: Financial Times as of 01.18.2024

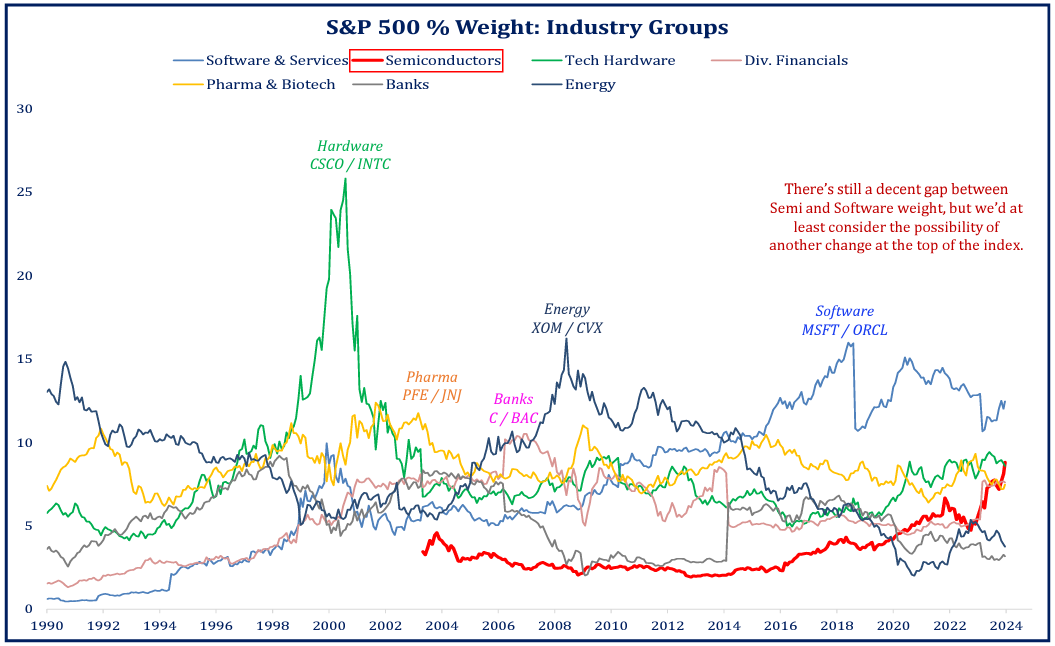

Dave: While the semiconductor industry has been eating its way into larger space in the S&P 500

