Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from market expectations to corporate fundamentals, a resilient economy relative to others, and changes in business over recent decades. Here’s to a great year ahead!

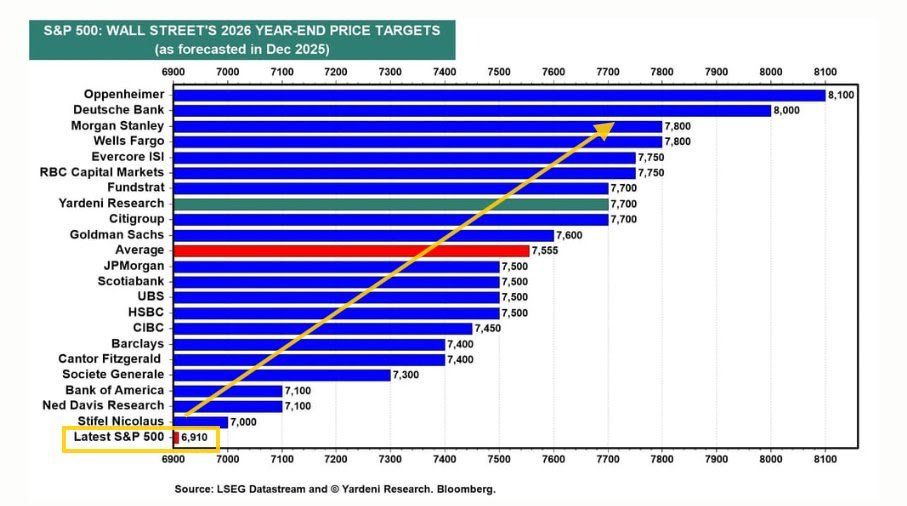

John Luke: Wall Street is bullish for 2026 but not to an overly enthusiastic degree

