Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

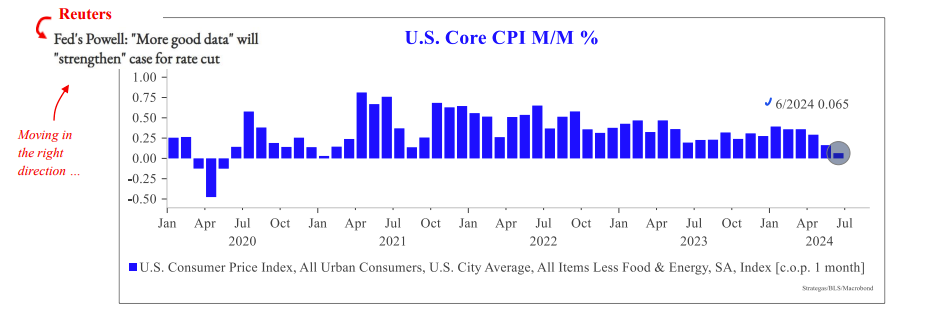

John Luke: Maybe, just maybe, the near-term inflation concerns can be reduced

Source: Strategas as of 07.11.2024

Source: Strategas as of 07.11.2024

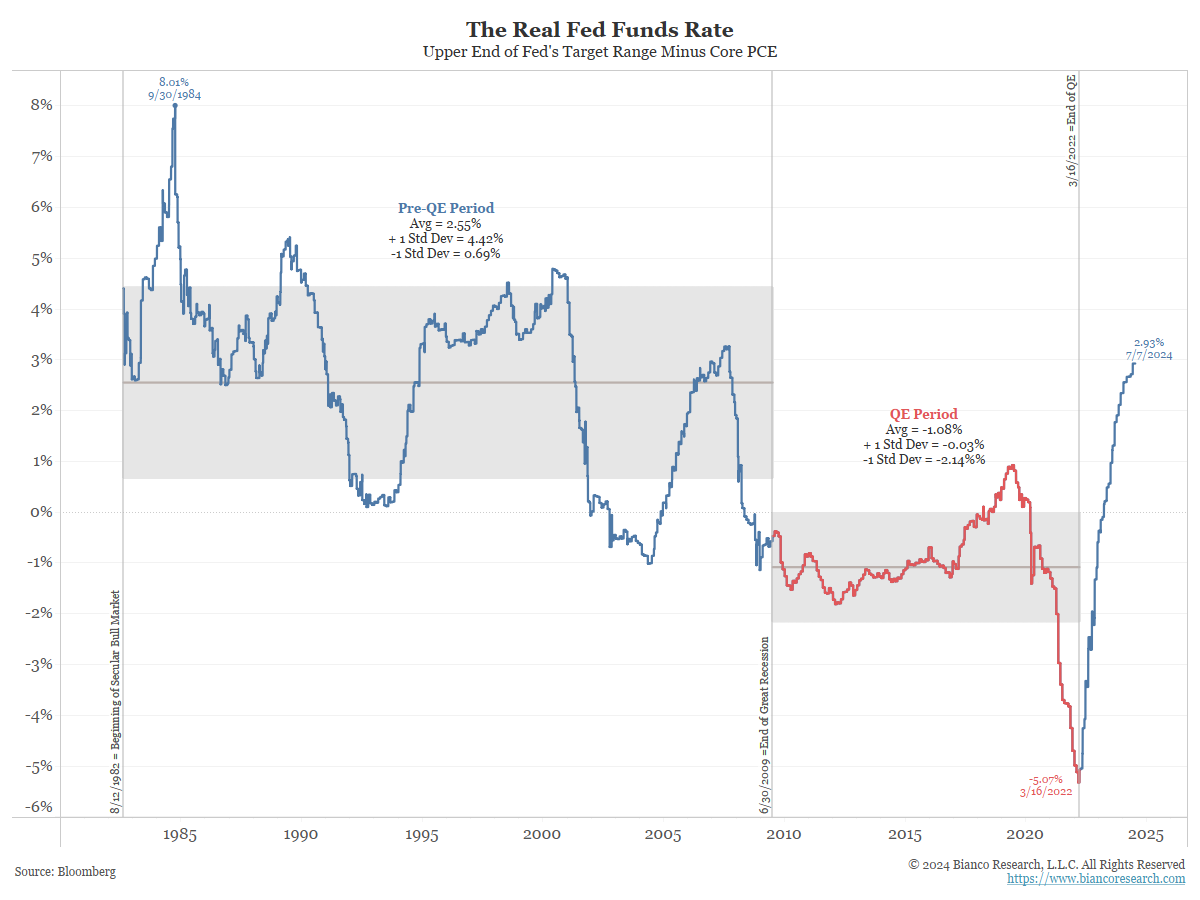

John Luke: which could free the Fed to relax what has now become a slightly restrictive policy stance

