Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

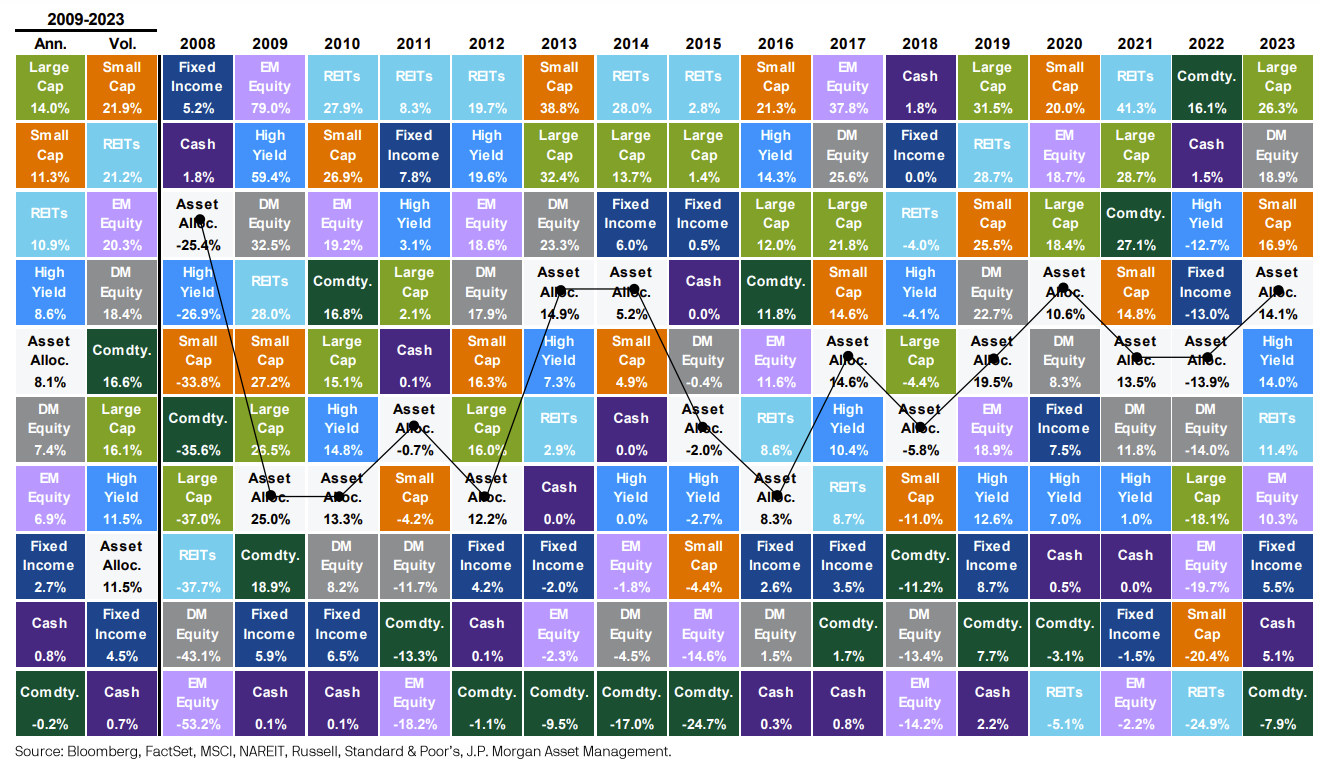

Joseph: In any given year, the leaders and laggards change but a diversified portfolio can get clients where they need to be