Graphic as of 12.30.2025

Graphic as of 12.30.2025

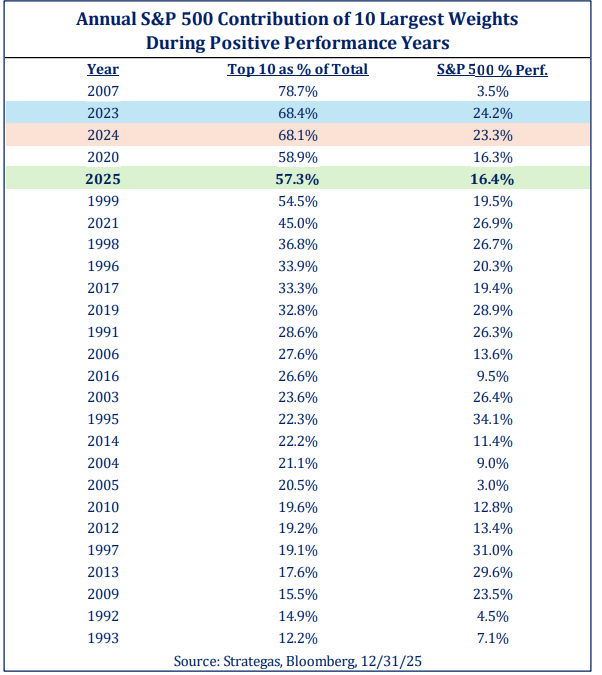

Dave: Megacap leadership has been a key theme in recent years

Brett: but don’t overlook the contribution from the rest of the S&P 500 stocks

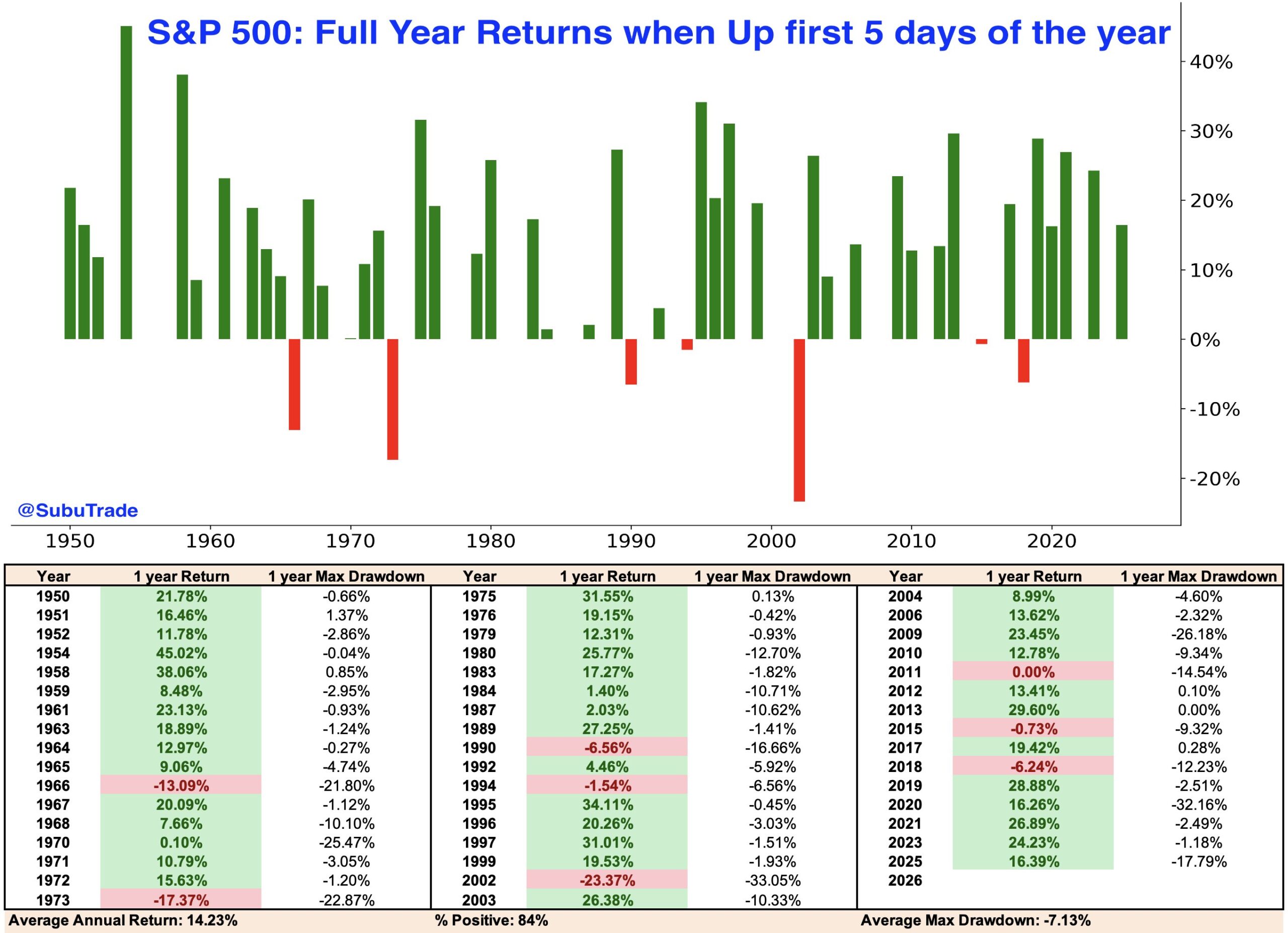

John: The “First 5 Days” barometer was in the green for January 2026

Data as of 01.08.2026

