Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and why:

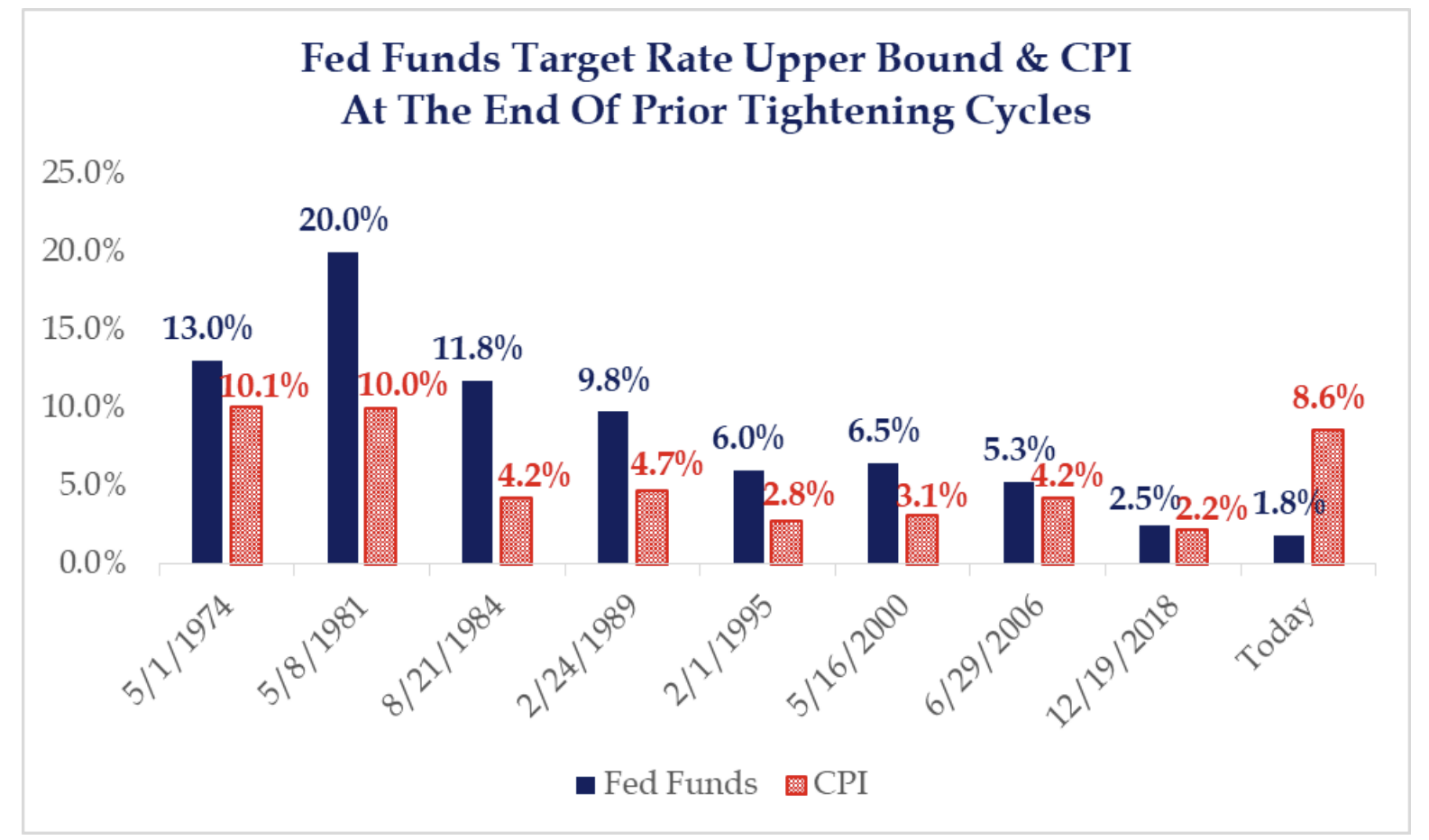

Dave: there hasn’t been a single instance in 50 years of Fed Funds < CPI at the end of a tightening cycle