Data as of 07.07.2024

Data as of 07.07.2024

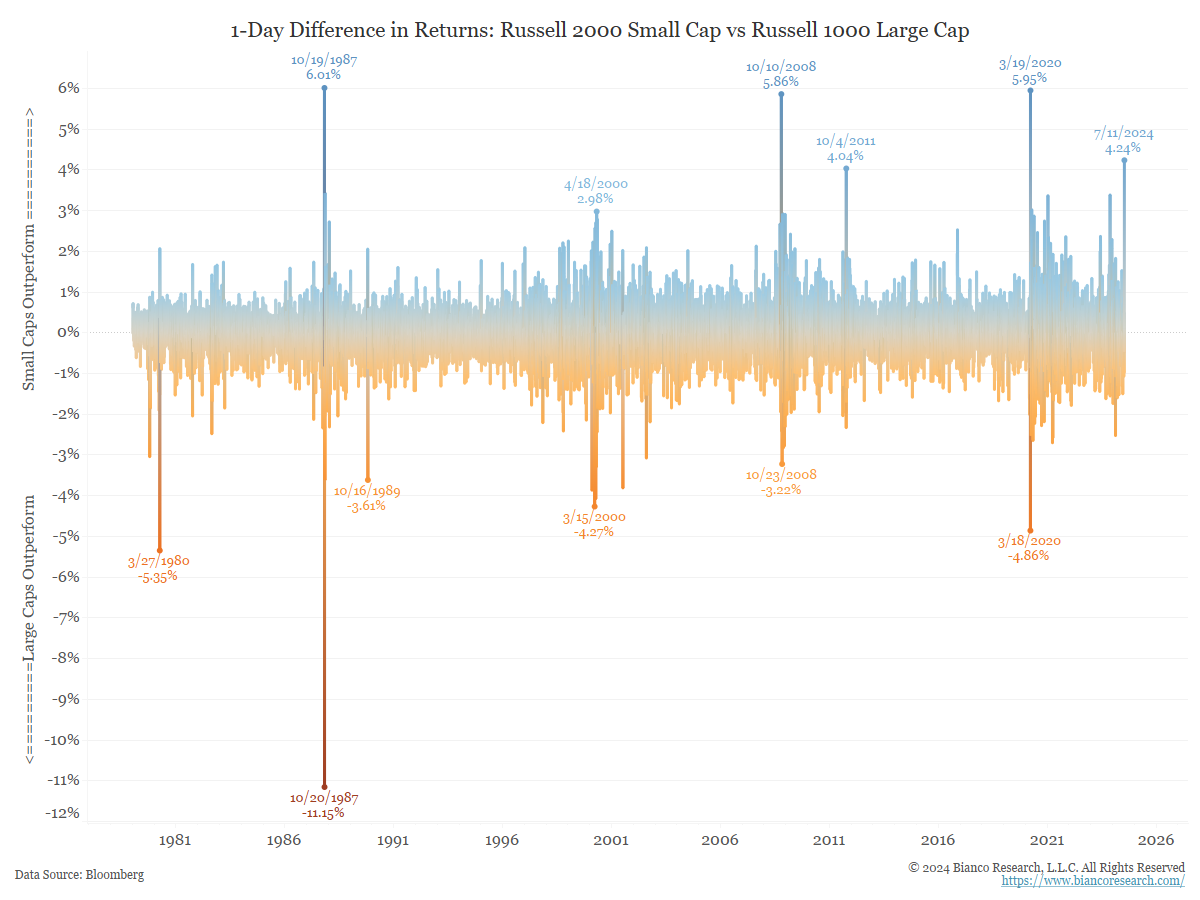

John Luke: The latest inflation report triggered a historic rotation from recent growth winners to value laggards, on hopes rate cuts can come sooner vs. later

