Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

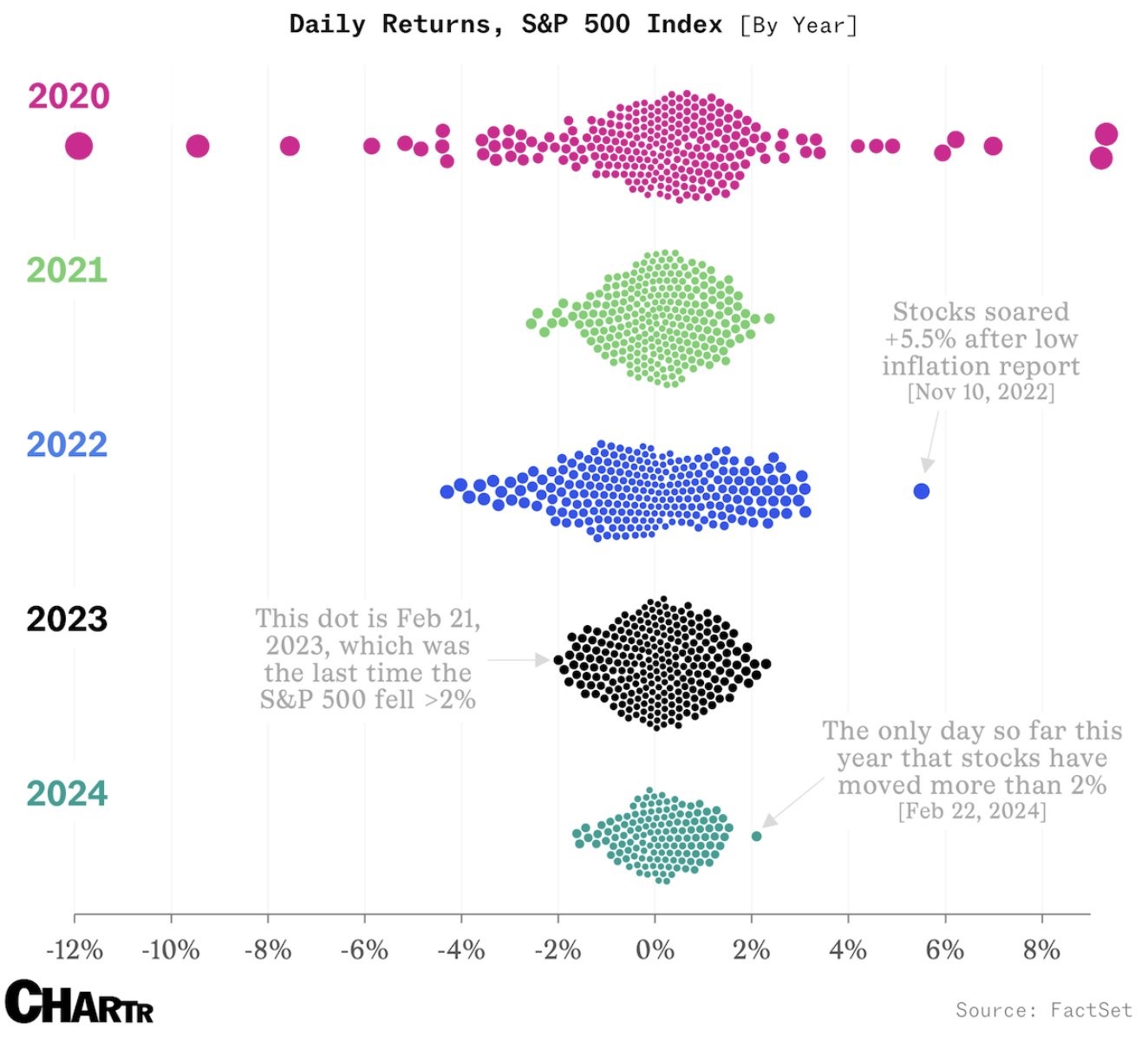

John Luke: We’re seeing a bump in market volatility but still a very tame year, with no 2% drops since Feb 2023

Data as of 07.17.2024

Data as of 07.17.2024

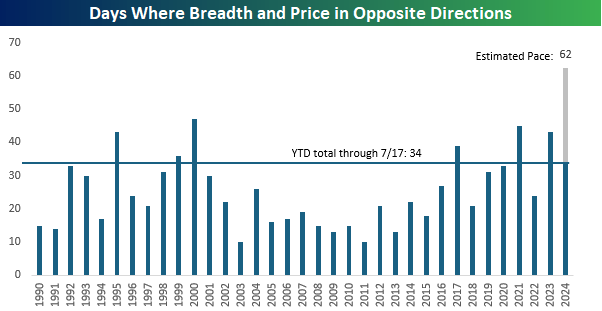

Brad: though the indexes are being cushioned by some serious flip-flopping under the surface headline numbers

