Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

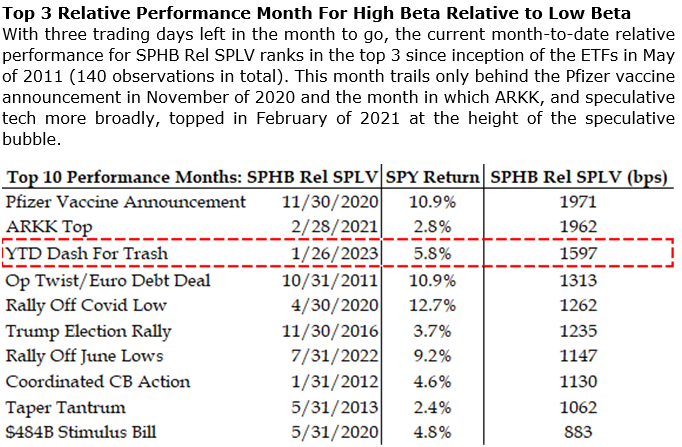

Brad: One of the “junkiest” rallies since the Global Financial Crisis, some of the past ones have broadened while others were fleeting

Source: Strategas as of 01.26.2023

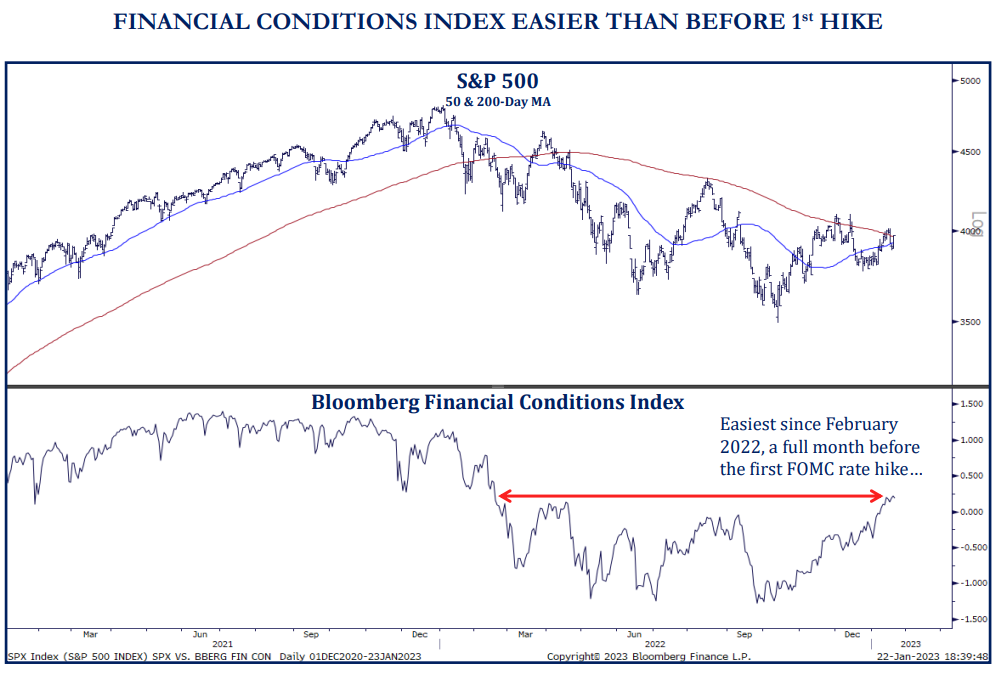

JL: maybe a reflection of less restrictive conditions?

Source: Strategas as of 01.22.2023

Source: Strategas as of 01.22.2023

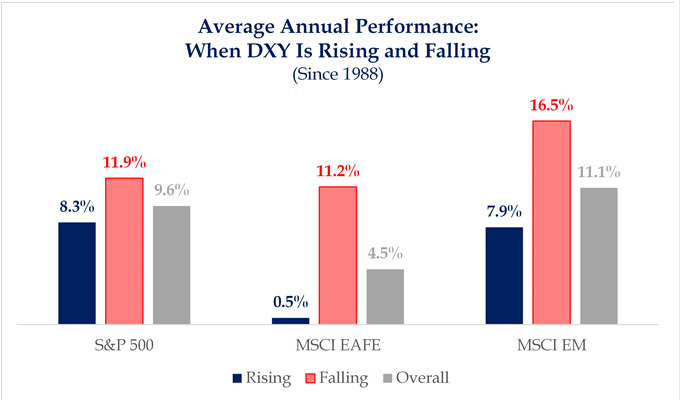

Brad: The recently falling U.S. dollar surely playing a role in the embrace of risk assets