Source: Data as of 07.11.2024

Source: Data as of 07.11.2024

Brad: an outcome long-awaited for those waiting on mean reversion

Data as of 07.10.2024

Data as of 07.10.2024

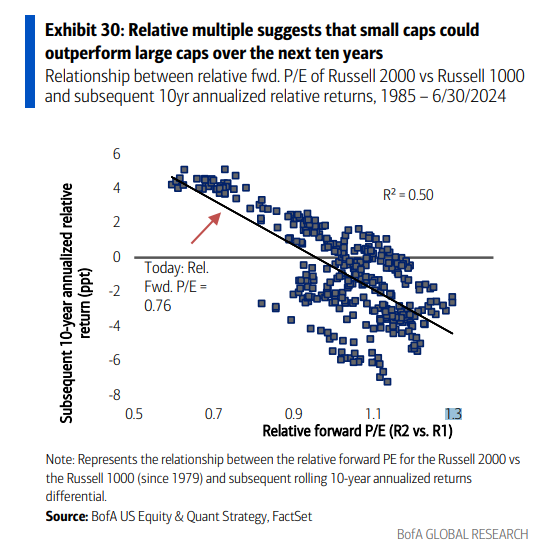

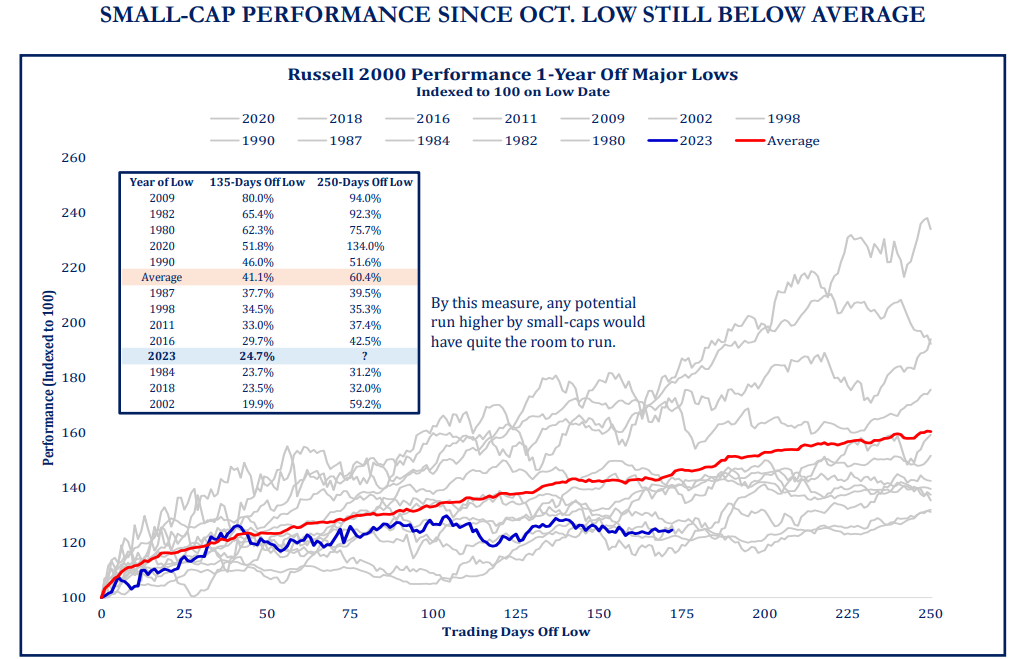

Dave: The chart below was pre-rotation day, but shows how much room remains for the small-cap reversion opportunity

Source: Strategas as of 07.09.2024

Source: Strategas as of 07.09.2024

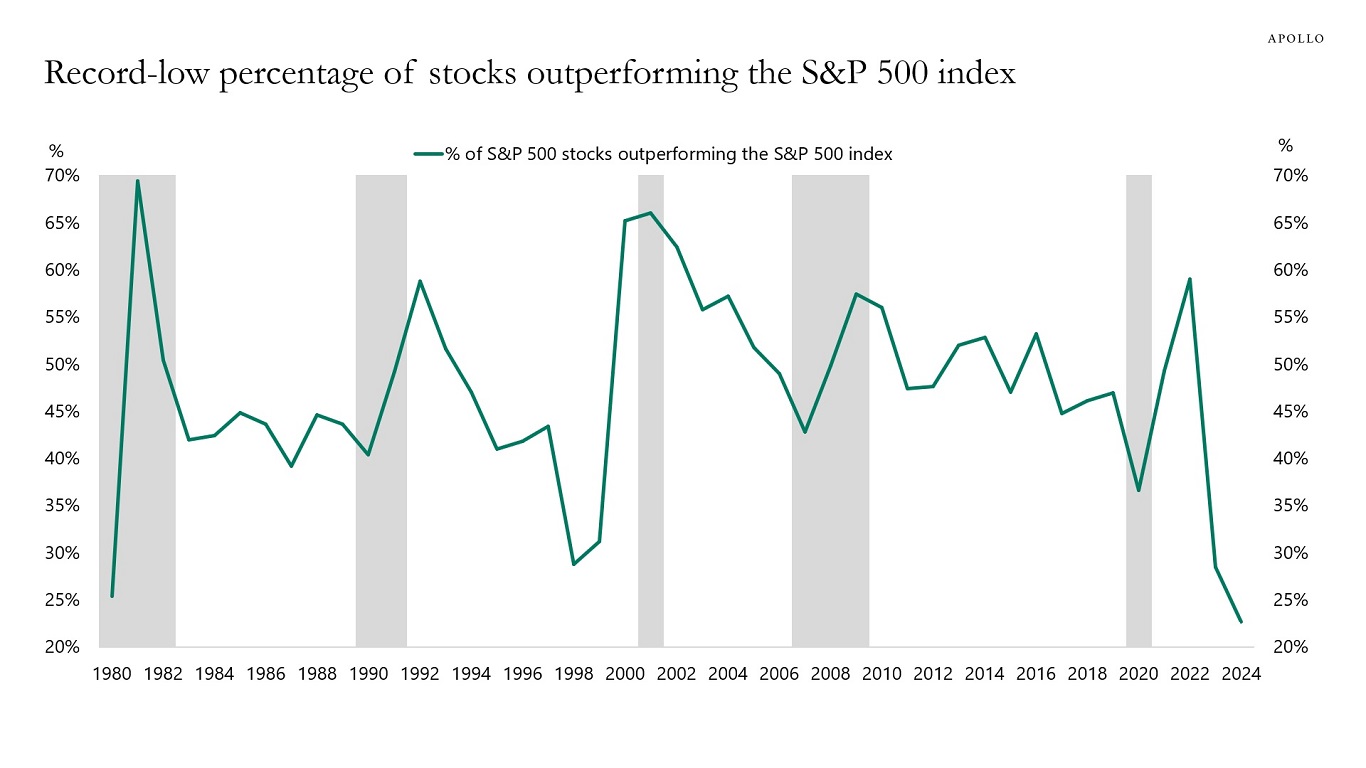

Beckham: also just before the big rotation, but clearly a historically high number of stocks that have room to play catch-up to the big kahuna S&P 500

