Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

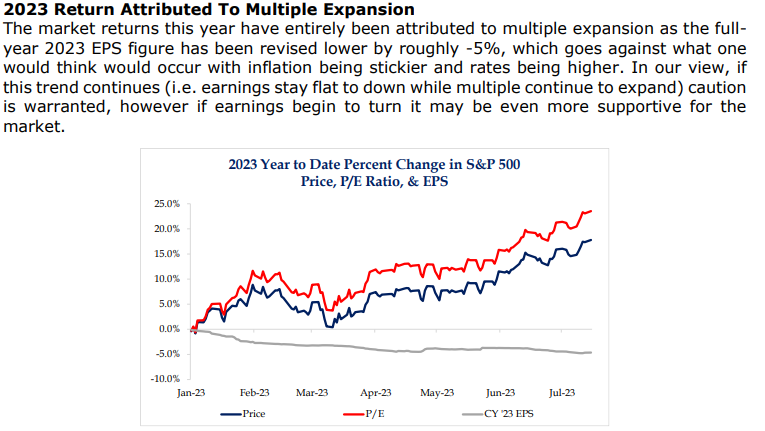

Beckham: The YTD rally in the S&P 500 has all been due to P/E multiples rising

Source: Strategas as of 07.16.2023

Source: Strategas as of 07.16.2023

JD: but that hasn’t stopped Wall Street strategists from lifting targets as price runs away from them

Data as of 07.20.2023

Data as of 07.20.2023

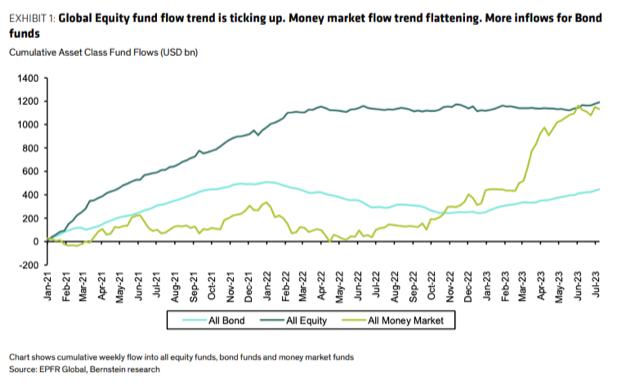

John Luke: though it’s taking some time for investors to look away from parking in cash