Source: Strategas as of 6/27/2022

Source: Strategas as of 6/27/2022

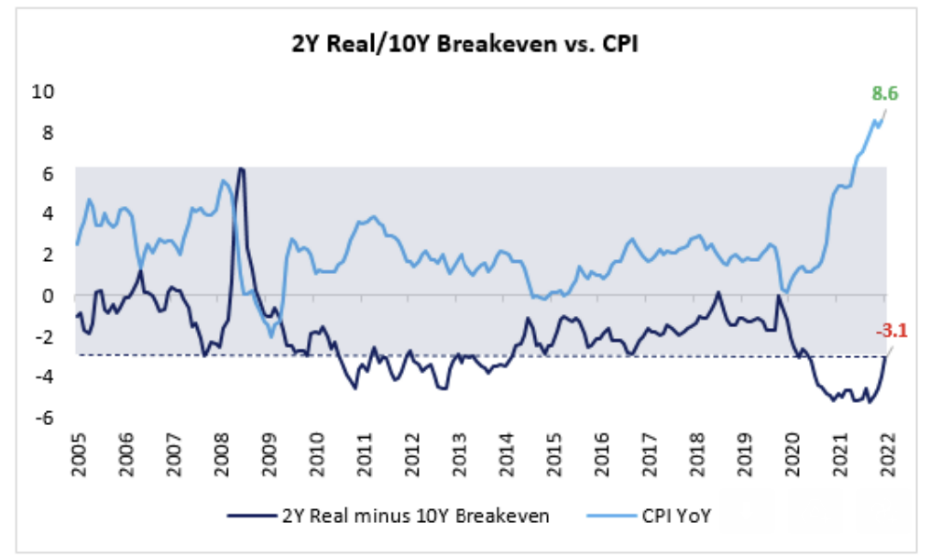

JL: real yields finally coming out of negative territory but still far lower than CPI