Source: Strategas as of 01.23.2023

Source: Strategas as of 01.23.2023

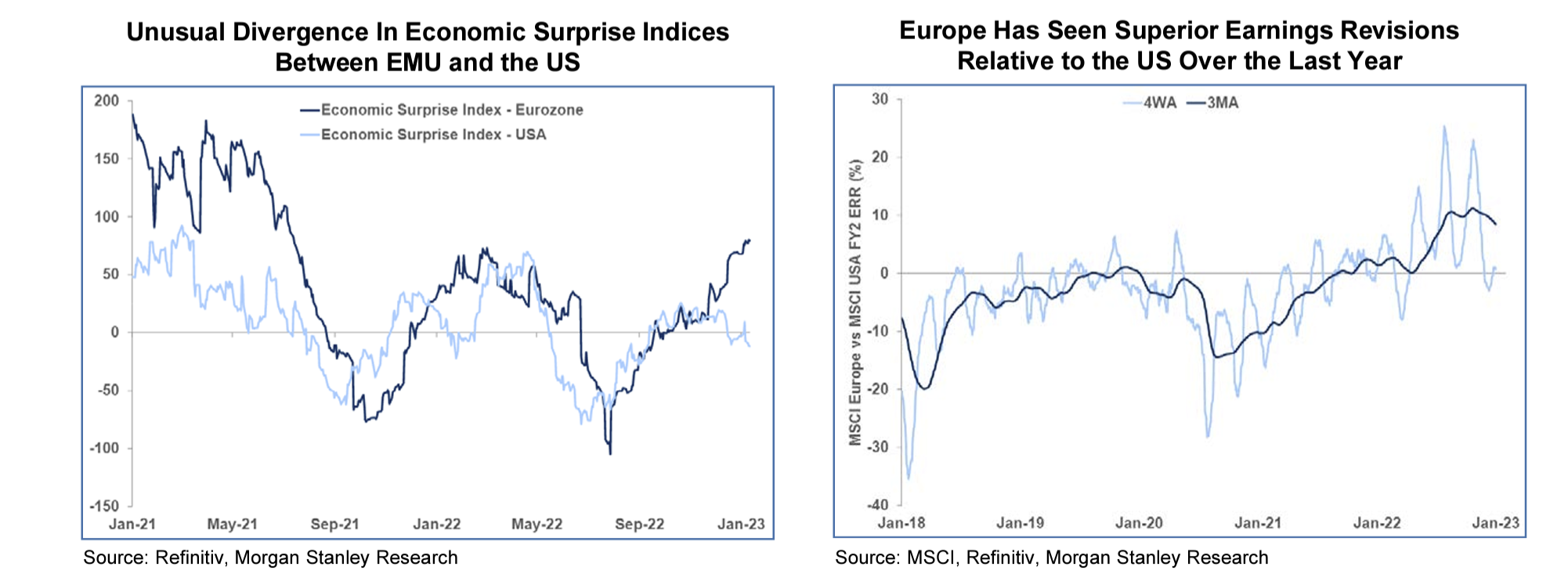

Dave: but there’s also been a surprisingly decent flow of news from European economies