Source: Bespoke as of 07.17.2024

Source: Bespoke as of 07.17.2024

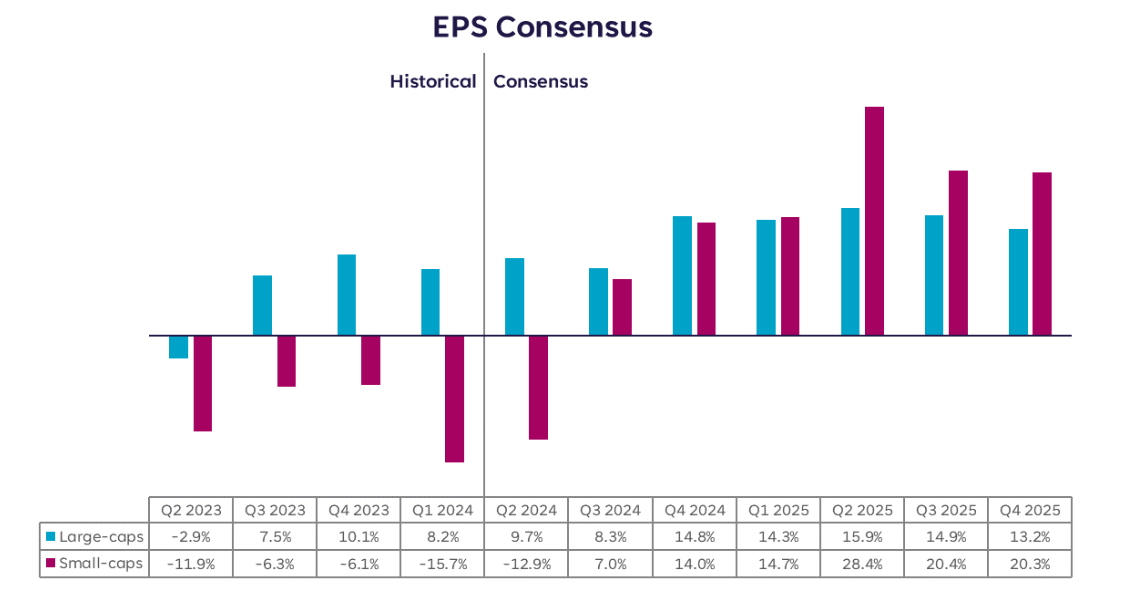

Brett: Of late, small-caps are providing support aginst the abrupt large-cap selling, perhaps on hopes the earnings turn is finally approaching

Source: SoFi as of 07.18.2024

Source: SoFi as of 07.18.2024

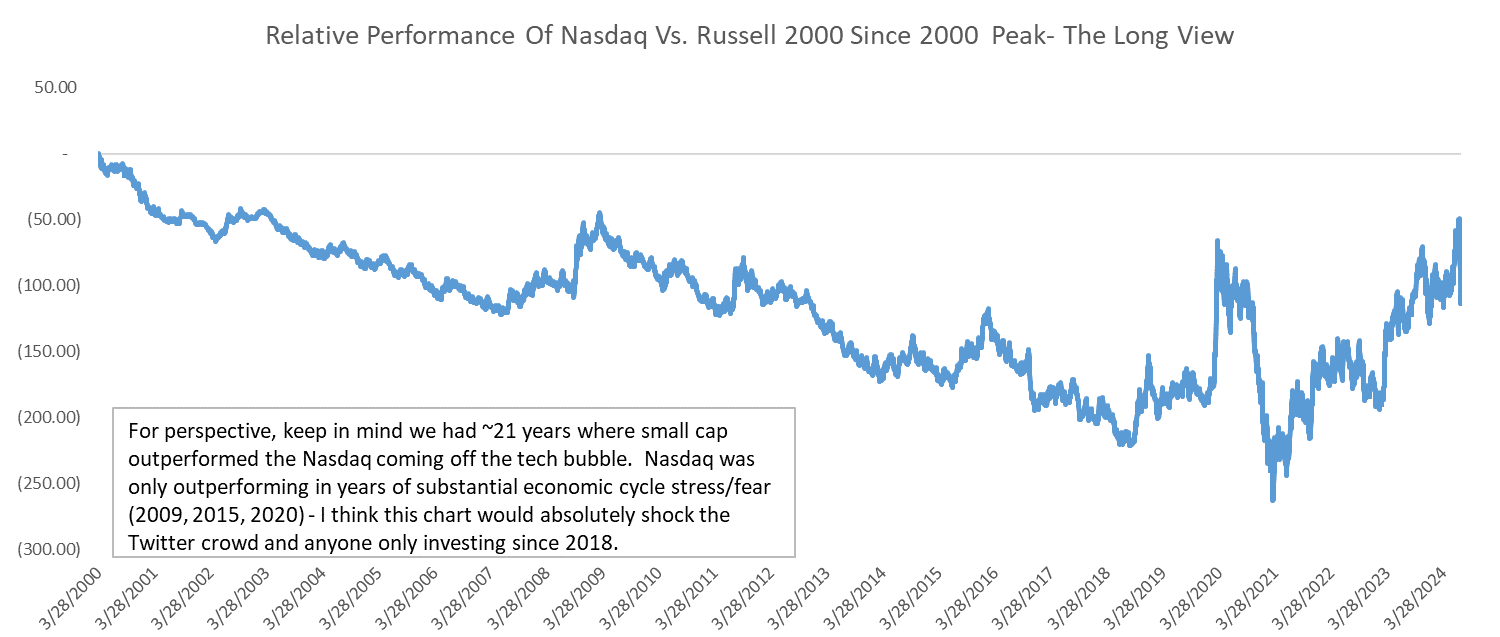

Dave: reversing the trend towards large caps in recent years. Which was a reversal from the preceding two decades