Source: Apollo as of 07.11.2024

Source: Apollo as of 07.11.2024

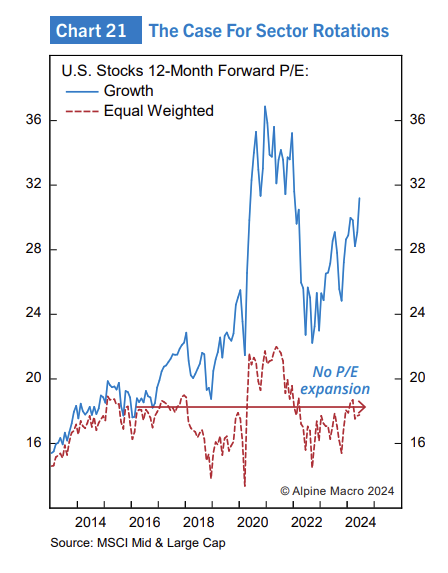

John Luke: But the catalysts are there for broadening participation, at least on a valuation basis

Source: Alpine Macro as of 07.08.2024

Source: Alpine Macro as of 07.08.2024

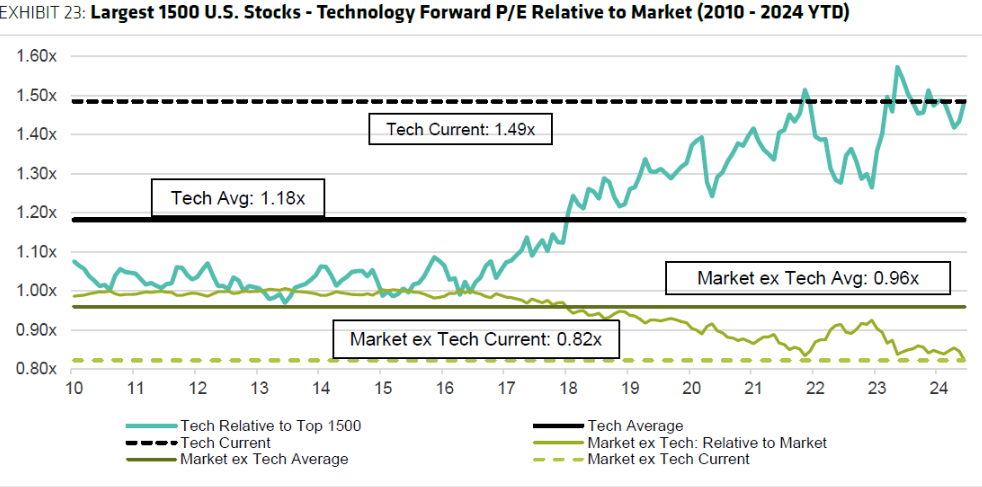

Dave: and in particular, huge performance dispersion between tech stocks and most everything else

Source: Bernstein as of 07.08.2024

Source: Bernstein as of 07.08.2024

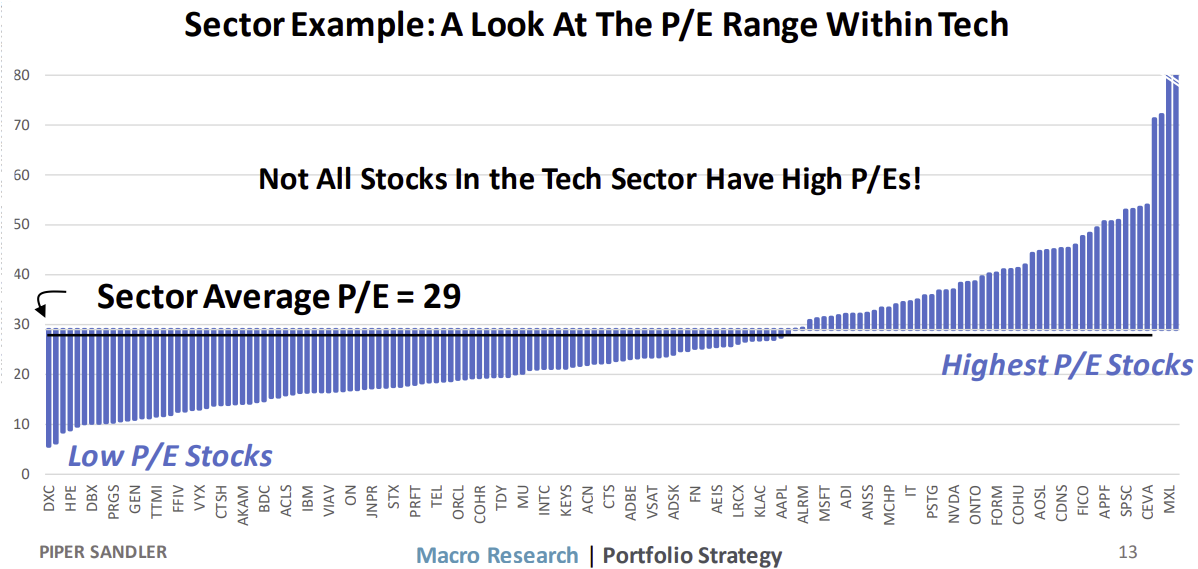

Joseph: but even within technology, there are a number of companies whose stocks haven’t attracted the same enthusiasm of the most favored names