Source: Strategas as of 01.22.2024

Source: Strategas as of 01.22.2024

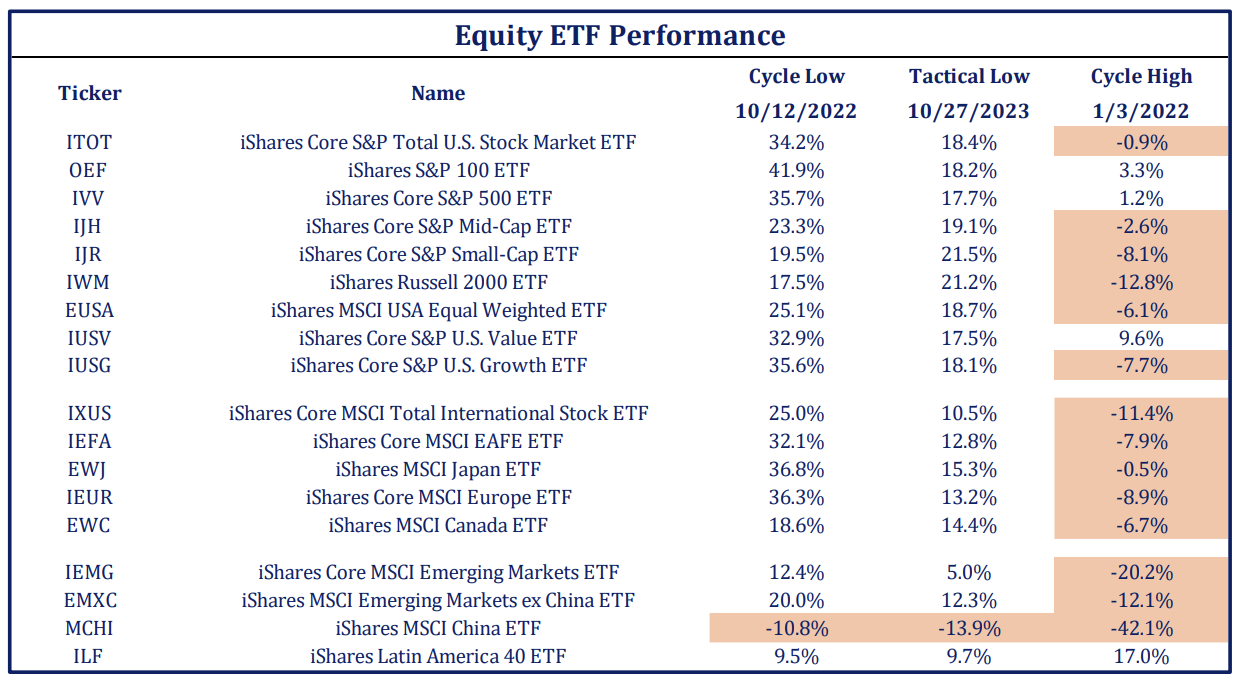

Brad: the broader universe of stocks has had underwhelming performance since the peak in late 2021