Data as of 01.08.2026

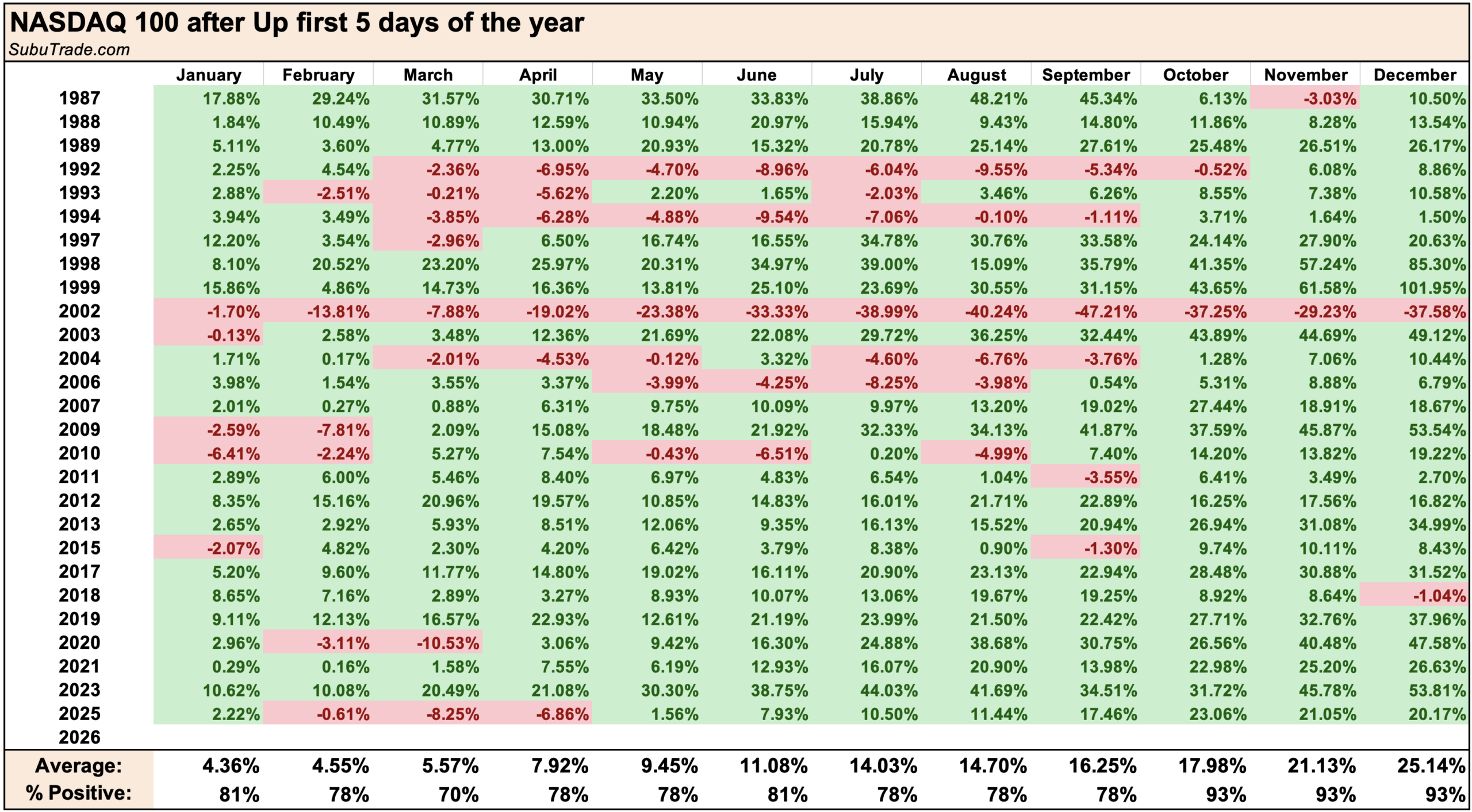

John: and the track record for NASDAQ’s First 5 Days is even more positive

Data as of 01.08.2026

Data as of 01.08.2026

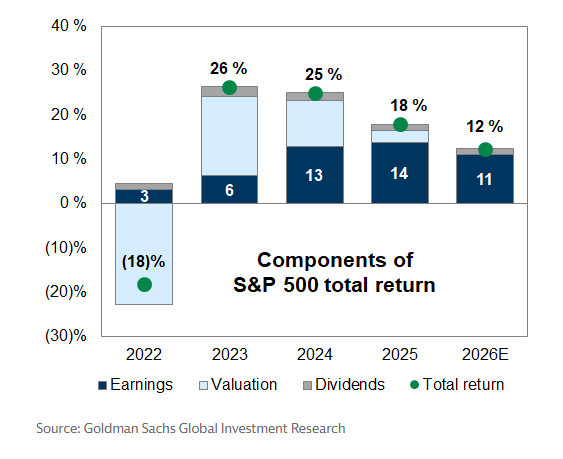

Brad: After a period of multiple expansion being a key driver of US stocks, earnings took charge as the catalyst in 2025