Data as of 07.03.2024

Data as of 07.03.2024

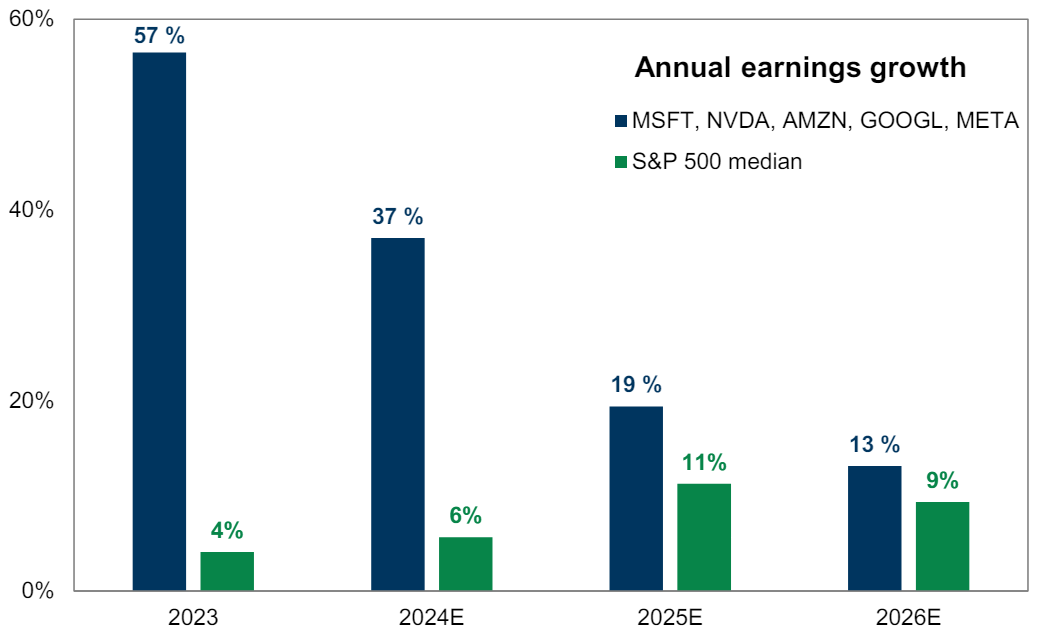

Dave: and on a fundamental basis, there is a case to be made that the broader market is about to close the earnings gap on the recently dominant Mag 5 or whatever you want to call them