Source: Morgan Stanley as of 01.24.2023

Source: Morgan Stanley as of 01.24.2023

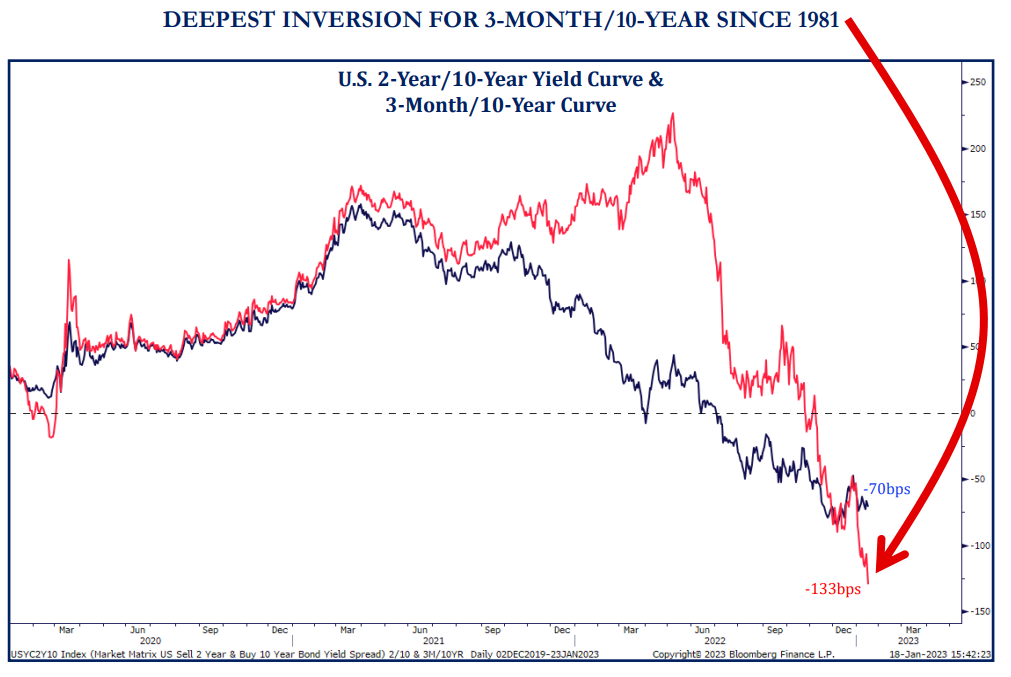

John Luke: The yield curve continues to fire signals of economic weakness

Source: Strategas as of 01.18.2023

Source: Strategas as of 01.18.2023