Data as of 01.02.2026

Data as of 01.02.2026

Brad: and the earnings backdrop remains favorable as large corporations continue to lift profit margins

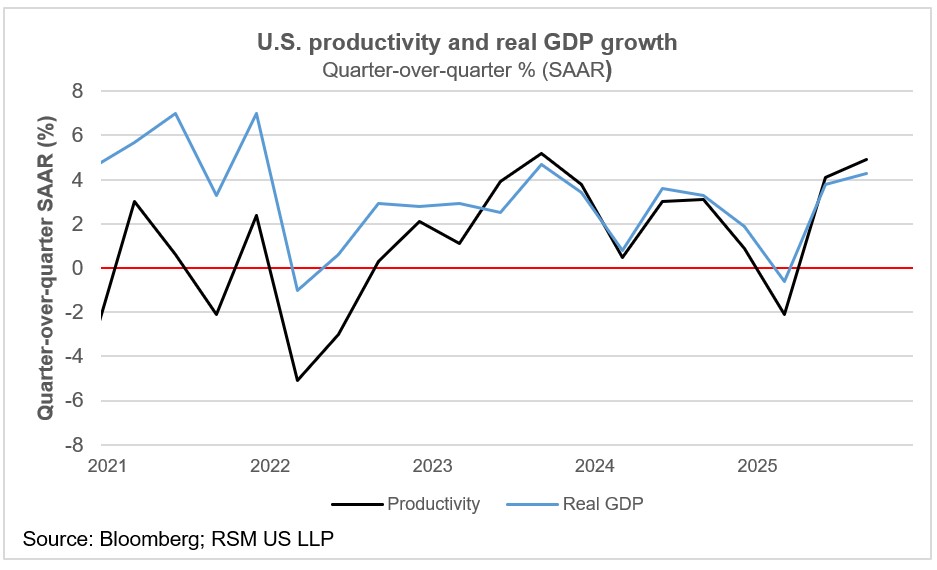

Beckham: Productivity is at the center of the “rising profit margins” story as companies do more without major hiring