Data as of 07.14.2023

Data as of 07.14.2023

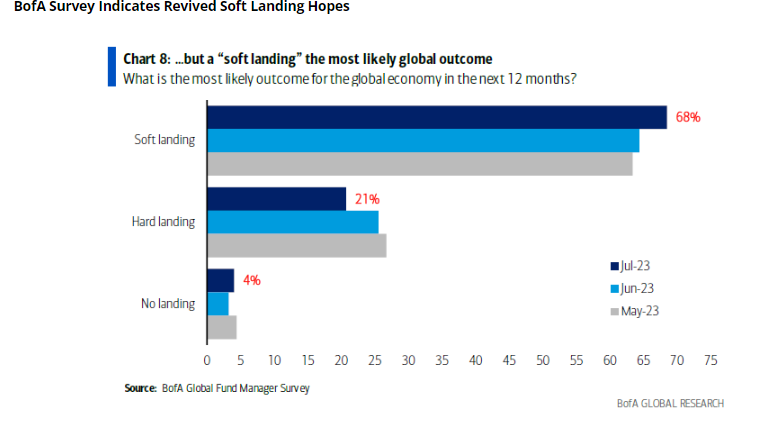

John Luke: Soft landing remains the expectation among global fund managers

Data as of 07.17.2023

Data as of 07.17.2023

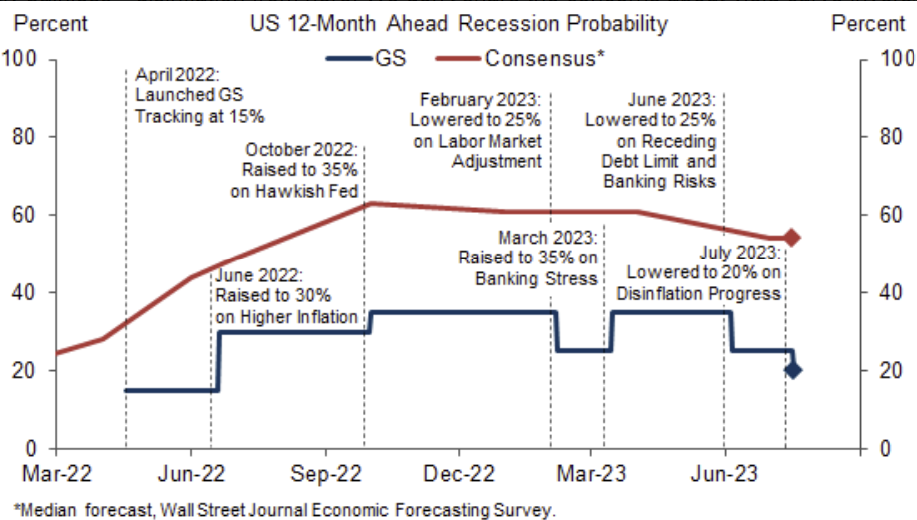

Dave: with Goldman more optimistic than consensus and again lowering their odds of a recession