Source: Jefferies as of 6.28.2022

Source: Jefferies as of 6.28.2022

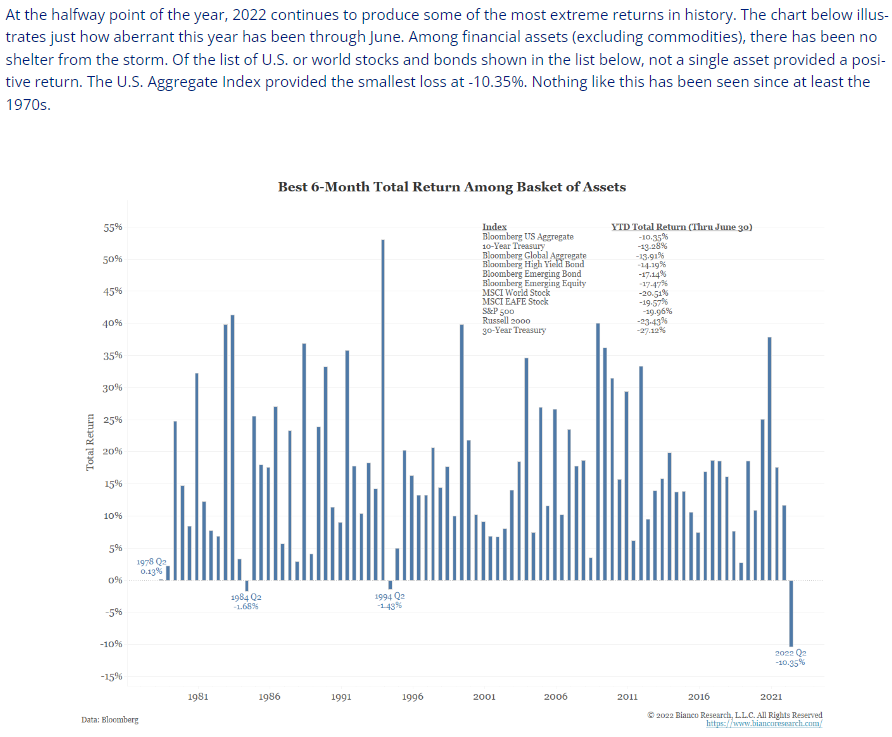

Beckham: have seen nothing like this in at least 50 years, nowhere to hide

Source: Bianco Research as of 07.01.2022

Source: Bianco Research as of 07.01.2022

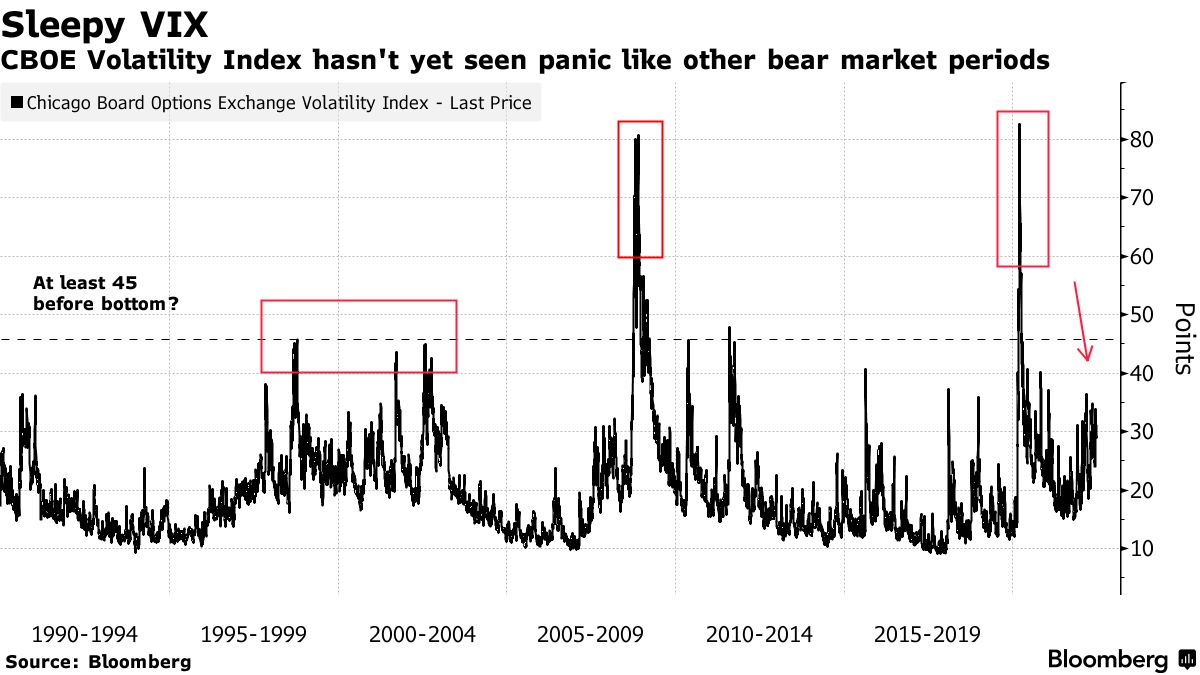

JD: yet we’ve not seen the type of volatility spike that usually accompanies market selloffs

Data as of 6/28/2022

Data as of 6/28/2022

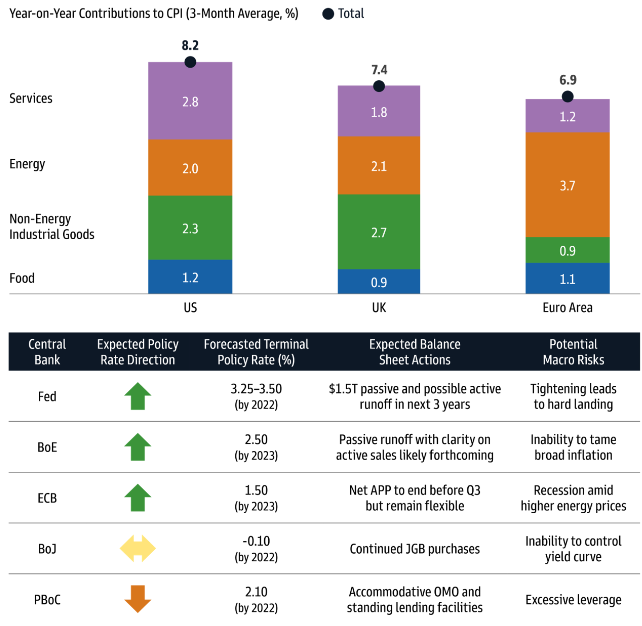

Brad: What’s driving inflation, and how are global Central Banks reacting?