Data as of 01.08.2026

Data as of 01.08.2026

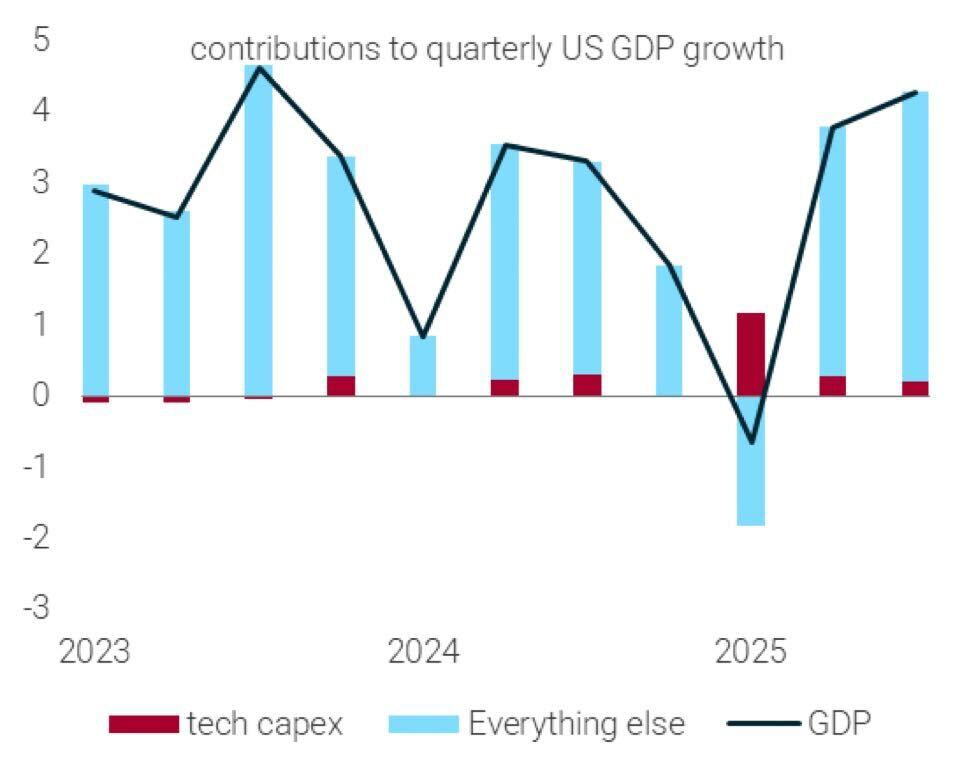

Jake: and the sources of strength go way beyond artificial intelligence (AI) spending

Source: TS Lombard as of 01.06.2026

Source: TS Lombard as of 01.06.2026

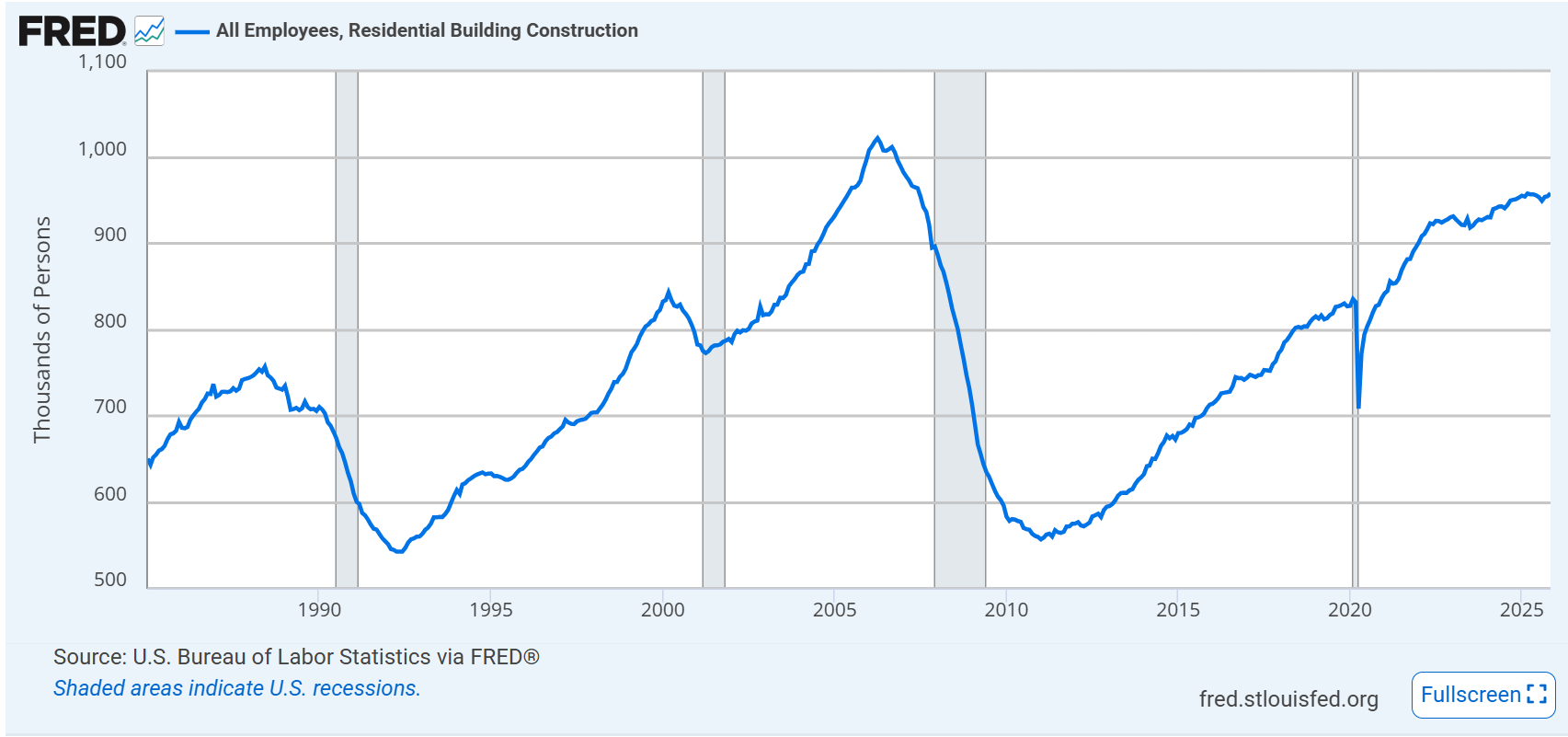

John Luke: As slow as the housing market has been, it’s at least strong enough to keep employment stable