Source: Raymond James as of 07.18.2024

Source: Raymond James as of 07.18.2024

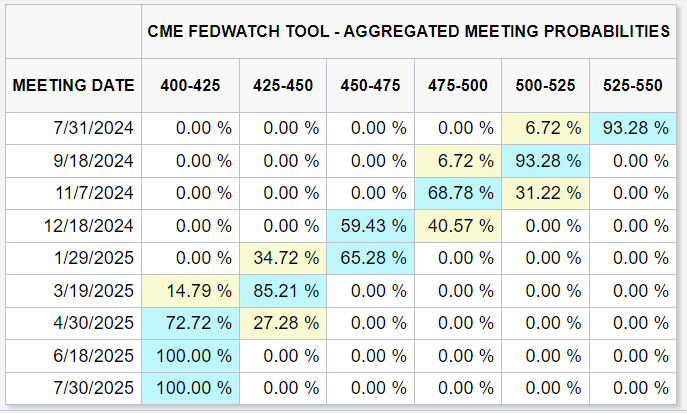

Beckham: Markets seem to be settling on the idea of a full 1% of cuts by March 2025

Source: CME Fedwatch Tool as of 07.17.2024

Source: CME Fedwatch Tool as of 07.17.2024

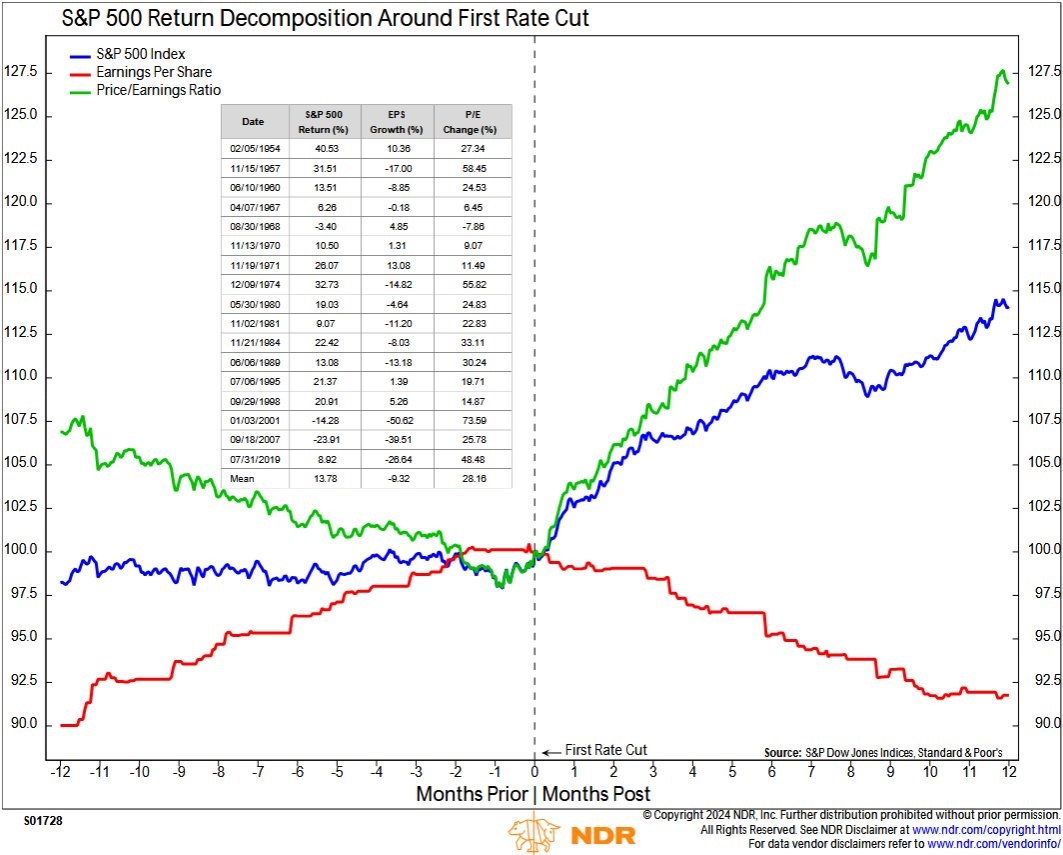

Arch: which historically has done more for valuations than for near-term earnings prospects