Data as of 12.29.2023

Data as of 12.29.2023

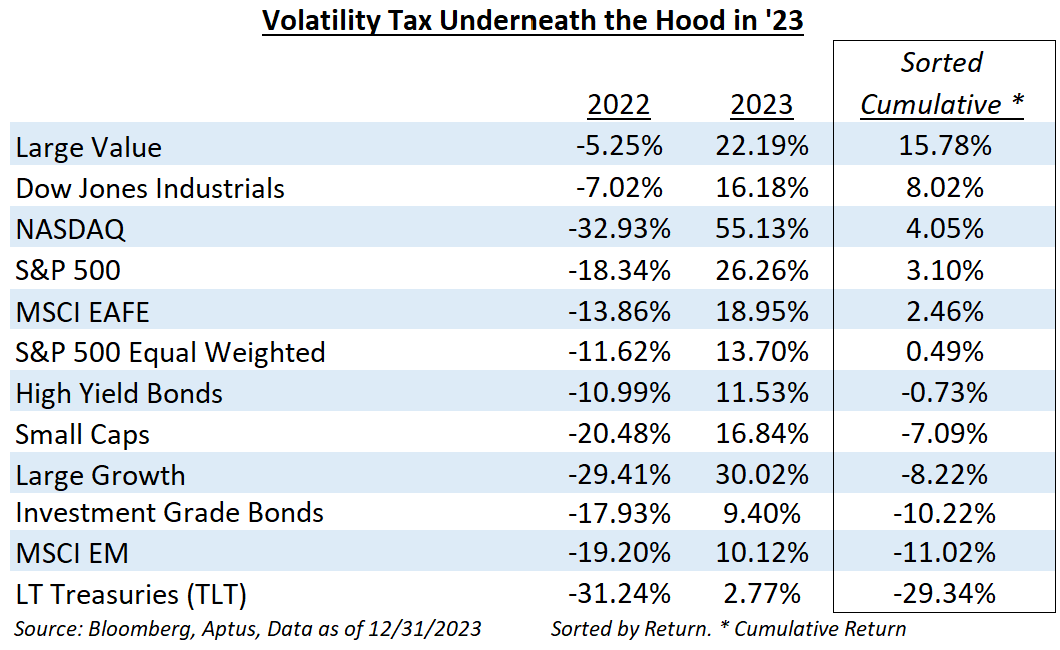

Dave: but it’s also worth noting that large variance from year-to-year can be a serious drag on compounded returns

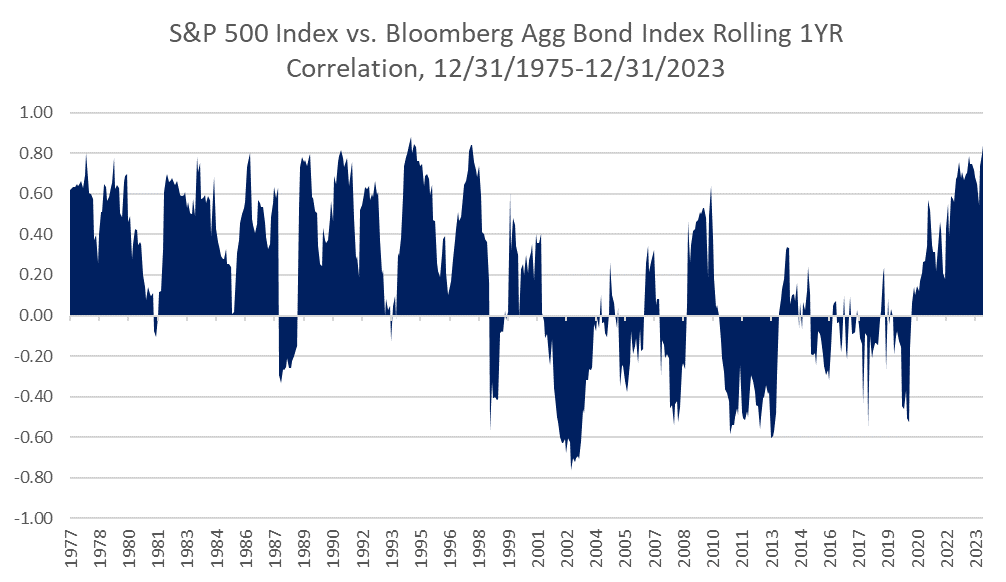

Brad: On top of that, the relationship between stock and bond prices swings wildly depending on the inflation regime