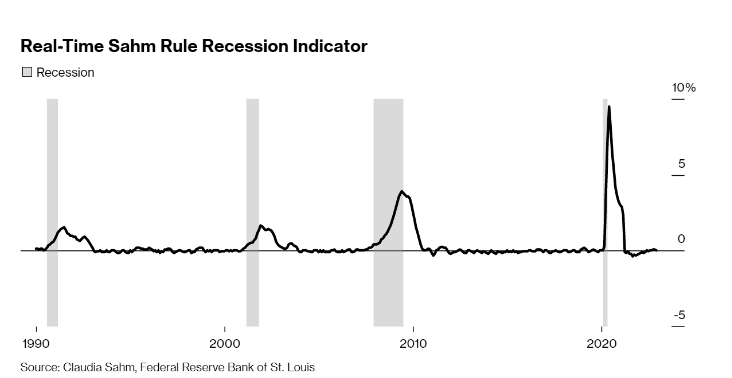

John Luke: yet employment has not yet shown signs of a weakening job market

Data as of 01.09.2023

Data as of 01.09.2023

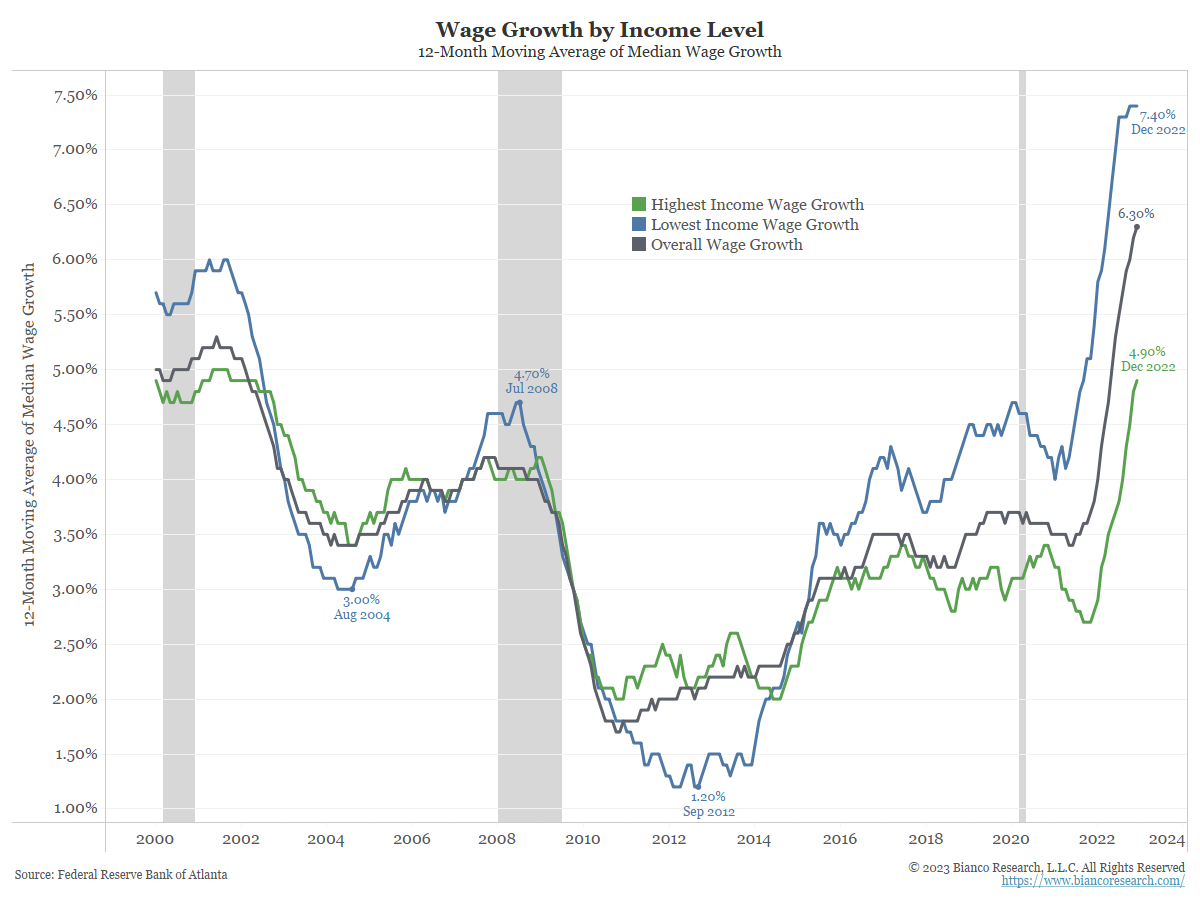

John Luke: In fact, wage growth continues to surge especially at the lower end of the income spectrum