Source: Goldman Sachs as of 07.14.2023

Source: Goldman Sachs as of 07.14.2023

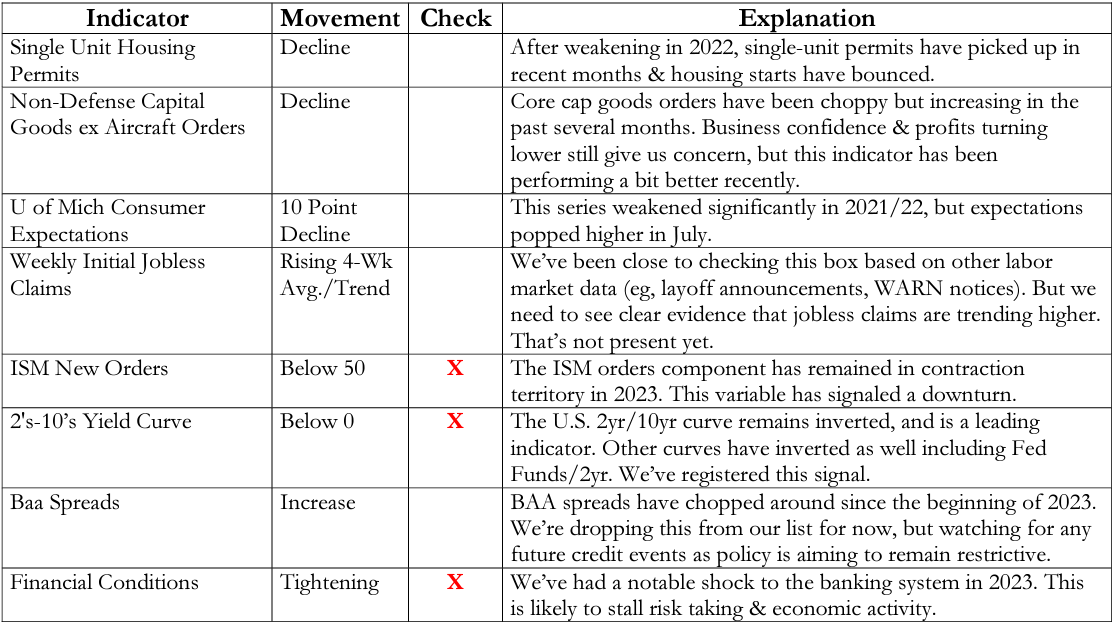

Brad: as some indicators firm up but others firmly pointed at a sharper slowdown

Source: Strategas as of 07.18.2023

Source: Strategas as of 07.18.2023

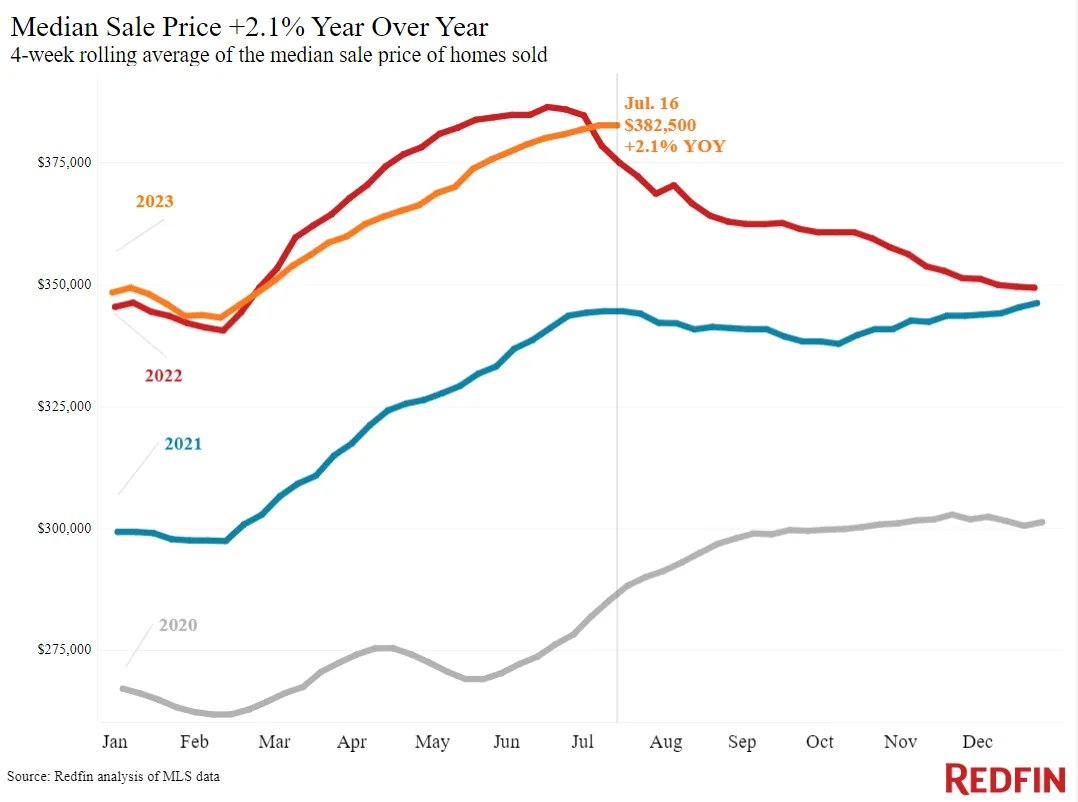

Joseph: Housing a topic of much discussion but prices generally stabilizing after some weakness