Source: Goldman Sachs as of 07.03.2024

Source: Goldman Sachs as of 07.03.2024

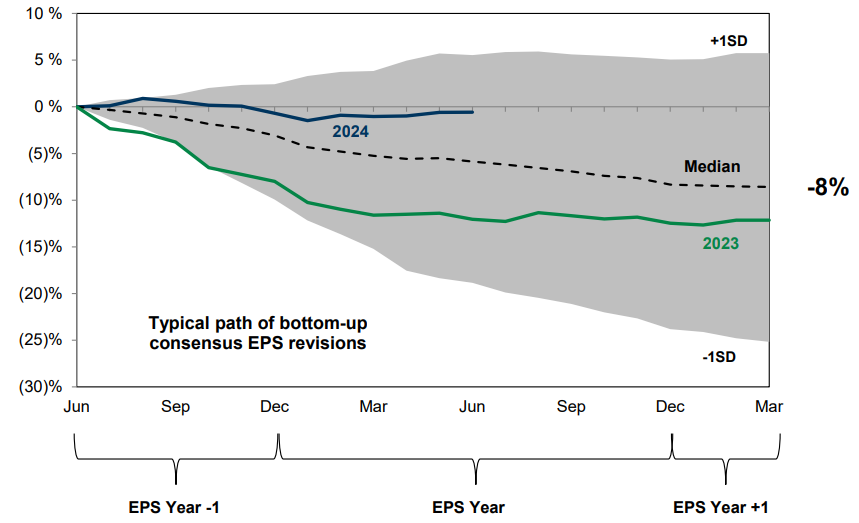

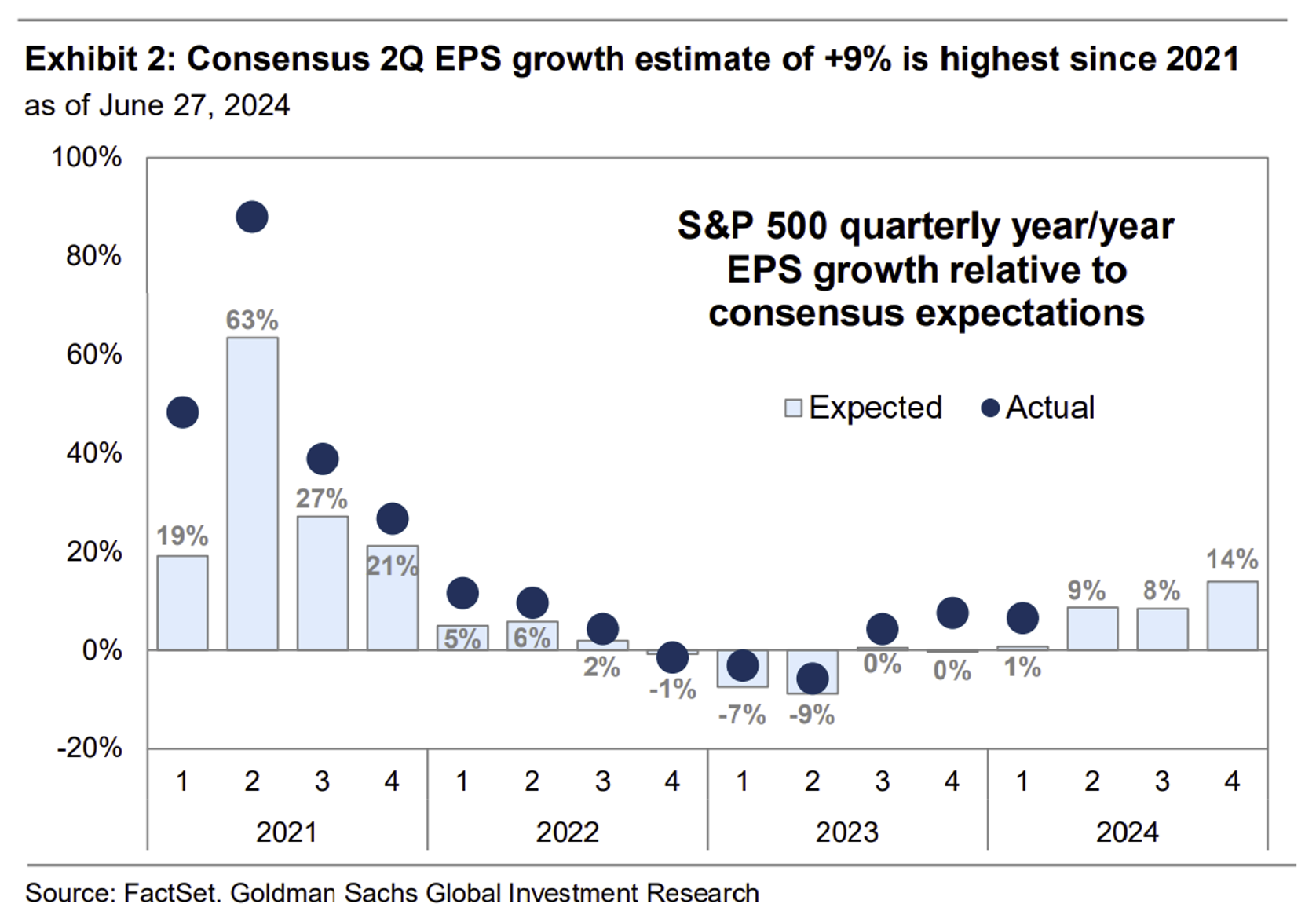

Dave: In general, the progression of earnings estimates is holding up nicely

Source: Goldman Sachs as of 06.24.2024

Source: Goldman Sachs as of 06.24.2024

Brett: a good sign, coming out of an earnings trough

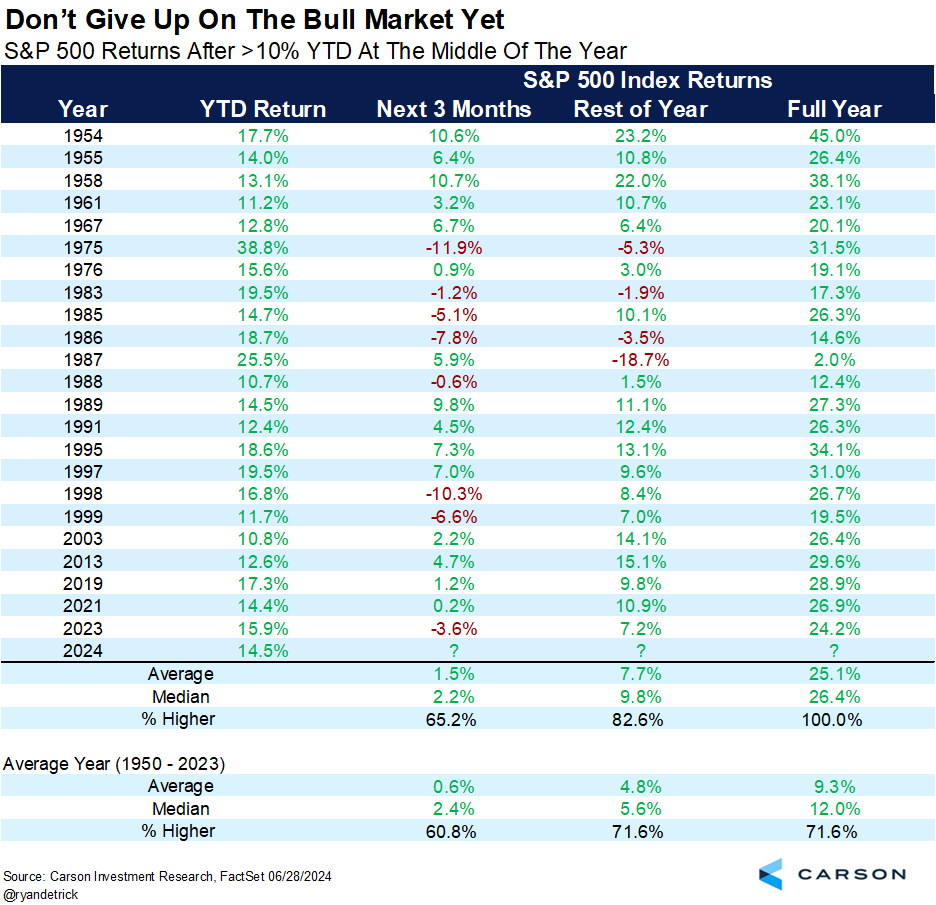

Arch: and good first halves for stocks have generally led to average or better second halves