Data as of June 2024

Data as of June 2024

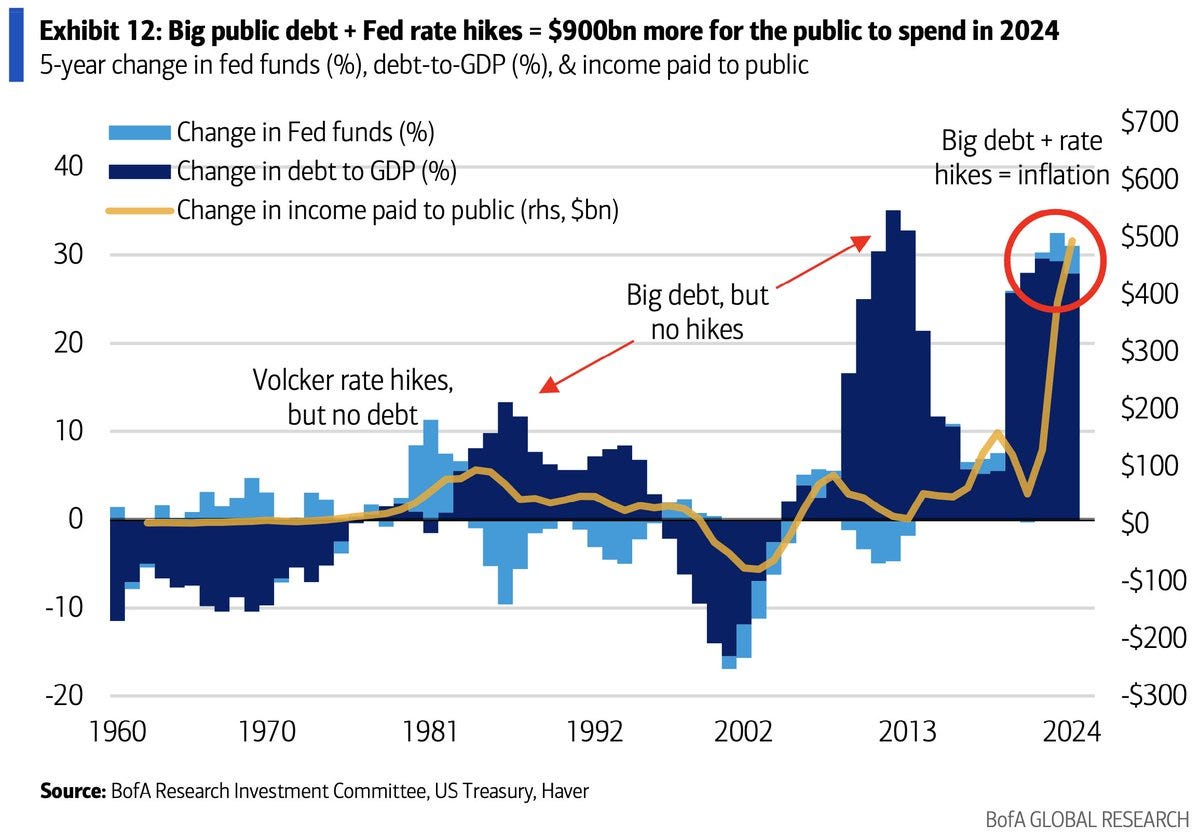

John Luke: While theory says rate cuts should stimulate economic activity, one area that has run counter to the Fed’s goals has been the high cash accruing through Treasury investments

Data as of 07.15.2024

Data as of 07.15.2024

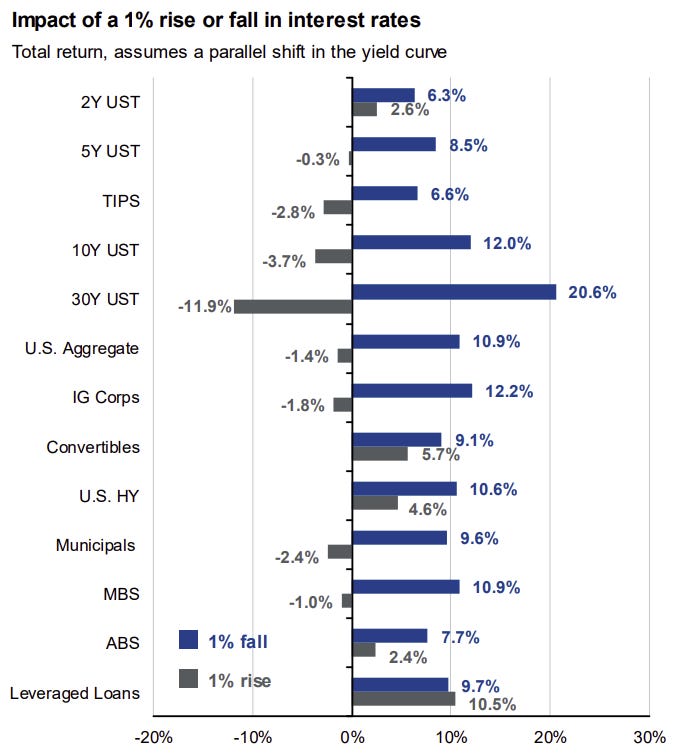

Joseph: Higher coupons means some bonds can now offer better reward : risk than when rates were lower