Data as of 07.16.2023

Data as of 07.16.2023

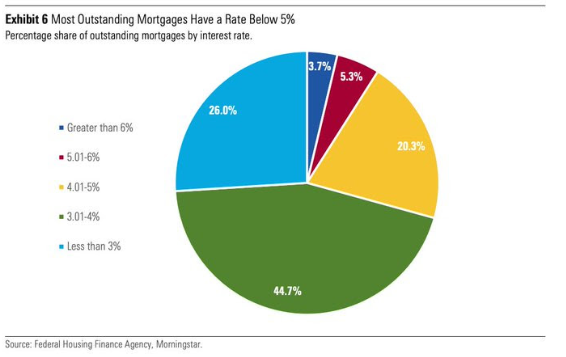

Beckham: as hopeful buyers wait for owners to give up their cheap mortgages

Data as of June 2023

Data as of June 2023

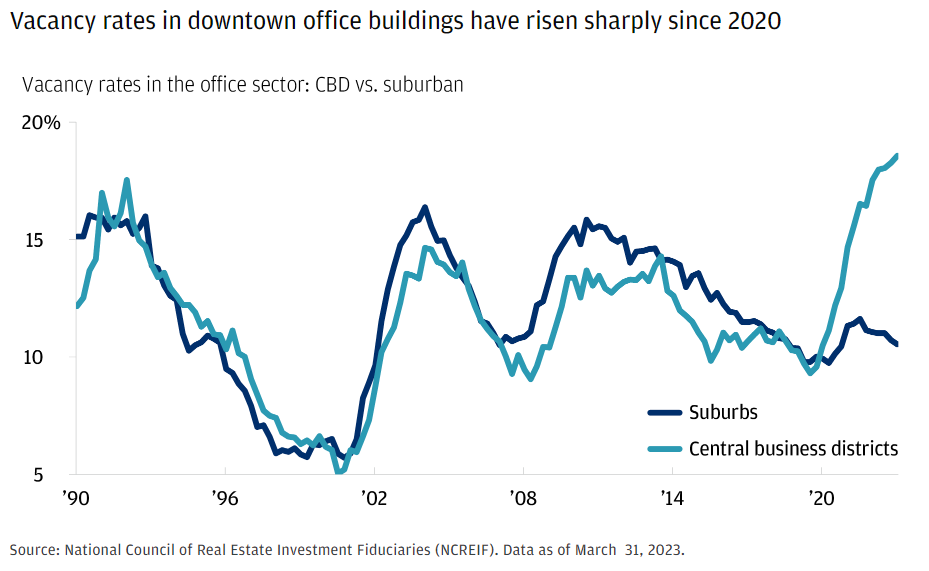

Brad: but long-term, just like commercial real estate it’s probably all about desirability of location

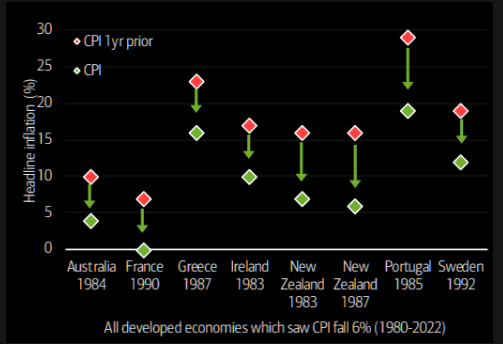

John Luke: A fall from above 9% to near 3% in US CPI would rank among the largest drops in modern history

Source: BofA as of 07.17.2023

Source: BofA as of 07.17.2023

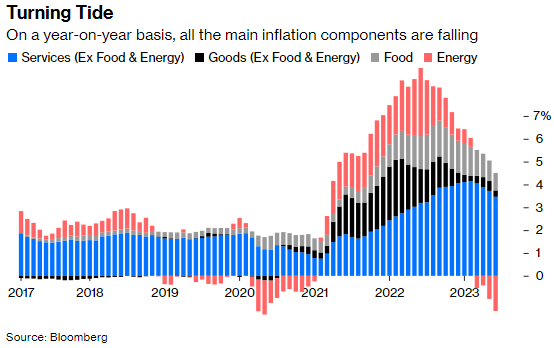

John Luke: as nearly all components of the inflation measures have fallen

Data as of 07.17.2023

Data as of 07.17.2023

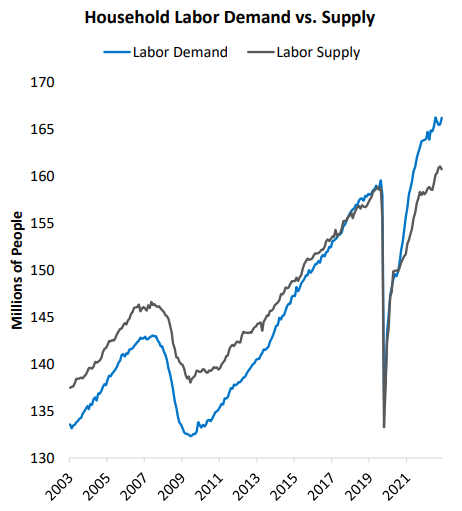

John Luke: but a structural shortage of workers will likely present a challenge to reaching the Fed’s stated 2% target for inflation