Source: Aptus via Bloomberg

Source: Aptus via Bloomberg

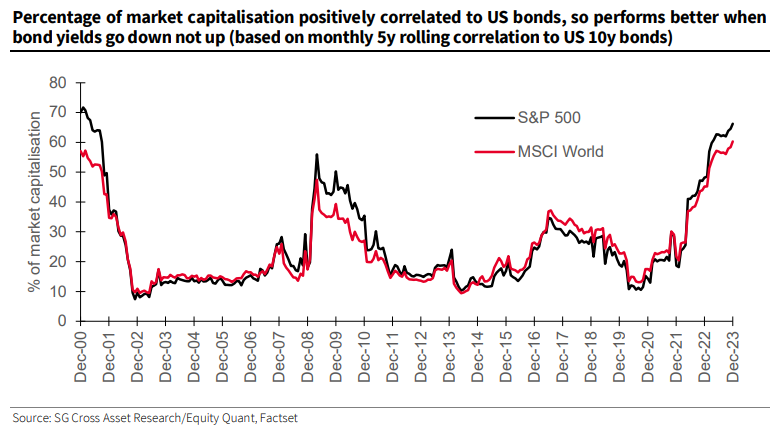

JD: and when a high % of your equity holdings are moving in tandem with bonds you have a lot less diversification than you might think