Source: Strategas as of 01.23.2024

Source: Strategas as of 01.23.2024

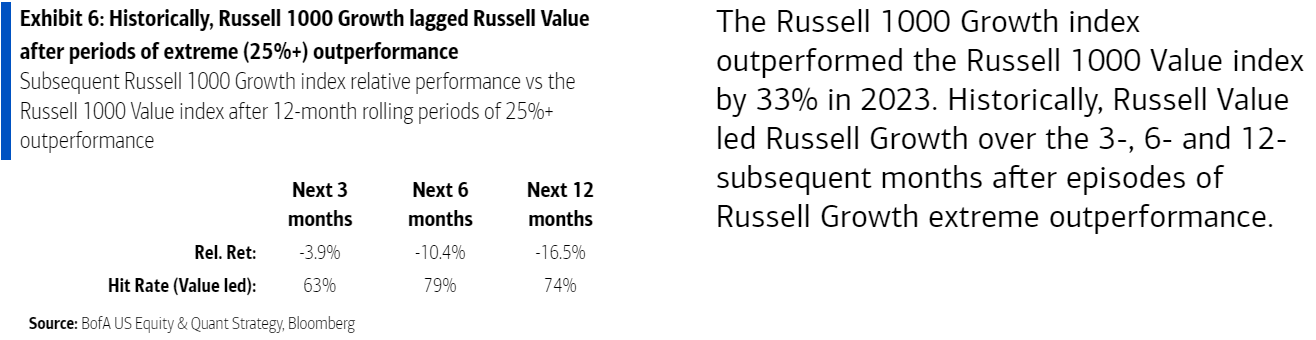

Brad: and value stocks also coming out of a year of extreme underperformance

Data as of January 2023

Data as of January 2023

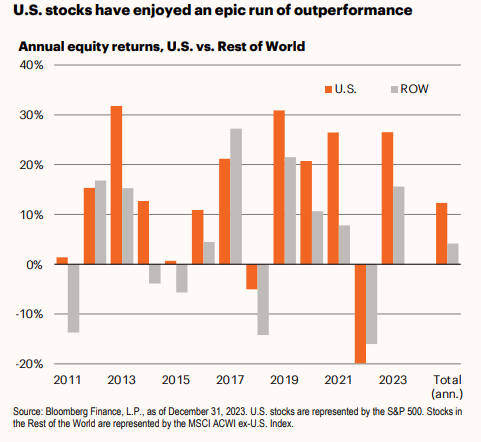

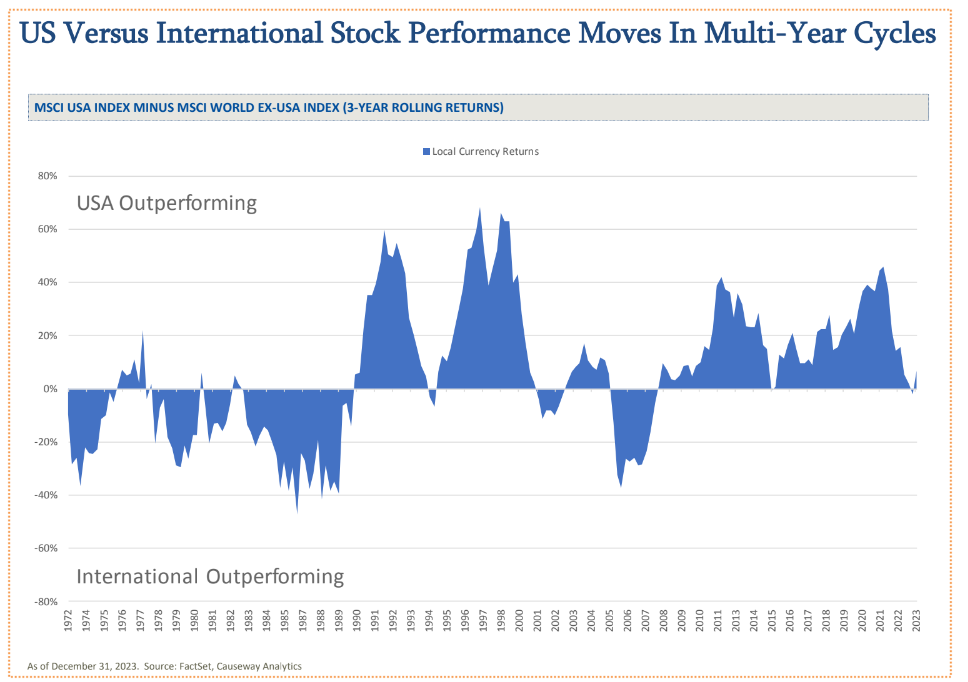

John Luke: US dominance over foreign markets has been quite dramatic in recent years

Brett: but these performance cycles have often been long in nature

Source: Bank of America

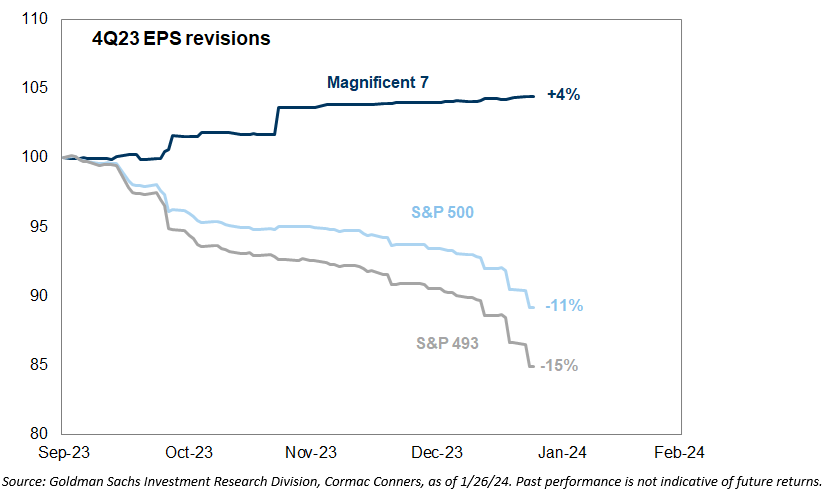

Brad: As tired as we all are of talking about the Mag 7, it’s important to recognize that markets aren’t crazy; their businesses are performing better than most

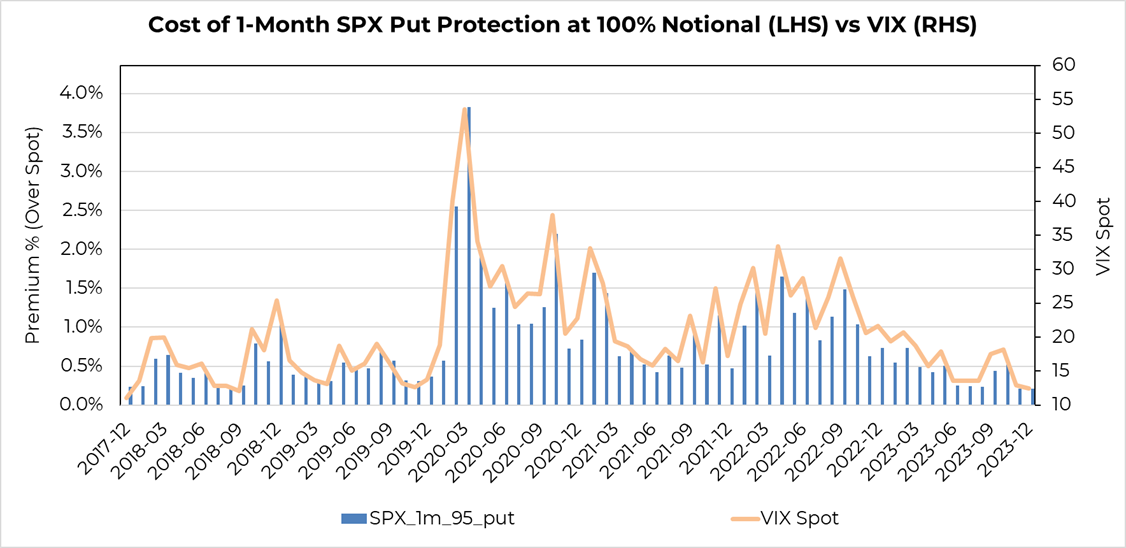

Brian: and if you’re really worried about their impact, it’s as cheap as it’s ever been to buy hedges on the S&P 500

Source: Aptus as of 01.24.2024

Source: Aptus as of 01.24.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-35.