Data as of 07.14.2023

Data as of 07.14.2023

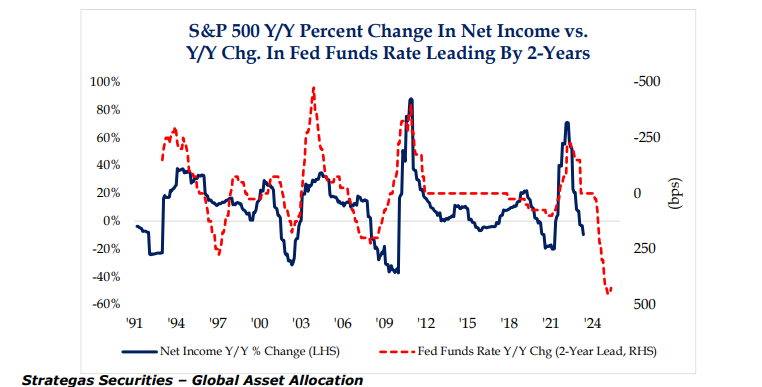

Beckham: Big swings in rates have led to big swings in net income for S&P companies, historically

Data as of 07.17.2023

Data as of 07.17.2023

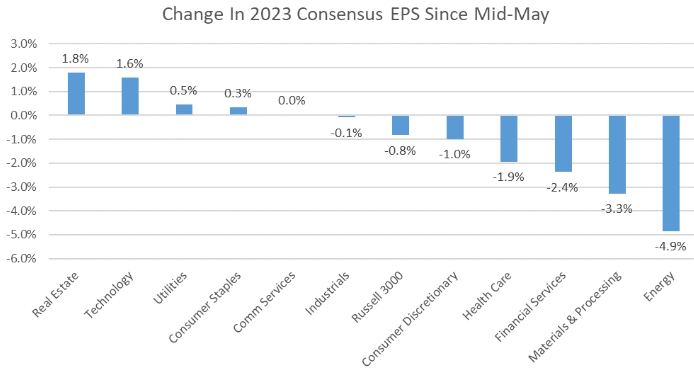

Brad: and right now, forecasts for energy and materials companies seem to be expecting the worst of it

Source: Raymond James as of 07.14.2023

Source: Raymond James as of 07.14.2023

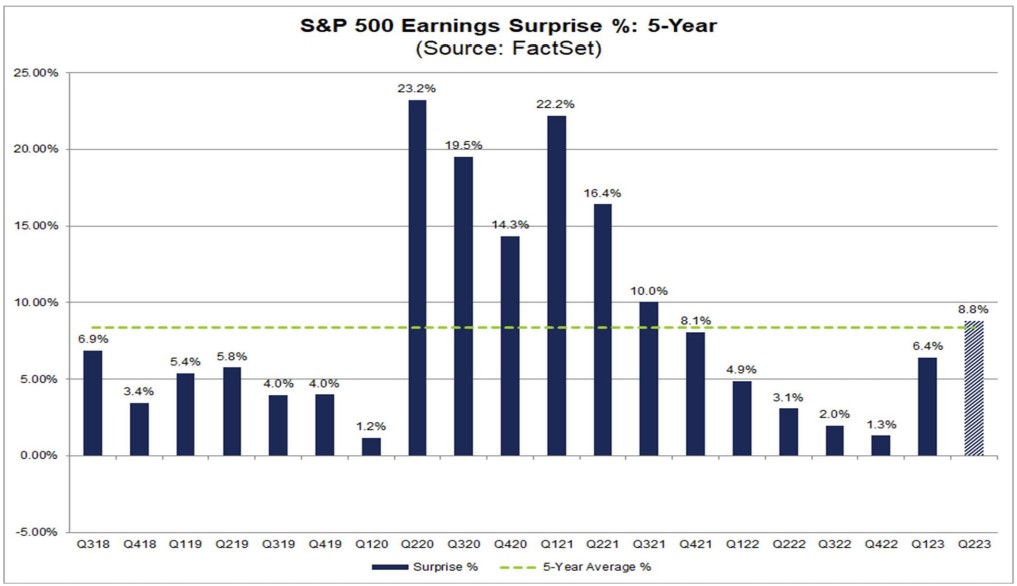

Derek: though maybe that can set a tone for positive earnings surprises, a key factor in recent market recoveries