Data as of December 2023

Data as of December 2023

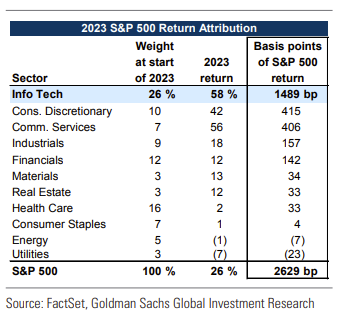

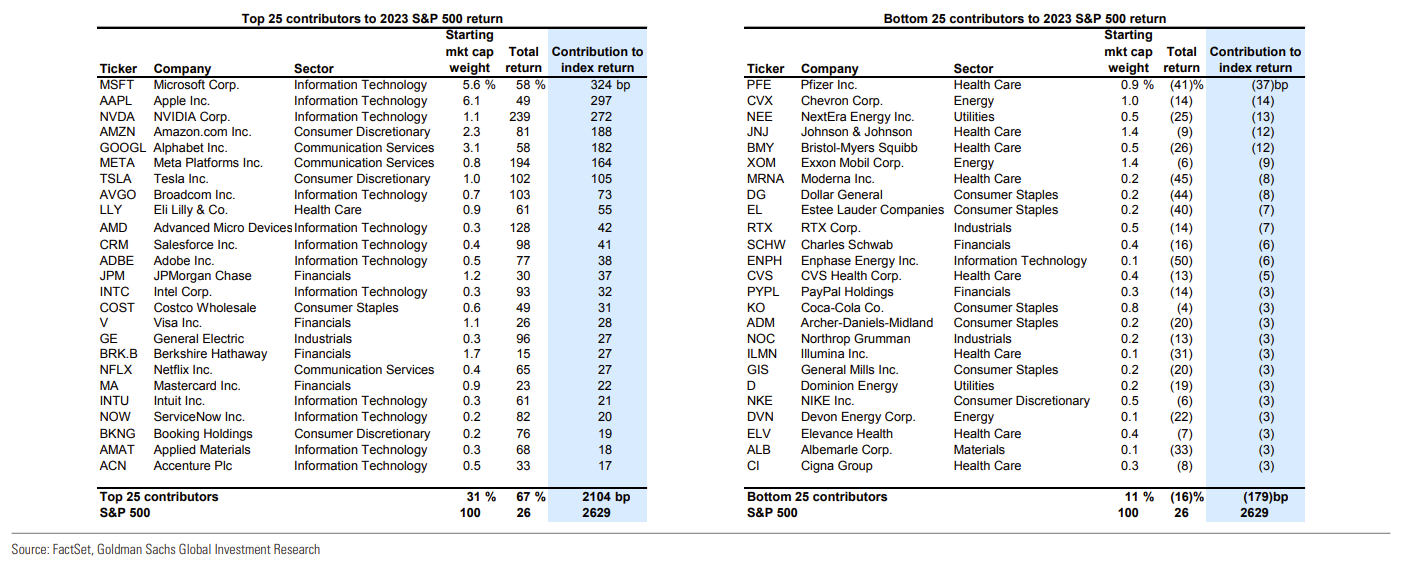

Mark: We all know technology dominated performance measures in 2023

Data as of 12.29.2023

Data as of 12.29.2023

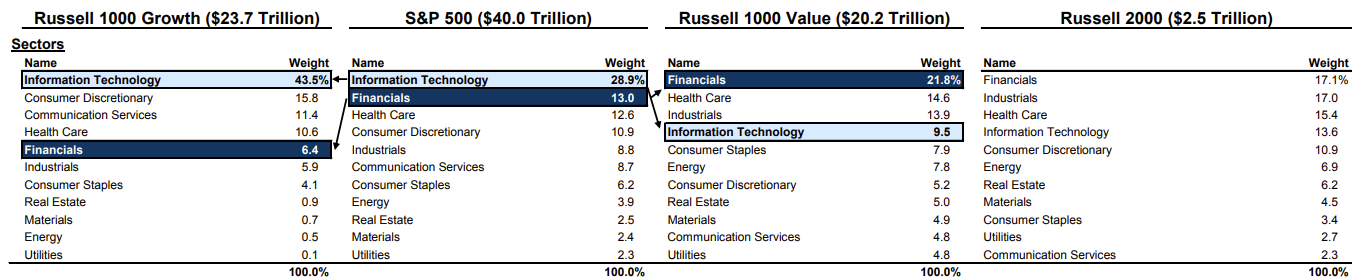

Brett: but it’s important to be aware of how sector weightings contribute to the performance of large vs. small and value vs. growth