Source: JP Morgan as of 06.30.2024

Source: JP Morgan as of 06.30.2024

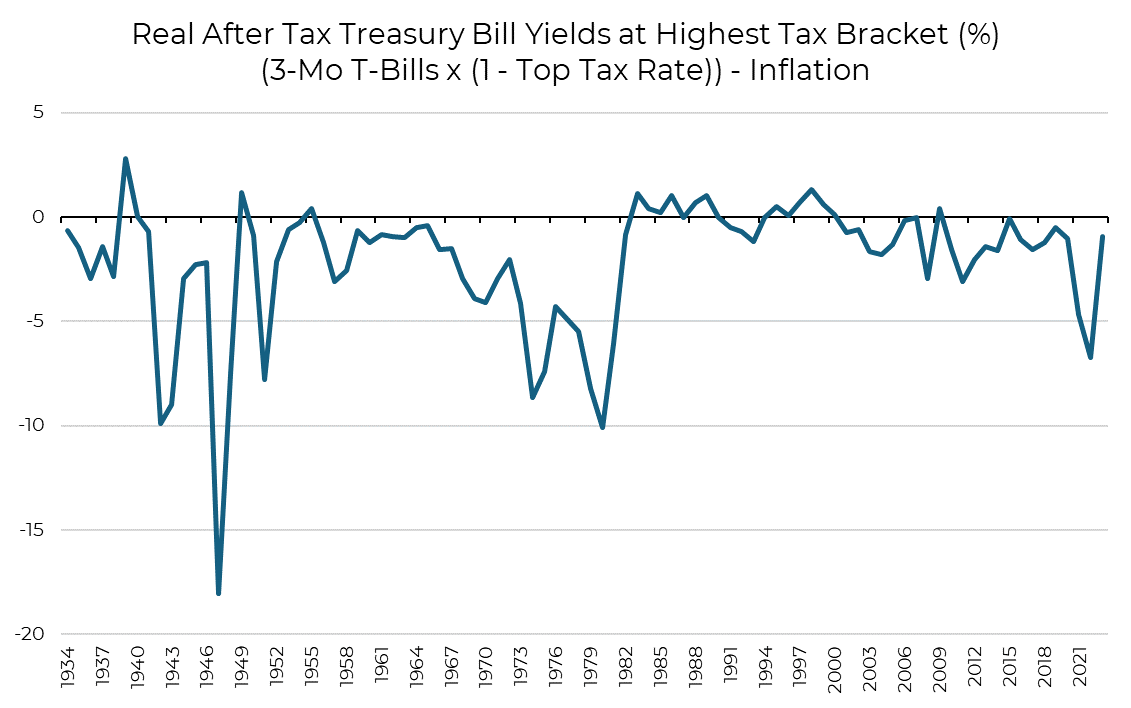

Brian: but once you factor in taxes and inflation, the reward is much less compelling

Source: Aptus via FRED as of 07.15.2024

Source: Aptus via FRED as of 07.15.2024

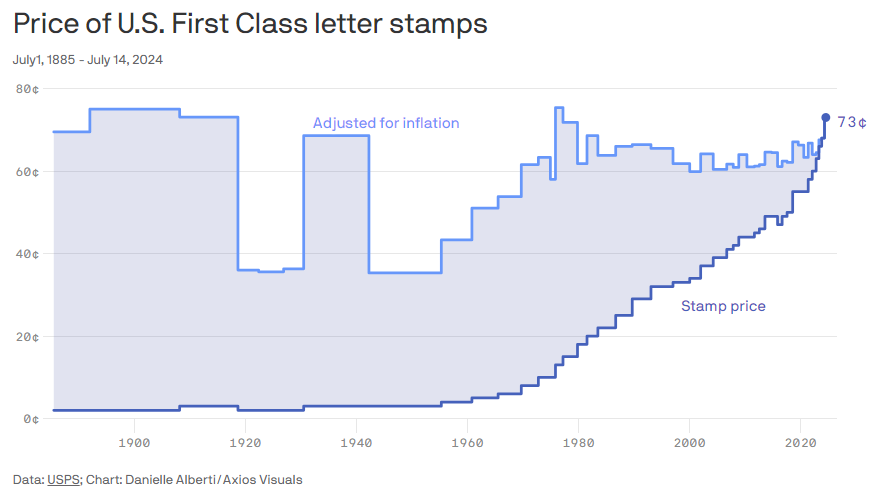

Brett: and once inflation creeps into the system, purchasing power never reverts back