Data as of 01.02.2026

Data as of 01.02.2026

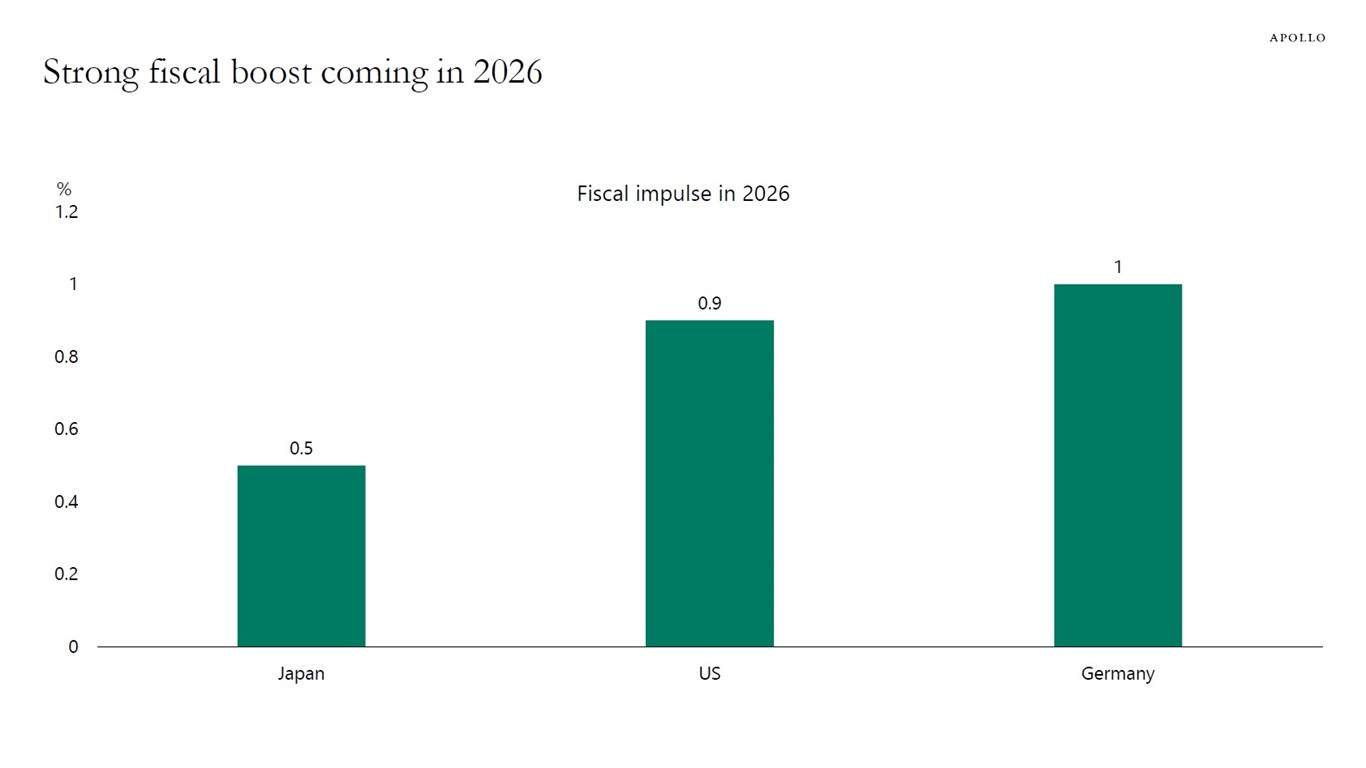

JD: and countries around the world are spending money to keep economies humming along