Source: Goldman Sachs as of December 2023

Source: Goldman Sachs as of December 2023

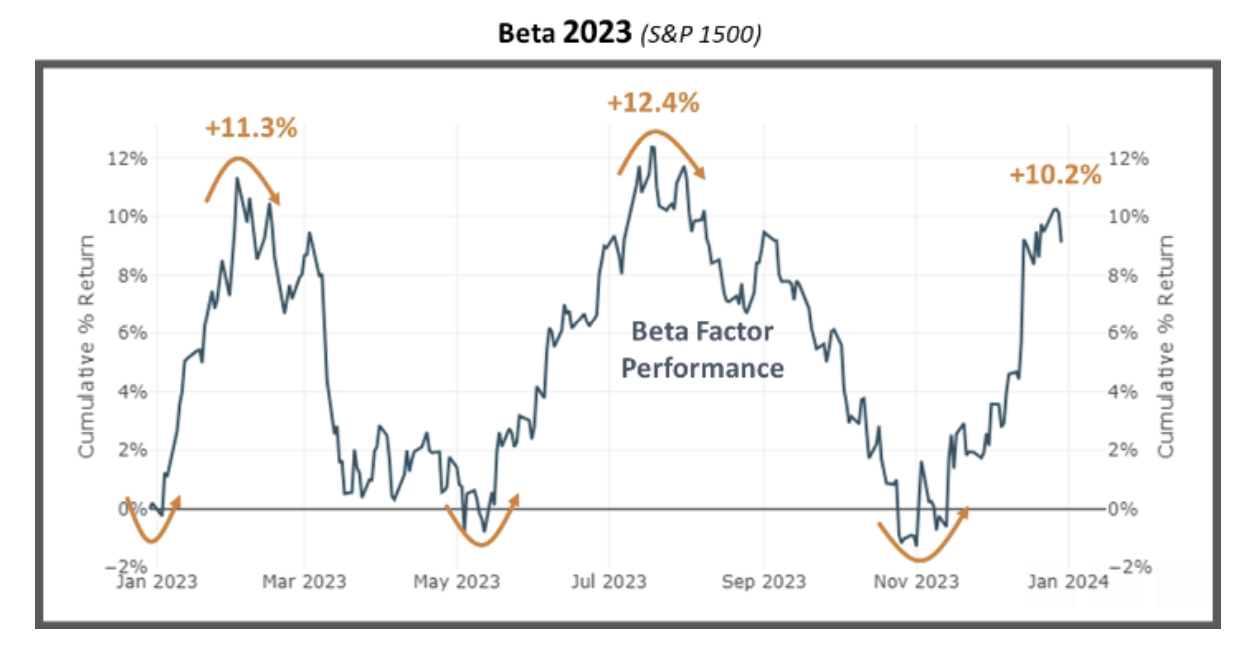

Dave: 2023 was a year of big streaks of up and down index moves

Source: PSC as of 01.02.2024

Source: PSC as of 01.02.2024

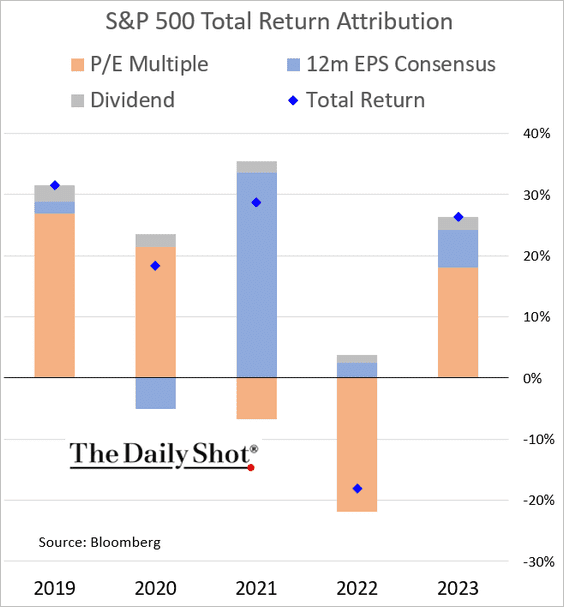

John Luke: with valuations being the primary contributor to returns in a flat earnings period