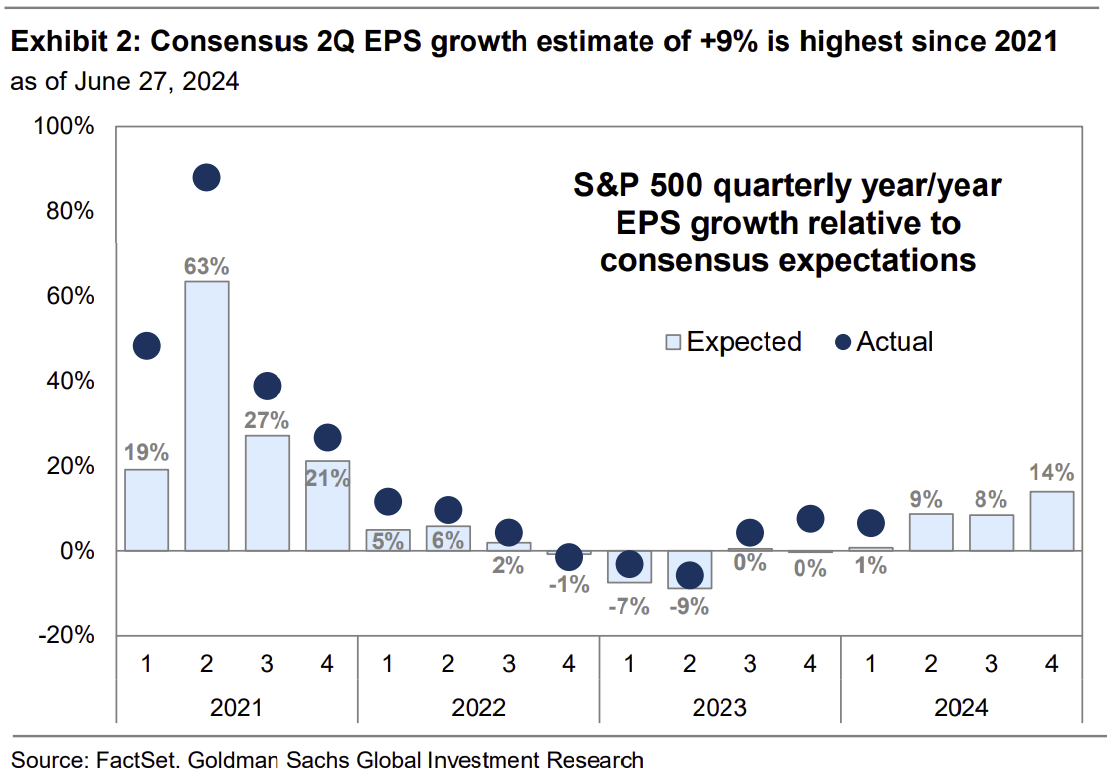

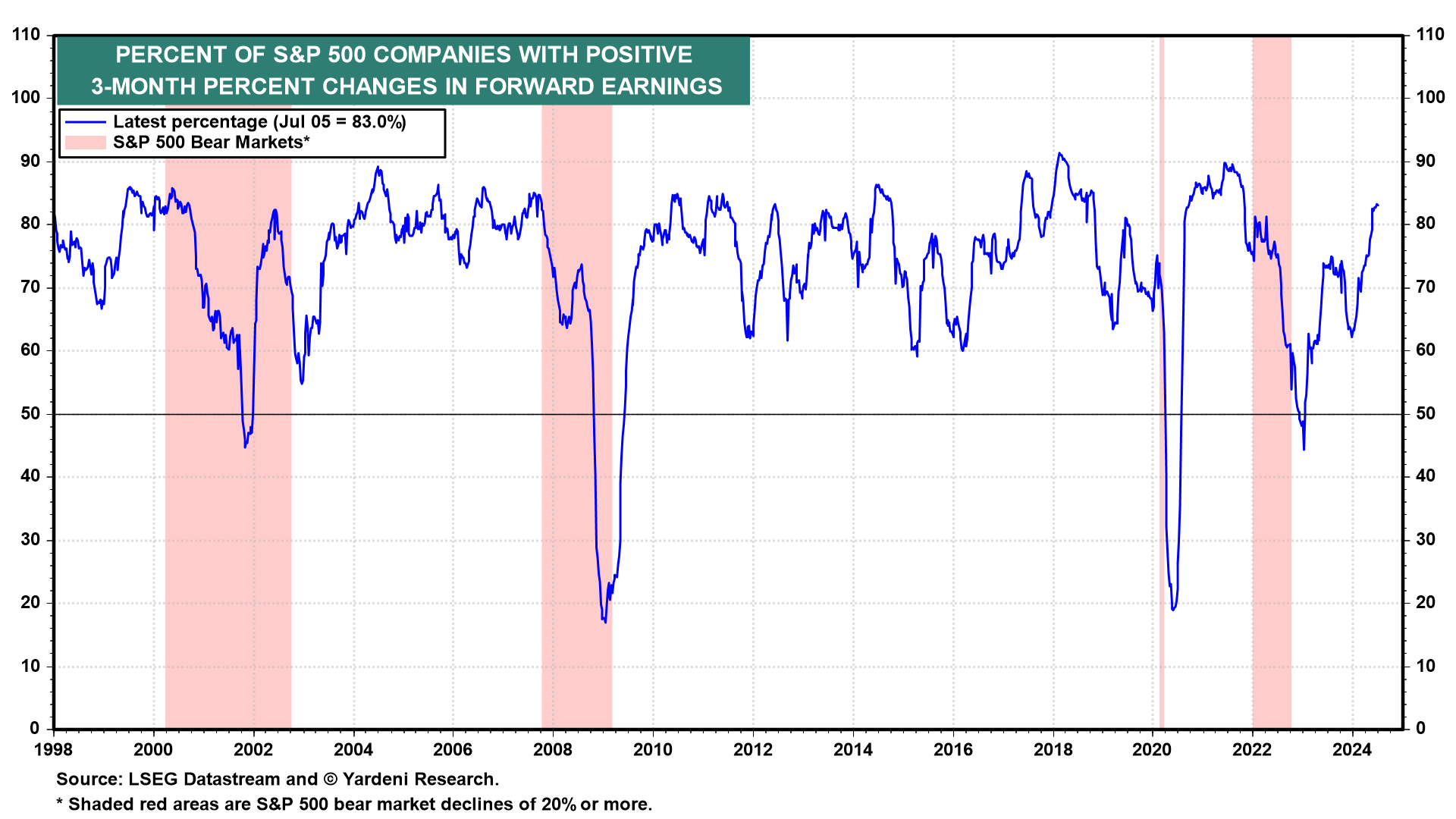

Dave: Q2 earnings are expected to move back into growth mode after two full years of flattish overall results

Beckham: and updated estimates are moving in a generally positive direction