Data as of 01.20.23

Data as of 01.20.23

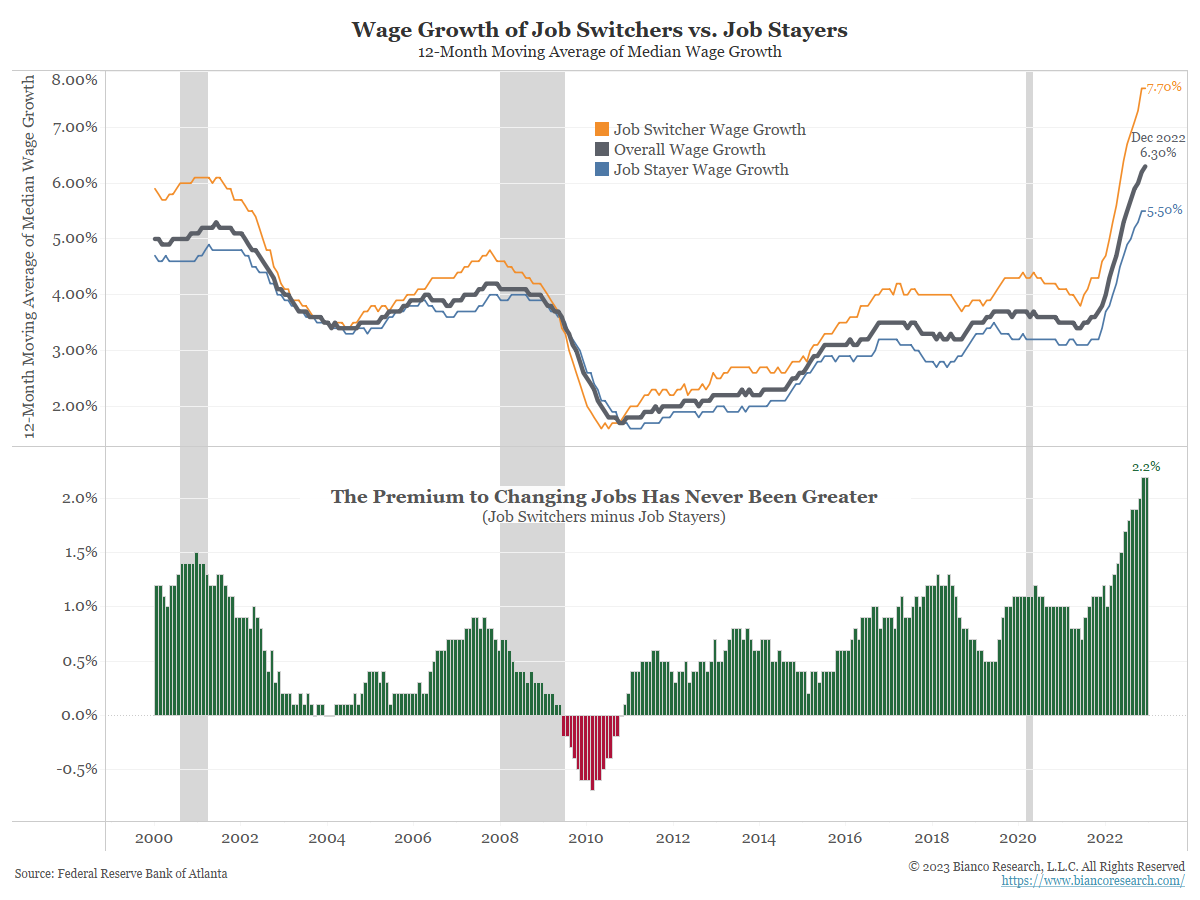

John Luke: and job-switchers continue to command significant wage bumps

Data as of 01.20.2023

Data as of 01.20.2023

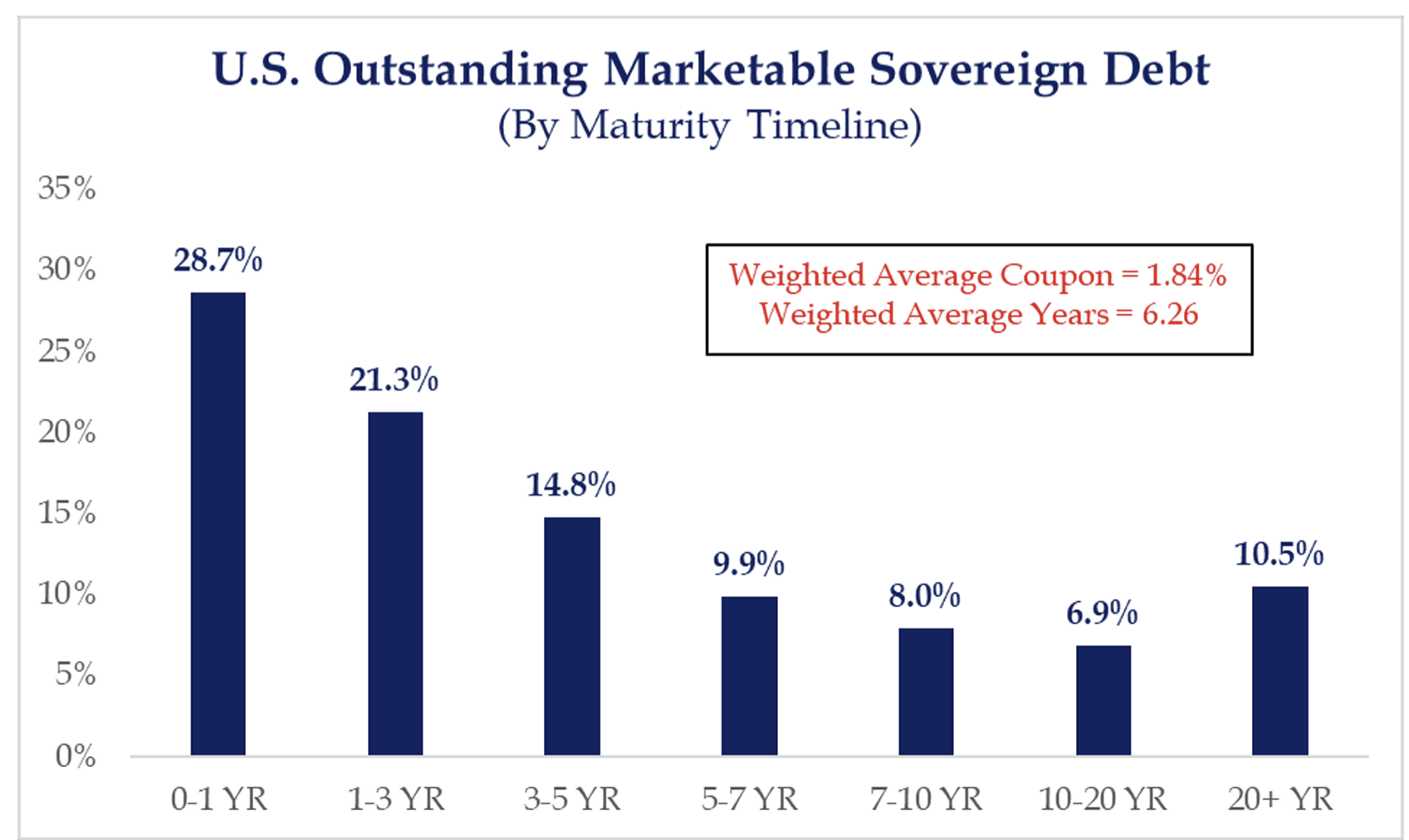