Data as of December 2023

Data as of December 2023

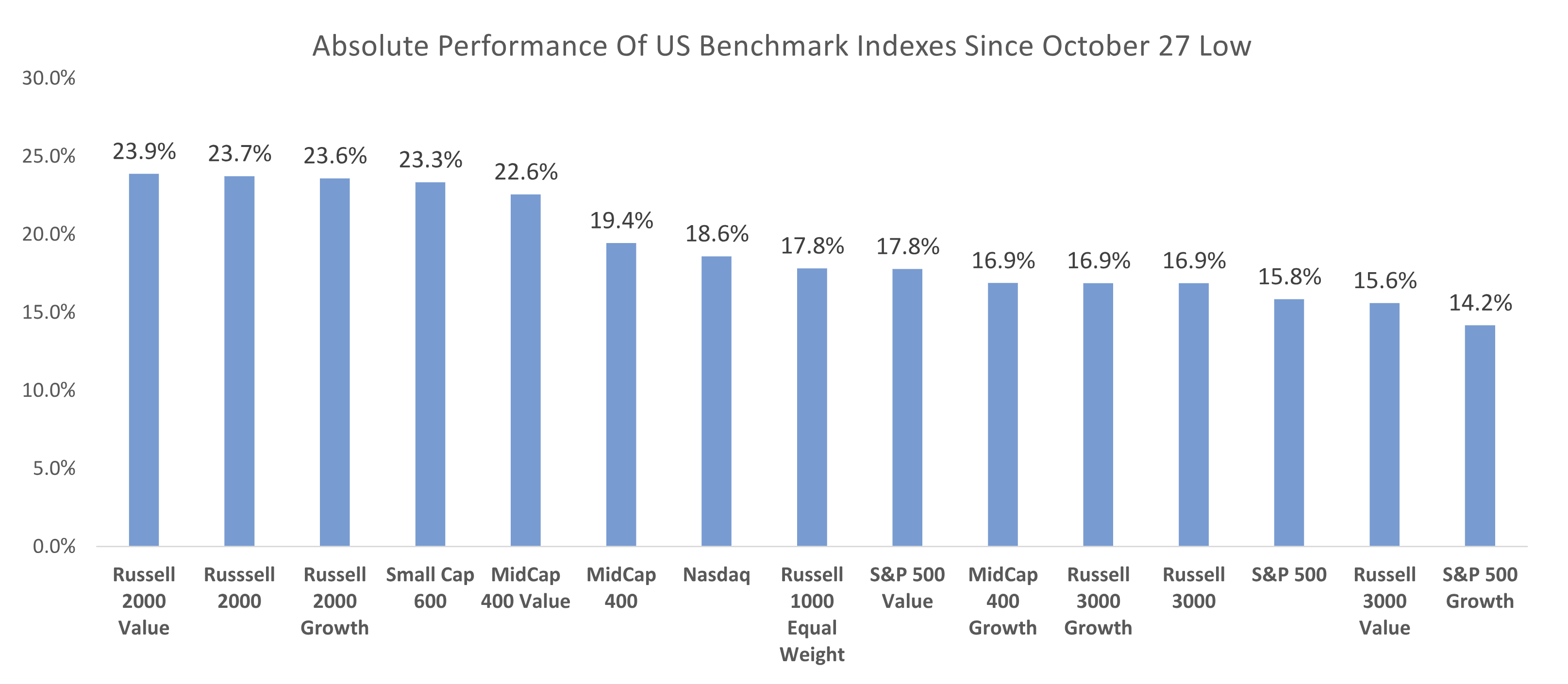

Dave: and small caps finally catching a nice bid in the final two months of the year