Data as of 07.14.2023

Data as of 07.14.2023

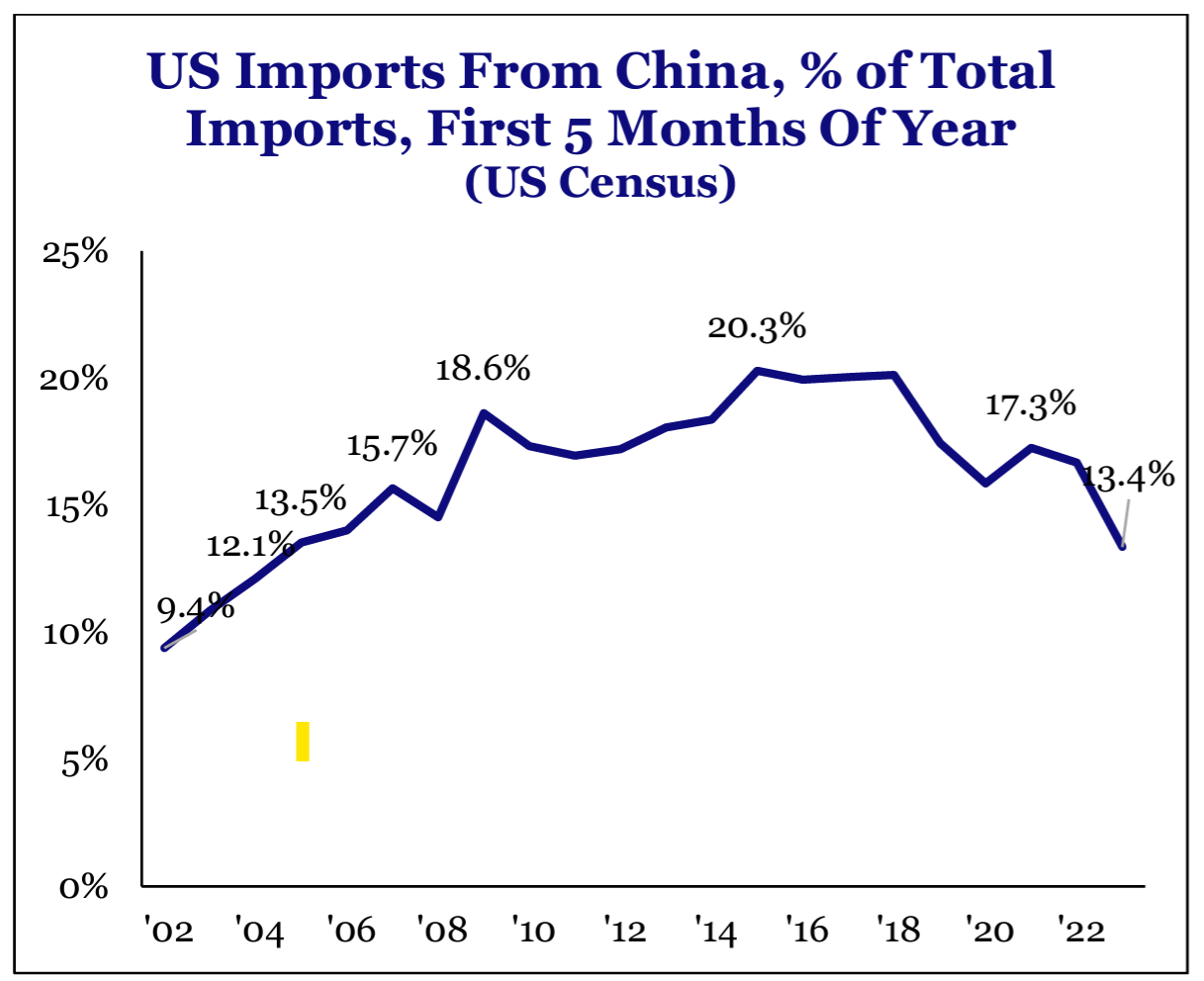

Dave: I think we can all agree a continuation of this trend would be in our best interest

Source: Strategas as of 07.17.2023

Source: Strategas as of 07.17.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-26.