Source: Goldman Sachs as of 5/31/2022

Source: Goldman Sachs as of 5/31/2022

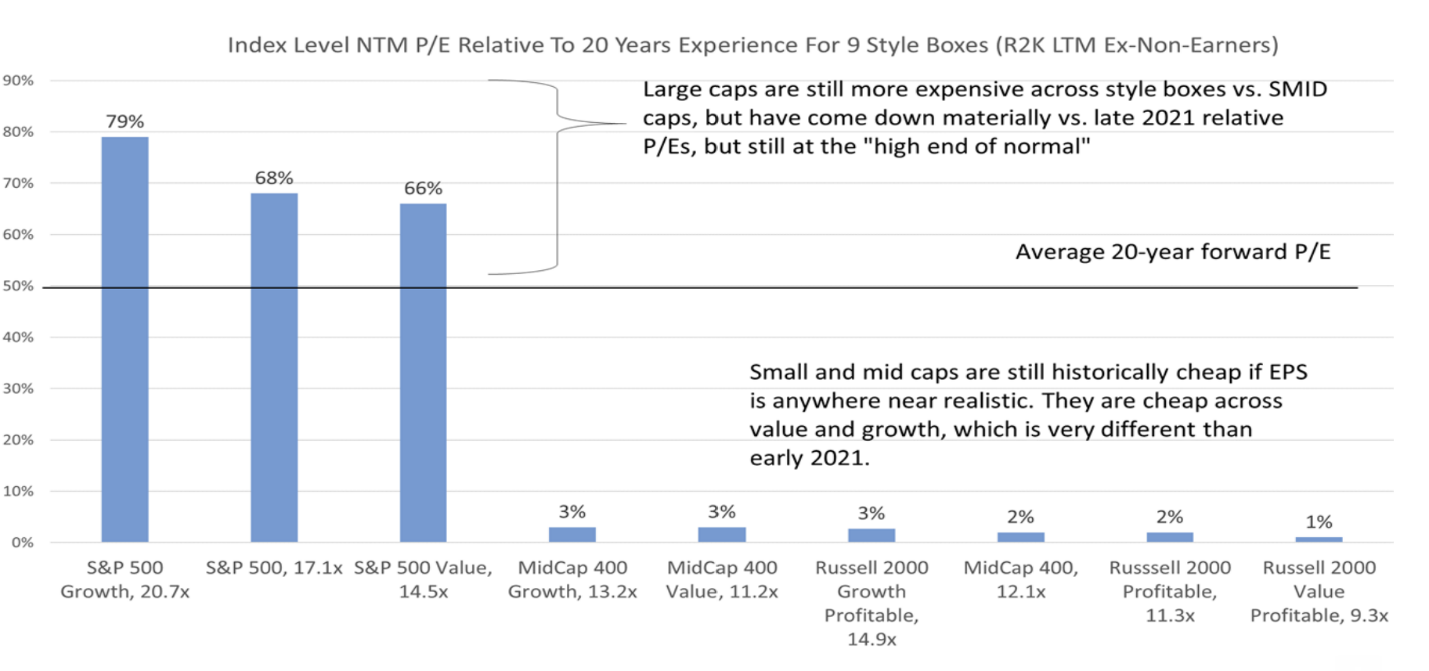

Joseph: stark valuation gap between US Large Cap vs. Mid/Small

Source: Raymond James as of 6.29.2022

Source: Raymond James as of 6.29.2022

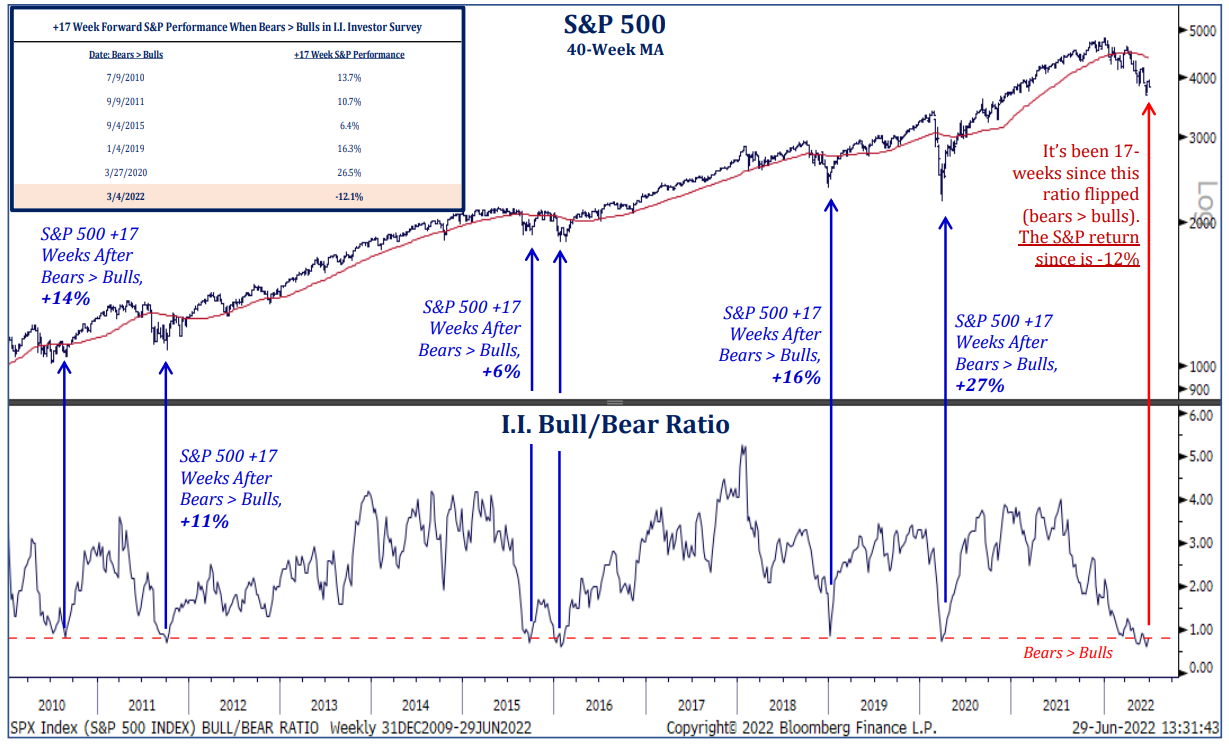

JL: maybe past buy signals were a result of a loose Fed, not “too much bearishness”?

Source: Strategas as of 6.30.2022

Source: Strategas as of 6.30.2022

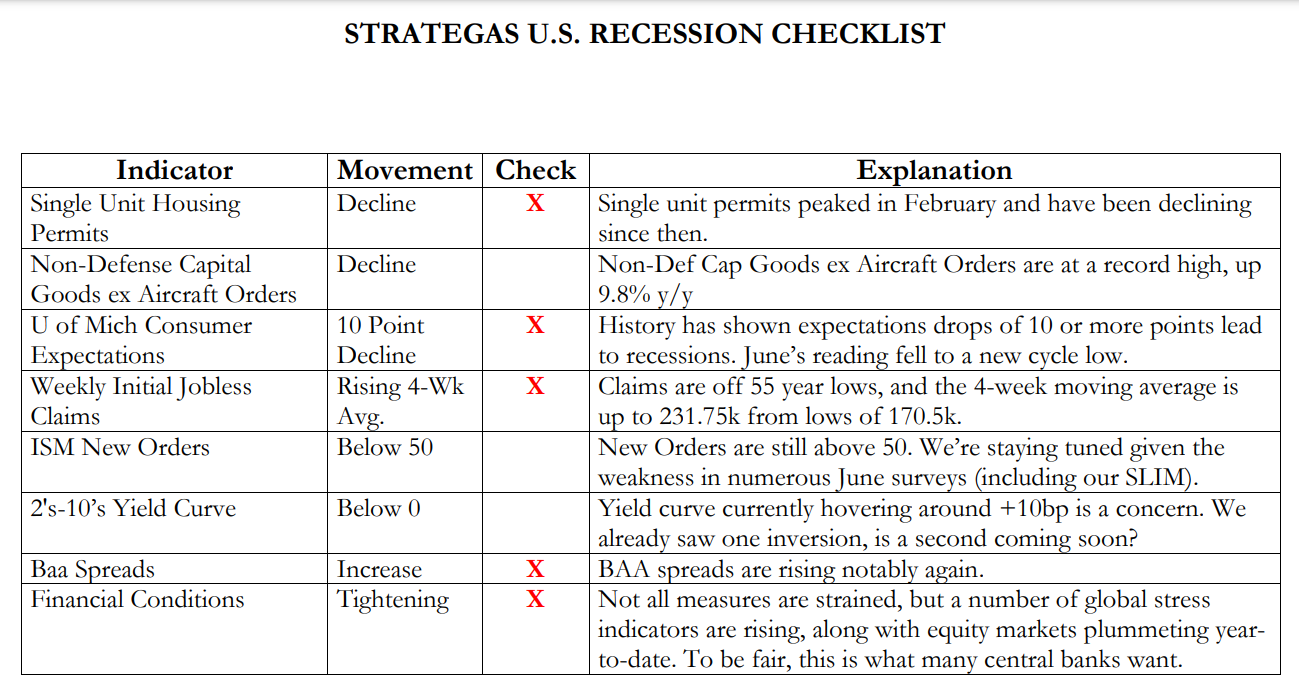

Dave: metrics to track in evaluating the potential for a recession

Source: Strategas as of 6.30.2022

Source: Strategas as of 6.30.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options. On a global basis, it is one of the most recognized measures of volatility — widely reported by financial media and closely followed by a variety of market participants as a daily market indicator.

The S&P MidCap 400® provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500®, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2207-1.