Source: Raymond James as of 01.02.2024

Source: Raymond James as of 01.02.2024

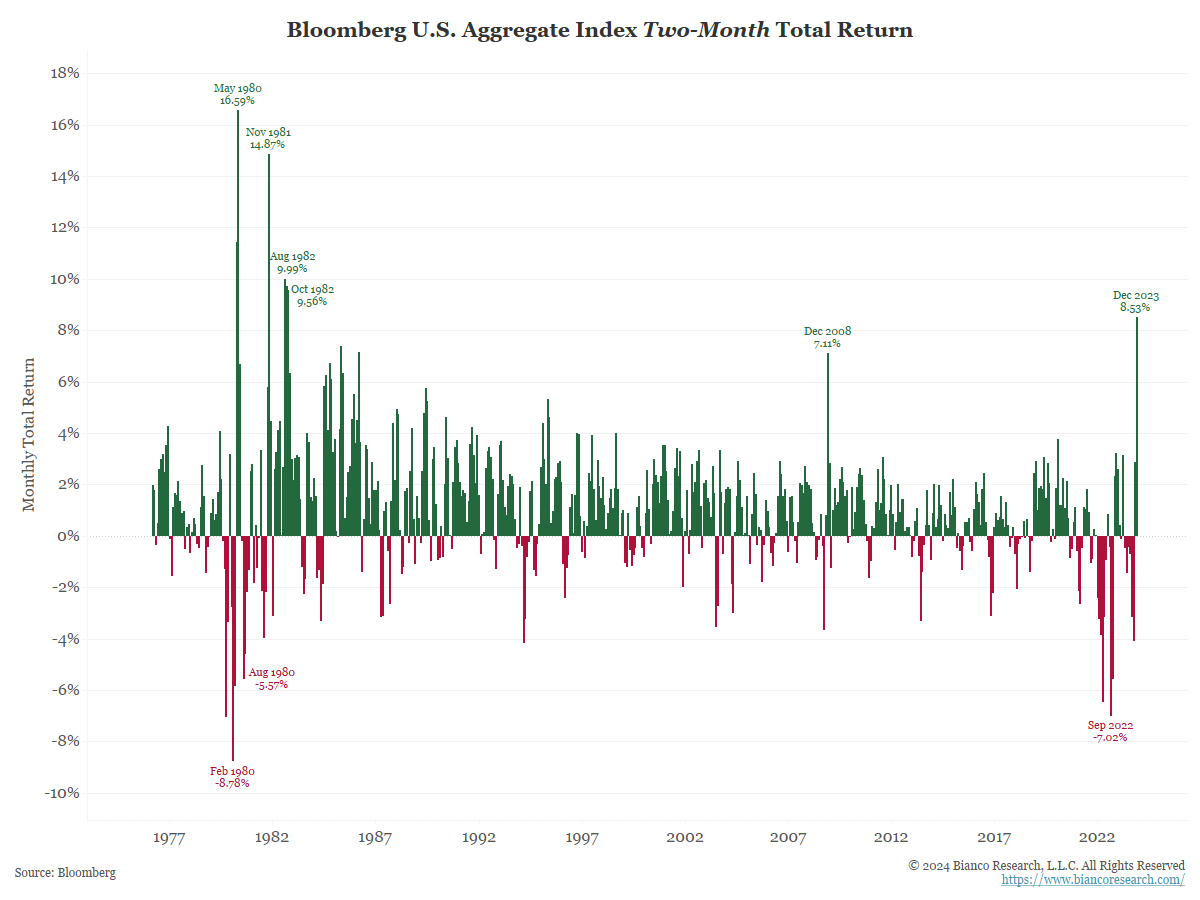

Dave: Bonds had an equally historic rally to end 2023

Data as of 12.29.2023

Data as of 12.29.2023

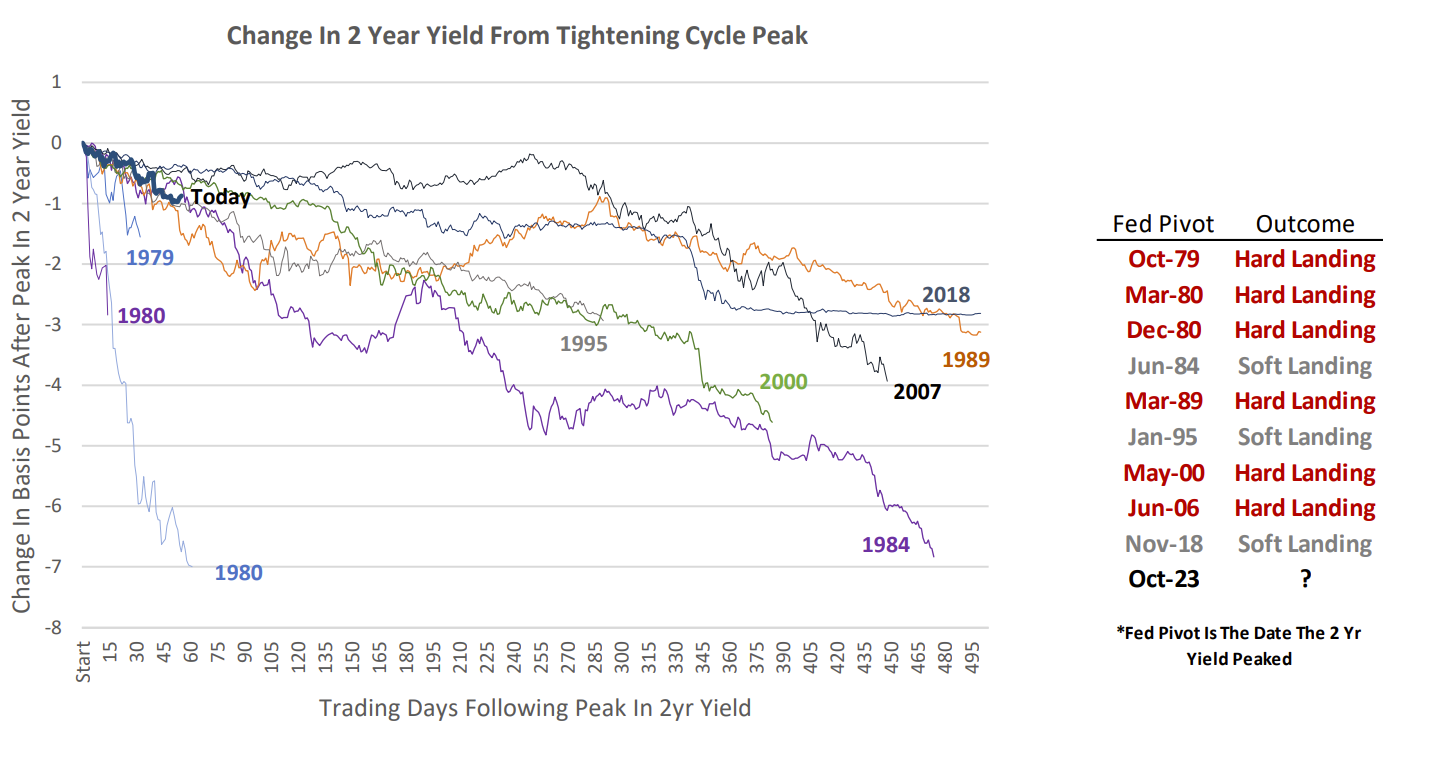

John Luke: following the historical tendency for yields to fall upon recognition of a Fed policy “pivot”

Source: PSC as of Dec 2023

Source: PSC as of Dec 2023

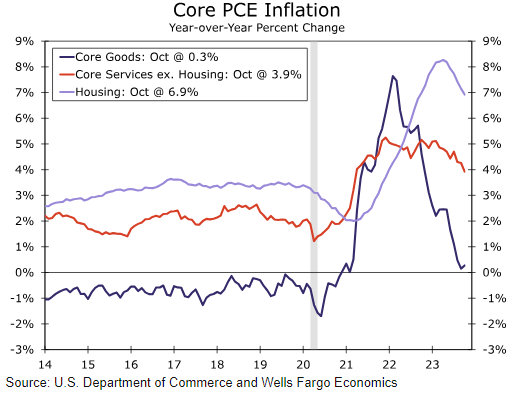

John Luke: but it remains to be seen if the stickier services inflation will come down enough to allow a rate-easing cycle