Dave: U.S. government debt expense is about to rise substantially due to higher rates

Source: Strategas as of 01.23.2023

Source: Strategas as of 01.23.2023

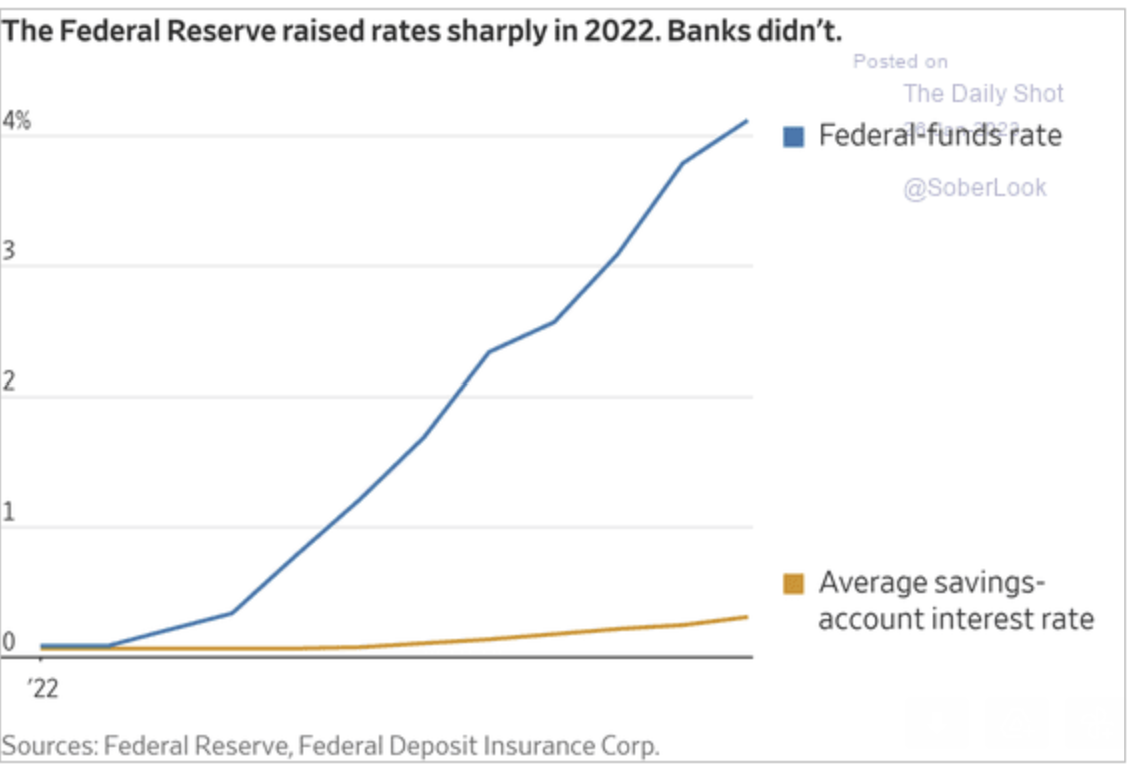

Dave: yet banks continue to take advantage of consumers who don’t have an advocate or the time to seek a better deal