Source: Apollo as of 01.05.2026

Source: Apollo as of 01.05.2026

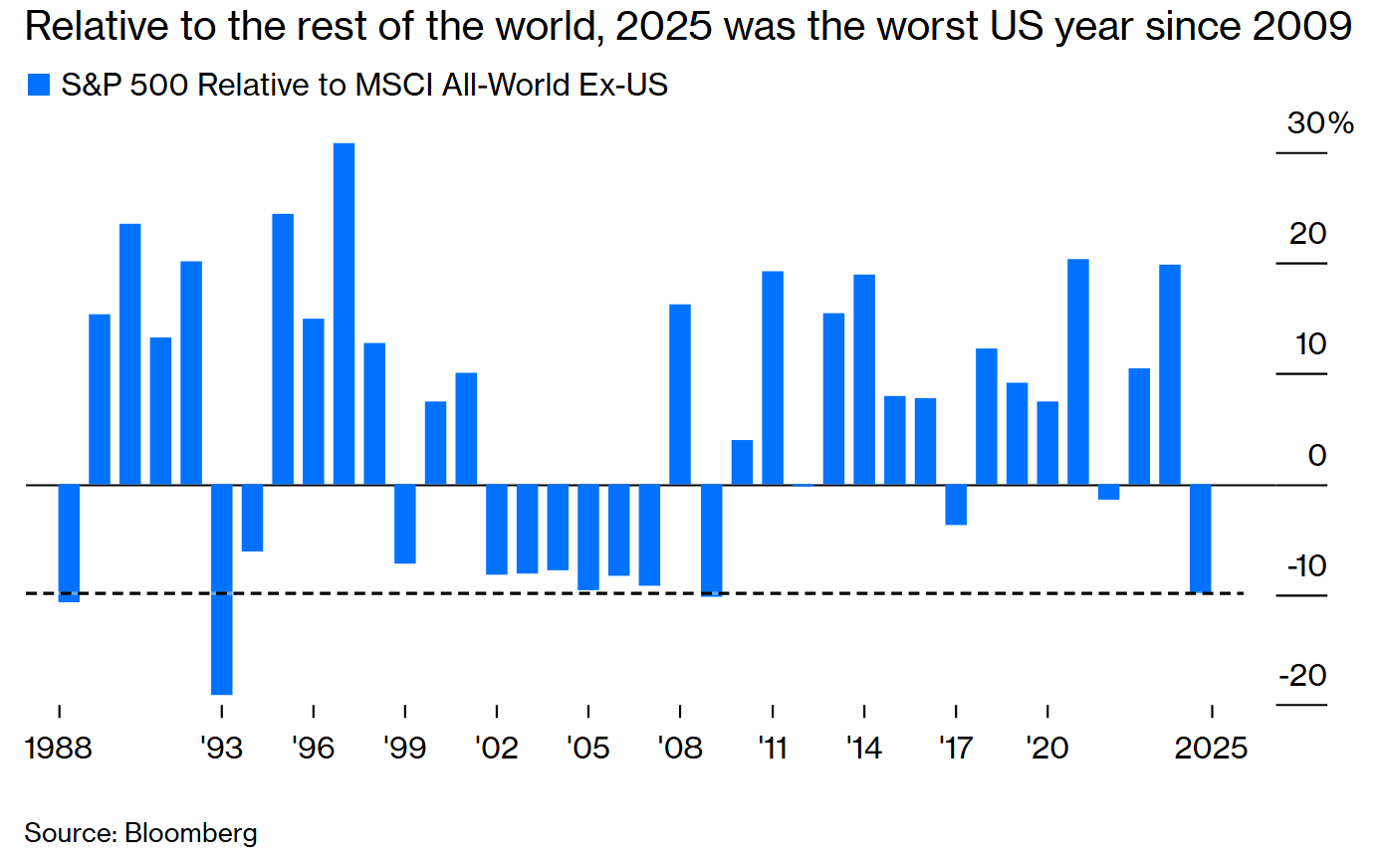

Ten: Foreign stocks took a rare position of leadership in 2025

Data as of 01.02.2026

Data as of 01.02.2026

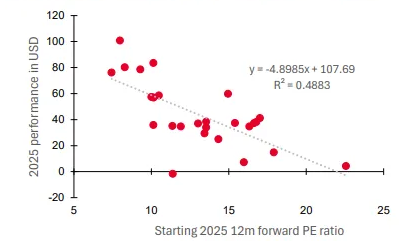

Brian: with valuation a key contributor to the catch-up trade

Source: Bloomberg as of 01.04.2026

Source: Bloomberg as of 01.04.2026

Joseph: and a weaker US dollar providing a tailwind to foreign stocks

Data as of 12.30.2025

Data as of 12.30.2025

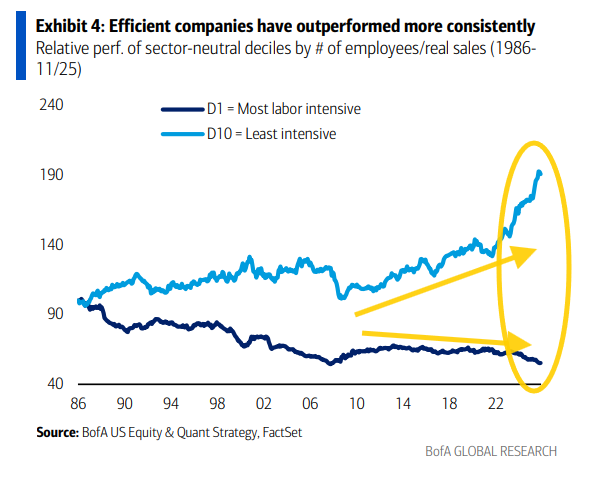