Data as of December 2023

Data as of December 2023

Beckham: Another way to see just what contributed stock market returns in 2023

Data as of 12.29.2023

Data as of 12.29.2023

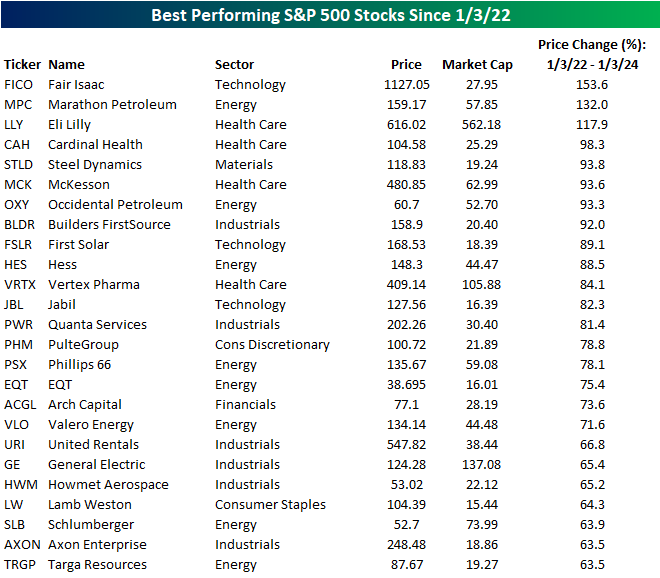

Dave: and a reminder that what worked in 2023 was wildly different than what worked in 2022, and the combination looks different than many would guess

Source: Bespoke as of 01.02.2024

Source: Bespoke as of 01.02.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-21.