Data as of 01.09.2023

Data as of 01.09.2023

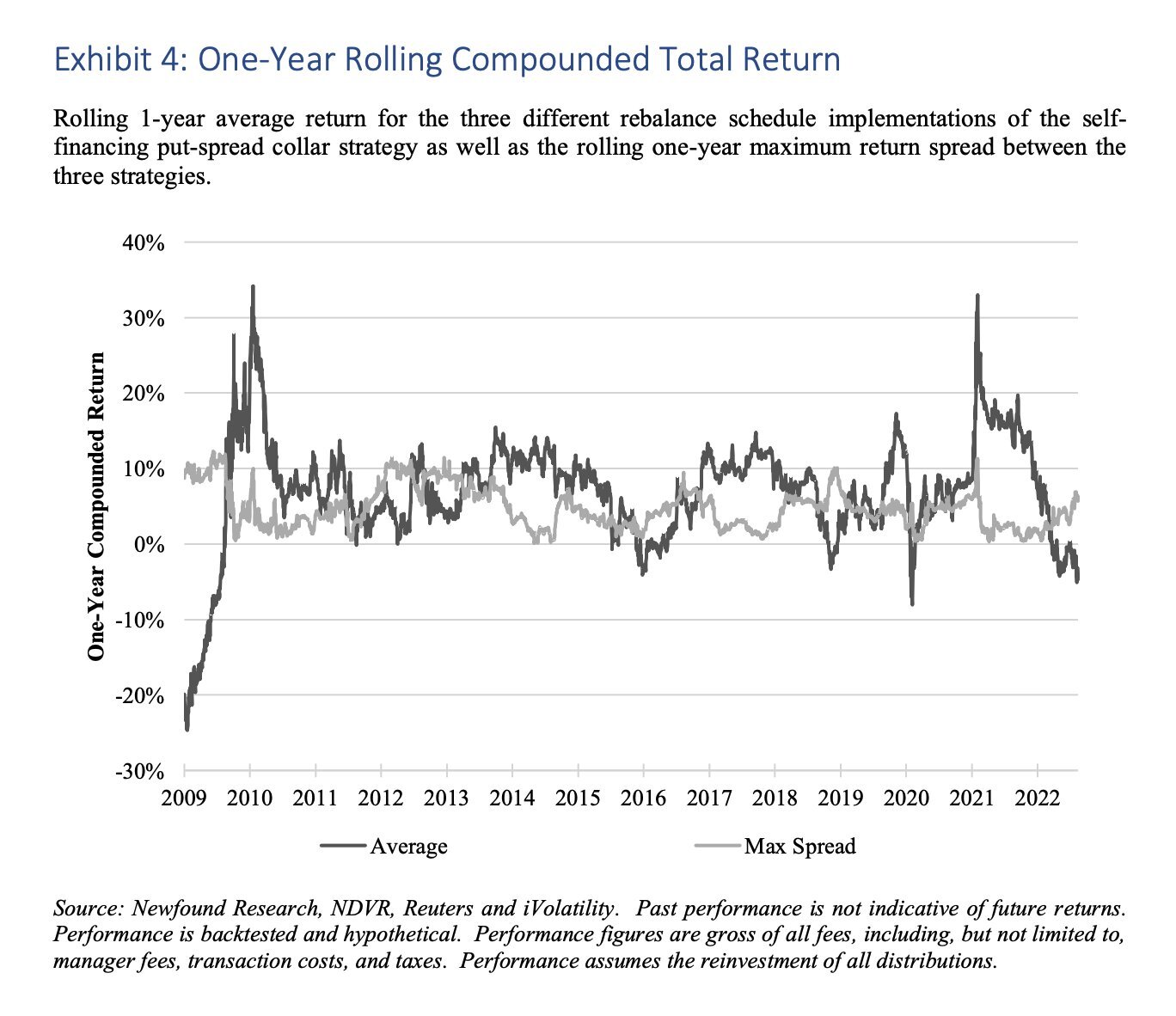

Derek: “Systematic” sounds helpful, but calendar-based strategies can lead to a wide range of outcomes

Data as of 01.24.2023

Data as of 01.24.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-25.