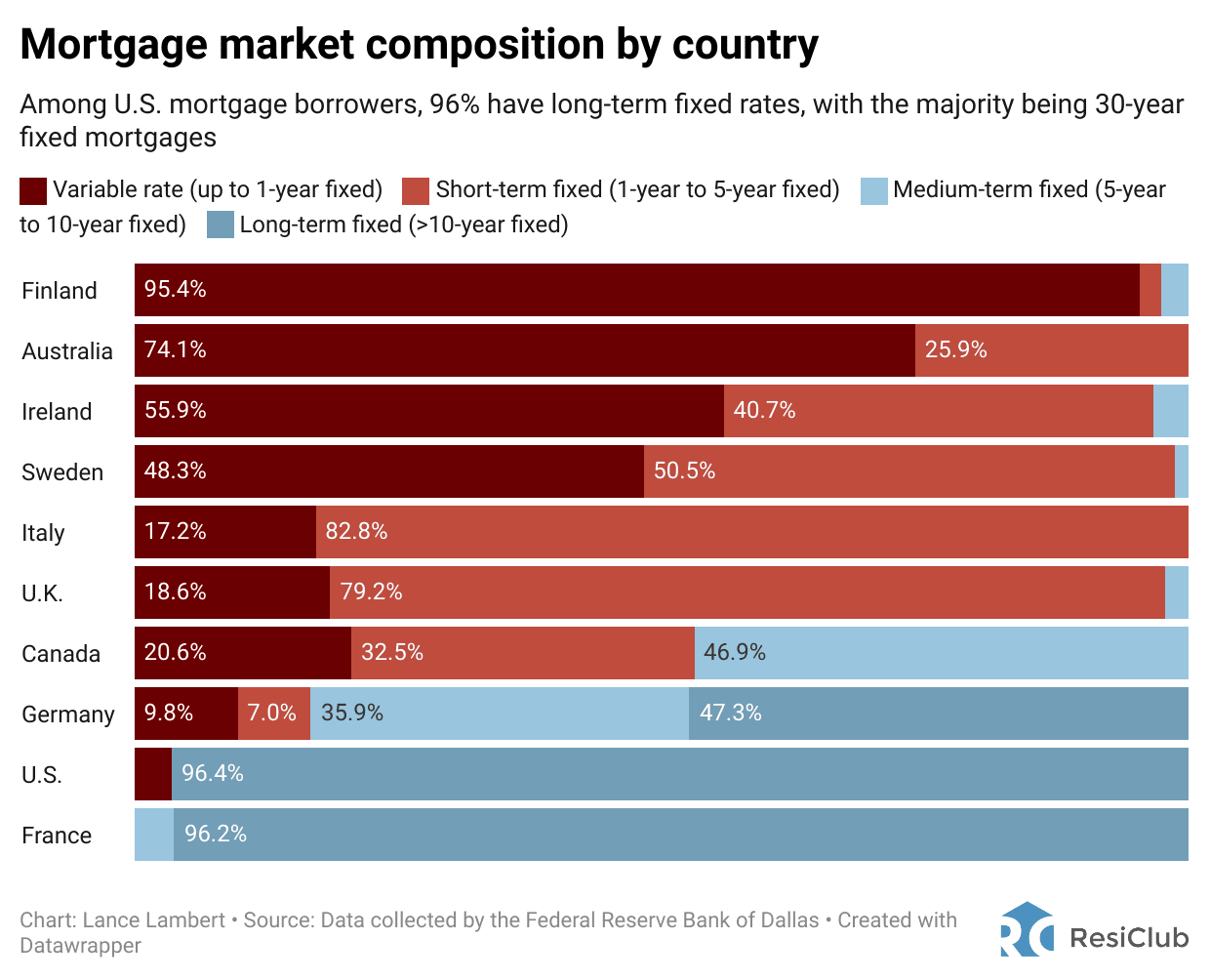

Brad: An interesting distinction between the U.S. and other developed countries is our preference for fixed-rate mortgages