Data as of 07.05.2024

Data as of 07.05.2024

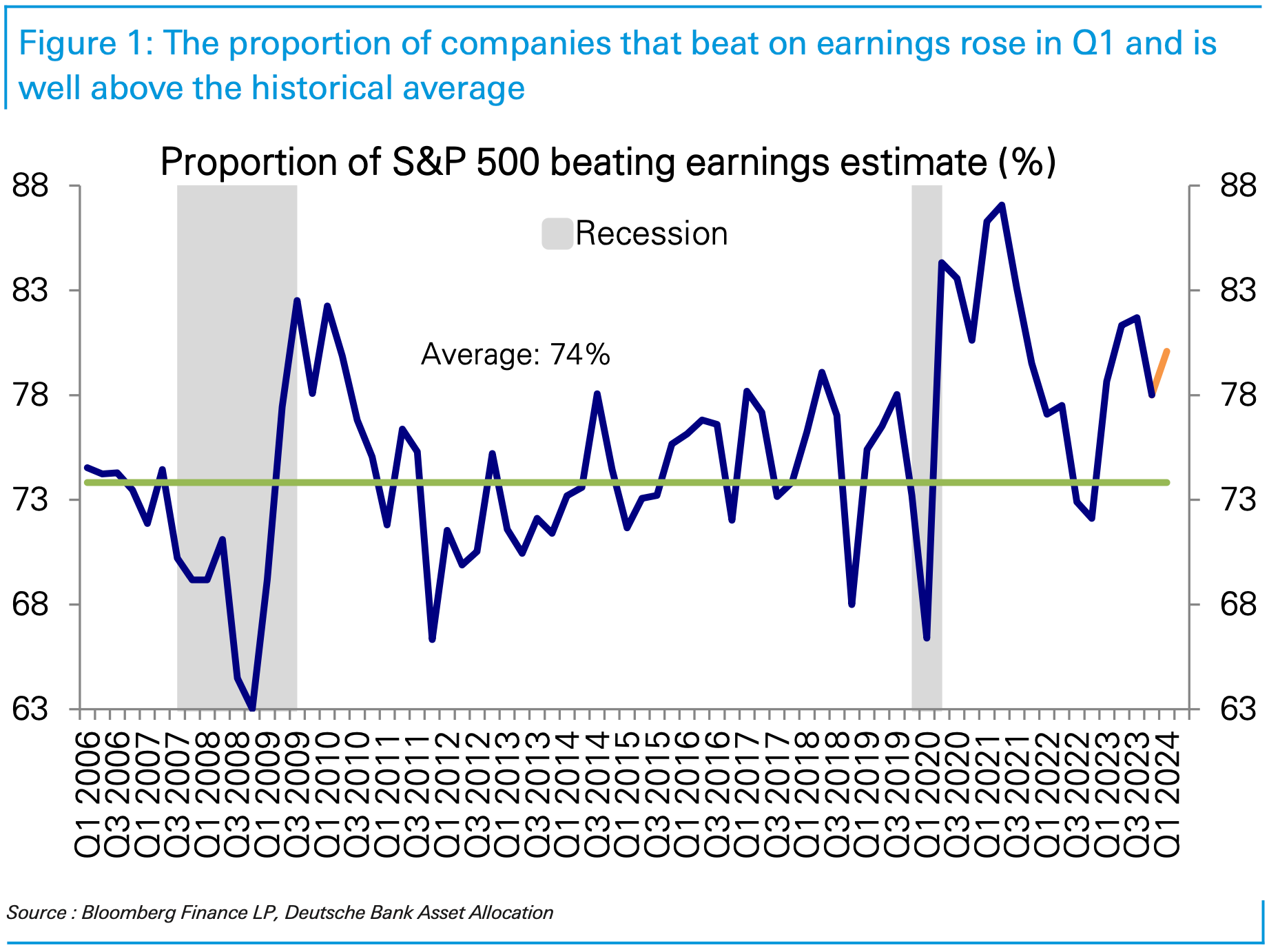

Brad: that said, headline results generally tell investors the story they want to hear as 3 out of 4 typically “beat” the estimate