John Luke: Companies and industries that have figured out how to get the most out of their workers have been rewarded by investors

Data as of November 2025

Data as of November 2025

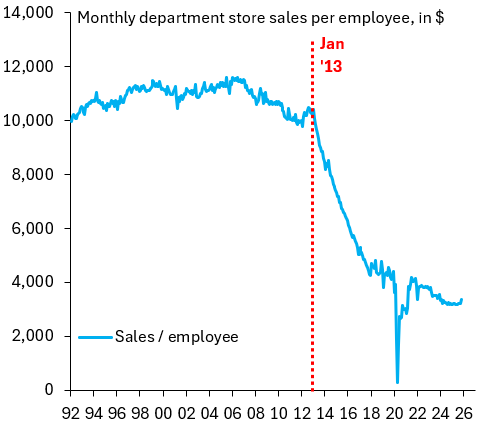

Beckham: but it looks like department stores missed that memo

Source: Brookings Institution as of 01.07.2026

Source: Brookings Institution as of 01.07.2026

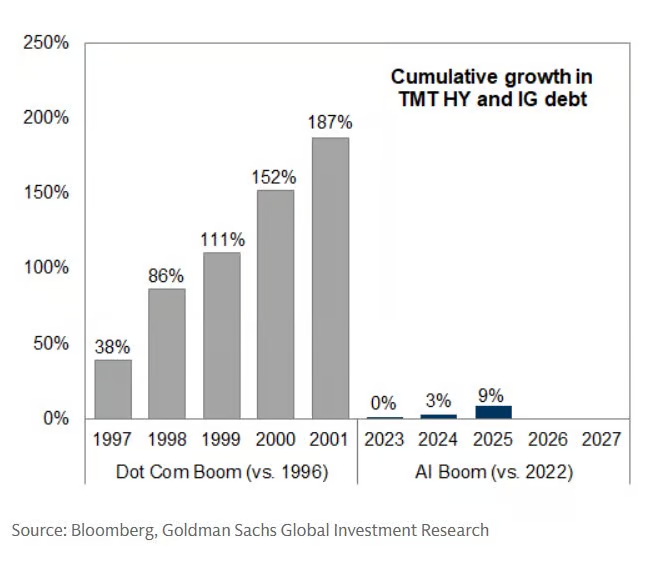

Brad: There seems to be a bubble in calling a tech bubble; the financing in this cycle is far cleaner than in the dotcom era

Data as of 01.02.2026

Data as of 01.02.2026

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2601-23.