Data as of June 2024

Data as of June 2024

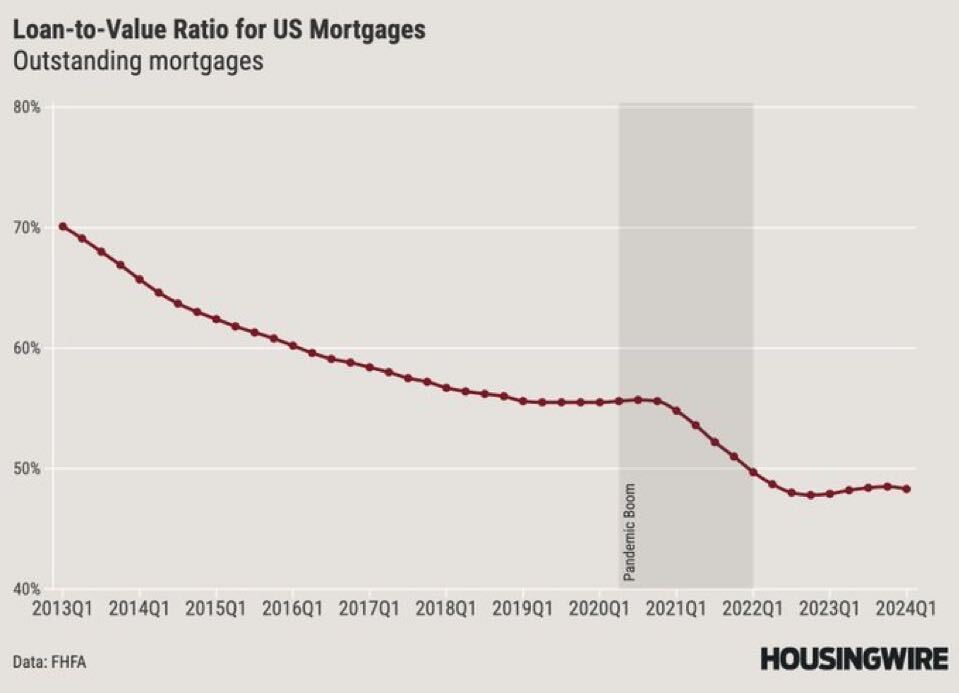

John Luke: which has helped make U.S. homeowners pretty immune to the rise in rates

Data as of June 2024

Data as of June 2024

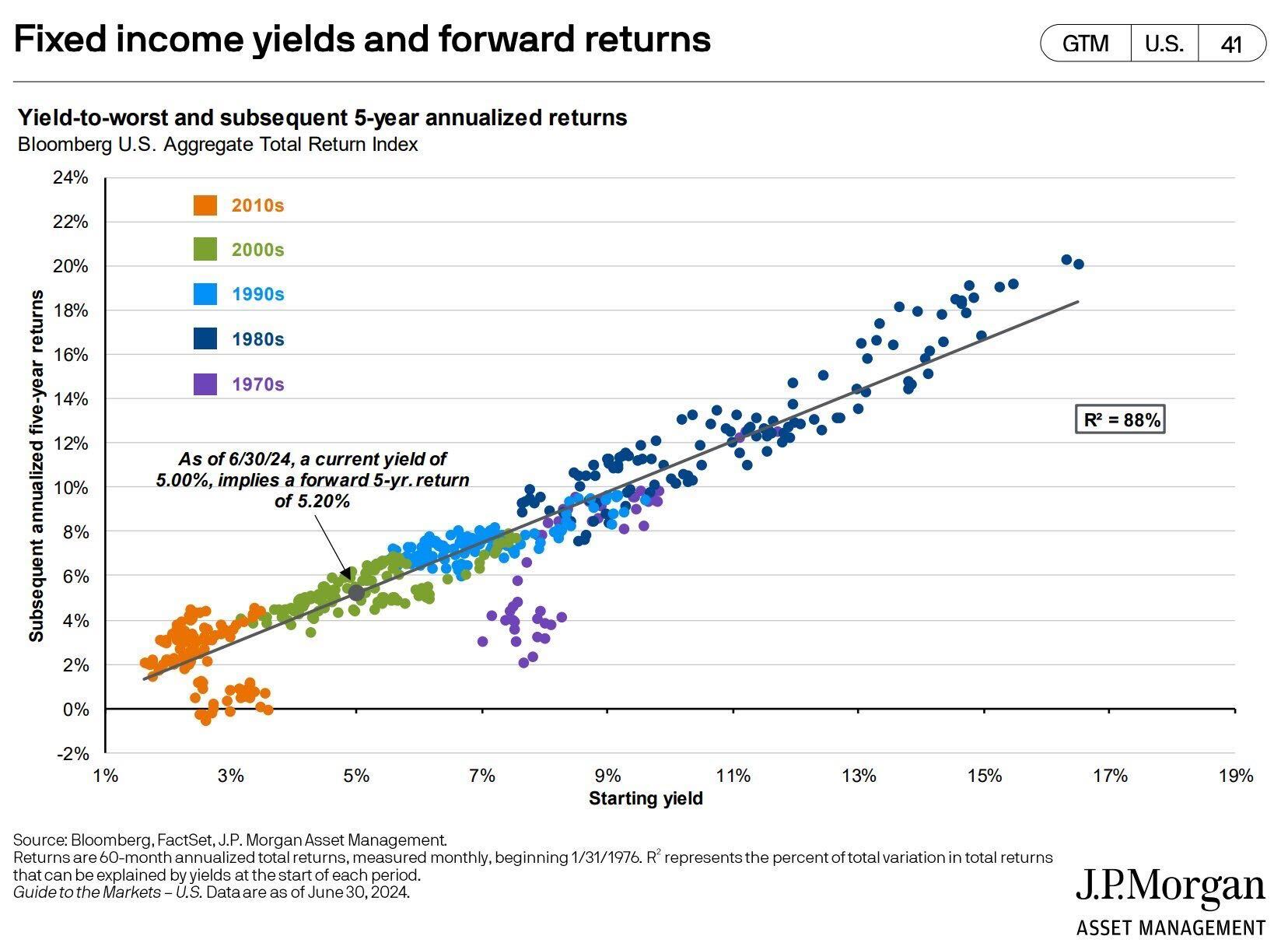

John Luke: Important to remember, forward yields are very tied to current yields. But lack the opportunity for growth!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-22.