Data as of 07.08.2024

Data as of 07.08.2024

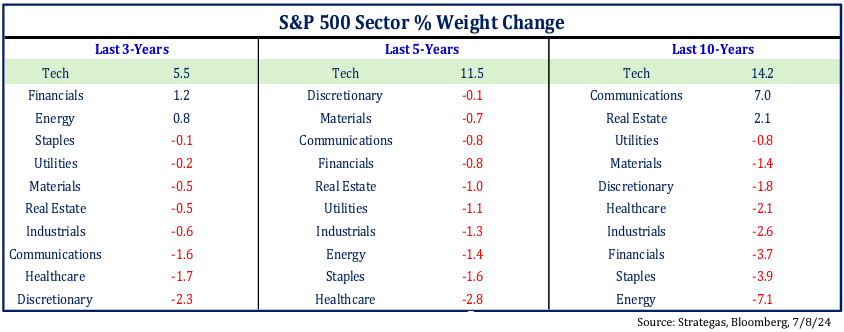

Brad: Another key consideration for aggregated earnings comparisons is that the underlying mix has changed quite a bit over time

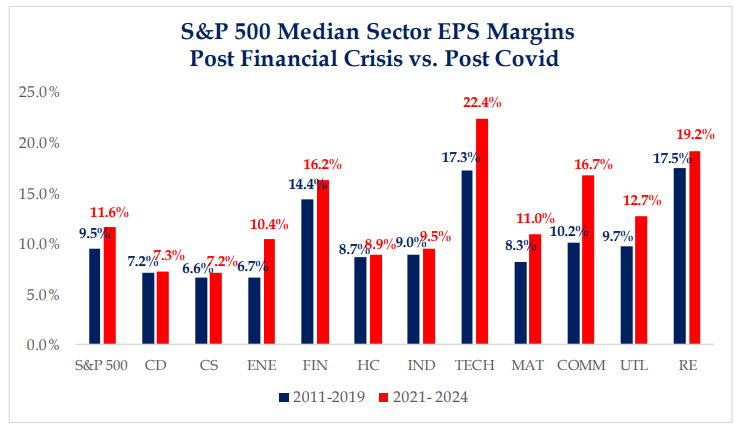

Dave: with a general trend towards higher profit margins but some sectors improving more than others

Source: Strategas as of 07.17.2024

Source: Strategas as of 07.17.2024

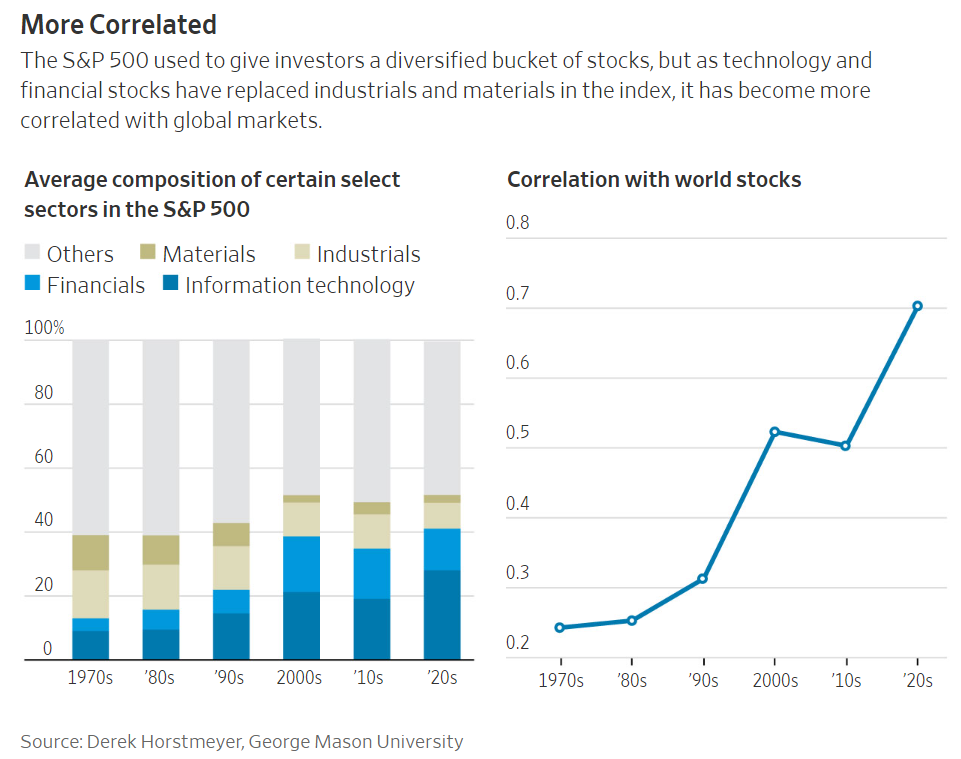

JD: It used to be helpful to own international stocks for diversification, but that value has shrunk in recent years

Source: WSJ as of 07.17.2024

Source: WSJ as of 07.17.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-27.